National client email

report

2013

Sponsored by

NATIONAL CLIENT EMAIL rEpOrT 2013

COpYrIGHT: THE DIrECT MArKETING ASSOCIATION (UK) LTD 2013

1

Contents

Contents ................................................................................................................................................1

cont. .....................................................................................................................................................1

1. Introduction ........................................................................................................................................3

Sponsor perspective ................................................................................................................................4

Executive results summary .......................................................................................................................5

2. Overall results .....................................................................................................................................6

2.1 Importance of email marketing within organisations ..............................................................................6

2.2 Purpose of email marketing ................................................................................................................7

2.3 Budget allocations ............................................................................................................................8

2.4 Budget projections ............................................................................................................................9

2.5 Constraints .......................................................................................................................................9

2.6 Email marketing management ............................................................................................................11

2.7 Staff hours .......................................................................................................................................12

2.8 Ability to calculate revenue contributions .............................................................................................12

2.9 ROI ..................................................................................................................................................14

2.10 Digital revenue contribution ..............................................................................................................14

2.11 Overall revenue contribution .............................................................................................................15

2.12 Revenue contributions of different email approaches ..........................................................................15

2.13 Performance of different types of email message ................................................................................16

2.14 Metrics - trends ..............................................................................................................................17

2.15 Metrics - predictions........................................................................................................................19

2.16 Satisfaction with email programmes ..................................................................................................20

2.17 Email marketing concerns ................................................................................................................21

2.18 Email marketing competence ...........................................................................................................22

2.19 Email marketing education ...............................................................................................................22

2.20 Integration approaches - ROI ............................................................................................................24

2.21 Integration approaches - relationships ...............................................................................................25

2.22 Contact strategies ...........................................................................................................................26

2.23 Maximum contact frequencies ..........................................................................................................26

2.24 List growth .....................................................................................................................................27

2.25 Segmentation practices ...................................................................................................................29

3. B2C and B2B results highlights ............................................................................................................30

3.1 Purpose of email marketing ................................................................................................................31

3.2 Budget allocations ............................................................................................................................32

3.3 Budget projections ............................................................................................................................32

3.4 Staff hours .......................................................................................................................................33

3.5 Ability to calculate revenue contributions .............................................................................................33

3.6 ROI ..................................................................................................................................................33

3.7 Digital revenue contribution ................................................................................................................34

3.8 Overall revenue contribution ...............................................................................................................34

3.9 Revenue contributions of different email approaches ............................................................................34

3.10 Popularity of different types of email message ....................................................................................35

3.11 Metrics - trends ..............................................................................................................................36

3.12 Metrics - predictions........................................................................................................................37

3.13 Email marketing competence ...........................................................................................................38

3.14 Email marketing education ...............................................................................................................38

3.15 Integration approaches - ROI ............................................................................................................39

3.16 Integration approaches - relationships ...............................................................................................39

cont.

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

2

3.17 Contact strategies ...........................................................................................................................40

3.18 Maximum contact frequencies ..........................................................................................................40

4. B2C results – annual comparisons ........................................................................................................41

4.1 Importance of email marketing within organisations ..............................................................................41

4.2 Constraints .......................................................................................................................................42

4.3 Email marketing management ............................................................................................................42

4.4 Satisfaction with email programmes ....................................................................................................43

4.5 Email marketing concerns ..................................................................................................................43

4.6 List growth .......................................................................................................................................44

4.7 Segmentation practices .....................................................................................................................44

5. B2B results – annual comparisons ........................................................................................................45

5.1 Importance of email marketing within organisations ..............................................................................45

5.2 Constraints .......................................................................................................................................46

5.3 Email marketing management ............................................................................................................46

5.4 Satisfaction with email programmes ....................................................................................................47

5.5 Email marketing concerns ..................................................................................................................47

5.6 List growth .......................................................................................................................................48

5.7 Segmentation practices .....................................................................................................................48

Methodology ..........................................................................................................................................49

Glossary of terms ....................................................................................................................................50

About the DMA .......................................................................................................................................51

About Alchemy Worx ................................................................................................................................52

Copyright and disclaimer ..........................................................................................................................53

NATIONAL CLIENT EMAIL rEpOrT 2013

COpYrIGHT: THE DIrECT MArKETING ASSOCIATION (UK) LTD 2013

3

2012 was an amazing year to live and work in Britain. We had the Queen’s Diamond Jubilee; the Olympics arrived in

London and England crashing out of another major tournament on penalties! For those of us excited by the goings

on in our inbox, what would the impact be? How did busy environment actually impact campaign results, email

tactics and email marketing’s position within businesses?

Responses to the annual national client email report reveal some interesting answers.

2012 saw maximum contact frequencies rise signicantly with the number of organisations never sending more

than 1 email a month to subscribers almost halving to 14%. How much of this was driven by fresh content from the

external environment can be debated, but recipients responded well to the increased frequency. Just over half of

respondents reported, open, click and conversion rates improving in 2012.

This is supported by the feedback on the strength of ROI from the email channel. Respondents estimating an average

return of £21.48 for each £1 spent on email in 2012.

It is no surprise then to see that email marketing remains critical to businesses. In fact 89% of respondents declared

email as “important” or “very important” to their organisation.

What perhaps is a surprise is that despite these signicant returns, there is a huge disconnect between email’s value

and position within an organisation. Despite its obvious success for business, respondents cited resources and

budget as the top two constraints to success. It is never too late to have a new year’s resolution – and it strikes me

that as an industry we need to help better communicate the value of email in 2013.

As chair of the EMC’s Benchmarking Hub, I would like to thank everyone who made this report possible.

First and foremost, I would like to thank all of the client email marketers who participated in the survey as well as

those ESPs who, in support of research, encouraged their clients to participate.

Secondly, this report, like the National Email Benchmarking reports, is made possible through generous time

given by certain individuals who constitute the Benchmarking Hub, namely: Matt Simons (Haves EHS); Joe Hunter

(ExactTarget), Fiona Robson (RocketSeed), Anthony Wilkey (Email Vision); and Lynn Hewitt of (Business Bound).

Yashraj Jain also deserves special acknowledgment for his tireless work in project managing the report; collecting

and analysing the data; and helping to structure and write the document you are now reading.

Further thanks are due to the report’s author, Mark Brownlow. Final thanks should be saved for the report’s sponsors:

Alchemy Worx.

James Bunting

Managing Director, Communicator Corp

james.bunting@communicatorcorp.com

Chairmen, Benchmarking Hub, Email Marketing Council, Direct Marketing Association UK Ltd.

1. Introduction

NATIONAL CLIENT EMAIL rEpOrT 2013

COpYrIGHT: THE DIrECT MArKETING ASSOCIATION (UK) LTD 2013

4

In the last edition of the DMA Email Client Study, we acknowledged that 2011 was as a remarkable year for email and

we are delighted to report that this trajectory has continued in 2012. If 2011 was the year that email came of age,

then 2012 saw it become the cornerstone of many marketing programmes, with a third of respondents reporting

that email accounted for more digital revenue than all other digital revenue channels combined. There were also no

signs of fatigue after a successful 2011, with brands sending more email as a proportion of their databases, while

continuing to see improvements in key metrics such as clicks and conversions. In fact, an exponential improvement

took place in the real number of visitors to websites and revenue on balance sheets.

Of course, as send frequency increases, so must the value of those emails to the subscriber and this is reected by

marketers diversifying their programmes to include a broader range of message types. The report shows increases in

every email category from newsletters and surveys, to customer lifecycle touch points, targeted oers and win-back

mailings. And, as email marketing programmes become necessarily more sophisticated and diverse to increase the

value of each send, the services of dedicated email specialists become increasingly important in achieving that goal.

