1

Communications Update

2015 Highlights

Aaron Wyatt & Emily Persky| Council Meeting| August 2015

Understanding Borrowing

in Washington

Rachelle Sharpe, PhD

Acting Executive Director

Becky Thompson

Director of Student Financial Assistance

Senate Higher Education

February 2, 2017

2

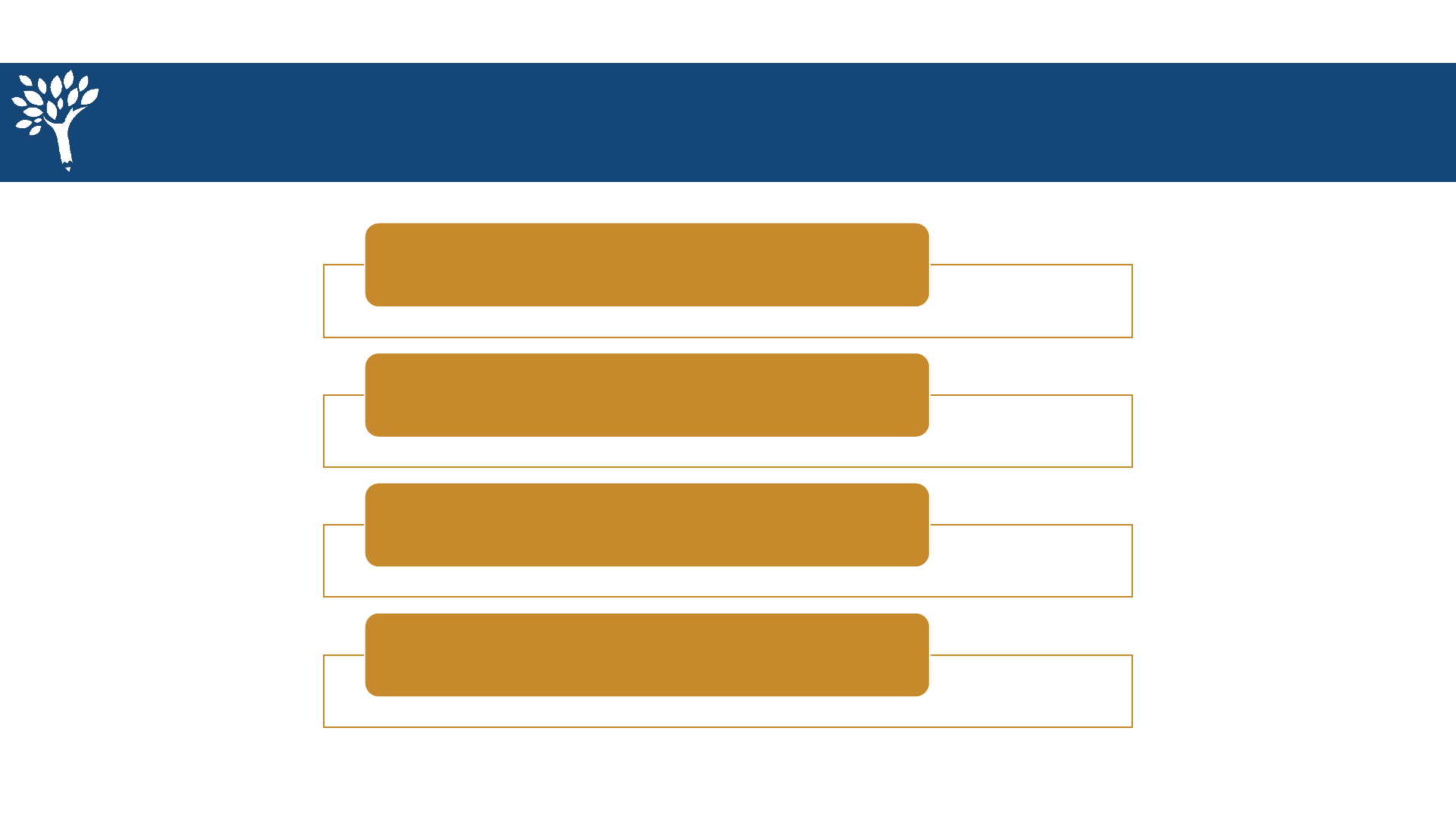

Agenda

Educational Loans Overview

