2022 Annual Report

PennyMac Mortgage Investment Trust (NYSE: PMT) is a specialty finance company that invests

primarily in residential mortgage loans and mortgage-related assets. As a real estate

investment trust (REIT), our objective is to provide attractive risk-adjusted returns to our

shareholders over the long-term, primarily through dividends and secondarily through capital

appreciation.

Our investment focus is on mortgage-related assets that we create through our industry-leading

correspondent production activities, including mortgage servicing rights (MSRs). In

correspondent production, we acquire, pool and securitize or sell newly originated prime credit

quality loans. Our interest rate sensitive investments include the MSRs, mortgage-backed

securities and related hedge instruments. Our credit sensitive investments primarily consist of

credit risk transfer investments related to loans sourced through our correspondent production

that were delivered to Fannie Mae.

PMT is managed by PNMAC Capital Management, LLC, a wholly-owned subsidiary of PennyMac

Financial Services, Inc. (NYSE: PFSI), and an investment adviser registered with the Securities

and Exchange Commission that specializes in mortgage assets. Our correspondent production

operations are conducted on a fee-for-service basis by another PennyMac Financial subsidiary,

PennyMac Loan Services, LLC, which also services most of the loans in our investment portfolio

and the loans for which we retain the obligation to service.

Dear Fellow Shareholders,

2022 proved to be a challenging year for the mortgage industry and mortgage REITs overall,

including PMT. The Federal Reserve’s tightening of monetary policy in response to high inflation

drove a rapid and significant increase in mortgage rates, which ended 2022 at the highest levels

observed in the last 15 years. While these higher interest rates drove strong financial

performance for PMT’s interest rate sensitive strategies, the results were more than offset by

related tax provisions attributable to fair value changes on investments held in its taxable REIT

subsidiary as well as fair value declines in its credit sensitive strategies as market credit

spreads widened due to the uncertain impact higher rates may have on the broader economy.

Additionally, the steep decline in the size of the origination market from $4.4 trillion in unpaid

principal balance (UPB) in 2021 to an estimated $2.3 trillion in 2022, according to Inside

Mortgage Finance, led to lower volumes and income in PMT’s correspondent production

segment. For the full year, PMT reported pre-tax income of $63 million. However, net of tax

provisions, PMT reported a net loss of $73 million; and after distributions to preferred holders,

the net loss to common shareholders was $115 million or $1.26 per common share. PMT

declared and paid dividends of $1.81 per common share, which combined with the net loss

resulted in a reduction in book value per common share to $15.78 at year-end from $19.05

1

at

year-end 2021. While overall performance last year did not meet our expectations, the

underperformance was largely driven by fair value changes of our investments and hedges.

However, the fundamentals underlying PMT’s diversified investment portfolio remain strong and

we are confident in the earnings potential of the platform over the longer term.

In 2022, PMT created nearly $700 million of new mortgage servicing rights (MSR) and credit

sensitive investments sourced primarily from $37 billion in UPB of conventional correspondent

production designated for its own account. Though the mortgage origination market is

expected to remain constrained in 2023 due to higher prevailing mortgage rates, we believe

PMT is well-positioned given its historical orientation towards purchase money loans, which are

expected to comprise the majority of originations over the next several years. Additionally, the

exit of Wells Fargo, a long-term and well-respected competitor in this channel, provides

opportunities for smaller community banks, credit unions and independent mortgage

companies across the country to benefit by partnering with PMT, who can provide the products,

1

As described in Note 3 of PMT’s Annual Report on Form 10-K for the year ended December 31, 2021, an accounting change

required that beginning in 2022, the portion of PMT’s senior notes that were exchangeable for PMT common shares of beneficial

interest originally allocated to additional paid-in capital were reclassified to the carrying value of exchangeable senior notes. Giving

effect to this change on a pro forma basis, PMT’s book value as of December 31, 2021 would have been $18.60.

stability and support they need to successfully navigate the current mortgage market. The

investments we have made in our correspondent lending platform in recent years have made

the business extremely scalable, and we stand ready and able to absorb the volumes left behind

by Wells Fargo and others who have decided to exit or reduce their participation in the channel

without a meaningful increase in associated expenses.

This management team has a long and successful track record of investing in and managing

credit sensitive investments. Although PMT’s financial performance in 2022 was negatively

impacted by fair value declines in its credit sensitive strategies due to wider market credit

spreads, the same market dynamics generated opportunities to deploy capital into additional

credit assets at attractive risk-adjusted returns. In fact, during 2022 we created or invested in

more than $200 million of new credit investments, and looking ahead to 2023 we expect

additional investment opportunities to arise. Further, our front-end lender risk share

investments, which comprise a large portion of our credit sensitive strategies, consist of loans

originated by PMT from 2015 to 2020. Since borrowers with loans underlying these investments

have built up a significant equity position in their homes as a result of seasoning and strong

home price appreciation in recent years, we ultimately expect realized losses to be limited.

Additionally, the vast majority of financing arrangements we maintain against those assets are

term notes that do not contain margin call provisions, which has served us extraordinarily well in

recent history, providing stable financing for these investments as their fair values fluctuated.

While our discussions around the resumption of front-end lender risk share transactions with

Fannie Mae and Freddie Mac continue, the GSEs’ priorities have shifted towards the expansion

of affordable home ownership, and therefore we do not expect to aggregate loans for delivery

into a new front-end lender risk share transaction with the GSEs for some time.

PMT’s interest rate sensitive strategies, primarily consisting of MSRs paired with Agency

mortgage-backed securities, performed well in 2022 as interest rates increased meaningfully

throughout the year. We expect performance in 2023 to remain strong, as the sensitivity to

changes in interest rates of MSR fair values has declined meaningfully given the significant

reduction in prepayment speeds from prior years and earnings from placement fees on

custodial balances have increased along with short term interest rate levels.

While PMT’s equity allocation to credit sensitive strategies has declined due to runoff and

decreases in fair value, the allocation to interest rate sensitive strategies increased

meaningfully given net new investments and fair value gains related to higher interest rates. In

order to more proactively allocate equity among credit sensitive and interest rate sensitive

segments, and to maintain capital for new opportunistic investments, in the fourth quarter of

2022 PMT began selling certain of its conventional correspondent loans to its manager and

services provider, PennyMac Financial Services, Inc. (NYSE: PFSI), a mutually beneficial

transaction for both companies that highlights the benefits of their synergistic relationship.

While 2022 was a year of transition for PMT, I am optimistic for improved financial performance

in 2023 due to the material improvement in the credit markets year-to-date, which supports both

the valuation of our credit sensitive investments and the broader structured product markets in

general. I also believe PMT’s strength in correspondent lending, decreased volatility of MSR fair

values, and our management team’s long, successful track record of disciplined risk

management positions PMT well to deliver strong risk adjusted returns to its shareholders as

we move forward. Thank you for your continued trust and confidence in PMT.

