NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

ANNUAL REPORT 2015

NORWEGIAN AIR SHUTTLE ASA

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

NORWEGIAN ANNUAL REPORT 2015

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

CONTENTS

HIGHLIGHTS

Highlights 2015

Key figures – financials

Key figures – operation

LETTER FROM CEO

BOARD OF DIRECTORS' REPORT

FINANCIAL STATEMENTS

Group financial statements

Notes to the consolidated financial statements

Financial statements for the parent company

Notes to financial statements of the parent company

Auditor's report

CORPORATE GOVERNANCE

BOARD AND MANAGEMENT

The Board of Directors

The Management team

DEFINITIONS

CONTACT

FINANCIAL CALENDAR

2016

Interim report 1Q 2016: April 21

General shareholder meeting: May 10

Interim report 2Q 2016: July 14

Interim report 3Q 2016: October 20

Norwegian Air Shuttle reserves the right to revise the dates.

NORWEGIAN ANNUAL REPORT 2015

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

HIGHLIGHTS

2015

Ä Awarded the title “World’s Best Low-Cost

Long Haul Airline” and the “Best Low-Cost

Airline in Europe” for the third year in a

row, also by SkyTrax

Ä Launched winter routes in domestic

Spain and to the Caribbean

Ä Eleven new aircraft delivered during 2015

Ä New order of 19 additional Dreamliners

Ä Leasing agreement with HK Express for

12 A320 Neo aircraft

Ä New unsecured bond issues

Ä Norwegian and OSM Aviation join forces

to increase global presence

For detailed information, see Board of

Directors' report on page 10.

New routes

Passengers (million) . +%

Aircraft utilization (BLH) . +.

New aircraft (737 and 787)

Average spot fuel price USD -%

USD/NOK . +%

New routes

Passengers (million) . +%

Aircraft utilization (BLH) . +.

New aircraft (737 and 787)

Average spot fuel price USD -%

USD/NOK . +%

New routes

Passengers (million) . +%

Aircraft utilization (BLH) . -.

New aircraft (737 and 787)

Average spot fuel price USD +%

USD/NOK . +%

New routes -

Passengers (million) . +%

Aircraft utilization (BLH) . +.

New aircraft (737 and 787)

Average spot fuel price USD -%

USD/NOK . +%

Q

Q

Q

Q

NORWEGIAN ANNUAL REPORT 2015

HIGHLIGHTS

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

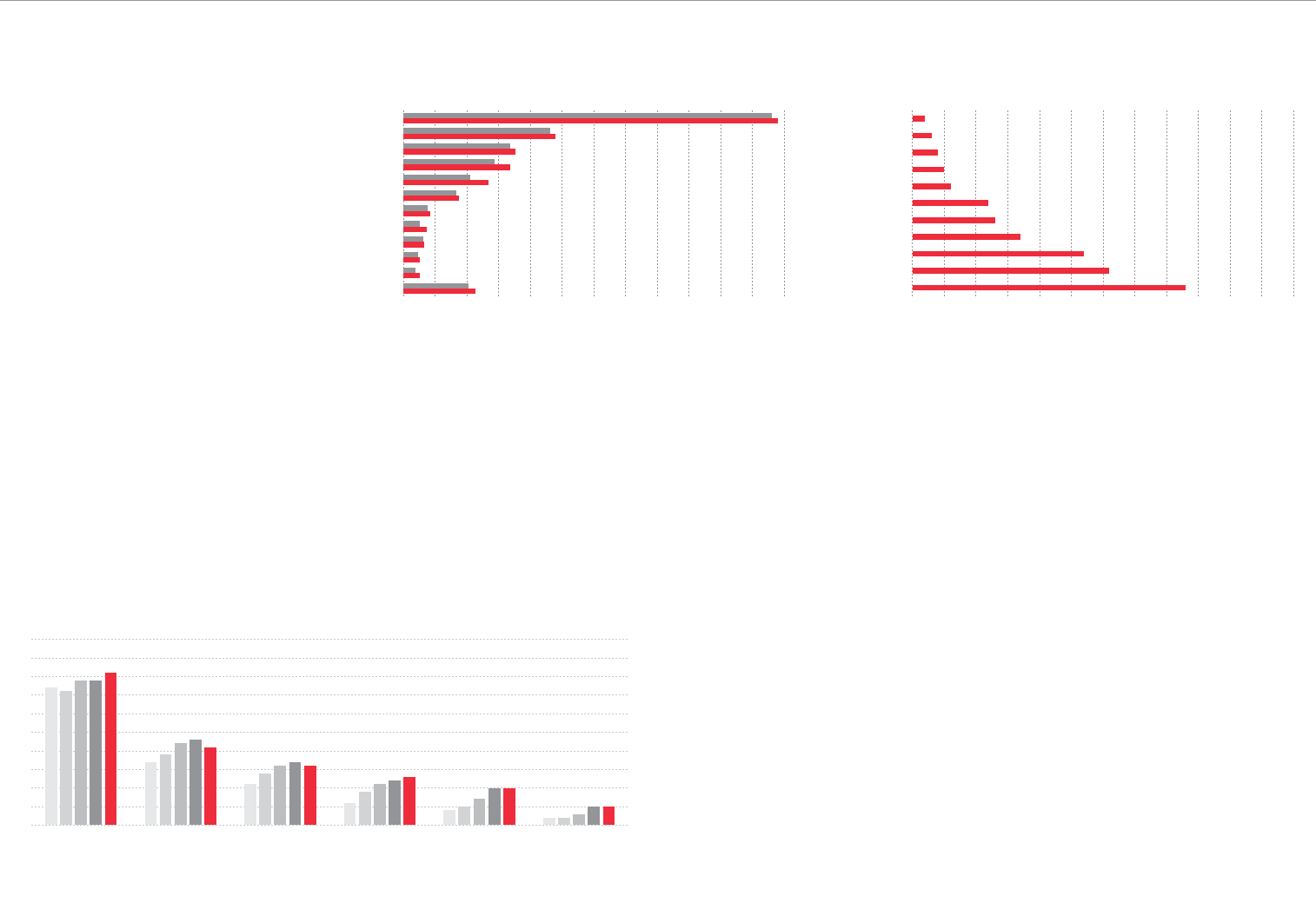

KEY FIGURES – FINANCIALS

(Amounts in NOK million) 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005

Operating revenue (MNOK)

EBITDAR (MNOK)

EBITDA (MNOK) () ()

EBIT/operating result (MNOK) () () ()

EBT (MNOK) () ()

Net profit/loss (-) () ()

Basic earnings per share (NOK) . (.) . . . . . . . (.) .

Diluted earnings per share (NOK) . (.) . . . . . . . (.) .

Equity ratio % % % % % % % % % % %

Cash and cash equivalents (MNOK)

Unit cost (CASK) . . . . . . . . . . .

Unit cost (CASK) excluding fuel . . . . . . . . . . .

ASK (million)

RPK (million)

Load factor .% .% .% .% .% .% .% .% .% .% .%

Passengers (million) . . . . . . . . . . .

Internet sales % % % % % % % % % % %

Number of routes (operated during the year)

Number of destinations (at year end)

Number of aircraft (at year end)