As the value, frequency and eectiveness of email programs has improved, it is perhaps unsurprising that the report

highlights an average ROI of over £20 for every £1 spent on email. That’s a gure that should attract the attention

of even the most sceptical budget-owners. And yet, 38% of respondents cited budget as a barrier to achieving their

goals. Marketers should be using the impressive ROI and brand engagement gures in this report to increase their

share of marketing spend. They should also be implementing eective measures of email’s contribution to sales

across all channels, as well as other brand KPIs, so that this inuential data is available to them at all times. If the

positive trend for email is to continue in 2013, we must see a signicant reduction in the 38% gure by the time of the

next report. That would represent real progress for our channel.

Dela Quist

CEO, Alchemy Worx

Sponsor perspective

NATIONAL CLIENT EMAIL rEpOrT 2013

COpYrIGHT: THE DIrECT MArKETING ASSOCIATION (UK) LTD 2013

5

Email continues to be highly valued with impressive ROI

• Email marketing remains critical to business, with 89% of respondents declaring email to be “important” or

“very important” to their organisation

• Email marketing’s ROI is strong: it returned an estimated average of £21.48 for each £1 spent in 2012

• For roughly a third of respondents, email marketing accounts for 50% or more of all digital business revenue

• Click and conversion rates are the factors that marketers rate most often as important to achieving

business goals

More budget and in-house resource set aside for email marketing – but marketers still feel constrained

• Budget allocation to email marketing increased slightly in 2012, with 15% more marketers spending at least

30% of their budget on email than in 2011. Over half expect their budget to increase across 2013

• More organisations are managing email marketing in-house, with sta hours dedicated to email marketing

rising accordingly

• Marketers are more comfortable with email marketing basics than in 2011, but there is still a need for more

customised, advanced training and education opportunities

• The disconnect between email’s value and email’s position in the organisation continues, with internal

resources and budget the top two constraints to success cited by respondents: marketers need to better

communicate email’s value internally

Customers respond positively as email tactics mature

• Just over half of respondents reported open, click and conversion rates improved in 2012. Even more expect

their numbers to improve in 2013. Only less than 12% reported any decline in these metrics

• Despite relatively low volumes, trigger email campaigns accounted for 21% of email revenue. Over 75% of

email revenue is now generated by alternatives to generic one-size-ts-all campaigns

• Marketers are making use of a far wider number of email marketing approaches, but there is still signicant

room for improvement. For example, just under half still don’t send a welcome email

Marketers nesse their list-building and usage strategies

• Marketers are getting better at using dierent techniques to build their lists. Organic website trac and

transactions remain the top two acquisition sources

• Marketers are also increasing their use of segmentation: the number segmenting into more than six dierent

audiences rose 28% in 2012

• The growth of diverse email streams has also encouraged marketers to develop strategies for maximum

email contact levels. Some 11% more have such a strategy than in 2011

• Maximum contact frequencies have risen signicantly, with the number of organisations never sending

more than one email a month to subscribers almost halving to 14%

More sophisticated integration of email with other channels

• Marketers are using email for an increasing range of objectives beyond straightforward revenue generation,

including retention, engagement, acquisition and brand awareness

• Marketers report that the best other channels to integrate with email are online marketing, social networks,

direct mail and mobile marketing – both for ROI and protable relationship building

Executive results summary

NATIONAL CLIENT EMAIL rEpOrT 2013

COpYrIGHT: THE DIrECT MArKETING ASSOCIATION (UK) LTD 2013

6

The DMA’s 2013 National client email report reveals a number of impressive evolutionary steps – both reactive and

proactive – as the medium becomes increasingly rened

Reactively, economic diculties have seen email’s role as a cost-eective and reliable source of response gain

signicant recognition, leading to vastly increased use of the email channel. DMA benchmarks, for example, show strong

year-on-year growth in the volume of email sent through ESPs, with 20% more emails sent in June 2012 than in June 2011

1

.

But email marketing has also matured greatly and at pace, beginning with a growing understanding of email’s wider

role in the marketing mix. This understanding has translated into a more diverse direct response role for email: in

campaigns designed to drive social network activity or oine event registrations, for example. It has also produced

an even better appreciation for the channel’s long-term role in building relationships and for its indirect role, with an

accumulative eect on brand awareness, search volume, and similar.

The past year in particular has also seen email marketing continue to grow in strength and versatility beyond the

reliable ‘old’ standards of a content newsletter or broadcast email promotion. This is most obvious in the growth of

behavioural email, where emails are sent out on a one-to-one basis and initiated by some kind of ‘trigger’ event. This

might be a subscriber action (like a purchase or browsing a particular website section) or a genuine event (like a

birthday or the anniversary of a product purchase). For example, 30% more of the top 1,000 retailers in the USA used

cart abandonment emails in 2012 than in 2011

2

.

The ongoing success of social networks also continues to inuence email. This inuence refers not only to formal

tactical and strategic integration of the two channels, but also to the way social network activity has changed

consumer expectations of the nature and style of communication between organisations and their customers.

Perhaps the largest change, though, comes from the continuing rapid increase in mobile email, with its consequences

for email design, strategy and tactics. A 2012 Google survey

3

already puts smartphone penetration at 51% of the UK

population, with 62% of these smartphone owners using their device for email at least once a day. YouGov predict

4

over 55% of UK mobile phone users will have an email-friendly smartphone by May 2013. And a late 2012 Return Path

analysis

5

found that “mobile open share has increased 300% since 2010 and shows no sign of slowing, with four out of

10 emails sent being read on a mobile device.”

With all of these trends and transformations, how do marketers feel about email marketing and its role in their

organisations? How are they actually using email? And what results are they getting? The DMA’s 2013 National client

email report set out to nd the answers…

In this report, we rst present overall survey results and interpretations. We then compare B2B with B2C ndings,

before looking at responses from B2C and B2B organisations separately.

