1

SAMSUNG FINANCING ACCOUNT PRICING, TERMS AND CONDITIONS

PLEASE SCROLL TO BOTTOM TO SEE ALL INFORMATION

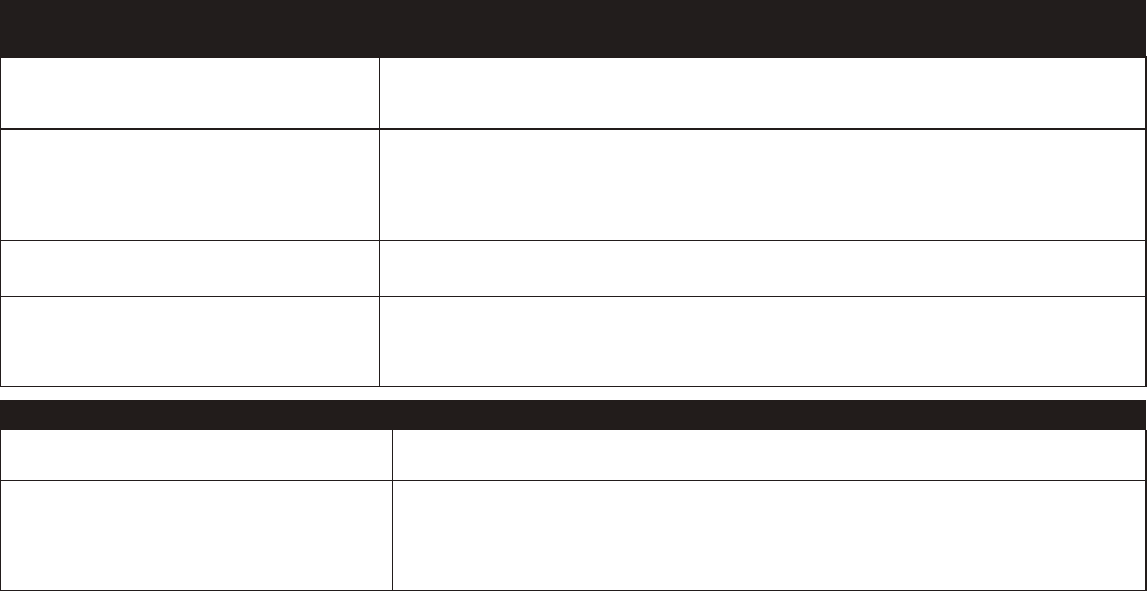

ACCOUNT SUMMARY TABLE

Interest Rates and Interest Charges

Annual Percentage Rate (APR)

for Purchases

29.99%

How to Avoid Paying Interest

Your due date is at least 25 days after the close of each billing cycle.

We will not charge you interest on purchases if you pay your entire

balance by the due date each month.

Minimum Interest Charge If you are charged interest, the charge will be no less than $1.00.

For Credit Card Tips from the

Consumer Financial

Protection Bureau

To learn more about factors to consider when applying for or

using a credit card, visit the website of the Consumer Financial

Protection Bureau at http://www.consumerfinance.gov/learnmore

Fees

Annual Fees None

Penalty Fees

• Late Fee

• Returned Payment Fee

Up to $40

Up to $35

How We Will Calculate Your Balance: We use a method called “Average Daily Balance (including new transactions).” See Section 3 of your

Cardholder Agreement for more details.

Billing Rights: Information on your rights to dispute transactions and how to exercise those rights is provided in your Cardholder Agreement.

Right to Reject: If you made a phone purchase with the account before receiving your Cardholder Agreement in writing, you may reject the

account. To reject the account, you must call TD Bank at 1-800-434-0050 within 45 days of opening the account. If you do so, the account will

be closed and you will be not responsible for any fees or charges on the account. You must also return any undamaged merchandise.

Alternatively, you may pay for the merchandise with another form of payment. Returns made as part of your right to reject are not subject to

mailing or return-shipment costs.

Current Rates on the Account: The Daily Periodic Rate for standard Purchases is 0.082164% (which corresponds to an APR of 29.99%).

Active Duty Service Members and Dependents: If you would like more information about special protections that may apply to your account,

please call 1-800-877-7467.

The information about the costs of credit described in this Account Summary Table and the Cardholder Agreement is accurate as of January

2021. This information may have changed after that date. To find out what has changed, call us at 1-800-434-0050 or write to us at: P.O. BOX

100114, Columbia, South Carolina 29202-3114.

Samsung(0121)

3

FINANCING OFFERS THAT MAY BE AVAILABLE TO YOU

1.

Deferred Interest / NO INTEREST IF PAID IN FULL – Standard Monthly Payments

Term Interest Rate

Can you avoid paying interest on

the promotional balance?

Will the minimum payment pay off the

promotional balance at the end of the

promotional period?

