August 22, 2024

Intuit Reports Strong Fourth Quarter and

Full Year Results; Sets Fiscal 2025

Guidance With Double Digit Revenue and

Earnings Growth

Full year revenue grew 13 percent, Small Business and Self-Employed Group revenue

grew 19 percent

MOUNTAIN VIEW, Calif.--(BUSINESS WIRE)-- Intuit Inc. (Nasdaq: INTU) the global financial

technology platform that makes TurboTax, Credit Karma, QuickBooks, and Mailchimp,

announced financial results for the fourth quarter and full fiscal year 2024, which ended July

31, 2024.

“We delivered very strong results for the fourth quarter and full year, and made meaningful

progress with our AI-driven expert platform strategy that positions the company for durable

growth in the future,” said Sasan Goodarzi, Intuit's chief executive officer. “Our strategy and

five Big Bets are solving our customers’ biggest problems as we deliver on our mission to

power prosperity for consumers, and small and mid-market businesses.”

Financial Highlights

For the full year, Intuit:

Grew total revenue to $16.3 billion, up 13 percent year-over-year.

Increased combined platform revenue, which includes the Small Business and Self-

Employed Group Online Ecosystem, TurboTax Online and Credit Karma, 14 percent to

$12.5 billion.

Grew Small Business and Self-Employed Group revenue 19 percent and Online

Ecosystem revenue 20 percent.

Grew Consumer Group revenue 7 percent to $4.4 billion.

Increased Credit Karma revenue 5 percent to $1.7 billion.

Grew GAAP operating income 16 percent to $3.6 billion, including a restructuring

charge of $223 million recognized in the fourth quarter related to the organizational

changes the company announced in July.

Increased non-GAAP operating income 16 percent to $6.4 billion.

Grew GAAP earnings per share 24 percent to $10.43, also including the restructuring

charge.

Increased non-GAAP earnings per share 18 percent to $16.94.

For the fourth quarter, Intuit:

Grew total revenue 17 percent to $3.2 billion.

Increased Small Business and Self-Employed Group revenue 20 percent to $2.6 billion

and Online Ecosystem revenue 18 percent.

Grew Credit Karma revenue 14 percent to $485 million.

Reported Consumer Group revenue of $113 million, down 12 percent.

Unless otherwise noted, all growth rates refer to the current period versus the comparable

prior-year period, and the business metrics and associated growth rates refer to worldwide

business metrics.

