Page 5 of 10

MortgageAssistanceApplicationFirst

Loan Number___________________

Mortgage Assistance Application

IMPORTANT – All sections/fields of the application must be complete. Use “0” or “N/A” if a category doesn’t apply to you.

ALL borrowers on the Note/Loan must provide application information and supporting documentation.

If you are not on the Note/Loan and are completing this application, provide a detailed explanation and relevant documents.

(For example: Divorce Decree, Death Certificate and Probate documents, recorded Quitclaim Deed)

For additional foreclosure prevention information and assistance, including a list of HUD-approved housing counselors, contact:

The US Department of Housing and Urban Development at (800) 569-4287 or www.hud.gov/counseling.

Homeowners’ HOPE Hotline (888) 995-HOPE – Call this hotline and let a HUD-approved housing counselor help you

understand your options, prepare your application, and help you work with PennyMac to complete your paperwork.

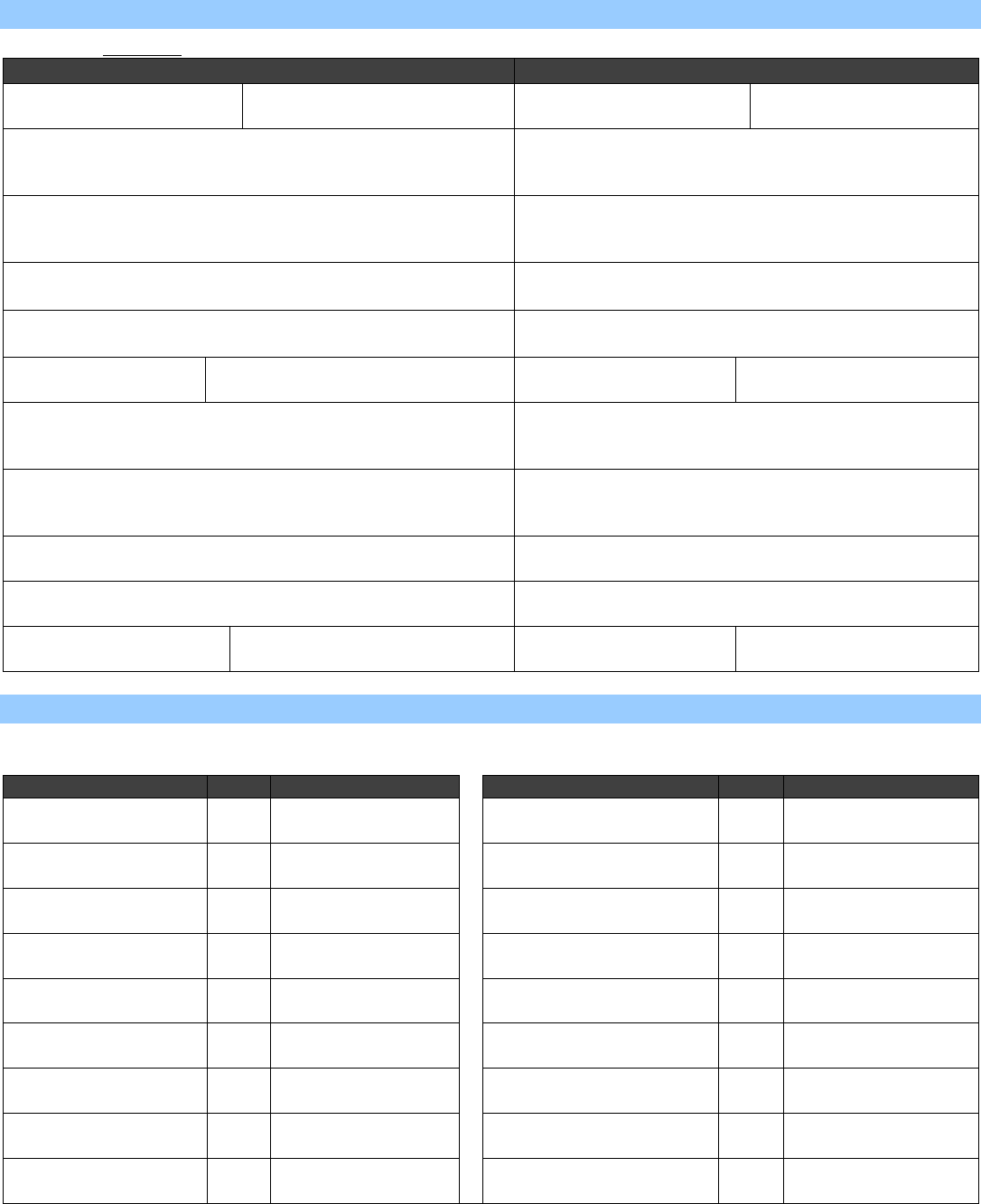

Borrower Information

Borrower’s name: ___________________________________

Social Security Number (last 4 digits): ___________________

Daytime phone number: _________________________

Alternate phone number: ________________________

E-mail address: _____________________________________

Co-Borrower’s name: __________________________________

Social Security Number (last 4 digits): _____________________

Daytime phone number: ___________________________

Alternate phone number: __________________________

E-mail address: _______________________________________

Preferred contact method: Phone Email Text

*By providing your cell phone number(s), you are giving PennyMac, and companies working on its behalf, permission to contact you at