Affordability Framework

Student Debt In Washington

Policy Implications

3

Educational Loans Overview

Loan Types

Loan Limits

Federal Loan Benefits

Federal Repayment Plans

Private Education Loans

Consumer Information

4

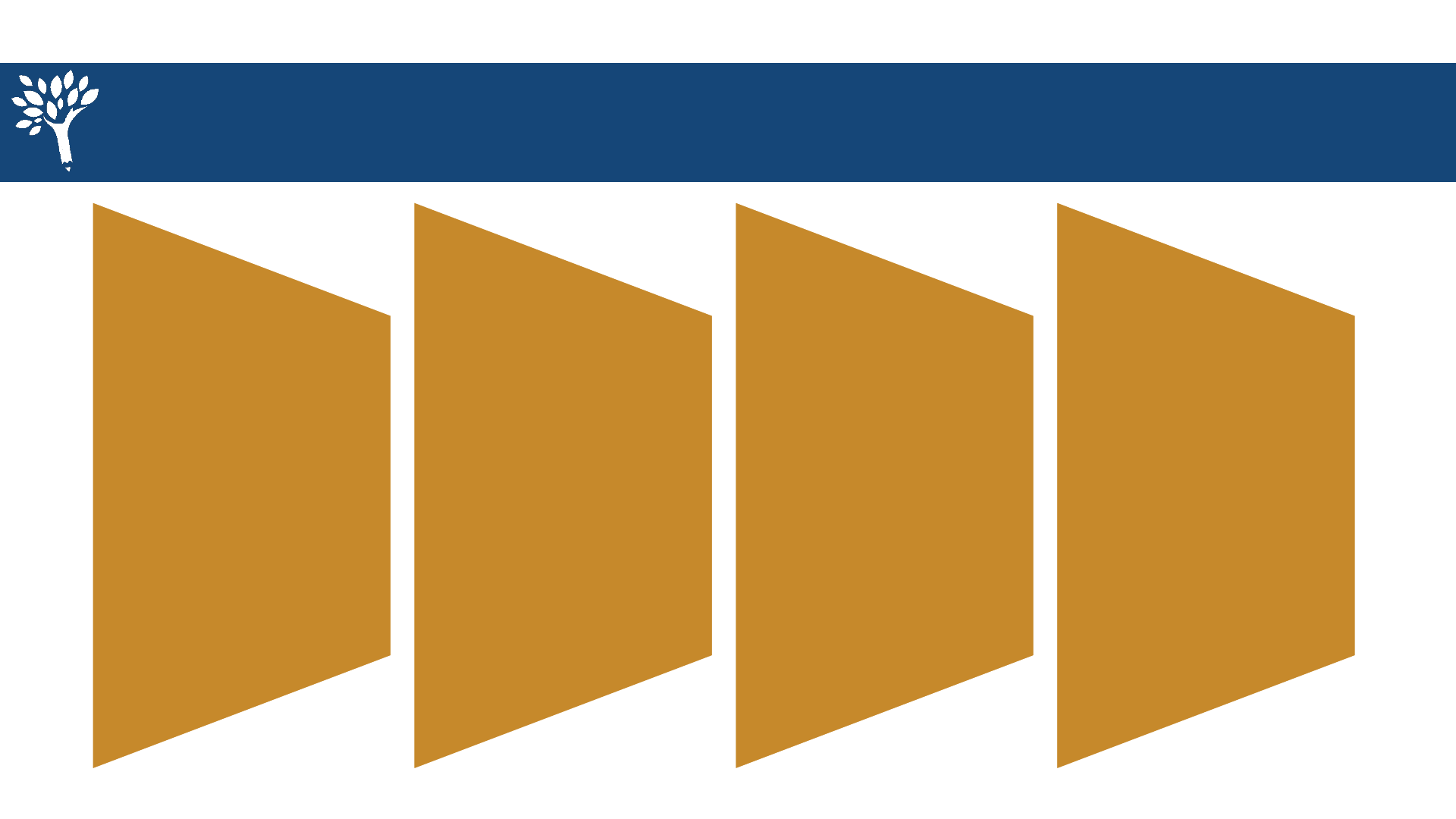

Federal

Part of

financial aid offer

Federal

Direct

U.S. Dept. of Ed.