NORWEGIAN ANNUAL REPORT 2015

HIGHLIGHTS

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

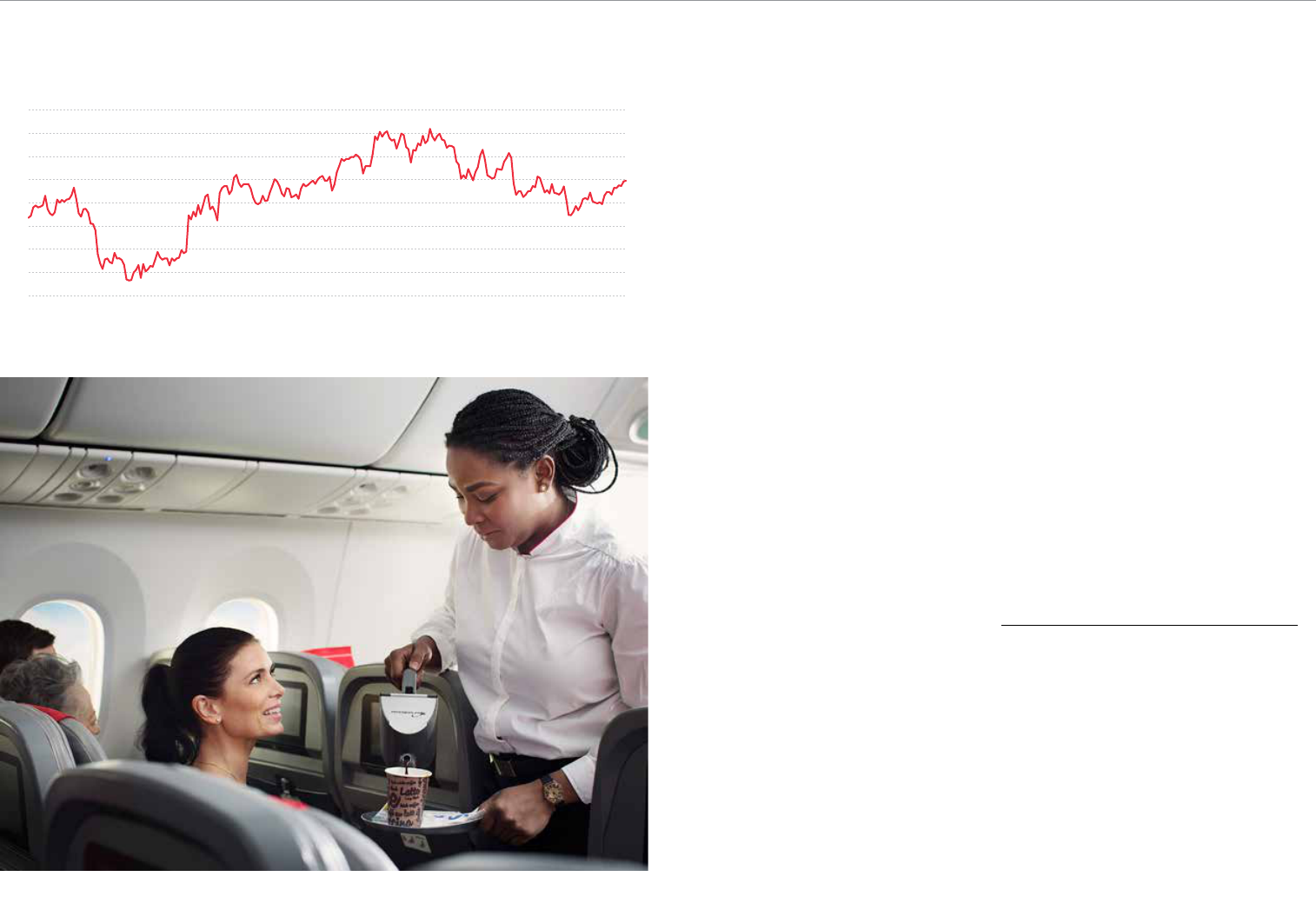

KEY FIGURES – OPERATION

UNIT COSTS

■

■ Unit cost excluding fuel in NOK

■

■ Fuel per unit in NOK

0.00

0.06

0.12

0.18

0.24

0.30

0.36

0.42

0.48

0.54

0.60

'15'14'13'12'11'10'09'08'07'06'05

UNIT COSTS PER QUARTER

Unit cost excluding fuel in NOK

■ 2014 ■

2015

Fuel per unit in NOK

■ 2014 ■ 2015

.

.

.

.

.

.

.

.

.

.

.

QQQQ

BLOCK HOURS PER QUARTER

Hours per day

■

2014 ■ 2015

.

.

.

.

.

.

.

.

.

.

.

QQQQ

BLOCK HOURS

Hours per day

7.0

7.5

8.0

8.5

9.0

9.5

10.0

10.5

11.0

11.5

12.0

'15'14'13'12'11'10'09'08'07'06'05

ASK PER QUARTER

ASK

in million (left axis) ■ 2014 ■ 2015

Load factor %

(right axis) ■ 2014 ■ 2015

Q4Q3Q2Q1

%

%

%

%

%

%

%

%

%

%

%

ASK

■

■ ASK in million (left axis)

■

Load factor % (right axis)

'15'14'13'12'11'10'09'08'07'06'05

%

%

%

%

%

%

%

%

%

%

%

RASK PER QUARTER

Rask in NOK

(left axis) ■ 2014 ■ 2015

Stage length in km

(right axis) ■ 2014 ■ 2015

.

.

.

.

.

.

.

.

.

.

.

QQQQ

RASK

■

■ Rask in NOK (left axis)

■

Stage length in km (right axis)

.

.

.

.

.

.

.

.

.

.

.

'15'14'13'12'11'10'09'08'07'06'05

NORWEGIAN ANNUAL REPORT 2015

HIGHLIGHTS

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

DEAR SHAREHOLDERS

2015 was yet another year of international growth for Norwegian with new

aircraft entering service, new route launches, a record-high number of

passengers choosing to fly with us and hundreds of new colleagues joining

the Norwegian family. It was also a year of strong passenger recognition, as

Norwegian received seven awards including the renowned Skytrax for “Best

Low-Cost Airline Europe” for the third consecutive year as well as the “Best

Low-Cost Long haul Airline”. This would not have been possible without

our loyal passengers and our hard-working colleagues in the air and on the

ground. Our strong commitment to reducing emissions was recognized in 2015

by the International Council of Clean Transportation voting us to the most

environmentally friendly transatlantic airline.

Strong demand for our domestic routes

in the Nordics and new Europeans routes

drove passenger traffic in 2015, while our

intercontinental operation reached critical

mass and contributed to Group profit. Our

results for 2015 were influenced by lower

fuel price offset by a weaker Norwegian

currency and impact of hedging.

Our operational fleet increased to 99

aircraft at year end – whereof eight 787-8

Dreamliners and 91 Boeing 737-800s. We

launched 37 new routes, including domestic

service in Spain and seasonal service be-

tween the French Caribbean islands of

Martinique and Guadeloupe to Boston,

New York and Baltimore/Washington.

We signed a new agreement to acquire

19 Boeing 787-9s, expanding our fleet of

Dreamliners to 38 by 2020.

Norwegian offers 447 routes to 138 des-

tinations. In 2015 our capacity (ASK) in-

creased by a moderate five per cent com-

pared to 2014 while revenue grew by 15

per cent. The revenue growth was driven

by a solid load factor improvement to 86

per cent (+ five p.p.), higher ancillary reve-

nue and strong demand for flights between

Europe and the U.S and Scandinavia and

Thailand. Our strongest growth occurred

on long haul operations between Europe

and the U.S. By year-end, Norwegian oper-

ated flights between Scandinavia/UK and

New York, Fort Lauderdale, Orlando, Los

Angeles, San Francisco, Las Vegas, Puerto

Rico (Caribbean) and Bangkok. In the con-

tinental European market, growth was pri-

marily a result of increased operations from

UK and Spain.

CONTINUED GLOBAL GROWTH

AHEAD

Continuous fleet renewal has become an

integral part of our business. In 2012,

Norwegian placed the largest aircraft or-

der in European aviation history, compris-

ing 222 short haul aircraft and 150 purchase

rights. Since then Norwegian has ordered a

total 38 Boeing 787 Dreamliners of which 30

787-9s, the longer and bigger version of the

787. By year-end 2015, the Group had a total

"Looking into 2016, we expect continued growth,

several new route launches and the delivery

of more than 20 brand new aircraft"

NORWEGIAN ANNUAL REPORT 2015

LETTER FROM CEO

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

of 266 undelivered aircraft on firm order:

36 Boeing 737-800s, 100 Boeing 737 MAX8s,

100 Airbus A320neos and 30 Boeing 787-9

Dreamliners (included eleven to be leased).

The performance of our 787-8 Dream-

liners has improved considerably since the

aircraft first entered service. The aircraft

are now performing on par with the 737,

confirming Norwegian’s confidence in the

Dreamliner as a true game changer. Pas-

senger comfort is unparalleled, with low

noise levels, high humidity and ambient

mood lighting, which reduces jet lag. Fuel

consumption is even lower than expected,

making fuel savings per seat higher than

twenty per cent compared to the most mod-

ern similar-sized aircraft types. In 2016, we

will take delivery of four 787-9 Dreamliners

to a total of twelve Dreamliners.

Following the slower growth in 2015, ca-

pacity growth will be significantly higher

in 2016. We are about to launch several

new routes and bases. We have already

announced the opening of a new base in

CURRENT COMMITTED FLEET PLAN

Number of planes at year-end

'''''''''''''''''

■BOwned

■B/BLeased

■Aneo

■BMAX

■Bowned

■BS&LB

■Bleased

■Bowned

■Bleased

■Mleased

1

30

29

85

13

5

5

2

25

10

23

5

5

68

21

57

7

2

22

5

23

62

8

15

11

5

40

5

23

7

5

16

2

46

5

23

22

20

2

32

8

22

2

13

13

11

11

8

8

95

2

13

5

5

41

29

3

5

13

99

27

51

3

9

13

117

23

4

68

12

15

12

22

87

13

16

177

7

19

5

12

85

13

14

155

NORWEGIAN ANNUAL REPORT 2015

LETTER FROM CEO

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

Rome, Italy as well as new routes between

Paris, France and the U.S. We will continue

to retire the oldest leased 737-800s from the

fleet, contributing to reduce unit costs and

capacity growth in low season.

