Digital Auto Report 2023

What consumers really want

VOLUME 1

Strategy& 2

✓ Eleventh annual Digital Auto Report,

developed by Strategy& and PwC

✓ Global consumer survey with a focus

on the US, EU and China (n = 3,000)

✓ Quantitative market outlook up to 2035,

based on regional structural analysis

✓ Interviews with industry executives at

OEMs and suppliers, and with leading

academics and industry analysts

Digital Auto Report 2023

Digital Auto Report

2023 – Volume 1

Coming up next: Volume 2

Assessing global mobility market

dynamics

• Market outlook – penetration of technologies and mobility types

• Technology – shifting gears in connected, electric, automated

• Regulation – slowdown or acceleration of key policies?

This report: Volume 1

Understanding consumer

preferences and implications

• Consumer view – changing mobility preferences

• Implications for auto players – interface, subscription and charging

Strategy&

Addressing changing consumer preferences requires auto

players to gear up their user interfaces and business models

Note: Please refer to respective section for detailed assumptions and sources behind stated propositions

Executive summary – Volume 1

Digital Auto Report 2023

3

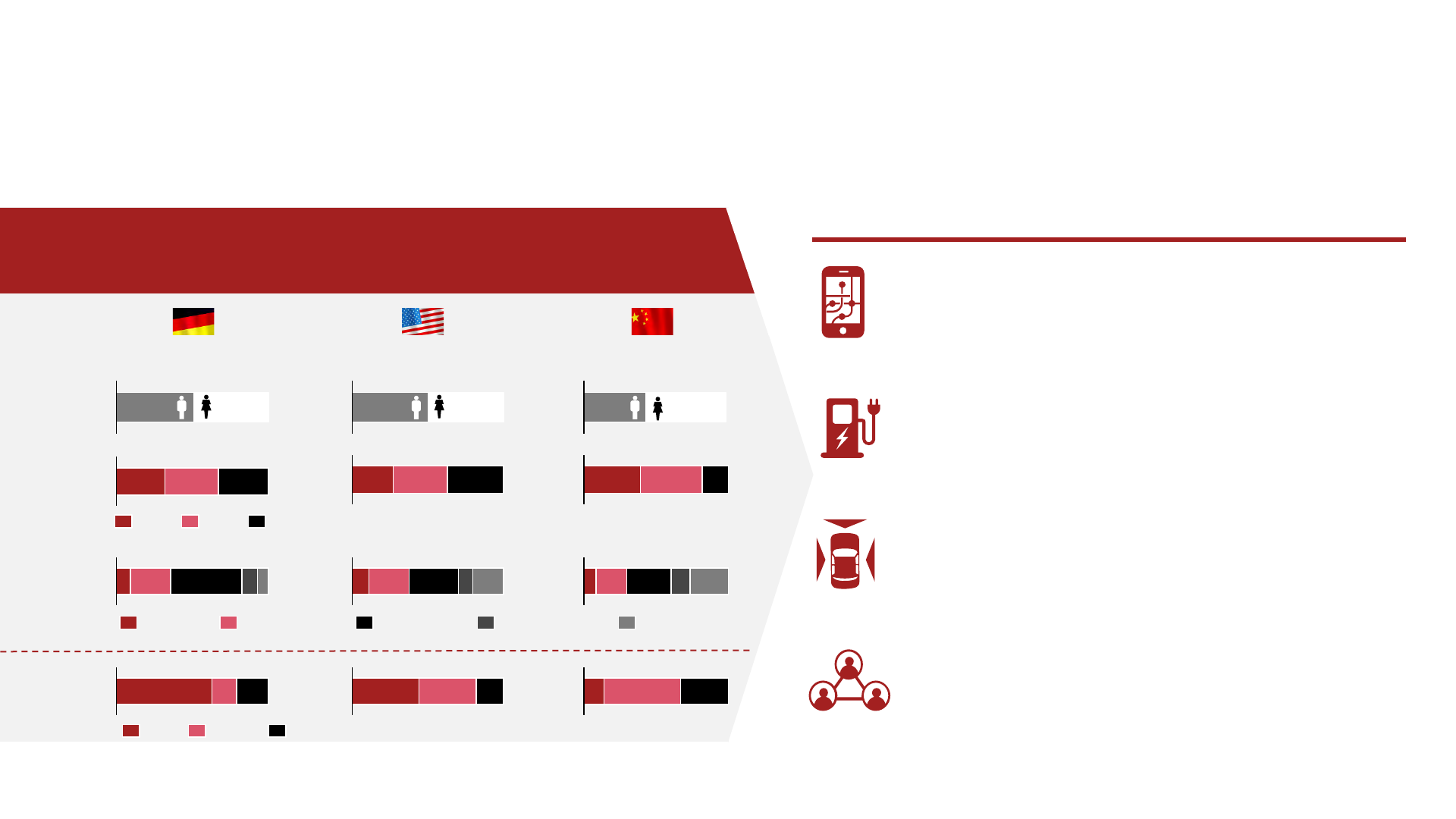

• Our consumer survey (n = 3,000 in Germany, US, China) captures current preferences in auto & mobility and is contrasted with expert opinions

• In respect of connected services, consumers first want to get the basics right – the highest priority is safety + navigation, phone mirroring is gaining

importance, on-demand car functions as well; experts rate the importance of infotainment and lifestyle higher than consumers do; willingness to pay

for full set of connected services stands at ~€20 / months in GER and the US, and at ~€40 in China – experts give more conservative estimates

• Germans still hesitant about BEV cars – only 35% would consider getting one; more openness in the US ~50%; China very open to BEVs with >90%

• Low trust towards L4 automated vehicles in GER and US with 60-70% feeling uncomfortable vs. 15% in China; but on the other hand, Germans who

want to use L4 have a higher willingness to pay to use robo-taxis than to use driver-driven taxis; in the US and China willingness to pay is lower

• Purchasing a new/used car preferred; subscription models gain traction; online car purchase scores highest in China (36% vs.10% in Germany)

• Consumers intend to use public transport more often than last year, but show similar intentions for own car; less interest in sharing / hailing

1. Consumer

preferences

2. Automotive

implications

• Auto players face strategic challenges with regard to connected, electric, automated & smart mobility. Volume 1 focuses on three key aspects:

A Getting the user interface right

As software-defined vehicles open the door to many new markets, OEMs need to be clear in which consumer life areas they want to play, which

experience differentiators to focus on (luxury vs. convenience), and how to build a corresponding service portfolio. Investment decisions should be

based on value creation beyond direct user revenues, with a balanced view on build vs. buddy vs. buy for tech components

B Rethinking vehicle sales

OEMs benefit from a rising demand for car subscriptions - expected to grow from 0.3m to 2-4m units by 2035 in Europe. To reach profitability.