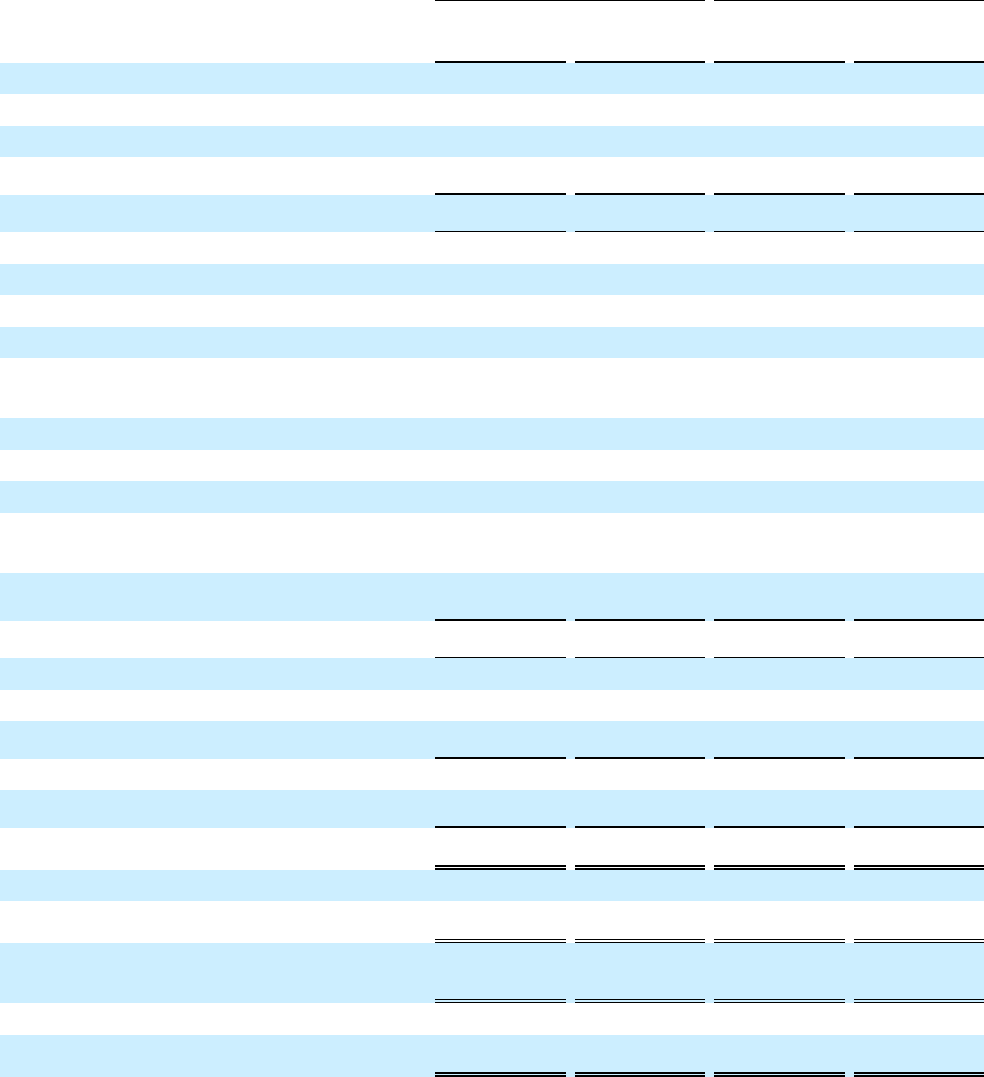

Snapshot of Fiscal Year 2024 Full-year Results

GAAP Non-GAAP

FY24 FY23 Change FY24 FY23 Change

Revenue

$16,285 $14,368 13% $16,285 $14,368 13%

Operating Income

$3,630 $3,141 16% $6,402 $5,503 16%

Earnings Per Share

$10.43 $8.42 24% $16.94 $14.40 18%

Dollars are in millions, except earnings per share. See “About Non-GAAP Financial

Measures” below for more information regarding financial measures not prepared in

accordance with Generally Accepted Accounting Principles (GAAP).

Snapshot of Fourth-quarter Fiscal Year 2024 Results

GAAP Non-GAAP

Q4

FY24

Q4

FY23 Change

Q4

FY24

Q4

FY23 Change

Revenue

$3,184 $2,712 17% $3,184 $2,712 17%

Operating Income

(Loss)

$(151) $17 NM $730 $627 16%

Earnings (Loss) Per

Share

$(0.07) $0.32 NM $1.99 $1.65 21%

NM = Not Meaningful

Dollars are in millions, except earnings per share. See “About Non-GAAP Financial

Measures” below for more information regarding financial measures not prepared in

accordance with Generally Accepted Accounting Principles (GAAP).

Business Segment Results

Small Business and Self-Employed Group

Small Business and Self-Employed Group revenue grew 20 percent for the quarter and 19

percent for the year. Online Ecosystem revenue grew 18 percent for the quarter and 20

percent for the year.

QuickBooks Online accounting revenue grew 17 percent for the quarter and 19 percent

for the year. Growth in the quarter was driven by customer growth, higher effective

prices, and mix shift.

Online services revenue grew 19 percent for the quarter and 21 percent for the year.

Growth in the quarter was driven by growth in payments, payroll, capital, and

Mailchimp.

Total international online revenue grew 11 percent for the quarter and 13 percent for

the year on a constant currency basis.

In August 2024, Intuit renamed the Small Business and Self-Employed Group to the Global

Business Solutions Group. This new name better aligns with the global reach of the

Mailchimp and QuickBooks platform, the company's focus on serving both small and mid-

market businesses, and its vision to become the end-to-end platform that customers use to

grow and run their business.

Consumer and ProTax Groups

Consumer Group revenue grew 7 percent for the year to $4.4 billion.

TurboTax Live revenue grew 17 percent for the year, representing approximately 30

percent of total Consumer Group revenue, and TurboTax Live customers grew 11

percent.

TurboTax Online units declined 2 percent and total TurboTax units declined 1 percent

for the year, due to share loss with customers who pay nothing or have a lower

average revenue per return.

TurboTax Federal Unit Data

Units in millions

Season

through

July 31, 2024

Season

through

July 31, 2023

Change

Year-Over-

Year

Desktop Units

4.6 4.5 2%

Online Units

35.4 36.0 (2)%

Total U.S. TurboTax Units

39.9 40.5 (1)%

ProTax Group revenue grew 7 percent for the year.

Credit Karma

Credit Karma revenue grew 5 percent to $1.7 billion for the year. Credit Karma revenue grew

14 percent for the quarter to $485 million, driven by strength in auto insurance, personal

loans, credit cards, and Credit Karma Money.

Capital Allocation Summary

The company:

Reported a total cash and investments balance of approximately $4.1 billion and total

debt of $6.0 billion as of July 31.

Repurchased $2.0 billion of stock during fiscal year 2024. The Board approved a new

$3.0 billion repurchase authorization, giving the company a total authorization of $4.9

billion to repurchase shares.

Received Board approval for a quarterly dividend of $1.04 per share, payable on

October 18, 2024. This represents a 16 percent increase versus last year.

Forward-looking Guidance

Intuit announced guidance for the full fiscal year 2025. The company expects:

Revenue of $18.160 billion to $18.347 billion, growth of approximately 12 to 13

percent.

GAAP operating income of $4.649 billion to $4.724 billion, growth of approximately 28

to 30 percent.

Non-GAAP operating income of $7.241 billion to $7.316 billion, growth of

approximately 13 to 14 percent.