For the five-year period 2015-2020 we

plan for an average annual growth rate of

20 per cent in ASK with a strong 40 per cent

annual growth for long haul and ten per

cent annual growth for short haul.

THE ENVIRONMENT

New aircraft supercharge our cost effi-

ciency and significantly enhance the pas-

senger experience. However, it also consid-

erably benefits the environment. In 2015,

CO

2

emissions per passenger per kilometre

were only 76 grams, a nine per cent reduc-

tion compared to previous year. Norwegian

is one of the most environmentally-friendly

airlines in Europe. Since 2008, Norwegian’s

fuel consumption per seat kilometre has

decreased by nine per cent. Today, emis-

sions per airline passenger are approaching

those per train passenger in many coun-

tries. Entering 2016, we boast one of the

world’s most efficient and greenest fleets

with an average age of 3.6 years. Our strong

commitment to reducing emissions was

also recognized in 2015, when the Inter-

national Council of Clean Transportation

voted us the most environmentally friendly

transatlantic airline.

Looking into 2016, we expect continued

growth, several new route launches and

the delivery of more than 20 brand new air-

craft. The entry of the bigger edition of the

Dreamliner, the 787-9, will be an important

milestone in strengthening the Company's

foothold in the low-cost long haul market.

2016 will also see the establishing of new

bases and more great people joining the

Norwegian family.

Bjørn Kjos

Chief Executive Officer

GRAMS CO2 PER PASSENGER

Per kilometer

'15'14'13'12'11'10'09'08'07

109

104

103

97

92

88

87

83

76

PASSENGERS PER QUARTER

In million

■ 2014 ■ 2015

Q4Q3Q2Q1

PASSENGERS

In million

0

3

6

9

12

15

18

21

24

27

30

'15'14'13'12'11'10'09'08'07'06'05

NORWEGIAN ANNUAL REPORT 2015

LETTER FROM CEO

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

BUILDING COMPETITIVE ADVANTAGE

Norwegian Air Shuttle ASA reported a solid revenue growth in 2015, enabled

by new aircraft entering the fleet and new routes launched. The production

growth (ASK) came in at a moderate five per cent. The load factor increased

to 86 per cent and the unit cost was reduced by one per cent to NOK 0.42.

Norwegian confirmed its competitive ability and attractiveness with almost

two million new passengers in 2015.

The Group’s results for 2015 were affected

by strong expansion of the network, con-

tinued revenue growth and efficiency im-

provements. The figures were also strongly

affected by the weaker Norwegian currency

(NOK) and unrealized losses on fuel hedges

for 2016 and 2017.

The consolidated operating revenue

grew by 15 per cent to NOK 22491 million,

with a net profit of NOK 246 million, com-

pared to a loss of NOK 1070 million in 2014.

The revenue growth is mainly a result of the

strong load factor, supported by new air-

craft delivered in 2015 and the strengthen-

ing of the international route network. Rev-

enues from international traffic increased

by 18 per cent in 2015 and amounted to NOK

17704 million.

The long haul operation developed well

and in line with the Group’s plans. The reg-

ularity of the long haul fleet of Dreamlin-

ers was on par with the 737 operation. The

intercontinental operation’s increased suc-

cess was reflected in the Group’s traffic

growth (RPK) of twelve per cent. This was

driven by a strong improvement in load fac-

tor by five p.p. to 86 per cent, in addition to

a five per cent increase in average distance

travelled per passenger. In total, eleven new

aircraft were delivered in 2015, and at the

end of 2015 the fleet comprized 99 aircraft,

including aircraft on maintenance, exclud-

ing wet-lease and aircraft for redelivery.

The ticket revenue per available seat

kilometer (RASK) for 2015 was NOK 0.38

(NOK 0.35), up eight per cent from previous

year related to increased yield and higher

load. Ancillary revenues rose by twenty per

cent to NOK 3275 million (2727). Per pas-

senger ancillary revenue grew by eleven per

cent to NOK 129 (116) driven by bundling

and the passengers’ freedom to choose.

The Group’s financial position at the end

of 2015 was solid, although affected by the

asset acquisitions, lower fuel prices and

currency fluctuations. Net interest bear-

ing debt increased to NOK 17131 million, up

from NOK 11273 million at the end of 2014

driven by financing of new aircraft and cur-

rency effects. Cash and cash equivalents

was NOK 2454 million as of December 31,

2015, a net increase of NOK 443 million.

The equity ratio was unchanged at nine per

cent.

The Board of Directors expects 2016 to

be a year of continued growth. Production

growth is expected to be around 18 per cent

in 2016, driven by 40 per cent growth in

long haul production. The level of advance

bookings at year end was good. Norwegian

will continue its efforts to improve cost effi-

ciency and expects the unit cost for 2016 to

NORWEGIAN ANNUAL REPORT 2015

BOARD OF DIRECTORS' REPORT

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

be further reduced by twelve per cent to ap-

proximately NOK 0.37 (0.42). The reduction

is driven by new aircraft with lower operat-

ing and fuel cost.

KEY EVENTS 2015

●

Awarded the title “World’s Best Low-

Cost Long Haul Airline”.

The renowned

Sky Trax World Airline Awards awarded

Norwegian the “World’s Best Low-Cost

Long Haul Airline” after slightly more

than two years in operation. In addition,

Norwegian won the title as the “Best

Low-Cost Airline in Europe” for the third

year in a row, also by SkyTrax.

●

Launched winter routes in Spain and to

the Caribbean.

Norwegian took our first

steps into the Spanish domestic market

by announcing a series of new routes

between mainland Spain and the Canary

Islands. In December, Norwegian

started routes between the French

islands Guadeloupe and Martinique

and North America. The seasonal offer

is targeting the cities New York, Boston

and Baltimore.

●

Eleven new aircraft delivered during

2015.

Ten new 737 800s and one Boeing

787-8 Dreamliner have been delivered

in 2015. Currently Norwegian has

eight Boeing 787-8 in operation and 91

Boeing 737 800s. During 2015 Norwegian

redelivered two older leased 737 800s

and retired five 737 300 classics.

●

New order of 19 additional

Dreamliners.

In October, Norwegian

agreed to buy 19 new 787-9s from Boeing

scheduled for delivery from 2017 to

2020 through Norwegians fully owned

subsidiary, Arctic Aviation Assets Ltd.

The agreement is the largest single

order of 787-9s in Europe and includes

purchase options for additional ten

aircraft of the same type. By 2020 the

Group will have 38 Dreamliners in

operation.

●

Leasing agreement with HK Express for

12 A320 Neo aircraft.

Arctic Aviation

Assets Ltd (AAA) – a fully owned

subsidiary of Norwegian Air Shuttle –

has agreed to lease out twelve Airbus

320neo aircraft to airline HK Express.

The twelve aircraft are scheduled to

delivery between 2016 and 2018 with

four each year.

●

New bond issues in Euro and local

currency.

During 2015 Norwegian issued

two new unsecured bonds (NAS 06 and

NAS 07) and tapped NOK 425 million on

an existing bond (NAS04). For the first

time Norwegian successfully issued a

bond in Euro with a four year tenor. The

net proceeds from the new bonds will be

used for general corporate purposes in

support of the growth of the Group.

●

Norwegian and OSM Aviation join

forces to increase global presence.

Norwegian Air Resources Holding

(NARH) and OSM Aviation have signed

an agreement to form a stronger

global partnership in employment and

management of aviation crew. NARH

acquires 50 per cent of OSM Aviation.

The new partnership will build on the

NORWEGIAN ANNUAL REPORT 2015

BOARD OF DIRECTORS' REPORT

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

experiences of Norwegian's and OSM

Aviation's established relationship

offering professional employment

and good career opportunities. This is

subject to approval by the EU Merger

Regulation. The transaction is expected

to be completed by the end of first half

2016.

COMPANY OVERVIEW

Norwegian Air Shuttle ASA (“Norwegian”

or “the Company”) is the parent company

of the Norwegian Group (“the Group”).

Norwegian is headquartered at Fornebu

outside Oslo, Norway.

Norwegian is one of Europe’s fastest

growing and most innovative airlines. The

parent company Norwegian Air Shuttle

ASA and its subsidiaries form the Norwe-

gian group with 4576 employees, at 19 loca-

tions in nine countries on three continents.

The Group operates both scheduled ser-

vices and charter services.

At the end of 2015, Norwegian operated

447 routes to 138 destinations. Norwegian’s

vision is “Affordable fares for all”. The busi-

ness idea is to attract customers by offering

a high-quality travel experience based on

operational excellence and helpful, friendly

service at a low fare. Operationally, safety

always comes first.