OEMs need to balance consumer needs (model flexibility, transparent pricing) with smart asset lifecycle management for maximum residual value

C Going beyond the vehicle

New business models emerge around batteries and bi-directional charging. With ~5m bi-di cars in Germany by 2035, market potential is €160-

220m for vehicle-to-home / microgrid and €470-550m for vehicle-to-grid solutions – assuming successful orchestration of ecosystem players

Strategy&

Contents

2. Implications for auto players – interface, subscription and charging

1. Consumer preferences – connected, electric, automated and smart

Digital Auto Report 2023

4

Strategy&

Latest consumer attitudes within CASE are reflected in a

survey of 3,000 respondents in Germany, US and China

*Age brackets harmonized; **Low income (<1,6T EUR, <2T USD, <12T YUAN), Rather low income (1,6-3,3T EUR, 2-4T USD, 12-25T YUAN), Medium income

(3,3-6,6T EUR, 4-8T USD, 25-51T YUAN), Rather high income (6,6-8,3T EUR, 8-10T USD, 52-64T YUAN), High income (>8,3T EUR, >10T USD, >64T YUAN)

Overview of consumer survey

Digital Auto Report 2023

5

Consumer – Overview

Key results

n = 1,000

Gender

(%)

n = 1,000 n = 1,000

51

49

Age*

(%)

Household

income**

(%, gross

monthly)

9 743248

Medium incomeLow income Rather low income Rather high income High income

333532

35-5418-34 55+

3

regions

15

questions

3,000

respondents

50

50

44

56

27 3736 184339

24 30 18910 21 31 27138

Employer

type of

experts (%)

211663

OEM Supplier Operator

183844 335314

50

experts

• Purchasing a new or used car still preferred option, but car

subscription models are gaining traction

• Consumers want to reduce CO

2

mainly through more

walking/cycling, switching to electric car, and using more

public transport

• Safety + navigation remain the most important connected

services features – on-demand functions gaining popularity

• Willingness to pay at ~20€ per month in Germany and

the US, while at ~40€ in China – experts more cautious

• Germans still sceptical about BEV cars – only 35% would

consider getting one, but more openness in the US ~50%

• In China, overwhelming preference for BEV with >90%

considering such option – vs. only 80% considering ICE

• German / US respondents sceptical about L4

automated cars – 60-70% uncomfortable vs. 15% in China

• Willingness to pay for robo-taxis vs. driver-driven taxis is

lower in the US and China than in Germany

Strategy&

Safety and navigation remain as most important connected

services features – on-demand car functions on the rise

Source: PwC Strategy& consumer research

Safety and navigation still most

important feature for respondents

across all regions.

Significant increase in the number

of participants in Germany who rate

smartphone mirroring as

important”

Mirror smart-

phone in car

27%

Navigation

Safety

Infotainment/

Entertainment

Vehicle

management

On-demand

car functions

Lifestyle and

comfort

80%

78%

69%

60%

45%

39%

82%

78%

71%

61%

55%

62%

59%

93%

92%

96%

76%

85%

89%

92%

Question: “Which connected

service categories are

particularly important to you?”

Consumer – Connected

2023 2021 2020

Infotainment/entertainment more

important for younger consumers

Digital Auto Report 2023

6

Connected services – Share of participants rating feature as important

+

Infotainment/entertainment more

important for younger consumers

Strategy&

Experts rate infotainment higher than consumers do –in

China, they underestimate relevance of on-demand functions

Source: PwC Strategy& expert survey

Connected services – Share of experts rating feature as important

Safety, navigation and entertainment

are considered the most important by

experts.

Experts in Germany are rather less

enthusiastic when assessing the

importance of mirroring smart-phones

Experts in China are comparatively less

upbeat when assessing the importance

of on-demand functions and lifestyle &

comfort services.”

94

89

89

31

73

68

63

Vehicle

management

Navigation

Safety

Lifestyle and

comfort

On-demand

car functions

Mirror smart-

phone in car

Infotainment/

Entertainment

-48%

+63%

+130%

69

94

69

69

75

81

75

+35%

+28%

80

93

67

80

87

73

67

-27%

+14%

-25%

Question: “Which connected

service categories are

particularly important to you?”

Expert – Connected

2023 – Experts 2023 – Consumer

Digital Auto Report 2023

7

Strategy&

Smartphone mirroring to the car has highest rating; Auto OEM

apps for service access are less popular

Source: PwC Strategy& consumer research; Difference to 100%: no/low likelihood

Connected services and media/entertainment in the car

53%

69%

45%

32%

On a screen mirroring

from a smartphone

into the vehicle

Highest preference across all countries

is for smartphone mirroring.

Media/entertainment via an auto OEM

application is less popular.”

Question: “How would you

prefer to enjoy connected

services and media/

entertainment in your car?”