Sincerely,

David A. Spector

Chairman and Chief Executive Officer

April 21, 2023

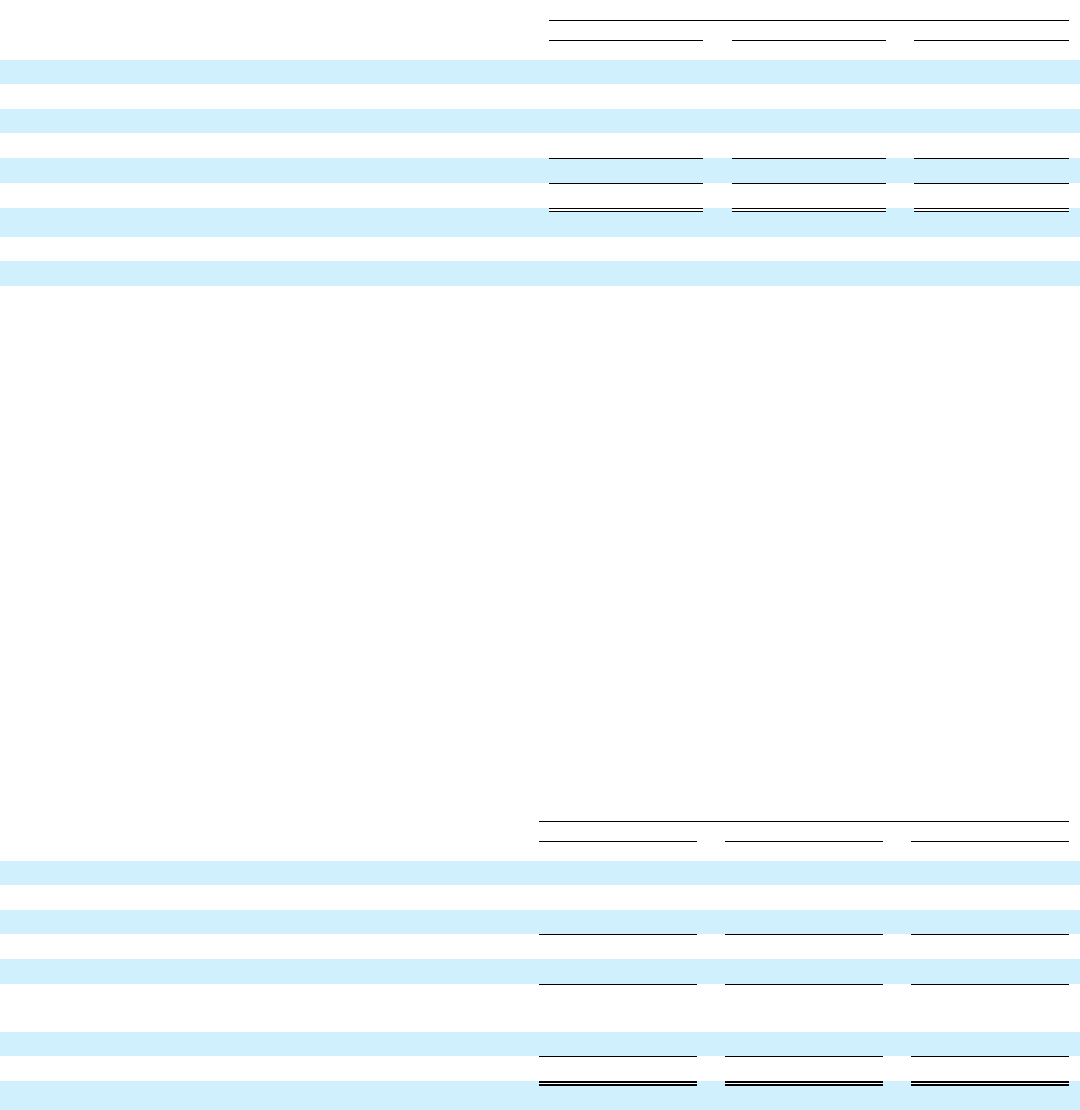

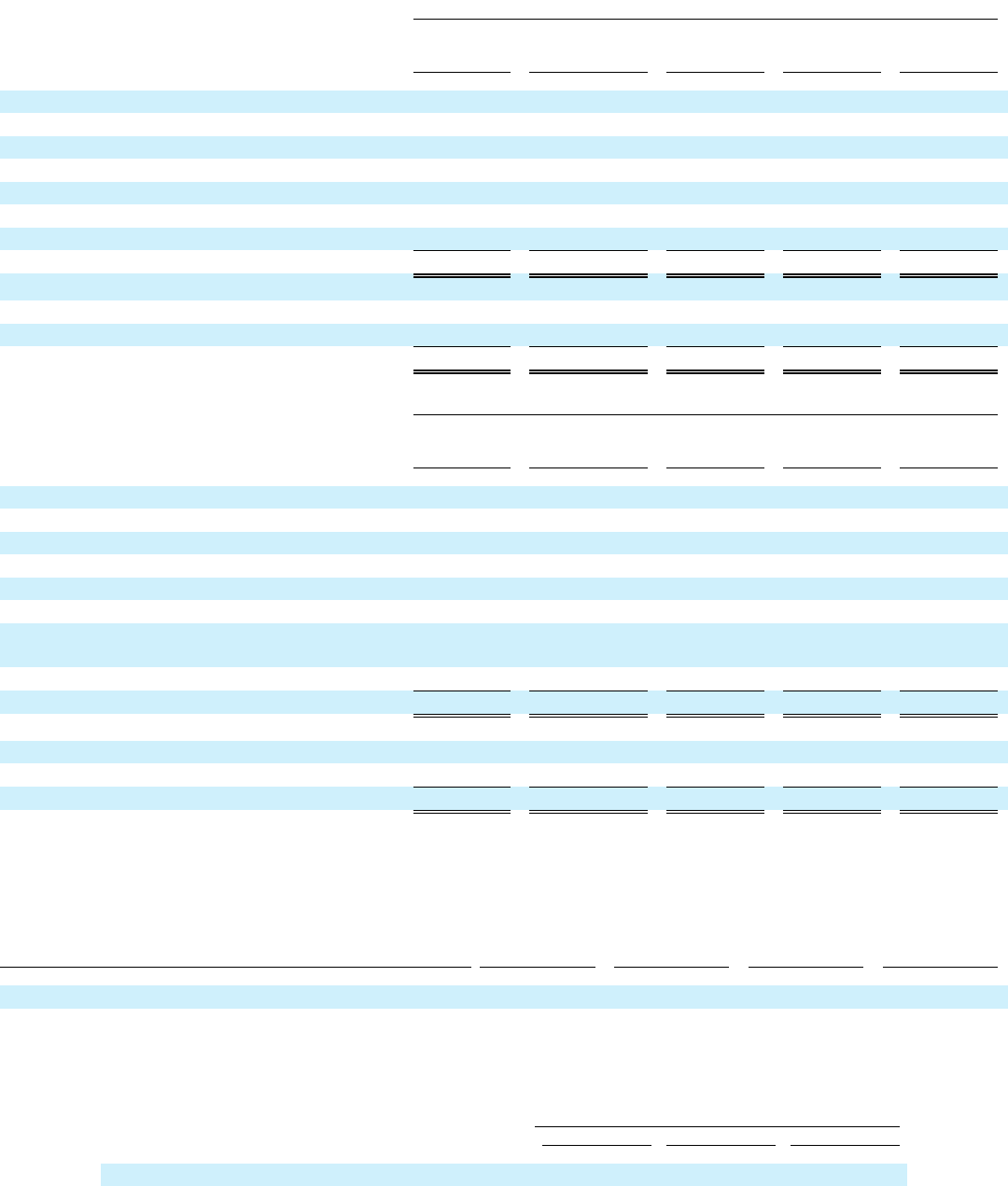

SHARE PERFORMANCE GRAPH

The following graph and table describe certain information comparing the cumulative total

return on our common shares of beneficial interest to the cumulative total return of the Russell

2000 Index and the Bloomberg REIT Mortgage Index. The comparison period is from December

31, 2017, to December 31, 2022, and the calculation assumes reinvestment of any dividends.

The graph and table illustrate the value of a hypothetical investment in our common shares of

beneficial interest and the two other indices on December 31, 2017.

Source: PMT & Russell 2000 from S&P Global Market Intelligence. Bloomberg REIT Mortgage Index from Bloomberg Professional

Services.

The information in the performance graph and table has been obtained from sources believed

to be reliable, but neither its accuracy nor its completeness can be guaranteed. The historical

information set forth above is not necessarily indicative of future performance. Accordingly, we

do not make or endorse any predictions as to future share performance. The share performance

graph and table shall not be deemed, under the Securities Act of 1933, as amended, or the

Securities Exchange Act of 1934, as amended, to be (i) “soliciting material” or “filed” or (ii)

incorporated by reference by any general statement into any filing made by us with the

Securities and Exchange Commission, except to the extent that we specifically incorporate such

share performance graph and table by reference.

60

80

100

120

140

160

180

200

Dec-17 Jun-18 Dec-18 Jun-19 Dec-19 Jun-20 Dec-20 Jun-21 Dec-21 Jun-22 Dec-22

PMT Russell 2000 Bloomberg REIT Mortgage Index

CORPORATE INFORMATION

Corporate Offices

3043 Townsgate Road

Westlake Village, CA 91361

818.224.7028

pmt.pennymac.com

2023 Annual Meeting

The 2023 Annual Meeting of Shareholders

will be held at 11:00 a.m. Pacific Time on June

8, 2023, via a live webcast at

www.virtualshareholdermeeting.com/PMT2023

Independent Registered Public

Accounting Firm

Deloitte & Touche LLP

Los Angeles, CA

PennyMac Mortgage Investment Trust

Securities

Traded: New York Stock Exchange

Common Share Symbol: PMT

Preferred Share Symbols: PMT PrA, PMT PrB, &

PMT PrC

Transfer Agent

Computershare

150 Royall Street, Suite 101

Canton, MA 02021

Toll-Free 800.522.6645

Shareholder inquiries

The Annual Report on Form 10-K of PennyMac

Mortgage Investment Trust filed with the SEC

and other reports can be accessed via our

website at pmt.pennymac.com or by emailing a

request to investorrelations@pennymac.com.

As of March 31, 2023, we had approximately

139 common shareholders of record. This

figure does not represent the actual number of

beneficial owners of common shares because

shares are frequently held in “street name” by

securities dealers and others for the benefit of

individual owners who may vote the shares.