CORPORATE STRUCTURE

The Norwegian Group consists of the par-

ent company Norwegian Air Shuttle ASA

and it’s directly or indirectly fully owned

subsidiaries in Norway, Sweden, Denmark,

Finland, Ireland, Spain, United Kingdom

and Singapore. The Group has reorganized

its operations into several new entities to

ensure international growth and necessary

traffic rights, in line with the strategy. The

goal is to build a structure that maintains

Norwegian’s flexibility and adaptability

when growing and entering into new mar-

kets. Norwegian’s operations are separated

into a commercial airline group with vari-

ous AOC’s (Air Operator’s Certificate), an as-

set group, a resource and service group and

other activities including brand.

AIRLINE GROUP

The Group´s commercial airline activities are

organized in the parent company Norwegian

Air Shuttle ASA (NAS), the fully owned sub

-

sidiaries Norwegian Air International Ltd.

(NAI) based in Dublin, Ireland, Norwegian

UK (NUK) based in London, UK and Norwe

-

gian Air Norway AS (NAN) based at Fornebu,

Norway. Norwegian's commercial airline ac

-

tivities are operated through twenty bases

globally in the following geographical loca

-

tions: Norway, Sweden, Denmark, Finland,

United Kingdom, Spain, Thailand, United

States and French Caribbean.

ASSET GROUP

The Group´s asset companies are organized

in a group of subsidiaries, based in Dublin,

Ireland. Arctic Aviation Asset Ltd. (previ-

ously September Aviation Assets Ltd) is the

parent company. Aircraft leases and own-

ership have been transferred to the Asset

group.

RESOURCE GROUP

In line with legal requirements in Europe,

fully owned country-specific resource com-

panies are being established, with the in-

tention of offering permanent local employ-

ment.

OTHER BUSINESS AREAS

●

Norwegian Brand Ltd (Dublin, Ireland)

was established in 2013, with the

intention of maintaining the Group’s

brand and marketing activities across

business areas.

●

Norwegian Cargo AS (Fornebu, Norway)

was established in April 2013, and is

carrying out the Group’s commercial

cargo activities.

●

Norwegian Holidays AS (Fornebu,

Norway) was established in 2013 and

provides the new business area of

holiday packages to customers in the

end market through the Group’s web

booking.

The parent company also owns 20 per cent

of the shares in the online bank, Bank Nor

-

wegian AS, through the associated company

Norwegian Finans Holding ASA. The air

-

line’s loyalty program, Norwegian Reward

with its more than three million members,

is run in cooperation with the bank.

MARKET CONDITIONS

Norwegian is the third largest low-cost car-

rier in Europe and seventh largest in the

world. The route portfolio stretches across

Europe into North Africa, the Middle East,

North America, The Caribbean and South-

east Asia. Norwegian has a vast domestic

route network in Norway, Sweden, Den-

mark, Finland and Spain, as well as a wide

range of routes between Scandinavia and

the European continent, Thailand, the Mid-

dle East and the USA.

Norwegian has strengthened its offering

further in 2015, with the launch of new do-

mestic services in Spain and seasonal ser-

vices between the French Caribbean is-

ASSE T/

FINANCING

AIRCRAFT

OPERATIONS

RESOURCES

& SERVICES

NORWEGIAN GROUP

BRANDS

OTHER

BUSINESS AREAS

Dry lease R&S

NORWEGIAN ANNUAL REPORT 2015

BOARD OF DIRECTORS' REPORT

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

lands of Martinique and Guadelope to Bos-

ton, New York and Baltimore. Norwegian’s

fleet of more than 100 aircraft is one of

Europe’s most modern and environmen-

tally friendly. The Group also wait for 266

aircraft on firm order for delivery over the

coming years, which is a strong confirma-

tion of the Group’s strategy to become a

global airline. In addition, the Group has

160 purchase rights for potential deliveries

from 2022.

The global airline industry is character-

ized by strong competition. Norwegian in-

tends to be a competitive player in this mar-

ket and believes that the ability to grow the

business internationally is key to remain

profitable in the future.

This is the reason behind the establish-

ment of the Group’s crew bases in New York,

Fort Lauderdale, Bangkok and London –

not in Oslo, Stockholm or Copenhagen for

its long haul operation. With crew placed at

these big catchment areas, you can operate

flights into smaller and less populated ar-

eas and maximize both crew and aircraft

utilization.

In 2015 the strongest growth in number

of passengers was in UK, Spain and the US

market. The growth rate was strongest in

USA with 46 per cent, followed by Poland

(31 per cent), UK (27 per cent) and Spain (17

per cent). The growth in Scandinavia was a

moderate 2.6 per cent from 2014.

Establishing new bases in Europe not

only allows Norwegian to tap into new mar-

kets, such as non-stop routes from Barce-

lona and Las Palmas to smaller cities in the

Nordics, or routes from London Gatwick to

destinations on the European Continent.

It also enables Norwegian to compete with

the most cost-efficient airlines. Recruit-

ment to new bases takes places locally, at

competitive local wages and benefits.

Norwegian continued its global expan-

sion in 2015 by taking delivery of ten brand

new Boeing 737-800s and one 787-8 Dream-

liner, launching scores of new routes and

welcoming hundreds of new coworkers to

the Norwegian family. It also launched new

long haul services to Las Vegas, San Juan

and St Croix. The international expansion

strategy will continue in 2016 where new

routes to Boston and San Francisco Oak-

land are already established.

Revenues from International flights

grew by 18 per cent in 2015 and represented

79 per cent of group revenues, up from 76

per cent in 2014. The company expect this

trend to continue in 2016, as most of the

growth will be in long haul.

SAFETY AND COMPLIANCE

The safety of customers and employees is a

prerequisite for Norwegian’s business. Safe

operations in the air and on the ground are

therefore Norwegian’s paramount priori-

ties. We have not experienced any serious

accidents since Norwegian was established

in 1993, neither to passengers nor to crew

involving aircraft operations.

In 2015, Norwegian's commercial airline

business is built around four separate air-

lines, Norwegian Air Shuttle and Norwe-

gian Air Norway based in Norway, Norwe-

gian Air International based in Ireland and

Norwegian United Kingdom based in U.K.

As Norwegian is expanding across the

globe this brings new people from different

cultures to our team. The Norwegian cor-

porate Safety Culture is the “engine” of our

PASSENGERS BY COUNTRY OF ORIGIN

In million ■ 2014 ■ 2015

. . . . . . . . . . . .

Other

Poland

Italy

France

USA

Germany

Finland

UK

Spain

Denmark

Sweden

Norway

GROWTH IN PASSENGERS BY COUNTRY 2015

In percent

0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 55% 60%

USA

Poland

UK

Spain

Germany

Italy

Finland

Denmark

France

Sweden

Norway

MARKET SHARE

■

2011 ■ 2012 ■ 2013 ■ 2014 ■ 2015

%

%

%

%

%

%

%

%

%

%

%

Market share

Int’l Spanish bases

(AGP, LPA, ALC, TFS)

Market share

Int’l Gatwick Airport

(LGW)

Market share

Helsinki Airport

(HEL)

Market share

Copenhagen Airport

(CPH)

Market share

Stockholm Airport

(ARN)

Market share

Oslo Airport

(OSL)

NORWEGIAN ANNUAL REPORT 2015

BOARD OF DIRECTORS' REPORT

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

Safety Management Systems. An important

goal is to create one corporate “safety cul-

ture” across all different parts of the Group

to avoid inefficiencies and a different ap-

proach to core safety goals. Initiatives that

develop the Company’s airlines into cohe-

sive, informed and cooperative units with a

common goal and operating procedures are

essential elements in creating an enduring

safety culture. Safe operations is core to all

airlines. Hence, Norwegian continuously

strive to improve inter airline communica-

tions, harmonized airlines management

systems and joint efforts in creating an en-

during safety culture.

The Norwegian airlines have separate

safety departments, which all are integrated

parts of the Airlines Safety Management

Systems. The Safety and Compliance de

-

partments are independent and report di-

rectly to the Airlines Accountable Manager.

As with all management systems, the

Safety Management System provides for

goal setting, planning, and performance

measuring. The Safety Management Sys-

tem is fully integrated across the organi-

zation. As it develops, it becomes part of

the company culture, nurturing safety at-

titudes and beliefs, encouraging a “Safety

Culture”, influencing how personnel go

about their work.

Norwegian focus on safety and encour-

age internal reporting of errors. The Group

is actively promoting an atmosphere where

any employee can openly discuss errors of

commission or omission, process improve-

ments, and/or systems corrections without

the fear of reprisal. The safety departments

approach safety in a holistic manner in-

volving all employees. Such activity is es-

sential to an effective Safety Management

System, where each department considers

not alone its own risks, but also the risk that

its plans and/or activities will have on other

departments.

In order to achieve Norwegians goal of

obtain best practices, the Group move be-

yond just authority compliance. The com-

pany engage actively in international safety

research projects, exchange data with the

aviation industry and strive to follow indus-

try best practices.

In Norwegian all employees play a vital

role in the continuous work to achieve excel

-

lence in safety. Through the Safety Manage-

ment System, Norwegian manage risk and

as a result achieve cost reduction through

efficiencies, whilst reducing financial loss

associated with accidents and incidents.