GAAP diluted earnings per share of $12.34 to $12.54, growth of approximately 18 to

20 percent.

Non-GAAP diluted earnings per share of $19.16 to $19.36, growth of approximately 13

to 14 percent.

The company expects the following segment revenue results for fiscal year 2025:

Small Business and Self-Employed Group: growth of 16 to 17 percent. This includes

online ecosystem revenue growth of approximately 20 percent, and desktop ecosystem

revenue growth in the low single digits.

Consumer Group: growth of 7 to 8 percent.

ProTax Group: growth of 3 to 4 percent.

Credit Karma: growth of 5 to 8 percent.

GAAP guidance reflects an expected $24 million restructuring charge related to the

reorganization the company announced in July.

Intuit also announced guidance for the first quarter of fiscal year 2025, which ends Oct. 31.

The company expects:

Revenue growth of approximately 5 to 6 percent, including:

Small Business and Self-Employed Group revenue growth of 6 to 7 percent. The

company expects online ecosystem revenue growth, the company's growth

catalyst, to accelerate to approximately 19 percent in the first quarter of fiscal

2025. The company expects desktop ecosystem revenue to decline

approximately 20 percent in the first quarter of fiscal 2025, but return to growth in

the second quarter. The first quarter desktop growth outlook reflects changes the

company made to its QuickBooks desktop offerings in early fiscal 2024 to

complete the transition to a recurring subscription model, including more frequent

product updates. The company expects these changes to lower revenue in the

first quarter of fiscal 2025 by approximately $160 million. This includes

approximately $50 million that was recognized in the first three quarters of fiscal

2024, approximately $60 million recognized in the fourth quarter of fiscal 2024,

and approximately $50 million that the company expects to shift from the first

quarter of fiscal 2025 to later quarters in fiscal 2025.

Credit Karma revenue to grow in the first quarter.

Consumer Group and ProTax revenue to decline in the first quarter, as the

company laps the period a year ago that included the extended California tax

filing deadline.

GAAP earnings per share of $0.61 to $0.66.

Non-GAAP diluted earnings per share of $2.33 to $2.38.

GAAP guidance reflects an expected $19 million restructuring charge that the company

expects to incur in the first quarter related to the reorganization the company announced in

July.

Conference Call Details

Intuit executives will discuss the financial results on a conference call at 1:30 p.m. Pacific

time on Aug. 22. The conference call can be heard live at https://investors.intuit.com/news-

events/ir-calendar. Prepared remarks for the call will be available on Intuit’s website after the

call ends.

Replay Information

A replay of the conference call will be available for one week by calling 800-938-1595, or

402-220-1544 from international locations. There is no passcode required. The audio

webcast will remain available on Intuit’s website for one week after the conference call.

Investor Day 2024

Intuit will host its annual Investor Day on Sept. 26 at 8:00 a.m. Pacific time, at its

headquarters in Mountain View, CA and it can be viewed live at

https://investors.intuit.com/news-events/ir-calendar. The half-day event will include

presentations from Sasan Goodarzi, chief executive officer, Sandeep Aujla, chief financial

officer, and other leaders.

About Intuit

Intuit is the global financial technology platform that powers prosperity for the people and

communities we serve. With approximately 100 million customers worldwide using products

such as TurboTax, Credit Karma, QuickBooks, and Mailchimp, we believe that everyone

should have the opportunity to prosper. We never stop working to find new, innovative ways

to make that possible. Please visit us at Intuit.com and find us on social for the latest

information about Intuit and our products and services.

About Non-GAAP Financial Measures

This press release and the accompanying tables include non-GAAP financial measures. For

a description of these non-GAAP financial measures, including the reasons management

uses each measure, and reconciliations of these non-GAAP financial measures to the most

directly comparable financial measures prepared in accordance with Generally Accepted

Accounting Principles, please see the section of the accompanying tables titled "About Non-

GAAP Financial Measures" as well as the related Table B1, Table B2, and Table E. A copy of

the press release issued by Intuit today can be found on the investor relations page of Intuit's

website.

Cautions About Forward-looking Statements

This press release contain forward-looking statements, including expectations regarding:

forecasts and timing of growth and future financial results of Intuit and its reporting

segments; the impact of macroeconomic conditions on our business, segments and

products; Intuit’s prospects for the business in fiscal 2025 and beyond; Intuit’s growth

outside the US; timing and growth of revenue from current or future products, features, and

services; innovation across our ecosystem; demand for our products; customer growth and

retention; average revenue per return and average revenue per customer; Intuit's corporate

tax rate; changes to our products, including the impact of AI; the amount and timing of any

future dividends or share repurchases; our capital structure; availability of our offerings; our

expectations regarding the timing and costs associated with our plan of reorganization

(“Plan”); and the impact of acquisitions and strategic decisions on our business; as well as

all of the statements under the heading "Forward-looking Guidance."