6 to 24 months 29.99% APR

Yes, if you pay the promotional

balance in full before the end of

the promotional period

No - you must pay more than the minimum

payment to pay off the promotional balance

INTEREST: 29.99% APR will be charged from the date of purchase if the promotional purchase is not paid in full within the promotional

period or if your account becomes 60 days past due.

PAYMENTS: Monthly payments are required on the promotional balance. These payments will be included in the total Minimum

Payment Due each month. Making only Minimum Monthly Payments WILL NOT pay off the promotional purchase within the promotional

period. To avoid the interest accrued at 29.99% APR, you must pay the total promotional purchase amount within the

promotional period.

2.

0% APR — Equal Monthly Payments

Term

Interest Rate

Will the minimum payment Pay Off the

promotional balance at the end of the

promotional period?

It will vary and will be from

12 to 100 months

0% APR Yes

INTEREST: No interest will be charged. If your account becomes 60 days past due your promotional offer will be revoked and any

remaining balance subject to the standard Purchase APR, 29.99%.

PAYMENTS: Monthly payments are required and equal the amount of the promotional purchase divided by the number of months in

the promotional period. Due to rounding your last payment may be less. These payments will be included in the total Minimum Payment

Due each month. Making only Minimum Monthly Payments will pay off the promotional purchase within the promotional period.

3.

Reduced APR — Fixed Monthly Payments

Term Interest Rate

Will the minimum payment Pay Off the

promotional balance at the end of the

promotional period?

It will vary and will be from

24 to 72 months

Varies Yes

INTEREST: The reduced APR described in the promotional offer will be used to calculate interest charges. If your account becomes

60 days past due your promotional offer will be revoked and any remaining balance subject to the standard Purchase APR, 29.99%.

PAYMENTS: Monthly payments are required and equal the amount of the promotional purchase and estimated interest divided by the

number of months in the promotional period. Due to rounding your last payment may be less. These payments will be included in your

total Minimum Payment Due each month. Making only Minimum Monthly Payments will pay off the promotional purchase within the

promotional period.

4.

Standard Purchase APR - Standard Monthly Payments

Term Interest Rate

Minimum Payment

No Term 29.99% APR Standard Monthly Payments

INTEREST: Purchases will have an APR of 29.99%.

PAYMENTS: Each month your account has a New Balance a minimum payment will be required based on the calculation described

in the Section 5 of your Cardholder Agreement.

5.

Pay-In-Full Charges

Certain purchases or transactions may be identified as "Pay-in-Full Charges". These charges will be included in the minimum

payment due calculated for the billing statement on which the charges appear. The minimum payment must be paid by the due date

shown on your billing statement. Interest will not be charged on such Pay-In-Full Charges.

4

General Questions Applicable to All Financing Offers

What if my purchase is not eligible for the promotional offer?

Your purchase may not be eligible for a promotional offer because it is an amount that is less than the minimum purchase

required to qualify for the offer or it may be a type of purchase that is specifically excluded from the promotion. You may

still be able to finance the purchase using your credit card; however, the standard Purchase APR on your account would

apply. Please see the Interest Rates and Interest Charges section of the Account Summary Table for the current APR for

Purchases if you are a new customer and your billing statement if you currently have an account with us.

What if promotional financing plans are not available at the time of my purchase?

You may still be able to finance the purchase using your credit card; however, the standard Purchase APR on your account

would apply. Please see the Interest Rates and Interest Charges section of the enclosed Account Summary Table for

the current APR for Purchases if you are a new customer and your billing statement if you currently have an account

with us.

If I am late on my payments will I lose my promotional offer?

If your account becomes 60 days past due your promotional offer will be revoked and the remaining balance on any

promotional offer on your account will be placed on the standard Purchase APR. See section 2 of Your Cardholder

Agreement With Us for additional information.

Is there a minimum purchase amount that you must make to be eligible for this Promotional Offer?

If a minimum purchase amount applies to your promotional offer you will be provided with that information at the time of

purchase.

YOUR CARDHOLDER AGREEMENT WITH US

In this Cardholder Agreement (the “Cardholder Agreement” or “Agreement”) “your” and “yours” mean the borrower(s) and

“we,” “us” and “Bank” mean TD Bank, N.A. “Account” means the credit Card Account governed by this Agreement. “Card”

means any device we provide to you to access your Account. Card may include, but is not limited to, your Account number

stored on a participating website or mobile wallet (your “Virtual Card”), physical cards, electronic tokens, or any other access

device we authorize. You may only receive a Virtual Card when you open your Account. You may or may not receive a

physical Card depending on the program.

Your Card is issued and your Account is owned by TD Bank, N.A. All extensions of credit in connection with the Account are

made by the Bank. This Agreement establishes the terms of the Account. You should retain it for your records. By signing for

your first purchase, keeping or otherwise accepting the Card or Account, you agree to the terms and conditions of the Agreement.

1. Your Promise to Pay and How to Use Your Account: You will be liable for all use of the Card or the Account by you or

by any person with actual, implied, or apparent authority to act for you or to use the Card or the Account, including but not

limited to any person you have designated to us as an authorized user (“Authorized User”). Any such use will constitute

acceptance of all the terms and conditions of this Agreement, even though this Agreement is not signed.