OPERATIONAL AND MARKET

DEVELOPMENT

In 2015 Norwegian expanded its network

extensively with 37 new routes: Two in Nor-

way, two in Finland, three in Sweden, four

in Denmark, six in the French Caribbean,

six in the UK and 14 in Spain. By year-end,

the Group operated 447 scheduled routes to

138 destinations. Norwegian took delivery

of ten environmentally friendly Boeing 737-

800 aircraft and one 787-8 during the year.

Net fleet growth was four aircraft, with the

year-end fleet comprising 99 aircraft, in-

cluding aircraft on maintenance, excluding

wet-lease and aircraft for redelivery.

NETWORK

The Group’s route portfolio spans across

Europe as well as into North Africa, the

Middle East, North America, The Carib-

bean and Southeast Asia, serving both busi-

ness and leisure markets. Norwegian’s net-

work development objectives are to iden-

tify major point-to-point markets that have

been excessively priced or underserved,

while simultaneously maximizing aircraft

and crew utilization.

In 2015, Norwegian launched two new

seasonal bases on the French Caribbean is-

lands of Martinique and Guadeloupe. The

short haul flights operate exclusively to

the Northeastern USA, from both islands

to New York (JFK), Boston and Baltimore/

Washington (BWI). The operation consti-

tutes the first scheduled Norwegian flights

never to enter neither Scandinavian nor

Continental European airspace. The ratio-

nale is to counter the seasonally weak win-

ter season in Europe where short haul air-

craft are grounded mid-winter. The Carib-

bean – USA short haul market has a count-

er-seasonal pattern with a demand peak in

mid-winter.

In total Norwegian operates 16 short

haul bases, six in Spain, four in Norway,

two in the French Caribbean and one in

Sweden, Denmark, Finland and the UK. All

mainland European bases serve a pan-Eu-

ropean international route network. Do-

mestic operations commenced in Spain in

2015 in addition to existing domestic routes

in Norway, Sweden, Denmark and Finland.

NORWEGIAN ANNUAL REPORT 2015

BOARD OF DIRECTORS' REPORT

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

Norwegian launched its long haul oper-

ations at the end of May 2013. In 2014, new

long haul crew bases were established in

Bangkok, New York and Fort Lauderdale

with London being added in 2015. By year-

end 2015, the long haul network covered 32

routes between four European cities to nine

destinations in the US and one in Asia. The

four crew bases in Europe, North America

and Asia corresponds well to the operating

pattern of the Group.

In 2015, eight Boeing 787-8 Dreamliners

ran the long haul operation. Norwegian is

taking delivery of the first four Boeing 787-9

Dreamliners in 2016, a higher capacity lon-

ger-range version of the 787-8s. Norwegian

has firm orders for 30 long haul aircraft in-

cluding eleven to be leased, and with pur-

chase rights for another ten.

Optimization of return on investment is

to be achieved by:

●

Operating high-RASK business routes

during peak hours, and focusing

production on low-RASK leisure routes

during midday off-peak hours.

●

Focusing on leisure destinations with

year-round interest in the Nordic

market. The Canary Islands is one

example.

●

Replacing Mediterranean routes with

routes to the Alps and the Middle East

during the winter season.

●

Replacing business routes with leisure

routes during the mid-summer period

operating flights at nighttime during

peak seasons.

Domestic, intra-Scandinavian and typi-

cal European business destinations have

the highest frequencies, which attracts

business travelers. The Oslo-Bergen and

Oslo-Trondheim routes have the high-

est frequencies with 13 daily rotations on

weekdays. Typical leisure destinations in

Southern Europe, Northern Africa and the

Middle East are typically served once a day

or less.

OPERATIONS INTERNATIONAL

Norwegian Air International Ltd. (NAI)

NAI was granted its own ticket code “D8” in

2015 and took over the fleet of 737-800 op-

erations at bases in UK, Spain and Finland

from Norwegian Air Shuttle (NAS).

During the process of transitioning

bases from NAS, NAI continues to use NAS

as wet-lease operator on certain D8 routes.

In February 2014, NAI applied to the US

Department of Transportations (DoT) for

the approval to operate to the USA. As of

year-end 2015 the application is still wait-

ing for the approval.

Norwegian Air UK Ltd. (NUK)

Norwegian Air UK Ltd (NUK) was estab-

lished in the United Kingdom January 2015,

and NUK got its Operational License and

Air Operating Certificate in October 2015.

NUK applied for operational approval for

operations between Europe and the USA in

December 2015, and the decision from the

Department of Transportation (DoT) is still

pending.

NUK has one Boeing 737-800 registered

on the operational specifications and plan

to start wet-lease operations for Norwegian

Air Shuttle ASA and Norwegian Air Inter-

national Ltd. from March or April 2016.

Aircraft maintenance

The Boeing 737 fleet is operated by the par-

ent company (NAS) and it is fully owned

PUNCTUALITY

■

Punctuality (12 months rolling) ■ Target (90%)

JAN

APR

AUG

DEC

JAN

APR

AUG

DEC

JAN

APR

AUG

DEC

JAN

APR

AUG

DEC

JAN

APR

AUG

DEC

JAN

APR

AUG

DEC

JAN

APR

AUG

DEC

JAN

APR

AUG

DEC

%

%

%

%

%

%

%

%

NORWEGIAN ANNUAL REPORT 2015

BOARD OF DIRECTORS' REPORT

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

subsidiary Norwegian Air Norway (NAN)

and Norwegian Air International (NAI).

Each individual operator has its own Air

Operator Certificate (AOC), each with in-

dividual civil aviation authority oversight

and approval. Each AOC must have a civil

aviation authority approved maintenance

organization and maintenance program.

NAS and NAN manages their mainte-

nance operations from their technical bases

at Oslo Airport Gardermoen. NAI manages

its maintenance operations from its techni-

cal base at Dublin, Ireland.

Line maintenance for the B737 fleet

is performed by NAS Part 145 organiza-

tion and it is at Oslo Airport Gardermoen,

Stavanger Airport Sola, Bergen Airport

Flesland, Trondheim Airport Værnes,

Stockholm Arlanda Airport and Copenha-

gen Airport Kastrup. We do line mainte-

nance on the Caribbean bases Martinique

and Guadeloupe. Line Maintenance for the

of B737 fleet are contracted to other exter-

nal suppliers outside Scandinavia.

Continuing Airworthiness activities

for B787 fleet are sub-contracted to Boeing

Fleet Technical Management (Boeing FTM).

Control and oversight of the activities are

performed by Norwegian Air Shuttle Main-

tenance operations in addition to civil avia-

tion authorities.

Major airframe maintenance as well as

workshop maintenance are performed by

external sources subject to approval by the

European Aviation Safety Agency (EASA)

and by the national aviation authorities.

Airframe (base) maintenance for

our B737 fleet currently carried out by

Lufthansa Technik in Budapest, Hungary.

Lufthansa Technik, MTU and Boeing are

undertaking engine and component work-

shop maintenance.

Airframe maintenance for our fleet of

B787 is currently carried out by BA, NAS

and Monarch.

Rolls Royce UK currently carries out en-

gine maintenance.

All maintenance, planning and fol-

low-up activities, both internal and exter-

nal, are performed in accordance with both

the manufacturers’ requirements and ad-

ditional internal requirements, and are in

full compliance with international author-

ity regulations. The Group carries out ini-

tial quality approval, and also continuously

monitors all maintenance suppliers.

All supplier contracts are subject to

approval and monitoring by the national

aviation authorities.

FINANCIAL REVIEW

Norwegian reports consolidated financial

information compliant to the International

Financial Reporting Standards (IFRS).

The preparation of the accounts and

application of the chosen accounting prin-

ciples involve using assessments and esti-

mates and necessitate the application of

assumptions that affect the carrying

amount of assets and liabilities, income

and expenses. The estimates and the per-

taining assumptions are based on expe-

rience and other factors. The uncertainty

associated with this implies that the actual

figures may deviate from the estimates.

It is especially the maintenance reserves

liabilities that are associated with this type

of uncertainty.

Consolidated statement of

profit and loss

The Group’s total operating revenues and

income for 2015 grew by 15 per cent and

came to NOK 22491 million (NOK 19540

million), of which ticket revenues ac-

counted for NOK 18506 million (NOK 16255

million). Ancillary passenger revenues

were NOK 3275 million (NOK 2727 million)

and NOK 710 million (NOK 558 million)

was related to freight, third-party prod-

ucts and other income. The revenue growth

is mainly a result of increased number of

passengers and increased average sector

length. The load factor increased by five per

cent compared to the same period last year.

The ticket revenue per available seat kilo-

meter (RASK) for 2015 was NOK 0.38 (NOK

0. 35), up eight per cent from previous year.