Because these forward-looking statements involve risks and uncertainties, there are

important factors that could cause our actual results to differ materially from the expectations

expressed in the forward-looking statements. These risks and uncertainties may be amplified

by the effects of global developments and conditions or events, including macroeconomic

uncertainty or geopolitical conditions, which have caused significant global economic

instability and uncertainty. Given these risks and uncertainties, persons receiving this

communication are cautioned not to place any undue reliance on such forward-looking

statements. These factors include, without limitation, the following: our ability to compete

successfully; potential governmental encroachment in our tax businesses; our ability to

develop, deploy and use artificial intelligence in our platform and products; our ability to

adapt to technological change and to successfully extend our platform; our ability to predict

consumer behavior; our reliance on intellectual property; our ability to protect our intellectual

property rights; any harm to our reputation; risks associated with our ESG and DEI practices;

risks associated with acquisition and divestiture activity; the issuance of equity or incurrence

of debt to fund an acquisition or for general business purposes; cybersecurity incidents

(including those affecting the third parties we rely on); customer concerns about privacy and

cybersecurity incidents; fraudulent activities by third parties using our offerings; our failure to

process transactions effectively; interruption or failure of our information technology; our

ability to maintain critical third-party business relationships; our ability to attract and retain

talent and the success of our hybrid work model; any deficiency in the quality or accuracy of

our offerings (including the advice given by experts on our platform); any delays in product

launches; difficulties in processing or filing customer tax submissions; risks associated with

international operations; risks associated with climate change; changes to public policy, laws

or regulations affecting our businesses; legal proceedings in which we are involved;

fluctuations in the results of our tax business due to seasonality and other factors beyond

our control; changes in tax rates and tax reform legislation; global economic conditions

(including, without limitation, inflation); exposure to credit, counterparty and other risks in

providing capital to businesses; amortization of acquired intangible assets and impairment

charges; our ability to repay or otherwise comply with the terms of our outstanding debt; our

ability to repurchase shares or distribute dividends; volatility of our stock price; and our ability

to successfully market our offerings; our ability to realize the anticipated benefits of the Plan;

risks related to the preliminary nature of the estimate of the charges to be incurred in

connection with Plan, which is subject to change; and risks related to any delays in the

timing for implementing the Plan or potential disruptions to our business or operations as we

execute on the Plan. More details about these and other risks that may impact our business

are included in our Form 10-K for fiscal 2023 and in our other SEC filings. You can locate

these reports through our website at http://investors.intuit.com. First quarter and full-year

fiscal 2025 guidance speaks only as of the date it was publicly issued by Intuit. Other

forward-looking statements represent the judgment of the management of Intuit as of the

date of this presentation. Except as required by law, we do not undertake any duty to update

any forward-looking statement or other information in this presentation.

TABLE A

INTUIT INC.

GAAP CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions, except per share amounts)

(Unaudited)

Three Months Ended

Twelve Months Ended

July 31,

2024

July 31,

2023

July 31,

2024

July 31,

2023

Net revenue:

Service $ 2,670 $ 2,340 $ 13,861 $ 12,317

Product and other 514

372

2,424

2,051

Total net revenue 3,184

2,712

16,285

14,368

Costs and expenses:

Cost of revenue:

Cost of service revenue 733 656 3,250 2,908

Cost of product and other revenue 14 16 69 72

Amortization of acquired

technology 36 41 146 163

Selling and marketing 1,104 840 4,312 3,762

Research and development 725 680 2,754 2,539

General and administrative 377 341 1,418 1,300

Amortization of other acquired

intangible assets 123 121 483 483

Restructuring 223

—

223

—

Total costs and expenses [A] 3,335

2,695

12,655

11,227

Operating income (loss) (151) 17 3,630 3,141

Interest expense (60) (68) (242) (248)

Interest and other income, net 71

46

162

96

Income (loss) before income taxes (140) (5) 3,550 2,989

Income tax provision (benefit) [B] (120)

(94)

587

605

Net income (loss) $ (20)

$ 89

$ 2,963

$ 2,384

Basic net income (loss) per share $ (0.07)

$ 0.32

$ 10.58

$ 8.49

Shares used in basic per share

calculations

280

280

280

281

Diluted net income (loss) per share $ (0.07)

$ 0.32

$ 10.43

$ 8.42

Shares used in diluted per share

calculations

280

283

284

283

See accompanying Notes.

INTUIT INC.

NOTES TO TABLE A

[A] The following table summarizes the total share-based compensation expense that we

recorded in operating income (loss) for the periods shown.

Three Months Ended

Twelve Months Ended

(In millions)

July 31,

2024

July 31,

2023

July 31,

2024

July 31,

2023

Cost of revenue $ 102 $ 83 $ 402 $ 374

Selling and marketing 137 119 506 429

Research and development 161 148 639 532

General and administrative 94 98 368 377

Restructuring 25

—

25

—

Total share-based compensation

expense

$ 519

$ 448

$ 1,940

$ 1,712

[B] We recognized excess tax benefits on share-based compensation of $183 million in our

provision for income taxes for the twelve months ended July 31, 2024 and $32 million for

the twelve months ended July 31, 2023.