Pursuant to Rule 303A.12 of the New York Stock Exchange Listed Companies Manual, each

listed company CEO must certify to the NYSE each year that he or she is not aware of any

violation by the company of NYSE corporate governance listing standards. David A. Spector’s

annual CEO certification regarding the NYSE’s corporate governance listing standards was

submitted to the NYSE on June 14, 2022.

f

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

(Mark One)

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2022

Or

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-34416

PennyMac Mortgage Investment Trust

(Exact name of registrant as specified in its charter)

Maryland

27-0186273

(State or other jurisdiction of

incorporation or organization)

(IRS Employer

Identification No.)

3043 Townsgate Road, Westlake Village, California

91361

(Address of principal executive offices)

(Zip Code)

(818) 224-7442

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class

Trading Symbol (s)

Name of Each Exchange on Which Registered

8.125% Series A Cumulative Redeemable Preferred

Shares of Beneficial Interest, $0.01 Par Value

PMT/PA

New York Stock Exchange

8.00% Series B Cumulative Redeemable Preferred

Shares of Beneficial Interest, $0.01 Par Value

6.75% Series C Cumulative Redeemable Preferred

Shares of Beneficial Interest, $0.01 Par Value

Common Shares of Beneficial Interest, $0.01 Par Value

PMT/PB

PMT/PC

PMT

New York Stock Exchange

New York Stock Exchange

New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past

90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-

T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging

growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the

Exchange Act:

Large accelerated filer

☒

Accelerated filer

☐

Non-accelerated filer

☐

Smaller reporting company

☐

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over

financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect

the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of

the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2022, the aggregate market value of the registrant’s common shares of beneficial interest, $0.01 par value (“common shares”), held by nonaffiliates

was $1,249,688,052 based on the closing price as reported on the New York Stock Exchange on that date.

As of February 22, 2023, there were 88,892,107 common shares of the registrant outstanding.

Documents Incorporated By Reference

Document

Parts Into Which Incorporated

Definitive Proxy Statement for 2023 Annual Meeting of Shareholders

Part III

2

PENNYMAC MORTGAGE INVESTMENT TRUST

FORM 10-K

December 31, 2022

TABLE OF CONTENTS

Page

Special Note Regarding Forward-Looking Statements ...................................................................................................................

3

PART I

6

Item 1

Business ....................................................................................................................................................................

6

Item 1A

Risk Factors...............................................................................................................................................................

18

Item 1B

Unresolved Staff Comments.....................................................................................................................................

47

Item 2

Properties ..................................................................................................................................................................

47

Item 3

Legal Proceedings.....................................................................................................................................................

47

Item 4

Mine Safety Disclosures ...........................................................................................................................................

47

PART II

48

Item 5

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities...............................................................................................................................................................

48

Item 6

Reserved....................................................................................................................................................................

48

Item 7

Management’s Discussion and Analysis of Financial Condition and Results of Operations...................................

49

Item 7A

Quantitative and Qualitative Disclosures About Market Risk..................................................................................

86

Item 8

Financial Statements and Supplementary Data.........................................................................................................

88

Item 9

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure..................................

89

Item 9A

Controls and Procedures ...........................................................................................................................................

89

Item 9B

Other Information .....................................................................................................................................................

91

Item 9C

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections......................................................................

91

PART III

92

Item 10

Directors, Executive Officers and Corporate Governance........................................................................................

92

Item 11

Executive Compensation...........................................................................................................................................

92

Item 12

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.................

92

Item 13

Certain Relationships and Related Transactions, and Director Independence .........................................................

93

Item 14

Principal Accounting Fees and Services...................................................................................................................

93

PART IV

94

Item 15

Exhibits and Financial Statement Schedules ............................................................................................................

94

Item 16

Form 10-K Summary ................................................................................................................................................

98

Signatures..................................................................................................................................................................

99

3

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Report”) contains certain forward-looking statements that are subject to various risks and

uncertainties. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,”

“should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,”

“continue,” “plan” or other similar words or expressions.

Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies,

contain financial and operating projections or state other forward-looking information. Examples of forward-looking statements

include the following:

• projections of our revenues, income, earnings per share, capital structure or other financial items;

• descriptions of our plans or objectives for future operations, products or services;

• forecasts of our future economic performance, interest rates, profit margins and our share of future markets; and

• descriptions of assumptions underlying or relating to any of the foregoing expectations regarding the timing of generating

any revenues.

Our ability to predict results or the actual effect of future events, actions, plans or strategies is inherently uncertain. Although we

believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and

performance could differ materially from those set forth in the forward-looking statements. There are a number of factors, many of

which are beyond our control that could cause actual results to differ significantly from management’s expectations. Some of these

factors are discussed below

You should not place undue reliance on any forward-looking statement and should consider the following uncertainties and

risks, as well as the risks and uncertainties discussed elsewhere in this Report and any subsequent Quarterly Reports on Form 10-Q.

Factors that could cause actual results to differ materially from historical results or those anticipated include, but are not limited

to:

• changes in interest rates and other macroeconomic conditions;

• our ability to comply with various federal, state and local laws and regulations that govern our business;

• the impact to our CRT arrangements and agreements of increased borrower requests for forbearance under the

Coronavirus Aid, Relief and Economic Security Act;

• changes in our investment objectives or investment or operational strategies, including any new lines of business or new

products and services that may subject us to additional risks;

• the degree and nature of our competition;

• volatility in our industry, the debt or equity markets, the general economy or the real estate finance and real estate markets

specifically, whether the result of market events or otherwise;

• events or circumstances which undermine confidence in the financial and housing markets or otherwise have a broad

impact on financial and housing markets, such as the sudden instability or collapse of large depository institutions or other

significant corporations, terrorist attacks, natural or man-made disasters, or threatened or actual armed conflicts;

• changes in general business, economic, market, employment and domestic and international political conditions, or in

consumer confidence and spending habits from those expected;

• declines in real estate or significant changes in U.S. housing prices or activity in the U.S. housing market;

• the availability of, and level of competition for, attractive risk-adjusted investment opportunities in loans and mortgage-

related assets that satisfy our investment objectives;

• the inherent difficulty in winning bids to acquire loans, and our success in doing so;

• the concentration of credit risks to which we are exposed;

• our dependence on our Manager and servicer, potential conflicts of interest with such entities and their affiliates, and the

performance of such entities;

• changes in personnel and lack of availability of qualified personnel at our Manager, servicer or their affiliates;

• the availability, terms and deployment of short-term and long-term capital;

4

• the adequacy of our cash reserves and working capital;

• our substantial amount of debt;

• our ability to maintain the desired relationship between our financing and the interest rates and maturities of our assets;

• the timing and amount of cash flows, if any, from our investments;

• our exposure to risks of loss and disruptions in operations resulting from adverse weather conditions, man-made or natural

disasters, climate change and pandemics such as the COVID-19 pandemic;

• unanticipated increases or volatility in financing and other costs, including a rise in interest rates;

• the performance, financial condition and liquidity of borrowers;

• the ability of our servicer, which also provides us with fulfillment services, to approve and monitor correspondent sellers

and underwrite loans to investor standards;

• incomplete or inaccurate information or documentation provided by customers or counterparties, or adverse changes in the

financial condition of our customers and counterparties;

• our indemnification and repurchase obligations in connection with loans we purchase and later sell or securitize;

• the quality and enforceability of the collateral documentation evidencing our ownership and rights in the assets in which

we invest;

• increased rates of delinquency, default and/or decreased recovery rates on our investments;

• the performance of loans underlying mortgage-backed securities in which we retain credit risk;

• our ability to foreclose on our investments in a timely manner or at all;

• the degree to which our hedging strategies may or may not protect us from interest rate volatility;

• the effect of the accuracy of or changes in the estimates we make about uncertainties, contingencies and asset and liability

valuations when measuring and reporting upon our financial condition and results of operations;

• our ability to maintain appropriate internal control over financial reporting;

• technology failures, cybersecurity risks and incidents, and our ability to mitigate cybersecurity risks and cyber intrusions;

• our ability to obtain and/or maintain licenses and other approvals in those jurisdictions where required to conduct our

business;

• our ability to detect misconduct and fraud;

• developments in the secondary markets for our loan products;

• legislative and regulatory changes that impact the loan industry or housing market;

• changes in regulations that impact the business, operations or governance of mortgage lenders and/or publicly-traded

companies or such changes that increase the cost of doing business with such entities;

• the Consumer Financial Protection Bureau and its issued and future rules and the enforcement thereof;

• changes in government support of homeownership;

• our ability to effectively identify, manage and hedge our credit, interest rate, prepayment, liquidity, and climate risks;

• changes in government or government-sponsored home affordability programs;

• limitations imposed on our business and our ability to satisfy complex rules for us to qualify as a real estate investment

trust (“REIT”) for U.S. federal income tax purposes and qualify for an exclusion from the Investment Company Act of

1940 and the ability of certain of our subsidiaries to qualify as REITs or as taxable REIT subsidiaries for U.S. federal

income tax purposes, as applicable, and our ability and the ability of our subsidiaries to operate effectively within the

limitations imposed by these rules;

• changes in governmental regulations, accounting treatment, tax rates and similar matters (including changes to laws

governing the taxation of REITs, or the exclusions from registration as an investment company);

5

• our ability to make distributions to our shareholders in the future;

• our failure to deal appropriately with issues that may give rise to reputational risk; and

• our organizational structure and certain requirements in our charter documents.

