Investor

Day 2023

This presentation, and other statements that BlackRock may make, may contain forward–looking statements within the meaning of the Private Securities Litigation Reform Act, with respect to BlackRock’s future financial or business

performance, strategies or expectations. Forward looking statements are typically identified by words or phrases such as “trend,” “potential,” “opportunity,” “pipeline,” “believe,” “comfortable,” “expect,” “anticipate,” “current,” “intention,”

“estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may” and similar expression.

BlackRock cautions that forward–looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward–looking statements speak only as of the date they are made, and BlackRock assumes

no duty to and does not undertake to update forward–looking statements. Actual results could differ materially from those anticipated in forward–looking statements and future results could differ materially from historical performance.

BlackRock has previously disclosed risk factors in its Securities and Exchange Commission (“SEC”) reports. These risk factors and those identified elsewhere in this report, among others, could cause actual results to differ materially from

forward–looking statements or historical performance and include: (1) the introduction, withdrawal, success and timing of business initiatives and strategies; (2) changes and volatility in political, economic or industry conditions, the

interest rate environment, foreign exchange rates or financial and capital markets, which could result in changes in demand for products or services or in the value of assets under management (“AUM”); (3) the relative and absolute

investment performance of BlackRock’s investment products; (4) BlackRock’s ability to develop new products and services that address client preferences; (5) the impact of increased competition; (6) the impact of future acquisitions or

divestitures; (7) BlackRock’s ability to integrate acquired businesses successfully; (8) the unfavorable resolution of legal proceedings; (9) the extent and timing of any share repurchases; (10) the impact, extent and timing of technological

changes and the adequacy of intellectual property, data, information and cybersecurity protection; (11) attempts to circumvent BlackRock’s operational control environment or the potential for human error in connection with BlackRock’s

operational systems; (12) the impact of legislative and regulatory actions and reforms, regulatory, supervisory or enforcement actions of government agencies and governmental scrutiny relating to BlackRock; (13) changes in law and

policy and uncertainty pending any such changes; (14) any failure to effectively manage conflicts of interest; (15) damage to BlackRock’s reputation; (16) geopolitical unrest, terrorist activities, civil or international hostilities, including

the war between Russia and Ukraine, and natural disasters, which may adversely affect the general economy, domestic and local financial and capital markets, specific industries or BlackRock; (17) a pandemic or health crisis, and related

impact on BlackRock’s business, operations and financial condition; (18) climate–related risks to BlackRock's business, products, operations and clients; (19) the ability to attract, train and retain highly qualified and diverse

professionals; (20) fluctuations in the carrying value of BlackRock’s economic investments; (21) the impact of changes to tax legislation, including income, payroll and transaction taxes, and taxation on products or transactions, which

could affect the value proposition to clients and, generally, the tax position of the Company; (22) BlackRock’s success in negotiating distribution arrangements and maintaining distribution channels for its products; (23) the failure by key

third–party providers of BlackRock to fulfill their obligations to the Company; (24) operational, technological and regulatory risks associated with BlackRock’s major technology partnerships; (25) any disruption to the operations of third

parties whose functions are integral to BlackRock’s exchange–traded funds (“ETFs”) platform; (26) the impact of BlackRock electing to provide support to its products from time to time and any potential liabilities related to securities

lending or other indemnification obligations; and (27) the impact of problems, instability or failure of other financial institutions or the failure or negative performance of products offered by other financial institutions.

BlackRock’s Annual Report on Form 10–K and BlackRock’s subsequent filings with the SEC, accessible on the SEC’s website at www.sec.gov and on BlackRock’s website at www.blackrock.com, discuss these factors in more detail and

identify additional factors that can affect forward–looking statements. The information contained on the Company’s website is not a part of this presentation, and therefore, is not incorporated herein by reference.

BlackRock reports its financial results in accordance with accounting principles generally accepted in the United States (“GAAP”); however, management believes evaluating the Company’s ongoing operating results may be enhanced if

investors have additional non–GAAP financial measures. Management reviews non–GAAP financial measures to assess ongoing operations and considers them to be helpful, for both management and investors, in evaluating

BlackRock’s financial performance over time. Management also uses non–GAAP financial measures as a benchmark to compare its performance with other companies and to enhance the comparability of this information for the

reporting periods presented. Non–GAAP measures may pose limitations because they do not include all of BlackRock’s revenue and expense. BlackRock’s management does not advocate that investors consider such non–GAAP financial

measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Non–GAAP measures may not be comparable to other similarly titled measures of other companies.

This presentation also includes non–GAAP financial measures. You can find our presentations on the most directly comparable GAAP financial measures calculated in accordance with GAAP and our reconciliations in the

appendix to this presentation, as well as BlackRock’s other periodic reports which are available on BlackRock’s website at www.blackrock.com. The information provided on our website is not part of this presentation, and

therefore, is not incorporated herein by reference.

Forward–looking Statements

Important Notes

As indicated in this presentation, certain financial information for 2012 to 2015 reflects accounting guidance prior to the adoption of the new revenue recognition standard. For further information, refer to Note 2, Significant Accounting

Policies, in the consolidated financial statements in our 2018 Form 10–K. Beginning in the first quarter of 2022, BlackRock updated its definitions of operating income, as adjusted, operating margin, as adjusted, and net income

attributable to BlackRock, Inc., as adjusted. Information from 2018–2022 reflects the updated definitions. Information for 2012–2017 does not reflect the updated definitions.

Please note this presentation includes footnotes. For footnoted information, including end notes regarding non–GAAP and other relevant information and reconciliation to GAAP, please open the full presentation PDF on BlackRock’s

website at www.blackrock.com.

2

Investor

Day 2023

Strategy: Delivering

platforms for performance

to clients

Martin Small

Chief Financial Officer and Global Head of Corporate Strategy

People using iShares ETFs

2

40 million

Invested across private

markets in last two years

3

>$50 billion

Americans with retirement

assets managed by BLK

4

35 million

ETFs offered with 85+ new

ETFs launched in 2022

6

1,300+

Aladdin users

5

130,000+

Leading insurers rely on

our product and services

7

400+

How we serve them

Our strategy is serving clients with excellence

Who we serve

1

Wealth management

Pension plans

Insurance companies

Governments & official institutions

Asset managers

Corporate treasurers

Foundations, endowments & family offices

$9.1T

“Units of Trust”

Note: For footnoted information, refer to slide 10.

4

Providing scale across

asset management &

technology

Delivering strong

investment

performance

Translating our

efficiency

to savings

for our clients

We are a platform for performance

Savings in fixed income

execution costs vs. market

average

5

25%

Saved for iShares investors

through fee reductions

since 2015

6

$600M

Private markets deals

reviewed in 2022

3

9,000

Risk factors monitored

by Aladdin

4

3,000

Active AUM above peer

median or benchmark for

5–yr period

1

81%

4– and 5–star active funds

2

165

Note: For footnoted information, refer to slide 10. Past performance is not indicative of future results.

