STARN ● O’TOOLE ● MARCUS & FISHER

A Law Corporation

TERENCE J. O’TOOLE 1209-0

ANDREW J. LAUTENBACH 8805-0

KUKUI CLAYDON (10378-0)

733 Bishop Street, Suite 1900

Pacific Guardian Center, Makai Tower

Honolulu, Hawaiʻi 96813

Telephone: (808) 537-6100

Email: [email protected];

ALIOTO LAW FIRM [Pro Hac Vice Applications Forthcoming]

JOSEPH M. ALIOTO (SBN 42680)

TATIANA V. WALLACE (SBN 233939)

One Sansome Street, 35

th

Floor

San Francisco, CA 94104

Telephone: (415) 434-8900

Email: [email protected]

Attorneys for Plaintiffs

WARREN YOSHIMOTO; KRISTIN BARROGA;

SEAN KETTLEY; CAROLYN FJORD;

DON FREELAND; DON FRY;

BILL RUBINSOHN; CLYDE D. STENSRUD

IN THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF HAWAII

WARREN YOSHIMOTO; KRISTIN

BARROGA; SEAN KETTLEY;

CAROLYN FJORD; DON

FREELAND; DON FRY; BILL

RUBINSOHN; CLYDE D.

STENSRUD,

Plaintiffs,

Case No. 1:24-cv-00173

COMPLAINT TO PROHIBIT THE

ACQUISITION OF HAWAIIAN

AIRLINES, INC. BY ALASKA

AIRLINES INC., IN VIOLATION

OF THE CLAYTON ANTITRUST

ACT, 15 U.S.C. § 18

(caption continued on next pa

g

e)

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 1 of 52 PageID.1

2

v.

ALASKA AIRLINES, INC.;

ALASKA AIR GROUP, INC.

Defendant.

COMPLAINT TO PROHIBIT THE ACQUISITION OF HAWAIIAN

AIRLINES, INC. BY ALASKA AIRLINES INC., IN VIOLATION OF THE

CLAYTON ANTITRUST ACT, 15 U.S.C. § 18

Plaintiffs WARREN YOSHIMOTO, KRISTIN BARROGA, SEAN

KETTLEY, CAROLYN FJORD, DON FREELAND, DON FRY, BILL

RUBINSOHN, and CLYDE D. STENSRUD (collectively “Plaintiffs”), by and

through their undersigned counsel, bring this Complaint to Prohibit the Acquisition

of Hawaiian Airlines, Inc. (“Hawaiian” or “Hawaiian Airlines”) by Alaska Airlines

Inc. and Alaska Air Group Inc. (“Alaska” or “Defendant”) in violation of the

Clayton Antitrust Act, 15 U.S.C. § 18.

OVERVIEW

1. Alaska’s proposed acquisition of Hawaiian not only violates federal

law because it may “substantially lessen competition or tend to create a monopoly”

in multiple markets in the passenger airlines industry

1

, but it could also threaten

Hawaiʻi’s economy and the well-being of Hawaiʻi’s people.

1

Section 7 of the Clayton Antitrust Act (15 U.S.C. § 18) provides in pertinent part

as follows: “No person engaged in commerce or in any activity affecting commerce

shall acquire, directly or indirectly, the whole or any part of the stock or other share

capital . . . where in any line of commerce or in any activity affecting commerce in

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 2 of 52 PageID.2

3

Hawaiʻi’s People and Hawaiʻi’s Economy Depend on Stable and

Predictable Air Travel

2. Unlike all other States, Hawaiʻi depends almost entirely on air travel

for its residents, visitors, and economy. A loss, or lessening, of airline capacity could

be geographically and/or economically disabling for Hawaiʻi in ways that any other

mainland destination in the United States would not experience. There are other

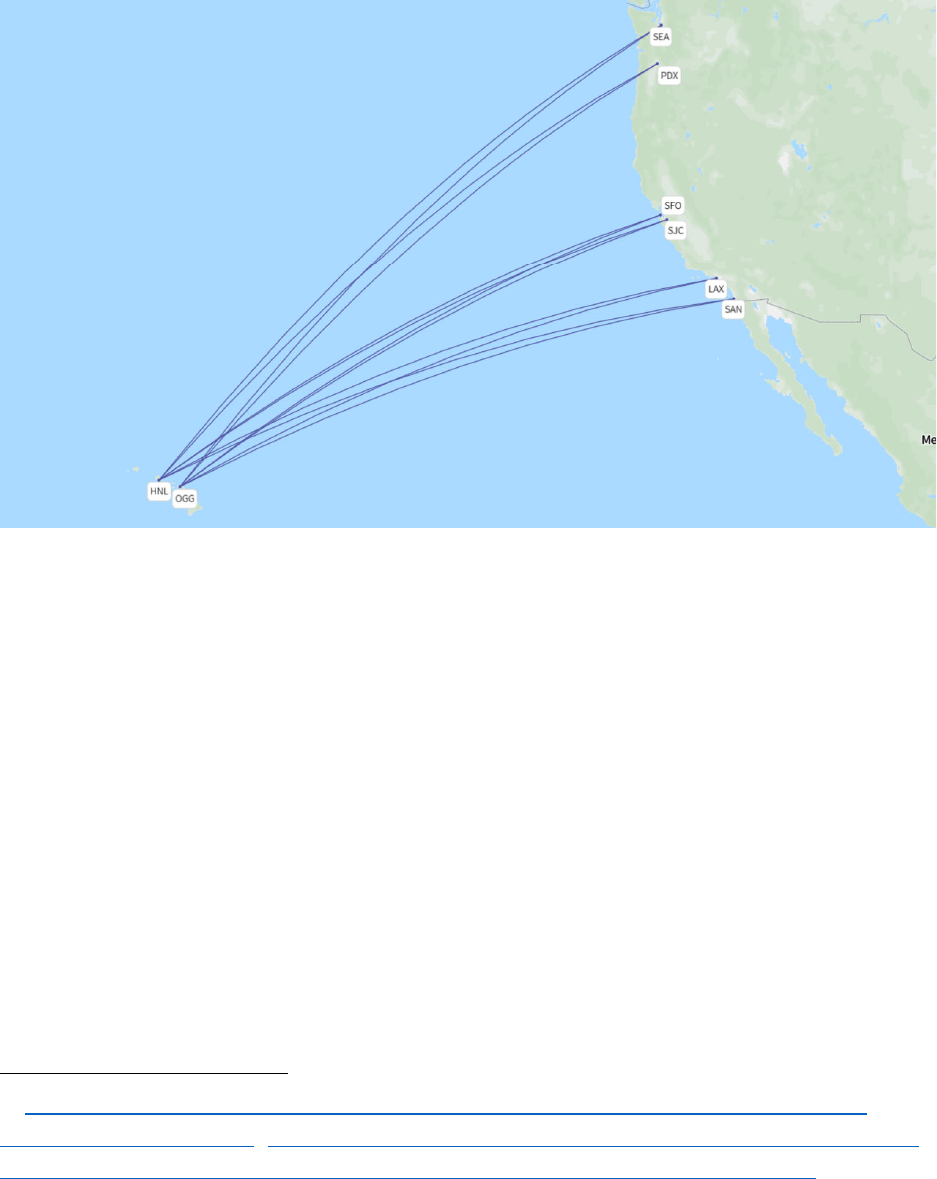

modes of transportation to and from all destinations in the other 49 states. Not so

with Hawaiʻi, where the only other inbound and outbound mode of transportation is

by ship - a totally impracticable alternative that hearkens back to the steamship era

100 years ago.

3. Healthy, stable and predictable airline capacity is absolutely essential

to Hawaiʻi’s economy and its residents. Travel and tourism deliver almost $20

billion in revenues to Hawaiʻi – representing approximately 27% of Hawaiʻi’s total

economy measured in dollars.

2

Airlines currently deliver over 9 million visitors

annually to Hawaiʻi,

3

generating almost $10 billion in lodging, another $4 billion in

any section of the country, the effect of such acquisition may be substantially to

lessen competition, or tend to create a monopoly.” (Emphasis added).

2

https://www.statista.com/statistics/187859/gdp-of-the-us-federal-state-of-hawaii-

since-1997/.

3

A total of 9,233,983 of visitors came to Hawaiʻi in 2022. Of those, 98.9%

(9,138,674) visitors arrived by air, and only 1% (95,309) visitors arrived by cruise

lines. See Department of Business Economic Development and Tourism 2022

Annual Visitor Research Report (DBEDT) at p. 2, available at

https://www.hawaiitourismauthority.org/media/11448/2022-annual-report-

final3.pdf.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 3 of 52 PageID.3

4

food and beverage, over $2 billion in transportation, and additional hundreds of

millions in conventions and other indirect business. Stable and predictable inter-

island airline connections are spokes of this important economic wheel.