You authorize us to charge your Account for all purchases resulting from the use of the Card or the Account (each a

“Purchase”). You promise to pay us in U.S. Dollars drawn on a U.S. bank for all of Purchases, plus interest charges and all

other fees and charges owed under this Agreement.

Use of the Card or Account may include physical use, orders by mail or telephone, computer or other electronic transactions

made without presenting the Card, or any other circumstance where you authorize a charge or authorize someone else to

make a charge to the Account. You agree to use the Card and the Account only for your own lawful personal, family or

household purposes. You agree that you and each Authorized User will not use the Card or the Account for any business or

commercial purposes. If this is a joint account, we may require that you pay the full amount owed without first asking any

other person to pay.

2. About the Financing Offers that May be Available to You for Eligible Transactions:

a. Generally: Notwithstanding any other provisions of this Agreement, we may, at our option, make certain financing offers

available for certain types of Purchases (“Promotional Offers”). Details of the Promotional Offer, such as minimum purchase

requirements or other restrictions, will be described in the specific offer. Features of Promotional Offers may include, among

other things, interest-free periods; deferral and forgiveness of interest if a purchase is paid in full within the promotional

period; reduced interest rates; and/or special payment terms, including payments higher than otherwise required. The benefits

of Promotional Offers may be contingent upon payment of your Account in accordance with this Agreement and/or the

Promotional Offers. Information about Promotional Offers will be shown separately on your monthly billing statement

(“Statement”) while the Promotional Offer is in effect. If you use your Account for a Promotional Offer, you acknowledge and

agree that the specific terms of the Promotional Offer will modify and become part of this Agreement, and all other terms

and conditions of this Agreement will apply to the Promotional Offer. Subject to applicable law, the Bank may revoke any

Promotional Offer if any required minimum payment is 60 days past due. This means that a 0% or reduced APR

balance may be moved to your standard Purchase APR, and any interest that has accrued on a deferred interest

Promotional Offer may be added to your balance.

b. Examples of Promotional Offers that May be Available for Eligible Transactions:

Promotional Offers with Deferred Interest and with Standard Payment Terms: For this type of Promotional Offer,

deferred interest charges are computed at the APR for standard Purchases listed in the Account Summary Table from the

date of purchase until the end of the promotional period. If on-time payments on the Account are made during the promotional

period and the promotional Purchase balance is paid in full before the end of the promotional period, the deferred interest

charges are waived. After the Promotional Offer period has expired or your Account becomes 60 days past due, your

Promotional Offer will be revoked and the deferred interest will be assessed. Thereafter, interest will continue to be charged

on any remaining balance (and also on any deferred interest assessed) at the then current standard APR for Purchases

listed in the Account Summary Table, until paid in full.

For this type of Promotional Offer there is no special payment calculation and the minimum payment for the promotional

balance is calculated in accordance with Section 5 of this Agreement. Making only the minimum monthly payment will

not pay off the promotional balance by the end of the promotional period and deferred interest will be assessed.

Larger payments are required to pay off the promotional balance to avoid paying the deferred interest. The

Promotional Offer period for this type of offer will generally be from 6 to 24 months.

Promotional Offers with a 0% APR and with an Equal Number of Payments: For this type of Promotional Offer, the

APR for Purchases during the promotional period will be 0%. If your account becomes 60 days past due, interest will be

charged on any remaining balance at the then current standard APR for Purchases listed in the Account Summary Table.

Payments will generally equal the amount of the purchase divided by the number of months in the promotional period. The

Promotional Offer period for this type of offer will generally be from 12 to 100 months.

Promotional Offers with a Reduced APR and with Fixed Monthly Payments: For this type of Promotional Offer, the

APR for Purchases will be the reduced APR disclosed to you at the time of the purchase. We will begin charging interest at

the reduced APR from the first day of the billing cycle that begins immediately after the billing cycle in which the reduced

APR promotional balance is added to your Account. You can avoid paying interest on this type of Promotional Offer Purchase

by paying all of the following, as shown on the first statement that includes the reduced APR promotional balance: i) the

required Minimum Payment Due; ii) all outstanding balance(s) with an APR higher than the APR on the reduced APR balance;

iii) any deferred interest promotional balance that is within the last two billing cycles of the promotional period; and iv) the

total of the reduced APR promotional balance. Otherwise, during the promotional period, interest at the reduced APR is

charged from the first day of the billing cycle that begins immediately after the billing cycle in which the reduced APR

promotional balance is added to your Account. If your account becomes 60 days past due, interest will be charged on any

remaining balance at the then current standard APR for Purchases listed in the Account Summary Table.

Payments are calculated by adding the promotional balance and the estimated amount of interest that would be assessed

on the promotional balance during the promotional term at the applicable APR if only on-time minimum payments are made.