Unsubsidized

Do not have to

demonstrate need

Subsidized

Undergraduate

students with need

Perkins

School as lender

PLUS

Parents of

undergraduate

Grad PLUS

Graduate students

Private

Private lenders

Washington

Target workforce

shortage areas

Primary Types of Educational Loans

5

Federal Student Loans for Undergraduates

Federal Direct Loan Program

Subsidized loans for students with financial need

• No interest while in school at least half-time and during grace and deferment periods

• Current interest rate is 3.76%

Unsubsidized loans for students

• Interest accrues from first loan disbursement

• Current interest rate is 3.76% (5.31% for graduate students)

Perkins Loan

• Subsidized loans for students with financial need

• Current interest rate is 5%

PLUS

• Graduate students or parents of dependent undergraduate

• Current interest rate is 6.31%

6

STAFFORD DIRECT LOANS

Year

in School Dependent Independent

Subsidized Cap

First Year

$5,500 $9,500 $3,500

Second Year

$6,500 $10,500 $4,500

Third and Beyond

(each year)

$7,500 $12,500 $5,500

Aggregate Limits

$31,000 $57,500 $23,000

PERKINS LOANS

Annual Aggregate

Undergraduate

$5,500 $27,500

Graduate

Student $8,000 $60,000

• Dependent students

must report their

parents’ income and

assets on the FAFSA.

• Dependent students

may borrow

additional amounts if

parents were denied

parent PLUS loan.

• PLUS loan limit is cost

of attendance and

requires credit check.

Federal Student Loan Limits

7

Repayment Options & Consequences

Deferments or Forbearance – delay of repayment

• In school half-time

• Active military service

• Economic hardship

• Illness

Forgiveness – teacher or public service

• Low-income school for five years (teacher)

• Certain positions and 120 payments (public service)

Cancellation or Discharge options

• Total and permanent disability

• Death

• Bankruptcy (only in rare cases)

• Closed school

• Unauthorized payment/false certification

Default

Failure to repay the

loan according to

the promissory note

terms results in a

default. For most

federal loans,

default occurs if no

payment for more

than 270 days.

8

Standard

• Fixed amount paid up to 10 years and less interest paid overall.

Graduated

• Lower at first, then increase every two years; pay more interest over time.

Extended

• Payments fixed or graduated but lower; students must have more than

$30,000 in outstanding loans.

Income-Based/Pay as You Earn

• Considers total loan debt, income, household size.

• Show high debt to income hardship.

Primary Federal Student Loan Repayment Plans

9

• Provide supplemental funding to cover unmet student need.

• Do not have caps. Students may borrow amounts up to school certified

cost of attendance.

• Essentially not regulated by the government.

• Loans issued by banks or credit unions.

• Approvals depend on credit worthiness of the borrower/co-signer.

• Often have variable interest rates.

• Higher interest rates than with federal loans.

• Repayment terms are often less flexible with private loans:

Typically no income-based repayment plans.

Typically no loan forgiveness or deferment options.