5

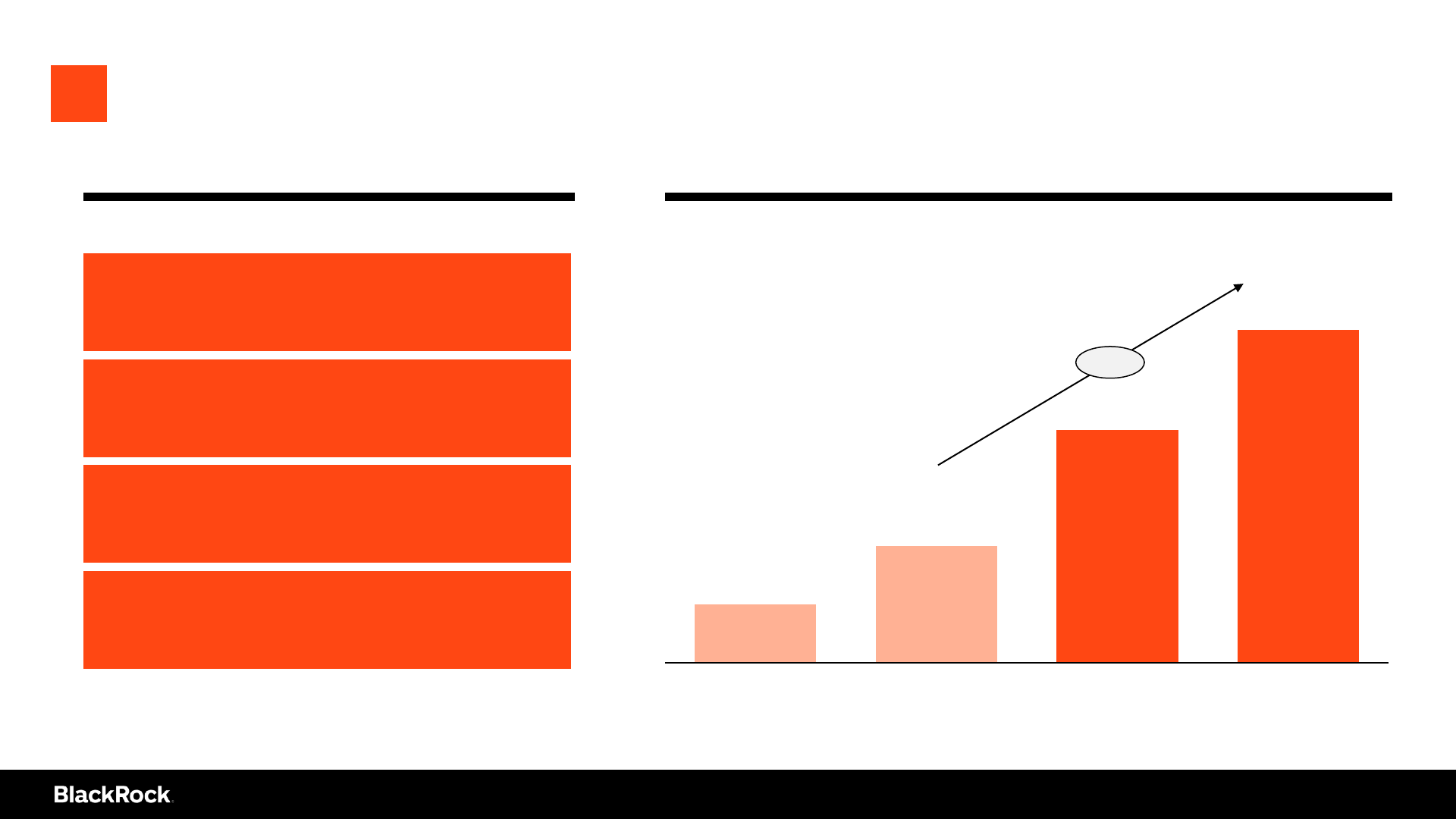

30%

41%

51%

2019 2022 2025E

Model

Portfolios

✓ Models–based advisors grow faster (vs. rep as

PM, brokerage)

✓ Reduce costs of maintaining in–house CIO staff

Aladdin

✓ Move to unified tech stack

✓ Positive network effects

✓ Opportunity for client margin premium

BlackRock’s “cloud–like” platforms fuel value for clients

Spend on cloud computing

2

Spend on traditional IT

2

• Access innovation & scale

• Faster deployment

• Cost restructuring & efficiencies

• Improve business agility

• Enhance resilience

• Positive network effects

iShares

✓ EM exposures instantly access 24 countries

1

✓ Derivatives replacement, reduce collateral

management costs

Institutional

Outsourcing

✓ Use scale of BLK trading, research, portfolio

management & investment servicing

✓ Cost variabilization & efficiency

One BlackRock – Platform Use Cases

Trends with asset owners match industrial

change driving “on–prem” to “cloud”

Cloud computing spend to grow ~1.5x vs.

traditional IT from 2019 to 2025E

Note: For footnoted information, refer to slide 11.

6

Our strategy continues to deliver

1. Alpha

at the

heart

$400B+ NNB generated from

mega–mandates

1

in last 3 years

$100B+ AUM transition

investing platform

4

$1.1B in 3–year ETF NNBF –

more than the next three ETF

issuers combined

5

$82B in private markets

gross fundraising since 2021

2

8% 3–year Active average

organic asset growth driven

by whole portfolio solutions

6

12% 3–year

technology revenue CAGR

3

Note: For footnoted information, refer to slide 11.

7

Bring strategy to life via access, expertise, and service

Markets, portfolios & advisory

Excellent performance, in

investments & operations

Sourcing, breadth & new markets

1. Alpha

at the

heart

8

Asset management revenue remains highly fragmented

3%

7%

90%

31%

69%

74%

26%

3%

Clients’

Whole

Portfolios

Asset Management

1

BlackRock #2–5 The rest

8%

Investment Banking

2

Top 5

The rest

33%

Cloud Computing

3

Top 5

The rest

Revenue share of top

firm in each industry:

Note: For footnoted information, refer to slide 11.

9

End notes

These notes refer to the financial metrics and/or defined term presented on:

Slide 4 – Our strategy is serving clients with excellence

1. AUM as of 3/31/2023. Client split as of FY2022.

2. Data as of 12/31/2022. Source: Broadridge, ExtraETF, AMF, Le Monde, Wisdom Tree, Finanzas, Italian Association of Asset Managers. The 40 million figure estimates the number of individual investors in iShares ETFs from

platform data across United States, European Union, United Kingdom, Canada, and Japan from the aforementioned sources. U.S. iShares investors estimated based on an empirical analysis of aggregate brokerage accounts in

the U.S. that hold iShares ETFs at the ticker level, and BlackRock estimates.

3. Refers to capital deployed from 1/1/2021 to 12/31/2022 in private markets strategies.

4. Data as of 12/31/2021. The overall number of Americans is calculated based on estimates of participants in BlackRock’s Defined Contribution (DC) and Defined Benefit (DB) plan clients. The Defined Contribution number is

estimated based on data from FERS as well as BrightScope for active participants across 401(k) and 403(b). Defined Contribution includes plans with over $100M+ in assets where participants have access to one or more

BlackRock funds; some may not be invested with BlackRock. The Defined Benefit number is estimated based on data from public filings and Pension & Investments for the total number of participants across the 20 largest U.S.

Defined Benefit plans that are not also Defined Contribution clients of BlackRock.

5. Data as of May 2023.

6. Data as of 12/31/2022.

7. Data as of 3/31/2023.

Slide 5 – We are a platform for performance

1. Source: BlackRock. Represents all active AUM for the 5–year period ending 3/31/2023. Please see appendix of this presentation for performance notes. Past performance is not indicative of future results. Please refer to page 12

of first quarter 2023 earnings release for performance disclosure detail.

2. Source: Morningstar Fund data as of 3/31/2023. Includes all BLK global active mutual funds (385 total). % AUM is calculated out of BLK funds that have any star rating, and does not include the AUM of non–rated funds as of

3/31/2023. Morningstar rates funds from one to five stars based on how well they’ve performed (after adjusting for risk) in comparison to similar funds. Within each Morningstar Category, the top 10% of funds receive five stars,

the next 22.5% four stars, the middle 35% three stars, the next 22.5% two stars, and the bottom 10% receive one star. Funds are rated for up to three time periods— three–, five–, and 10 years—and these ratings are combined to

produce an overall rating. Funds with less than three years of history are not rated. Ratings are objective, based entirely on a mathematical evaluation of past performance. They’re a useful tool for identifying funds worthy of

further research, but shouldn’t be considered buy or sell recommendations.

3. Source: BlackRock. Figures for 2022.

4. Source: BlackRock. Figures for 2022.

5. Source: BlackRock analysis of all Fixed Income High Yield and Investment Grade Credit, FX, and Equity trades excluding derivatives for 2022 as of 12/31/2022. BlackRock Execution Cost is the average difference between: the

actual price achieved on the trade and the benchmark price. For Equity and FX, benchmark price is the market price ,based on exchange data at the time when the PM submitted the order. For Fixed Income, benchmark price is the

previous day’s closing price. The Market Half Spread (or Expected Cost) is an estimate of the average execution cost of a market participant. For Fixed Income, Market Half Spread is estimated quarterly for each sector and

maturity bucket based on a consensus opinion of BlackRock traders as well as a set of over 10 broker dealers. For FX, brokers provide Market Half Spread quarterly on a consensus basis for each currency pair and size range. For

Equity, BlackRock calculates Market Expected Cost using an average of multiple independent broker models. Subject to change.

6. BlackRock as of December 2022. Cumulative cost–savings figure is calculated by taking the difference between the previous fund expense ratio and the new fund expense ratio from 2015 through December 2022, multiplied by

the fund assets under management at the time of the fund reduction. Methodology does not account for compounding savings over time.

10

End notes

These notes refer to the financial metrics and/or defined term presented on:

Slide 6 – BlackRock’s "cloud–like" platforms fuel value for clients

1. iShares exposures accounted for coming from total countries listed in MSCI EM Index as of May 2023. MSCI EM Index accounts for large and mid–cap representation across 24 emerging markets (EM) countries.

2. Source: Gartner.

Slide 7 – Our strategy continues to deliver

1. Represent last three years ending 3/31/2023. Mega mandates reflect client outsourcing assignments greater than $5 billion in assets.

2. Gross fundraise figures from 1/1/2021 through 3/31/2023.

3. BLK Form 10–Ks for respective years. 3–year CAGR represents 12/31/2019 to 12/31/2022.

4. Data as of 3/31/2023.

5. Source: BlackRock, Bloomberg, covers the period from 4/1/2020 to 3/31/2023. Net new base fees represents annualized base fee revenue earned on net asset inflows.