This amount is then divided by the number of months of the promotional period. The Promotional Offer period for this type

of offer will generally be from 24 to 72 months.

Pay-In-Full Charges: Certain purchases or transactions may be identified as “Pay-in-Full Charges”. These charges will be included

in the minimum payment due calculated for the billing statement on which the charges appear. The minimum payment must be

paid by the due date shown on your billing statement. Interest will not be charged on such Pay-In-Full Charges.

3. How We Calculate the Interest Charges on Your Account:

a. Interest and Any Minimum Interest Charges: Each billing cycle, we separately determine the interest charges on

standard Purchases and each separate kind of promotional Purchase (each, a “Type of Balance”). For each Type of Balance,

we determine interest charges each billing cycle by multiplying the Balance Subject to Interest Rate by the applicable Daily

Periodic Rate (see Account Summary Table for Interest Rate information) and by then multiplying the result by the number

of days in the billing cycle. For each Type of Balance, the Balance Subject to Interest Rate is the average daily balance

(including new transactions), as calculated pursuant to Section 3.b. below. To get the total interest charges each billing cycle,

we add together the interest charges for all Type of Balances. We charge a Minimum Interest Charge (or “Minimum Charge”)

of $1.00 in any billing cycle in which the interest charge calculated under this Section 3 is less than $1.00. If a minimum

interest charge is assessed on your Account in a billing cycle, it will appear on your Statement as a “Minimum Charge” and

will be included in the “Interest Charged” section on your Statement.

b. How We Will Calculate Interest on Your Account: We use a method called “Average Daily Balance (including new

transactions)” to compute the interest charge. For each type of Balance, the Balance Subject to Interest Rate is the total of

the closing daily balances for such Type of Balance for all the days in the billing cycle (treating any negative balance as $0),

divided by the number of days in such cycle. Generally, the closing daily balance for each Type of Balance equals the

balance at the beginning of the day plus any new transactions of the same Type of Balance and less any payments applied

to such balance. At the beginning of each billing cycle, the closing daily balance for each Type of Balance will also include

any applicable interest charges and fees carried over from the immediately preceding billing cycle; and in the case of a

deferred interest Promotional Offer, it will include any interest charges that may have been assessed on the unpaid

promotional balance at the end of the Promotional Offer term.

c. How Interest Accrues and How to Avoid Paying Interest on Purchases: On each Purchase, interest begins to accrue

on the transaction date. Generally, you can avoid paying interest on standard Purchases in any given billing cycle if you pay

your entire statement closing balance (identified on your Statement as the “New Balance”) for that billing cycle in full by the

Payment Due Date reflected on that Statement.

If you have a promotional balance(s) on your Account, you may still be able to avoid paying interest on standard Purchases

provided you pay by the Payment Due Date the amount that equals the required Minimum Payment Due for that billing cycle

plus the total outstanding standard Purchase balance as of the first day of that billing cycle.

For each Type of Balance that is a separate kind of promotional Purchase, please see Section 2 of this Agreement for more

information about how to avoid paying interest on these transactions.

d. Treatment of Late Fees and Returned Payment Fees: We do not charge interest on Late Fees or Returned Payment Fees.

4. The Interest Rates on your Account: The “Annual Percentage Rate” or “APR” is the annual rate of interest charged on

Account balances. In connection with a special promotion we may charge a reduced promotional rate of interest (which

could be as low as a 0% APR). The Daily Periodic Rate (“DPR”) will equal the APR divided by 365. See the Account Summary

Table for the APR(s) on this Account and the corresponding DPR(s).

5. A Minimum Payment is Due Each Month: Each billing cycle you agree to pay at least the minimum payment due by the

payment due date shown on your monthly Statement (the “Minimum Payment Due”). Each Minimum Payment Due will be

due the same day of each month (“Payment Due Date”) as reflected on the Statement (which will be at least 25 days after

your Statement closing date each month).

The Minimum Payment Due will be calculated as follows:

The greater of:

a. 3.5% of each outstanding Purchase balance without a special payment calculation; PLUS each payment amount

due in connection with each balance that is subject to a Promotional Offer that has a special payment calculation

(e.g. Equal or Fixed Monthly Payment offers),

PLUS any Pay-In-Full Charges; OR

b. $29. However, if a payment of $29 for each month during the promotional period would pay off the balance on

a Deferred Interest Promotional Offer before the promotional expiration date, then the minimum payment shall be

calculated as set forth in (1) above; PLUS

c. any applicable fees and charges (except interest charges) assessed in the billing cycle; PLUS

d. any past due amount.

Credits, adjustments, refunds and similar Account transactions may not be used in place of payment of any portion of a

required minimum payment. If you pay ahead by paying more than the Minimum Payment Due in one billing cycle, you will

not be excused from paying the Minimum Payment Due in subsequent billing cycles.

6. How You Can Make Payments on Your Account: Instructions on how you can make payments on your account will be on

your Statement each month.