Ancillary revenues rose by eleven per cent

to NOK 129 per PAX (116).

Operating costs (including leasing and

excluding depreciation and write-downs)

amounted to NOK 21010 million (NOK

20202 million), with a unit cost of NOK

0.42 (NOK 0. 42). The unit cost excluding

fuel was up by nine per cent to NOK 0.31

(NOK 0.29). The increase in unit cost is

mainly a consequence of depreciation of

NOK, offset by lower fuel price. Earnings

before interest, depreciation and amorti-

zations (EBITDA) were NOK 1481 million,

compared to a loss of NOK 662 million last

year.

Financial items in 2015 resulted in a loss

of NOK 376 million, compared to a loss of

NOK 274 million in 2014. Included in finan-

cial items is NOK 27 million in net foreign

exchange gains, compared to a loss of NOK

37 million previous year. With regards to

accounting for the prepayments on pur-

chase contracts with aircraft manufactur-

ers, NOK 269 million (NOK 145 million) in

interest costs were capitalized in 2015.

In 2007, the Group established Bank

Norwegian, a wholly-owned subsidiary of

Norwegian Finans Holding ASA, in which

the Group has a 20 per cent stake. The

Group’s share of Bank Norwegian’s net

profit resulted in a net gain of NOK 103 mil-

lion (NOK 57.6 million) in the consolidated

profit and loss.

Earnings before tax in 2015 amounted to

a gain of NOK 75 million (negative of NOK

1627 million) and net profit after tax was a

gain of NOK 246 million (negative of NOK

OPEX BREAKDOWN

Percent ■ 2014 ■ 2015

% % % % % % % % % % %

Sales and distribution

Technical maintenance expenses

General and administrative expenses

Other ight operation expenses

Aircraft leasing

Handling Charges

Airport & ATC charges

Personell expenses

Aviation Fuel

NORWEGIAN ANNUAL REPORT 2015

BOARD OF DIRECTORS' REPORT

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

1070 million). Earnings per share was

positive NOK 6.99 per share (negative of

NOK 30.42).

Consolidated statement of financial

position

The Group’s total debt and assets are im-

pacted by the asset acquisitions, depreci-

ation of NOK against USD and the capac-

ity increase that have taken place during

the year. Total assets at December 31, 2015

were NOK 31634 million (NOK 22706 mil-

lion). The book value of aircraft increased

by NOK 5980 million during the year. Pre-

payments to aircraft manufacturers were

NOK 5939 million at the end of 2015, an in-

crease of NOK 1837 million from December

31, 2014. Trade and other receivables were

NOK 2551 million (NOK 2174 million).

At the balance sheet date, the Group had

a cash balance of NOK 2454 million (NOK

2011 million). Total borrowings increased

by NOK 6310 million to NOK 19594 million

(NOK 13284 million), mainly related to new

unsecured bonds, the purchase of new air-

craft and financing of prepayments to air-

craft manufacturers.

Capital structure

The Group’s total equity was NOK 2965

million (NOK 2108 million) at December 31,

2015 with an equity ratio of nine per cent

(nine per cent). Total equity increased by

NOK 857 million following net profit for the

period of NOK 246 million, exchange rate

gains on equity in Group companies of NOK

421 million and actuarial gains on pension

plans of NOK 45 million. Equity changes

from employee options amounted to NOK

145 million, whereof NOK 138 million re-

lated to share issue.

All issued shares in the parent company

are fully paid with a par value of NOK 0.1

per share. There is only one class of shares,

and all shares have equal rights. The

Group’s articles of association have

no limitations regarding the trading of

Norwegian Air Shuttle ASA’s shares on the

stock exchange.

The Group’s aggregated net inter-

est-bearing debt was NOK 17131 mil-

lion (NOK 11273 million) at year end. The

Group’s gross interest-bearing liabilities of

NOK 19594 million (NOK 13284 million)

mainly consisted of financing for aircraft

amounting to NOK 14899 million, bond

loans with a net book value of NOK 3222

million, and Pre-Delivery Payment syn-

dicated credit facilities of NOK 1473 mil-

lion. In 2015, the Group successfully issued

two new bonds, and a tap issue on existing

bond. The new bonds will mature in 2018

and 2019. NOK 3041 million of the inter-

est-bearing loans mature in 2016. NOK 1473

million is related to financing of prepay-

ments to aircraft manufacturers and will be

replaced by long term financing at the time

of delivery of the aircraft.

Consolidated statement of cash flow

The Group’s cash flow from operations was

NOK 2357 million (NOK 287 million) in

2015. The net cash flow from operating

activities consists of the profit before tax of

NOK 75 million; add back of depreciation

and other expenses without cash effects of

NOK 2001 million and interests on borrow-

ings of NOK 582 million included in finan-

cial activities. Changes in working capital

mainly due to traffic growth amounted to

NOK 868 million. During 2015 the Group

paid NOK 44 million in taxes.

The net cash flow used for investment

activities was negative NOK 5189 million

(negative of NOK 4931 million), of which

the prepayments to aircraft manufactur-

ers constituted negative NOK 3139 million.

The purchases of ten new Boeing 737-800s,

a 787-8 Dreamliner and intangible assets

amounted to NOK 2069 million.

The net cash flow from financial activ-

ities in 2015 was NOK 3282 million (NOK

4478 million). New loans, including draw

downs on facilities for aircraft prepayments

and bond issues were NOK 5554 million,

while repayments on long term debt were

NOK 1828 million. Interest paid on borrow-

ings was NOK 582 million (NOK 323 mil-

lion). The Group has a strong focus on

liquidity planning and the Board is confi-

dent in the Group’s financial position at the

beginning of 2016.

FINANCIAL RISK AND RISK

MANAGEMENT

Risk management in the Norwegian Group

is based on the principle that risk evaluation

is an integral part of all business activities.

Policies and procedures have been estab

-

lished to manage risks. The Group’s Board of

Directors reviews and evaluates the overall

risk management systems and environment

in the Group on a regular basis.

The Group faces many risks and uncer-

tainties in a marketplace that has become

NORWEGIAN ANNUAL REPORT 2015

BOARD OF DIRECTORS' REPORT

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

increasingly global. The variety of eco-

nomic environments and market condi-

tions can be challenging, with the risk that

Norwegian may not succeed in reducing

the unit cost sufficiently to compensate

in case of weaker consumer and business

confidence in its key markets. Price vola-

tility may have a significant impact on the

Group’s results. Higher leverage as well as

changes in borrowing costs may increase

Norwegians borrowing cost and cost of cap-

ital. Norwegian is continuously exposed

to the risk of counterparty default. The

Group’s reported results and net assets de-

nominated in foreign currencies are influ-

enced by fluctuations in currency exchange

rates and in particular the US dollar.

The Group’s main strategy for mitigat-

ing risks related volatility in cash flows is

to maintain a solid financial position and

a strong credit rating. Financial risk man-

agement is carried out by a central treasury

department (Group treasury), under pol-

icies approved by the Board of Directors.

Group treasury identifies, evaluates and

hedges financial risk in close cooperation

with the Group’s operating units. The Board

provides principles for overall risk manage-

ment such as foreign currency risk, jet fuel

risk, interest rate risk, and credit risk, use

of derivative financial instruments and in-

vestment of excess liquidity.

Interest risk

The Group is exposed to changes in the

interest rate level, following the substan-

tial amount of interest bearing debt. The

Group’s cash flow interest rate risk arises

from cash and cash equivalents and float-

ing interest rate. Floating interest rate

borrowings consist of unsecured bonds, air-

craft and prepayment financing, loan facil-

ity and financial lease liabilities. Borrow-

ings issued at fixed rates expose the Group

to fair value interest rate risk. Fixed interest

rate borrowings consist of aircraft financ-

ing guaranteed by the Ex-Im Bank of the

United States and unsecured bond. Bor-

rowings are denominated in USD, EUR and

NOK. Hence, there is an operational hedge

in the composition of the debt.

Foreign currency risk

A substantial part of the Group’s revenues

and expenses are denominated in foreign

currencies. Revenues are increasingly

exposed to changes in foreign currencies

against NOK as the Group expands globally

with more customers travelling from the US

and between European destinations. The

Group’s leases, aircraft borrowings, main-

tenance, jet-fuel and related expenses are

mainly denominated in USD, and airplane

operation expenses are partly denomi-

nated in EUR. Foreign exchange risk arises

from future commercial transactions, rec-

ognized assets and liabilities and net in-

vestments in foreign operations. In order

to reduce currency risk, the Group has a

mandate to hedge up to 100 per cent of its

currency exposure for the following twelve

months. The hedging consists of forward

currency contracts and flexible forwards.