this number about any PennyMac account. Your consent permits the use of text messaging, artificial or prerecorded voice messages

and automatic dialing technology. Message and data rates may apply. You may contact us at any time to change these preferences.

Is any borrower an active duty service member, the dependent of an active duty service member, or the surviving spouse or dependent

of a service member, who was on active duty at the time of death? Yes No

Are you working with a 3

rd

party that’s authorized to speak on your behalf during the modification review process? Yes No

If yes, provide: Name_____________________________________________ Phone Number: _______________________

E-mail address: _________________________________________________

Property Information

Property Address: _____________________________________________________________________________________________

Mailing address (if different from property address): _________________________________________________________________

The property is currently:

A primary residence

A second home

An investment property

The property is (select all that apply):

Owner occupied

Renter occupied

Vacant

Number of people in household

_________________

Borrower’s preference:

Keep the property

Sell or transfer the property

Undecided

Is the property listed for sale? Yes No; if yes, provide the listing agent’s name and phone number—or indicate “for sale by

owner” if applicable: _________________________________________________

Is the property subject to condominium or homeowners association (HOA) fees? Yes No. If yes, provide the most recent

account statement and indicate dues and frequency: $_____________ Monthly Quarterly Annually

NOTE: If your homeowners insurance is not included in your mortgage payment, include a copy of your insurance declaration page.

Cell

Home

Work

Cell

Home

Work

Cell

Home

Work

Cell

Home

Work

Page 6 of 10

MortgageAssistanceApplicationFirst

Loan Number___________________

Hardship Information

Hardship is defined as a decrease in income or an increase in expenses that make it difficult for you to afford your mortgage payments.

Answering the following questions will help us better assess your financial hardships and determine what relief options are right for

you.

The hardship causing mortgage payment challenges began on approximately (date) ______________________ and is believed to be:

Short-term (up to 6 months) Long-term or permanent (greater than 6 months) Resolved as of (date) __________________

TYPE OF HARDSHIP (CHECK ALL THAT APPLY)

REQUIRED HARDSHIP DOCUMENTATION

Unemployment

I am available for work and actively seeking

employment

A copy of your benefits statement or letter detailing the amount,

frequency and duration of your unemployment benefits; or

If actively seeking employment, sign Acknowledgement and

Agreement section below. No further documentation required.

Reduction in income: a hardship that has caused a

decrease in your income due to circumstances

outside your control (e.g., elimination of overtime,

reduction in regular working hours, a reduction in

base pay)

Documentation to show decreased income. For example:

Paystubs before and after hardship date reflecting decrease in income

Lay Off/Separation Notice from employer

Loss of child support or alimony benefits

Increase in expenses: a hardship that has caused

an increase in your housing expenses due to

circumstances outside your control (e.g.,

uninsured losses, increased property taxes,

increased mortgage payment, HOA special

assessment), OR increase of personal expenses

Documentation to support the increased expense. For example:

Uninsured home repairs

Car repairs

Medical bills/receipts (do not provide medical records or details of your

illness/disability)

Long-term or permanent disability, serious illness

of a borrower/co-borrower or dependent family

member

Do not provide medical records or details of your illness/disability

If you are experiencing a reduction in income due to disability or

illness, provide documentation to show the income change (before

and after the reduction)

If you are experiencing increased expenses due to disability or illness,

provide bills or other documentation that show expense amounts and

duration

Disaster (natural or man-made) impacting the

property, the customer’s place of employment, or

the property/employment of any other applicable

party.