7. If You Pay Late You Will be Assessed a Late Fee: The first time a Minimum Payment Due is not received by the Payment

Due Date, we may charge you a late fee of an amount equal to the Minimum Payment Due or $29, whichever is less. If over

the next six billing cycles, the Minimum Payment Due is not received by the Payment Due Date, we will charge you a late

fee of an amount equal to the Minimum Payment Due or $40, whichever is less. You understand and agree that at our

option, such late fee will be immediately due and payable.

8. If a Payment is Returned You Will be Assessed a Returned Payment Fee: The first time your check or electronic

payment is returned to us by your financial institution unpaid or dishonored, we may charge you a returned payment fee of

an amount equal to the Minimum Payment Due or $25, whichever is less. If over the next six billing cycles, your check or

electronic payment is returned to us by your financial institution unpaid or dishonored, we will charge you a returned payment

fee of an amount equal to the Minimum Payment Due or $35, whichever is less. You understand and agree that at our

option, such returned payment fee will be immediately due and payable.

9. Administrative Fees: If you request a copy of a Statement, sales draft or payment check, you will pay a fee if permitted

by applicable law. The amount of the fee will be disclosed at the time you request this optional service. However, you will not

be charged for copies of Statements, sales drafts, or other documents that you request for a billing error/inquiry you may

assert under applicable law.

10. Your Credit Limit:

a. Generally: Your initial credit limit for the Account is shown in the materials that accompany the Card(s) and documents we

send to you when your Account is opened. Your current credit limit for the Account will be shown on your Statement. You may

also telephone Customer Service at the number on the back of your Card or your Statement to find out what your current

credit limit is.

b. Changes to Your Credit Limit: In our discretion, at any time, subject to applicable law, we may increase or decrease

your credit limit without providing prior notice to you. You may ask us to change your credit limit by contacting Customer

Service at the number on the back of your Card or your Statement. We do not have to agree to any such request.

c. Going Over Your Credit Limit: You may not go over your credit limit. We may permit you to go over your limit, but we are

not required to do so. If your Account goes over your credit limit, you must pay the over limit amount when it is billed to you,

or sooner upon our request. If we permit you to exceed your credit limit, and we do not have to allow you to exceed your

credit limit at a later date.

11. Your Monthly Billing Statements: We will send a Statement to the physical address on our records each month, if

required by applicable law. If you have agreed to receive electronic statements, you may access your statements online at

https://www.myonlineaccount.net or such other website we make available to you.

12. How Your Payments Are Applied to Your Account Balance: Subject to the following and applicable law, payments

will generally be applied first to the oldest Purchases.

a. How the Minimum Payment is Applied to Your Account: We will generally apply your Minimum Payment Due in the

following order: (i) to interest charges and other fees; (ii) to Pay-In-Full Charges; (iii) to purchase transactions with the lowest

Daily Periodic Rates and corresponding APRs.

b. Application of Payments in Excess of Minimum Payment. We will generally apply payments and credits in excess of

the Minimum Payment Due in the following order: (i) to purchase transactions with the highest Daily Periodic Rates and

corresponding APRs; (ii) to purchase transactions with the lowest Daily Periodic Rates and corresponding APRs; and (iii) to

interest charges and other fees.

c. Application of Payments during a Deferred Interest Promotional Offer Period: If you have one or more deferred

interest Promotional Offer on your Account, payments will be applied differently during the last two billing cycles before the

expiration of the deferred interest promotional plan to help ensure that as much of the outstanding balance as possible is

repaid by the end of the promotional period. We will apply any payments in excess of the Minimum Payment Due to the

promotional plan balance. If more than one promotional offer is expiring when a payment in excess of the Minimum Payment

Due is received, we may apply the payment in any manner permitted by applicable law. See Section 2 of this Agreement, and

any disclosures provided to you at the time of the deferred interest offer for more information on this type of promotional offer.

13. If Your Payment is Returned Unpaid: If a payment you make is not honored by your bank and it has already been

credited by us to your Account, we will reverse the credit and add the amount of the payment back to the Account as of the

day the payment was first credited to the Account.

14. Irregular Payment and Delay in Enforcement: We may accept late payments, partial payments, checks and money

orders marked “Paid in Full” or language having the same effect without losing any of our rights under this Agreement.

15. If You Have a Credit Balance: We will make a good faith effort to return to you any credit balance on your Account over

$1.00 if the credit balance has been on your Account longer than six (6) months (or, in our discretion, for a shorter time

period). You may also request a refund of a credit balance on your Account at any time, by sending your request to Customer

Service at P.O. Box 100114, Columbia, South Carolina 29202-3114, by first class mail, postage prepaid. We may reduce

the amount of any credit balance on your Account by applying the credit balance towards new fees and charges posted to

your Account.

16. Purchases Made by Your Authorized Users: We may allow you to have Authorized Users who may use your Account.

When you allow an Authorized User to use your account, you will be liable for all transactions made by the person, including

transactions for which you may not have intended to be liable, and even if the amount of liability causes you to exceed your

credit limit. You must notify us at the telephone number on the back of your Card to revoke your permission to allow an

Authorized User to use your Card or Account. Until you revoke your permission, you remain responsible for all charges

made by the Authorized User, even if you did not intend to be liable.