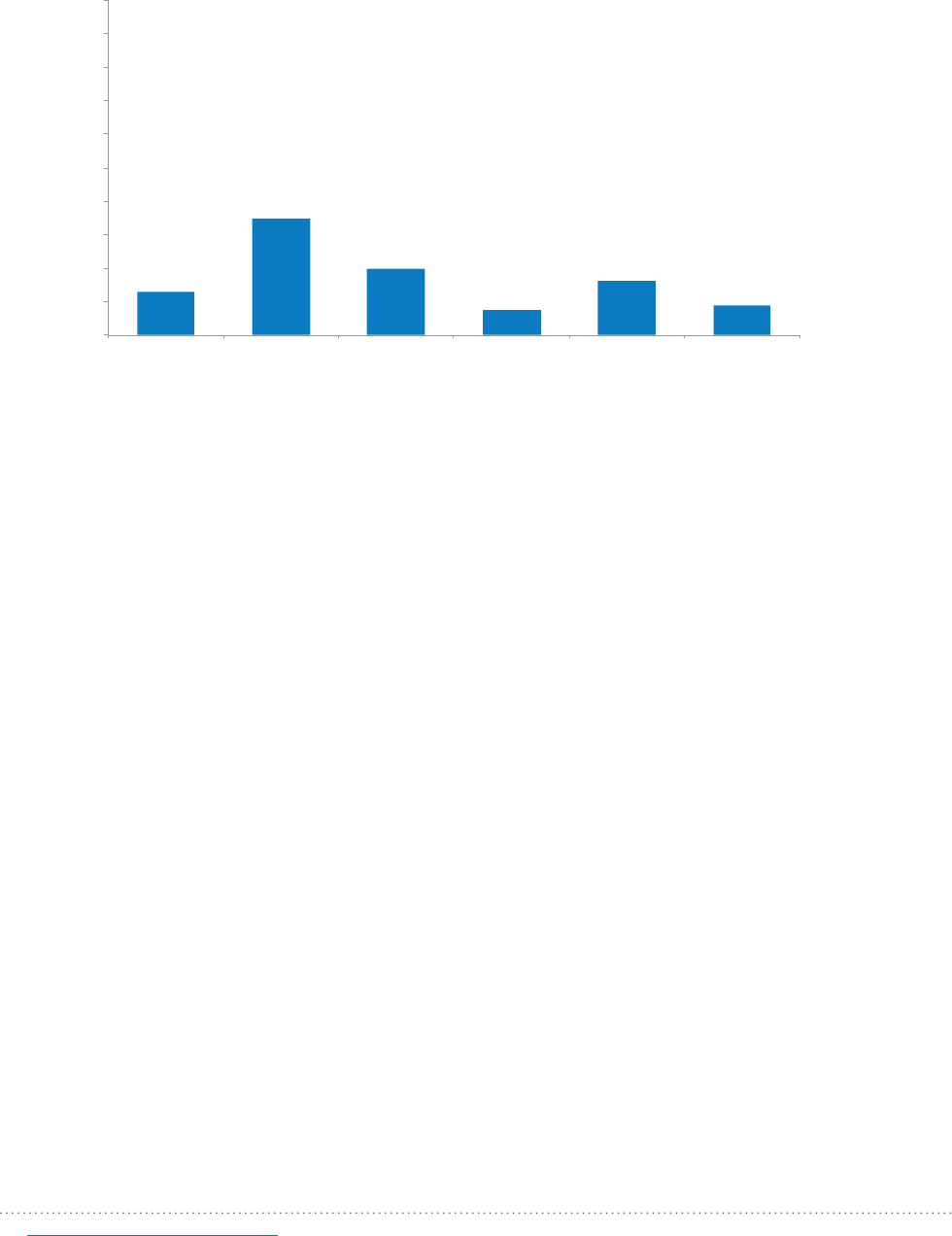

2.1 Importance of email marketing within organisations

The strategic importance of email remained high in 2012, with 89% of respondents declaring email as “important”

or “very important” to their business.

The continuing strength of email’s status, which is still on a slight upward trend, is a reminder of the channel’s

durability and provides further evidence that newer marketing channels have not eroded email’s importance. Instead,

they have accentuated this importance, with email’s ubiquity among Internet users making it a useful complement to

other online initiatives.

1. DMA (2013) National email benchmarking report H1 2012

2. Internet Retailer (2013) Cart abandonment e-mails gain more attention from e-retailers

3. Google (2012) Our Mobile Planet: United Kingdom

4. YouGov (2012) Smartphone growth in the UK?

5. Return Path (2012) Return Path Report Reveals Nearly Half of All Emails Received Now Read on Mobile Devices

2. Overall results

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

7

How important is email marketing within your business strategically?

2.2 Purpose of email marketing

Most traditional media coverage of the sector tackles retail email and email’s role in driving revenue, yet this objective

is cited less often by respondents than “retention” (cited by 78%) and engagement (70%).

This reects the recent transformations in email marketing described in the introduction: marketers are using the

channel in a range of roles and recognising the broader impacts beyond immediate sales, particularly in terms of

loyalty, branding and long-term eects. The recent DMA Email tracking report

6

, for example, found 63% of consumers

keep emails in their inbox for longer than a day (25% keep them for longer than a week).

The associated ability to generate an ongoing brand presence compares favourably with the visibility and longevity

of, for example, Tweets or Facebook posts. It also speaks to email’s nudge eect

7

, where the sender and subject lines

inuence purchase decisions, even when the email remains unopened.

The strong showing for engagement also demonstrates the pervasive impact of social marketing needs and goals

– where engagement plays a particularly prominent role – on those goals set for other marketing approaches.

A challenge, of course, is to dene “engagement” and set appropriate objectives. The open rate has known

measurement weaknesses (specically image blocking preventing image-based tracking), but there may be

promise in new email intelligence tools that provide information on, for example, “read rates”.

6. DMA (2012) Email tracking report 2012

7. Alchemy Worx (2009) Dela Quist on the Nudge Eect

48%

41%

8%

2%

1%

55%

36%

5%

4%

0%

57%

32%

9%

1%

1

%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Very important Important Neither important

or unimportant

Unimportant Very unimportant

2010 2011

2012

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

8

1

Another problem with goal setting is that traditional email marketing metrics do not measure all active responses to

email. The DMA’s Email tracking report, for example, found 22% of consumers might “go to the company’s website via

another route” after receiving an interesting email from a trusted brand.

These strong, indirect responses also have obvious implications for dening “inactive” subscribers: just because a

recipient is not “opening” or clicking on an email does not mean they are not “engaged” with the sender’s brand.

What is the purpose of your email marketing programmes? Which business goals does it help you to achieve?

2.3 Budget allocations

When asked about future budget changes, 63% of respondents to the client survey in 2011 said they expected

increases. Allocations did increase, but not to that predicted extent. For example, compared to 2011, the number of

respondents spending 30% or more of their budget on email marketing in 2012 rose by 15%.

Given continuing economic problems and uncertain budgets, it’s not clear if an increased percentage allocation

translates into more actual money, since this also depends on whether the overall budget is growing or shrinking.

After all, internal resources and budget were cited as the two most important constraints to achieving (email)

marketing goals (see Chart 2.5).

What proportion of your marketing budget is spent on email?

4%

58% 58%

68%

70%

78%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Other Acquisition Brand

awareness

Revenue

generation

Engagement Retention

Proportion of marketing budget spent on email marketing

55%

16% 16%

13%

48%

19%

11%

22%

51%

12%

17%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

10 percent 20 percent 30 percent 40 percent and more

2010

2011

2012

20%

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

9

2.4 Budget projections

Over half of respondents (56%) expect their expenditure to increase in 2013. Nevertheless, expectations regarding

future budget allocation are not as optimistic as in 2011.

While only one in twenty marketers expects their budget to decline, 39% do expect it to remain unchanged (26%

more than said so in 2011).

Looking forward, how would you expect your company’s expenditure on email to change?

2.5 Constraints

Constraints to reaching (email) marketing goals reveal the problems marketers face when looking to get more

investment in email and make use of advanced tools or technology to improve results.

Which of the following stop you from achieving your marketing goals?

63%

31%

6%

56%

39%

5%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Increase Stay the same Decrease

2011

2012

38%

26%

22%

19%

22%

54%

38%

30%

28%

27%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Internal resource Budget

I

nternal process In-house technology Lack of data

2011 2012

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

10

Compared with 2011, there are across-the-board, often signicant, increases in the importance attached to

almost every constraint listed.

In absolute terms, the top constraints are internal resources, cited by 54%, and budget, cited by 38%. The 28% citing

in-house technology is also notable, as this represents the biggest increase from 2011 (+47%), though this is partially

explained by more marketers actually using in-house technology (see Chart 2.6).

There is an apparent and ongoing disconnect between email’s importance, email’s performance and email’s ability to

capture budget.

As later charts demonstrate, email continues to produce great results in terms of revenue. Respondents also report

that process metrics like clicks and conversions are rising. So why the budget and resource constraints?