Other factors that could also cause results to differ from our expectations may not be described in this Report or any other

document. Each of these factors could by itself, or together with one or more other factors, adversely affect our business, results of

operations and/or financial condition.

Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update any forward-

looking statement to reflect the impact of circumstances or events that arise after the date the forward-looking statement was made.

6

PART I

Item 1. Business

The following description of our business should be read in conjunction with the information included elsewhere in this Report.

This description contains forward-looking statements that involve risks and uncertainties. Actual results could differ significantly from

the projections and results discussed in the forward-looking statements due to the factors described under the caption “Risk Factors”

and elsewhere in this Report. References in this Report to “we,” “our,” “us,” “PMT,” or the “Company” refer to PennyMac

Mortgage Investment Trust and its consolidated subsidiaries, unless otherwise indicated.

Our Company

We are a specialty finance company that invests primarily in mortgage-related assets. We conduct substantially all of our

operations, and make substantially all of our investments, through PennyMac Operating Partnership, L.P. (our “Operating

Partnership”) and its subsidiaries. A wholly-owned subsidiary of ours is the sole general partner, and we are the sole limited partner,

of our Operating Partnership. Certain of the activities conducted or investments made by us that are described below are conducted or

made through a wholly-owned subsidiary that is a taxable REIT subsidiary (“TRS”) of our Operating Partnership.

The management of our business and execution of our operations is performed on our behalf by subsidiaries of PennyMac

Financial Services, Inc. (“PFSI”). PFSI is a specialty financial services firm focused on the production and servicing of loans and the

management of investments related to the U.S. mortgage market. Specifically:

• We are managed by PNMAC Capital Management, LLC (“PCM” or our “Manager”), a wholly-owned subsidiary of PFSI

and an investment adviser registered with the United States Securities and Exchange Commission (“SEC”) that specializes

in, and focuses on, U.S. mortgage assets.

• Our loan production and servicing activities (as described below) are performed on our behalf by another wholly-owned

PFSI subsidiary, PennyMac Loan Services, LLC (“PLS” or our “Servicer”).

Our investment focus is on residential mortgage-backed securities (“MBS”) and mortgage-related assets that we create through

our correspondent production activities. Correspondent production activities include purchasing, pooling and selling newly originated

prime credit quality residential loans (“correspondent production”). Through our correspondent production activities, we create and

hold mortgage servicing rights (“MSRs”), non-Agency MBS, credit risk transfer (“CRT”) agreements (“CRT Agreements”), and other

CRT securities (together, “CRT arrangements”).

Our business includes four segments: credit sensitive strategies, interest rate sensitive strategies, correspondent production, and

corporate.

• The credit sensitive strategies segment represents our investments in CRT arrangements, subordinate MBS, distressed

loans and real estate.

• The interest rate sensitive strategies segment represents our investments in MSRs, excess servicing spread (“ESS”)

purchased from PFSI, Agency and senior non-Agency MBS and the related interest rate hedging activities.

• The correspondent production segment represents our operations aimed at serving as an intermediary between lenders and

the capital markets by purchasing, pooling and reselling newly originated prime credit quality loans either directly or in

the form of MBS, using the services of PCM and PLS.

We primarily sell the loans we acquire through our correspondent production activities to government-sponsored entities

(“GSEs”) such as the Federal National Mortgage Association (“Fannie Mae”) and the Federal Home Loan Mortgage

Corporation (“Freddie Mac”) or to PLS for sale into securitizations guaranteed by the Government National Mortgage

Association (“Ginnie Mae”). Fannie Mae, Freddie Mac and Ginnie Mae are each referred to as an “Agency” and,

collectively, as the “Agencies.”

• Our corporate segment includes management fee and corporate expense amounts and certain interest income.