17. Entire Agreement: This Agreement (as amended and supplemented from time to time), including the Account Summary

Table and the application, constitute the final expression of the agreement between you and us. This Agreement may not

be contradicted by evidence of any prior, contemporaneous or subsequent oral agreement between you and us regarding

your Account. The retail store and its employees have no authority to change, add to or explain the terms of this Agreement

except to provide you with our Promotional Offers. For more information or questions, call Customer Service at the number

on the back of your Card.

18. If You Default on This Agreement: You agree that you will be in default if any of the following events occurs:

• We do not receive a required minimum payment by 5 p.m., Eastern Time, on the Payment Due Date, accompanied

by your Statement payment stub (if mailed), or we do not receive any other payment required by this Agreement

when such payment is due.

• You exceed the credit limit.

• You die or are declared legally incompetent or incapable of managing your affairs, become insolvent, file for

bankruptcy, or otherwise become the subject of a bankruptcy petition or filing.

• You give us false or misleading information at any time in connection with your Account.

• You send us a check or similar instrument that is returned to us unpaid, or any automatic, electronic or other payment

on your Account cannot be processed or is returned unpaid, for any reason, within the last six (6) billing cycles.

• You breach or otherwise fail to comply with any term or condition of this Agreement.

• We have reason to suspect that you or any Authorized User may have engaged or participated in any unusual,

suspicious, fraudulent, or illegal activity on your Account.

• You do not give us any updated information about your finances, employment, or any other information we may

reasonably request, promptly after the request.

Upon default: (a) we will not be obligated to honor any attempted use of your Account (even if we do not give you advance

notice); (b) we may require you to pay at once all or any portion of the balance outstanding under the Account; and (c) we

may exercise any right provided by this Agreement or applicable law.

19. Your Liability for Unauthorized Use: If your Card is lost or stolen or if you believe someone may have used your Account

without your permission, you must notify us at once. You may be liable for the unauthorized use of your Account. You will not

be liable for unauthorized use that occurs after you notify us by writing to P.O. Box 100114, Columbia, South Carolina 29202-

3114 or by calling Customer Service at 1-800-434-0050, of the loss or theft of the Card or the possible unauthorized use of

the Account. Your maximum liability is $50. Subject to any restrictions of applicable law, we may terminate or limit access to

your Account if you have notified us or we have determined that your Card may have been lost or stolen, or that there may

be unauthorized access to your Account.

20. Closing Your Account:

a. We May Close your Account at Any Time: We may without prior notice suspend or close your Account to new

transactions at any time, for any reason, including but not limited to a change to your creditworthiness or Account inactivity.

If we suspend or close your Account to new transactions, you still must pay us all amounts you owe under this Agreement

(including any future interest charges or fees), and you agree that we are not liable to you for any consequences resulting

from closing your Account. If you are in default, we may close your Account and require you to pay us the entire amount

owed under this Agreement in full, immediately. We may also increase the dollar amount of your minimum payment, subject

to applicable law. If we close your Account to new transactions, you must immediately destroy all Cards and other Account

access devices (cut, tear, or otherwise deliberately damaged the devices to prevent unauthorized use by third parties).

b. You May Ask Us to Close Your Account: You may ask us to close your Account to new transactions at any time, by

notifying Customer Service at P.O. Box 100114, Columbia, South Carolina 29202-3114, and returning all Cards and other

Account access devices to us (cut, torn, or otherwise deliberately damaged to prevent unauthorized use by third parties)

with your written notice or, by calling Customer Service at the number on the back of your Card. If you request to close your

Account by phone, we reserve the right to require written notice from you. You also agree to stop using the Account

immediately after you notify us that you want to close your Account.

21. The Address on Your Account and Our Notices to You: If required by applicable law, we will send Statements and

Account notices to your physical address on our records. If you have elected to receive electronic Statements and Account

notices, we will send a notification email to the email address we have in our records when such documents are ready. You

will promptly inform us of any change in your email address or your mailing address. You may change your address by

writing to us at Customer Service, P.O. Box 100114, Columbia, South Carolina 29202-3114 or by calling us at the number

on the back of your Card. We may in our discretion accept changes to your mailing address from the U.S. Postal Service.

If this is a joint Account, we may send billing statements and notices to either of you.

22. Our Rights Continue: Any failure or delay in exercising any of our rights under the Agreement will not preclude us from

later exercising those rights.

23. Changing This Agreement: Subject to applicable law, we may change this Agreement at any time or from time to time.

For example, we may change fees, add new fees, change the interest rates or rate formulas that apply to your Account,

increase your minimum payment due or add, delete or modify non-economic terms. We will notify you of changes to this

Agreement if required by applicable law. Any change, including any increase or decrease in the APRs on your Account, will

become effective at the time stated in our notice and will apply to those balances, including new transactions, on your

Account as described in our notice.