Alaska Airlines Acquisition of Hawaiian Airlines May Lessen Competition

in Violation of Federal Law and May Threaten Harm to Passengers, Hawaiʻi,

and Its Economy

4. Because of Hawaiʻi’s unique geographic location and its

travel/tourism-based economy, a loss of airline competition in key Hawaiʻi-related

markets due to airline consolidation could be catastrophic to Hawaiʻi and may have

significant anti-competitive ripple effects. Alaska Airlines acquisition of Hawaiian

Airlines may have such probable effects causing labor layoffs, higher prices, less

frequent flights interisland, from Hawaiʻi to the mainland, and from Hawaiʻi to Asia

and Pacific.

5. Federal anti-trust law seeks to enjoin further consolidation of an already

heavily consolidated and concentrated airline industry where the effect of such

consolidation “may be to lessen competition.” The most recent example of a court

striking down a similar acquisition, is the January 16, 2024, decision of the United

States District Court, District of Massachusetts, in United States of America et al v.

JetBlue Airways Corporation, and Spirit Airlines, Civil No. 23, 10511-WGY, 2024

WL 162876 (D. Mass, 2024) where the court permanently enjoined the acquisition

of Spirit Airlines by JetBlue.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 4 of 52 PageID.4

5

6. The JetBlue decision is notable for its lucid analysis of the Clayton

Antitrust Act where Congress’s fundamental goal was “to arrest the trend toward

concentration, the tendency to monopoly…. before the consumer’s alternatives

disappear [ ] through merger”.

4

Congress therefore “sought to assure … the courts

the power to brake this force at its outset and before it gathered momentum”.

5

7. As the JetBlue court noted, Congress used the words “may be to

substantially lessen competition … to indicate that its concern was with

probabilities, not certainties”

6

(emphasis added). Here, the strong probability, if

not certainty, is that Alaska’s acquisition of Hawaiian could substantially lessen

competition and otherwise harm Hawaiʻi in the following ways:

(1) Control over the Hawaiʻi- Mainland Market: Hawaiian and Alaska are the

second a third largest providers of Hawaiʻi-U.S. mainland capacity at present, behind

United. United has a 23.5% capacity share. Hawaiian has 23.2% and Alaska has

16.9%. By acquiring Hawaiian, Alaska would have over 40% capacity share for

Hawaiʻi -U.S. mainland routes and become the largest airline for those routes.

7

The

acquisition may allow Alaska to limit or eliminate flights, raise fares, add ancillary

4

United States v. Philadelphia Nat’l Bank, 374 U.S. 321,367 (1963).

5

Brown Shoe Co. v. United States, 370 U.S. 294, 317-18 (1962).

6

F.T.C. v Hackensack Meridian Health, Inc., 30 F.4th 160,166 (3rd Cir. 2022).

7

More like 48% to West Coast States. https://airserviceone.com/alaska-airlines-

hawaiian-would-have-40-of-hawaii-mainland-us-capacity-but-compete-on-just-12-

routes/

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 5 of 52 PageID.5

6

fees, lessen services, and effectively control 40% of the seat capacity traffic between

Hawaiʻi and the US mainland.

(2) Overlapping Mainland Markets: Not only could Alaska gain a 40% share of

the mainland market, but it could also eliminate Hawaiian as a competitor in twelve

specific routes. Hawaiian currently serves fifteen destinations non-stop (via 28

separate flights to include different departure airports) on the U.S. mainland, and

Alaska serves twenty-four. Twelve of Alaska and Hawaiian’s flights between the

U.S. mainland directly overlap. Alaska’s acquisition of Hawaiian would eliminate

competition between these two carriers on these routes.

(3) Alaska’s Control of the Hawaiʻi-Mainland Market Could Significantly Impact

Hawaiʻi’s Almost $20 Billion Travel/Tourism Industry:

a. 85% of Hawaiʻi Visitors Come from the Mainland Markets: In 2022,

of the 9,138,674 visitors to Hawaiʻi, approximately 85% (7,746537)

came from the U.S. mainland. Of this number, approximately 60%

(5,277,349) came from the U.S. West and 27 % (2,469,128) from the

U.S. East.

b. Alaska’s Acquisition of Hawaiian Could Give It Significant Control

Over Hawaiʻi’s Travel/Tourism Industry: By definition, Alaska’s

control over 40% of the Hawaiʻi-Mainland market may give it

significant control and influence over Hawaiʻi’s $20 billion

travel/tourism industry.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 6 of 52 PageID.6

7

(4) Control of Interisland Service: Hawaiian is the largest provider of interisland

service in Hawaiʻi, holding a 67% achieved market in interisland flights—a market

that Alaska is seeking to buy into, rather than compete into.

(5) International Destinations: Hawaiian offers flights to ten international

destinations across seven countries in the Pacific and Asia, none of which are served

by Alaska—these are additional markets that Alaska is seeking to buy into, rather

than compete into. The Japan market is critical to Hawaiʻi’s economy.

(6) Other Significant Direct Impacts and Threatened Harm Which May Result in

a Lessening of Competition from Alaska’s Acquisition of Hawaiian.

a. Hawaiian’s Contribution to the local Hawaiʻi Economy: In 2022,

Hawaiian spent $1.6 Billion in Hawaiʻi.

8

Over time, Hawaiian’s

employees and resources may be eliminated, and may move to Alaska’s

headquarters in Seattle or elsewhere. This significant level of spending

may diminish and perhaps disappear.

b. Elimination of Hawaiian’s Oahu Headquarters: The proposed

acquisition could eliminate Hawaiian’s headquarters on Oahu and leave

the brand subject to absentee ownership with no meaningful connection

to Hawaiʻi: Alaska Airlines isn’t even based in Alaska; it operates out

of Seattle.

8

https://www.civilbeat.org/2023/03/hawaiian-vs-southwest-good-news-for-

travelers-bad-news-for-the-bottom-line/.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 7 of 52 PageID.7

8

c. Likely Loss of Local Jobs: Hawaiian employs 7,200 individuals, most

of which are Hawaiʻi residents.

.

9

As with every acquisition, the

acquiring company may cut costs, including jobs – particularly where

those jobs may be redundant or duplicative, or no longer needed by

reason of the elimination of competition.

d. Hawaiian’s Connection and Contributions to the Community May Be

Lost: In 2018, Hawaiian supported 284 non-profit organizations

through cash donations, in-kind donations to 501(c)3s, and the

Hawaiian Airlines Foundation. Between 2013 and 2018, Hawaiian

donated more than $2 million to local charities and non-profits.

e. Loss of Hawaiian’s Culture and Aloha Spirit: Unlike any other airline,

Hawaiian embodies the culture and spirit of its origin State, Hawaiʻi,

its people and its land. Every passenger who boards a Hawaiian flight

immediately knows that they are on a “Hawaiian” airline – from the

logo on the tail that honors “Pualani” and the hospitality she represents,

to the aloha spirit of the crew. Once the acquisition is complete,

“Hawaiian” may be nothing more than a brand name, which Alaska

may dispose of at some future date when the name no longer serves its

9

See https://www.hawaiianairlines.com/careers/working-with-

us#:~:text=Our%207%2C000%2B%20employees%20are%20honored,the%20rest

%20of%20the%20world.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 8 of 52 PageID.8

9

purpose, as Alaska did after acquiring Virgin America and having

promised not to abandon the brand.

The History and Legacy of Hawaiian Airlines

8. Since 1929, Hawaiian Airlines has been a source of pride for the State

of Hawaiʻi and has deep roots in the Islands. Prior to its founding in 1929, Hawaiʻi

residents and visitors travelled by steamship—Hawaiian was the first to introduce

interisland air service, taking passengers between the islands and working to get its

customers accustomed to the novelty of flying. In 1941, Hawaiian was the first

company to connect Hawaiʻi to the Continental United States by air.

9. Hawaiian has continued to build on its legacy. Generations of Hawaiʻi

residents and visitors have flown Hawaiian, and generations of Hawaiʻi residents

have worked, and continue to work, for Hawaiian. Hawaiian is, in fact, the largest

private employer in the State of Hawaiʻi, and employs over 7200 people, of which

approximately 5800 are union employees. With its headquarters on Oahu, Hawaiian

remains in tune with what is happening locally in a way that only a local carrier can.

For those living in Hawaiʻi, having an airline based in Honolulu with international,

mainland and interisland routes has long provided a sense of pride, and of Aloha

spirit.

10. Hawaiian is also a hugely visible brand that contributes meaningfully

to the local community, including by sponsoring large events, awarding grants to

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 9 of 52 PageID.9

10

nonprofits, and helping to evacuate people after the August 2023 Lahaina fire.