Our effective tax rate for the twelve months ended July 31, 2024 was approximately

17%. Excluding certain tax benefits primarily related to share-based compensation, our

effective tax rate was approximately 24%. This rate differed from the federal statutory

rate of 21% primarily due to state income taxes and non-deductible share-based

compensation, which were partially offset by the benefit we received from the federal

research and experimentation credit.

Our effective tax rate for the twelve months ended July 31, 2023 was approximately

20%. Excluding tax benefits related to share-based compensation and a transfer of

certain intangible assets during the three months ended July 31, 2023 from our United

Kingdom subsidiary to the United States, our effective tax rate was approximately 24%.

This rate differed from the federal statutory rate of 21% primarily due to state income

taxes and non-deductible share-based compensation, which were partially offset by the

benefit we received from the federal research and experimentation credit.

In the current global tax policy environment, the U.S. and other domestic and foreign

governments continue to consider, and in some cases enact, changes in corporate tax

laws. As changes occur, we account for finalized legislation in the period of enactment.

TABLE B1

INTUIT INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

TO MOST DIRECTLY COMPARABLE GAAP FINANCIAL MEASURES

(In millions, except per share amounts)

(Unaudited)

Fiscal 2024

Q1

Q2

Q3

Q4

Full Year

GAAP operating income (loss) $ 307 $ 369 $ 3,105 $ (151) $ 3,630

Amortization of acquired technology 38 36 36 36 146

Amortization of other acquired

intangible assets 120 120 120 123 483

Restructuring [A] — — — 223 223

Professional fees for business

combinations — — — 5 5

Share-based compensation expense 495

475

451

494

1,915

Non-GAAP operating income

(loss)

$ 960

$ 1,000

$ 3,712

$ 730

$ 6,402

GAAP net income (loss) $ 241 $ 353 $ 2,389 $ (20) $ 2,963

Amortization of acquired technology 38 36 36 36 146

Amortization of other acquired

intangible assets 120 120 120 123 483

Restructuring [A] — — — 223 223

Professional fees for business

combinations — — — 5 5

Share-based compensation expense 495 475 451 494 1,915

Net (gain) loss on debt securities

and other investments 1 (3) 1 1 —

Loss on disposal of a business 1 — 9 (1) 9

Income tax effects and adjustments

[B]

(198)

(235)

(202)

(298)

(933)

Non-GAAP net income (loss) $ 698

$ 746

$ 2,804

$ 563

$ 4,811

GAAP diluted net income (loss)

per share $ 0.85 $ 1.25 $ 8.42 $ (0.07) $ 10.43

Amortization of acquired technology 0.13 0.13 0.13 0.13 0.51

Amortization of other acquired

intangible assets 0.42 0.42 0.42 0.43 1.70

Restructuring [A] — — — 0.79 0.79

Professional fees for business

combinations — — — 0.02 0.02

Share-based compensation expense 1.75 1.67 1.59 1.74 6.75

Net (gain) loss on debt securities

and other investments

0.01 (0.01) — — —

Loss on disposal of a business 0.01 — 0.03 — 0.03

Income tax effects and adjustments

[B]

(0.70)

(0.83)

(0.71)

(1.05)

(3.29)

Non-GAAP diluted net income

(loss) per share

$ 2.47

$ 2.63

$ 9.88

$ 1.99

$ 16.94

Shares used in GAAP diluted per

share calculations

283

284

284

280

284

Shares used in non-GAAP diluted

per share calculations

283

284

284

283

284

[A] Restructuring charges for the three and twelve months ended July 31, 2024 includes $25

million in share-based compensation expense. See "About Non-GAAP Financial

Measures" for further information on restructuring charges.

[B] As discussed in “About Non-GAAP Financial Measures - Income Tax Effects and

Adjustments” following Table E, our long-term non-GAAP tax rate eliminates the effects

of non-recurring and period-specific items. Income tax adjustments consist primarily of

the tax impact of the non-GAAP pre-tax adjustments and tax benefits related to share-

based compensation.

See “About Non-GAAP Financial Measures” immediately following Table E for information

on these measures, the items excluded from the most directly comparable GAAP measures

in arriving at non-GAAP financial measures, and the reasons management uses each

measure and excludes the specified amounts in arriving at each non-GAAP financial

measure.

TABLE B2

INTUIT INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

TO MOST DIRECTLY COMPARABLE GAAP FINANCIAL MEASURES

(In millions, except per share amounts)

(Unaudited)

Fiscal 2023

Q1

Q2

Q3

Q4

Full Year

GAAP operating income (loss) $ 76 $ 270 $ 2,778 $ 17 $ 3,141

Amortization of acquired technology

41 41 40 41 163

Amortization of other acquired

intangible assets 121 121 120 121 483

Professional fees for business

combinations 2 1 1 — 4

Share-based compensation expense 422

423

419

448

1,712

Non-GAAP operating income

(loss)