Private Loans

10

Consumer Information

Federal

• Entrance

counseling

• Financial

awareness

counseling

• Repayment

calculators

Campus

• Financial aid

orientations

• Information –

award letters,

portal, website

State

• readysetgrad.org

• Financial literacy

– Dept. of

Financial

Institutions

Private

• Online resources

• Nonprofit

assistance

11

Affordability Framework

Principles

Partners

Measuring affordability

Packaging

Aid by income

12

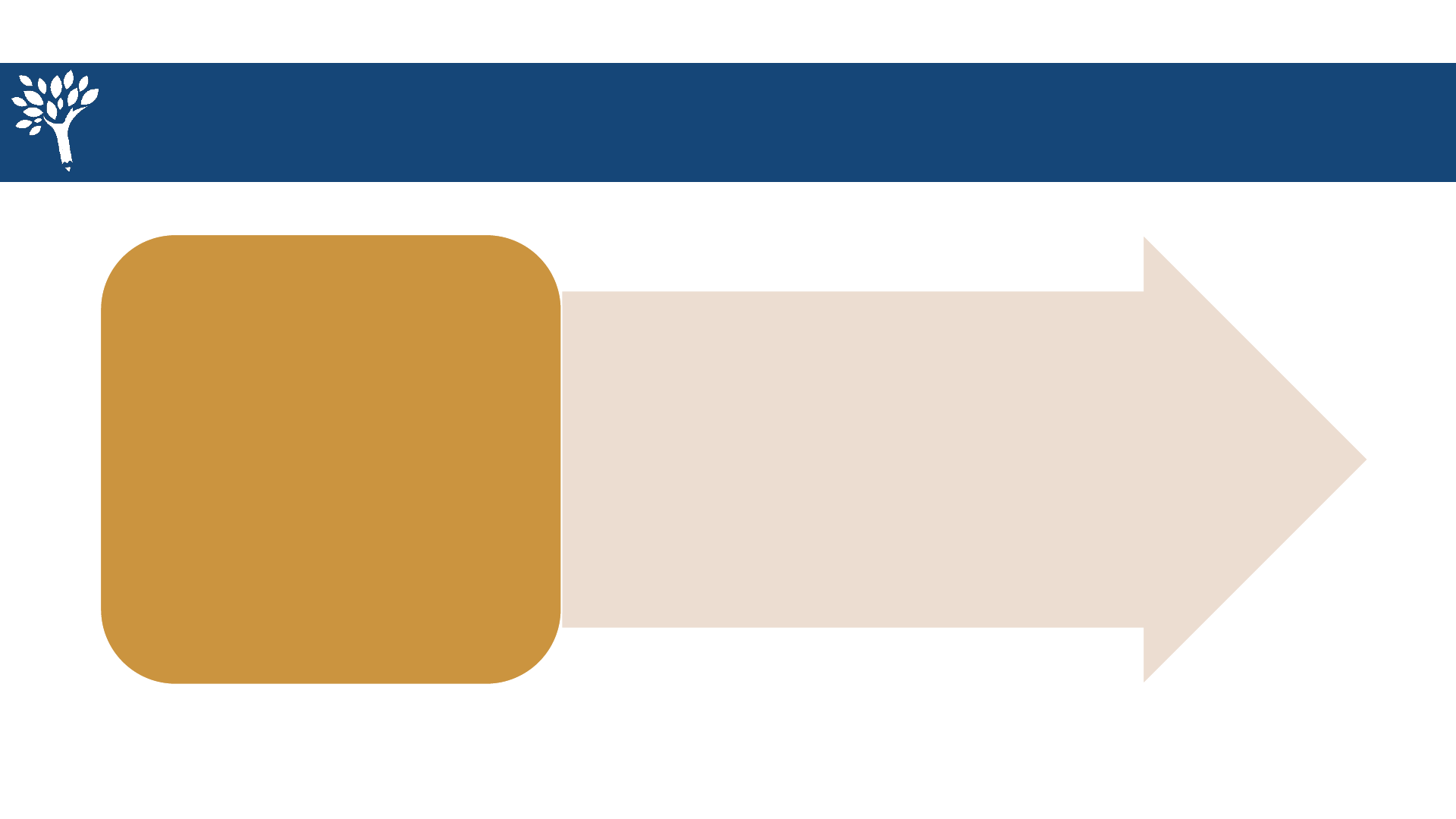

Paying for College is a Shared Investment

Students &

Families

Federal & State

Governments

Institutions

Business &

Philanthropy

Every Washington resident who desires and is able to attend

postsecondary education should be able to cover educational costs.

13

• All students and their families are

responsible for sharing in the cost

of their education.

• Families should receive early,

high-quality information about

financing options.

• A reasonable amount of work

supports student success.

Affordability is

viewed from the

perspective of

students and

families.

Students and Families

14

• Set stable and predictable tuition

and financial aid policies.

• Provide a variety of affordable

educational pathways for students.

• Consider the full cost of

attendance for each sector

when addressing affordability.

Ensure affordable

access to

high-quality

instruction through

coordinated

funding to public

institutions.

State Policymakers

15

• Provide services that support

student success.

• Commit to serving a diverse

student body, including low-income

and first-generation students.

Play a critical role

in addressing

affordability,

including through

institutional aid and

financial aid

policies.

Institutions

16

• Employer training programs.

• Employer tuition assistance.

• Funding for scholarship support.

• Internships and mentoring programs.

Businesses and

private donors play

an important role in

addressing

affordability through

tuition and

scholarship support

and mentorship.