6. Represents last three years ending 3/31/2023. Organic asset growth rate calculated by dividing net asset inflows over beginning of period assets.

Slide 9 – Asset management revenue remains highly fragmented

1. Source: Company filings for public peers with revenue data as of 12/31/2022. Private peers data based on AUM from websites with BlackRock estimate of average fee rate to calculate revenue. Total asset management industry

2022 revenue estimate from McKinsey Performance Lens.

2. Source: Dealogic. Investment banking revenue with data for year ending 12/31/2022.

3. Source: Synergy Research Group. Cloud provider revenue market share for year ending 12/31/2022.

11

Platform as a Service

Rob Goldstein

Chief Operating Officer

Investor

Day 2023

The only “Platform as a Service” (PaaS)

in asset management

Fundamental

Fixed Income

High

Alpha

Fundamental

Equities

Secondaries

Municipals Private Credit

Event

Driven

Decarb &

Transition

Financial

Institutions

Systematic

Infrastructure

Private Equity

Partners

Liability–

Driven

Multi–

Asset

Real

Estate

Cash

Management

Americas Institutional

EMEA Wealth

Asia–Pacific Retirement

Financial Markets Advisory

Markets & trading Investment operations Corporate operations

Client segments

One BlackRock

Combining the “pieces of

the puzzle” enables unique

product innovation

& Index

Fundamental

Fixed Income

Financial

Institutions

Liability–

Driven

Municipals

High

Alpha

Fundamental

Equities

Secondaries

Private

Credit

Systematic

Multi–

Asset

Event

Driven

Real

Estate

Infrastructure

Decarb &

Transition

Cash

Management

Private

Equity

Partners

Enables clients to grow and

expand over time while

remaining within the

BlackRock Ecosystem

Aladdin – the “language of

portfolios” – as the core

foundation provides

operating leverage

Investment teams

We are a platform for scale…

13

100+

languages

spoken

3

60+

BLK

offices

3

30+

countries

globally

3

Dedicated capital markets function

to unlock unique deal flow

Asset classes across the

Whole Portfolio

Investment strategies spanning

global markets

Public

Markets

Private

Markets

Active

Technology

Tools

Cash

Index

ServiceExpertise

1BLK: Seamless connectivity

across businesses

Investment platform that

shares insights globally

…with the unique ability to service clients no matter their requirements

Access

19,500

employees

1

Industry–leading financial

advisory capabilities

Unified, scaled markets and

operations functions

are tech and

data

professionals

2

33%

are investment

professionals

2

26%

dedicated to client

relationships

2

16%

25%

are corporate

and business

operations

professionals

2

Note: For footnoted information, refer to slide 20.

14

The BlackRock Ecosystem in action

Client Case Study: Insurance Company

1

2020

Aladdin Risk implemented for the whole portfolio

Advisory: Started investment and insurance

advisory discussions

2023

Entire portfolio managed end–to–end on the

Aladdin Enterprise platform, including eFront

$28B of core fixed income allocations

$3B of investment grade private placements

Client

AUM

~$55B

BLK AUM

$1B

Client

AUM

~$65B

BLK AUM

$1B

Client

AUM

~$55B

BLK AUM

$32B+

2017

$1B infrastructure

debt mandate

New Client

Note: For footnoted information, refer to slide 20.

15

Combining capabilities unlocks innovation across investment strategies

Investments Case Study: Private Equity Partners + BlackRock Systematic Investing

Leveraging BlackRock’s Systematic Model to identify and catalyze private equity investments

Private Equity Partners

1

195

Investment

professionals

$46B

In client

commitments

20+

Years of

history

BlackRock Systematic Investing

2

220+

Person team

$224B

In client

assets

35+

Years of

history

Fundamental Value

Analyst Sentiment

Earnings Quality

Flows

Macro Themes

Big Data

Machine Learning

1985 1990 1995 2000 2005 2010 2015 2017 Today

Evolution of private data science

Natural language processing (NLP):

NLP can assist users with the collection of reporting data for

quarterly reporting documents

3

Machine Learning (ML):

ML can be used to help managers source transactions and enhance

existing due diligence processes, transforming unstructured data into organized knowledge

4

Research driven process elevates investment insight using cutting edge technology

Note: For footnoted information, refer to slide 20.

PE / VC

16

• “Whole Portfolio” is expanding the Aladdin pipeline –

40% of new Aladdin clients leverage eFront

1

• Insight data business has grown from ~$6M to ~$30M

ACV and models over 12,000 funds and 141,000

underlying assets

2

Aladdin Community

• Monitoring assets across private equity businesses

• Centralized deal management across all private

markets

• 2.25M transactions booked on eFront

3

• 1000+ eFront users

4

BlackRock

Unlocking operating leverage through Aladdin

Technology Case Study: Aladdin–izing Alternatives

Next generation Private

Credit solution

New solutions for Asset

Servicers: eFront Provider

Enriched private markets

analytics

More and more private

markets fund operations at

BLK on eFront

What’s coming

Note: For footnoted information, refer to slide 20.

Acquired

in 2019 to bring

into Aladdin

private markets

17

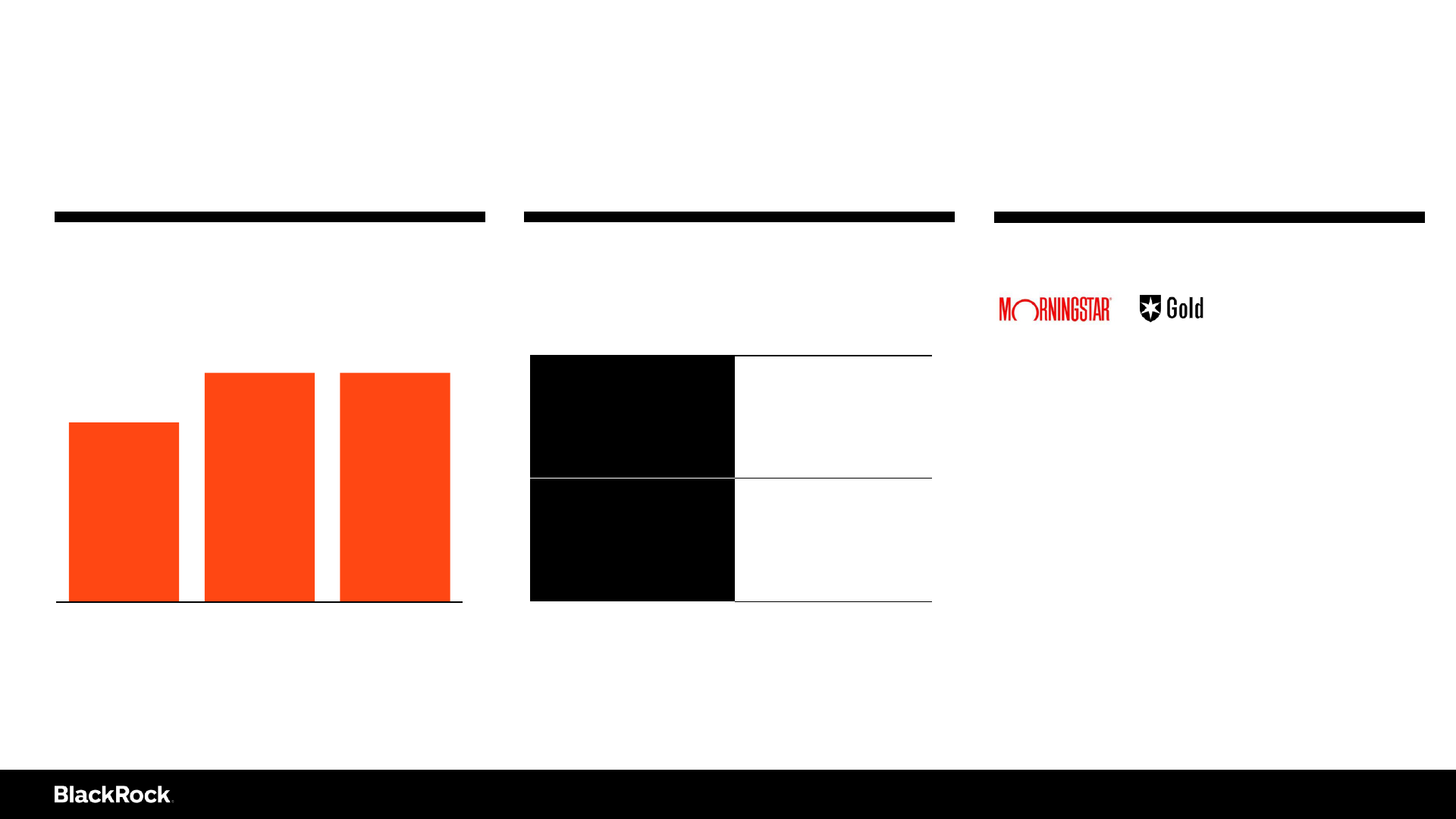

3%

3%

7%

90%

BlackRock #2-5 The rest

43%

57%

Top 5 The rest

Revenue share

of top firm in

each industry:

Asset

Management

2

U.S.