$ 662

$ 856

$ 3,358

$ 627

$ 5,503

GAAP net income (loss) $ 40 $ 168 $ 2,087 $ 89 $ 2,384

Amortization of acquired technology 41 41 40 41 163

Amortization of other acquired

intangible assets 121 121 120 121 483

Professional fees for business

combinations 2 1 1 — 4

Share-based compensation expense 422 423 419 448 1,712

Net (gain) loss on debt securities

and other investments — 2 6 1 9

Loss on disposal of a business — — — 8 8

Income tax effects and adjustments

[A]

(156)

(136)

(150)

(241)

(683)

Non-GAAP net income (loss) $ 470

$ 620

$ 2,523

$ 467

$ 4,080

GAAP diluted net income (loss)

per share $ 0.14 $ 0.60 $ 7.38 $ 0.32 $ 8.42

Amortization of acquired technology 0.14 0.14 0.14 0.14 0.57

Amortization of other acquired

intangible assets 0.43 0.43 0.43 0.43 1.71

Professional fees for business

combinations 0.01 — — — 0.01

Share-based compensation expense 1.49 1.50 1.48 1.58 6.05

Net (gain) loss on debt securities

and other investments — 0.01 0.02 — 0.03

Loss on disposal of a business — — — 0.03 0.03

Income tax effects and adjustments

[A]

(0.55)

(0.48)

(0.53)

(0.85)

(2.42)

Non-GAAP diluted net income

(loss) per share

$ 1.66

$ 2.20

$ 8.92

$ 1.65

$ 14.40

Shares used in GAAP diluted per

share calculations

284

282

283

283

283

Shares used in non-GAAP diluted

per share calculations

284

282

283

283

283

[A] As discussed in “About Non-GAAP Financial Measures - Income Tax Effects and

Adjustments” following Table E, our long-term non-GAAP tax rate eliminates the effects

of non-recurring and period-specific items. Income tax adjustments consist primarily of

the tax impact of the non-GAAP pre-tax adjustments and tax benefits related to share-

based compensation.

See “About Non-GAAP Financial Measures” immediately following Table E for information

on these measures, the items excluded from the most directly comparable GAAP measures

in arriving at non-GAAP financial measures, and the reasons management uses each

measure and excludes the specified amounts in arriving at each non-GAAP financial

measure.

TABLE C

INTUIT INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions)

(Unaudited)

July 31,

2024

July 31,

2023

ASSETS

Current assets:

Cash and cash equivalents $ 3,609 $ 2,848

Investments 465 814

Accounts receivable, net 457 405

Notes receivable held for investment, net 779 687

Notes receivable held for sale 3 —

Income taxes receivable 78 29

Prepaid expenses and other current assets 366

354

Current assets before funds receivable and amounts held for

customers 5,757 5,137

Funds receivable and amounts held for customers 3,921

420

Total current assets 9,678 5,557

Long-term investments 131 105

Property and equipment, net 1,009 969

Operating lease right-of-use assets 411 469

Goodwill 13,844 13,780

Acquired intangible assets, net 5,820 6,419

Long-term deferred income tax assets 698 64

Other assets 541

417

Total assets $ 32,132

$ 27,780

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Short-term debt $ 499 $ —

Accounts payable 721 638

Accrued compensation and related liabilities 921 665

Deferred revenue 872 921

Income taxes payable 8 698

Other current liabilities 549

448

Current liabilities before funds payable and amounts due to

customers 3,570 3,370

Funds payable and amounts due to customers 3,921

420

Total current liabilities 7,491 3,790

Long-term debt 5,539 6,120

Operating lease liabilities 458 480

Other long-term obligations 208

121

Total liabilities 13,696

10,511

Stockholders’ equity 18,436

17,269

Total liabilities and stockholders’ equity $ 32,132

$ 27,780

TABLE D

INTUIT INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

(Unaudited)

Twelve Months Ended

July 31,

2024

July 31,

2023

Cash flows from operating activities:

Net income $ 2,963 $ 2,384

Adjustments to reconcile net income to net cash provided by

operating activities:

Depreciation 159 160

Amortization of acquired intangible assets 630 646

Non-cash operating lease cost 81 90

Share-based compensation expense 1,940 1,712

Deferred income taxes (554) (628)

Other 92

81

Total adjustments 2,348

2,061

Originations and purchases of loans held for sale (96) —

Sales and principal repayments of loans held for sale 98 —

Changes in operating assets and liabilities:

Accounts receivable (52) 42

Income taxes receivable (48) 64

Prepaid expenses and other assets (30) (75)

Accounts payable 133 (97)

Accrued compensation and related liabilities 257 88

Deferred revenue (49) 111

Operating lease liabilities (71) (81)

Income taxes payable (691) 690

Other liabilities 122

(141)

Total changes in operating assets and liabilities (429)

601

Net cash provided by operating activities 4,884

5,046

Cash flows from investing activities:

Purchases of corporate and customer fund investments (780) (1,015)

Sales of corporate and customer fund investments 526 240

Maturities of corporate and customer fund investments 676 449

Purchases of property and equipment (250) (260)

Acquisitions of businesses, net of cash acquired (83) (33)