To some extent, email is a victim of its own success. Senior managers may ask why investment is needed, when

results are excellent with current budgets. Marketers may also be failing to internally communicate both email’s

benets and the potential benets of more investment.

Email marketers and the email marketing media often focus on metrics specic to the email world, notably opens and

clicks. Broader appreciation for email marketing within an organisation comes from properly communicating email’s

contribution to business units and bottom line success, such as increases to web visitor numbers, order numbers,

revenue, registrations or coupon redemptions.

However, senior management support may still not be enough. After all, a lack of such support was only cited by a

fth of respondents. Clearly, then, a general tightening of marketing budgets is (still) a fundamental problem in a

weak UK economy.

15%

10%

9%

13%

12%

21%

13% 13%

10%

3%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Senior support

ESP technology Lack of concept

Lack of interdepartmental/

geographical communication

Degradation

2011 2012

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

11

2.6 Email marketing management

Around 75% of respondents manage at least some of their email marketing in-house, with 61% of those doing so

using an ESP’s system.

How do you manage your email marketing programme?

Despite the availability of ESP ancillary services for campaign management, the number outsourcing everything to an

ESP dropped to 8% from 14% in 2011. More marketers are outsourcing at least some functions to an agency, reecting

the rise in ESP-independent services for managing or helping with campaigns. Nevertheless, at least two-thirds of

those that use agencies are still keeping some email management functions in house.

The growth of in-house email marketing management can be explained by various factors:

• More experience and condence with email marketing, though Chart 2.18 suggests insucient improvement

in perceived levels of competence from 2011 to fully explain the changes

• Budget restrictions, leading to increased use of existing in-house labour resources. This factor is supported by

the data on increasing sta hours in Chart 2.7

• Transition to a hybrid email marketing model

19%

10%

61%

32%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Outsource it to an

agency

Outsource it to an

ESP

In-house, using

ESP’s system

In-house, operations

managed by

specialists

12%

14%

74%

16%

8%

76%

0%

20%

40%

60%

80%

100%

Outsource it to an

agency

Outsource it to an

ESP

In-house

2011

2012

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

12

The last point speaks to the trend commonly identied in other DMA benchmark reports. Marketers are not

switching from broadcast mail to one-to-one automated trigger and behavioural email. Instead, many are

retaining broadcast email while developing additional automated, data-driven email streams. Those making the

transition may need outside help for conception and setup. Those that have completed it may be able to reduce

outside agency or ESP use once automation is in place, and rely on internal resources for the always-changing

broadcast promotions or content newsletters.

2.7 Staff hours

More evidence for a shift of email management to in-house comes from data on internal sta hours dedicated to

email marketing. For example, the number of organisations where sta worked more than 90 hours per month on

email rose 36%, from 28% in 2011 to 38% in 2012.

How many sta hours are dedicated to email marketing in an average month?

2.8 Ability to calculate revenue contributions

Many of the constraints to email marketing goals identied in Chart 2.5 would be reduced if marketers could clearly

communicate the strong revenue contribution of email to the business. An understanding of email returns is also

critical for accurate evaluation and planning of email campaigns.

A rst step, of course, is actually being able to calculate that revenue. Some 61% of respondents said they were

able to do so, representing barely any change from the 2011 number.

An inability to calculate revenue might be due to one of several reasons. For example:

• The organisation does not understand the importance of tracking email revenue

• The organisation lacks the tools or integrations to measure email response beyond an open or click

• The marketer recognises that email responses are not fully captured by even sophisticated email and web

analytics tools

53%

19%

10%

15%

3%

48%

14%

15%

7%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

0 - 30 31 - 90 91 - 180 181 - 360 361 +

2011

2012

16%

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

13

This last point is perhaps the most problematical. As we saw in Section 2.2, email response often takes place outside

the immediate email environment. Here are the full results from the DMA’s Email tracking report 2012 when consumers

were asked which three actions they would most likely take when receiving an interesting email:

• 14% might go to a comparison shopping engine

• 22% might go to the sender’s website using their browser (i.e. without clicking on an email link)

• 27% might visit the shop or retail outlet

• 40% might bear the information in mind for later

• 55% might save the email for later use

These numbers make it clear that online tracking tools will struggle to capture all responses to email.

Those organisations with cross-channel customer data often estimate the impact of their emails by comparing

average revenue generated by their subscribers with average revenue earned from non-subscribers. Unfortunately,

this comparison is misleading, since subscribers tend by denition to be better customers who would likely spend

more anyway, even without receiving emails.

Possible alternatives for getting a better handle on email’s net impacts are:

• Compare sales patterns across all channels with email deployment dates to identify matching spikes

• Compare online trac patterns (e.g. pageviews) with email deployment dates to nd matching spikes

• Conduct holdout tests, where a group of subscribers receive no email, to compare customer activity,

response, sales etc. between mailed and non-mailed subscribers

Holdout tests require, unfortunately, multichannel customer data. However, they give a far truer picture of email’s

impact by including oine sales and other sources of email revenue not measured in conventional email campaign

reports. They also account for those sales that would happen anyway, even if you didn’t send an email, so which

cannot truly be attributed to the email programme.

Are you able to calculate the revenue generated from your email marketing activities?

61%

33%

6%

60%

34%

6%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Yes No Don't know

2011

2012

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

14

2.9 ROI

An ability to measure revenue allows marketers to calculate the prots attributable to email and also the ROI, both of

which can be used to gain internal approval for email marketing investment.

How much is the approximate return you get back for every pound spent on email marketing?

Of those able to report gures in the survey, a fth are producing an astonishing £51 or more in returns for each £1

spent on email marketing.

If we assume the average return for that top category is £55 (it’s likely much higher) then we get an estimated

average return across all organisations of £21.48 for each £1 spent on email marketing.

This gure compares with numbers

8

from the USA, where a 2012 survey by the USA’s DMA found email produces

$28.50 for every dollar spent.

2.10 Digital revenue contribution

Another indicator of the value of email is its share of business revenue. The majority of organisations (62%) produce

30% or more of their digital business revenue through email. For roughly a third of respondents, email marketing

even accounts for at least as much digital business revenue as all other channels combined.

The associated value of email marketing to the economy is clear, given the UK’s National Oce of Statistics

9

estimated

website sales at £129.1 billion in 2011 and total ecommerce sales at £482.9 billion.

What does email contribute overall to the business as percentage of DIGITAL business revenue?

8. Ken Magill (2012) Email Response Rates Pathetically Low

9. National Oce of Statistics (2012) ICT Activity of UK Businesses, 2011

22%

27%

17%

7%

4%

%

20%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

£1 - £5 £6 - £10 £11 - £20 £21 - £30 £31 - £40 £41 - £50 More than

£51

27%

11%

18%

10%

13%

21%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

10 percent 20 percent 30 percent 40 percent 50 percent 60 percent

and more

Percentage of contribution to digital business revenue

3

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

15

2.11 Overall revenue contribution

According to respondents, email also plays an important role in driving total business revenue.

Just over half of organisations (53%) generate 20% or more of this overall revenue through email marketing. It’s

interesting here to compare this total revenue contribution with email’s share of the marketing budget. In 2011, there

was still an imbalance, with email producing a higher proportion of revenue than its budget share might suggest. This

gap narrowed in 2012. For example, email claims at least 30% of the budget share for 38% of respondents (see Chart

2.3) and produces at least 30% of total revenue for 40% of respondents.

What does email contribute overall to the business as percentage of TOTAL business revenue?