Hawaiian often partners with other local organizations, and boasts that:

Hawaiʻi is our home. At Hawaiian Airlines, we feel that it is our

kuleana to support the local businesses and organizations that fuel the

economy of these beautiful islands. We are proud to offer our kokua

through donations, volunteering and offering locally made products in

flight to spotlight businesses here in Hawaiʻi.

10

11. After 95 years in business, Hawaiian continues to serve as the primary

carrier between Hawaiʻi and the mainland for residents of Hawaiʻi, the primary

interisland carrier, and a significant provider of key routes to Asia and the Pacific.

Hawaiian’s purpose is to connect people with Aloha, and to safely bring them closer

together. Consistent with this mission, Hawaiian offers its travelers flexibility to

travel when it’s most convenient, by, among other things eliminating exchange fees.

And Hawaiian’s reward program boasts “Hawaiian Miles” that never expire and are

redeemable for free flights and a wide variety of benefits.

12. As further alleged herein, and as the data shows, Alaska’s proposed

acquisition of Hawaiian could eliminate Alaska’s main competition between

Hawaiʻi and the US mainland including 12 specific overlapping flights. This

elimination of competition may have the following anticompetitive effects:

eliminate flights, raise fares, charge ancillary fees, lessen services, and effectively

control 40% of the seat capacity traffic between Hawaiʻi and the US mainland. The

10

https://www.hawaiianairlines.com/about-us/why-fly-hawaiian.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 10 of 52 PageID.10

11

proposed acquisition could also give Alaska control over one of just two carriers that

provide interisland flights in Hawaiʻi and allow Alaska to buy its way into the Pacific

and Asia market, without having to compete for a share of said market.

13. The proposed acquisition violates Section 7 of the Clayton Antitrust

Act and should be enjoined.

INTRODUCTION

14. This is private antitrust action brought under Section 16 of the Clayton

Antitrust Act (15 U.S.C. § 26) charging that the acquisition of Hawaiian by Alaska

violates Section 7 of the Clayton Antitrust Act, seeking an Order of the Court

prohibiting the proposed elimination of Hawaiian by Alaska, as a violation of the

antitrust laws.

15. The proposed acquisition of Hawaiian for $1.9 Billion

11

by Alaska is a

violation of Section 7 of the Clayton Antitrust Act, 15 U.S.C. § 12-27 (“Clayton

Antitrust Act”), in that the effect of the elimination of Hawaiian may be

“substantially to lessen competition or tend to create a monopoly” in multiple

markets in the passenger airlines industry.

12

This lessening of competition by the

11

This includes $.09 Billion of Hawaiian’s outstanding adjusted net debt.

12

Section 7 of the Clayton Antitrust Act provides in pertinent part as follows: “No

person engaged in commerce or in any activity affecting commerce shall acquire,

directly or indirectly, the whole or any part of the stock or other share capital . . .

where in any line of commerce or in any activity affecting commerce in any section

of the country, the effect of such acquisition may be substantially to lessen

competition, or tend to create a monopoly.” (Emphasis added).

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 11 of 52 PageID.11

12

elimination of Hawaiian constitutes irreparable injury and harm because a major

competitor is eliminated.

16. Hawaiian and Alaska are the second and third largest providers of

flights between Hawaiʻi and the US mainland. As of December 2023, United had a

23.5% capacity share, with Hawaiian at 23.2% and Alaska at 16.9%. Based on

current schedules (and ignoring any acquisition effects) the proposed acquisition will

make Alaska account for more than 40% of all airline seat capacity on Hawaiʻi-US

mainland routes, significantly more than the current number one, United Airlines,

and make Alaska the largest airline in Hawaiʻi.

17. Hawaiian serves fifteen destinations non-stop on the U.S. mainland,

and Alaska offers twenty-four. Twelve of Alaska and Hawaiian’s flights to the U.S.

mainland directly overlap.

18. Hawaiian is the largest provider of interisland service in Hawaiʻi,

achieving a 67% market share in interisland flights—a market that Alaska is seeking

to buy into, rather than compete into. This comes just shortly after Alaska eliminated

its substantial competitor on the West Coast by acquiring Virgin America in 2017.

19. Alaska now dominates the West Coast corridor and serves the same

cities as Hawaiian on numerous overlapping direct flights.

13

13

“A company’s history of expansion through mergers presents a different economic

picture than a history of expansion through unilateral growth. Internal expansion is

more likely to be the result of increased demand for the company’s products and is

more likely to provide increased investments in plants, more jobs and greater output.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 12 of 52 PageID.12

13

20. Hawaiian offers flights to ten international destinations across seven

countries in the Pacific and Asia, none of which are served by Alaska—these are

additional markets that Alaska is seeking to buy into, rather than compete into.

21. If the acquisition goes forward, competition may be lessened in each of

the foregoing markets.

22. If Alaska desires to enter, or expand its presence in, these markets, it

should compete for such market share, not buy it.

23. The “threatened loss or damage” to Plaintiffs and to the public at large

by the potential elimination of Hawaiian as a competitor in the market is substantial

and foreboding, and the proposed acquisition clearly violates the Clayton Antitrust

Act:

a. Hawaiian is a significant rival of Alaska, as well as a significant

rival of other domestic airlines including Network Carriers (also

known as Legacy Carriers), Low Fair Premium Product Carriers

(“LFPC”), and Low-Cost Carriers (“LCC”).

b. The acquisition price of $1.9 Billion is not trivial, the acquisition

follows a trend of consolidation in the industry, and the acquisition

Conversely, expansion through merger is more like to reduce available consumer

choice while providing no increase in industry capacity, jobs or output. It was for

these reasons, among many others, Congress expressed its disapproval of successive

acquisitions. Section 7 [of the Clayton Antitrust Act] was enacted to prevent even

small mergers that added to concentration of the industry.” Brown Shoe Co. v. U.S.,

370 U.S. 294, 345 fn. 72 (1962).

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 13 of 52 PageID.13

14

could (a) eliminate a significant rival of Alaska, and (b) allow

Alaska to buy its way into new markets, rather than to enter into

them competitively.

24. The current trend toward concentration, the lessening of competition

and the tendency to create a monopoly in the airlines industry is unmatched,

unparalleled, and dangerous.

25. Alaska’s proposed acquisition of Hawaiian follows this dangerous

trend, will substitute an absentee owner for the State’s current largest private

employer, may eliminate jobs, and may lead to higher fares, higher fees, new fees,

reduction of routes, reduction of capacity, and a downgrading of flight amenities,

amongst other dangers.

26. The proposed acquisition is prohibited by the binding authority of the

Supreme Court of the United States in its decisions in Brown Shoe Co. v. United

States, 370 U.S. 294 (1962), United States v. Philadelphia Nat’l Bank, 374 U.S. 321

(1963), United States v. Aluminum Co. of America, 377 U.S. 271 (1964), United

States v. Von’s Grocery Co., 384 U.S. 270 (1966), United States v. Pabst Brewing

Co., 384 U.S. 546 (1966), and United States v. Falstaff Brewing Corp., 410 U.S. 526

(1973).

PARTIES

27. Plaintiffs named below are individual citizens of cities and states listed.

Each Plaintiff is an airline passenger, and some are former travel agents, all with the

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 14 of 52 PageID.14

15

express interest and intent in ensuring that the unique qualities of Hawaiian are

preserved as a competitive option for them, now and in the future. The potential

elimination of Hawaiian may cause loss and harm to the Plaintiffs, and to the public

at large, of the salutary benefits of the competition that Hawaiian brings, as well as

the opportunity to fly and continue to fly on Hawaiian.

Warran Yoshimoto (Honolulu, HI)

Kristin Barroga (Honolulu, HI)

Sean Kettley (Kailua, HI)

Carolyn Fjord (Winters, CA)

Don Freeland (Thousand Palms, CA)

Don Fry (Colorado Springs, CO)

Bill Rubinsohn (Jenkintown, PA)

Clyde S. Stensrud (Kirkland, WA)

28. Defendant Alaska Air Group, Inc. is the parent company of Defendant

Alaska Airlines, Inc. It is a corporation incorporated under the laws of the State of

Delaware with its principal place of business in Seattle, Washington.

29. Defendant Alaska Airlines, Inc. is an Alaska corporation with its

principal place of business in Seattle, Washington.

JURISDICTION AND VENUE

30. This private action is specifically authorized by Section 16 of the

Clayton Antitrust Act (15 U.S.C. § 26) which provides in pertinent part that “any

person…shall be entitled to sue and have injunctive relief …against threatened loss

or damage by a violation of the antitrust laws.” (Emphasis added).

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 15 of 52 PageID.15

16

31. The remedy afforded to private plaintiffs includes divestiture or

prohibiting any potential unlawful acquisition. As was unequivocally stated by the

United States Supreme Court in California v. American Stores Co., 495 U.S. 271,

283 (1990), “[T]he literal text of Section 16 is plainly sufficient to authorize

injunctive relief [in favor of a private Plaintiff], including an order of divestiture,

that will prohibit that conduct from causing that harm.”