Business and Philanthropy

17

Measuring affordability

College affordability has three major financial components:

Costs

Include tuition and fees,

books, room and board, etc.

Financial Aid

The system by which

some costs are reduced

or waived, lowering

total cost for recipients.

Student Options

Students have to decide how

to pay for their net costs –

the cost remaining

after any aid is applied.

They can work, borrow,

attend part-time, choose

different institutions, etc.

18

64%

34%

2%

2015-16 Total Aid by Type

Grants/Scholarship Loans Work

55%

21%

19%

5%

2015-16 Total Aid by Source

Federal State Institutional Private

Source: Washington Student Achievement Council. Unit Record Report, 2015-16. [WA resident undergraduate need-based recipients].

Nearly $1.8 Billion in aid Provided to Students

19

Financial Aid Type by Income

Source: Washington Student Achievement Council. Unit Record Report, 2015-16 (CB12121 1/13/2017).

[WA resident undergraduate need-based recipients by Median Family Income (MFI).

11%

28%

1%

12%

31%

39%

40%

15%

36%

29%

23%

23%

7%

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

MFI > 90

MFI 51-90

MFI 0-50

Federal Grants State Grants Institutional/Other Grants

Student Loans Parent PLUS Loans Work Study

• Low-income

students have

financial gaps.

• Institutional aid

supports middle

income.

• Students are

borrowing at all

income levels.

20

grants

$1.1 billion in total grant funding

$379 million in Pell Grant to 102,300 students

$370 million in state grants to 82,900 students

Source: Unit Record Report, 2015-16: Financial aid dataset submitted by 67 institutions. Narrowed to undergraduate, resident, need-based recipients.

Sample Budget

$21,800

Tuition

$10,000

Books

$800

Room/Board

$7,600

Transportation

$1,500

Personal

$1,900

Various Types of Aid Help Students Meet Costs

21

grants

campus aid

scholarships

Campus aid includes tuition waivers, grants,

and scholarships – need-based or merit.

$334 million in institutional aid provided to 61,800 students

$55 million in private scholarships (theWashboard.org)

Source: Unit Record Report, 2015-16: Financial aid dataset submitted by 67 institutions. Narrowed to undergraduate, resident, need-based recipients.

Various Types of Aid Help Students Meet Costs

22

grants

campus aid

scholarships

work study

$25 million in work study funding

earned by 9,500 students

Source: Unit Record Report, 2015-16: Financial aid dataset submitted by 67 institutions. Narrowed to undergraduate, resident, need-based recipients.

Various Types of Aid Help Students Meet Costs

23

grants

campus aid

scholarships

work study

loans

$551 million in student loans to 86,400

undergraduate resident students last year

Source: Unit Record Report, 2015-16: Financial aid dataset submitted by 67 institutions. Narrowed to undergraduate, residents. (CB17618 2/1/2017)

Various Types of Aid Help Students Meet Costs

24

Debt in Washington

Borrowing over time

Differences by dependency status

Loan volume by type

Total debt upon graduation

Default

25

Annual Student Borrowing by Sector Over Time

Source: Unit Record Report, Financial aid dataset submitted by 67 institutions. 2008-09 to 2015-16. Undergraduate, residents. All loans except PLUS. (CB17614 2/1/2017)

Annual borrowing

increased somewhat

at public institutions

during the recession.

Private averages

decreased due to a

change in

participating

institutions.

2008-2009 2009-2010 2010-2011 2011-2012 2012-2013 2013-2014 2014-2015 2015-2016

Research

$6,800 $6,900 $7,100 $7,200 $7,200 $7,300 $7,200 $7,100

Comprehensive

$6,600 $6,700 $6,800 $7,100 $7,000 $7,000 $7,000 $6,900

Private 4-Year

$9,200 $9,100 $9,000 $9,200 $9,200 $8,100 $7,600 $7,600

CTC

$4,800 $5,300 $5,500 $5,600 $5,500 $5,600 $5,600 $5,600

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

$10,000

26

$6,400

$6,200

$8,000

$4,000

$6,400

0

5,000

10,000

15,000

20,000

25,000

$0

$2,000

$4,000

$6,000

$8,000

$10,000

Research Comprehensive Private 4-Year CTC Private Career

Average Loan Amount Headcount

Annual Student Loans: Dependent Students 2015-16

Source: Unit Record Report, Financial aid dataset submitted by 67 institutions. 2015-16. Undergraduate, residents. All loans except PLUS. (CB17612 1/31/2017)