24. Your Credit Performance: Your Account was established based upon criteria reflecting your particular credit history.

From time to time we review your credit performance. If your credit performance changes, we may change some or all of

your Account terms. We will notify you of such changes in accordance with applicable law.

25. Your Credit Information and Your Credit Report: You authorize us to obtain reports from consumer reporting agencies

in connection with this Agreement and from time to time in connection with the review of your Account, or any update,

extension or renewals of your Account, and for the purpose of collecting your Account. You authorize us to verify with others

any information and to provide information about our transactions with you to third parties (including consumer reporting

agencies, merchants and other lenders) for lawful purposes. YOU UNDERSTAND WE MAY REPORT INFORMATION

ABOUT YOUR ACCOUNT TO CREDIT BUREAUS. SUBJECT TO APPLICABLE LAW, LATE PAYMENTS, MISSED

PAYMENTS, OR OTHER DEFAULTS ON YOUR ACCOUNT MAY BE REFLECTED IN YOUR CREDIT REPORT.

26. How to Dispute Credit Reports Regarding Your Account: If you think the information we furnished to consumer

reporting agencies on the Account is not accurate, you should write us at P.O. Box 100114, Columbia, South Carolina 29202-

3114 Attn: Credit Report Dispute. You may experience a delay if you do not write to this address. In order for us to investigate

your dispute, you will need to provide us with your name, address, and telephone number; the Account number you are

disputing; and why you believe there is an inaccuracy. We will complete any investigation and notify you of our findings and,

if necessary, corrections. You understand that calling us will not preserve your rights.

27. Your Authorization for Automatic Dialing and Monitoring/ Recording of Calls: We may telephone you using an

automatic dialing-announcing device. Your telephone conversations with employees or agents of ours may be monitored

and/or recorded. We also may monitor and record mail or conversations on our Websites between you and us and you and

our agents, whether initiated by you or us or our agents. Use of your Account will signify your consent to such use of an

automatic dialing announcing device, monitoring, and/or recording.

28. Telephone Numbers We May Use to Contact You. When you give us your mobile phone number, we have your

permission to contact you at that number about all of your TD Bank accounts. Your consent allows us to use text messaging,

artificial or pre-recorded voice messages and automatic dialing technology for informational and account service calls, but

not for telemarketing or sales calls. It may include contact from companies working on our behalf to service your accounts.

Message and data rates may apply. You may contact us anytime to change these preferences.

29. Assignment. We may at any time assign or sell this Account, any sums due on this Account, this Agreement, or your

rights or obligations under this Agreement. Any person(s) to whom we make any such assignment or sale shall be entitled

to all of our rights under this Agreement, to the extent assigned. You may not sell, assign or transfer your Account or any of

your obligations under this Agreement.

30. Governing Law: This Agreement, including the rate of interest and fees, is governed by applicable federal law

and the substantive laws of the State of Delaware (to the extent not preempted by federal law) without regard to

principles of conflict of law or choice of law.

31. Your Consent to Receive Electronic Disclosures. If you applied for this Account electronically, you agreed that any and

all account opening disclosures and/or notices required by applicable law and regulation may be delivered to you electronically,

so long as you have not withdrawn consent. Other documents that we may make available to you electronically from time to

time, and after we have obtained your consent, include but are not limited to disclosures required by the Federal Truth in

Lending Act, notices or disclosures required by the Equal Credit Opportunity Act or Fair Credit Reporting Act, privacy notices,

changes in terms, account statements, and any other notices required by federal or state law to be provided to you in writing.

You may request a paper copy of any notice you receive electronically, and any required notice will be provided at no charge

to you. If this is a joint account, any account holder may elect to receive electronic notices and that election will apply to all

account holders. You may withdraw your consent to receive documents electronically at any time. To withdraw your consent

or request paper copies of notices, you must call us at 1-800-434-0050. However, withdrawing such consent may result in

your account being closed. In order to receive this information electronically, you must have a PC using Microsoft Internet

Explorer 8® or greater, or other current version of Google Chrome®, Mozilla Firefox®, or Google Safari®. All browsers must

support JavaScript, Cookies and SSL (Secured Socket Layer) for channel encryption, using 128-bit encryption. You must

have a public IP address that does not change mid-session, otherwise for security reasons the session will be terminated.

NOTICES

A. YOU MAY AT ANY TIME PAY YOUR TOTAL INDEBTEDNESS UNDER THIS AGREEMENT.

B. YOU WILL KEEP A COPY OF THIS AGREEMENT TO PROTECT YOUR LEGAL RIGHTS.

C. SUBJECT TO APPLICABLE LAW, THE BANK CAN CHANGE THE TERMS OF, ADD NEW TERMS TO, OR DELETE

TERMS FROM THIS AGREEMENT. THE BANK WILL GIVE YOU ADVANCE NOTICE OF THE CHANGE, ADDITION

OR DELETION WHEN REQUIRED BY APPLICABLE LAW. ANY CHANGE, ADDITION, OR DELETION TO THIS

AGREEMENT WILL BECOME EFFECTIVE AT THE TIME STATED IN THE NOTICE.