2.12 Revenue contributions of different email approaches

Section 1 mentioned how the last year has seen growth in more advanced trigger approaches to email marketing. The

importance of this development is clear from the below chart.

What percentage of your email revenue comes from the following types of emails?

42%

14%

15%

29%

46%

13%

25%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

10 percent 20 percent 30 percent 40 percent and

more

Percentage of contribution to overall business revenue

2011

2012

23%

25%

30%

13%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Unsegmented email

to whole list

Segmented email

to whole list

Activity-based

triggers

Lifecycle-based

triggers

16%

9%

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

16

Activity and lifecycle-based triggers produced 21% of total email marketing revenue. This is despite the fact

that trigger email volumes are typically very small as a proportion of total email volume. After all, it’s hard to send

more than one birthday email a year to customers. One North American review

10

of 170 organisations that use email

marketing found they sent 6.5 billion emails in Q3 2012, of which 166 million (2.5%) were trigger emails. The revenue

generated by trigger emails is far higher than their relative volume would suggest.

Segmented email campaigns accounted for 55%, so 76% of all email marketing revenue came from more advanced

practices than generic broadcast email.

2.13 Performance of different types of email message

Chart 2.13 conrms the suggestion that marketers are using a wider number of advanced email approaches.

What type of email message helps you to achieve your business goals?

Regular newsletters are still the most popular, but almost all types of email message showed increases in use to

achieve email marketing goals.

The biggest increases were observed for welcome emails (+253% compared with 2011), customer surveys (+164%),

thank you messages (+180%), win-back emails (+109%), purchase conrmations (+250%) and abandoned cart

reminders (+133%).

However, there still remains enormous potential for further development of email tactics. Welcome messages, for

example, are easily created using any professional ESP or email marketing software. Nevertheless, almost half of

respondents (47%) still don’t send one.

10. Epsilon (2012) Q3 2012 North America Email Trend Results: More Brands Rely on Triggered Messaging

45%

15%

14%

36%

22%

10%

21%

11%

68%

53%

37%

34%

30%

28%

25%

23%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Regular

newsletter

Welcome

message

Customer

survey

Regular newsletter

segmented based

on purchase habits

Thank you

message

Alert breaking

news

Win-back targeting

lapsed

2011

2012

12%

6%

4%

11%

7%

2%

4%

3%

20%

14% 14%

12%

9%

7% 7 %

3%

Abandoned

cart

Product

replenishment

Warranty

renewal

2011

2012

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

17

This gap is made all the more frustrating by studies such as the one by Experian CheetahMail back in 2010

11

,

which found welcome emails typically produce 4x the opens, 5x the CTR and 8x the revenue per email of standard

promotional emails.

Options for welcome message content (which can be spread over several emails) include:

• Thank the subscriber for signing up and conrm the success of the action

• Establish the copy and design elements (sender name, logo etc.) that encourage recognition of future emails

• Remind subscribers of the benets of the emails

• Provide administrative links or information, such as contact or support information, or a link to a subscriber

preference centre

• Encourage readers to provide more information about themselves, for example through a survey or poll

• Encourage subscribers to whitelist the sender

• Oer a reward for signing-up, whether the incentive promised during the sign-up process or as a surprise

• Present the most popular oers or content

• Introduce related themes, such as the sender’s social network presence or information on important

website features

2.14 Metrics - trends

The majority of respondents found open, click and conversion rates improved through 2012.

How have the following trended over the past 12 months?

Open rates

11. Experian CheetahMail (2010) The Welcome Email Report

43%

37%

20%

51%

37%

12%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Increased

S

tayed the same Decreased

2011 2012

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

18

Click rates

Conversion rates

Compared with 2011, there was a notable drop in the number of respondents who saw these process metrics decline.

For example, those seeing decreased open rates fell from 20% in 2011 to 12% in 2012. Only 11% found click rates

dropped (compared with 19% in 2011) and the same number found conversion rates declining (less than half of the

24% who saw decreased conversion rates in 2011).

The improvement seems inevitable, given the pervading theme of this report, which sees email marketing

maturing, increased growth in segmentation (see Chart 2.25) and the spread of behavioural email (see Chart 2.13).

Benchmarks

12

from North America, for example, found trigger emails delivered an average 75.1% higher open rate

and 114.8% higher click rate than standard “business as usual” mails.

12. Epsilon (2012) Q3 2012 North America Email Trend Results: More Brands Rely on Triggered Messaging

45%

36%

19%

51%

38%

11%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Increased Stayed the same Decreased

2011 2012

45%

31%

24%

53%

36%

11%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Increased Stayed the same Decreased

2011 2012

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

19

2.15 Metrics - predictions

Respondents are even more optimistic about their future metrics than they were in the previous National client

email report.

Some 59% expect open rates to increase, 68% expect click rates to increase and a mammoth 73% expect conversion

rates to increase. This is despite the perceived rise in email marketing constraints (see Chart 2.5).

How do you expect the following to trend in the next 12 months?

Open rates

Click rates

Conversion rates

57%

28%

15%

68%

25%

7%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Increase Stay the same Decrease

2011 2012

56%

30%

14%

73%

20%

7%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Increase Stay the same Decrease

2011 2012

53%

29%

18%

59%

31%

10%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Increase Stay the same Decrease

2011 2012

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

20

The greater optimism about conversion rates suggests the focus is shifting towards the more important end of the

email conversion chain and away from open rates. This optimism also likely reects continued growth in trigger/

behavioural emails and segmentation, both of which ensure better matching and timing of oers and content to

recipient needs. Survey respondents may also be expecting to better adapt to mobile email.

The accelerated spread of mobile email brings changes to reading behaviour. For example, the share of email opens

occurring on mobile devices peaks in the evening, late at night and in the early morning

13

. A key change is also to the

range of available email display environments, with smaller screen sizes beginning to dominate.

Until recently, many marketers assumed HTML email-friendly smartphones and tablets would deal adequately with

emails designed for the desktop. While true, there is now growing realisation that adapting emails to account for

mobile email use simply leads to higher responses

14

.

As such, marketers are beginning to invest in responsive email design, where email layouts adapt on-the-y to the

properties of the screen they are viewed on. In particular, marketers need to make sure their email links account for

people using ngers and thumbs on touchscreens. For example:

• Links need to look like links: a mouse cursor changes shape to alert the user to the availability of a link.

Fingers don’t change shape when hovering over links, so there are no visual cues other than those built into

the email’s design.

• Links need spacing out so clumsy prodding still allows accurate “clicking”. Apple recommends a block of

around 44 x 44 points for each link.

Marketers should also consider how email content and oers might exploit the fact that more messages are now

carried around by recipients, and are not left behind on desktop computers at home or in the oce.

2.16 Satisfaction with email programmes

Respondent satisfaction with their email marketing programmes is largely unchanged from 2011. A majority (61%)

are either “satised” or “very satised” and only 20% are “unsatised” or “very unsatised”. Given the very strong

returns from email marketing and improvements in metrics (both historical and predicted), it’s perhaps surprising

that satisfaction levels are not higher than in 2011. There are two explanations:

1. The strong performance is counterbalanced by growing concerns and constraints.

2. As marketers become more competent and educated, their expectations rise and they can better perceive

the diculties, challenges and frustrations preventing them from turning knowledge and potential into

bottom line results.

How satised are you with your email marketing programme in relation to meeting your marketing goals?