Originations and purchases of loans held for investment (2,538) (1,983)

Sales of loans originally classified as held for investment 234 —

Principal repayments of loans held for investment 2,068 1,727

Other (80)

(47)

Net cash used in investing activities (227)

(922)

Cash flows from financing activities:

Proceeds from issuance of long-term debt, net of discount and

issuance costs 3,956 —

Repayments of debt (4,200) (1,009)

Proceeds from borrowings under unsecured revolving credit

facility 100 —

Repayments on borrowings under unsecured revolving credit

facility (100) —

Proceeds from borrowings under secured revolving credit

facilities 180 222

Repayments on borrowings under secured revolving credit

facilities (25) (23)

Proceeds from issuance of stock under employee stock plans 282 228

Payments for employee taxes withheld upon vesting of restricted

stock units (1,002) (633)

Cash paid for purchases of treasury stock (1,988) (1,967)

Dividends and dividend rights paid (1,034) (889)

Net change in funds receivable and funds payable and amounts

due to customers 3,436 (197)

Other (2)

(1)

Net cash used in financing activities (397)

(4,269)

Effect of exchange rates on cash, cash equivalents, restricted

cash, and restricted cash equivalents

(13)

—

Net increase (decrease) in cash, cash equivalents, restricted

cash, and restricted cash equivalents 4,247 (145)

Cash, cash equivalents, restricted cash, and restricted cash

equivalents at beginning of period

2,852

2,997

Cash, cash equivalents, restricted cash, and restricted cash

equivalents at end of period

$ 7,099

$ 2,852

Reconciliation of cash, cash equivalents, restricted cash, and

restricted cash equivalents reported within the consolidated

balance sheets to the total amounts reported on the consolidated

statements of cash flows

Cash and cash equivalents $ 3,609 $ 2,848

Restricted cash and restricted cash equivalents included in funds

receivable and amounts held for customers

3,490

4

Total cash, cash equivalents, restricted cash, and restricted

cash equivalents at end of period

$ 7,099

$ 2,852

Supplemental disclosure of cash flow information:

Interest paid $ 200

$ 272

Income taxes paid $ 1,881

$ 484

Supplemental schedule of non-cash investing activities:

Transfers of loans originated or purchased as held for investment

to held for sale

$ 231

$ —

TABLE E

INTUIT INC.

RECONCILIATION OF FORWARD-LOOKING GUIDANCE FOR NON-GAAP FINANCIAL

MEASURES TO PROJECTED GAAP REVENUE, OPERATING INCOME, AND EPS

(In millions, except per share amounts)

(Unaudited)

Forward-Looking Guidance

GAAP

Range of Estimate

Non-GAAP

Range of Estimate

From

To

Adjmts

From

To

Three Months Ending October

31, 2024

Revenue $ 3,114 $ 3,145 $ — $ 3,114 $ 3,145

Operating income $ 231 $ 251 $ 653 [a]$ 884 $ 904

Diluted earnings per share

$ 0.61 $ 0.66 $ 1.72 [b]$ 2.33 $ 2.38

Twelve Months Ending July 31,

2025

Revenue $ 18,160 $ 18,347 $ — $ 18,160 $ 18,347

Operating income $ 4,649 $ 4,724 $ 2,592 [c]$ 7,241 $ 7,316

Diluted earnings per share $ 12.34 $ 12.54 $ 6.82 [d]$ 19.16 $ 19.36

See “About Non-GAAP Financial Measures” immediately following Table E for information

on these measures, the items excluded from the most directly comparable GAAP measures

in arriving at non-GAAP financial measures, and the reasons management uses each

measure and excludes the specified amounts in arriving at each non-GAAP financial

measure.

[a] Reflects estimated adjustments for share-based compensation expense of approximately

$477 million; amortization of acquired technology of approximately $37 million;

amortization of other acquired intangible assets of approximately $120 million; and

restructuring charges of approximately $19 million.

[b] Reflects estimated adjustments in item [a], income taxes related to these adjustments,

and other income tax effects related to the use of the non-GAAP tax rate.

[c] Reflects estimated adjustments for share-based compensation expense of approximately

$1.9 billion; amortization of acquired technology of approximately $148 million;

amortization of other acquired intangible assets of approximately $482 million; and

restructuring charges of approximately $24 million.

[d] Reflects estimated adjustments in item [c], income taxes related to these adjustments,

and other income tax effects related to the use of the non-GAAP tax rate.

INTUIT INC.

ABOUT NON-GAAP FINANCIAL MEASURES

The accompanying press release dated August 22, 2024 contains non-GAAP financial

measures. Table B1, Table B2, and Table E reconcile the non-GAAP financial measures in

that press release to the most directly comparable financial measures prepared in

accordance with Generally Accepted Accounting Principles (GAAP). These non-GAAP

financial measures include non-GAAP operating income (loss), non-GAAP net income (loss),

and non-GAAP net income (loss) per share.

