Board of Governors of the Federal Reserve System

For use at 11:00 a.m. EST

February 25, 2022

Monetary Policy rePort

February 25, 2022

Letter of transmittaL

B G

F R S

Washington, D.C., February 25, 2022

T P S

T S H R

The Board of Governors is pleased to submit its Monetary Policy Report pursuant to

section 2B of the Federal Reserve Act.

Sincerely,

Jerome H. Powell, Chairman

Statement on Longer-run goaLS and monetary PoLicy Strategy

Adopted effective January24, 2012; as reafrmed effective January25, 2022

The Federal Open Market Committee (FOMC) is rmly committed to fullling its statutory mandate from

the Congress of promoting maximum employment, stable prices, and moderate long-term interest rates. The

Committee seeks to explain its monetary policy decisions to the public as clearly as possible. Such clarity

facilitates well-informed decisionmaking by households and businesses, reduces economic and nancial

uncertainty, increases the eectiveness of monetary policy, and enhances transparency and accountability,

which are essential in a democratic society.

Employment, ination, and long-term interest rates uctuate over time in response to economic and nancial

disturbances. Monetary policy plays an important role in stabilizing the economy in response to these

disturbances. The Committee’s primary means of adjusting the stance of monetary policy is through changes

in the target range for the federal funds rate. The Committee judges that the level of the federal funds rate

consistent with maximum employment and price stability over the longer run has declined relative to its

historical average. Therefore, the federal funds rate is likely to be constrained by its eective lower bound

more frequently than in the past. Owing in part to the proximity of interest rates to the eective lower bound,

the Committee judges that downward risks to employment and ination have increased. The Committee is

prepared to use its full range of tools to achieve its maximum employment and price stability goals.

The maximum level of employment is a broad-based and inclusive goal that is not directly measurable

and changes over time owing largely to nonmonetary factors that aect the structure and dynamics of the

labor market. Consequently, it would not be appropriate to specify a xed goal for employment; rather, the

Committee’s policy decisions must be informed by assessments of the shortfalls of employment from its

maximum level, recognizing that such assessments are necessarily uncertain and subject to revision. The

Committee considers a wide range of indicators in making these assessments.

The ination rate over the longer run is primarily determined by monetary policy, and hence the Committee

has the ability to specify a longer-run goal for ination. The Committee rearms its judgment that ination

at the rate of 2percent, as measured by the annual change in the price index for personal consumption

expenditures, is most consistent over the longer run with the Federal Reserve’s statutory mandate. The

Committee judges that longer-term ination expectations that are well anchored at 2percent foster price

stability and moderate long-term interest rates and enhance the Committee’s ability to promote maximum

employment in the face of signicant economic disturbances. In order to anchor longer-term ination

expectations at this level, the Committee seeks to achieve ination that averages 2percent over time, and

therefore judges that, following periods when ination has been running persistently below 2percent,

appropriate monetary policy will likely aim to achieve ination moderately above 2percent for some time.

Monetary policy actions tend to inuence economic activity, employment, and prices with a lag. In setting

monetary policy, the Committee seeks over time to mitigate shortfalls of employment from the Committee’s

assessment of its maximum level and deviations of ination from its longer-run goal. Moreover, sustainably

achieving maximum employment and price stability depends on a stable nancial system. Therefore, the

Committee’s policy decisions reect its longer-run goals, its medium-term outlook, and its assessments of

the balance of risks, including risks to the nancial system that could impede the attainment of the

Committee’s goals.

The Committee’s employment and ination objectives are generally complementary. However, under

circumstances in which the Committee judges that the objectives are not complementary, it takes into account

the employment shortfalls and ination deviations and the potentially dierent time horizons over which

employment and ination are projected to return to levels judged consistent with its mandate.

The Committee intends to review these principles and to make adjustments as appropriate at its annual

organizational meeting each January, and to undertake roughly every 5years a thorough public review of its

monetary policy strategy, tools, and communication practices.

iii

Contents

note: This report reects information that was publicly available as of noon EST on February23, 2022

(the one exception is the GDP data published on February 24, 2022). Unless otherwise stated, the time series

in the gures extend through, for daily data, February22, 2022; for monthly data, January2022; and, for

quarterly data, 2021:Q4. In bar charts, except as noted, the change for a given period is measured to its nal

quarter from the nal quarter of the preceding period.

For gures 23 and 35, note that the S&P/Case-Shiller U.S. National Home Price Index, the S&P 500 Index, and the Dow Jones Bank Index are products

of S&P Dow Jones Indices LLC and/or its afliates and have been licensed for use by the Board. Copyright © 2022 S&P Dow Jones Indices LLC, a division

of S&P Global, and/or its afliates. All rights reserved. Redistribution, reproduction, and/or photocopying in whole or in part are prohibited without

written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices, please visit www.spdji.com.

S&P® is a registered trademark of Standard & Poor’s Financial Services LLC, and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings

LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their afliates, nor their third-party licensors make any representation or

warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent, and neither

S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their afliates, nor their third-party licensors shall have any liability for any errors,

omissions, or interruptions of any index or the data included therein.

Summary .................................................................1

Recent Economic and Financial Developments ................................... 1

Monetary Policy

........................................................... 2

Special Topics

............................................................. 3

Part 1: Recent Economic and Financial Developments .....................5

Domestic Developments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Financial Developments

.................................................... 31

International Developments

................................................. 36

Part 2: Monetary Policy ..................................................41

Part 3: Summary of Economic Projections ................................47

Abbreviations ............................................................65

List of Boxes

The Limited Recovery of Labor Supply .......................................... 8

Differences in Wage and Employment Growth across Jobs and Workers

................ 11

How Widespread Has the Rise in Ination Been?

................................. 15

Supply Chain Bottlenecks in U.S. Manufacturing and Trade

......................... 19

Developments Related to Financial Stability

..................................... 34

Developments in the Federal Reserve’s Balance Sheet and Money Markets

.............. 44

Forecast Uncertainty

....................................................... 62

1

summary

U.S. economic activity posted further

impressive gains in the second half of last

year, but ination rose to its highest level since

the early 1980s. The labor market tightened

substantially further amid high demand for

workers and constrained supply, with the

unemployment rate reaching the median of

Federal Open Market Committee (FOMC)

participants’ estimates of its longer-run

normal level and nominal wages rising at their

fastest pace in decades. With demand strong,

and amid ongoing supply chain bottlenecks

and constrained labor supply, ination

increased appreciably last year, running well

above the FOMC’s longer-run objective of

2percent and broadening out to a wider range

of items. As 2022 began, the rapid spread of

the Omicron variant appeared to be causing a

slowdown in some sectors of the economy, but

with Omicron cases having declined sharply

since mid-January, the slowdown is expected

tobe brief.

Over the second half of last year, the FOMC

held its policy rate near zero to support the

continued economic recovery. The Committee

began phasing out net asset purchases in

November and accelerated the pace of the

phaseout in December; net asset purchases will

end in early March. With ination well above

the FOMC’s longer-run objective and a strong

labor market, the Committee expects it will

soon be appropriate to raise the target range

for the federal funds rate.

Recent Economic and Financial

Developments

Economic activity and the labor market. In the

second half of 2021, gross domestic product

(GDP) growth slowed somewhat from its

brisk rst-half pace but nevertheless rose at a

solid annualized rate of 4.6percent. Average

monthly job gains remained robust at 575,000

in the second half. The unemployment rate

has plummeted almost 2percentage points

since June and, at 4percent in January, has

reached the median of FOMC participants’

estimates of its longer-run normal level.