14

32. The private action to vigorously challenge an acquisition is encouraged

by the Congress and the Supreme Court of the United States. In strong and

unmistakable language, the Supreme Court has declared: “The Act’s other

provisions manifest a clear intent to encourage vigorous private litigation against

anticompetitive mergers.” American Stores Co., 495 U.S. at 284.

14

This private action is specifically authorized by Section 16 of the Clayton Antitrust

Act on the grounds that the proposed acquisition threatens loss or damage to the

Plaintiffs by reason of the potential lessening of competition in the airline market in

violation of the antitrust laws.

Section 16 of the Clayton Antitrust Act, 15 U.S.C. § 26, provides: “Injunctive relief

for private parties; exception; costs: Any person, firm, corporation, or association

shall be entitled to sue for … against threatened loss or damage by a violation of the

antitrust laws, including section[] . . . 18 … this title, when and under the same

conditions and principles as injunctive relief against threatened conduct that will

cause loss or damage is granted by courts of equity, under the rules governing such

proceedings, and upon the execution of proper bond against damages for an

injunction improvidently granted and a showing that the danger of irreparable loss

or damage is immediate, a preliminary injunction may issue . . . In any action under

this section in which the Plaintiff substantially prevails, the court shall award the

cost of suit, including a reasonable attorney's fee, to such Plaintiff.” (Emphasis

added).

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 16 of 52 PageID.16

17

33. Plaintiffs bring this action under the authority of Section 16 of the

Clayton Antitrust Act (15 U.S.C. § 26) and allege that the proposed elimination of

Hawaiian by Defendant Alaska constitutes a substantial threat of injury to the

Plaintiffs because the acquisition may have the effect substantially to lessen

competition and tend to create a monopoly in various markets in violation of Section

7 of the Clayton Antitrust Act (15 U.S.C. 14 § 18).

34. This Court has subject matter jurisdiction over this action under Section

15 of the Clayton Antitrust Act, 14 U.S.C. 25, and 28 U.S.C. §§ 1331 and 1337(a).

35. The proposed acquisition is in and substantially affects the interstate

and foreign commerce of the United States in those flights, supplies, maintenance,

parts and all the accoutrements and other necessities of the passenger airline industry

are in the constant flow of the interstate and foreign commerce of the United States.

Because Defendants transact business in this judicial district, venue is proper

pursuant to 15 U.S.C. §§15, 22 and 26, and 28 U.S.C. § 1391.

FACTS

The Trend of Mergers and Acquisitions in the Airline Industry

36. The passenger airline industry is a critical and vital modern necessity

to the commercial, social and political well-being of the United States. Competition

rather than combination is the rule of trade in the United States so that these

Plaintiffs, and the public at large, may enjoy the benefits of competition, including,

inter alia, the best possible services at the lowest possible prices. Vigorous

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 17 of 52 PageID.17

18

enforcement of the antitrust laws by private persons is an essential part of the

Congressional plan to ensure that competition rather than monopoly is, and remains,

the rule of trade in the United States, including the airline industry.

37. Four major airlines dominate the United States industry today, but this

was not always the case. Two decades ago, more than a dozen significant airlines

competed domestically. Several legacy carriers like American Airlines and United

Airlines utilized “hub-and-spoke” systems to offer travelers access to numerous

domestic and international destinations. These airlines offered multiple classes of

service and a broad range of amenities in order to cater to many different types of

travelers. The legacy carriers faced competition from “low-cost” carriers like

Southwest, Airtran and JetBlue. These low-cost carriers typically had a single class

of service, fewer amenities, and a smaller network which enabled them to offer fares

that were frequently lower than their competitors. More recently, ultra-low-cost

carriers (“ULCC’s”) emerged offering travelers even lower fares by lowering their

cost structures, offering simplified onboard experiences, and removing some

features typically included in ticket price.

38. Consolidating has reshaped the industry, and in 2008, major airlines

began their feeding frenzy of mega-acquisitions which has resulted in the reduction

of the major airlines from eight competitors to four, effectively halving the principal

competitive air transportation choices to the passenger public.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 18 of 52 PageID.18

19

39. The vital and critical importance of the longstanding and unique

offering of Hawaiian and its presence in the airline markets can be measured against

the near total lack of competition among the other major airlines and the abuses that

have flowed and continue to flow as a result of their calculated scheme, which

threatens to inundate the entire industry like an enveloping tsunami. Hawaiian is an

important bulwark to stop this almost unstoppable trend toward complete

concentration and monopoly in the airline industry.

40. In 2008, Delta Airlines swallowed its significant actual and potential

rival, Northwest Airlines, to form the largest airline in the United States at the time.

Less than two years later, in 2010, United Airlines devoured its significant actual

and potential rival, Continental Airlines, to become the then-largest airline in the

United States. In 2011, Southwest Airlines consumed its significant actual and

potential Low-Cost Carrier rival, AirTran, to become the carrier with the largest

number of passengers in the United States and the largest Low-Cost Carrier. In

2013, American Airlines ingested its significant actual and potential competitor,

USAir, becoming the largest airline in the United States. In 2016-17, Alaska

consumed Virgin America. And in 2023-2024, JetBlue attempted to acquire Spirit

Airlines, an acquisition that was enjoined in 2024, after suits by private parties and

the Department of Justice (DOJ).

41. Since these airline mega-acquisitions began, capacity has been

substantially reduced and airfares increased notwithstanding a strengthening

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 19 of 52 PageID.19

20

economy and increased demand for air travel. According to a 2013 study, since

2007, scheduled domestic capacity in the 29 largest hubs has been reduced by 9%;

in the 35 medium hubs, scheduled domestic capacity has been reduced by 26%; and

in the 70 small hubs, scheduled domestic capacity has been reduced by 18%. The

remaining flights have become more crowded.

42. Since the mega-acquisitions began, the major airlines have increased

and continue to increase their ancillary fees. In 2012, Delta, United, American and

USAir charged more than $1 billion in reservation change fees. In 2012, U.S.

domestic airlines collected more than $3.5 billion in baggage fees. In 2013, the four

major carriers Delta, United, American and USAir all raised their charge for

accommodating ticket changes from $150 to $200.

43. Indeed, JetBlue warned in 2019 that “[a]ll power in the hands of a very

few deep-pocketed airlines has implications for consumers in the form reduced

options, high fares, and often poor service.” These implications also include an

increased risk of coordination in the oligopolistic airline industry. JetBlue and

Alaska then attempted to join the legacy airlines. JetBlue was enjoined. Alaska, in

this case, must be enjoined.

44. If the proposed acquisition of Hawaiian Airlines is consummated, these

fees, particularly in Hawaiʻi, may likely increase. Alaska admits that the

consolidation in the industry has “fundamentally changed the industry structure” and

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 20 of 52 PageID.20

21

that the airlines have found several “new revenue sources,” earning a whopping $45

billion from 2010 to 2015.

45. The four behemoths, Delta, United, Southwest and American, after

having substantially eliminated all significant major competition, now control 84%

of all passenger airline service in the United States. To maintain this dominance and

control of the industry, these four giants stay in constant contact and instant price

communication by means, among others, of a jointly owned and controlled “clearing

house”, APTCO, as well as CEO and executive contacts through secretive email,

private telephone calls, and personal meetings at resorts, association meetings,

private offices, restaurants, the secretive “Conquistadores del Cielo” annual shindig,

and elsewhere, to stabilize fares, encourage “capacity discipline,” shutdown flights,

and commit other anticompetitive practices and conduct.

46. This breakdown in the free enterprise system in this important and

critical American industry has resulted in the most unfriendly of skies for passenger

airline service and pricing in the history of the industry since “deregulation" occurred

in 1978. Fares have substantially increased regardless of plunging costs and higher

demand. Airplane capacity growth has been stifled by agreement. Thousands of

employees (including executives, middle management, administrators, planners,

pilots, flight attendants, maintenance workers, etc.) have been laid off because of the

substantial elimination of meaningful competition. Absentee owners who have little

if any care for local communities and markets have prevailed. Available flights have

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 21 of 52 PageID.21

22

been sharply reduced. New, illogical and unreasonable fees - many of which have

been purposefully hidden from the public - have been initiated in concert and by

agreement among those competitors. Airports have been abandoned. Markets have

been divided. Additional seats have been added to aircraft to cram passengers into

sardine-tin airplanes. Round-trip, “open jaw,” and end-to-end passengers (mostly

small, medium and even large business travelers flying to multiple city destinations)

have been forced to pay higher fares than the simple addition of their flight segments

for the same flight, same seat, and same time in order to subsidize the Big Four’s

below cost and predatory pricing on certain segments specifically aimed at fledging

Ultra Low Cost Carriers [“ULCC"] such as Spirit, Allegiant and Frontier and Low

Cost Carriers [“LCC”] such as Sun Country.