Consumer – Connected

59%

69%

37%

35%

59%

63%

45%

33%

1

st

and 2

nd

rank

On an app

of content provider

installed in your car

On my smartphone

directly

Auto OEM app

accessing content

Digital Auto Report 2023

8

Strategy&

0

10

20

30

40

50

60

70

Notes: 1) Calculation of price points based on van-Westendorp-methodology

Source: PwC Strategy& consumer research; Exchange rates: USD/EUR 0.93, YUAN/EUR 0.14 (15.02.2023); PwC Strategy& expert survey research 2023; n=50

Connected services – Median willingness to pay

1)

High spread of willingness to pay in

China indicates strong polarisation of

luxury vs. budget customers →

differentiated service packaging needed

Higher optimal price in China indicates

that consumers envision more benefits

from the “perfect connected service

bundle” than in the US/GER – expert

view more conservative on prices.”

Consumer – Connected

…for a full set of connected services in

the vehicle that “perfectly fit your needs”

Willingness to pay

1)

(monthly in €)

Question: “At what price would

you consider a full set of relevant

connected services

• Too cheap?”

• A good value for money?”

• Starting to get expensive?”

• Too expensive?”

By nationality

X

X

X

Maximum price

Minimum price

Optimal price

Expert estimate

Willingness to pay for connected services around 20€/month

in Germany and the US but twice as much in China (40€)

Digital Auto Report 2023

9

Strategy&

Among on-demand functions, automated driving features such

as traffic jam pilot / parking pilot are attracting more interest

Source: PwC Strategy& consumer research

On-demand car functions – Share of participants rating function as important

Consumer – Connected

Automated driving functions –

traffic jam pilot or parking pilot –

attract considerably more

interest vs. previous year.

Air condition activation is still

viewed as the most important

on-demand car function.”

Question: “How important

would be on-demand car

function [...] to you?”

69%

63%

63%

53%

48%

49%

44%

Traffic jam pilot

Advanced headlight

functions/performance

Air condition

activation

Extension of battery

range (e.g. +80 km)

Seat heating

activation

Parking pilot

Increase of engine

power (e.g. +50 hp)

60%

52%

53%

77%

65%

62%

41% 87%

95%

78%

85%

87%

86%

90%

2023 2021

Digital Auto Report 2023

10

+

Traffic jam pilot more important

for older consumers

Strategy&

Experts in Germany / US attach even more importance than

consumers to automated driving function attractiveness

Source: PwC Strategy& expert survey

On-demand car functions – Share of experts rating function as important

Expert – Connected

Extension of battery range and

traffic jam pilot are considered

the most important functions

among experts

When compared with consumers,

experts are particularly bullish

about on-demand engine power.”

Question: “How important

would be on-demand car

function [...] to you?”

84%

74%

58%

89%

84%

95%

100%

Increase of engine

power (e.g. +50 hp)

Air condition

activation

Extension of battery

range (e.g. +80 km)

Advanced headlight

functions/performance

Seat heating

activation

Traffic jam pilot

Parking pilot

+94%

+129%

94%

63%

69%

81%

81%

94%

81%

+81%

+108%

87%

73%

73%

80%

87%

73%

87%

2023 – Experts 2023 – Consumer

Digital Auto Report 2023

11

+

Experts in US & China are more

conservative in assessing the

importance of air conditioning

activation

Strategy&

H

2

O

2

+

–

77%

84%

85%

90%

82%

93%

93%

95%

81%

Source: PwC Strategy& consumer research

Share of participants rating engine types as likely for next purchase (%)

Question: “Assuming you wanted to

buy/lease/subscribe to a passenger

car, how likely are you to consider

the following types of engines?”

Consumer – Electric

53%

87%

89%

52%

79%

57%

51%

41%

42%

44%

Gasoline

BEV

69%

80%

PHEV

73%

44%

39%

35%

35%

35%

18-34yo 55+yo35-54yo

Age bracket

Looking at powertrain preferences, German and US

consumers stick with gasoline, while Chinese prefer BEV

Digital Auto Report 2023

12

+

Gasoline engine surprisingly

more attractive for younger

consumers

Gasoline is most popular engine type

in USA and Germany, followed by

PHEV engines, which are slightly more

popular than BEVs.

Chinese consumers exhibit opposite

preferences with BEVs being most

popular, ahead of hybrid and ICE

engines.”

Strategy&

Question: “How comfortable

would you feel using an

autonomous vehicle (Level 4

1)

)”

1) There is still a steering wheel and pedals, but no human action or supervision is required, except in more complex cases such as inclement weather or an unusual environment

2) Can operate fully automatically on any road and under any conditions that a human could negotiate. There is no steering wheel or pedals. All you have to do is specify a destination to the vehicle

Source: PwC Strategy& consumer research

Automated driving – Consumer attitudes

Consumer – Automated

Question: “How comfortable

would you feel using a fully

autonomous vehicle (Level 5

2)

)”

50%

43%

24%

19%

11%

17%

23%

38%

9%

16%

47%

4%

100%

Very comfortable

Not comfortable at all

Rather not comfortable

Rather comfortable

66%

53%

18%

18%

13%

10%

17%

30%

6%

12%

51%

100%

6%

Vs.

14% in

2021

Vs.

18% in

2021

Vs.

39% in

2021

In general, willingness to use automated cars has recovered in

comparison with relatively low 2020 figures, which resulted from

negative headlines at the time e.g. following accidents and

cybersecurity threats. Scepticism towards “fully automated”

vehicles (Level 5) still stronger than for Level 4.

Consumer acceptance of automated driving remains low in

Germany and the US – more openness in China

Digital Auto Report 2023

13

Level 5Level 4

Strategy& Source: PwC Strategy& consumer research

Automated driving – Top 3 preferences for usage of time gained

The intention to use time gained from not driving went down compared to 2021 – the

reduction was significant in Germany and the US. Media & Entertainment as well as

relaxation are still the main intended activities.”

