Capital Gains Tax

Return

This guide will take you through the capital gains tax return.

Disclaimer: All information used in this return are not actual figures.

WASHINGTON STATE DEPARTMENT OF REVENUE

2

Select the filing status from the drop-down menu.

WASHINGTON STATE DEPARTMENT OF REVENUE

3

• You will need the federal net long term capital gains/losses from your federal income tax return. This information is

located on Schedule D.

• From the gains/losses detail entered on Form 8949, determine which items are not allocated to Washington state.

If you have loss carryforward on your federal return, determine what is not allocated to Washington state.

• The remaining should be long term capital gains/losses allocated to Washington state.

WASHINGTON STATE DEPARTMENT OF REVENUE

4

This page requires you to enter the detail of each item allocated to Washington

state. Enter the items by clicking Add Item.

WASHINGTON STATE DEPARTMENT OF REVENUE

5

Provide the required information for each allocated item. To add another item, select Add Item.

The total of these items should equal the federal net long term capital gains/losses allocated to Washington

state from the first page.

WASHINGTON STATE DEPARTMENT OF REVENUE

6

If you have charitable donations to deduct, select Add Donation.

To be eligible, the charity donated to must be principally directed or managed in Washington state.

WASHINGTON STATE DEPARTMENT OF REVENUE

7

If you have charitable donations to deduct, select Add Donation.

WASHINGTON STATE DEPARTMENT OF REVENUE

8

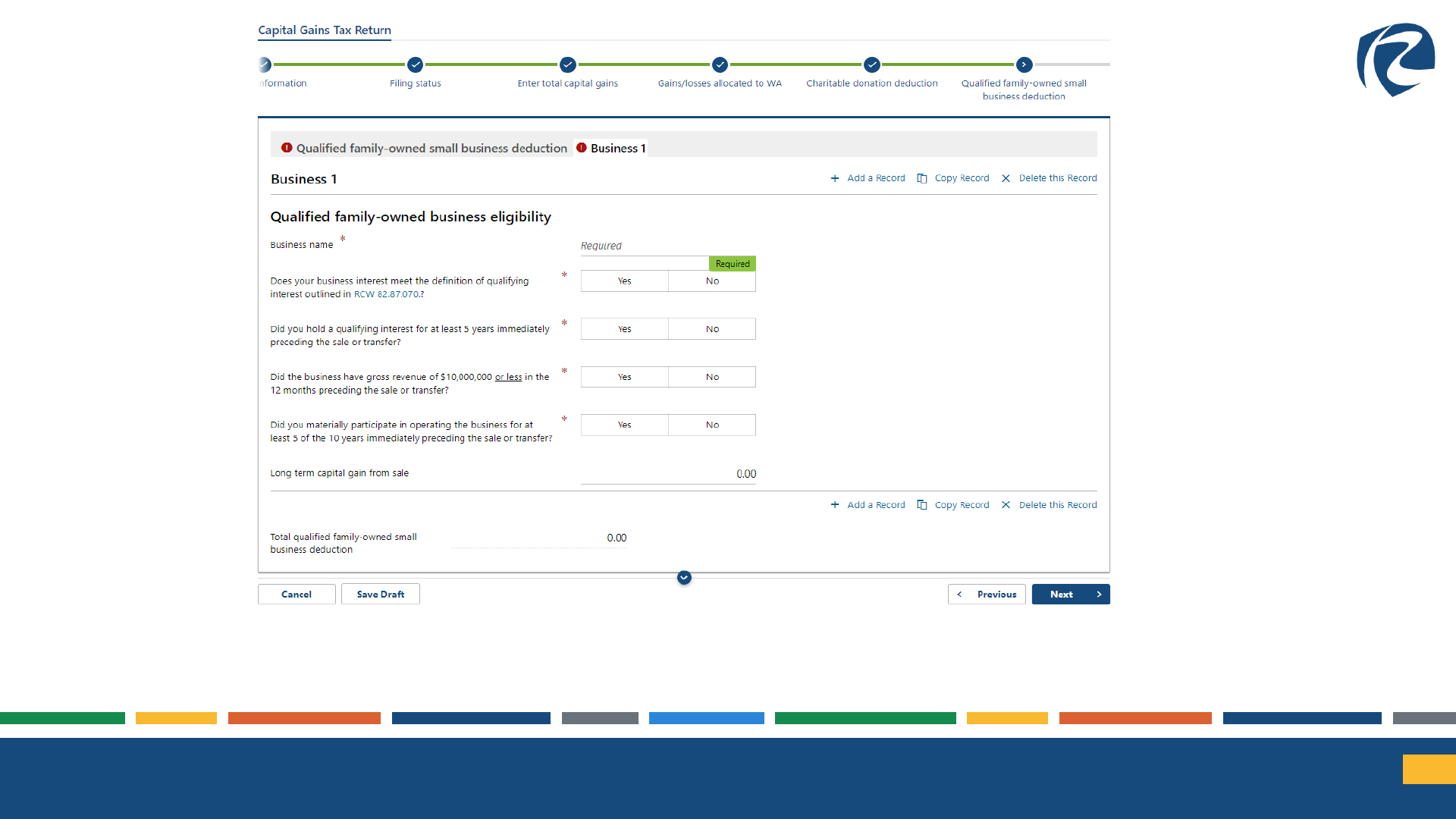

If you sold a qualified family-owned small business, select Add a Record.

WASHINGTON STATE DEPARTMENT OF REVENUE

9

Answer the required questions to determine if the gain can be deducted.

WASHINGTON STATE DEPARTMENT OF REVENUE

10

If you have any deductions not listed, enter the information here.

This will be rarely used.

WASHINGTON STATE DEPARTMENT OF REVENUE

11

This page is for items allocated to Washington state, and capital gains taxes

have been paid to other jurisdictions

.

WASHINGTON STATE DEPARTMENT OF REVENUE

12

Summary page of what was entered on the return.

WASHINGTON STATE DEPARTMENT OF REVENUE

13

Totals page showing any penalty and/or interest if applicable.

WASHINGTON STATE DEPARTMENT OF REVENUE

14

Select Add Attachment to upload a copy of the federal income tax return as required by law.

If the copy of the federal return will not upload due to the document being too large, select the I am unable to upload my

federal return checkbox.

You will be required to mail a copy of your federal return.

WASHINGTON STATE DEPARTMENT OF REVENUE

15

Submitter information on who is preparing the tax return.

WASHINGTON STATE DEPARTMENT OF REVENUE

16

Select the payment type.

WASHINGTON STATE DEPARTMENT OF REVENUE

17

Confirmation page of the tax return.