47. By reason of this “closed” market, the Big Four are able to (1) engage

in extraordinary anticompetitive and monopolistic practices and conduct without

fear of competitive retribution by new entrants; (2) impose a cavalcade of abusive

and discriminatory charges and fees against a helpless public, and (3) repudiate the

laws of supply and demand. For example, when the price of oil dropped more than

50% from $103 to $47 per barrel – fuel being 40% of the cost to run an airline - the

leader of the Big Four, Douglas Parker, CEO of American Airlines, announced that

fares were going to continue at the higher rates just as though the price of oil had

remained at $100 or more! Or, after all of the Big Four had eliminated their

significant actual and potential rivals, the CEOs continued to meet at their annual

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 22 of 52 PageID.22

23

conclave, designated by them as the “Conquistadores del Cielo” (Conquerors of the

Sky) - a closed group who adopted a covenant of secrecy about anything discussed

at their dude ranch gatherings. At these outings, previously held in Arizona and now

currently held at the A-Bar-A Ranch in Jackson, Wyoming, and subsequently at an

IATA meeting, they agreed to observe “capacity discipline” in order to stabilize and

raise fares and increase profits.

48. And in a calculated insult to business travelers, American, Delta, and

United further agreed through their wholly owned IATA “clearing house” to

significantly raise the fares booked as multi-city flights even though the combined

fares for individual segments on the same trip were much lower. American, Delta

and United have threatened both travel agents and passengers: the travel agents were

required to pay the difference between the multi-city fare and the individual fares,

or fear losing their licenses; the passengers were threatened with the possibility of

lost baggage and missed flights due to baggage delays or flight cancellations.

49. In sum, the Big Four, acting in unison, have transformed the historical

joy, adventure, and pleasure of air travel into drudgery, or, sometimes, even punishment

and hidden thievery. To counter the plethora of complaints levelled against the Big

Four, American Airlines launched a multi-million dollar “Great Flyer” advertising

campaign implying that the plight of the passengers is really their own fault in failing

to accept inconvenience, abuse, exorbitant expense and discomfort as the price for the

privilege to fly.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 23 of 52 PageID.23

24

50. The Big Four airlines (American, United, Delta and Southwest),

account for 74/84% of US capacity.

15

Alaska is the fifth largest.

16

51. Departing Seats (One Way), for the busiest US airlines in June 2023

showed

17

:

Carrier Name Seats

American Airlines 20,055,506

Southwest Airlines 19,148,642

Delta Airlines 18,357,826

United Airlines 15,364,457

Alaska Airlines 4,653,246

Spirit Airlines 4,063,415

JetBlue Airways Corporation 3,667,066

Frontier Airways Corporation 2,829,332

Allegiant Air LLC 1,969,386

Hawaiian Airlines 1,125,462

15

https://www.oag.com/blog/biggest-airlines-in-the-

us#:~:text=The%20%22big%20four%22%20US%20airlines,under%2073%20milli

on%20between%20them.

16

https://aviationweek.com/air-transport/airports-networks/network-analysis-

alaska-hawaiian-union;. Alaska is the fifth largest airline in the domestic market as

of December 2023.

17

Data Obtained from https://www.oag.com/blog/biggest-airlines-in-the-

us#:~:text=The%20%22big%20four%22%20US%20airlines,under%2073%20milli

on%20between%20them.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 24 of 52 PageID.24

25

52. The current breakdown of carrier types is:

Network Carriers/Legacy Carriers United

Delta

American

Low Fair Premium Product Carriers

(“LFPC”)

Alaska

Hawaiian

Jet Blue

Low-Cost Carriers (“LCC”) Southwest

Sun Countr

y

Ultra Low-Cost Carriers (“ULCC”) Spirit

Allegiant

Frontier

Hawaiʻi-US Mainland Market

53. Six major airlines comprise most direct flights to and from the US

mainland and Hawaiʻi: Hawaiian, Alaska, American, Delta, Southwest, and United.

54. As of December 2023, the Hawaiʻi-U.S. mainland seat capacity by

airline was:

Sun Country

0%

KaiserAir

0%

United Airlines

24%

Hawaiian Airlines

23%

Alaska Airlines

17%

Southwest Airlines

13%

Delta Airlines

12%

American Airlines

11%

Sun Country KaiserAir United Airlines Hawaiian Airlines

Alaska Airlines Southwest Airlines Delta Airlines American Airlines

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 25 of 52 PageID.25

26

Hawaiian Airlines

55. Hawaiian is Hawaiʻi’s biggest and longest serving airline, having

servicing Hawaiʻi for 95 years. Hawaiian employs over 7,200

18

workers and is a key

factor in tourism in the State. In 2022, Hawaiian spent $1.6 Billion in Hawaiʻi.

Hawaiian supports approximately $10 Billion in economic activity.

56. Hawaiian offers more services to its customers than any other domestic

airline, including Island-inspired meals for every palate, in-flight entertainment, a

pau hana cart with island-style snacks, pillows/blankets and last-minute gift items,

Hana Hou - the award-winning inflight magazine, featured in-flight partners and

music of Hawaiʻi from the moment you step on board. Hawaiian has long lasting

ties to the local community and culture. It supports local businesses, has an

extensive flight schedule, and very loyal customer base. When Southwest Airlines

began interisland flights, studies showed that even if Hawaiian flights were more

expensive than Southwest to the same destination, customers would still choose

Hawaiian. In 2023, Hawaiian outperformed Southwest by 23% for airplane

occupancy, even with average higher prices.

18

See https://www.hawaiianairlines.com/careers/working-with-

us#:~:text=Our%207%2C000%2B%20employees%20are%20honored,the%20rest

%20of%20the%20world.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 26 of 52 PageID.26

27

57. Hawaiian is committed to social responsibility and to help malama aina.

This commitment includes aircraft that are 20% more environmentally friendly.

Hawaiian’s fleet includes wide body planes, and flat-bed seats in business class.

58. Hawaiian has a vast loyalty program and offers amazing benefits to its

members such as free or discounted checked baggage, earning miles on how far you

fly, miles that will never expire, miles redeemable for any seat in Main Cabin, no

blackout dates, miles on every purchase, an annual companion discount, and 60,000

bonus miles just for signing up for the Hawaiian credit card.

59. Hawaiian has the most on time carriage for the last 3 years.

60. A 2019 90

th

Anniversary Economic Impact Report of Hawaiian

Airlines (the “2019 Impact Report”), reported that according to Department of

Transportation (DOT) figures, Hawaiian carried more passengers who were starting

or ending their trip in Hawaiʻi than any other airline.

19

61. In 2018, Hawaiian supported 284 non-profit organizations through cash

donations, in-kind donations to 501(c)3s, and the Hawaiian Airlines Foundation.

Between 2013 and 2018, Hawaiian donated more than $2 million to local charities

and non-profits.

62. Hawaiian provides a service to Hawaiʻi which is unmatched anywhere

else in the U.S. and most of the world. The regional economy could be severely

19

https://www.responsibilityreports.com/HostedData/ResponsibilityReportArchive/

h/NASDAQ_HA_2018.pdf.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 27 of 52 PageID.27

28

stalled and irreparably harmed without the airline’s inter-island, domestic, and

international flight services.

63. The 2019 Impact Report showed that in 2018, Hawaiian generated the

equivalent of $9.3 billion for the local economy, supporting 60,600 total jobs, and

transporting 2.7 million passengers to the State.

64. The 2019 Impact Report further addressed that because Hawaiian is

based in the State, and because every one of its flights starts or ends its journey in

Hawaiʻi, most of its pilots, cabin crews, mechanics, and administrative staff are

based locally.

65. In 2018, Hawaiian was the number one global provider of seats to and

from Hawaiʻi, according to the 2019 Impact Report, amounting to about 11.8 million

total passengers who fly to, from and between the Islands, and continued to spend

money throughout the State on commodities such as food, beverage, retail, car

parking and rental expenditures.

66. The 2019 Impact Report also discussed the huge role Hawaiian has to

play in cargo transports. Businesses in Hawaiʻi rely on imports to fulfill nearly half

of industry demands and many rely on daily shipments of high value and perishable

goods both from neighbor islands and the US Mainland. The State’s economy

greatly benefits from Hawaiian’s ability to provide a critical component of

infrastructure to meet the demands of industries such as healthcare, food and

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 28 of 52 PageID.28

29

beverage, retail, and veterinary services. Only freight carriers such as UPS and

FedEx carry more cargo to Hawaiʻi than Hawaiian.