Moreover, unemployment declines have been

widespread across demographic groups. That

said, labor force participation only crept up

last year and remains constrained. The tight

labor supply, in conjunction with a continued

surge in labor demand, has resulted in strong

nominal wage growth, especially for low-wage

workers. Supply bottlenecks also continued

to signicantly limit activity throughout the

second half, while the Delta and Omicron

waves led to notable, but apparently

temporary, slowdowns in activity.

Ination. The personal consumption

expenditures (PCE) price index rose

5.8percent over the 12 months ending in

December, and the index that excludes food

and energy items (so-called core ination)

was up 4.9percent—the highest readings for

both measures in roughly 40years. Upward

pressure on ination from prices of goods

experiencing both supply chain bottlenecks

and strong demand, such as motor vehicles

and furniture, has persisted, and elevated

ination has broadened out to a wider range

of items. Services ination has also stepped

up further, reecting strong wage growth in

some service sectors and a signicant increase

in housing rents. While measures of near-term

ination expectations moved substantially

higher over the course of last year, measures of

longer-term ination expectations have moved

up only modestly; they remain in the range

observed over the decade before the pandemic

and thus appear broadly consistent with the

FOMC’s longer-run ination objective of

2percent.

Financial conditions. Yields on nominal

Treasury securities across maturities increased

notably since mid-2021, with much of the

increase having occurred in the past couple

of months, as the expected timing for the

2 SUMMARY

beginning of the removal of monetary

policy accommodation has moved forward

signicantly. Equity prices decreased slightly,

on net, and corporate bond yields rose but

remain low, with stable corporate credit

quality. Financing conditions for consumer

credit continue to be largely accommodative

except for borrowers with low credit scores.

Mortgage rates for households remain

low despite recent increases. Bank lending

standards have eased across most loan

categories, and bank credit has expanded.

All told, nancing conditions have been

accommodative for businesses and households.

Financial stability. While some nancial

vulnerabilities remain elevated, the large banks

at the core of the nancial system continue to

be resilient. Measures of valuation pressures

on risky assets remain high compared with

historical values. Nonnancial-sector leverage

has broadly declined, and credit growth in

the household sector has been driven almost

exclusively by residential mortgages and auto

loans to prime-rated borrowers. Vulnerabilities

from nancial-sector leverage are within their

historical range, with relatively lower leverage

at banks partially oset by higher leverage at

life insurers and hedge funds. Funding markets

remain stable. Domestic banks continue to

maintain signicant levels of high-quality

liquid assets, while assets under management

at prime and tax-exempt money market funds

have declined further since mid-2021. The

Federal Reserve continues to evaluate the

potential systemic risks posed by hedge funds

and digital assets and is closely monitoring

the transition away from LIBOR. (See the box

“Developments Related to Financial Stability”

in Part 1.)

International developments. Foreign GDP

has continued to recover briskly, on balance,

despite successive waves of the pandemic,

which have been mirrored in slowdowns and

rebounds in economic activity. This recovery

has been supported by vaccination rates that

have steadily increased in both advanced

foreign economies and emerging market

economies (EMEs). Ination rose notably in

many economies in the second half of last

year, importantly boosted by higher energy

and other commodity prices as well as supply

chain constraints. Several emerging market

foreign central banks and a few advanced-

economy foreign central banks have raised

policy rates, though foreign monetary and

scal policies have generally continued to be

accommodative.

Foreign nancial conditions have tightened

modestly but are generally contained. In

advanced foreign economies, sovereign yields

have increased since the rst half of last year

on rming expectations for higher policy rates.

The change in nancial conditions in EMEs

has been relatively muted in the face of the

shift in monetary policy in some advanced

economies. The trade-weighted value of the

dollar appreciated modestly, on net, over the

past six months. Recent geopolitical tensions

related to the Russia–Ukraine situation are a

source of uncertainty in global nancial and

commodity markets.

Monetary Policy

Interest rate policy. The FOMC has continued

to keep the target range for the federal funds

rate at 0 to ¼percent since the previous

Monetary Policy Report. With ination well

above the Committee’s 2percent longer-run

goal and a strong labor market, the Committee

expects it will soon be appropriate to raise the

target range for the federal funds rate.

Balance sheet policy. From June2020

until November2021, the Federal Reserve

expanded its holdings of Treasury securities

by $80billion per month and its holdings

of agency mortgage-backed securities by

$40billion per month. In December2020,

the Committee indicated that it would

continue to increase its holdings of securities

at least at this pace until the economy had

made substantial further progress toward its

maximum-employment and price-stability

goals. Last November, the Committee

MONETARY POLICY REPORT: FEBRUARY 2022 3

judged that this criterion had been achieved

and began to reduce the monthly pace of

its net asset purchases. In December, in

light of ination developments and further

improvements in the labor market, the

Committee announced it would double the

pace of reductions in its monthly net asset

purchases. At its January meeting, the FOMC

decided to continue to reduce its net asset

purchases at this accelerated pace, which will

bring them to an end in early March, and

issued a statement of principles for its planned

approach for signicantly reducing the size of

the Federal Reserve’s balance sheet.

1

A number

of participants at the meeting commented that

conditions would likely warrant beginning to

reduce the size of the balance sheet sometime

later this year.

2

In assessing the appropriate stance of

monetary policy, the Committee will continue

to monitor the implications of incoming

information for the economic outlook. The

Committee is rmly committed to its price-

stability and maximum-employment goals and

is prepared to use its tools to prevent higher

ination from becoming entrenched while

promoting a sustainable expansion and strong

labor market.

Special Topics

Low labor supply. Labor supply has been

slow to rebound even as labor demand has

been remarkably strong. The labor force

participation rate remains well below estimates

of its longer-run trend, principally reecting a

wave of retirements among older individuals

and increases in the number of people out

of the labor force and engaged in caregiving

responsibilities. The ongoing pandemic has

1. See the January26, 2022, press release regarding the

Principles for Reducing the Size of the Federal Reserve’s

Balance Sheet, available at https://www.federalreserve.

gov/newsevents/pressreleases/monetary20220126c.htm.

2. The minutes for the January2022 FOMC meeting

note these comments and are available on the Federal

Reserve’s website at https://www.federalreserve.gov/

monetarypolicy/fomcminutes20220126.htm.

also aected labor supply through fear of the

virus or the need to quarantine. Moreover,

savings buers accumulated during the

pandemic may have enabled some people to

remain out of the labor force. (See the box

“The Limited Recovery of Labor Supply” in

Part 1.)

Wage and employment growth across jobs and

workers. Wage and employment gains were

widespread across jobs and industries last

year, with the lowest-wage jobs experiencing

the largest gains in both median wages and

employment. Wage growth in the leisure and

hospitality industry accelerated sharply, which,

together with a lagging employment rebound

and high job openings, suggests a lack of

available workers in the industry. Median

wages also increased across racial and ethnic

groups, leaving dierences in wage levels across

groups little changed relative to 2019. (See the

box “Dierences in Wage and Employment

Growth across Jobs and Workers” in Part 1.)

Broadening of ination. Higher PCE price

ination broadened out over the course of

2021, with the share of products experiencing

notable price increases moving appreciably

higher. The broadening was evident in both

goods and services, though most of last year’s

very high ination readings were concentrated

in goods, a reection of the strong demand

and supply bottlenecks that have particularly

aected these items. (See the box “How

Widespread Has the Rise in Ination Been?” in

Part 1.)

Supply bottlenecks. Supply chain bottlenecks

have plagued the economy for much of the

past year. Against a backdrop of robust

demand for goods, global distribution

networks have been strained, and domestic

manufacturers have had trouble nding the

materials and labor needed to ll orders for

their products. U.S. ports have been congested

amid record volumes of shipping, and delivery

times for materials have remained elevated.