13. Knotice (2012) Mobile Email Opens Report 1st Half of 2012

14. See, for example, StyleCampaign (2011) Media query trifecta

18%

44%

16%

20%

2%

16%

45%

19%

18%

2%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2011

2012

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

21

2.17 Email marketing concerns

The increased focus on click and conversion rates suggested in Section 2.15 is backed up by the factors respondents

consider most important to achieving business goals: the same two metrics top the list, both cited by 63% of marketers.

In general, there is far greater focus on all factors in email marketing than in 2011, reinforcing the impression of a

more enlightened industry that is aware of the challenges and constraints (but well-placed to meet them, as indicated

by performance results and metrics predictions).

The two biggest percentage changes in importance were to content (rated important by 110% more respondents

than in 2011) and data (+87%). This is no surprise, given the continuing resurgence in interest in content marketing

across 2012 and the growth of trigger/behavioural emails: the latter is only possible given the right data.

Marketers often assume content marketing means authoring new and expensive content. This need not be the case.

Much content can be repurposed from other channels, for example from blog posts, social network photos and event

reports, FAQ and support documents, or existing product and marketing literature. Surveys, interviews and social

network conversations can also produce content which has the added advantage of coming direct from customers

and prospects (and thereby resonating well with the same audience).

Thinking about the following factors, which of them are most important to you in helping you achieve your

business goals?

68%

60%

63%

69%

63%

43%

48%

28%

39%

38%

63% 63%

59%

55%

53%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Click rates Conversion

rates

Content Deliverability Open rates

2010 2011 2012

61%

66%

63%

51%

36%

31%

23%

34%

18%

6%

50%

43%

36%

23%

17%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Return on

investment

Data Reputation Opt out rates Resources

2010 2011 2012

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

22

2.18 Email marketing competence

There were no huge shifts in perceived email marketing competence. What we’re beginning to see, however, is some

progression up the initial learning curve, with slightly more marketers comfortable with at least the basics.

How would you rate your company’s overall level of competence in email marketing?

We might also expect to see a gradual rise in those with an advanced level of competence, but this is not the case. Why?

Chart 2.19 shows the main sources of email marketing education and most of these are, by denition, unable to

deliver detailed insights on complex issues or tackle the unique situations and needs of individual marketers.

While the industry does a solid job of general education, there is a need for more customised, advanced training opportunities.

These might be provided through ESPs, agencies and consultants. Alternatively, ESPs and software manufacturers can

continue working to ensure advanced tools and integrations are as user-friendly as possible, reducing the need for

advanced knowledge in the rst place.

2.19 Email marketing education

One of the themes of this report is the contrast between growing marketer constraints and concerns, and the

increased performance and high returns through email marketing. As such, marketers are doing a remarkably good

job of improving results while the environment for them to work in remains dicult.

Another reason marketers may be doing more with less is through a better understanding of optimisation and email

practices. Certainly the below chart shows marketers draw on far more sources of insight and advice than in 2011,

even if their self-reported level of competence hasn’t changed much.

As in 2011, industry email newsletters, blogs and webinars were the top three sources of information in 2012, with

each growing signicantly in relevance.

40%

30%

24%

2%

39%

33%

20%

6%

2%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Advanced: would be

able to take advantage

of modern tools and tactics

Very comfortable with

the essentials

Basic, still feeling

our way

Only just started

out

None at all

2011

2012

4%

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

23

Recognition of tradeshows saw the biggest percentage leap, with over twice as many respondents getting their

education from such events in 2011 than in 2012. Is there a lesson there for marketers at ESPs and other organisations

serving the email marketing community?

Where do you get your email marketing education from?

61%

54%

37%

35%

26%

80%

61%

48%

46%

44%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Industry email

newsletters

Industry blogs Industry webinars and

online presentations

The ESP we use Industry vendor

websites and white

papers

2011

2012

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

20%

30%

11%

29%

19%

28%

27%

25%

23% 23%

events (workshops,

seminars,

conferences)

Industry online

discussions

Tradeshows Communication with

other marketers

through social

networks

Direct exchange with

other marketers

through instant

messaging, phone,

face to face

2011

2012

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

24

Only three sources of information declined in popularity. The number of “entirely self-taught” respondents dropped

by half to 7%: as the sector ages and matures, so the proportion of self-taught industry participants from the “early

days” declines. Ironically, both online discussions and social networking dropped in prevalence and are far less

important than more traditional information sources, like newsletters.

This is partly due to the novelty factor of such interactive venues wearing o, not to mention the problem with the

time commitment often required to read through, for example, Twitter and Facebook feeds. However, social network

and discussion groups, such as those run by the DMA on LinkedIn or the Only Inuencers Discussion List remain

strong sources of information, and the new “Communities” feature on Google+ also shows much promise.

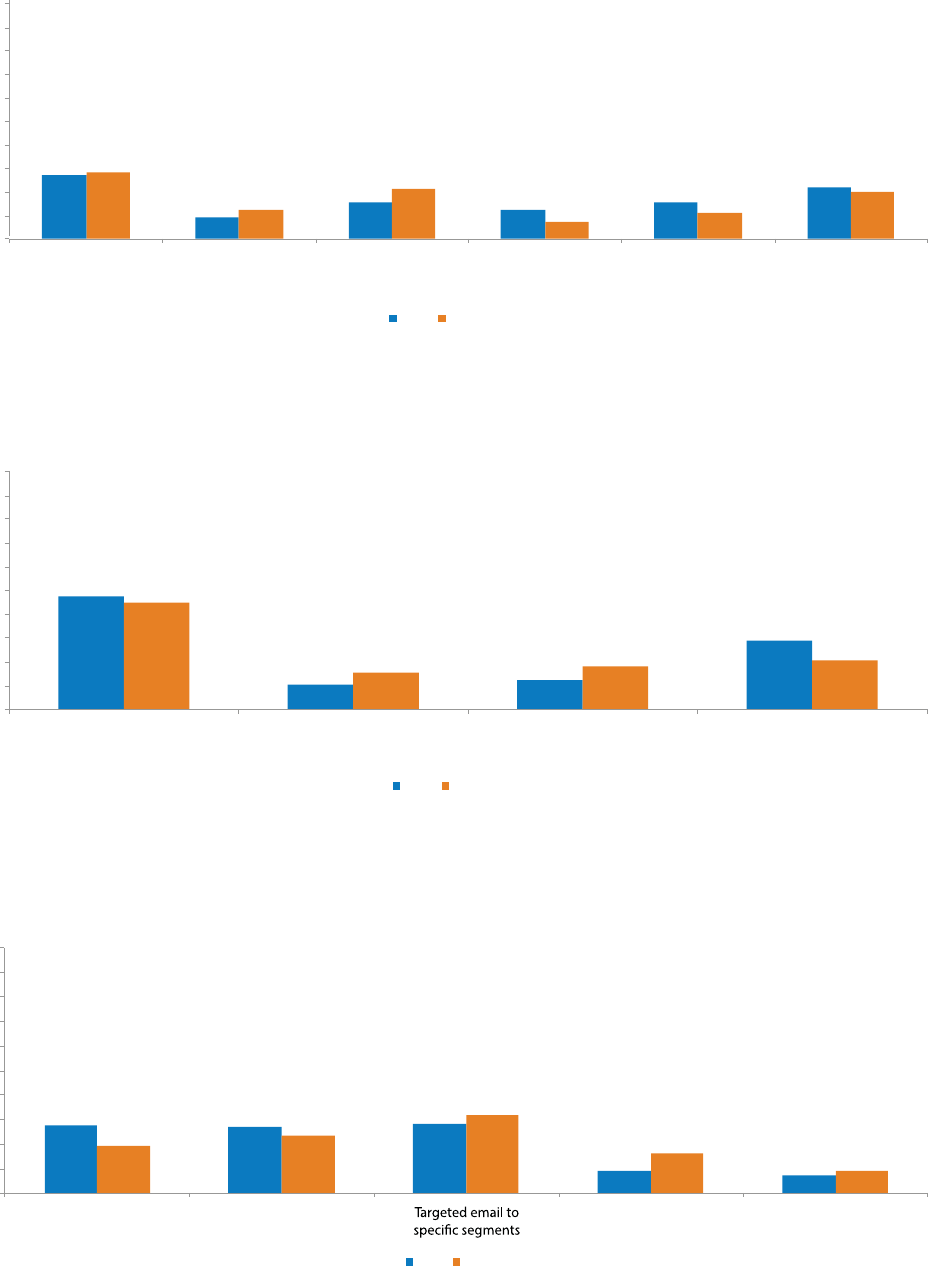

2.20 Integration approaches - ROI

Given the apparent wider appreciation for email’s role in supporting a range of marketing objectives, it’s interesting