Credit

Card

Issuers

3

Market share (revenue) of industry, %

13%

80%

16%

76%

$75T

$108T

Top 5

Rest of

industry

7%

8%

BLK

Clients are consolidating to trusted providers, with room to grow

15%

Market share of asset management industry AUM, %

1

Note: For footnoted information, refer to slide 20.

2016 2022

18

The PaaS value proposition is resonating with clients more and more

No firm has been able to offer the “whole

portfolio”

Asset managers have historically been

designed around their skills as opposed to the

needs of the client

Individual relationships with several providers

are expensive from a client perspective

We start with the client, always –

their needs are our north star

We work together

as One BlackRock

We operate with excellence, passing

scale benefits through to our clients

We evolve with our clients, leading them

to trust us with more of their portfolio

of our 25 largest clients have

increased their BLK wallet

share in the last five years

1

68%

>$5B whole–portfolio

outsourcing mega mandates

won by BLK since 2019

1

~20

in NNB

1

$400B+

Our platform goal is to make it “better, faster, and cheaper” for the client to expand within the BLK ecosystem

=

The BLK Model

Note: For footnoted information, refer to slide 20.

19

End notes

These notes refer to the financial metrics and/or defined term presented on:

Slide 14 – …with the unique ability to service clients no matter their requirements

1. BlackRock 1Q23 10–Q filing.

2. BlackRock as of 3/31/23.

3. BlackRock 2022 Annual Report.

Slide 15 – The BlackRock Ecosystem in action

1. BlackRock as of 3/31/23.

Slide 16 – Combining capabilities unlocks innovation across investment strategies

1. BlackRock as of 3/31/23. Represents cumulative commitments raised since inception.

2. BlackRock as of 3/31/23.

3. eFront – “AI2 : Alternative Investments Meet Artificial Intelligence.”

4. eFront – “AI2 : Alternative Investments Meet Artificial Intelligence.”

Slide 17 – Unlocking operating leverage through Aladdin

1. BlackRock as of 3/31/23.

2. BlackRock, reflects ACV growth from acquisition close to 3/31/23. Underlying assets defined as portfolio companies and properties.

3. BlackRock as of 3/31/23.

4. BlackRock as of 3/31/23.

Slide 18 – Clients are consolidating to trusted providers, with room to grow

1. Source: 2022 asset management industry total AUM is forecasted scenario data from McKinsey Performance Lens.

2. Source: Company filings for public peers with revenue data as of 12/31/2022. Private peers data based on AUM from websites with BlackRock estimate of average fee rate to calculate revenue.

Total asset management industry 2022 revenue estimate from McKinsey Performance Lens.

3. Source: IBISWorld Credit Card Issuing Industry Report, 2022.

Slide 19 – The PaaS value proposition is resonating with clients more and more

1. BlackRock as of 3/31/23.

20

Outsourcing:

A scale engine for our clients

Stephen Cohen

Head of Europe, Middle East and Africa

Investor

Day 2023

$200B+

1Q23 LTM net new business

2

$400B+

3–year net new business

2

$500B+

5–year net new business

2

Mega mandates

2

organic growth

$252B

$73B

$280B

$114B

BlackRock’s outsourcing platform

22

$719B

Outsourcing AUM

1

Note: For footnoted information, refer to slide 29.

Outsourced CIO

EMEA & APAC Wealth Solutions

Insurance

1

Managed Models

Regulatory change Competitive pressure

Portfolio of the future Scalable growth Focus on core

strengths

Challenging macro

environment

23

The investment management industry is seeing rapid and

multi–dimensional transformation…

… changing the needs of our clients

24

Regulatory change Competitive pressure Challenging macro

environment

Portfolio of the future Scalable growth Focus on core

strengths

Clients are looking to scaled asset managers to provide a whole platform of

investment management and technology services

$2.9

$5.3

Whole portfolio

outsourcing is

growing faster

than the

industry

AUM ($T)

Global whole portfolio solutions market

1

CAGR

16%

Note: For footnoted information, refer to slide 29.

2017

2022

25

Local

Presence and

Talent

TechnologyGlobal Scale Diversity and

Breadth of

Platform

Trusted

Execution

Delivering outsourcing solutions to clients

26

BlackRock is well–positioned for growth in outsourcing through

our global scale, broad investment platform and technology

Clients are entrusting us with their portfolios in every region

27

Wealth Managers

Corporate Pensions

Asia–Pacific

State Pensions

Insurance Companies

Corporate Pensions

Endowments

Family Offices

Asset Managers

Private Banks

U.S., Canada & LatAm

Wealth Managers

Corporate Pensions

Pensions Consolidator

Insurance Companies

Family Offices

Charities

Europe, Middle East & Africa

Support our

clients’ long–term

growth

By delivering scale and

service, we grow as

clients grow

Expanding into

new markets

Across regions and

client types

Creating

enhanced value

for our clients

And a scalable

platform for

BlackRock

Driving

innovation

Combining

investment and

technology

BlackRock is driving investment management and

technology transformation for our clients

28

End notes

29

These notes refer to the financial metrics and/or defined term presented on:

Slide 22 – BlackRock’s outsourcing platform

1. AUM as of 3/31/23. Insurance assets represent AUM associated with insurance mandates greater than $5B in assets.

2. Mega mandates reflect client outsourcing assignments greater than $5B over last for 1, 3 and 5 year periods ending 3/31/23.

Slide 25 – Whole portfolio outsourcing is growing faster than the industry

1. Sources: Cerulli for Wealth SMAs, as of Q2 2022; P&I for OCIO, as of 1Q22; Morningstar for U.S. unaffiliated models, as of Q1 2022. Does not include Wealth Solutions due to lack of data

availability.

Innovating Aladdin®

for the future

Sudhir Nair

Global Head of Aladdin

Investor

Day 2023

$1.4B

2022 revenue

1

12%

3–year revenue CAGR

2

98%

3–year average client retention

3

Technology revenue

BlackRock’s Aladdin® technology solves for key aspects of the

investment process

For institutional investors

Aladdin Enterprise Aladdin Risk Aladdin Climate

eFront

Aladdin Accounting Aladdin Studio

For wealth managers

Aladdin Wealth

For asset servicers

Aladdin Provider

Note: For footnoted information, refer to slide 41.

31

Industry dynamics are reshaping the investment landscape

End Investors

Demand custom–tailored portfolios at high value for money

Wealth Managers & Distributors

Serve end clients with a high–quality value proposition

Investment Managers

Need technology to operate horizontally and efficiently

Technology & Data Providers

Deliver solutions that are integrated and cost–effective

32

BlackRock delivers

differentiated growth

through technology innovation

Expanding the

suite of capabilities

Pursuing new

client segments

Creating a

platform with 3

rd

party partners

Enabling

technology

transformations

Expanding the

suite of capabilities

Pursuing new

client segments

Creating a

platform with 3

rd

party partners

Enabling

technology

transformations

BlackRock delivers

differentiated growth

through technology innovation

Expanding the

suite of capabilities

End–to–end capabilities

Multi–asset

Sustainability

+

+

+

Expanding the

suite of capabilities

Pursuing new

client segments

Creating a

platform with 3

rd

party partners

Enabling

technology

transformations

BlackRock delivers

differentiated growth

through technology innovation

Pursuing new

client segments

U.S. → Global

Public markets → Private markets

Institutional → Wealth

Expanding the

suite of capabilities

Pursuing new

client segments

Creating a

platform with 3

rd

party partners

Enabling

technology

transformations

BlackRock delivers

differentiated growth

through technology innovation

Creating a platform with

3

rd

party partners

Technology

partners

Asset servicing

network

Strategic

investments

1

Note: For footnoted information, refer to slide 41.

$1.4B

ACV

2

in 2022

17

New large client

wins

4

in 2022

11%

3–Year ACV

CAGR

3

$0.8

$1.0

$1.1

$1.3

$1.4

Aladdin® is a high–quality, fast–growing technology business

that fuels BlackRock's growth

Technology services revenues

1

($B)

15%

CAGR

20192018 2020 2021 2022

37

Note: For footnoted information, refer to slide 41. Annual Contract Value (ACV) represents forward–looking recurring subscription fees under client contracts for the next twelve months at the end of a respective quarter, assuming all client contracts that

come up for renewal are renewed. ACV excludes nonrecurring fees such as implementation and consulting fees.

~11% of market captured

Of ~$12.5B addressable market

Market share increasing

By continuously investing in our platform and

solving for client needs

Continued growth expected

From winning new clients, expanding to

adjacent markets and creating a network of

ecosystem partners

The market opportunity for Aladdin® continues to grow

~$5B

Large institutional &

wealth managers

~$12.5B addressable market

1

:

Note: For footnoted information, refer to slide 41.