Supply shortages of semiconductors have been

particularly acute and have weighed heavily

4 SUMMARY

on motor vehicle production and sales. While

there are some signs of improvement, general

supply chain bottlenecks are not expected to

resolve for some time. (See the box “Supply

Chain Bottlenecks in U.S. Manufacturing

andTrade” in Part 1.)

Developments in the Federal Reserve’s balance

sheet. The size of the Federal Reserve’s balance

sheet continued to grow, albeit at a slower

rate given the reduced monthly pace of net

asset purchases since November. However,

reserve balances—the largest liability on the

Federal Reserve’s balance sheet—were little

changed, on net, reecting growth in nonreserve

liabilities such as currency and overnight

reverse repurchase agreements (ON RRP). The

elevated level of reserves continued to put broad

downward pressure on short-term interest rates,

while the decline in Treasury bill supply over

2021 has contributed to a shortage of short-

term investments. Amid these developments, the

ON RRP facility continued to serve its intended

purpose of helping to provide a oor under

short-term interest rates and support eective

implementation of monetary policy. (See the

box “Developments in the Federal Reserve’s

Balance Sheet and Money Markets” in Part 2.)

5

2

4

6

8

10

12

14

16

Percent

202220202018201620142012201020082006

2. Civilian unemployment rate

Monthly

S

OURCE

: Bureau of Labor Statistics via Haver Analytics.

125

130

135

140

145

150

155

Millions of jobs

202220202018201620142012201020082006

1. Nonfarm payroll employment

Monthly

SOURCE: Bureau of Labor Statistics via Haver Analytics.

Domestic Developments

The labor market has continued to

recover rapidly

Payroll employment increased by 3.5million

jobs in the second half of 2021, bringing the

gains for the year to a robust 6.7million. And

despite the headwind caused by the Omicron

wave, employment growth in January remained

robust at 467,000 (gure1). Payroll gains over

the past year have been widespread across

industries, with a particularly large increase

in the leisure and hospitality sector as people

continued their return to many activities that

had been curtailed by the pandemic.

Meanwhile, the unemployment rate

continued to move down rapidly, declining

from 6.7percent at the end of 2020 to

4.0percent this January (gure2). Notably,

the nearly 2percentage point decline in the

unemployment rate since June of last year was

the fastest half-year decline since the 1950s,

apart from the unprecedented rebound when

the economy rst reopened in 2020. Moreover,

this decline was broad based across racial and

ethnic groups and was particularly large for

Hispanics and African Americans (gure3).

While these recent declines brought the gaps

between Hispanic and African American

unemployment rates and those of whites

and Asians to near historic lows, the gaps

nevertheless remain and largely reect long-

standing structural issues.

Labor demand is very strong, but labor

supply remains constrained . . .

Last year’s job gains were driven by an

appreciable and steady rise in labor demand as

the economy reopened and activity bounced

back. By the end of the year, the number of

unlled job openings was about 60percent

above pre-pandemic levels and at an all-time

high. However, labor supply struggled to

Part 1

reCent eConomiC and finanCiaL deveLoPments

6 PART 1: RECENT ECONOMIC AND FINANCIAL DEVELOPMENTS

Employment-to-

population ratio

50

52

54

56

58

60

62

64

66

68

Percent

202220202018201620142012201020082006

4. Labor force participation rate and

employment-to-population ratio

Monthly

Labor force participation rate

N

OTE: The labor force participation rate and the employment-

to-population ratio are percentages of the population aged 16 and over.

S

OURCE

: Bureau of Labor Statistics via Haver Analytics.

keep up. In particular, the labor force

participation rate—which measures the share

of people either working or actively seeking

work—moved up only a little over the past

year and remains below its February2020

level (gure4).

3

Several pandemic-related

factors appear to be holding back labor

3. The 0.3percentage point jump in the labor force

participation rate (LFPR) in January2022 is the result

of revisions to the Current Population Survey (CPS)

population controls, which introduced a discontinuity

in the LFPR between December and January. (The

Bureau of Labor Statistics (BLS) does not revise its

published estimates for December2021 and earlier

months.) Population controls—population estimates

for disaggregated demographic groups that are used

to weight the CPS sample to make it representative of

the U.S. population—are updated annually based on

information provided by the Census Bureau. The BLS

has indicated that the LFPR revision was mostly due to

an increase in the size of the population in age groups

that participate in the labor force at high rates (those

aged 35 to 64) and a large decrease in the size of the

population aged 65 and older, which participates at a

lowrate.

Black or African American

Asian

Hispanic or Latino

2

4

6

8

10

12

14

16

18

20

Percent

202220202018201620142012201020082006

3. Unemployment rate, by race and ethnicity

Monthly

White

N

OTE: Unemployment rate measures total unemployed as a percentage of the labor force. Persons whose ethnicity is identied as Hispanic or L

atino

may

be of any race. Small sample sizes preclude reliable estimates for Native Americans and other groups for which monthly data are not reported b

y

the Bureau of Labor Statistics.

S

OURCE

: Bureau of Labor Statistics via Haver Analytics.

MONETARY POLICY REPORT: FEBRUARY 2022 7

Compensation per hour,

business sector

Atlanta Fed’s

Wage Growth Tracker

Employment cost index,

private sector

2

+

_

0

2

4

6

8

10

Percent change from year earlier

20222020201820162014

6. Measures of change in hourly compensation

Average hourly earnings,

private sector

N

OTE: Business-sector compensation is on a 4-quarter percent chang

e

basis.

For the private-sector employment cost index, change is over

the

12

months ending in the last month of each quarter; for p

rivate-sector

average

hourly earnings, the data are 12-month percent changes; for

the

Atlanta

Fed’s Wage Growth Tracker, the data are shown as a

3-month

moving average of the 12-month percent change.

SOURCE: Bureau of Labor Statistics; Federal Reserve Bank of Atlanta

,

Wage Growth Tracker; all via Haver Analytics.

Vacancy-to-

unemployment ratio

0

.3

.6

.9

1.2

1.5

1.8

2.1

Ratio

.8

1.2

1.6

2.0

2.4

2.8

3.2

202120192017201520132011200920072005

5. Ratio of job openings to job seekers and quits rate

Percent of employment

NOTE: The data are monthly and extend through December 2021. The

vacancy-to-unemployment ratio data are the ratio of job openings to

unemployed excluding temporary layos.

S

OURCE: Bureau of Labor Statistics, Job Openings and Labor

Turnover Survey.

Nonfarm quits rate

supply, including a pandemic-induced

surge in retirements, increased caregiving

responsibilities, and fears of contracting

COVID-19. (See the box “The Limited

Recovery of Labor Supply.”) As a result, the

recovery in employment—though rapid—has

been incomplete, with payrolls nearly 3 million

below their pre-pandemic level as of January.

. . . resulting in an extremely tight

labormarket . . .

A wide range of indicators have been pointing

to a very tight labor market, reecting robust

demand for workers and constrained supply.

There were two job openings per unemployed

person at year-end, the highest level on

record (gure5). Both households’ and small

businesses’ perceptions of labor market

tightness were near or above the highest levels

observed in the history of these series. The

share of workers quitting jobs each month,

an indicator of the availability of attractive

job prospects, climbed from 2.4percent to

2.9percent last year, reaching an all-time high.

Moreover, employers continued to report

widespread hiring diculties.