to see which other channels respondents feel email best integrates with. In terms of ROI, general online marketing

is (unsurprisingly) way out in front, cited by 65% of marketers. This is followed by social networks (38%), direct mail

(32%) and mobile marketing (25%). All other channels were cited by no more than 15% of respondents.

The high ranking accorded social networks conrms the end of the tedious “email versus social” debate. Marketers

have accepted that both can work in tandem, specically through:

1. Using email to drive participation in social networks and subscriptions to social network feeds

2. Using social networks to encourage email sign-ups

3. Using content and intelligence gained through social networks to drive email content and oers

It’s slightly surprising to nd event-related integration rated so low. Email is normally considered valuable to event

marketing: for driving attendance, keeping attendees updated with useful information and for follow-up surveys.

It will be interesting to see how all these results change through time, particularly whether integration with mobile

marketing will receive wider approval.

16%

9%

14%

0%

21%

15%

7%

5%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Industry print The consultant we use None, entirely

self-taught

Other, please specify

2011 2012

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

25

Email when integrated with which of the following marketing tactics delivers the best ROI?

2.21 Integration approaches - relationships

Respondent opinions on which channels integrate best with email from a relationship-building perspective dier

little from those for ROI. Online marketing and social networks are still the top two, albeit with fewer ‘votes’ than

in the ROI chart. The only other big dierence is how online fan communities are rated: three times as many

respondents claim integration of these with email is good for enduring and protable relationships than claim the

same for fan communities and ROI.

Email when integrated with which of the following marketing tactics delivers creates enduring and protable

customer relationships?

65%

38%

32%

25%

15%

15%

13%

12%

11%

10%

10%

8%

5%

4%

1%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Online marketing

Social networking sites

Direct mail

Mobile marketing

Print ads

Webinars

Telemarketing

Public Relations

Field marketing &

experiential events

Trade shows

TV ads

Event sponsorship

Online fan communities

Radio

Podcasts

Online marketing

Social networking sites

Direct mail

Mobile marketing

Print ads

Webinars

Telemarketing

Public Relations

Field marketing &

experiential events

Trade shows

TV ads

Event sponsorship

Online fan communities

Radio

Podcasts

52%

34%

32%

25%

16%

15%

15%

12%

11% 11%

10%

9%

6%

5%

4%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

26

2.22 Contact strategies

The majority of respondents (51%) had a contact strategy in place for the maximum amount of times each address is

contacted, up 11% on the 2011 gure.

This development likely reects growing awareness of the role of frequency in driving response, and its impact on

unsubscribes and spam complaints. The need for a contact strategy is also increased by the growth of trigger emails:

unlike with broadcast email, dierent subscribers can get very dierent amounts of email, depending on their activity

and characteristics. If you only send a generic monthly newsletter, a contact strategy is not as critical as when a

customer can potentially receive between one and 50 emails a month.

Is there a contact strategy for the maximum amount of times you contact an address (based on time and

behaviour)?

2.23 Maximum contact frequencies

Compared with 2011, maximum monthly contact frequencies have risen quite signicantly. Only 14% send a maximum

of one a month (down from 26% in 2011), while 33% have a maximum of at least six a month (up from just 15% in 2011).

These changes have clearly not aected open, click or conversion rates negatively. DMA benchmark statistics also

report unsubscribe rates at long-time lows in 2012

15

.

Of course, these gures refer to maximum, rather than average, frequencies. Those same benchmarks also

show actual average contact frequencies (at least for email sent through ESPs) were extremely low in H1 2012,

at just under two a month. Nevertheless, higher maximums give senders the exibility to exploit appropriate

opportunities, whether seasonal (such as increased emails during the Christmas shopping season) or behavioural

(such as post-purchase email streams).

Recipients, too, benet from increased frequency, provided the delivered value justies the increase (as tends to be

the case with seasonal and trigger emails).

15. DMA (2013) National email benchmarking report H1 2012

46%

49%

5%

51%

44%

5%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Yes No Don't know

2011

2012

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

27

Tolerance for more email may also be higher than typically assumed by marketers, since average consumer inboxes

are far less busy than those working in online marketing might think. The DMA’s 2012 Email tracking report

16

,

for example, found around 40% of those who do get brand emails get no more than three such emails a day on

average and about 63% get no more than six.

What is the maximum number of times you contact an address on your list in one month?

2.24 List growth

More evidence of growing competence comes from opinion on eective address acquisition sources.

Nearly every potential source was rated higher in 2012 than in 2011, suggesting marketers are getting better at

using dierent techniques to build out their lists.

Organic website trac was cited most often by respondents (54% - an increase of 64% on the 2011 gure), swapping

its 2011 second-place position with transactions (cited by 50%, up 9% on 2011).

Despite this top position, many organisations still do not fully exploit their website as a source of new subscribers.

Basic requirements are:

• Ensure subscription forms or links are as prominent and on as many web pages as possible

• Test page positions, multiple positions, formats, colours, button sizes etc. to optimise response

• Ensure opt-in opportunities are built into online transactional processes: not just purchases, but downloads,

event registrations etc

• Link to an email policy to reassure those with privacy concerns

• Communicate the benets of subscribing clearly

• Use subscriber-friendly terminology and test copy, button text and calls to action

16. DMA (2012) Email tracking report 2012

13%

35%

20%

16%

9%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Once 2 – 3 times 4 – 6 times 6 - 8 times More than 8

times

Don’t know

7%

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

28

Social media remained in third place, despite a small decline from 25% in 2011 to 23% in 2012, one of few techniques

that didn’t see increased recognition in 2012. Social media certainly deserves attention as a source of sign-ups, not

least because it oers a chance to move consumers from a more conversational channel (social media) to a more

conversion-friendly one (email). Opportunities include:

• Telling social network followers about upcoming (exclusive) email oers or newsletter content

• Posting links to the latest email, “best of” emails and email archives

• Posting links to the newsletter sign-up form and copy at the organisation’s website

• Embedding sign-up forms and promotional copy in the organisation’s social network prole pages

• Ensuring subscribers can easily share email oers and content with their own networks, eectively

endorsing the email list to their friends, family and colleagues

Which from the following are the most eective methods to acquire new email addresses?