NOTICE: ANY HOLDER OF THIS CONSUMER CREDIT CONTRACT IS SUBJECT TO ALL CLAIMS AND DEFENSES

WHICH THE DEBTOR COULD ASSERT AGAINST THE SELLER OF GOODS OR SERVICES OBTAINED WITH THE

PROCEEDS HEREOF. RECOVERY HEREUNDER BY THE DEBTOR SHALL NOT EXCEED AMOUNTS PAID BY THE

DEBTOR HEREUNDER.

New Jersey Residents: Certain provisions of this Agreement may be void, unenforceable or inapplicable in some

jurisdictions. None of these provisions, however, are void, unenforceable or inapplicable in New Jersey.

Active Duty Service Members and Dependents: The following important notice applies if you are an active duty service

member or a dependent of one at the time you request an Account. Federal law provides important protections to members

of the Armed Forces and their dependents relating to extensions of consumer credit. In general, the cost of consumer credit

to a member of the Armed Forces and his or her dependents may not exceed an annual percentage rate of 36 percent. This

rate must include, as applicable to the credit transaction or account: the costs associated with credit insurance premiums;

fees for ancillary products sold in connection with the credit transaction; any application fee charged (other than certain

application fees for specified credit transactions or accounts); and any participation fee charged (other than certain participation

fees for a credit card account). If you would like more information regarding your account, please call us at 1-800-877-7467.

YOUR BILLING RIGHTS:

KEEP THIS DOCUMENT FOR FUTURE USE

This notice tells you about your rights and our responsibilities under the Fair Credit Billing Act.

What To Do If You Find a Mistake on Your Statement

If you think there is an error on your statement, write to us at: Customer Service at P.O. Box 100114, Columbia, South Carolina 29202-3114.

In your letter, give us the following information:

• Account Information: Your Name and Account number.

• Dollar Amount: The dollar amount of the suspected error.

• Description of the problem: If you think there is an error on your bill, describe what you believe is wrong and why you believe it is a

mistake.

You must contact us:

• Within 60 days after the error appeared on your statement.

• At least 3 business days before an automated payment is scheduled, if you want to stop payment on the amount you think is wrong.

You must notify us of any potential errors in writing. You may call us, but if you do we are not required to investigate any potential errors and

you may have to pay the amount in question.

What Will Happen After We Receive Your Letter

When we receive your letter, we must do two things:

1. Within 30 days of receiving your letter, we must tell you that we received your letter. We will also tell you if we have already corrected

the error.

2. Within 90 days of receiving your letter, we must either correct the error or explain why we believe the bill is correct.

While we investigate whether or not there has been an error:

• We cannot try to collect the amount in question or report you as delinquent on that amount.

• The charge in question may remain on your statement, and we may continue to charge you interest on that amount.

• While you do not have to pay the amount in question, you are responsible for the remainder of your balance.

• We can apply any unpaid amount against your credit limit.

After we finish our investigation, one of two things will happen:

• If we made a mistake: You will not have to pay the amount in question, or any interest or other fees related to that amount.

• If we do not believe there was a mistake: You will have to pay the amount in question, along with applicable interest and fees. We

will send you a statement of the amount you owe and the date payment is due. We may then report you as delinquent if you do not pay

the amount we think you owe.

If you receive our explanation but still believe your bill is wrong, you must write to us within 10 days telling us that you still refuse to pay. If you

do so, we cannot report you as delinquent without also reporting that you are questioning your bill. We must tell you the name of anyone to

whom we reported you as delinquent, and we must let those organizations know when the matter has been settled between us.

If we don’t follow all of the rules above, you do not have to pay the first $50 of the amount you question even if your bill is correct.

Your Rights If You Are Dissatisfied With Your Credit Card Purchases

If you are dissatisfied with the goods or services that you have purchased with your credit card, and you have tried in good faith to correct the

problem with the merchant, you may have the right not to pay the remaining amount due on the purchase.

To use this right, all of the following must be true:

1. The purchase must have been made in your home state or within 100 miles of your current mailing address, and the purchase price

must have been more than $50. (Note: Neither of these are necessary if your purchase was based on an advertisement we mailed to

you, or if we own the company that sold you the goods or services.)

2. You must have used your credit card for the purchase. Purchases made with cash advances from an ATM or with a check that

accesses your credit card account do not qualify.

3. You must not yet have fully paid for the purchase.

If all of the criteria above are met and you are still dissatisfied with the purchase, contact us in writing at: Customer Service at P.O. Box 100114,

Columbia, South Carolina 29202-3114.

While we investigate, the same rules apply to the disputed amount as discussed above. After we finish our investigation, we will tell you our

decision. At that point, if we think you owe an amount and you do not pay, we may report you as delinquent.