67. Because of Hawaiian, Hawaiʻi businesses are also able to reach markets

all over the globe. Goods exported from the State support over 3,200 jobs and the

direct income from major export industries continues to grow, increasing 25% from

1990 to 2016. As of 2019, each week Hawaiian exported 500 tons or so of goods

from and across the Islands to the U.S. mainland alone, adding $129.7 million to

Hawaiʻi’s economy.

68. By the numbers, 2018 therefore showed Hawaiian generated $3.22

billion in visitor spending in State, 1.9 million visitors to Hawaiʻi, 500 tons of cargo

to the U.S. mainland each week, 765 tons of cargo from the U.S. mainland each

week, Hawaiian spent $1.2 billion on operational expenditures in the State, and spent

$106 million on capital expenditures.

69. While Hawaiʻi’s tourism took a huge hit with the COVID-19 pandemic,

which was evidenced by a more than 90% decrease in Transient Accommodation

Tax, Hawaiian avoided large numbers of layoffs and acted as a buffer against major

economic shock.

70. The number of visitors to Hawaiʻi was significantly impacted by

COVID-19 and the related restrictions imposed on travel. Statewide, Hawaiʻi has

not recovered its international tourist volumes to pre-pandemic rates, with foreign

visitor markets such as Japan, Canada, and others in the Asia-Pacific region

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 29 of 52 PageID.29

30

continuing to impose mandatory quarantine periods and sentiment toward

international travels. For example, Japan placed caps on international arrivals.

Additionally, macroeconomic factors impacted foreign exchange rates, inflation in

the United States and airline fuel surcharges, which contributed to a slow return to

pre-pandemic travel.

71. Nonetheless, Hawaiian remained a driving force in the State’s

economy.

72. Post pandemic, Hawaiian Airlines 2022 Economic Impact Report

(“2022 Impact Report”)

20

concluded Hawaiian directly contributed 7,158 jobs to

the State of Hawaiʻi, and Hawaiian’s activity annually supported the employment of

an additional 46,342 people throughout Hawaiʻi, for a total of 53,500 jobs statewide.

This equated to approximately 9% of Hawaiʻi’s total jobs.

73. Hawaiian additionally supported more than $10.1 billion of industry

activity, which made up 11% of Hawaiʻi’s total GDP. This translated to $607.5

million of realized tax revenue to the state, or 6% of total tax revenue to the State.

74. The 2022 Impact Report showed Hawaiian had $2.4 billion in operating

revenue and was named as #1 in Hawaiʻi by Forbes in America Best Employers.

20

https://issuu.com/hoike/docs/ha-economic-impact-report-02-23.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 30 of 52 PageID.30

31

75. The 2022 Impact Report showed Hawaiian carried 9.4 million

passengers total, of which 4.7 million were interisland; exported 630 tons of cargo

weekly and imported 820 tons of cargo weekly.

76. An assessment of both the economic and cultural impacts of Hawaiian’s

activities in the State of Hawaiʻi shows a picture of a company that is not only a

driver of the State’s economy and unique culture, but a key linchpin that significantly

affects the daily lives of our citizens and the countless business and organizations

that rely on services.

77. And the future for Hawaiian has even more to offer. Hawaiian has

recently begun cargo service for Amazon. Hawaiian is in the process of receiving

or expecting delivery of a fleet of Boeing 787s with more premium seats. Hawaiian

ordered 12, took 1, and will be taking 3 more this year.

78. Hawaiian operates 170 interisland flights per day, including flights to

and from Honolulu to Lihue, Kahului, Kailua-Kona, and Hilo. Hawaiian also runs

interisland flights between Kahului and Hilo, Kailua-Kona, Lihue; and to and from

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 31 of 52 PageID.31

32

Kailua-Kona and Lihue.

21

79. Hawaiian has twenty-eight routes (28) (to fifteen (15) destination cities)

in its network linking Hawaiʻi with the Mainland. Hawaiian offers numerous direct

flights to and from the mainland, including connections with Austin, Boston, Las

Vegas, Long Beach, Los Angeles, New York City, Oakland, Ontario, Phoenix,

Portland, Sacramento, San Diego, San Francisco, San Jose and Seattle. Hawaiian

also offers connecting flights with partners around the Continental United States.

21

Map obtained from https://www.hawaiianairlines.com/destinations.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 32 of 52 PageID.32

33

80. Hawaiian also serves as an anchor gateway airline from Hawaiʻi to

Asia and the Pacific, with direct flights to and from American Samoa, Australia,

the Cook Islands, French Polynesia, Japan, New Zealand, South Korea, as well as

connecting partner flights around the Pacific and Asia.

22

Alaska’s Trend of Consolidation through Acquisitions

81. Alaska, headquartered out of Seattle, Washington, is the fifth largest

airline in the United States. Alaska and its regional partner serve more than 120

22

https://www.hawaiianairlines.com/destinations.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 33 of 52 PageID.33

34

destinations across the United States, the Bahamas, Belize, Canada, Costa Rica,

Guatemala and Mexico.

82. With Alaska’s acquisition of Virgin America (“Virgin”) in 2017 for

$2.6 Billion, it cemented its presence on the West Coast of the United States, and

erased all vestiges of the Virgin America brand and retired its former planes.

83. In 2007, when the trend toward concentration and the elimination of

competition was beginning to heat-up in the airline industry, Virgin, with much fanfare,

initiated service from San Francisco International Airport. Virgin offered a new

promise of adventure, fun and excitement, as well as important destinations, convenient

flight availabilities, new aircraft, expansion to major cities and lower cost of travel.

84. Since 2007, while the Big Four were shrinking their services, initiating

hidden charges, cutting back their flights and inflating their fares, newborn Virgin was

expanding and burgeoning. By 2015, Virgin achieved annual revenues of $1.5 billion

and pre-tax profits of $200 million – by the end of March 2016, Virgin posted net

income of $345 million. Just four days later, Alaska announced that it had bought

Virgin.

85. More than seven million annual passengers flew on Virgin to twenty-four

destinations. Virgin flew to all ten of the top ten markets from San Francisco and to all

ten of the top ten markets served out of Los Angeles. Its fleet of aircraft climbed to 63

Airbus planes with 45 new Airbus aircraft on order. Destinations and capacity

expanded to 24 prime locations stretching from Hawaiʻi to San Francisco and Los

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 34 of 52 PageID.34

35

Angeles, and from the West Coast to Boston, New York and Washington DC, with

flights to Mexico as well. Hubs were established in San Francisco, Los Angeles and

Dallas. In addition to these extraordinary successes and growth through increased

capacity, Virgin was particularly well-positioned for the anticipated future demand for

air travel for business and pleasure which is concededly “bullish” for premium low fare

carriers and the rest of the airline industry. Virgin was on the rise.

86. With such astonishing successes and an ever-increasing and loyal

passenger base, Virgin was eyed as a very substantial and dangerous competitive

threat to the status quo, and especially to its significant West Coast rival, Alaska, the

defendant in this case.

87. In 2017, Alaska expanded exponentially, and eliminated its substantial

competitor, by acquiring Virgin. Alaska thereby gained dominance over the entire

West Coast of the United States. When Alaska acquired Virgin, Alaska essentially

bought the West Coast.

88. Alaska now dominates the West Coast corridor and serves the same

cities as Hawaiian on numerous overlapping direct flights.

89. Alaska began flying to Hawaiʻi in 2007. Now Alaska is trying to buy

the largest traffic to and from Hawaiʻi, and to buy key markets in Asia and the Pacific

via Hawaiʻi, in a clear effort to expand its monopolistic dominance over the markets

that Hawaiian serves.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 35 of 52 PageID.35

36

Alaska’s Acquisition of Hawaiian Could Hurt Travelers

90. Alaska and Hawaiian are both somewhat traditional airlines. Their

fares are typically in line with larger carriers, and higher than those charged by

discount airlines. In September of 2023, both charged slightly lower than average

fares for economy class seats between Hawaiʻi and the mainland, according to

figures from aviation data firm Cirium.

91. Hawaiian often tops the industry for on-time flights, and Alaska usually

also ranks near the top. Both score in the middle for consumer complaint rates,

according to U.S. Department of Transportation data.

92. Of the twenty-eight (28) routes in Hawaiian’s network with the

mainland, Alaska serves 12 of these routes, equating to an overlap of 43% of

Hawaiian’s Hawaiʻi-mainland market, and 25.5% of Hawaiian’s overall network.

93. Alaska’s Hawaiʻi-mainland network spans 24 routes – therefore

Hawaiian serves half of them currently.

94. Of Alaska’s 24 routes between the U.S. mainland and Hawaiʻi, 8 are to

Honolulu, 7 are to Kahului, 5 are to Kona, and 4 are to Lihue.