7

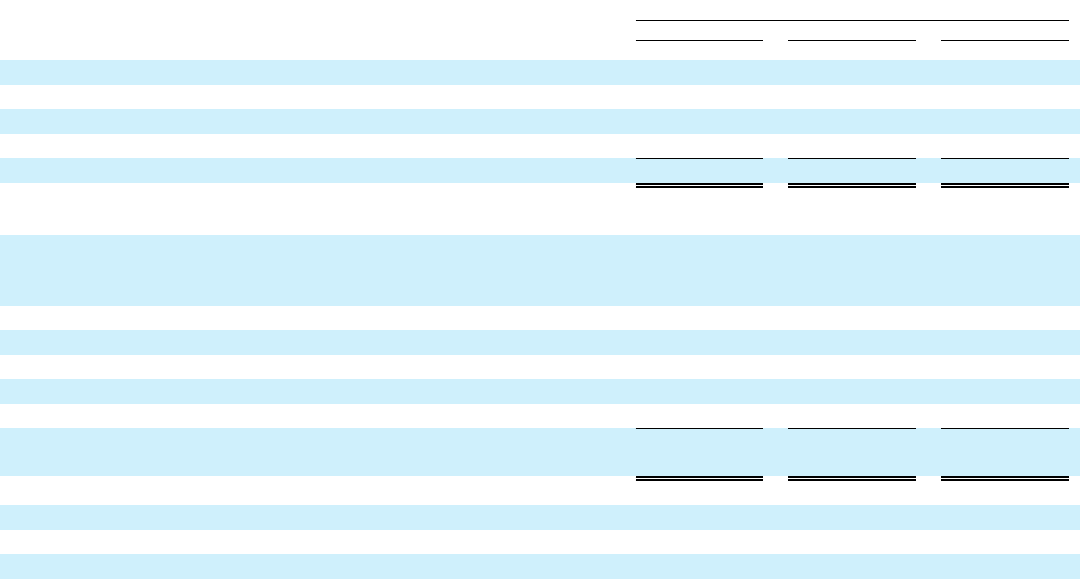

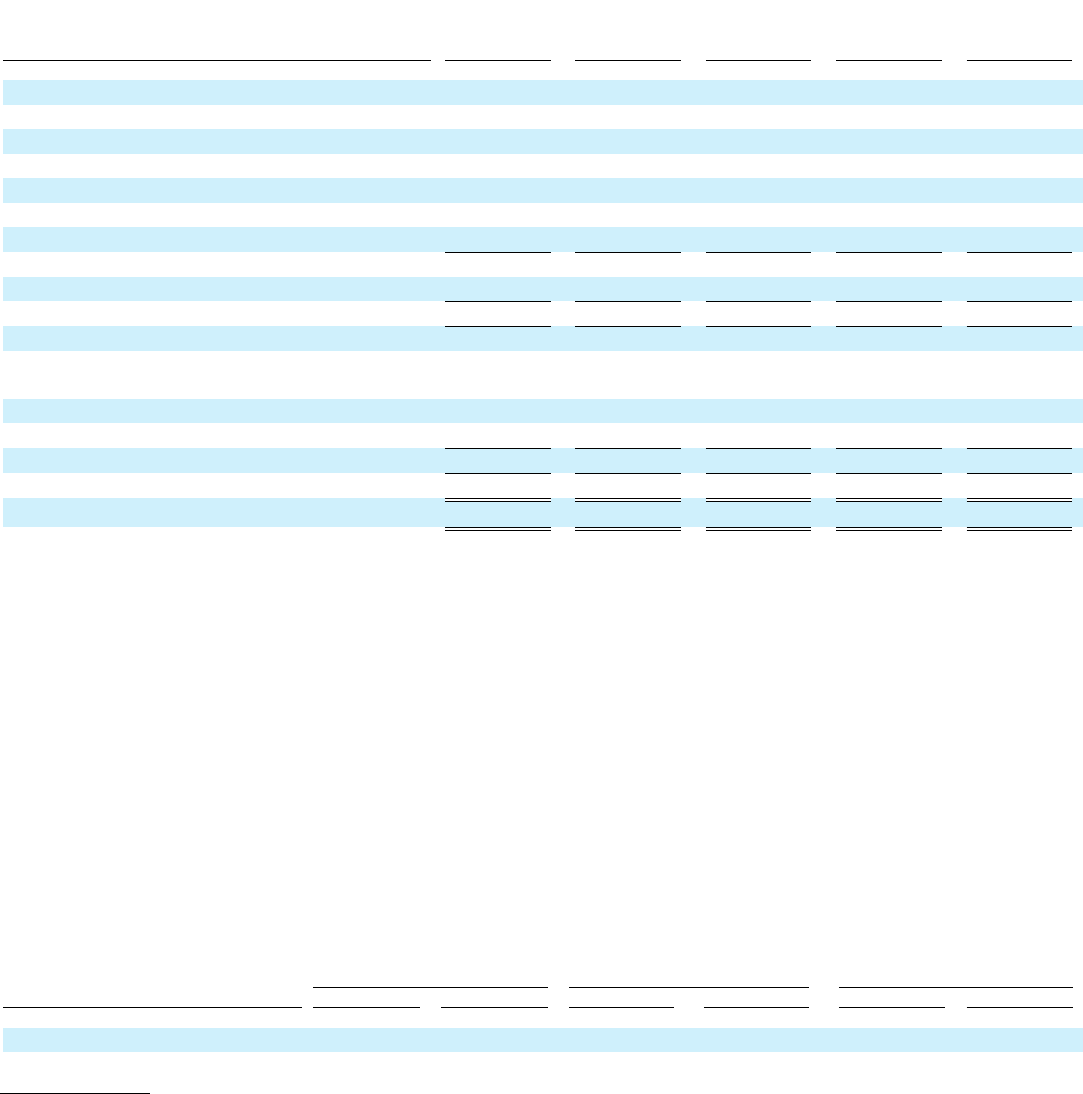

Following is a summary of our segment results for the years presented:

Year ended December 31,

2022

2021

2020

(in thousands)

Net investment income:

Credit sensitive strategies

$

(106,772

)

$

323,121

$

(305,340

)

Interest rate sensitive strategies

297,726

(204,665

)

174,558

Correspondent production

111,078

298,925

597,222

Corporate

1,739

2,916

2,911

$

303,771

$

420,297

$

469,351

Pretax income:

Credit sensitive strategies

$

(112,566

)

$

306,643

$

(317,143

)

Interest rate sensitive strategies

207,802

(290,065

)

105,697

Correspondent production

27,557

86,936

344,639

Corporate

(59,706

)

(58,853

)

(53,463

)

$

63,087

$

44,661

$

79,730

Total assets at year end:

Credit sensitive strategies

$

1,614,977

$

1,848,294

$

2,920,558

Interest rate sensitive strategies

9,991,621

7,363,878

4,593,127

Correspondent production

1,936,797

4,325,750

3,781,010

Corporate

378,169

234,786

197,316

$

13,921,564

$

13,772,708

$

11,492,011

In our correspondent production segment, we purchase Agency-eligible and jumbo loans. A jumbo loan is a loan in an amount

that exceeds the maximum loan amount for loans that are eligible for sale to the Agencies under their guidelines. We then either:

• sell Agency-eligible loans meeting the guidelines of the government-sponsored entities eligibility of loans for sale to Fannie

Mae or Freddie Mac (“GSEs-Eligible Loans”) on a servicing-retained basis whereby we retain the related MSRs;

• sell government loans (insured by the Federal Housing Administration or guaranteed by the U.S. Department of Veterans

Affairs or U.S. Department of Agriculture) and certain GSEs-Eligible Loans on a servicing-released basis to PLS, a Ginnie

Mae approved issuer and servicer, for which we earn sourcing fees as described in Note 4 – Transactions with Related

Parties to the consolidated financial statements included in this Report;

• create and issue structured MBS, retain a portion of the subordinate securities and sell the remaining senior MBS to

nonaffiliates; or

• sell loans with certain specified characteristics to banks or other investors, generally on a servicing retained basis.

Our correspondent production segment involves purchases of loans from approved mortgage originators that meet specific

criteria related to management experience, financial strength, risk management controls and loan quality. During 2022, we were the

largest correspondent aggregator in the United States as ranked by Inside Mortgage Finance. As of December 31, 2022, we had 722

approved sellers with delegated underwriting authority, primarily independent mortgage originators and small banks located across the

United States. PLS also serves as a source of correspondent production to us.

8

Following is a summary of our correspondent production activities:

Year ended December 31,

2022

2021

2020

(in thousands)

Correspondent loan purchases at fair value:

GSEs-Eligible Loans (1)

$

41,575,252

$

113,667,618

$

106,472,654

Held for sale to PLS ‒ Government insured or guaranteed (2)

46,562,853

67,702,945

63,574,547

Jumbo

5,029

—

—

Home equity lines of credit

132

—

2,569

$

88,143,266

$

181,370,563

$

170,049,770

Interest rate lock commitments issued

$

91,031,903

$

172,953,139

$

185,414,040

Fair value of loans at year end pending sale to:

Nonaffiliates

$

1,662,262

$

3,856,030

$

3,085,910

PLS

159,671

314,995

460,414

$

1,821,933

$

4,171,025

$

3,546,324

Number of approved sellers at year-end (2)

722

768

714

(1) The Company sells or finances a portion of its GSEs-Eligible Loans production to or with other investors, including PLS.

(2) Includes only sellers with delegated underwriting authority.

The sale of loans to nonaffiliates from our correspondent production activities serves as the source of our investments in MSRs,

CRT arrangements and subordinate non-Agency MBS which are summarized below:

Year ended December 31,

2022

2021

2020

(in thousands)

Sales of loans acquired for sale:

To nonaffiliates

$

39,077,156

$

110,919,477

$

106,306,805

To PennyMac Financial Services, Inc.

50,575,617

67,851,630

63,618,185

$

89,652,773

$

178,771,107

$

169,924,990

Net gains on loans acquired for sale

$

25,692

$

87,273

$

379,922

Investment activities resulting from correspondent production:

Receipt of MSRs as proceeds from sales of loans

$

670,343

$

1,484,629

$

1,158,475

Retention of interests in securitizations of loans secured

by investment properties, net of associated asset-backed financings

23,485

42,256

—

Purchase of subordinate bonds backed by previously-sold loans

secured by investment properties held in consolidated

variable interest entities

—

28,815

—

Investments in CRT arrangements:

Deposits securing CRT arrangements

—

—

1,700,000

Recognition of firm commitment to purchase CRT securities (1)

—

—

(38,161

)

Change in face amount of firm commitment to

purchase CRT securities and commitment

to fund Deposits securing CRT arrangements

—

—

(1,502,203

)

Total investments in CRT arrangements

—

—

159,636

Total investments resulting from correspondent activities

$

693,828

$

1,555,700

$

1,318,111

(1) Initial recognition of firm commitment upon sale of loans.

We also invest in MBS and have historically invested in ESS on MSRs acquired by PLS and distressed mortgage assets (loans

and real estate acquired in settlement of loans (“REO”)). We have liquidated our investment in ESS and substantially liquidated our

investment in distressed mortgage assets.

9

Following is a summary of our acquisitions of other mortgage-related investments:

Year ended December 31,

2022

2021

2020

(in thousands)

MBS, net of sales

$

2,638,267

$

932,270

$

352,307

ESS, net of sale

—

(129,304

)

2,093

$

2,638,267

$

802,966

$

354,400

Our portfolio of mortgage investments was comprised of the following:

December 31,

2022

2021

2020

(in thousands)

Credit sensitive assets:

CRT arrangements, net (1)

$

1,144,078

$

1,686,445

$

2,617,509

Subordinate credit-linked mortgage-backed securities

177,898

—

—

Subordinate interests in loans held in VIEs, net of associated

asset-backed financings

84,044

85,266

8,981

Distressed loans at fair value

3,457

4,161

8,027

Real estate acquired in settlement of loans

7,734

14,382

28,709

Other (2)

2,424

4,229

6,576

1,419,635

1,794,483

2,669,802

Interest rate sensitive assets:

Mortgage-backed securities

4,284,703

2,666,768

2,213,922

Mortgage servicing rights at fair value

4,012,737

2,892,855

1,755,236

Excess servicing spread

—

—

131,750

Net interest rate lock commitments

(478

)

2,451

72,386

Net interest rate hedges (3)

77,483

(2,546

)

(123,490

)

8,374,445

5,559,528

4,049,804

$

9,794,080

$

7,354,011

$

6,719,606

(1) Investments in CRT arrangements include deposits securing CRT arrangements, CRT strips, CRT derivatives and an interest-

only security payable.

(2) Comprised of home equity lines of credit and a small balance commercial loan.

(3) Derivative assets, net of derivative liabilities, excluding interest rate lock commitments (“IRLCs”) and CRT derivatives.