Insurance claim documentation, OR

FEMA grant or Small Business Administration loan documents, OR

Customer or employer property in federally-declared disaster area

Divorce or legal separation; Separation of

borrowers unrelated by marriage, civil union, or

similar domestic partnership under applicable law

Note: all borrowers of record may still be required to

sign any modification agreement

Final divorce decree or final separation agreement

Recorded quitclaim deed

Legally binding agreement evidencing that the non-occupying

borrower or co-borrower has relinquished all rights to the property

Business failure

Tax returns from previous year (all schedules) or IRS Form 4506-C(*),

Most recent signed and dated quarterly or year-to-date profit and

loss statement

* IRS Form 4506-C can be obtained from our web-site (pennymac.com) or

the IRS website (www.irs.gov/pub/irs-pdf/f4506c.pdf)

Death of borrower or death of either the primary

or secondary wage earner

Death certificate or other evidence of death

Distant employment transfer / relocation

Proof of transfer OR Military Permanent Change of Station (PCS)

Other - hardship that is not covered above:

(Attach an additional page if needed)

___________________________________________

___________________________________________

Any relevant documentation to support your hardship not covered

above.

Hardship is defined as a decrease in income or an increase in expenses.

Page 7 of 10

MortgageAssistanceApplicationFirst

Loan Number___________________

Household Income

MONTHLY TOTAL HOUSEHOLD INCOME TYPE & AMOUNT

REQUIRED INCOME DOCUMENTATION

Are you receiving any form of income?

Yes No

(see “required income documentation”)

Borrower

Co-Borrower

or Income

Contributor

If yes, complete this section and include required

documentation.

If no, provide an explanation.

Gross (pre-tax) wages, salaries and

overtime pay, commissions, tips, and

bonuses

If you’re a teacher, indicate the number

of months you are paid:_____________

$

$

Include paystubs reflecting the most recent 30

days, or four weeks, of earnings for all employers

and

Documentation reflecting year-to-date earnings,

if not reported on the paystubs (signed letter or

print out from employer)

USDA loans (Rural Housing) also require your

most recent W2 or form IRS Form 4506-C (* see

below)

Self-employment income

* 4506-C can be obtained from our

web-site (pennymac.com) or IRS

website (www.irs.gov/pub/irs-pdf/

f4506c.pdf)

$

$

Most recent signed and dated quarterly OR year-

to-date Profit and Loss Statement AND

Most recent complete business tax return OR

Most recent complete and signed individual

federal income tax return OR IRS Form 4506-C (*)

VA loans require 2 years of above documentation

Unemployment income

$

$

Benefits statement or letter detailing the

amount, frequency and duration of

unemployment benefits

Social Security, pension, disability, death

benefits, adoption assistance, housing

allowance, other public assistance

$

$

Award letters, Benefit Statement or other

documentation showing the amount and

frequency of the benefits OR

Two most recent bank statements showing direct

deposit amounts (or 2 recent cancelled checks)

Rental income (Rents received, less

expenses other than mortgage)

If taxes, insurance and HOA are not

included in your mortgage, provide copies

of most recent bill(s)

$

$

Lease Agreement AND Mortgage Statement

Two most recent bank statements

demonstrating receipt of rent OR

Two most recent cancelled rent checks

Is rental income likely to continue for 12 months

minimum? Yes No

Investment or insurance income

$

$

Two most recent investment statements OR

Two most recent bank statements supporting

receipt of the income

Other income (You are not required to

disclose Child Support, Alimony or

Separation Maintenance income, unless

you choose to have it considered as

income for your loan assistance request)

$

$

Two most recent bank statements showing

receipt of income OR

Other documentation showing the amount and

frequency of the income

Household Assets – excluding retirement funds such as a 401(k) or Individual Retirement Account (IRA), and college savings

accounts, such as a 529 plan.

Checking account(s) and cash on hand Savings, money market funds, and Certificates of Deposit (CDs)

$

Stocks and bonds (non-retirement accounts), Other (e.g. other real estate you own):

$

Page 8 of 10

MortgageAssistanceApplicationFirst

Loan Number___________________

Recent Employment Information

Provide prior 12 months of employment (VA loans require 24 months). Attach an additional page if needed.

BORROWER

CO-BORROWER

Are you currently employed?

(Y/N)

Are you self-employed?

(Y/N)

Are you currently employed?

(Y/N)

Are you self-employed?

(Y/N)

Current/Most recent employer name:

Current/Most recent employer name:

Business Address:

Business Address:

Business Phone #:

Business Phone #:

Monthly Income (before tax): $

Monthly Income (before tax): $

Start Date

(MM/DD/YY):

End Date

(MM/DD/YY):

Start Date

(MM/DD/YY):

End Date

(MM/DD/YY):

Prior Employer Name :

Prior Employer Name:

Business Address:

Business Address:

Business Phone #:

Business Phone #:

Monthly Income (before tax): $

Monthly Income (before tax): $

Start Date

(MM/DD/YY):

End Date

(MM/DD/YY):

Start Date

(MM/DD/YY):

End Date

(MM/DD/YY):

Expense Information

Provide monthly amounts below. (We may require supporting documentation.)