Consumer – Automated

41

45

33

52

51

39

Relaxation

and recovery

(e.g. sleep)

Media and

entertainment

(e.g. video

streaming)

Work and

productivity

(e.g. email)

41

40

30

45

55

39

Work and

productivity

(e.g. email)

Media and

entertainment

(e.g. video

streaming)

Relaxation

and recovery

(e.g. sleep)

2022

2021

57

53

49

62

62

57

Relaxation

and recovery

(e.g. sleep)

Media and

entertainment

(e.g. video

streaming)

Social

exchange

(e.g. video-

conferencing)

Question: “For which activities

would you use the time gained

while driving in a fully

autonomous vehicle?”

On an robo-ride, people want to be entertained or relax – in

GER / US they also want to work, but in China prefer to socialize

Digital Auto Report 2023

14

Strategy&

~60% of US citizens want to pay less for a robo-taxi vs. a driver-

driven taxi; only ~5% want to pay more vs. ~30% in Germany

Source: PwC Strategy& consumer research

Automated driving – Willingness to pay

Question: “When considering an

average taxi ride and its price,

what would be your willingness to

pay for an autonomous ride

compared to this taxi ride?”

Consumer – Automated

28%

24%

45%

56%

64%

67%

36%

37%

57%

44%

39%

44%

37%

30%

30%

53%

53%

37%

27%

37%

12%

7%

12%

9%

6%

55+y35-54y18-34y 35-54y18-34y 55+y

3%

18-34y 35-54y

6%

55+y

100%

I’m willing to pay more

I’m willing to pay the same

I’m willing to pay less

Digital Auto Report 2023

15

While younger German respondents are willing to pay more for an autonomous ride,

older Germans are less inclined to do so.

.

US and Chinese respondents overwhelmingly intend to pay less for an automated ride

– among those who want to pay less, a 40-50% price cut from driver-driven taxis is the

norm.”

Strategy&

Majority of respondents prefer to purchase a new or used car;

but car subscription models are attracting interest

Source: PwC Strategy& consumer research | Difference to 100%: no/low likelihood

Ranking of buying/leasing/subscribing to a car

70%

87%

47%

33%

27%

Purchase of

a new car

Leasing

of a new car

Purchase of

a used car

Subscription

of a car

The intention to purchase a used car

is growing, especially in Germany and

the US.

Subscription is gaining in popularity

– especially in China. The preference

for subscription increased strongly in

Germany and the US in 2023 (27% vs.

14% in Germany and 19% vs. 15% in

US).”

Question: “How would you rank the

following ways of acquiring a car if

you needed to purchase, lease, or

subscribe to a passenger car in the

next one to two years?”

Consumer – Smart Mobility

76%

78%

31%

19%

19%

82%

29%

56%

7%

43%

1

st

and 2

nd

rank

Leasing of

a used car

Digital Auto Report 2023

16

Strategy&

Readiness for online car purchases very high in China, while

rather low in Germany – the US falls in between

Source: PwC Strategy& consumer research

Willingness to make car purchases online

Question: “Would you buy your

next car online?

The willingness to buy a car online

varies significantly across countries.

In China, people are particularly open

to completing certain steps or even the

entire buying process online.

In contrast, the majority in Germany

feel more comfortable with store

processes.”

2023

41%

10%

37%

12%

I would rather do everything at the store

Yes, I feel comfortable configuring and signing online, but I would prefer to do a test drive at the store

I would configure it online, but sign and test drive it at the store

Yes, I feel comfortable with doing all steps online

18%

2023

32%

27%

22%

2023

36%

15%

19%

31%

Consumer – Smart Mobility

High High HighLowLowLow

Willingness Willingness Willingness

Digital Auto Report 2023

17

Strategy&

2021

2023

Even as immediate COVID-19 risks decline, using one’s own

car remains popular; increasing use of shared modes in China

Source: PwC Strategy& consumer research

Mobility pattern after COVID-19 restrictions (%)

Consumer – Smart Mobility

Question: “COVID-19 has temporarily

changed our mobility behavior in many

aspects. How do you plan to use modes

[…] of transport once we have left the

pandemic behind us?”

More Same Less/not at all

Using one’s own car is still seen as

the most convenient means of

transportation – with highest increase in

demand in Germany and the US.

In China, consumers plan to use

shared modes more.

Across all regions, the number of

people planning to use public

transport more has increased.”

2023

2021

2021

2023

2021

2023

2021

2023

2021

2023

2021

2023

Own bike

By foot

Own car

Public

transport

Shared

micro-

mobility

Car-

sharing

Ride-

hailing

Digital Auto Report 2023

18

Strategy&

45%

60%

60%

29%

2021

36%

2023

54%

40%

28%

13%

20232021

25%

Source: PwC Strategy& consumer research

Factors encouraging sustainable transportation modes

In Germany, there has been a sharp

increase in the number of consumers

who say that better availability is an

important factor in persuading them to

use sustainable transport.

US respondents focus strongly on

cheaper prices, whereas user-

friendly access is most likely to

encourage respondents to use

sustainable transport in China.”

59%

40%

23%

10%

2021 2023

24%

Family offers

(e.g. 4 bikes for the price of 2, ...)

Cheaper price

Better availability

(e.g. more bikes)

User-friendly access

(e.g. cashless payment via app, ...)

Incentives by the employer

(e.g. job bike, car sharing

benefit package, ...)

Consumer – Smart Mobility

Question: “What would encourage

you to use sustainable transportation

(e.g. bike sharing, car sharing, public

transportation) more frequently?”

Price and availability are by far the top drivers for encouraging

consumers to use sustainable transport

Digital Auto Report 2023

19

Strategy&

25%

75%

Source: PwC Strategy& consumer research

Top-3 contributions to CO

2

reduction

High willingness to contribute to

CO

2

reduction, especially in China

(98%) – strong increase in the US

(79% vs. 52% last year)

Main contributions will be

completing short-distance

journeys more often on foot / by

bicycle, switching to an

electric car, or using public

transport more frequently.”

Question: “What major personal

changes would you like to do to

contribute to a reduction in CO

2

emissions?”