33%

46%

25%

17%

16%

10%

54%

50%

23%

21% 21% 21%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

People who

transact

Social media

telemarketing

Search

2011 2012

14%

8%

12%

0%

7%

17%

10%

18%

16% 16% 16%

15%

14%

0%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Forward to a

friend

Banner Website pop-up

or lightbox

In-store Email list rental Other

2011 2012

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

29

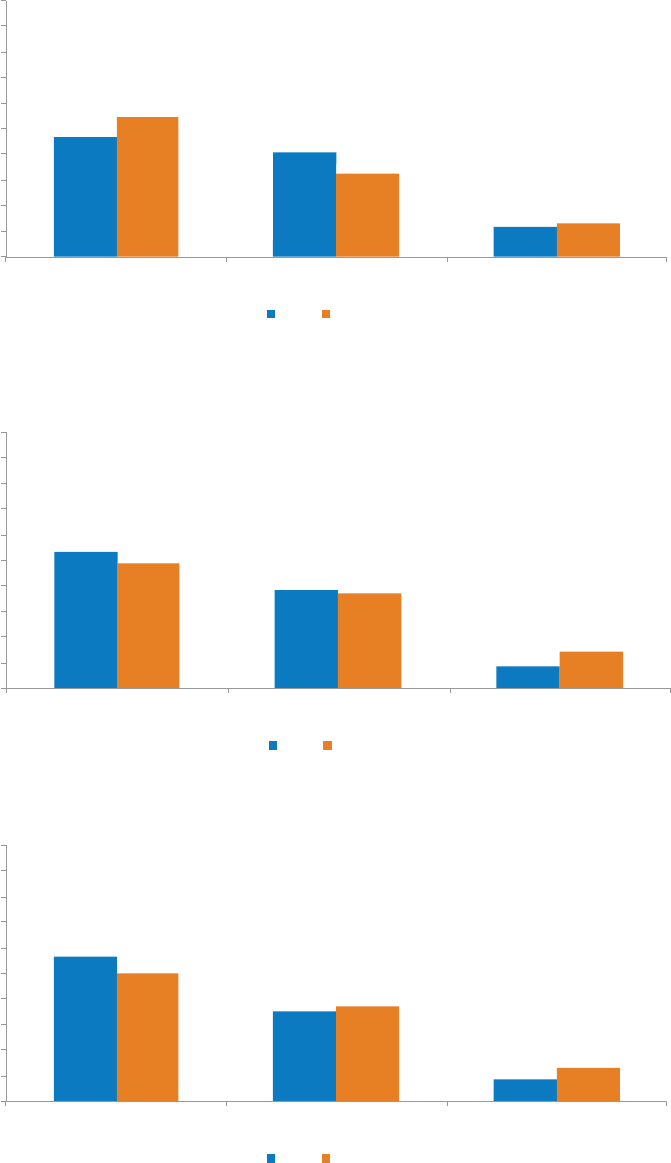

2.25 Segmentation practices

Continuing the “email maturity” theme, one of the more promising developments to emerge from the survey is a clear

increase in segmentation. For example, the number of organisations not segmenting at all fell by a quarter from 19%

in 2011 to 15% in 2012. In contrast, the number segmenting into more than six dierent audiences rose 28% from

29% in 2011 to an impressive 37% in 2012.

On average how many dierent customer segments does your business use to segment your mailings?

11%

38%

15%

7%

19%

34%

18%

29%

0%

15%

27%

20%

37%

1%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Don’t segment our list Don’t Know

2010 2011

2012

29%

NATIONAL CLIENT EMAIL rEpOrT 2013

COpYrIGHT: THE DIrECT MArKETING ASSOCIATION (UK) LTD 2013

30

The charts in this section compare B2C and B2B results. Charts tracking specic annual changes in B2C and B2B

results are given in Sections 4 and 5 respectively.

Most results and interpretations match those in the main section or are self-explanatory given the nature of the

dierences between B2C and B2B email marketing.

For example, B2C organisations dedicate more sta hours to email marketing than B2B organisations, an expected

result given the higher frequencies, bigger lists, more advanced tactics typical of B2C senders. The same argument

applies to email budget shares, where, for example, 37% of B2C marketers spent 30% or more of their marketing

budget on email (the equivalent gure for B2B is 22%).

Selected highlights are:

B2C emailers put at least as much or more emphasis on engagement and retention than their B2B counterparts.

This is perhaps surprising, given the traditional role of the B2B newsletter in strengthening customer relationships.

The strong overall role for retention may, of course, stem from the economic diculties of recent years, where

customer loyalty becomes scarcer and more valuable. B2C organisations do, however, place less-than-average

emphasis on building brand awareness. Since they tend to email far more often than their B2B colleagues, brand

awareness is more likely to be seen as an inevitable side benet, rather than a main objective that needs working on.

The return generated on email marketing spend by B2B organisations takes more of a U-form than with their B2C

equivalents. The majority (56%) of B2B organisations produce under £11 return per £1 spend. However, 22% create a

return on the pound of £51 or more. As with the overall results, if we assume the average return for the top category

is £55 (it’s likely much higher) then we get an estimated average return across all B2B respondents of £19.09 for each

£1 spent on email marketing.

The more even spread in returns in B2C organisations sees 42% returning under £11, 18% more than £50 and an

estimated average return of £23.21.

Email marketing is, perhaps unexpectedly, even more important to online B2B sales than to online B2C revenue,

with some 49% of B2B respondents seeing email contribute over 40% of total digital revenue, compared with 38%

seeing the same result in B2C. This result is mimicked in contributions to total revenue per se, with 29% of B2B

organisations seeing email contribute 40% or more to this revenue (21% in B2C).

B2C organisations have been particularly successful at moving beyond generic, broadcast email, with less than

20% of email revenue coming from unsegmented email to the whole list.

Given many retailers have post-purchase email capabilities, there is, however, considerably more scope for

developing product lifecycle campaigns, covering such things as purchase and shipping confirmations, review

requests, upsells, cross-sells, how-tos, product feature highlights, or introductions to customer service, customer

support or social communities.

In light of the importance of email to B2B revenue, there is also a strong argument for B2B emailers to push

for more resources and pursue the kind of advanced tactics previously limited to the consumer sector, such as

abandonment emails for white paper downloads, lifecycle campaigns for subscription sales and similar. Since

welcome emails have value irrespective of industry sector, it’s a little disappointing that only 43% of B2B

organisations put this message type to use.

Compared with their B2B colleagues, B2C organisations are unusually optimistic that open, click and conversion

rates will increase in the next 12 months. This likely speaks to the huge potential of simple trigger emails,

which are more easily implemented by B2C organisations, given they are more likely to have online transactions

and the required data. Studies of cart abandonment emails, for example, commonly report huge increases in

metrics when compared to “normal” emails. One such study

17

found a cart abandonment campaign generating

US$17.90 in revenue per email.

17. SeeWhy (2011) Shopping Cart Abandonment Emails Generate $17.90 per Email

3. B2C and B2B results highlights

COPYRIGHT: THE DIRECT MARKETING ASSOCIATION (UK) LTD 2013

NATIONAL CLIENT EMAIL REPORT 2013

31

B2C marketers feel condent about their abilities: 75% are at least very comfortable with the essentials, highlighting the

need for more advanced sources of training and education. B2B marketers are, however, more divided in terms of levels

of competence. While a solid 43% consider themselves advanced, there are still 28% near the start of the learning curve.

Since much email marketing education focuses on retail, there is perhaps a need for more introductory-level training

specically for the B2B sector. B2B marketers are also less likely than their B2C counterparts to get their education

through online or one-to-one discussions. This suggests there would be value in more formal B2B networking

opportunities outside the social networks.

Dierences in the value of integration of email with other channels follow the usual patterns expected, given the

nature of B2B and B2C business. However, the former perceive far more ROI potential in email/mobile marketing