Expense Category

N/A

Monthly Payment

Expense Category (cont)

N/A

Monthly Payment

Child Care

$

Sewer

$

Personal Loans

$

Auto Gas

$

Groceries

$

Auto Insurance

$

Gas for home

$

Uninsured Medical Expenses

$

Water and Electric

$

Life Insurance (not deducted

from paycheck)

$

Home Phone

$

Health Insurance (not

deducted from paycheck)

$

Cell Phone

$

Child Support

$

Cable / Internet

$

Alimony

$

Trash

$

Other (specific)

$

Page 9 of 10

MortgageAssistanceApplicationFirst

Loan Number___________________

Acknowledgment and Agreement

I certify, acknowledge, and agree to the following:

1. All of the information in this Mortgage Assistance Application is truthful, and the hardship I identified contributed to my need for

mortgage relief. Knowingly submitting false information may violate Federal and other applicable law.

2. I may be required to provide additional supporting documentation. I will provide all requested documents no later than the due

date specified in the document request.

3. PennyMac will use the information I am providing to determine if I’m eligible for mortgage assistance, but PennyMac isn’t

obligated to offer me assistance based solely on the statements in this or any other document I’ve sent as part of this request.

4. PennyMac or its authorized agents may obtain a current credit report for me.

5. I consent to the disclosure by PennyMac, and its authorized agents, of any of my personal information collected during the

mortgage assistance process and information about any relief I receive, to any investor, insurer, guarantor, or servicer of my

mortgage loan(s) or any companies that provide support services to them. Personal information may include, but is not limited

to: (a) my name, address, telephone number; (b) my Social Security number; (c) my credit score; (d) my income; and (e) my

payment history and information about my account balances and activity.

6. The property securing the mortgage for which I’m requesting assistance is able to be lived in and hasn’t been or isn’t at risk of

being condemned.

7. If I, or someone on my behalf, instructed PennyMac to stop contacting me about my mortgage loan, I withdraw that instruction

so that I may apply for mortgage assistance.

8. If I’m eligible for an assistance option that requires an escrow account to pay property taxes and/or hazard insurance and my loan

didn’t have one, PennyMac may establish one to make tax and/or insurance payments on my behalf.

9. I consent to being contacted concerning this application for mortgage assistance at any telephone number, including mobile

telephone number, or email address I have provided to PennyMac or its authorized agents

10. I understand that if I have misrepresented any fact(s) in connection with this document, PennyMac may cancel any Agreement,

proceed with foreclosure on my home, and/or pursue any other available legal remedies.

Borrower signature: _____________________________________________ Date: _________________________

Co-Borrower signature: __________________________________________ Date: _________________________

Non-Borrower (Income Contributor) Authorization Form (If indicated on Income page)

The undersigned Non-Borrower authorizes PennyMac

Loan Services, LLC to obtain, share, and release, as provided above, his/her public

and non‐public personal information including (but not limited to) the name, address, telephone number, social security number, credit score,

credit report, income, government monitoring information, loss mitigation application status, account balances, program eligibility, and payment

activity of the Non-Borrower.

I reside in the home at ______________________________________________ and request my income be included in the review for a modification

on the loan secured by the property address that is the subject of this application for mortgage assistance. I consent to allow PennyMac or its

authorized agents to order a current credit report for me in connection with this application for mortgage assistance.

________________________/____________________/_____________________/$__________________/________________________/_____

Name Relationship to Borrower Social Security Number Contribution Amount Signature Date

________________________/____________________/_____________________/$__________________/________________________/_____

Name Relationship to Borrower Social Security Number Contribution Amount Signature Date

Page 10 of 10

MortgageAssistanceApplicationFirst

Loan Number___________________

Important Information

Property Valuation

We may order an appraisal or other forms of valuations to determine the property's value in the course of reviewing your

application. If we do order any valuations in connection with the application in determining whether your loan qualifies for

a loan modification, a copy of the valuation(s) will be provided to you.

Beware of Scams

Please beware of foreclosure rescue scams. Foreclosure rescue and mortgage modification scams are a growing problem

that could cost you thousands of dollars – or even your home. Scammers make promises they cannot keep, such as

guaranteeing to “save” your home or lower your mortgage, usually for a fee, and often pretending they have direct contact

with PennyMac – which they do not.

Beware of anyone who asks you to pay a fee in exchange for counseling services or the modification of a delinquent

loan.

Beware of people who pressure you to sign papers immediately or who try to convince you that they can “save”

your home if you sign or transfer over the deed to your house.

Do not sign over the deed to your property to any organization or individual unless you are working directly with

PennyMac to forgive your debt.

Never make a mortgage payment to anyone other than PennyMac without our approval.

If you think you have been scammed, please go to www.preventloanscams.org or call (888) 995-HOPE.