51%

29%

25%

Completely

cut out short-

haul flights

Short distances more

often on foot / by bicycle

Use public

transport more

frequently

Short distances

more often on foot /

by bicycle

43%

24%

37%

Switch to an

electric car

Use public

transport more

frequently

Use public

transport more

frequently

49%

48%

54%

Switch to an

electric car

Short distances

more often on

foot / by bicycle

21%

79%

Do

nothing

Change

behavior

98%

2%

Consumer – Smart Mobility

Every country has different priorities to reduce CO2: In GER

more walking, in the US switch to BEV, in CN public transport

Digital Auto Report 2023

20

Strategy&

2. Implications for auto players – interface, subscription and charging

1. Consumer preferences – connected, electric, automated and smart

Digital Auto Report 2023

21

Contents

Strategy&

Digital Auto Report 2023

22

Getting the user interface right

Strategy&

The relevant market for automotive players is expanding

beyond the car itself – maintaining user access is crucial

Source: Strategy&, PwC Ecosystemizer

Realiser

Enabler

Mobility demand

• Mobility demand is influenced by

long-term economic, political and

social trends as well as generational

changes

• The individual user is located at the

center of the ecosystem approach

(business to human)

• Consumer needs can be grouped

into ten distinct Life Areas

• Within these Life Areas,

ecosystems emerge in the form of

business-to-business and business-

to-consumer relationships around

specific customer needs

Mobility solutions

Human needs in mobility Life Areas

determine customer requirements

Successful mobility ecosystem

players are clear on four key topics:

Digital portfolio scope

E.g. life area coverage, niche positioning, …

Experience differentiators

E.g. luxury, convenience, …

Value chain integration

E.g. vertical/horizontal integration, partnering, …

Value levers

E.g. top-line, bottom-line optimization, …

Digital Auto Report 2023

23

Redefining business models to meet human-centric mobility needs

Recreation

Orchestrator

E.g.

Aggregator

E.g.

OEM

E.g.

Supplier

Strategy&

Getting the digital interface right means creating a

differentiated experience for diverse customer needs

Source: Strategy& analysis

Experience differentiators – Examples

At your fingertips

FINN manages to provide customers with their

vehicle of choice around seven days after booking

7

Hassle-free service

Genesis picks up and returns the

car for aftersales services at a place

of choice, managed through a

personal assistant

Seamlessly integrated offerings

Uber integrates multi-modal mobility options

with related services such as food delivery,

health or transit on one platform

Full flexibility

Sixt offers various vehicle ownership models (renting,

subscription, sharing) with flexible run times and payment

schemes in one app

Proactive offerings

BMW 7 Series actively welcomes

riders into the car by extending a

carpet made of light

Trading scarcity

Lamborghini has created only 5 digital NFT’s based on physical keys

made from carbon fiber from the international space station

Differentiated

experience:

Luxury

Differentiated

experience:

Convenience

Digital Auto Report 2023

24

Efficient interactions

Mercedes me app lets users manage their vehicles on the go,

from scheduling service, to making payments, to getting

assistance at the push of a button

Bespoke services

Bentley allows their buyers to customize every

part of the car, including paint, finishes,

materials and even light-projected logos

Digital opulence

Rolls Royce cements the credentials of its bold new brand identity

for its website with mood videos similar to perfume ads

Crafted touchpoint

NIO broadens their services with the EP House,

a space where owners can come together and

celebrate the brand

Strategy&

A value-creating digital service portfolio requires automotive

players to balance multiple trade-offs

Source: Strategy& analysis

Digital portfolio scope – Examples

Vehicle

Function

-as-a-Service

Consumer

onboard

services

Consumer

offboard

services

B2B/data

services

Portfolio Trade-offs

Differentiation vs.

revenue potential

Reach vs.

profitability

Synergy focus

vs. risk hedging

Touchpoint control

vs. open partners

Digital first vs. BEV/

AD availability

Mobility Entertainment Work Health

Sound

– BMW e-engine sound pack

Autonomous driving

– Tesla autopilot upgrade

Light

– BMW high beam assist

Camera

– Tesla sentry mode

Access

– Tesla virtual bluetooth keys

Parking search and pay

– VW we park

P2P car/ride sharing

– Sono motors app

Fleet mgmt./diagnostics

– Daimler connect business

Car data marketplace

– Caruso, Otonomo, High M.

Car data based insurance

– BMW CarData

Driver’s log/GPS tracking

– Daimler connect business

Predictive maintenance

– BOSCH, Carmen

Intelligent car assistant

– Alibaba, Volvo/Daimler

Gaming

– Tesla arcade, Racing

Entertainment

– Tesla caraoke

Advanced navigation

– MB live traffic

Music streaming

– BMW Spotify, NIO Radio

Passenger safety

– NIO fatigue warning

Smart Office Connection

– BMW IFTTT

Last Mile Logistics

– NIO delivery in trunk

Emergency assistant

– GM OnStar guardian

Plug and charge

– VW/Ionity

Mood-based lightening

– Mercedes-Benz ambient

In-car Office

– Mercedes me connect

Meditation

– Porsche Feel-Good-Coach

NFT Collections

– Roll Royce Phantom

AI Avatar

– Fetch.ai autonomous agents

Crypto Car Wallet

– Various pilots

In-car AR gaming

– Audi/holoride partnership

Roadside assistant support

– Urgently/Otonomo

Automated park and charge

– Bosch Autom. Valet Parking

Safer traffic planning

– Mercedes Data/London

Web3 Loyalty Program

– BMW/Coinweb

Digital Auto Report 2023

25

Strategy&

30-40% additional revenue

potential based on customer insights

30-40% of incidents can partly/fully

be prevented by OTA

20-30% cost reduction potential

through variant reduction

20-30% inventory decrease due to

demand forecasting

50-60% of companies indicate that

they do sell data to third parties

30-40% switch to paid subscription

after free trial

45-55% are more loyal to brands

to which they have a subscription

35-50% are interested in post-

purchase activations

60-70% are willing to pay 180$/year

for connectivity service set

Along the value chain and vehicle life cycle, digital services

unlock value beyond direct user monetization

Value levers of digital services – Examples

Implications

Bottom-line:

OpEx/CapEx

Optimization

Top-line:

Direct

revenue and

customer

lifetime value

Services

monetization

Brand

loyalty

Post-purchase

activations

Platform access/

data sales

Connected services activation fees and/or recurring revenues

related to monthly subscriptions

Higher satisfaction with on-board experience and creation of

‘stickiness’ through subscription services

Upselling effect during the ownership cycle by unlocking

personalization features or activating built-in hardware

Direct revenues from granting third parties access to own

platform or monetizing (anonymized) data/insights

Leverage of real time data on customer preferences/behaviors

for timely adjustment of vehicle specifications and features

Reduction of the number of model-specific variants by

activating on-demand vehicle features

Optimized inventory management through advanced planning

of upcoming repairs enabled by predictive maintenance

After-sales

Loyalty

Higher revenues for dealers from original parts sale and

workshops traffic triggered by predictive maintenance

R&D optimization

Recall campaigns

Variant

management

Parts inventory

management

Prevention of recall campaigns by leveraging OTA updates to

fix potential technical issues within the circulating fleet

Source: Strategy& analysis + expert discussion

Digital Auto Report 2023

26

• Ecosystem business cases

should extend beyond

vehicle-centric business

cases

• Direct and indirect

revenue potential, and

opportunities beyond

vehicle offerings, should

be considered along the

customer life cycle

• B2B offerings offer

significant direct

monetization potential

• In addition to external

opportunities, a significant

amount of internal

opportunities exist, e.g.

to increase efficiency in

processes & portfolio

Strategy&

I II III IV V

OEMs are forced to partner with technology players to deliver

compelling digital services – risking a loss of control

Source: Strategy& analysis

Value chain integration – Range of partnership options

No tech player

involvement

Operating system and all

applications are developed

by the OEM

Full control for OEM, no

standardization, slower

development, reduced offering

compared to market leaders

Operating system

supply

Standardized tech stack is

provided by supplier,

e.g. Android Automotive OS

Faster development, easier

integration of external applications

(e.g. Spotify), standardized setting

cannot be adjusted by OEM

Content

mirroring

Apple/Google content is

displayed by using apps within

the vehicle, e.g. Android Auto

Common mobile apps (e.g.

Google Maps) are immediately

available in-vehicle; less use of

OEM native apps / content

Tech player

involvement

OEM

Control

Next ?

A winning digital experience requires customer proximity, tech capabilities and effective data governance

Digital Auto Report 2023

27

Tech player content

using vehicle data

Usage of car data to enrich 3

rd

party in-

vehicle apps, e.g. for usage based

insurance or location based commerce

Compelling user experience on par

with mobile app UX, but OEM apps

loose advantage of specific driver /

vehicle insights

External development

of the digital experience

Entire automotive software

is developed by tech

supplier

Data governance between

involved stakeholders crucial to

avoid downgrading of OEM to

pure hardware provisioning

Strategy&

Digital Auto Report 2023

28

Rethinking vehicle sales

Strategy&

Duration (average figures for Germany)

Included

services

Relative price per month

Leasing

2

years

5-9

years

2)

Ø

3 years

1)

Low, due to fewer services and

longer duration

trend

1

month

2-6

years

Subscription

Ø

1 year

1)

High, due to high convenience

Rental

1

day

1

year

High, due to high amount of

included mileage

Ø

7 days

1)

Sharing

10

min.

1

week

Ø

30 min

1)

Highest, due to highest convenience

and most services included

trend

Exact model selection/some configuration

~

🗶

✔✔

Ø

Up-front down payment

🗶✔

Insurance, tax and registration

✔🗶

Flexible cancellation

~

✔🗶

Delivery and collection

✔

~

✔🗶

Switching models

~

✔

🗶

Residual value coverage

✔🗶

Additional driver allowed

✔

~~

Risk-dependent fee (driver history)

🗶

~

✔

Scheduled service, repairs/wear and tear

✔🗶

Fully digitized customer journey

✔🗶

✔/ ~ / 🗶 = Usually included / Depends on provider / Usually not included

Subscription fills the gap between leasing and rental offerings

– resulting overall in four major vehicle ownership archetypes

1) Based Strategy& analysis; 2) Depending on specific regulatory environment allowing “prolonged lease”

Source: Strategy& analysis

Vehicle ownership archetypes

Digital Auto Report 2023

29

Strategy&

2. Lifecycle: Used car leasing (different customer(s))

As alternative ownership models such as subscription emerge,

OEMs need to sharpen their vehicle lifecycle mgmt. skills

Subscription customer and asset journey – Example

4. Used car leasing

Customer journeyVehicle journey

0 1 2 3 4 5 7 8 9

Car handover

Scheduled

maintenance

Subscription

model suggested

to customer

For their vacation,

the customer

temporarily adds

a second driver

Customer

occasionally

uses car sharing

Car enters used

leasing contract with

a new customer

Scheduled

maintenance

Repairs

following

accident

Scheduled

maintenance

After the

lease, the car

is returned

Year

Refurbish battery and

ADAS in preparation

for next lifecycle

Interior

refurbish

1. New car leasing

2. Subscription 3. New subscription 5. Car sharing and rental

Maintenance

and minor fixes

Family plans:

subscription

renewal with

bigger car

Due to increased price

consciousness, customer

decides to lease a used car

Move into city: end of lease

and switch to sporadic

sharing and rental cars

Customer signs contract

to lease new car

New car is

in-fleeted

In the last lifecycle,

the car moves into

the sharing fleet

At the end of its

useful life, the car is

recycled or sold B2B

After the lease,

the car is returned

Car rental

during vacation

Residual value

optimal: customer

offered to trade

cars

Customer

increases

the annual

km

6

Scheduled

maintenance

1. Lifecycle: New car leasing 3. Lifecycle: Car sharing (different customers)

Source: Strategy& analysis

Digital Auto Report 2023

30

Strategy&

Suitable ownership models

Holistic vehicle lifecycle management aims to increase revenue

and utilization, especially during 2

nd

and 3

rd

phase

Subscription “3x3” asset lifecycle

1

st

Lifecycle phase (years 1-3) 2

nd

Lifecycle phase (years 4-6) 3

rd

Lifecycle phase (years 7-9)