95. Of the 12 overlapping routes, six originate from Honolulu, and six

originate from Kahului Airport (OGG) on Maui. From the two airports, both Alaska

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 36 of 52 PageID.36

37

and Hawaiian serve Los Angeles, Portland, San Diego, San Francisco, San Jose, and

Seattle, as shown below.

23

23

https://aviationweek.com/air-transport/airports-networks/network-analysis-

alaska-hawaiian-union; https://airserviceone.com/alaska-airlines-hawaiian-would-

have-40-of-hawaii-mainland-us-capacity-but-compete-on-just-12-routes/.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 37 of 52 PageID.37

38

96. As this chart

24

demonstrates, the acquisition of Hawaiian would result

in some monopoly markets (Seattle/Honolulu) and some oligopoly markets (Los

Angeles/Honolulu; Seattle/Kahului; Portland/Honolulu; San Diego/Honolulu).

97. Hawaiian and Alaska are the second and third largest providers of

Hawaiʻi-U.S. mainland capacity at present, behind United, which has a 23.5%

capacity share. Hawaiian has 23.2% and Alaska has 16.9%. If Alaska’s acquisition

is allowed, Alaska would have over 40% capacity share for Hawaiʻi-U.S. mainland

24

Chart obtained from https://airserviceone.com/alaska-airlines-hawaiian-would-

have-40-of-hawaii-mainland-us-capacity-but-compete-on-just-12-routes/.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 38 of 52 PageID.38

39

routes (and about 48% to West Coast states

25

) and become the largest airline in

Hawaiʻi.

98. Travelers to and from Hawaiʻi benefit from Hawaiian’s competition

against Alaska, particularly on the 12 distinct direct overlapping routes. Alaska’s

acquisition of Hawaiian could hurt these travelers in numerous ways. It could

eliminate vigorous head-to-head competition between Hawaiian and Alaska that

travelers rely on every day. The airline industry as a whole could lose a major

competitor offering distinct services, and see Alaska become the dominant seat

capacity from and between Hawaiʻi and the U.S. mainland.

99. Alaska’s elimination of Hawaiian as competition increases the risk that

it could reduce flights on the 12 overlapping routes, raise fares and other fees and/or

reduce capacity. Additionally, Alaska, already the fifth largest carrier in the country,

in acquiring Hawaiian, increases the risk that the remaining airlines could cooperate

to raise fares on particular routes to and from Hawaiʻi.

100. The acquisition may reduce various aspects of consumer choice,

including where both Alaska and Hawaiian compete in service, on-time

performance, and cancellation rates.

101. The acquisition may cause fares to rise not only within Hawaiʻi and

between Hawaiʻi and the U.S. Mainland, but also throughout the Pacific and Asia,

25

https://airserviceone.com/alaska-airlines-hawaiian-would-have-40-of-hawaii-

mainland-us-capacity-but-compete-on-just-12-routes/.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 39 of 52 PageID.39

40

from Australia to Japan, because Hawaiian’s route map will give Alaska a

commanding presence in the region post-acquisition.

102. Further the acquisition may not just decrease Alaska’s competition in

the region – its partners could also benefit from shrinking competition in the Pacific

and Asia, allowing them more leeway to charge higher fares.

26

103. Under controlling U.S. Supreme Court precedent interpreting the

Clayton Antitrust Act, Alaska’s acquisition is presumed to have anti-competitive

effects on the market between the U.S. and the mainland, because it could

significantly increase concentration and result in highly concentrated markets on

those routes. See United States v. Philadelphia Nat’l Bank, 374 U.S. 321, 363-64

(1963).

104. A combined network of Hawaiian and Alaksa would look like this:

26

https://www.cntraveler.com/story/alaska-hawaii-airlines-merger-impact-on-

travelers

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 40 of 52 PageID.40

41

27

Alaska’s Proposed Acquisition of Hawaiian Heightens the Risk that

Remaining Airlines Could Coordinate to Raise Fares

105. Companies are incentivized to maximize profits. Competitive markets

force companies to reduce price or improve products to offer customers better deals

than their rivals. Sometimes markets do not work this way: instead of fierce

competition, companies accommodate their mutual desire for higher profits and thus

engage in activities designed to soften competition with each other. Antitrust law

refers to this as coordination or coordinated behavior, and it may come through

27

Alaska Air Group Investor Presentation, December 3, 2023, available at

https://investor.alaskaair.com/static-files/b576ec5f-3b6c-4ae5-8b52-

9606195cbd43.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 41 of 52 PageID.41

42

formal agreements, implied understandings, or parallel accommodating conduct.

Regardless of how it is accomplished, coordinated behavior comes at a price to

consumers who face higher prices and or reduced output. The Clayton Antitrust Act

prohibits mergers and acquisitions that increase the risk of coordinated effects and

substantially lessen competition.

106. The airline industry is already very vulnerable to coordination, and the

ever-shrinking consolidated number of airlines only increases the likelihood of

coordinated behavior. Airlines publicly file their fares through ATPCO, which

provides all airlines with detailed real-time access to published fares. Airlines have

a history of using ATPCO to engage in coordinated behavior, conduct which became

the subject of a Department of Justice action and court-ordered injunction in 1992.

107. Additionally, airlines utilize data-scraping tools to track prices and

schedules that their competitors offer on individual websites. Because on most

routes there are only a small number of significant competitors, it is easy for airlines

to send each other signals. Many airlines overlap on multiple routes, providing

opportunities to use fare increases or discounts on one route to influence or discipline

a rival’s behaviors on another – all in coordinated pursuit of higher fares. Airlines

have a strong incentive to protect high prices on routes to and from certain airports

where they have high shares of traffic.

108. These factors make it easier for airlines to play “follow the leader” in

the industry, particularly with respect to fair increases. If one airline increases a

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 42 of 52 PageID.42

43

price, other airlines can immediately see the increase and consider following with

their own increase. The initiating airline will then check to see if the other airlines

matched the increase. If so, the initiating airline is likely to maintain its price

increase. If not, the initiating airline may withdraw the increase shortly thereafter.

Relevant Geographic Markets

109. The Clayton Antitrust Act bars acquisitions where “any activity

affecting commerce in any section of the country” where the effect of such

acquisition “may be to substantially to lessen competition, or to tend to create a

monopoly.” Clayton Antitrust Act (15 U.S.C. § 18).

110. Courts define relevant product and geographic markets to determine

which lines of commerce and which areas of the country may be harmed by an

acquisition. Here, scheduled air passenger service is a relevant product market and

there are three relevant large geographic markets.

111. Airfares are generally constrained by actual and potential competition

from other airlines within the market. Since any major existing airline has the

capability to enter any market throughout the United States, the threat of potential

competition from other existing airlines entering the market constrains airfares and

services.

112. The proposed acquisition of Hawaiian by Alaska may greatly reduce

airline competition in three distinct markets:

a. Hawaiʻi – US mainland

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 43 of 52 PageID.43

44

b. Interisland in Hawaiʻi

c. Hawaiʻi to Pacific and Asia

113. The proposed acquisition of Hawaiian by Alaska may give Alaska a

40% capacity of the Hawaiʻi – US mainland market, more than any other airline.

Hawaiian and Alaska already dominate the Hawaiʻi-West coast corridor, with 12

overlapping flights. There is little doubt that, post-acquisition, airfares will rise

between the Hawaiʻi and the US mainland generally, and specifically between

Hawaiʻi and the West Coast.

114. The proposed acquisition may give Alaska Hawaiian’s 67% achieved

market in interisland flights. Executives of Hawaiian and Alaska have described

controlling the Hawaiian interisland market as a large part of the deal’s attraction.

This would add Hawaiian’s market share in the state, already bigger than any other

airline, to Alaska. While Hawaiian competes with Southwest for interisland fares,

Hawaiian’s load factor, a measure of occupancy, was 22 percentage points higher

than Southwests, and passenger revenue per available seat mile, was 29.3 cents for

Hawaiian versus 10.6 cents for Southwest, as reported in 2023.

28

Even though

Southwest dropped its interisland fares to compete with Hawaiian, people continued

to choose Hawaiian. Concerns about interstate dominance will only be enhanced if

28

https://www.civilbeat.org/2023/03/hawaiian-vs-southwest-good-news-for-

travelers-bad-news-for-the-bottom-line/

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 44 of 52 PageID.44

45

there is an acquisition by a larger carrier with more resources and capital to fight off

competition with Southwest.

115. The acquisition of Hawaiian may also create far reaching negative

effects throughout Asia and the Pacific. Alaska is a member of “Oneworld” which

along with SkyTeam and Star are the three global “mega-alliances” granted anti-

trust immunity to permit cross-border marketing and codesharing agreements. A

2011 Department of Justice study found these three groups reduce competition and

raise fares. Oneworld’s 15 members include American, Cathay Pacific, Japan

Airlines, Malaysia and Qantas. The acquisition of Hawaiian can be expected to

impact travelers from Australia to Japan and beyond, as Alaska, American and their

Oneworld partners could gain a significant toehold in the critical Hawaiʻi based

market.