Aladdin

®

Platform:

~$1.4B

~$6B

Smaller

institutions

38

Enabling a

Whole Portfolio

ecosystem

Opening Aladdin®

Empowering our

clients through

data

Leading in

sustainability

Investing in our engineering talent

Our strategy targets the needs of the future investor

Leveraging new technology

39

BlackRock is

leading through

innovation

Aladdin® is

interwoven into

BlackRock’s

strategy

Technology

revenues are

diversified

Low to mid–teen

long–term

growth target

We are delivering on our mission to make Aladdin®

the language of portfolios

40

End notes

These notes refer to the financial metrics and/or defined term presented on:

Slide 31 – BlackRock’s Aladdin® technology solves for key aspects of the investment process

1. Technology services revenue per BLK 2022 Form 10–K filing. Revenue as of 12/31/2022.

2. BLK Form 10–K filings for respective years. 3–year CAGR represents 2019–2022.

3. Client retention represents annual contract value 'ACV' at the beginning of the year less client attrition during the year, divided by ACV at the beginning of the year. ACV represents forward–looking

recurring subscription fees under client contracts for the next twelve months at the end of a respective quarter, assuming all client contracts that come up for renewal are renewed. ACV excludes

nonrecurring fees such as implementation and consulting fees. Management believes ACV is an effective metric for reviewing BlackRock’s technology services’ ongoing contribution to its operating

results and provides comparability of this information among reporting periods while also providing a useful supplemental metric for both management and investors of BlackRock’s growth in

technology services revenue over time, as it is linked to the net new business in technology services. ACV represents forward–looking, annualized estimated value of the recurring subscription fees

under client contracts, assuming all client contracts that come up for renewal are renewed, unless we received a notice of termination, even though such notice may not be effective until a later date.

ACV also includes the annualized estimated value of new sales, for existing and new clients, when we execute client contracts, even though the recurring fees may not be effective until a later date and

excludes nonrecurring fees such as implementation and consulting fees.

Slide 36 – Creating a platform with 3

rd

party partners

1. Subject to customary regulatory and closing conditions. Minority investment in Avaloq expected to close in 2Q 2023.

Slide 37 – Aladdin® is a high-quality, fast–growing technology business that fuels BlackRock's growth

1. BLK Form 10–K filings for the period 2018–2022.

2. ACV represents forward–looking recurring subscription fees under client contracts for the next twelve months at the end of a respective quarter, assuming all client contracts that come up for

renewal are renewed. ACV excludes nonrecurring fees such as implementation and consulting fees. See note on slide 37 for more information on ACV.

3. Represents CAGR for 2019–2022. See note on slide 37 for more information on ACV.

4. Large clients represent new mandates over $1 million annual subscription revenues signed in 2022.

Slide 38 – The market opportunity for Aladdin® continues to grow

1. McKinsey and P&I data as of year–end 2022 and internal BlackRock estimates.

41

A scale growth platform to access

an expanding world of investments

Salim Ramji

Global Head of iShares and Index Investments

Investor

Day 2023

$719B

3–year ETF net new business

2

10

%

3–year average ETF

organic asset growth

3

$1.1B

3–year ETF organic revenue growth

2

$5.7B

FY 2022 ETF revenue

5

ETF organic asset and revenue growth

8

%

3–year average ETF

organic revenue growth

4

3–year compounded

annual ETF growth rate

8

%

$6.8B

FY 2022 Total ETF & Index revenue

5

ETF & Index Investing at BlackRock is a scale growth platform

$3.1T

$2.9T

$5.9T

ETF & Index AUM

1

Institutional Separate Accounts, Index Mutual Funds & Sub–Advisory

ETFs

Note: For footnoted information, refer to slide 54.

43

iShares Factor ETFs

iShares Thematic ETFs

iShares Sustainable and Transition ETFs

iShares Core ETFs

Over 1,300 ETF choices to access a world of investments

2

P

iShares Fixed Income ETFs

iShares Precision ETFs

BlackRock Alpha–Seeking ETFs

BlackRock and third–party managed model portfolios

ETF technology access to

more investments

Custom/direct indexing,

active risk, voting choice

Leading ETF quality &

tracking performance

Algos & automation

across trading processes

Shift to multiple ETF

servicers & providers

BlackRock’s ETF & Index Investing platform is differentiated

Individual investors through digital wealth platforms

Wealth managers primarily through model portfolios

Asset managers through active use cases of ETFs

Asset owners: insurers, official institutions and pensions

iShares ETFs are used by 40 million people globally

1

Note: For footnoted information, refer to slide 54.

A scaled ETF & Index Investing “engine” that delivers performance, customization, and scale

44

iShares generated high single–digit organic revenue growth,

driven by strategic product segments

iShares ETF product segments:

30%

50%

27%

33%

15%

13%

37%

35%

60%

AUM Revenue 3Y organic

revenue growth

$5.7B $1.1B

Note: For footnoted information, refer to slide 54.

$3.1T

8%

organic

revenue

growth

5

17 bps

8 bps

31 bps

18 bps

1 3

4

Effective

fee rate

2

Strategic ETF segments

Enabling clients to efficiently access:

• An expanding universe of Fixed Income exposures

• Sources of return from active risk benchmarks

(Factor, Sustainable/Transition, Thematic)

Core equity ETFs

• Serves buy–and–hold clients with low cost ETFs

• Grows assets and revenues

Precision ETFs

• Targeted, liquid exposures for tactical allocators

• Market–driven growth

14%

7%

4%

45

$279

$296

$314

$318

$462

$1,108

ETF Issuer #6 ETF Issuer #5 ETF Issuer #4 ETF Issuer #3 ETF Issuer #2 iShares ETFs

iShares generated over $1.1 billion in organic revenue growth, more

than the next three ETF issuers combined

Strategic ETF segments

Fixed Income, Factor,

Sustainable/Transition,

Thematic

Core Equity ETFs

Precision ETFs

3 year organic revenue growth ($M)

1

Leveraged Active IndexIndex Index

Note: For footnoted information, refer to slide 54.

46

4

8

12

19

1

2

3

6

$5T

$10T

$15T

$25T

2018 1Q23 2025P 2030P

Projected ETF industry AUM ($T)

4

We expect the ETF industry to grow to $25T of AUM by 2030

Fixed Income ETFs Equity ETFs

Fixed income: ETFs modernizing the bond

market with more clients seeking efficiency

Model portfolios: $4.2T market growing

16% with ETFs expanding share in wealth

2

Technology: ETFs unlocking access to an

expanding world of active & index investing

Industry trends driving ETF adoption

Digital wealth: $17T market growing 15% as

ETFs become the preferred vehicle

1

<1% fixed income

<3% equities

<2% fixed income

<7% equities

<3% fixed income

<9% equities

ETFs still a small % of global capital markets

3

<5% fixed income

<10% equities

Note: For footnoted information, refer to slide 54.

47

Modernize the bond

market by unlocking

client use cases for

fixed income ETFs

to generate returns

more efficiently.

Enable wealth and

asset manager CIOs to

build and customize

managed models with

iShares and BlackRock

ETFs.

Increase investment

access for tens of millions

of people by making

iShares central on

digital wealth platforms.

01

Generate a majority of ETF

flows through models

1

Triple fixed income ETF assets

to $2.5T by 2030

1

Triple ETF assets in digital

wealth to $1T by 2030

1

02 03

BlackRock’s platform improves clients’ access to investments and

unlocks multiple trillion–dollar growth opportunities

Note: For footnoted information, refer to slide 54.

48

$0.2T

$0.35T

$0.7T

$1.0T

2018 2022 2027T 2030T

Triple ETF assets in digital wealth to $1T by 2030

Global iShares ETF AUM

on digital wealth platforms ($T)

1

Increase investment access for tens of millions of people by

making iShares central on digital wealth platforms

1

Note: For footnoted information, refer to slide 55.

3x

Digital wealth is a global growth channel

iShares is growing adoption through

commission–free trading globally

Tens of millions of people use iShares

ETFs on digital wealth platforms globally

Millions of iShares ETF savings plans are

being adopted across Europe

iShares is investing in greater awareness

with the mass affluent

49

Managed models are growing and our breadth of ETFs

are playing an expanded role in portfolios

U.S. managed

model industry size ($T)

2

2022 2027E

33%

>50%

2020 2022

Enable wealth and asset manager CIOs to build and customize

managed models with iShares and BlackRock ETFs

2

Note: For footnoted information, refer to slide 55.