Residual value

Revenue and

utilization potential

Maintenance and

refurbishment

1)

• In accordance with residual value

• Additional revenue from e.g.,

contract extras or repair charges

Asset potential

• Regular maintenance costs

• Sporadic refurbishment costs

• Potential repair costs

• Depending on vehicle utilization

in respective ownership model

Contract add-on

Recycle

✔

✔

✔

✔

✔

✔

🗶

✔

🗶

✔

Leasing

Subscription

Rental

Car sharing

2)

3)

(✔)

✔

Repurpose vehicle Refurbish vehicle Maintain/repair vehicle Recycle componentsAdd contract extras

• Sequence of ownership models

as well as external market

conditions have influence on

most suitable selection for each

lifecycle phase

• For certain ownership models,

assets that are viewed as too old

may not be favored

• The younger the asset, the

shorter the duration - especially if

utilization is high

1) Annual OEM-prescribed maintenance/service intervals and use-based repairs – sporadic refurbishment;

2) Depending on specific regulatory environment allowing “prolonged lease”; 3) As low-budget option

Source: Strategy& analysis

Digital Auto Report 2023

31

Strategy&

Alternative ownership models are on the rise and offer profit

potential for OEMs – if the asset life cycle is managed well

1) Estimate of share development for ownership model depends on shares of competing models; LCP: Life cycle phase;

2) Profitability estimate based on individual consideration of ownership model for average middle class passenger EV (price 53.5k EUR)

Source: Strategy& analysis

Vehicle ownership model split and profitability – Indicative

Sharing

42%

100%

10%

Leasing

2%

Subscription

Purchase

45%

Rental

1%

6.0

5.6

0.3

1.4

0.2 13.4

Ownership model split 2023 [m units]

Region Europe,

40 countries

Profitability of ownership models

2)

Ownership

models

Traditional car ownership Alternative ownership

Purchase Leasing Subscription Rental Sharing

LCP 1

year 1-3

LCP 2

year 4-6

LCP 3

year 7-9

7%

9%

11%

-115%

83%

76%

-91%

78%

71%

10-15%

–

–

<5%

<5%

<5%

Total 5-7% 10-15% 10-15% 10-15% <5%

Subscription

has potential to grow

to 2-4m units

by 2035 in Europe

1)

Leasing

has potential to grow

to 7-8m units

by 2035 in Europe

1)

Digital Auto Report 2023

32

Overall profitability potential higher for leasing, subscription and rental

than for purchase

Profitability across LCPs varies – from relatively constant to a sharp

increase. With rental, there is only one LCP.

It is not individual consideration but a merged portfolio view that is crucial

for OEMs

Strategy&

More flexible ownership models offer benefits and risks for

OEMs and customers – a win-win solution is required

Vehicle subscription benefit and risk perspective

• Alternative ownership models

need to create a win-win

situation for customers and

OEMs

• Currently, they mostly play

into the strategic agenda of

OEMs

• Strong customer centricity

and efficient asset

management of used cars

are needed to reach

profitability

OEMs may leverage their

existing retail network and

preferential vehicle

acquisition conditions to

differentiate themselves from

start-up competitors

Product piloting and learning from data

insights into longer-term car usage

Keeping track of battery lifecycle/recycling

requirements according to regulations

Customers willingness to pay and price

pressure for alt. ownership offering

OEM

Customer

Flexibility of car ownership in case of

changing life circumstance

Residual value and admin process

(insurance, maintenance, etc.) peace of mind

Residual value risk at end of lifetime and

need for strong operational excellence

Source: Strategy& analysis

Digital Auto Report 2023

33

Key takeaways

Opaque pricing and difficulty of

comparing offerings

Perception of ownership is absent

Strategy&

Digital Auto Report 2023

34

Going beyond the vehicle

Strategy&

Rise of e-mobility provides ample opportunities to capture

value beyond the vehicle – e.g. with batteries and charging

Source: Strategy& analysis

Value pools beyond the vehicle – Focus e-mobility

Digital Auto Report 2023

35

Battery value chain

Charging value chain

Adjacent ecosystem services

eMSP

1)

Last mile

services

Location-

based

commerce

Fleet mgmt.

services

Onboard

entertainment

Charge point

operation

Energy

provisioning

Site and asset

ownership

Charging

equipment

manufacturing

Energy system

integration

Bi-directional

Charging

Battery

exchange

Car/battery usage

Battery

production

Battery in

car assembly

Battery

recycling

Battery

second life

Installation

and

maintenance

Strategy&

Infrastructure and vehicle penetration are key requirements

for successful realization of bi-directional charging use cases

Bi-directional charging – Market simulation Germany

Parking

Home and

apartment

buildings

Charging

hubs

1.8m

0.16m 0.03m

0.7m

Bi-directional sockets by 2030 Bi-directional charging-capable vehicle fleet (#)

Office

Private

2.5m

Public

0.19m

Total 2030: 2.7 million bi-directional sockets Total 2030: ~5 million bi-directional vehicles

Bi-directional charging capable vehicle fleet in Germany

(as share of total EV fleet)

Source: PwC Strategy& Study (2022): “Der E-Mobility-Check: Wie bereit ist Deutschland?”; Strategy& analysis