. . . and a broad-based acceleration

inwages

Measures of hourly labor compensation

growth have risen sharply over the past year

in nominal terms, reecting the inuences

of strong labor demand and pandemic-

related reductions in labor supply. Total

hourly compensation as measured by the

employment cost index, which includes both

wages and benets, rose at an annual rate of

5.2percent in the second half of 2021, lifting

the 12-month change to 4.4percent, well above

pre-pandemic rates (gure6). Wage growth

as computed by the Federal Reserve Bank of

Atlanta, which tracks the median 12-month

wage growth of individuals responding to

the Current Population Survey, has also been

rising smartly, as have average hourly earnings

and compensation per hour in the business

8 PART 1: RECENT ECONOMIC AND FINANCIAL DEVELOPMENTS

this factor is likely to dwindle as the date when these

individuals had previously planned to retire is reached,

provided that younger cohorts continue to retire at

expected rates.

beginning of the pandemic, who had likely planned to retire in

the next few years.

Although labor demand has bounced back strongly

over the past year, labor supply has been much slower

to rebound, resulting in an extremely tight labor

market. In particular, the labor force participation

rate (LFPR)—the share of working-age adults either

employed or actively seeking work—fell early in the

pandemic and changed little last year despite plentiful

job openings and rapidly rising wages ( gure A).

1

The behavior of the LFPR re ects a combination of

factors that have limited the recovery of labor supply

following the pandemic. The most important of these

factors are listed in turn.

Retirements: The retired share of the population is

now substantially higher than before the pandemic,

accounting for more than two-thirds of the net decline

in the LFPR. About half (0.6percentage point) of this

increase was to be expected even in the absence of the

pandemic, as additional members of the large baby-

boom generation have reached retirement age in the

past two years.

2

The other half of the increase comes

from excess retirements, above and beyond what would

have been expected in the absence of the pandemic,

due to individuals “pulling forward” their planned

future retirements by a couple of years.

3

The effect of

1. The table shows changes only through December2021

to maintain comparability with pre-pandemic data. With the

release of January2022 data, the BLS revised the population

base for labor force statistics, which complicates comparisons

with pre-pandemic data.

2. For estimates of the effects of population aging on the

LFPR during the 2020–22 period that predate the pandemic,

see Joshua Montes (2018), “CBO’s Projection of Labor

Force Participation Rates,” Working Paper Series 2018-04

(Washington: Congressional Budget Of ce, March), https://

www.cbo.gov/publication/53616.

3. Federal Reserve Board staff calculations from the Current

Population Survey indicate that many of the excess retirements

are concentrated among individuals aged 71 to 73 at the

The Limited Recovery of Labor Supply

(continued)

A. Change in labor force participation

Monthly

Metric Dec. 2020 June2021 Dec. 2021

Change since Feb. 2020

. . . . . . −1.9 −1.7 −1.5

Contribution of

Retirement

. . . . . . . . . . . . . . . . −.8 −1.1 −1.1

Expected retirement

. . . . . . −.3 −.4 −.6

Excess retirements

. . . . . . . . −.5 −.7 −.6

Caregiving

. . . . . . . . . . . . . . . . −.8 −.5 −.4

Parents of school-age

children*

. . . . . . . . . . . . . . −.3 −.1 −.1

Parents of only young

children**

. . . . . . . . . . . . . −.1 .0 .0

Nonparents

. . . . . . . . . . . . . . −.4 −.4 −.4

Disability, illness, and

schooling

. . . . . . . . . . . . . . . .2 .1 .5

Other reasons, including

COVID-19 fears

. . . . . . . . . . −.6 −.2 −.4

N: The data are monthly and extend through December 2021. The data

comprise individuals aged 16 and over. Contributions are derived from Current

Population Survey (CPS) non-labor-force participants’ answers to the question

“What best describes your current situation at this time?” We break out catego-

ries for the answers “in retirement”; “taking care of home or family,” which we

categorize as caregiving; “ill or disabled” and “in school,” which we combine;

and “other.” Contribution lines are seasonally adjusted by Federal Reserve

Board sta . Details may not sum to totals due to rounding.

*Adults with at least one child between ages 6 and 17.

**Adults with at least one child only between ages 0 and 5.

S: Bureau of Labor Statistics; Federal Reserve Board sta calculations

using CPS microdata.

MONETARY POLICY REPORT: FEBRUARY 2022 9

3percent of out-of-work adults reported fear of

contracting or spreading the virus as their main

reason for being out of work; the rate is even higher

among individuals with no college education, who

are more likely to work in contact-intensive sectors

when employed.

6

This factor may exacerbate other

labor supply factors, as retirees or caregivers may be

especially fearful of contracting or spreading the virus.

Additionally, many households built up larger-than-

normal savings during the pandemic, which may have

enabled workers to retire, spend time on caregiving,

or remain out of the labor force until virus conditions

subside. Finally, reduced immigration likely has held

back total labor supply, even though the effect on the

LFPR is likely to be much smaller.

7

workers are counted as employed in the Current Population

Survey, these absences do not affect the LFPR. In addition,

some vaccine-hesitant workers who are subject to vaccine

mandates may have left the labor force and may be reluctant

to return.

6. See the data from week 41 of the Household Pulse

Survey, which can be found on the Census Bureau’s website

at https://www.census.gov/data/tables/2021/demo/hhp/hhp41.

html#tables.

7. Slower immigration during the pandemic period has

reduced population growth—and labor force growth—since

2019, lowering the foreign-born working-age population in

the United States by about 2million people, according to

one estimate. See Giovanni Peri and Reem Zaiour (2022),

“Labor Shortages and the Immigration Shortfall,” Econofact,

January11, https://econofact.org/labor-shortages-and-the-

immigration-shortfall. Although foreign-born individuals

tend to have higher LFPRs than the overall population, the

difference is not large enough for the reduced immigration to

have a substantial effect on the (overall) LFPR.

Caregiving: Many individuals who have left the

labor force have taken on caregiving responsibilities

during the pandemic, accounting for an additional

0.4percentage point of the LFPR shortfall as of

December2021.

4

Caregiving responsibilities among

parents of school-aged children exerted a large drag

on labor supply in 2020, when schools were largely

closed. This drag on labor supply eased over the course

of 2021 as schools reopened, although the ongoing

pandemic may leave parents unsure whether in-person

schooling could be disrupted again. Other caregiving

responsibilities (for example, elder care) remain a

drag on labor supply, accounting for nearly all of the

negative contribution of this category to the LFPR.

Additional factors: Labor supply has also been

held back by other short-term factors related to the

pandemic, including fear of contracting the virus and—

especially during the Omicron wave—high numbers of

quarantining workers.

5

As of early January2022, nearly

4. The contribution of caregiving responsibilities is

measured by the increase in nonparticipants in the Current

Population Survey who report “taking care of home or family”

as their current situation. Note that this question refers to the

respondent’s current situation rather than the causal reason

why they left the labor force; nonetheless, it is reasonable to

infer that caregiving responsibilities are an important factor

contributing to the net decline in LFPR.

5. Many workers have had to quarantine during the

Omicron wave, resulting in the number of workers absent

from work due to illness being more than 600,000 higher in

December2021 than is typical for this time of year and about

2.5million higher in January2022. However, because these

10 PART 1: RECENT ECONOMIC AND FINANCIAL DEVELOPMENTS

0

1

2

3

4

Percent, annual rate

7. Change in business-sector output per hour

1949–73 1974–95 1996–

2003

2004–19 2020–

21

NOTE: Changes are measured from Q4 of the year

immediately

preceding the period through Q4 of the nal year of the period.

S

OURCE

: Bureau of Labor Statistics via Haver Analytics.

sector.