Anticompetitive Effects of the Transaction

Hawaiian Will be Eliminated as a Competitor in the Airline Industry

116. The proposed acquisition will allow Alaska, the country’s fifth largest

airline, to swallow the country’s tenth largest airline.

117. The proposed acquisition will presumably give Alaska 40% of the

Hawaiʻi US-mainland market and over 60% of the interisland market, and will allow

Alaska to buy its way into Asia and the Pacific along with its mega-alliance, rather

than enter through competition, in contravention of the U.S. Supreme Court’s

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 45 of 52 PageID.45

46

decisions in Brown Shoe Co. v. U.S., 370 U.S. 294 (1962) and U.S. v. Falstaff, 410

U.S. 526 (1973).

29

118. As set forth by Brown Shoe Co., it is the policy of the United States

making competition rather than merger and acquisition, as the rule of trade.

30

119. The proposed acquisition will eliminate Hawaiian as a competing

LFPC, leaving only Alaska and JetBlue, who as discussed above, was recently

enjoined from trying to swallow ULCC Spirit.

120. Post-acquisition air fares may increase, and there may be less routes as

those currently covered by both Hawaiian and Alaska are consolidated.

121. The proposed acquisition will eliminate the only airline headquartered

in Hawaiʻi, leaving Hawaiian controlled by an absentee owner in Seattle. While

Alaska claims many of the 7200 jobs of Hawaiian airline employees will be

protected, much is unclear at this time.

29

Discussing how company who was not a competitor in a geographic market, nor

would its merger with smaller company in market give it a dominant market force,

was still a potential competitor to enter the market, and thus the proposed acquisition

posed a threat to competition.

30

“A company’s history of expansion through mergers presents a different economic

picture than a history of expansion through unilateral growth. Internal expansion is

more likely to be the result of increased demand for the company’s products and is

more likely to provide increased investments in plants, more jobs and greater output.

Conversely, expansion through merger is more like to reduce available consumer

choice while providing no increase in industry capacity, jobs or output. It was for

these reasons, among others, Congress expressed its disapproval of successive

acquisitions. Section 7 was enacted to prevent even small mergers that added to

concentration in an industry.” Brown Shoe Co., 370 U.S. at 345, fn. 72.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 46 of 52 PageID.46

47

122. Hawaiian currently contributes upwards of $10.2 billion in Hawaiʻi’s

economy annually, with a tax impact of over §607.5 million. Hawaiian controlled

by Alaska may not.

123. And while Alaska promises now to maintain the Hawaiian brand and

commitment to the community, Alaska’s acquisition of Virgin American tells a

different story, where nothing of Virgin America remains.

The Relevant Markets are Highly Concentrated and the Proposed Acquisition of

Hawaiian May Result in Presumptively Unlawful Market Concentrations

124. The decrease in the number of major airlines over the last decade

reflects a persistent and deliberate pattern of concentration and reduction of

competition in the U.S. airline industry, a trend which the Supreme Court has said

must be arrested at its incipiency.

125. The acquisition of Hawaiian by Alaska will result in the fifth largest

airline in the United States, currently with 16.92% of capacity of flights between

Hawaiʻi and the U.S. mainland, acquiring the tenth largest airline and increasing that

capacity to 40%.

126. Market concentration is an indication of the level of competition in a

market. The more concentrated a market, and the more a transaction may increase

concentration in a particular market, the more likely it is that a transaction may result

in a meaningful lessening in competition.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 47 of 52 PageID.47

48

127. Hawaiian and Alaska have overlapping non-stop flights on 12 routes.

The elimination of Hawaiian as a competitor may result in fare increases, fewer

flights and availability, and the elimination of consumer choice, and, in all events

may create a substantial increase in concentration.

128. Alaska’s acquisition of Hawaiian may cause substantial “lessening of

competition” and thereby irreparable injury to Plaintiffs and to all consumers for

Hawaiʻi-US mainland routes, as well those who fly interisland and between Hawaiʻi

and Asia and the Pacific. Consumer choice may be gone, and the danger and threat

of harm may be irreparable.

129. Further, Plaintiffs and all consumers are threatened with (1) the loss of

the distinct services and in-flight experiences offered by Hawaiian; (2) a reduction

of customer choice; (3) a reduction in capacity and the curtailment of flights thereby

creating higher prices and severe inconvenience to consumers; (4) the loss of the

only local airline currently headquartered in Hawaiʻi with the substitution of an

absentee owner and operator; and (5) ultimately the loss of a vibrant, respected local

competitor who has brought so much to Hawaiʻi since its inception.

130. If Hawaiian is acquired, Plaintiffs may sustain irreparable harm for

which damages may be inadequate to compensate Plaintiffs in that a direct rival may

be extirpated and customer choice for travel options eradicated.

131. Moreover, there may likely be no startup entrants into the airline market

because new entrants could face significant barriers to entry, including difficulty in

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 48 of 52 PageID.48

49

obtaining access to gate facilities; difficulty in competing with the effects of

corporate discount programs offered by dominant incumbents; difficulty due to

customer loyalty to existing frequent flyer programs; difficulty of promoting an

unknown brand; and the risk of aggressive responses to new entry by the dominant

incumbent carriers. The former CEO of United testified that only an established

airline could now enter the major markets in the United States. Indeed, American’s

CEO Doug Parker further admitted that no new airline could enter the market

because it could not even be able to cover its cost of capital.

132. Since the prospect of a new start-up entry is unlikely, the entry of new

competitors in the marketplace cannot serve as a basis to mitigate the anticompetitive

effects that may result from Alaska’s proposed acquisition.

133. Alaska as an existing airline, however, has the wherewithal, experience,

financial ability, intent, size and expertise to enter into the very markets and areas it

seeks to gain by its acquisition of Hawaiian. Such an entry by Alaska on new routes

and into new markets would increase competition, create new jobs, lower fares,

increase capacity, increase availability, and enhance consumer choice. The

acquisition of Hawaiian could do the exact opposite.

134. Accordingly, Plaintiffs bring this action for both preliminary and

permanent injunctive relief against Defendants’ proposed acquisition of Hawaiian

and seek an order prohibiting Alaska from acquiring Hawaiian.

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 49 of 52 PageID.49

50

VIOLATIONS ALLEGED

Clayton Antitrust Act, Section 7 15 U.S.C. § 18

135. The effect of the proposed acquisition may be substantially to lessen

competition, or tend to create a monopoly, in interstate trade in commerce in the

relevant markets in violation of Section 7 of the Clayton Antitrust Act, 15 U.S.C. §

18.

136. Unless enjoined, the proposed acquisition may, and most probably

could, have the following potential effects in the relevant markets, among others:

d. Actual and potential competition between Alaska and Hawaiian may be

eliminated;

e. Competition in general among other airlines may be lessened

substantially;

f. Ticket fares and ancillary fares may be higher than they otherwise could

be;

g. Industry capacity may be lower than it otherwise could be;

h. Consumer choice may be lessened;

i. Service may be lessened;

j. The proposed acquisition may facilitate increased coordination among

Alaska and its remaining competitors; and

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 50 of 52 PageID.50

51

k. Job layoffs, huge economic impacts on the State of Hawaiʻi, less

frequent flights interisland, from Hawaiʻi to the mainland, and from

Hawaiʻi to Asia and Pacific.

137. By reason of this violation, Plaintiffs are threatened with loss or damage

in the form of potentially higher ticket prices and diminished service, the potential

elimination of a favored airline, as well as additional irreparable harm for which

damages will be inadequate to compensate Plaintiffs. Plaintiffs are entitled to bring

suit under Section 16 of the Clayton Antitrust Act, 15 U.S.C. § 26, to obtain

preliminary and permanent injunctive relief against the proposed acquisition, and to

recover their costs of suit including reasonable attorneys’ fees.

PRAYER FOR RELIEF

WHEREFORE, Plaintiffs respectfully request the following relief from this

Honorable Court:

A. Declaring, finding, adjudging and decreeing that the agreement of

Alaska to acquire Hawaiian violates Section 7 of the Clayton Antitrust Act, 15

U.S.C. § 18;

B. Preliminarily enjoining Alaska from consummating the acquisition of

Hawaiian, or, if necessary, ordering divestiture, during the pendency of this action;

C. Permanently enjoining Alaska and Hawaiian from consummating the

acquisition or requiring divestiture;

Case 1:24-cv-00173 Document 1 Filed 04/15/24 Page 51 of 52 PageID.51

52

D. Declaring the contract between Hawaiian and Alaska to be null and

void and against public policy of the United States which declares that competition

rather than combination is the rule of trade in the United States;