Over time, our targeted asset classes may change as a result of changes in the opportunities that are available in the market,

among other factors. We may not continue to invest in certain of the investments described above if we believe those types of

investments will not provide us with suitable returns or if we believe other types of our targeted assets provide us with better returns.

Investment Policies

Our board of trustees has adopted the policies set forth below for our investments and borrowings. PCM reviews its compliance

with our investment policies regularly and reports periodically to our board of trustees regarding such compliance.

• No investment shall be made that would cause us to fail to qualify as a REIT for U.S. federal income tax purposes;

• No investment shall be made that would cause us to be regulated as an investment company under the Investment

Company Act of 1940 (the “Investment Company Act”); and

• With the exception of real estate and housing, no single industry shall represent more than 20% of the investments or total

risk exposure in our portfolio.

These investment policies may be changed by a majority of our board of trustees without the approval of, or prior notice to, our

shareholders.

We have not adopted a policy that expressly prohibits our trustees, officers, shareholders or affiliates from having a direct or

indirect financial interest in any investment to be acquired or disposed of by us or in any transaction to which we are a party or have

an interest. We do not have a policy that expressly prohibits any such persons from engaging for their own account in business

10

activities of the types conducted by us. However, our code of business conduct and ethics contains a conflicts of interest policy that

prohibits our trustees and officers, as well as employees of PFSI and its subsidiaries who provide services to us, from engaging in any

transaction that involves an actual or apparent conflict of interest with us without the appropriate approval. We also have written

policies and procedures for the review and approval of related party transactions, including oversight by designated committees of our

board of trustees and PFSI’s board of directors.

Competition

In our correspondent production activities, we compete with large financial institutions, the government-sponsored enterprise

cash windows and other independent residential loan producers and servicers such as Mr. Cooper, Rithm Capital Corp., Truist

Financial, Western Alliance Bank and Ocwen Financial. We compete on the basis of product offerings, technical knowledge, loan

quality, speed of execution, rate and fees.

In the acquisition of mortgage assets, we compete with specialty finance companies, private funds, other mortgage REITs,

thrifts, banks, mortgage bankers, insurance companies, mutual funds, institutional investors, investment banking firms, governmental

bodies and other entities such as Chimera Investment Corporation, Invesco Mortgage Capital Inc., Rithm Capital Corp., MFA

Financial, Inc., New York Mortgage Trust, Redwood Trust Inc. and Two Harbors Investment Corp., which may also be focused on

acquiring mortgage-related assets, and therefore may increase competition for the available supply of mortgage assets suitable for

purchase.

Many of our competitors are significantly larger than we are and have stronger financial positions and greater access to capital

and other resources than we have and may have other advantages over us. Such advantages include the ability to obtain lower-cost

financing, such as deposits, and operational efficiencies arising from their larger size.

Some of our competitors may have higher risk tolerances or different risk assessments and may not be subject to the operating

constraints associated with REIT tax compliance or maintenance of an exclusion from the Investment Company Act, any of which

could allow them to consider a wider variety of investments and funding strategies and to establish more relationships with sellers of

mortgage assets than we can.

Because the availability of mortgage assets may fluctuate, the competition for assets and sources of financing may increase.

Increased competition for assets may result in our accepting lower returns for acquisitions of assets or adversely influence our ability

to bid for such assets at levels that allow us to acquire the assets.

To address this competition, we have access to PCM’s professionals and their industry expertise, which we believe provides us

with a competitive advantage and helps us assess investment risks and determine appropriate pricing for certain potential investments.

We expect this relationship to enable us to compete more effectively for attractive investment opportunities. Furthermore, we believe

that our access to PLS servicing expertise provides us with a competitive advantage over other companies with a similar focus.

However, we can provide no assurance that we will be able to achieve our business goals or expectations due to the competition and

other risks that we face.

Cyclicality and Seasonality

The demand for loan originations is affected by consumer demand for home loans. Demand for home loans generally comes

from the demand for loans made to finance the purchase of homes and the demand for loans made to refinance existing loans.

The demand for loans made to finance the purchase of homes is most significantly influenced by the overall strength of the

economy, housing prices and availability and societal factors such as household formation and government support for home

ownership.

The demand for loans made to refinance existing loans is most significantly influenced by movements in interest rates and to a

lesser extent, to changes in property values and employment.

11

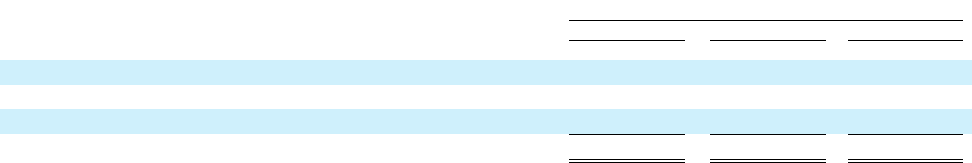

Our Financing Activities

Following is a summary of our financing, including borrowings and the assets pledged to secure those borrowings as of

December 31, 2022:

Assets financed

Financing

MBS

Loans

acquired

for sale

Loans at

fair value

CRT assets

MSRs (1)

REO

Total

(in thousands)

Borrowings

Short term

Assets sold under agreements to

repurchase

$

4,250,638

$

1,678,554

$

64,501

$

237,835

$

385,000

$

—

$

6,616,528

Mortgage loan participation purchase

and sale agreements

—

—

—

—

—

—

—

Long term

Notes payable secured by CRT

arrangements and MSRs

—

—

—

591,027

2,213,001

—

2,804,028

Asset-backed financings at fair value

—

—

1,414,955

—

—

—

1,414,955

Interest-only security payable

—

—

—

21,925

—

—

21,925

Total secured borrowings

4,250,638

1,678,554

1,479,456

850,787

2,598,001

—

10,857,436

Exchangeable senior notes

546,254

Total borrowings

$

4,250,638

$

1,678,554

$

1,479,456

$

850,787

$

2,598,001

$

—

11,403,690

Shareholders' equity

1,962,815

Total financing

$

13,366,505

Assets pledged to secure borrowings

$

4,462,601

$

1,801,368

$

1,510,148

$

1,326,556

$

4,063,708

$

3,297

$

13,167,678

Debt-to-equity ratio:

Excluding non-recourse debt

5.1:1

Total

5.8:1

(1) Amounts pledged to secure borrowings include pledged servicing advances.

Debt

Our current debt financing strategy is to finance our assets in such a way as to match the term of the liabilities used to finance

them to the expected life of the underlying assets where we believe such borrowing is prudent, appropriate and available. Our

borrowings are primarily collateralized borrowings in the form of sales of assets under agreements to repurchase, loan and security

agreements, and loan participation purchase and sale agreements. We supplement these borrowings with long-term securitized notes,

including secured term financing for our MSRs and our CRT arrangements.

Terms of our borrowings are summarized in Notes 14 and 15 to our consolidated financial statements included in this Report. A

significant portion of our balance sheet is comprised of longer-lived assets - such as MSRs, servicing advances, CRT arrangements

and distressed loans - that have historically been less liquid, and more difficult to finance than our newly originated mortgage loans

and MBS. As a result, we have historically relied on shorter-term financing arrangements, primarily sales of the assets under

agreements to repurchase, to finance our longer-lived assets. As we have grown, our ability to finance more of our assets under longer

term arrangements that more closely align the term of the borrowings with the expected life of the corresponding assets, on terms that

are economically viable for us, has increased.

Following is a summary of the types of debt we use to finance our investing and operating activities:

Short-term debt

Sales of assets under agreements to repurchase

Our largest source of debt financing is the sale of assets under agreements to repurchase. Under these agreements, we sell assets

or participation certificates to a lender under a commitment to repurchase the asset or participation certificate within a specified

period - generally ranging from 30 to 90 days for MBS and CRT assets, 60 to 120 days for mortgage loans and two to five years for

participation certificates secured by MSRs.

During the period the agreement to repurchase is outstanding, our lender is generally contractually authorized to repledge the

assets underlying the repurchase agreement. The repurchase agreements generally contain margin provisions that require us to

maintain our borrowings at a specified percentage of the fair value of the assets pledged to secure the borrowings. As a result, we are

subject to margin calls during the period the repurchase agreements are outstanding and, therefore, may be required to repay a portion

of the borrowings before the respective repurchase agreements mature if the fair value (as determined by the applicable lender) of the

assets securing those repurchase agreements decreases.

12

We are exposed to loss in the event a lender makes a margin call to us and we are unable to fund the margin call. In such a

circumstance, the lender is contractually allowed to liquidate the assets securing the repurchase agreement and pursue repayment from

us for any balance not satisfied through the sale of the collateral. To the extent we finance long-lived assets with repurchase

agreements, we are also exposed to the risk of our being unable to refinance these assets under terms that are reasonable to us when

the repurchase agreements mature.