4

Indeed, nominal wages are increasing

at the fastest pace in at least 20years. This

wage growth has been widespread across most

sectors and particularly large in the leisure

and hospitality sector and for lower-wage

workers. (See the box “Dierences in Wage

and Employment Growth across Jobs and

Workers.”) Even so, in the aggregate, these

wage gains did not keep pace with the rise in

prices last year.

Labor productivity also appears to have

accelerated

The extent to which sizable wage gains raise

rms’ costs and act as a source of ination

pressure depends importantly on the pace

of productivity growth. In that regard, the

behavior of labor productivity since the start

of the pandemic has been encouraging. Over

the 2020–21 period, productivity growth in the

business sector averaged 2.3percent per year—

about 1percentage point faster than its average

pace since the mid-2000s (gure7). Some of

this acceleration in productivity might

be the result of transitory factors. For

example, worker eort, which surged in

response to employment shortages and hiring

diculties, appears to be elevated, possibly

above sustainable levels.

5

But other pandemic-

related developments could have a more

persistent eect on productivity growth. For

example, the pandemic has resulted in a high

4. The average hourly earnings and compensation per

hour measures are no longer likely to be as signicantly

aected by changes in the composition of the workforce

as they were early in the pandemic, when job losses were

much larger for lower-wage workers, which raised average

wages and measured wage growth. This process then

reversed as many lower-wage workers, particularly in

services, were rehired, thus lowering average wages and

measured wage growth. The employment cost index and

Federal Reserve Bank of Atlanta wage growth measure

are largely free of such composition eects.

5. The November2021 Beige Book—in which the

Federal Reserve reports on discussions with our business

and other contacts throughout the country—reported

that many employers were planning to increase hiring

because of concerns that their current workforce was

being overworked.

MONETARY POLICY REPORT: FEBRUARY 2022 11

The industry-speci c effects of the pandemic are

also apparent in the patterns of employment and wages

for lower-paying jobs relative to higher-paying jobs. As

shown in gure B, job losses initially aligned closely

with workers’ level of earnings, with the lowest-wage

jobs (which are disproportionately found in service-

producing industries) experiencing the greatest

employment declines. As the economy has reopened,

lower-wage employment has rebounded more.

Consistent with the rebound in labor demand for these

jobs coupled with hiring dif culties, gure C shows

that wage growth has been especially strong for lower-

wage jobs.

Wages have increased strongly during the past

year, especially for workers in lower-paying jobs

and industries. For example, gure A shows that

compensation growth for leisure and hospitality jobs as

measured by the employment cost index was stronger

than for goods-producing and service-producing

industries overall in the second half of 2021. The leisure

and hospitality industry was substantially affected by

social distancing earlier in the pandemic, leading to

outsized employment losses relative to other industries

and a much weaker recovery. However, job openings for

this industry are very high, which, in combination with

strong wage growth, indicates that the comparatively

weak employment rebound in leisure and hospitality

now largely re ects a lack of available workers.

Differences in Wage and Employment Growth across

Jobs and Workers

Goods production

Leisure and hospitality

1

2

3

4

5

6

7

8

Percent change from year earlier

20212020201920182017

A. Hourly compensation, by industry

Quarterly

Services production

N

OTE: The data are the employment cost index for tota

l

compensation.

SOURCE: Bureau of Labor Statistics via Haver Analytics.

(continued on next page)

Top

Bottom

Bottom-middle

60

70

80

90

100

110

Week ending February 15, 2020 = 100

202220212020

B. Employment, by wage quartile

Weekly

Top-middle

N

OTE: Series are adjusted to make total employment consistent

with

Current

Employment Statistics private employment. Wage q

uartile

cutos

are adjusted for wage growth over time. The data extend throug

h

January 15, 2022.

SOURCE: Federal Reserve Board sta calculations using ADP,

Inc.,

Payroll Processing microdata.

12 PART 1: RECENT ECONOMIC AND FINANCIAL DEVELOPMENTS

Differences in Wage and Employment Growth (continued)

Finally, gure D illustrates how wages have evolved

across racial and ethnic groups over the course of

the pandemic. In 2019, median hourly wages were

around $1 higher for Asian and white workers relative

to Black and Hispanic workers. From 2019 to 2021,

median wages increased between $1.10 and $1.90 for

all groups, leaving the disparities in wage levels across

these groups little changed relative to 2019.

1

1. The wage estimates in gure D are only for workers

paid hourly and exclude the incorporated self-employed.

Because hourly wages for demographic groups are published

at only an annual frequency by the Bureau of Labor Statistics,

it is not possible to infer from these data whether some

demographic groups experienced faster wage gains more

recently (for example, whether wage growth has been faster

for demographic groups with lower median wages in the

second half of 2021, mirroring the more rapid wage growth for

lower-paying jobs, as illustrated in gure C).

Top

Bottom

Bottom-middle

2

4

6

8

10

Percent change from year earlier

202220212020

C. Median wage growth, by quartile

Weekly

Top-middle

N

OTE: Quartiles are dened by hourly wage distribution from

base

period

of year-over-year calculations. Wages are measured as hourl

y

earnings,

excluding tips, overtime, and other forms of compensation. Th

e

data extend through January 15, 2022.

S

OURCE: Federal Reserve Board sta calculations using ADP, I

nc.,

Payroll Processing microdata.

Dollars

D2. Change in annual median, 2019 to 2021

Change, 2019 to 2021

Dollars

D1. Annual median, 2019 and 2021

NOTE: The data exclude incorporated self-employed.

S

OURCE:Bureau of Labor Statistics.

D. Median hourly earnings, by race and ethnicity, wage and salary workers

2019

2021

0

4

8

12

16

20

White Black or Asian Hispanic

African American or Latino

0

.4

.8

1.2

1.6

2.0

White Black or Asian Hispanic

African American or Latino

MONETARY POLICY REPORT: FEBRUARY 2022 13

Excluding food

and energy

Trimmed mean

0

.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

5.5

6.0

Percent change from year earlier

20212020201920182017201620152014

8. Change in the price index for personal consumption

expenditures

Monthly

Total

NOTE: The data extend through December 2021.

S

OURCE: For trimmed mean, Federal Reserve Bank of Dallas; for all

else, Bureau of Economic Analysis; all via Haver Analytics.

rate of new business formation, the widespread

adoption of remote work technology, and a

wave of labor-saving investments. Nevertheless,

it is too early to tell what the ultimate eect of

the pandemic will be on productivity growth in

coming years.

Ination increased signicantly

last year . . .

Consumer prices posted further sizable

increases in the second half of 2021.

Monthly increases in personal consumption

expenditures (PCE) prices averaged about the

same in the second half as in the rst half,

bringing the 12-month change in December

to 5.8percent—far above the Federal Open

Market Committee’s (FOMC) longer-run

objective of 2percent (gure8). The core

PCE price index, which excludes the more

volatile food and energy prices categories,

rose 4.9percent last year as supply chain

bottlenecks, hiring diculties, and other

capacity constraints amid strong demand

exerted pervasive upward pressure on prices.

Notably, these were the largest price increases

since the early 1980s. In January, a further

sizable rise in the consumer price index (CPI)

indicated that price pressures had not yet

begun to abate.

. . . and became more broad based in the

second half . . .

Whereas the sizable price increases seen last

spring were concentrated in a few key items,

inationary pressures broadened over the

second half of 2021. As an illustration, the

Federal Reserve Bank of Dallas trimmed mean

index, which removes the PCE categories with

the largest price increases and decreases each

month, rose only modestly in the rst half of

last year but picked up in the second half and

increased 3.1percent for the year as a whole—

its highest reading since 1991.