27

$8,700

$8,400

$7,100

$6,100

$7,900

0

5,000

10,000

15,000

20,000

25,000

$0

$2,000

$4,000

$6,000

$8,000

$10,000

Research Comprehensive Private 4-Year CTC Private Career

Average Loan Amount Headcount

Annual Student Loans: Independent Students 2015-16

Source: Unit Record Report, Financial aid dataset submitted by 67 institutions. 2015-16. Undergraduate, residents. All loans except PLUS. (CB17612 1/31/2017)

28

Educational Loans

• $450 million to

17,600 graduate

students

• Average annual

loan $25,600 for

graduate

students

Source: Unit Record Report, Financial aid dataset submitted by 67 institutions. 2015-16. Loans by type to resident undergraduates. (CB17618 2/1/2017)

$551 M

$140 M

$33 M

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

100,000

$0

$100

$200

$300

$400

$500

$600

Federal Student Loans Parent Loans Private Loans

Dollars in millions

2015-2016 Amount 2015-2016 Headcount

29

Source: Unit Record Report, Financial aid dataset submitted by 67 institutions. 2015-16. Undergraduate, residents by MFI. All loans except PLUS. (CB17622 2/1/2017)

Student Debt by Income and Sector 2015-16

$7,100

$7,100

$7,700

$5,700

$7,300

$7,100

$6,600

$7,300

$5,300

$7,000

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

Research Comprehensive Private 4-Year CTC Private Career

Average Loan Amount (excluding PLUS) by Median Family Income (MFI) and Sector

MFI 0-90% Average Loan Amount MFI >90% Average Loan Amount

30

Student Debt by Sector (2015 Graduates)

Institution Type

Average Debt

(2015 graduates)

Proportion of

Graduates with Debt

(2015 graduates)

Research

$22,715 50%

Comprehensive

$23,569 60%

Private 4-year

$29,213 68%

State Average

Public + Private

$24,600 57%

Source: Project on Student Debt – Sector averages computed by WSAC for state aid participating institutions