U.S. iShares flows from

managed models (%)

1

A majority of iShares ETF flows are now from managed

models, especially third party managed models

>2x

Wealth models (home office & advisor–driven) & asset manager models

BlackRock managed models

$4.2T

>$9.0T

U.S. managed model industry invested in ETFs

U.S. managed model industry invested in mutual funds, SMAs & other investments

50

Triple fixed income ETF assets to $2.5T by 2030

Global iShares fixed income

ETF AUM ($T)

6

Modernize the bond market by unlocking client use cases for

fixed income ETFs to generate returns more efficiently

6 of 10

largest U.S.

Insurance

companies use

iShares fixed

income ETFs

4

Liquidity: 8 of the top 10 most liquid

fixed income ETFs are iShares

2

Choice: ~500 ETFs tracking slices of

the global bond market

1

Access: lower trading costs vs.

underlying bond trading

Performance: active processes to

generate tracking and liquidity

$0.4T

$0.8T

$1.6T

$2.5T

2018 1Q23 2027T 2030T

Unique features of iShares are unlocking active client use cases

Note: For footnoted information, refer to slide 55.

3

9 of 10

largest asset

managers use

iShares fixed

income ETFs

3

43

Official institutions,

including 21 central

banks use iShares

fixed income ETFs

5

3x

51

ETF technology for active

& outcome strategies

Expansion of

custom / direct indexing

& active risk

Tokenization as a new

investment wrapper

More efficient access to

digital & alternatives

Market modernization &

ETF on–ramps

ETF technology access to

more investments

>1,000 benchmarks tracked

across countries, sectors &

asset classes

1

Custom / direct indexing,

active risk, voting choice

Custom/direct indexing: ~$150B

2

Active risk benchmarks: $1.1T

3

Voting choice: $2.2T

4

Leading ETF quality &

tracking performance

Exchange bid–ask spreads are

half the industry average in

Europe & the U.S.

5

Algos & automation

across trading processes

Systems–driven, rules–based

approach enables scale &

customization

Shift to multiple ETF

servicers & providers

Adds scale, diversification &

increased operating leverage

for BlackRock

BlackRock’s ETF & Index Investing “engine”

Our investment “engine” enables performance and customization at scale

Our platform enables innovative access to new markets and growth opportunities

Note: For footnoted information, refer to slide 55.

BlackRock’s investment “engine” delivers performance and

customization at scale and innovative access to new markets

52

A differentiated

ETF & Index business

• Efficient access for tens of millions

of people

• Breadth of high quality

investments

• Leading organic revenue growth,

driven by strategic segments

Multiple trillion–dollar

growth opportunities

• Triple ETF assets in digital wealth

worldwide

• Generate a majority of ETF flows

through managed models

• Triple fixed income ETF assets by

unlocking client use cases

Scale investment “engine”

enabling innovation

• Leading performance &

customization at scale

• Diversity of service providers &

operating leverage

• Innovative access to new markets

and investments

ETF & Index Investing at BlackRock is a scale growth platform to

access an expanding world of investments

53

End notes

These notes refer to the financial metrics and/or defined term presented on:

Slide 43 – ETF & Index Investing at BlackRock is a scale growth platform

1. Source: BlackRock, as of March 31, 2023.

2. Source: BlackRock, as of March 31, 2023. Net new business (NNB) represents net asset inflows and organic revenue growth represents net new base fees (NNBF) earned on net asset inflows.

3. Source: BlackRock, as of March 31, 2023. Organic asset growth rate calculated by dividing net new business (NNB) over beginning of period AUM and averaging annual growth rates over the thirty–six month period.

4. Source: BlackRock, as of March 31, 2023. Organic revenue growth rate calculated by dividing net new base fees (NNBF) earned on net new business (NNB) by the base fee run–rate at the beginning of period and averaging annual

growth rates over the thirty–six month period.

5. Revenue includes base fees and from securities lending revenue.

Slide 44 – BlackRock’s ETF & Index Investing platform is differentiated

1. The nearly 40 million figure estimates the number of individual investors that are using iShares ETFs. Sources:

• United States: Sources: Broadridge Financial Solutions, as of March 31, 2023. BlackRock estimate, as of March 31, 2023. Approximately 33 million people use iShares based on a ticker–level analysis of unique, anonymized

individual brokerage account numbers that hold at least one iShares ETF and have an account balance greater than $0.

• Europe: Sources: ExtraETF, as of March 2022: “2026 ETF Savings Plans Market: How Retail Investors Invest in ETFs.” BlackRock estimate, as of March 31, 2023. Approximately 50% of iShares clients in Europe invest in iShares

ETFs through savings plans.

2. Source: BlackRock, as of March 31, 2023.

Slide 45 – iShares generated high single–digit organic revenue growth, driven by strategic product segments

1. Source: BlackRock, Bloomberg, as of March 31, 2023.

2. Source: BlackRock, as of March 31, 2023. Effective fee rate represents the annualized effective fee rate, defined as run–rate base fees: individual product NAVs multiplied by individual product TER, aggregated and divided by total

segment assets under management.

3. Source: BlackRock, Bloomberg, as of March 31, 2023. Run–rate revenue represents the base fee run–rate at the beginning of period.

4. Source: BlackRock, for the thirty–six month period between April 1, 2020 and March 31, 2023. Organic revenue growth represents net new base fees (NNBF) earned on net asset inflows.

5. Source: BlackRock, as of March 31, 2023. Three year organic revenue growth rate calculated by dividing net new base fees earned on net asset inflows by the base fee run–rate at the beginning of period and averaging over the three

year period.

Slide 46 – iShares generated over $1.1 billion in organic revenue growth, more than the next three ETF issuers combined

1. Source: BlackRock, Bloomberg. Organic revenue growth represents annualized base fee revenue earned on net asset inflows. Data covers the period between April 1, 2020 to March 31, 2023.

Slide 47 – We expect the ETF industry to grow to $25T of AUM by 2030

1. Source: BlackRock, as of March 31, 2023.

2. Sources: Broadridge Global Advisory Services, as of May 31, 2023: “U.S. advisor sold asset management: this time it’s personal”. BlackRock, as of March 31, 2023: “A Model Moment for Asset Managers”. Managed model portfolio

market sizing includes both ETF and non–ETF allocations within managed models.

3. Source: SIFMA Capital Markets Factbook, as of December 31, 2022. Figures represent the equity and bond market sizes globally.

4. Source: BlackRock, as of March 31, 2023. Estimates include 2025 and 2030 scenario calculations based on proprietary research. Subject to change. The figures are for illustrative purposes only and there is no guarantee the projections

will come to pass.

Slide 48 – BlackRock’s platform improves clients’ access to investments and unlocks multiple trillion–dollar growth opportunities

1. 2030 represents target. Multi–trillion dollar growth opportunities described are for illustrative purposes only and are subject to change. There is no guarantee the figures will occur in the time periods described.

54

End notes

These notes refer to the financial metrics and/or defined term presented on:

Slide 49 – Increase investment access for tens of millions of people by making iShares central on digital wealth platforms

1. Source: BlackRock, as of March 31, 2023. 2027T and 2030T are targets. Estimates include 2027 and 2030 scenario calculations based on proprietary research. Growth opportunities described are for illustrative purposes only and are

subject to change. There is no guarantee the figures will occur in the time periods described.

Slide 50 – Enable wealth and asset manager CIOs to build and customize managed models with iShares and BlackRock ETFs

1. Third–party flows include wealth models, including advisor–driven models created by financial advisors, e.g., Rep as PM and RIAs and home office models created by centralized, in–house investment teams at wealth managers. Third–

party flows also include models managed by other asset managers that distribute models through wealth managers. Source: BlackRock, iShares Global Business Intelligence, as of March 31, 2023.

2. $4.2T U.S. model portfolio industry size includes: $2.1T of advisor–driven models; $1.6T of home–office models; $415B third–party asset manager models; and $114B of BlackRock–managed models, primarily captured in BlackRock

Retail and ETF AUM. Growth opportunities described are for illustrative purposes only and are subject to change. Sources:

• Wealth models. Advisor–driven: Broadridge Global Advisory Services, as of May 2023: “U.S. advisor sold asset management: this time it’s personal”. Home office models: Cerulli, as of December 2022: “U.S. Asset Allocation Model

Portfolios 2022: Model Customization and Tax Optimization”, as of December 31, 2022.

• Third–party asset manager models. “U.S. Asset Allocation Model Portfolios 2022: Model Customization and Tax Optimization”, as of December 31, 2022.

• BlackRock managed models. BlackRock, as of March 31, 2023.

Slide 51 – Modernize the bond market by unlocking client use cases for fixed income ETFs to generate returns more efficiently

1. Source: BlackRock, as of March 31, 2023.

2. Source: Bloomberg, for the period between January 1, 2022 and December 31, 2022. BigXYT, for the period between January 1, 2022 and December 31, 2022.

3. Source: BlackRock, as of December 31, 2022. Analysis of SEC 13–F filings for U.S. domiciled asset managers and BlackRock analysis of self–reported holdings by asset managers in Europe and Asia. Top 10 global asset managers

determined by Pensions & Investments.