The broadening of price ination is further

evident when examining the price indexes for

major PCE categories (gure9). In the rst

half of 2021, rising ination was driven by

Differences in Wage and Employment Growth (continued)

Finally, gure D illustrates how wages have evolved

across racial and ethnic groups over the course of

the pandemic. In 2019, median hourly wages were

around $1 higher for Asian and white workers relative

to Black and Hispanic workers. From 2019 to 2021,

median wages increased between $1.10 and $1.90 for

all groups, leaving the disparities in wage levels across

these groups little changed relative to 2019.

1

1. The wage estimates in gure D are only for workers

paid hourly and exclude the incorporated self-employed.

Because hourly wages for demographic groups are published

at only an annual frequency by the Bureau of Labor Statistics,

it is not possible to infer from these data whether some

demographic groups experienced faster wage gains more

recently (for example, whether wage growth has been faster

for demographic groups with lower median wages in the

second half of 2021, mirroring the more rapid wage growth for

lower-paying jobs, as illustrated in gure C).

Top

Bottom

Bottom-middle

2

4

6

8

10

Percent change from year earlier

202220212020

C. Median wage growth, by quartile

Weekly

Top-middle

N

OTE: Quartiles are dened by hourly wage distribution from base

period of year-over-year calculations. Wages are measured as hourly

earnings, excluding tips, overtime, and other forms of compensation. The

data extend through January 15, 2022.

S

OURCE: Federal Reserve Board sta calculations using ADP, Inc.,

Payroll Processing microdata.

Dollars

D2. Change in annual median, 2019 to 2021

Change, 2019 to 2021

Dollars

D1. Annual median, 2019 and 2021

NOTE: The data exclude incorporated self-employed.

S

OURCE:Bureau of Labor Statistics.

D. Median hourly earnings, by race and ethnicity, wage and salary workers

2019

2021

0

4

8

12

16

20

White Black or Asian Hispanic

African American or Latino

0

.4

.8

1.2

1.6

2.0

White Black or Asian Hispanic

African American or Latino

14 PART 1: RECENT ECONOMIC AND FINANCIAL DEVELOPMENTS

Brent oil

Agriculture

and livestock

20

40

60

80

100

120

Dollars per barrel

60

80

100

120

140

160

2014 2015 2016 2017 2018 2019 2020 2021 2022

10. Spot prices for commodities

Week ending January 3, 2014 = 100

Industrial metals

N

OTE: The data are weekly averages of daily data and extend through

February 18, 2022.

S

OURCE: For oil, ICE Brent Futures via Bloomberg; for industrial

metals, S&P GSCI Industrial Metals Index Spot via Haver Analytics; for

agriculture and livestock, S&P GSCI Agriculture & Livestock Spot

Index

via Haver Analytics.

Percent change from year earlier

Monthly

NOTE: The data extend through December 2021.

S

OURCE

: Bureau of Economic Analysis via Haver Analytics.

Services

ex. energy

and housing

Goods ex. food,

beverages, and

energy

2

+

_

0

2

4

6

8

2021202020192018

Housing

services

Percent change from year earlier

9. Personal consumption expenditures price indexes

Percent change from year earlier

NOTE: The data are monthly and extend through December 2021.

S

OURCE

: Bureau of Economic Analysis via Haver Analytics.

Food and

beverages

4

2

+

_

0

2

4

6

8

20

10

+

_

0

10

20

30

40

2021202020192018

Energy

sharp increases in prices for certain goods

such as motor vehicles, which experienced

strong demand coupled with severe supply

chain bottlenecks; a recovery in demand

for nonhousing services, where many prices

rebounded after having softened earlier in

the pandemic; and rapid increases in energy

prices. In the second half, prices of those items

continued to move higher, and prices began to

rise more rapidly for food and beverages (as

increases in the costs of food commodities,

labor, and transportation were passed on to

consumers) as well as for housing services

(as rents began to reect the large increase

in housing demand). (See the box “How

Widespread Has the Rise in Ination Been?”)

. . . with further upward pressure on

ination from rising commodity and

import prices

Oil prices continued climbing over the

second half of last year and into this year,

reaching their highest level in over seven years

(gure10). Demand for oil rose as the global

economy recovered further, and oil supply was

constrained by U.S. oil production disruptions

due to Hurricane Ida and by only modest

production increases by OPEC (Organization

of the Petroleum Exporting Countries) and

its partners. Geopolitical tensions with Russia

have also contributed to higher energy prices,

including oil and natural gas.

MONETARY POLICY REPORT: FEBRUARY 2022 15

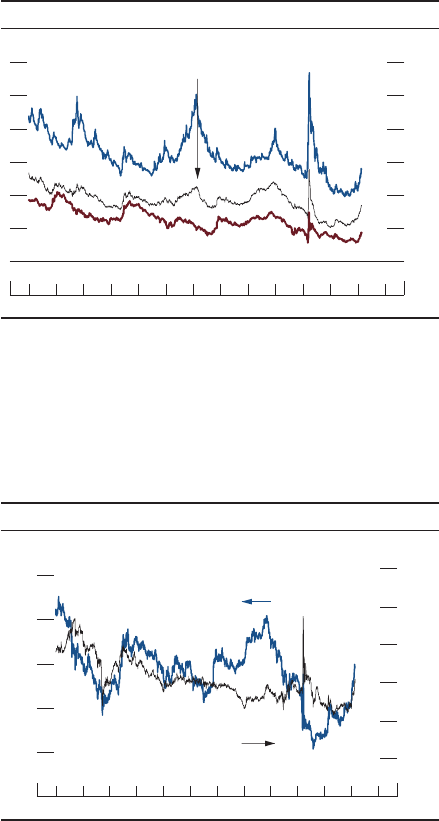

was stable at around 35percent between 2016

and 2019—close to the average share observed

since the mid-1990s—and continued to be stable

in 2020. However, the share of products with more

than 3percent in ation increased last year to above

60percent. And, as is evident from the black line, the

share of categories with price increases of more than

3percent (annual rate) over a three-month window

increased gradually over the course of the year. As

shown by the left panel, the share of product categories

with in ation above 3percent temporarily reached a

similar level on two other occasions since the 1990s

(in 2001 and 2007), but this share is still notably lower

than that in the high-in ation regime of the 1970s.

As seen in gure B, which reports the shares of

product categories with 12-month price changes

above 3percent separately for goods and services, the

increase in the breadth of large price increases was

especially unusual for goods. Yet the share of higher

in ation in services has also been moving up in the

past few months, likely in part because of mounting

in ation pressures from the labor market.

in ation but is somewhat more volatile. A price increase

of 3percent is one standard deviation above the mean of

annualized price increases for the different PCE product

categories from 2016 to 2019.

Consumer price in ation increased markedly in

2021, with the price index for personal consumption

expenditures (PCE) rising 5.8percent over the

12 months through December, following a subdued

increase of 1.3percent in 2020. In the rst half of last

year, the increase in in ation was driven by a fairly

small number of categories. In contrast, over the second

half of the year, relatively high price increases became

more widespread, suggesting that broader-based

in ationary pressures had taken hold. This discussion

reviews how in ation evolved across a comprehensive

set of product categories last year to help shed light on

the forces generating higher in ation.

Although price increases driven by bottlenecks and

production constraints have been more concentrated

in a relatively small set of product categories that have

been particularly affected by these supply–demand

imbalances, labor shortages, rising wages, and other

broad-based cost pressures likely contributed to a pickup

in in ation across a wide range of goods and services.

Figure A divides PCE into 146 product categories

and presents the share of those categories for which

prices were increasing by over 3percent.

1

This share

1. The gure presents the consumption-weighted share of

product categories with 12-month price changes—and, for the

recent period, annualized three-month price changes—over

3percent. The calculation based on three-month changes

provides a timely account of broadening in total PCE price

How Widespread Has the Rise in In ation Been?