Our repurchase agreement facilities include a mix of committed and uncommitted facilities. Committed facilities contractually

bind the lender to purchase assets meeting the criteria of the credit facility up to a committed amount, whereas the lender is not

required to fund repurchase agreements on uncommitted amounts. We pay a facility commitment fee to maintain committed amounts

and endeavor to minimize our borrowing costs while maintaining adequate committed amounts to fund our expected loan inventory

levels during the facility commitment period.

Mortgage loan participation purchase and sale agreements

We finance a portion of our inventory of loans acquired for sale using mortgage loan participation purchase and sale

agreements. Under mortgage loan participation purchase and sale agreements, we sell participation certificates to a lender,

representing undivided beneficial ownership interests in pools of loans deemed eligible to back pass-through MBS issued and

guaranteed by Fannie Mae or Freddie Mac, while the pools are pending securitization and the sale of the resulting securities. As part

of the sale of the participation certificates, we arrange to deliver the resulting securities to the lender, and assign the commitments

between us and nonaffiliates to sell the securities.

Mortgage loan participation purchase and sale certificates generally have a term of up to 45 days based on the anticipated

delivery date of the related MBS and are repaid when the nonaffiliated investors purchase the securities.

Our mortgage loan participation purchase and sale agreement facilities are both committed and uncommitted facilities.

Mortgage loan participation certificates do not contain margin call provisions. However, in the event the purchasers of the securities

fail to settle the purchase, we are obligated to purchase the securities from the lender.

Loan and security agreements

We finance our MSRs related to mortgage loans pooled into Freddie Mac securities using a loan and security agreement or

similar credit agreements with terms to maturity of two years from their original effective dates. Under the agreements, we borrow

amounts collateralized by the MSRs, the fair value of which is determined by the lender or a third-party agent, on a monthly basis, or

at the discretion of the lender. The lender makes available both committed and uncommitted amounts, with the maximum maturity of

borrowed balances not to exceed the maturity of the agreements.

The agreements include provisions that require us to maintain our borrowings at a level not to exceed a specified percentage of

the fair value of the MSRs pledged to secure the borrowings. As a result, we are subject to margin calls during the period if any

amount is outstanding under the agreements. We are exposed to loss in the event the lender makes a margin call to us and we are

unable to fund the margin call. In such a circumstance, the lender is contractually allowed to liquidate any portion of the MSRs

securing the agreements and pursue repayment from us for any balance not satisfied through their subsequent sale of the MSRs.

Long-term debt

Notes payable secured by CRT arrangements and MSRs

Our notes payable secured by CRT arrangements and MSRs represent long-term financing of our CRT and MSR assets and

include:

• $1.1 billion in secured term notes issued to qualified institutional buyers under Rule 144A of the Securities Act of 1933, as

amended (the “Securities Act”). The term notes are secured by MSRs on Fannie Mae loans that are pledged to a subsidiary

trust that has also issued variable funding notes (“VFNs”) that may be financed with certain lenders in the form of sales of

assets under agreements to repurchase. VFNs are typically used to finance a portion of the fair value of MSRs held by the

subsidiary trust in excess of the fair value required to collateralize the secured term notes. The term notes include margin call

provisions that require us to maintain a certain advance rate based on the fair value of the underlying MSRs. As the fair value

of MSRs is subject to periodic fluctuation, we are required to either pledge additional MSRs or cash to the subsidiary trust

when the fair value of the MSRs decreases even though the borrowings have a long-term maturity.

• $1.1 billion in various credit agreements secured by Freddie Mac MSRs

• $593 million of term notes secured by our investment in CRT assets issued to qualified institutional buyers under Rule 144A

of the Securities Act. These term notes do not include margin call provisions. However, these term notes must be repaid

based on the amortization of the CRT assets that collateralize them. These term notes have maturities ranging from

March 2023 through October 2024. A portion of these term notes have terms that provide for optional extensions of two

years under conditions provided in the respective agreements.

13

Asset-backed financings

We have participated in various transactions whereby we invest in subordinate securities issued in loan securitizations. These

transactions are sponsored by us or a nonaffiliate. We acquire the loans underlying these loan securitizations through our

correspondent lending activities. We then either sell the loans to a nonaffiliate which pools the loans into securities, or we pool the

loans into securities issued by one of our subsidiary trusts. We purchase subordinate securities from nonaffiliate sponsored

transactions and retain subordinate securities in the transactions we sponsored. Any mortgage servicing rights for the loans underlying

these securities are owned by us, and sub-serviced by PLS for the subsidiary trusts issuing the securities.

Because we hold substantially all of the subordinate securities created in these transactions and we or PLS service the

underlying loans, we include the assets of the issuing trust on our consolidated balance sheet, primarily in Loans at fair value. We also

include the securities issued to nonaffiliates by the issuing trusts as Asset-backed financings at Fair Value on our consolidated balance

sheet.

This debt is repaid by the issuing trust from the cash flows received on the loans underlying these subordinated securities. Cash

flows from those loans represent the sole source of repayment of this debt and the holders of this debt have no recourse to other assets

on our consolidated balance sheet. The maturities of these financings are based on the loan(s) with the latest maturity of the loans in

the issuing subsidiary trusts.

Interest-only security payable

One of the classes of the securities issued by the trusts relating to our investments in CRT arrangements is an interest-only

security that was offered to a nonaffiliate. As discussed in Note 6 – Variable Interest Entities to the consolidated financial statements

included in this Report, we consolidate the trusts that issue the securities underlying our investments in the CRT arrangements. As part

of the consolidation of the CRT arrangements, we recognize this interest-only security.

This debt is repaid by the issuing trust from the cash flows based on the reference loans underlying these securities. Cash flows

from those loans represent the sole source of repayment of this security and its holder has no recourse to other assets on our

consolidated balance sheet.

Exchangeable senior notes

We have $210 million in outstanding exchangeable senior notes due to mature on November 1, 2024, and $345 million in

outstanding exchangeable senior notes due on mature on March 15, 2026. The exchangeable senior notes are unsecured obligations.

The exchangeable senior notes are exchangeable into 40.101 PMT common shares per $1,000 principal amount for the notes maturing

on November 1, 2024 and 46.1063 PMT common shares per $1,000 principal amount for the notes maturing on March 15, 2026,

subject to adjustment upon the occurrence of certain events. The exchangeable senior notes bear interest at 5.50%.

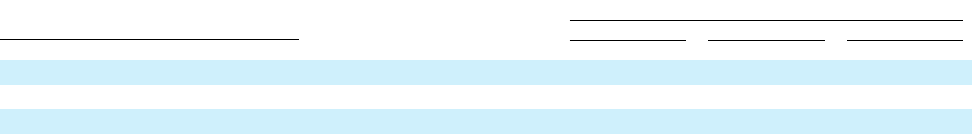

Equity

Our shareholders’ equity includes both common and cumulative preferred shares, partially offset by our accumulated deficit as

summarized below:

December 31,

2022

2021

2020

(in thousands)

Paid-in capital

Preferred shares

$

541,482

$

541,482

$

299,707

Common shares

1,948,155

2,082,706

2,097,886

2,489,637

2,624,188

2,397,593

Accumulated deficit

(526,822

)

(256,670

)

(100,734

)

$

1,962,815

$

2,367,518

$

2,296,859

We actively manage our equity financing and endeavor to obtain an equity structure that optimizes the returns to our common

shareholders. This approach to managing our equity includes supplementing our common shares with issuances of preferred shares

and common share repurchase activities. At December 31, 2022, we had $200 million of common shares available for issuance under

our at-the-market equity offering program and $101.3 million authorized for share repurchases.

14

Following is a summary of our offerings and repurchases of common shares:

Year ended December 31,

Share offerings

Share repurchases

(in thousands)

2022

$

—

$

87,992

2021

$

—

$

56,855

2020

$

5,597

$

37,267

Our preferred shares are comprised of three series of $25 par value cumulative preferred shares that have dividend rates ranging

from 6.75% to 8.125% of their par values and liquidation preferences totaling $560 million. Our preferred shares have no stated

maturity, are not subject to any sinking fund or mandatory redemption and will remain outstanding indefinitely unless we redeem or

repurchase the shares or the shares are converted into common shares in connection with a change of control by the holders of the

preferred shares, as provided in the respective articles supplementary establishing the terms of each series of preferred shares. The

preferred shares become redeemable between March 15, 2024 and August 24, 2026.