4. Source: BlackRock, S&P Global Intelligence and Bloomberg, as of December 31, 2022. Analysis of filings with the National Association of Insurance Commissioners (NAIC) and the Securities and Exchange Commission (SEC).

5. Source: BlackRock, as of March 31, 2023. Estimate based on client engagements, as of March 31, 2023.

6. Source: BlackRock, estimates as of March 31, 2023. 2027T and 2030T are targets. Growth opportunities described are for illustrative purposes only and are subject to change. There is no guarantee the figures will occur in the time

periods described.

Slide 52 – BlackRock’s investment “engine” delivers performance and customization at scale and innovative access to new markets

1. Source: BlackRock, iShares Global Business Intelligence, as of March 31, 2023.

2. Source: BlackRock, Aperio, as of March 31, 2023. ~$150B in custom/direct indexing includes AUM managed in index equity SMAs by Aperio for wealth management clients and in custom/direct indexing mandates. All client transitions

to custom/direct indexing have been funded.

3. Source: BlackRock, as of March 31, 2023. $1.1T of ETFs managed against active risk benchmarks include: factor–based investment strategies that target specific drivers of return (growth, value, momentum, and minimum volatility

indexes); sustainable strategies that encompass exclusionary screens, optimization or various metrics that tilt toward a client’s unique ESG objective; thematic benchmarks that aim to capture long–term secular trends; capped indexes

that include modified market cap–weighted, optimized country or optimized sector benchmarks; additional indexes with alt–weighted methodologies (e.g., equal–weighted).

4. Source: BlackRock, as of March 31, 2023. $2.2T includes client funds participating in BlackRock Voting Choice. Assets include index equity assets held in multi–asset fund of funds strategies. Certain institutional pooled funds that

implement Systematic Active Equity (SAE) strategies are also eligible for BlackRock Voting Choice but are not displayed in the chart. Eligible SAE institutional pooled funds and separate accounts amount to $102B in eligible Voting

Choice assets.

5. Source: BlackRock, as of March 31, 2023. Exchange bid–ask spreads defined as ETF trading costs as compared to the industry average in both Europe and the United States.

55

Growth beyond the U.S.

Building BlackRock in local markets

Rachel Lord

Chair and Head of APAC

Investor

Day 2023

$628B

3–year net new business

2

7

%

3–year avg.

organic

asset growth

3

$1.0B

3–year net new base fees

4

3–year Avg.

Organic base

fee growth

5

6

%

$8.3B

2022 Revenue

6

3–year

CAGR

7

4

%

Non–U.S. organic growth and revenue

BlackRock’s international platform

$428B

$927B

$1,138B

$130B

$245B

$463B

$133B

Americas ex–U.S.

UK

Europe ex–UK

Middle East & Africa

Asia ex–Japan

Japan

Australasia

Note: For footnoted information, refer to slide 63.

$3.5T

non–US

client assets

1

57

Americas ex-US Asia ex–Japan AustralasiaJapanMiddle East &

Africa

UK Europe ex–UK

We have deep local presence

Strong Regional Connectivity

1

Note: For footnoted information, refer to slide 63.

58

$400B+ AUM

~400 employees

$900B+ AUM

~3,700 employees

$1.1T+ AUM

~2,300 employees

$100B+ AUM

50+ employees

$200B+ AUM

3,700+ employees

$400B+ AUM

~400+ employees

$100B+ AUM

~200+ employees

Powered by our localized approach and global platform

Global platform

✓ Global investment capabilities

✓ Global client specialization

✓ Operational and risk platform

✓ Technology

✓ Insights and thought leadership

Localized approach

✓ Investing strengths

✓ Market expertise

✓ Client relationships

✓ Client service

✓ Country leaders

4%

6%

BlackRock

(excluding U.S.)

Industry

(excluding U.S.)

Outpacing the broader industry

3–Year Organic Asset Growth, 2020–2022

1

(%)

How we drive growth and create value for our clients

and shareholders

Note: For footnoted information, refer to slide 63.

59

Outsourcing and

Asset Allocation

Wealth

Distribution

Private Markets

Technology

Global & Local

ETFs

Opportunity in developed local markets

Growth in local markets driven by key

strategic focus areas…

…with non–U.S. markets continuing to

drive market share gains

Germany

Industry

2

BlackRock

1

$4.4T AUM$191B AUM

+10% org. growth +4% org. growth

Japan

$5.4T AUM$463B AUM

+15% org. growth +8% org. growth

Australia &

New Zealand

$2.2T AUM$133B AUM

+15% org. growth +4% org. growth

Note: For footnoted information, refer to slide 63.

60

Opportunity in fast–growing local markets

How we differentiate ourselves

Positioning for the future

China

• Building our presence in a

growing market for retirement

products

• Expanding local reach

through JV and wholly–owned

domestic businesses

+9.5%

projected growth of China

asset management industry

through 2030

3

Building offshore presence

India

• Driving investment in public

and private markets

• Leading international investor

in Indian public markets

$6.8B+

of Indian exposures for

global investors

2

Partnering in infrastructure

Saudi Arabia

• Decades–old institutional

business, with local team

established in 2019

• Newly established

infrastructure platform with

strong pipeline for future

investment

$15B+

investment in natural

gas pipelines

Embedded local asset manager

Mexico

• Diverse platform across local

and international ETFs, mutual

funds, private markets, and

risk management technology

530+

BlackRock ETFs and mutual

funds locally distributed

1

Note: For footnoted information, refer to slide 63.

61

Manager

consolidation

Clients increasingly

focusing on fewer partners

amid cost pressures

Regional

investing

Increasingly localized

product offering

Global and local

insights

Combining macro thought

leadership with regional

knowledge

Growth of

wealth markets

Emergence of digital

distribution products in

growing markets

APAC

Sustainable

investing

Sustainable products

driving a tectonic shift in

capital

Portfolio

customization

Significant growth in

customized portfolios and

OCIO

Government

policy

Ambitious government

agendas, but fragmented

regulation

Digital revolution

in wealth

New generation of individual

savers moving into

investment products

62

EMEA

We see regional industry trends as strong tailwinds for

BlackRock to consolidate share

End notes

63

These notes refer to the financial metrics and/or defined term presented on:

Slide 57 – BlackRock’s international platform

1. AUM as of 3/31/23. AUM refers to client assets in each region.

2. Represents last 3 years ending 3/31/23. Net new business represents net asset inflows.

3. Represents last 3 years ending 3/31/23. Organic asset growth rate calculated by dividing net asset inflows over beginning of period assets.

4. Represents last 3 years ending 12/31/22. Net new base fees represents net new base fees earned on net asset inflows.

5. Organic base fee growth rate calculated by dividing net new base fees earned on net asset inflows by the base fee run–rate at the beginning of period.

6. Revenue includes base, securities lending and performance fees.

7. 3–year CAGR represents 2020–2022.

Slide 58 – We have deep local presence

1. Data as of 3/31/23. AUM refers to client assets in each region.

Slide 59 – How we drive growth and create value for our clients and shareholders

1. Source: Broadridge for industry data. Represents last 3 years ending 12/31/22. Organic asset growth rate calculated by dividing net asset inflows over beginning of period assets.

Slide 60 – Opportunity in developed local markets

1. AUM as of 3/31/23. Organic growth reflects organic asset growth over the last 3 years (2020–2022) to align with industry data.

2. Source: BVI, Japan Investment Advisers Association; The Investment Trusts Association Japan, Rainmaker, RBNZ, and BlackRock FMA for industry data. AUM as of 3/31/23. Organic growth reflects

organic asset growth over the last 3 years (2020–2022) due to data availability.

Slide 61 – Opportunity in fast–growing local markets

1. Source: BlackRock. Data as of 4/30/23.

2. Source: BlackRock. Data as of 12/31/22.

3. Source: CICC estimates as of August 2022.

Active for the portfolio

of the future

Rich Kushel

Head of the Portfolio Management Group

Investor

Day 2023

$570B

3–year net new business

2

8

%

3–year average

organic asset growth

3

$1.1B

3–year net new base fees

2

$7.3B

2022 Base and Performance Fees

5

Organic growth and revenue

3–year CAGR

6

(15)

%

7

%

(2)

%

7

%

3–year average organic

base fee growth

4

$411B

$1,099B

$758B

$207B

Equity Fixed Income Multi–asset Alternatives

$2.5T

Active AUM

1

BlackRock active strategies

Note: For footnoted information, refer to slide 76.

65

$1,947

$2,251

$2,606

$2,317

$2,474

2.9%

3.0%

3.1%

3.2%

2019 2020 2021 2022 1Q23

BlackRock Active AUM ($B) % Market Share

BlackRock active market share

2

Note: For footnoted information, refer to slide 76.