Price risk

Expenses for jet-fuel represents a substan-

tial part of the Group’s operating costs, and

fluctuations in the jet-fuel prices influence

the projected cash flows. The objective of

the jet-fuel price risk management policy is

to safeguard against significant and sudden

increases in jet-fuel prices whilst retain-

ing access to price reductions. The Group

manages jet-fuel price risk using fuel de-

rivatives. The Management has a mandate

to hedge up to 100 per cent of its expected

consumption over the next 24 months with

forward commodity contracts.

Liquidity risk

The Group monitors rolling forecasts of the

liquidity reserves, cash and cash equiva-

lents, on the basis of expected cash flows.

In addition, the Group’s liquidity manage-

ment policy involves projecting cash flows

in major currencies and evaluating the level

of liquid assets required. Furthermore,

these analyses are used to monitor bal-

ance sheet liquidity ratios against internal

and external regulatory requirements and

maintaining debt financing plans.

Following the acquisition of aircraft

with future deliveries, Norwegian will have

ongoing financing activities. The Group’s

strategy is to diversify the financing of air-

craft through sale-and- leaseback transac-

tions and term loan financing supported

by the export credit agencies in the United

States and EU.

Credit Risk

Credit risks are managed on a group level.

Credit risks arise from cash and cash equiv-

alents, derivative financial instruments

and deposits with banks and financial in-

stitutions, as well as credit exposure to

commercial customers. The Group’s policy

is to maintain credit sales at a minimum

level and sales to consumers are settled by

using credit card companies. The risks aris-

ing from receivables on credit card compa-

nies or credit card acquirers are monitored

closely. At December 31, 2015, 45 per cent

of total trade receivables are with counter-

parties with an external credit rating of A

or better, and 87 per cent of total cash and

cash equivalents are placed with A+ or bet-

ter rated counterparties.

THE SHARE

The company’s shares are listed on Oslo

Børs (Oslo Stock Exchange) with the ticker

symbol NAS and is included in the bench-

mark index OBX, which comprizes the 25

most liquid shares on Oslo Børs.

Norwegian aims at generating competi-

tive returns to its shareholders. The Board

has recommended not to distribute divi

-

dends but to retain earnings for investment

in expansion and other investment opportu

-

nities as stated in the articles of association,

thereby enhancing profitability and returns

to shareholders. The company has not paid

dividends during the last three years.

The share had a closing price of NOK

323.7 at December 31, 2015 and yielded a

return of 17 per cent from the beginning of

the year.

Norwegian had 11183 shareholders at

December 31, 2015 and the 20 largest share-

holders accounted for 62.4 per cent of the

share capital.

HBK Invest AS is the largest shareholder,

currently holding 24.6 per cent of the

"The Group’s main

strategy for mitigating

risks related to cash flow

volatility is to maintain

a solid financial position

and strong credit rating"

NORWEGIAN ANNUAL REPORT 2015

BOARD OF DIRECTORS' REPORT

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

shares. Its majority owner is Mr. Bjørn Kjos,

CEO of Norwegian. HBK Invest AS is repre-

sented on the Board of Directors of Norwe-

gian Air Shuttle ASA by Mr. Bjørn H. Kiese,

who is elected Chair of the Board.

EVENTS AFTER DECEMBER 31

On January 26, 2016, Norwegian an-

nounced a new charter agreement for the

summer 2016, to continue its cooperation

with TUI Nordic, TUI UK, Thomas Cook

Northern Europe and Nazar Nordic to fly

their customers from the Nordics and the

UK to various summer destinations includ-

ing the Balearics, the Greek Isles and the

Canaries. The total value of the contracts

is approximately NOK 500 million, up NOK

100 million from previous year, and include

more than 2200 flights.

An arrangement for pre-delivery pay-

ment financing (PDP) for fifty Airbus 320

Neo aircraft scheduled for delivery in 2016

to 2019 was finalized at the end of January

2016. The facility covers PDP financing for

deliveries until the end of 2019 and is struc-

tured as a revolving credit facility. These

deliveries over the next four years are key

to the Norwegian Group's future growth

plans, and the PDP financing facility is a

milestone in Norwegian's ongoing program

for financing direct-buy aircraft.

On February 2, 2016, a long-term financ-

ing of six Boeing 737 800 aircraft was com-

pleted. The financing is structured as a pri-

vate placement directed to institutional in-

vestors in the US market.

In February 2016, Norwegian reached an

agreement with cabin crew in Norway and

Denmark. The new collective agreements

are for a two-year period.

GOING CONCERN ASSUMPTION

Pursuant to the requirements of Norwegian

accounting legislation, the Board confirms

that the requirements for the going concern

assumption have been met and that the an-

nual accounts have been prepared on this

basis.

PARENT COMPANY RESULTS AND

DISTRIBUTION OF FUNDS

Net profit for the parent company Norwe-

gian Air Shuttle ASA was negative of NOK

862.2 million.

In accordance with the Company’s cor-

porate governance policy, the Board recom-

mends the following distribution of funds:

(Amounts in NOK million)

Dividend

Transferred from other equity .

Total allocated .

CORPORATE RESPONSIBILITY

Norwegian is committed to operating in ac-

cordance with responsible, ethical, sustain-

able and sound business principles, with re-

spect for people and the environment.

Norwegian’s corporate responsibility

strategy is built on the Group’s commit-

SHARE PRICE DEVELOPMENT 2015 – NORWEGIAN AIR SHUTTLE ASA

NOK per share

200

225

250

275

300

325

350

375

400

Jan

2015

Feb

2015

Mar

2015

Apr

2015

May

2015

Jun

2015

Jul

2015

Aug

2015

Sep

2015

Oct

2015

Nov

2015

Dec

2015

"The Norwegian share yielded a

return of 17 per cent in 2015"

NORWEGIAN ANNUAL REPORT 2015

BOARD OF DIRECTORS' REPORT

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

ment to reduce emissions and make avia-

tion more environmentally friendly. The

single most important action an airline can

take to reduce its environmental footprint

is to invest in new aircraft, consequently re-

ducing emissions considerably. With an av-

erage fleet age of 3.6 years (as of January 1,

2016) and a pending order of more than 250

new aircraft, Norwegian boasts one of the

greenest and most fuel-efficient fleets in

the world, and from 2014 to 2015, the total

emissions were reduced by as much as 9.3

per cent. In 2015, The International Council

on Clean Transportation named Norwegian

the most fuel-efficient transatlantic airline,

with an average fuel burn of 40 passenger

kilometers per liter. Norwegian goal is to

help make aviation carbon neutral by 2050.

Other key aspects of the Group’s corpo-

rate responsibility strategy are its humani-

tarian work through a long-term signature

partnership with UNICEF as well as its code

of ethics.

THE ENVIRONMENT

Norwegian is committed to actively engage

in and support a sustainable environmental

policy, and to continue to reduce emissions

from aviation. Norwegian boasts one of the

greenest and most fuel-efficient fleets in

the world, thanks to its state-of the art Boe-

ing 737-800 and 787 Dreamliner.

Norwegian’s fleet renewal program com-

menced in 2007 and the Group has continu-

ously taken deliveries of brand new Boeing

aircraft, enabling it to open new routes and

expand into new markets. In 2012, Norwe-

gian placed an order of 222 new Boeing and

Airbus single-aisle aircraft. The order was

the single largest order made by any Euro-

pean airline. The Group currently has more

than 250 new aircraft on order, including

30 Boeing 787-9 Dreamliners. In 2015, Nor-

wegian took delivery of ten Boeing 737-800s

and one Boeing 787-8 Dreamliner. It also

phased out seven Boeing 737s.

In 2015, The International Council on

Clean Transportation named Norwegian

the most fuel-efficient transatlantic airline.

According to the study, Norwegian’s mod-

ern Dreamliner fleet – with its average fuel

burn of 40 passenger kilometers per liter –

is significantly more fuel-efficient than any

of the other 19 leading transatlantic air-

lines. The second most fuel-efficient airline

burned 14 per cent more fuel per passen-

ger kilometer than Norwegian. The three

least-efficient airlines were collectively

responsible for one-fifth of transatlantic

available seat kilometers and burned 44 per

cent to 51 per cent more fuel per passenger

kilometer.

In 2015, the Group consumed 1015,337

tons of Jet A-1 fuel, equivalent to 77 grams

of CO

2

per passenger per kilometer, a reduc-

tion of 9.3 per cent from last year.

Norwegian encourages the development

of biofuel and is fully committed to replac-

ing traditional jet fuel with a greener alter-

native when it becomes commercially avail-

able and sustainable. In 2014, Norwegian

conducted its first ever biofuel flight, reduc-

ing emissions by 40 per cent compared to

an average flight with traditional fuel. This

biofuel flight was an important milestone

in the industry's shared commitment to

make sustainable biofuel more easily avail-

able for airlines. Through the development

of new technologies and frameworks, Nor-

wegian wants to help make aviation carbon

neutral by 2050. All employees should fo-

cus on how they can contribute to a better

environment.