As a REIT, we face limits on our ability to finance our operations and investments with retained earnings, as we are generally

required to distribute to our shareholders at least 90% of our taxable income each year for us to qualify as a REIT under the Internal

Revenue Code of 1986 (the “Internal Revenue Code”). To the extent we satisfy the 90% distribution requirement but distribute less

than 100% of our taxable income, we are subject to U.S. federal corporate income tax on our undistributed taxable income. We

establish the level of our periodic common share distributions based on this requirement as well as our earnings, our financial

condition and such other factors as our board of trustees may deem relevant from time to time.

Operating and Regulatory Structure

Taxation – REIT Qualification

We have elected to be treated as a REIT under Sections 856 through 860 of the Internal Revenue Code beginning with our

taxable year ended December 31, 2009. Our qualification as a REIT depends upon our ability to meet on a continuing basis, through

actual investment and operating results, various complex requirements under the Internal Revenue Code relating to, among other

things, the sources of our gross income, the composition and values of our assets, our distribution levels and the diversity of ownership

of our common shares. We believe that we are organized in conformity with the requirements for qualification and taxation as a REIT

under the Internal Revenue Code, and that our manner of operation enables us to meet the requirements for qualification and taxation

as a REIT.

As a REIT, we generally are not subject to U.S. federal income tax on the REIT taxable income we distribute to our

shareholders. If we fail to qualify as a REIT in any taxable year and do not qualify for certain statutory relief provisions, we will be

subject to U.S. federal income tax at regular corporate rates and may be precluded from qualifying as a REIT for the subsequent four

taxable years following the year during which we lost our REIT qualification. Accordingly, our failure to qualify as a REIT could

have a material adverse impact on our results of operations and amounts available for distribution to our shareholders.

Even though we have elected to be taxed as a REIT, we are subject to some U.S. federal, state and local taxes on our income or

property. A portion of our business is conducted through, and a portion of our income is earned in, our TRS that is subject to corporate

income taxation. In general, a TRS of ours may hold assets and engage in activities that we cannot hold or engage in directly and may

engage in any real estate or non-real estate related business. A TRS is subject to U.S. federal, state and local corporate income taxes.

To maintain our REIT election, at the end of each quarter no more than 20% of the value of a REIT’s assets may consist of stock or

securities of one or more TRSs.

If our TRS generates net income, our TRS can declare dividends to us, which will be included in our taxable income and

necessitate a distribution to our shareholders. Conversely, if we retain earnings at the TRS level, no distribution is required and we can

increase shareholders’ equity of the consolidated entity. As discussed in Section 1A. of this Report entitled Risk Factors, the

combination of the requirement to maintain no more than 20% of our assets in the TRS coupled with the effect of TRS dividends on

our income tests creates compliance complexities for us in the maintenance of our qualified REIT status.

The dividends paid deduction of a REIT for qualifying dividends to its shareholders is computed using our taxable income as

opposed to net income reported on our financial statements. Taxable income generally differs from net income reported on our

financial statements because the determination of taxable income is based on tax laws and regulations and not financial accounting

principles.

Compliance and Regulation

Our business is subject to extensive federal, state and local regulation. The Consumer Financial Protection Bureau (“CFPB”)

was established on July 21, 2010 under Title X of the Dodd-Frank Wall Street Reform and Consumer Protection Act. The CFPB is

responsible for ensuring consumers are provided with timely and understandable information to make responsible decisions about

15

financial transactions, federal consumer financial laws are enforced and consumers are protected from unfair, deceptive, or abusive

acts and practices and from discrimination. Although the CFPB’s actions may improve consumer protection, such actions also have

resulted in a meaningful increase in costs to consumers and financial services companies including mortgage originators and servicers.

Our and our Manager’s loan production and loan servicing operations are regulated at the state level by state licensing

authorities and administrative agencies. Our Manager’s employees who engage in regulated activities must apply for licensing as a

mortgage banker or lender, loan servicer and debt collector pursuant to applicable state law. These state licensing requirements

typically require an application process, the payment of fees, background checks and administrative review. Our Manager’s servicing

operations are licensed (or exempt or otherwise not required to be licensed) to service mortgage loans in all 50 states, the District of

Columbia, Guam and the U.S. Virgin Islands. From time to time, we or our Manager receive requests from states and Agencies and

various investors for records, documents and information regarding our policies, procedures and practices regarding our loan

production and loan servicing business activities, and undergo periodic examinations by federal and state regulatory agencies.

The Secure and Fair Enforcement for Mortgage Licensing Act of 2008 (the “SAFE Act”) requires all states to enact laws that

require all individuals acting in the United States as mortgage loan originators to be individually licensed or registered if they intend to

offer mortgage loan products. These licensing requirements include enrollment in the Nationwide Mortgage Licensing System,

application to state regulators for individual licenses and the completion of pre-licensing education, annual education and the

successful completion of both national and state exams.

We must comply with a number of federal consumer protection laws, including, among others:

• the Real Estate Settlement Procedures Act (“RESPA”), and Regulation X thereunder, which require certain disclosures to

mortgagors regarding the costs of mortgage loans, the administration of tax and insurance escrows, the transferring of

servicing of mortgage loans, the response to consumer complaints, and payments between lenders and vendors of certain

settlement services;

• the Truth in Lending Act (“TILA”), and Regulation Z thereunder, which require certain disclosures to mortgagors regarding

the terms of their mortgage loans, notices of sale, assignments or transfers of ownership of mortgage loans, new servicing

rules involving payment processing, and adjustable rate mortgage change notices and periodic statements;

• the Equal Credit Opportunity Act and Regulation B thereunder, which prohibit discrimination on the basis of age, race and

certain other characteristics, in the extension of credit;

• the Fair Housing Act, which prohibits discrimination in housing on the basis of race, sex, national origin, and certain other

characteristics;

• the Home Mortgage Disclosure Act and Regulation C thereunder, which require financial institutions to report certain public

loan data;

• the Homeowners Protection Act, which requires the cancellation of private mortgage insurance once certain equity levels are

reached, sets disclosure and notification requirements, and requires the return of unearned premiums;

• the Servicemembers Civil Relief Act, which provides, among other things, interest and foreclosure protections for service

members on active duty;

• the Gramm-Leach-Bliley Act and Regulation P thereunder, which require us to maintain privacy with respect to certain

consumer data in our possession and to periodically communicate with consumers on privacy matters;

• the Fair Debt Collection Practices Act, which regulates the timing and content of debt collection communications;

• the Fair Credit Reporting Act and Regulation V thereunder, which regulate the use and reporting of information related to the

credit history of consumers;

• the National Flood Insurance Reform Act of 1994, which provides for lenders to require borrowers/owners of properties in

special flood hazard areas to purchase flood insurance for such properties, or for lenders to purchase flood insurance on

behalf of such borrowers/owners; and

• the CARES Act, which allows borrowers with federally-backed loans to request temporary payment forbearance in response

to the increased borrower hardships resulting from the ongoing COVID-19 pandemic.

Many of these laws are further impacted by the SAFE Act and implementation of new rules by the CFPB.

16

Our Manager and Our Servicer

We are externally managed and advised by PCM pursuant to a management agreement. PCM specializes in and focuses on

investments in U.S. mortgage assets.

PCM is responsible for administering our business activities and day-to-day operations, including developing our investment

strategies, and sourcing and acquiring mortgage-related assets for our investment portfolio. Pursuant to the terms of the management

agreement, PCM provides us with our senior management team, including our officers and support personnel. PCM is subject to the

supervision and oversight of our board of trustees and has the functions and authority specified in the management agreement.

We also have a loan servicing agreement with PLS, pursuant to which PLS provides primary and special servicing for our

portfolio of residential loans and MSRs. PLS’ loan servicing activities include collecting principal, interest and escrow account

payments, accounting for and remitting collections to investors in the loans, responding to customer inquiries, and default

management activities, including managing loss mitigation, which may include, among other things, collection activities, loan

workouts, modifications and refinancings, foreclosures, short sales and sales of REO. Servicing fee rates are based on the delinquency

status, activities performed, and other characteristics of the loans serviced and total servicing compensation is established at levels that

we believe are competitive with those charged by other primary servicers and specialty servicers. PLS acted as the servicer for loans

with an unpaid principal balance totaling approximately $551.7 billion, of which $233.6 billion was subserviced for us as of

December 31, 2022.

Human Capital Resources

All of our senior officers are employees of PFSI or its affiliates and we have no employees. Our long-term growth and success is

highly dependent upon PFSI’s employees and PFSI’s ability to maintain a diverse, equitable and inclusive workplace representing a

broad spectrum of backgrounds, ideas and perspectives. As part of these efforts, PFSI strives to offer competitive compensation and

benefits, foster a community where everyone feels a greater sense of belonging and purpose, and provide employees with the

opportunity to give back and make an impact in the communities where we live and serve.