BlackRock is growing faster than the industry, and has

significant room to grow share

7%

5%

12%

5%

12%

2%

1%

4%

(1%)

2019 2020 2021 2022 1Q23

Ann'd

BlackRock Organic Growth Industry Organic Growth

BlackRock and industry active organic asset growth

1

Note: For footnoted information, refer to slide 76.

66

# Funds % of AUM

Equity

73 60

%

Fixed

Income

45 59

%

Multi–Asset &

Alternatives

47 57

%

Strong lineup of 4– and 5–star active mutual funds

2

78%

90%

90%

83%

66%

71%

81%

64%

90%

Fundamental Equity Systematic Equity Taxable Fixed Income

3/31/2018 3/31/2020 3/31/2023

Differentiated long–term performance

% of assets above benchmark or peer median for the 5–year period

1

Note: For footnoted information, refer to slides 76. Past performance is not indicative of future results

Strong relative performance across active platform

Note: For footnoted information, refer to slide 76. Past performance is not indicative of future results.

67

EMEA & APAC Wealth Solutions AUM ($B)BlackRock–Managed Models ($B)

1

$34

$114

2018 1Q23

BlackRock-Managed Model AUM ($B)

33%

CAGR

BlackRock Outsourced CIO AUM ($B)

$1

$73

2018 1Q23

BlackRock Int'l Wealth AUM ($B)

$110

$252

2018 1Q23

BlackRock OCIO AUM ($B)

22%

CAGR

174%

CAGR

BlackRock’s whole portfolio business is delivering outcomes for

clients, and unlocking new channels for delivering active

Note: For footnoted information, refer to slide 76.

68

>$9.0T

$2.1

$1.6

$0.4

Potential

Opportunity

Advisor Driven Home Office Third-Party

U.S. Model Adoption and Addressable Market ($T)

2

2022 industry estimates

5–year expected growth

$4.2

>2x

1.4

2.7

1.4

2.3

2017 2022

Outsourced CIO and U.S. Wealth SMA Industry ($T)

1

CAGR

(2017–2022):

U.S. Wealth SMAs

11%

Outsourced CIO

15%

$2.9

$5.1

13%

CAGR

Note: For footnoted information, refer to slides 76.

Accelerating demand for whole portfolio solutions

and model portfolios

Note: For footnoted information, refer to slide 76.

69

\

U.S. Advisor Segments and Model Outsourcing

2

0%

10%

20%

5% 7% 9% 11% 13% 15% 17%

Broker

Dealers

Home

Office

RIA

Industry AUM Growth Rate

% of assets

that are

outsourced

models

Traditional

model buyers

increasingly

saturated

5%

7%

17%

67%

Advisor Industry Model Industry 3rd-Party Model

Industry

BLK Models

Organic CAGR

(2019–2021)

U.S. Model Portfolio Solutions Industry

1

BLK outpaced the industry 4x

BlackRock model growth outpacing the industry, with

additional channels to drive growth

Note: For footnoted information, refer to slide 76.

70

Custom Model Solutions (CMS): differentiated outcome–

oriented capabilities through mass customization

Scaled

infrastructure

through

Aladdin

BlackRock

building

blocks

Strong RIA

relationships

Custom

models

$23B

Q1 2023 AUM

$8B

NNB in 2022 and Q1 2023

$15M

NNBF in 2022 and Q1 2023

71

Account

size

Qualified Illiquid & other

Below $500K

(13%)

$500K – $2M

(51%)

$2M–$5M

(16%)

Over $5M

(20%)

Taxable

Difficult to reach

(UHNW, Illiquids)

% of each RIA

firm assets

26%

38%

36%

Expanding custom model offerings to grow share

with RIA clients

Whole portfolio expanded reach

(with Aperio, Munis, tax)

Current CMS reach

Typical RIA Custom Model Solutions Client

1

:

Asset Breakdown

Note: For footnoted information, refer to slide 76.

72

Manager

research

Client

reporting

Models

infrastructure

Investment

tools

We win in whole portfolios by managing complexity for our

clients, leveraging our technology to scale

Scalable

Strategic, robust, performant

solutions

Flexible

Easily extendable and designed for

varying client use–cases

Integrated

Scaled across our Aladdin platform

73

World–class investment building

blocks designed to meet evolving

client needs

Active Equities

Multi–Asset

Private Markets

iShares & Index

Cash Management

Active Fixed Income

Combining our investment solutions with asset allocation

expertise to deliver investment outcomes for clients

Portfolio

construction &

asset allocation

expertise

74

Delivering

traditional active

strategies through

whole portfolios

Unlocking new

markets to deliver

alpha in innovative

ways for clients

Effectively

managing

complexity and

delivering alpha

at scale through

technology

Ability to generate durable alpha for clients and differentiated organic

asset and base fee growth for shareholders over the long–term

Well positioned to meet evolving client demand for active over

the long–term

75

End notes

These notes refer to the financial metrics and/or defined term presented on:

Slide 65 – BlackRock active strategies

1. AUM as of 3/31/23.

2. Represents last three years ending 3/31/23. Net new business represents net asset inflows and Net new base fees represents net new base fees earned on net asset inflows.

3. Represents last three years ending 3/31/23. Organic asset growth rate calculated by dividing net asset inflows over beginning of period assets.

4. Represents last three years ending 3/31/23. Organic base fee growth rate calculated by dividing net new base fees earned on net asset inflows by the base fee run–rate at the beginning of period.

5. Revenue includes base, securities lending and performance fees.

6. 3–year CAGR represents compounded annual growth rate for the three years ending 2022.

Slide 66 – BlackRock is growing faster than the industry, and has significant room to grow share

1. Source: Simfund for U.S. MFs, Broadridge for non–U.S. MFs and Institutional, Bloomberg for ETFs, HFR for Hedge Funds and Preqin for Illiquid Alts. BlackRock 1Q23 organic growth is annualized.

2. Source: McKinsey Performance Lens, as of YE 2021. 2022 Industry AUM per McKinsey estimates.

Slide 67 – Strong relative performance across active platform

1. Source of performance information is BlackRock’s first quarter 2023, first quarter 2020 and first quarter 2018 earnings releases. Please see appendix of this presentation for performance notes. Past performance

is not indicative of future results. Please refer to page 12 of first quarter 2023 earnings release for performance disclosure detail.

2. Source: Morningstar Fund data as of 3/31/2023. Includes all BLK global active mutual funds. % AUM is calculated out of BLK funds that have any star rating, and does not include the AUM of non–rated funds as

of 3/31/2023. Morningstar rates funds from one to five stars based on how well they’ve performed (after adjusting for risk) in comparison to similar funds. Within each Morningstar Category, the top 10% of funds

receive five stars, the next 22.5% four stars, the middle 35% three stars, the next 22.5% two stars, and the bottom 10% receive one star. Funds are rated for up to three time periods— three–, five–, and 10 years—

and these ratings are combined to produce an overall rating. Funds with less than three years of history are not rated. Ratings are objective, based entirely on a mathematical evaluation of past performance.

They’re a useful tool for identifying funds worthy of further research, but shouldn’t be considered buy or sell recommendations.

Slide 68 – BlackRock’s whole portfolio business is delivering outcomes for clients, and unlocking new channels for delivering active

1. AUM in BlackRock managed models is primarily captured in BlackRock ETF and Retail AUM; underlying assets are in BlackRock ETFs and mutual funds.

Slide 69 – Accelerating demand for whole portfolio solutions and model portfolios

1. Sources: Cerulli for Wealth SMAs, as of Q2 2022; P&I for OCIO, as of Q1 2022. Excludes Affiliated Wealth Solutions due to lack of data availability.

2. Source: Broadridge Advisory Services, 2023.

Slide 70 – BlackRock model growth outpacing the industry, with additional channels to drive growth

1. Source: Cerulli 2021 U.S. Asset Allocation Model Portfolios.

2. Sources: Cerulli “The State of U.S. Retail and Institutional Asset Management 2022” and Cerulli “U.S. Asset Allocation Model Portfolios 2022”.

Slide 72 – Expanding custom model offerings to grow share with RIA clients

1. Source: Cerulli; BlackRock estimates.

76

Built on Bonds

Rick Rieder

Chief Investment Officer of Global Fixed Income

Investor

Day 2023

$727B

3–year net new business

2

10

%

3–year average organic

asset growth

3

$576M

3–year net new base fees

2

$3.5B

2022 Base and Performance Fees

5

(2)

%

(15)

%

3–year CAGR

6

2

%

3–year average organic

base fee growth

4

6

%

$1.1T

$1.6T

BlackRock fixed income

$2.7T

Fixed Income AUM

1

Active Fixed Income

ETF & Non–ETF Index Fixed Income

$683B

Cash Management AUM

$30B

Private Credit Client AUM

across fixed income, cash, and

private credit

$3.4T

Fixed Income organic growth and revenue

Note: For footnoted information, refer to slide 87.

78

Platform delivers fixed income solutions…

BlackRock

Fixed

Income

Technology and

risk management