Non-GAAP financial measures should not be considered as a substitute for, or superior to,

measures of financial performance prepared in accordance with GAAP. These non-GAAP

financial measures do not reflect a comprehensive system of accounting, differ from GAAP

measures with the same names, and may differ from non-GAAP financial measures with the

same or similar names that are used by other companies.

We compute non-GAAP financial measures using the same consistent method from quarter

to quarter and year to year. We may consider whether other significant items that arise in the

future should be excluded from our non-GAAP financial measures. Beginning with the fourth

quarter of fiscal 2024, we exclude from our non-GAAP measures restructuring charges, as

described below. There were no restructuring charges in any prior period presented.

We exclude the following items from all of our non-GAAP financial measures:

Amortization of acquired technology

Amortization of other acquired intangible assets

Restructuring charges

Share-based compensation expense

Goodwill and intangible asset impairment charges

Gains and losses on disposals of businesses and long-lived assets

Professional fees and transaction costs for business combinations

We also exclude the following items from non-GAAP net income (loss) and diluted net

income (loss) per share:

Gains and losses on debt securities and other investments

Income tax effects and adjustments

Discontinued operations

We believe these non-GAAP financial measures provide meaningful supplemental

information regarding Intuit’s operating results primarily because they exclude amounts that

we do not consider part of ongoing operating results when planning and forecasting and

when assessing the performance of the organization, our individual operating segments, or

our senior management. Segment managers are not held accountable for share-based

compensation expense, amortization, restructuring, or the other excluded items and,

accordingly, we exclude these amounts from our measures of segment performance. We

believe our non-GAAP financial measures also facilitate the comparison by management

and investors of results for current periods and guidance for future periods with results for

past periods.

The following are descriptions of the items we exclude from our non-GAAP financial

measures.

Amortization of acquired technology and amortization of other acquired intangible assets.

When we acquire a business in a business combination, we are required by GAAP to record

the fair values of the intangible assets of the business and amortize them over their useful

lives. Amortization of acquired technology in cost of revenue includes amortization of

software and other technology assets of acquired businesses. Amortization of other acquired

intangible assets in operating expenses includes amortization of assets such as customer

lists and trade names.

Restructuring charges. This consists of costs incurred as a direct result of discrete strategic

restructuring actions, including, but not limited to severance and other one-time termination

benefits, and other costs, which are different in terms of size, strategic nature, and frequency

than ongoing productivity and business improvements.

Share-based compensation expense. This consists of non-cash expenses for stock options,

restricted stock units, and our Employee Stock Purchase Plan. When considering the impact

of equity awards, we place greater emphasis on overall shareholder dilution rather than the

accounting charges associated with those awards.

Goodwill and intangible asset impairment charges. We exclude from our non-GAAP financial

measures non-cash charges to adjust the carrying values of goodwill and other acquired

intangible assets to their estimated fair values.

Gains and losses on disposals of businesses and long-lived assets. We exclude from our

non-GAAP financial measures gains and losses on disposals of businesses and long-lived

assets because they are unrelated to our ongoing business operating results.

Professional fees and transaction costs for business combinations. We exclude from our

non-GAAP financial measures the professional fees we incur to complete business

combinations. These include investment banking, legal, and accounting fees.

Gains and losses on debt securities and other investments. We exclude from our non-GAAP

financial measures credit losses on available-for-sale debt securities and gains and losses

on other investments.

Income tax effects and adjustments. We use a long-term non-GAAP tax rate for evaluating

operating results and for planning, forecasting, and analyzing future periods. This long-term

non-GAAP tax rate excludes the income tax effects of the non-GAAP pre-tax adjustments

described above, and eliminates the effects of non-recurring and period specific items which

can vary in size and frequency. Based on our long-term projections, we are using a long-

term non-GAAP tax rate of 24% for fiscal 2024 and fiscal 2025. This long-term non-GAAP

tax rate could be subject to change for various reasons including significant acquisitions,

changes in our geographic earnings mix, or fundamental tax law changes in major

jurisdictions in which we operate. We will evaluate this long-term non-GAAP tax rate on an

annual basis and whenever any significant events occur which may materially affect this

rate.

Operating results and gains and losses on the sale of discontinued operations. From time to

time, we sell or otherwise dispose of selected operations as we adjust our portfolio of

businesses to meet our strategic goals. In accordance with GAAP, we segregate the

operating results of discontinued operations as well as gains and losses on the sale of these

discontinued operations from continuing operations on our GAAP statements of operations

but continue to include them in GAAP net income or loss and net income or loss per share.

We exclude these amounts from our non-GAAP financial measures.

The reconciliations of the forward-looking non-GAAP financial measures to the most directly

comparable GAAP financial measures in Table E include all information reasonably

available to Intuit at the date of this press release. These tables include adjustments that we

can reasonably predict. Events that could cause the reconciliation to change include

acquisitions and divestitures of businesses, goodwill and other asset impairments, sales of

available-for-sale debt securities and other investments, and disposals of businesses and

long-lived assets.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20240822939959/en/

Investors

Kim Watkins

Intuit Inc.

650-944-3324

kim_watkins@intuit.com

Media

Kali Fry