Digital Auto Report 2023

36

2028

2023

2026

2024

2025

2031

2027

2032

2029

2030

2033

2034

2035

36%

11%

6%

15%

29%

22%

54%

42%

48%

58%

61%

62%

63%

Strategy&

Enablers & Limitations

Front-of-meter prosumer use cases depend on a multitude of

external factors that limit mainstream adoption in short term

V2L: Vehicle-to-load (e.g. e-bike, another EV, etc.) V2H/B: Vehicle-to-home / building V2G/VGI: Vehicle-to-grid / vehicle-grid-integration PV: Photovoltaic

1) Includes software for grid optimization of households (V2H) and public charge point operators only; 2) Includes software for power market trading for households and public charge point operators only

Source: Strategy& analysis

Prosumer charging business model comparison – Germany

Power market trading

Load shiftingSelf-supply optimization

V2H/B

V2G / VGI

V2L

• Mid-term: EV user demand driven by incentive to earn/save

money, but depending on available solutions & attractive pricing

• Short-term: Growing EV user demand to use vehicle e.g. as

additional storage for home PV or emergency power bank (in the US)

Customer

Demand

• Need for penetration of bi-directional capable vehicles and infrastructure (i.e. EV charger) to reach “critical mass”

• Need for development of standard protocols (interconnection, communication, vehicle and charging station safety & functionality)

Energy

Tech

• Fully supportive regulation not expected before 2028 at EU

level due to high stakeholder complexity (smart meter as reference)

• Fully supportive behind-the-meter regulation expected by

2024 due to limited complexity of “closed” micro-ecosystem

Regulation

• Need for flexible V2G tariffs: Time-of-Use or Time-of-Day pricing

• Minimum number of kwh must be available at a certain point in

time for utility providers to rely upon when managing the grid

• Tech cost reduction (vehicle / infrastructure) required for scale up

• Availability of comprehensive ancillary services as important enabler

Economics

Use Cases

Application Area

Enabler Revenues

Potential for software enablers: €160-220m

1)

in 2030

While front of meter still requires more regulatory alignment at European level, behind the meter already has a high market readiness in the short term

Potential for software enablers: €470-550m

2)

in 2030

Digital Auto Report 2023

37

Behind the meter Front of meter

Consumption optimization

Strategy&

Bi-directional

energy provision

Charge and

discharge

Connect

to charger

Realization and scale-up of prosumer use cases require

efficient charging and battery stakeholder coordination

Source: Strategy& analysis

Digital Auto Report 2023

38

Services

White label

Software

Charging

data

Charging data

Integration

Charging

data

Services

EV data

Charging

data

Charging

data

EV/Battery

Service provider

Software supplier

Battery

manufacturer

Vehicle

manufacturer

Parking

provider

Utility

sector

CPO

End user

V2H

Main scale-up challenges

Stakeholder fear of losing control

points to a central, dominant player

(e.g. OEMs see USP in unique

charging experience)

Enabling ecosystem partnersCharging stakeholders

Charging & battery ecosystem stakeholder activation

Can a decentralized coordination

approach help to solve these challenges?

Relatively high transactions costs

for clearing and billing (given

comparatively low value of single

transactions)

Different interests and priorities

across parties (e.g. CPOs want to

maximize utilization, whereas OEMs

want to maximize charging availability)

Data

exchange

Strategy&

Implication for automotive players: Holistic ecosystem

approach beyond core business is key to future success

Source: Strategy&, PwC Ecosystemizer

✔ Be clear about own ecosystem role – whether orchestrator, realizer or enabler

✔ Build offering portfolio and allocate resources accordingly

✔ Maintain a holistic and iterative approach in the selection of suitable offerings

✔ Actively manage the portfolio and prioritize clearly according to a coherent,

consistent and multi-layered ecosystem logic

On the one hand…

• Ecosystems can create lock-in effects

based on differentiated offerings

• Customer lifetime value can be

increased through holistic journey

coverage

• Faster growth and higher earning

potential can be achieved when

compared with traditional approaches

to value creation

On the other hand…

• Building & managing ecosystems is

complex

• Theoretically, unlimited number of

potential offerings complicates the

selection process

• Product-centric view carries risk of

missing market/customer needs

(particularly for more advanced

topics)

Success factors

Ecosystems…

Digital Auto Report 2023

39

Recreation

New Work

Personalized

pleasure

Holistic

wellbeing

Smart

environ-

ment

Rest and

relaxation

Believe and

mindfulness

Relation-

ships

Green and

seamless

mobility

Customized

and fast

demand

fulfillment

Personal

wealth and

legal

Strategy&

Network contacts

Digital Auto Report 2023

40

Jörg Krings

joerg.krings@

strategyand.de.pwc.com

Automotive Europe

Dr. Jörn Neuhausen

joern.neuhausen@

strategyand.de.pwc.com

Alternative Powertrains

Jonas Seyfferth

jonas.seyfferth@

strategyand.de.pwc.com

Connected and Smart Mobility

Contributors

© 2023 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details. Mentions of Strategy& refer to the

global team of practical strategists that is integrated within the PwC network of firms. For more about Strategy&, see www.strategyand.pwc.com. No reproduction is permitted in whole or part without written permission of PwC.

Disclaimer: This content is for general purposes only, and should not be used as a substitute for consultation with professional advisors.

Dr. Andreas Gissler

andreas.gissler@

strategyand.de.pwc.com

Digital Transformation

Kentaro Abe

kentaro.abe@

pwc.com

Automotive Japan

Akshay Singh

akshay.singh@

pwc.com

Automotive US

Steven Jiang

steven.jiang@

strategyand.cn.pwc.com

Automotive China

Steven van Arsdale

Sebastian Hauk

Carl Heselschwerdt

Tobias Karl

Tobias Killmeier

Tobias Seemann

Patrick Schwenke

Malien Zehnpfenning

Milos Bartosek

milos.bartosek@

pwc.com

Infrastructure Deals

Thilo Bühnen

thilo.buehnen@

pwc.ch

Mobility Venturing

Hartmut Güthner

hartmut.guethner@

strategyand.de.pwc.com

Automated Driving