12-month changes

0

10

20

30

40

50

60

70

80

90

100

Percent

1976 1981 1986 1991 1996 2001 2006 2011 2016 2021

A. Share of personal consumption expenditures product categories with ination over 3 percent

Monthly

0

10

20

30

40

50

60

70

80

90

100

Percent

2021202020192018

Monthly

3-month changes

N

OTE

: Each series is created from 146 product categories. Each product category is weighted by its expenditure share in personal consumption expenditures. Series a

re

derived

from 12-month price changes, except where otherwise indicated. The data extend through December 2021. The at line in each panel marks where 50 percent o

f

product categories experience ination over 3 percent.

S

OURCE: Bureau of Economic Analysis; Federal Reserve Board sta calculations.

(continued on next page)

16 PART 1: RECENT ECONOMIC AND FINANCIAL DEVELOPMENTS

Goods

Goods

0

10

20

30

40

50

60

70

80

90

100

Percent

1976 1981 1986 1991 1996 2001 2006 2011 2016 2021

B. Share of personal consumption expenditures goods and services categories with ination over 3 percent

Monthly

Services

0

10

20

30

40

50

60

70

80

90

100

Percent

2021202020192018

Monthly

N

OTE

: The series for goods is created from 81 product categories, and the series for services is created from 65 product categories.

Each product category is weighted by its

expenditure

share in personal consumption expenditures (PCE) goods or PCE services. Series are derived from 12-month price changes. The data extend through Decembe

r

2021. The at line in each panel marks where 50 percent of product categories experience ination over 3 percent.

S

OURCE

: Bureau of Economic Analysis; Federal Reserve Board sta calculations.

Services

While robust price increases became more prevalent

across product categories in the past year, the size of

price increases still varied signi cantly across product

categories. To better understand the drivers of the high

aggregate in ation last year, gure C presents the full

distribution of price changes for different products and

further emphasizes the different roles being played by

prices of goods versus services in explaining changes in

this distribution compared with the 2016–19 period.

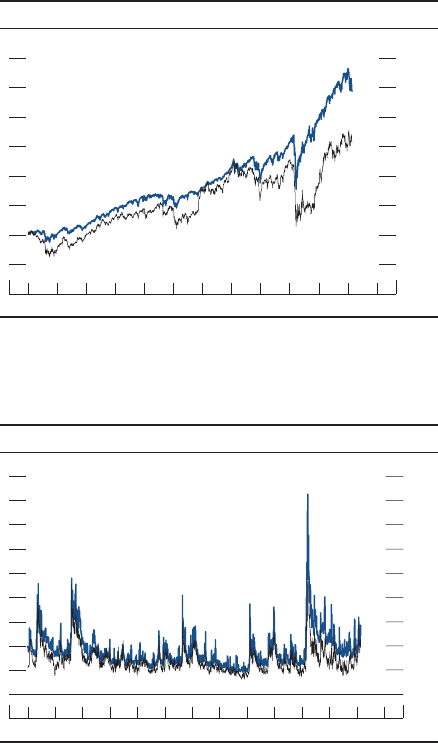

In gure C, the blue line depicts the distribution of

annualized monthly price changes observed from 2016

to 2019, while the black line depicts the dis trib ution in

2021.

2

In both periods, this distribution is very wide,

re ec t ing the sizable heterogeneity in price behavior

across items. The higher and broader in ation during 2021

is re ected in the chart as a rightward shift in the dis trib u-

tion of price changes relative to the 2016–19 period.

3

2. For each of the 146 disaggregated product categories

mapped back to 1972, the chart presents one-month

annualized in ation rates for each of the months indicated in

the legend. From 2016 to 2019 there are 7,008 observations

(48months times 146 categories) sorted into 51 bins (negative

25 or lower, negative 24, . . . , negative 1, 0, 1, . . . , 24, and

25 or higher), while in 2021 there are 1,752 observations

(12 months times 146 categories). The product categories

are weighted according to their share in overall PCE. The

comparison shown in gure C does not importantly depend

on the length of the pre-pandemic comparison period; for

example, the distribution of price changes over 2000 to 2019

looks similar to the distribution over 2016 to 2019.

3. As the price change distribution shifts rightward and

in ation becomes more broadly experienced across product

categories, a greater percent of spending occurs on products

with in ation exceeding 3percent, as depicted in gure A.

However, by combining all increases of at least 3percent,

gure A does not portray the marked increase in the number

of very large price increases, particularly for goods affected by

supply chain disruptions.

How Widespread Has the Rise in In ation Been? (continued)

(continued)

0

2

4

6

8

10

12

14

16

Share of PCE in each bin

C. Distribution of ination across personal consumption

expenditures product categories

Annualized monthly price change for a given product category

2016 to 2019

2021

25 20 15 10 50510 15 20 25–+

NOTE: The height of each line indicates the share of personal

consumption

expenditures (PCE) spent on product categories whose

annualized

monthly price changed by the percentage indicated on the

horizontal

axis. Values on the horizontal axis are binned in unit

increments

and are truncated at positive and negative 25 percent. Blue

shading

indicates that the PCE spending share was greater in 2016 to

2019

than in 2021 for the associated values of price change on the

horizontal

axis. Gray shading indicates that the PCE spending share was

greater

in 2021 than in 2016 to 2019 for the associated values of price

change

on the horizontal axis. The histogram includes 146 product

categories over the periods indicated.

SOURCE: Bureau of Economic Analysis; Federal Reserve Board sta

calculations.

MONETARY POLICY REPORT: FEBRUARY 2022 17

Four aspects of the change in the distribution are worth

noting:

(1) fewer items with price decreases, which are

depicted in the blue shaded areas below zero on

the horizontal axis

(2) a notable decline in the occurrence of price

increases of between 1 and 4percent, shown by the

blue shaded area in the middle of the distribution

(3) more items with in ation between 5 and

12percent as well as slightly more with in ation

between 13 and 24percent, shown in the gray shaded

area in those ranges on the horizontal axis

(4) a striking 6percentage point increase at the very

top of the distribution, indicated by the large (gray

shaded) spike in the share of items with price increases

of at least 25percent

These features of the distribution of price changes

can be better understood by considering the

contributions of goods and services to the changes.

First, the left panel of gure D shows the contribution

of goods to the total price change distribution between

2016 and 2019 (the blue line) and 2021 (the black

line). Goods account for about 4percentage points

of the 6percentage point increase in the spike at the

top of the price change distribution in gure C as well

as nearly all of the rightward shift in the price change

distribution in excess of 12percent in ation. Moreover,

the increased occurrence of high in ation for goods

is a stark departure from small positive or slightly

negative price changes between 2016 and 2019 (seen

D. Distribution of ination across personal consumption expenditures product categories

0

2

4

6

8

10

12

14

16

Share of PCE in each bin

D1. Contribution of goods

2016 to 2019

Annualized monthly price change for a given product category

2021

25 20 15 10 50510152025–+

0

2

4

6

8

10

12

14

16

Share of PCE in each bin

D2. Contribution of services

Annualized monthly price change for a given product category

2016 to 2019

2021

25 20 15 10 50510152025–+

N: The height of each line indicates the share of personal consumption expenditures (PCE) spent on product categories whose annualized monthly

price changed by the percentage indicated on the horizontal axis. Values on the horizontal axis are binned in unit increments and are truncated at positive

and negative 25 percent. Blue shading indicates that the PCE spending share was greater in 2016 to 2019 than in 2021 for the associated values of price

change on the horizontal axis. Gray shading indicates that the PCE spending share was greater in 2021 than in 2016 to 2019 for the associated values of

price change on the horizontal axis. The histograms include 81 product categories for goods (left panel) and 65 product categories for services (right

panel) over the periods indicated.