"The second most fuel-efficient airline

burned 14 per cent more fuel per passenger

kilometer than Norwegian"

NORWEGIAN ANNUAL REPORT 2015

BOARD OF DIRECTORS' REPORT

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

The Group’s business model promotes

high load factors and higher capacity per

flight, which makes Norwegian’s operations

more environmentally sustainable as emis-

sions per passenger are lower. The Group’s

emissions per passenger kilometer are well

below the industry average and less than

many forms of land and sea-based trans-

portation.

Other key measures that minimize Nor-

wegian’s environmental impact:

●

“Green” approaches, or Continuous

Descent Approaches (CDAs), designed to

reduce overall emissions during the final

stages of the flight

●

Winglets, a tailfin-like extension of each

wingtip on the Boeing 737-800, reduce

drag. The effect is a reduction in fuel

consumption, as the same lift and speed

is created with less engine thrust.

●

The technologically advanced 787

Dreamliner uses more than 20 per cent

less fuel than its counterparts. With a

pending order of 30 Dreamliners, to be

delivered in the coming years, Norwegian

will continue to be one of the most

environmentally friendly airlines in the

world

●

Modern, slim and light seats, reducing

weight and emissions

●

As opposed to traditional network

carriers, Norwegian bypasses the big

“hubs” and offers more direct flights.

The result is a significant reduction of

fuel-intensive take offs and landings.

●

A special engine and aircraft wash

decreases fuel consumption, reducing

carbon emissions by approximately

16000 tons per year.

●

Our new aircraft reduce noise

considerably, improving the conditions

for people living around the airport.

HUMANITARIAN WORK

Norwegian has a collaboration with

UNICEF, the United Nation’s Children

Fund. Norwegian also believes that it is im-

portant to enable staff and customers to

make a difference. Fundraisers, internal

activities, relief flights and other activities

contribute to supporting UNICEF and its

important efforts to help children in need

all over the world. Norwegian and UNICEF

have had a Signature Partnership since

2007.

Norwegian's support to UNICEF con-

sists of travel funding, fundraisers and em-

ployee engagement:

NORWEGIAN ANNUAL REPORT 2015

BOARD OF DIRECTORS' REPORT

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

●

Every year, Norwegian conducts “The

most important flight of the year”. In

cooperation with UNICEF, partners and

customers, Norwegian fills an aircraft

with emergency aid and flies it to an

area where the need for help is vital. In

2015, “The most important flight of the

year went to Jordan and Syrian refugee

children and in 2014, it went to the

Central African Republic.

●

In June 2015, Norwegian and Amadeus

launched a service that enables

customers to donate money to UNICEF

when booking a flight on Norwegian’s

website. The response from the

customers have been overwhelming, and

in seven months, they donated a total of

almost NOK 3.2 million.

●

Instead of giving its employees a

Christmas present, Norwegian donates

money to UNICEF

●

UNICEF Norway employees fly for free

with Norwegian

●

In 2013, Norwegian donated 1 NOK

from each water bottle sold on board

to UNICEF's important work. Our

passengers bought 1.3 million water

bottles and consequently contributed

with 1.3 million NOK to the world's

children.

CODE OF ETHICS

Norwegian’s code of ethics provides the di-

rections for a good working environment

and highlights the Group’s guidelines for

human rights, preventing corruption, em

-

ployee rights and safety for all – both for

customers and employees. Everyone has a

joint responsibility to create a good working

environment and develop a sound corpo

-

rate culture characterized by openness and

tolerance. Norwegian promotes an environ

-

ment free from any discrimination, based

on religion, skin color, gender, sexual ori

-

entation, age, nationality, race or disability.

The work environment shall be free from

bullying or harassment. The Group has zero

tolerance for behavior that may be perceived

as degrading or threatening. When engag

-

ing in businesses with third party suppliers,

Norwegian will, whenever possible, ensure

that the suppliers adhere to international

rules of ethical standards. The Group has re

-

viewed and updated its ethical guidelines.

EMPLOYEES AND ORGANIZATION

The airline business is a service business

where good relations and respect between

people are key success factors. Everyone at

Norwegian has a joint responsibility to cre-

ate a good working environment and de-

velop a sound corporate culture marked by

openness and tolerance. Norwegian sup-

ports the international human rights as

outlined by the UN declaration and conven-

tions. No one shall in any way cause or con-

tribute to the violation or circumvention of

human rights. Norwegian places great im-

portance on ensuring compliance with em-

ployees’ basic human rights as outlined in

the International Labor Organization's core

conventions.

Equality between the genders in terms

of employment, working conditions, career

opportunities and remuneration is a given

essentiality for Norwegian Group. Norwe-

gian has a long-term focus on creating an

attractive workplace for employees. An im-

portant success factor is maintaining a

workforce of highly motivated and skilled

employees and leaders. The goal is to offer

unique opportunities to the employees as

well as a corporate culture that helps us to

attract and retain the best people in the in-

dustry, regardless of where the business is

located. Creating effective arenas for learn-

ing and professional development at all lev-

els of the organization is a priority at Nor-

wegian.

At the end of 2015, the Group employed

a total of 4576 full-time equivalents (FTE’s)

compared to 4375 FTEs at the end of 2014.

(Apprentices and hired staff included). This

was a planned increase, which has taken

place in line with the 2015 expansion of the

route network.

Norwegian’s successful apprentice pro-

gram in Travel & Tourism continued in 2015

with apprentices from both Norway and

"Norwegian promotes

an environment free

from any discrimination,

based on religion, skin

color, gender, sexual

orientation, age,

nationality, race

or disability"

NORWEGIAN ANNUAL REPORT 2015

BOARD OF DIRECTORS' REPORT

NorwegiaN aNNual report 2015.iNdd • Created: 09.10.2014 • Modified: 08.04.2016 : 10:05 all rigths reserved © 2016 teigeNs desigN

Sweden. The program is approved by the

Norwegian Educational Authorities, and

comprized round about a 100 apprentices

at the end of 2015. The program runs over a

two to three year period dependent on the

apprentice’s educational background, and

has year round rolling admission. A further

intake is due in 2016, and the program is

continuously developed.

At graduation, the apprentices have suc-

cessfully completed modules in Sales &

Marketing, Customer Support & Booking

and Ground Handling and had at least one

international assignment over a longer pe-

riod. On top of that, they have spent sev-

eral months flying as cabin crew members

across Scandinavia and Europe. The stan-

dard of our apprentices is at the highest

level with a perfect pass rate in 2015. The

labor unions are actively included in plan-

ning of the apprentices’ curriculum.

Norwegian’s human resources policy

strives to be equitable, neutral and non-dis-

criminatory, regardless of for example eth-

nicity and national background, gender,

religion or age. The airline industry has his-

torically been male-dominated, but Nor-

wegian has a strong tradition of practicing

equality since its inception in 2002. Norwe-

gian gives weight to have staff with exper-

tise related to tip tasks and is committed to

recruit both women and men to these posi-

tions.

In 2015, 47 (48.3) per cent of the employ-

ees were women and 53 (51.7) per cent were

men. Most of the pilots are men. The share

of female pilots is around 4.5 (5) per cent.

The majority of the cabin personnel are

women, while men account for approxi-

mately 23 (23) per cent.

Among administrative staff, there is

more or less an equal spread between

women and men. Among employees in tech

-

nical positions as technicians and engineers

there has historically been a predominance

of men, but this has changed in last few

years with an increasing share of female em

-

ployees. The Board of Directors has above

40 (40) per cent female representation.

SICKNESS LEAVE PER GROUP OF EMPLOYEES IN THE NORWEGIAN GROUP,

INCLUDING AGENCY STAFF*:

Cabin crew Pilots Other

Norway .% .% .% .% .% .%

Sweden .% .% .% .% - -

Denmark .% .% .% .% - -

Finland .% .% .% .% - -

Spain .% .% .% .% - -

UK .% .% .% .% - -

US .% .% - - - -

Thailand .% .% .% .% - -

*) Calculated sick leave comparable across all units. For Norway the external reported sick leave is calculated

different. The official reported sick leave for Cabin Crew was 13.3% (12.7%) and 8.6% (8.1%) for Pilots.

Active monitoring of HSE indicators, corpo-

rate health insurance policies and continu-

ing cooperation with protective services

will contribute to ensure that reduction of

sickness leave remains a priority.

A number of key HSE activities (Health,

Safety and the Environment) are conducted

in compliance with labor laws and corpo-

rate guidelines, such as risk assessments,

audits, handling of occurrence reports,

work environment surveys and following

up with group processes on base-meetings

both for crew and technical staff. Activi-

ties also include participation in ERM-or-

ganization, FRSAG (Fatigue Risk Safety

Action Group), SAG (Safety Action Group),

Non SAG and in several HSE-related proj-

ects. HSE information is also provided in

connection with training of crew, pilots and

technical staff.

The Group HSE function also ensures

group HSE supervision, leading the work