S: Bureau of Economic Analysis; Federal Reserve Board sta calculations.

in the blue shading). These observations are consistent

with the very large price increases in goods categories

such as motor vehicles and other categories disrupted

by supply constraints against the backdrop of strong

demand as consumption shifted away from services

during the pandemic.

Second, the right panel of gure D shows the

contribution of services to the total price change

distribution. Services account for the vast majority of

the shift from the middle of the distribution of price

changes (the blue shaded area) to in ation between

5 and 12percent (the gray shaded area), while they

account for less than one-third of the increase in the

spike at the top of the distribution.

In summary, the share of products experiencing

notable price increases moved appreciably higher

in 2021, with the broadening due to both goods and

services prices. That said, most of last year’s very high

in ation readings were concentrated in goods—a

re ection of strong demand in the face of supply

bottlenecks that have particularly affected these items.

Finally, although currently more widespread than in

recent history, large price increases were considerably

less widespread than was seen during the high-in ation

regime of the 1970s. In the period ahead, the large

price changes in goods may ease once supply chain

disruptions nally resolve, but, if labor shortages

continue and wages rise faster than productivity in a

broad-based way, in ation pressures may persist and

continue to broaden out.

18 PART 1: RECENT ECONOMIC AND FINANCIAL DEVELOPMENTS

CIE, projected onto

10-year SPF

Michigan survey,

next 12 months

SPF, 10 years ahead

CIE, projected onto Michigan

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

5.5

Percent

202220202018201620142012201020082006

12. Measures of ination expectations

Michigan survey,

next 5 to 10 years

N

OTE

: The Survey of Professional Forecasters (SPF) data are

quarterly, begin in 2007:Q1, and extend through 2022:Q1. The Index of

Common Ination Expectations (CIE) data are quarterly and extend

through 2022:Q1. The Michigan survey data are monthly and extend

through February 2022; the February data are preliminary.

S

OURCE: University of Michigan Surveys of Consumers; Federal

Reserve Bank of Philadelphia, SPF; Federal Reserve Board, CIE;

Federal Reserve Board sta calculations.

Nonfuel commodity prices have risen with the

global economic recovery since the rst half

of last year, reecting considerable increases

in the prices of both industrial metals and

agricultural commodities. Although still

below their peak last year, lumber prices have

increased sharply again in recent months

because of elevated demand from residential

construction and supply disruptions.

Import prices and the cost of transporting

imported goods—a cost not included

in measured import prices—are rising,

and bottlenecks in supply chains have

exacerbated the rise (see the box “Supply

Chain Bottlenecks in U.S. Manufacturing

and Trade”). Import price ination has also

remained elevated largely because of continued

increases in commodity prices, bringing the

12-month change through January 2022 to

6.9percent (gure11).

Measures of near-term ination

expectations rose notably, but longer-

term expectations moved up less

Ination expectations likely inuence actual

ination by aecting wage- and price-setting

decisions. In the University of Michigan

Surveys of Consumers, households’

expectations for ination over the next

12months continued to climb, reaching

levels that are among the highest observed

since the early 1980s (gure12). In contrast,

expectations for average ination over the next

5 to 10years from the same survey attened

out in the second half of 2021 after having

moved up modestly in the rst half, and

they now stand near levels observed about a

decade ago. Meanwhile, 10-year PCE ination

expectations in the Survey of Professional

Forecasters edged up, on net, since mid-2021

and stood at 2.2percent in the rst quarter

of this year. That increase was driven by

higher expectations for the next ve years,

with expectations for ination remaining at

2percent over years 6 through 10.

4

2

+

_

0

2

4

6

8

12-month percent change

202220212020201920182017201620152014

11. Nonfuel import price index

Monthly

S

OURCE

: Bureau of Labor Statistics via Haver Analytics.

MONETARY POLICY REPORT: FEBRUARY 2022 19

Over the past year, global transportation and

distribution networks have been overwhelmed, and

manufacturers have struggled to nd the materials

and labor needed to meet demand for their products.

Demand for goods has been notably boosted,

as ongoing concerns about COVID-19 have led

consumers and businesses to shift spending away from

services, such as travel, in favor of goods, such as

those related to increased time at home. While some

distribution and production bottlenecks showed signs

of improvement toward the end of last year, other

bottlenecks are expected to remain for some time.

The surge in demand for imports has strained

shipping networks worldwide, and U.S. ports have

been particularly congested. About one-third of all

U.S. goods imports (by value) arrive via seaborne

containers, and, consistent with the strength in imports

of consumer and capital goods in 2021, the number of

containers processed at domestic ports last year was

signi cantly higher than in any previous year ( gureA).

Supply Chain Bottlenecks in U.S. Manufacturing and Trade

Real goods imports

60

80

100

120

140

2019:Q4 = 100

2021202020192018201720162015201420132012

A. U.S. imports

Seaborne containers

N

OTE: The seaborne containers data are monthly, are not

seasonally

adjusted,

and extend through December 2021. The real goods

imports

data are quarterly and are seasonally adjusted.

S

OURCE

: Bureau of Economic Analysis; Maryland Por

t

Administration;

Virginia Port Authority; South Carolina

Ports

Authority;

Port of Houston Authority; Port of Los Angeles; Port o

f

Long

Beach; Port of New York and New Jersey; Port of

Oakland;

Georgia

Ports Authority; Northwest Seaport Alliance; all via Have

r

Analytics; Federal Reserve Board sta calculations.

Vessel schedule

reliability

0

200

400

600

800

1,000

December 2019 = 100

0

20

40

60

80

100

2022202120202019

B. Developments in shipping

Percent of vessels on schedule

Cost of chartering

a container ship

N

OTE

: “On schedule” is dened as a vessel arriving within 1 day of its

listed schedule. The shipping data are monthly averages of daily data and

extend through February 22, 2022. Vessel reliability data are monthly

S: NewConTex, © VHSS e.V., Hamburg and Bremen

Shipbrokers’ Association; Sea-Intelligence (2021), Global Liner

Performance, issue 125 (January).

and extend through December 2021.

The combined ports of Los Angeles and Long Beach

have faced substantial congestion, with the number of

ships waiting for a berth recently reaching an all-time

high.

1

Elevated levels of port congestion in the United

States and abroad have caused on-time arrivals of

global shipping vessels to plunge and have resulted in

dramatic increases in charter rates for container ships

( gure B). Moreover, once goods arrive in port, major

bottlenecks in U.S. trucking and rail transportation have

further delayed their movement. Trucking cargo rates

have risen sharply since mid-2020, and some measures

are now more than 15percent above the levels

prevailing in 2019.

1. Though primarily driven by strong demand for goods,

the congestion has been worsened by COVID-19 outbreaks

in emerging Asia, where port delays have tied up vessels and

containers, sending ripple effects through the global network.

(continued on the next page)

20 PART 1: RECENT ECONOMIC AND FINANCIAL DEVELOPMENTS

Supply Chain Bottlenecks (continued)

Distribution problems have also weighed heavily

on domestic production. In 2021, a record number

of manufacturers reported that an insuf cient supply

of materials was one reason they were unable to

produce at full capacity ( gure C). Together with

increasingly strong demand for goods, these limitations

on production led to backlogs of orders and to supplier

delivery times well above historical norms ( gure D).

With supply unable to satisfy demand, prices for a

wide range of goods increased last year, sometimes

sharply. Indeed, the producer price index for overall

manufacturing was more than 15percent higher in