Total Student Debt by Sector

31

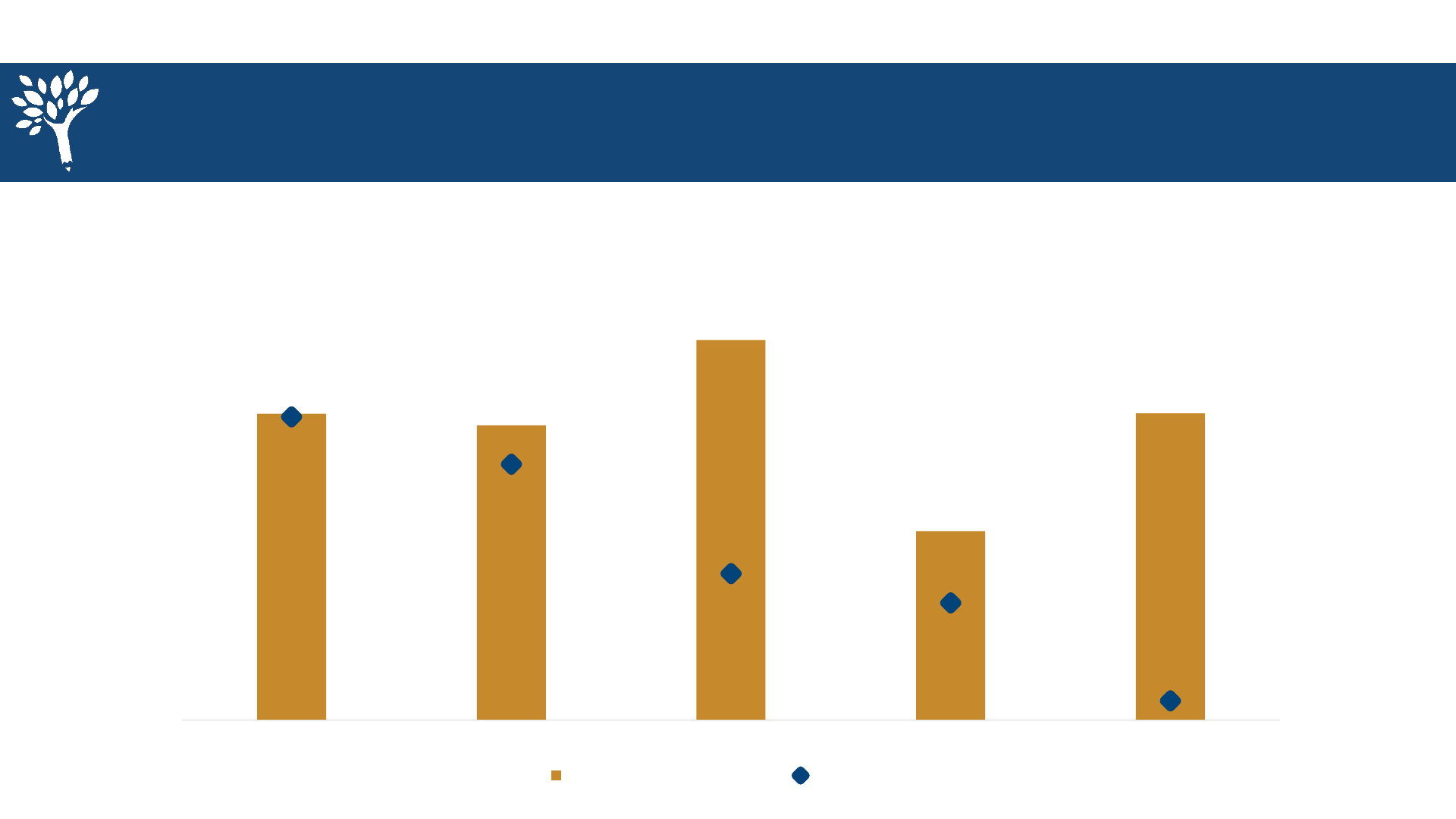

Cohort Default Rates in Washington

Source: U.S. Department of Education, Financial Aid “Official Cohort Default Rates,” 2009-2013 available at:

http://www2.ed.gov/offices/OSFAP/defaultmanagement/cdr.html. *US Total includes International institutions approved for federal lending

• Default rates

have come down

and are below

the national

average.

• Rates vary by

sector.

• Students with

lower balances

have higher

defaults.

Private Career (for- and

nonprofit), 26.1%

16.4%

For-Profit, Four-year,

21.1%

13.7%

Nonprofit, Four-year, 4.0%

2.9%

CTC, 17.1%

17.5%

Public, Four-year, 4.8%

3.7%

Washington Total, 11.3%

10.1%

US* Total, 13.2%

11.2%

2009 Cohort 2010 Cohort 2011 Cohort 2012 Cohort 2013 Cohort

Three-Year Cohort Default Rates in Washington

32

FP 2: 63.7% borrowing,

17.0% defaulted

FP 4: 69.4% borrowing,

13.7% defaulted

NP 2: 79.2% borrowing,

9.9% defaulted

NP 4: 60.2%…

CTC: 15.5% borrowing,

17.5% defaulted

PBI…

Washington Total

31.0% borrowing,

10.1% defaulted

0%

5%

10%

15%

20%

25%

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

For-Profit, 2 and lower For-Profit, 4 and higher Nonprofit, 2 and lower Nonprofit, 4 and higher

Public, 2 and lower Public, 4 and higher Washington Total

Three-Year

Cohort

Default Rate

Fewer borrowers,

More borrowers,

higher default rate

More borrowers,

lower default rate

Undergraduate Borrowers

Borrowing and Default Rates Vary by Sector

Sources: U.S. Department of Education, Financial Aid “Official Cohort Default Rates” and IPEDS SFA Survey. Retrieved January 2017. Percent undergraduates accepting federal loans, 2012-14

average.

33

Policy Implications

Affordable debt

Role of savings

Middle income gaps

34

• Federal loans are broadly accessible and available at virtually every

Title IV participating campus (the Seattle CC District and Centralia do

not participate in Stafford loans).

• Federal loans require entrance and exit counseling to provide information

regarding repayment obligation, benefits and consequences of

delinquency.

• Any student can borrow through the Stafford loan program if they submit

a valid FAFSA, regardless of income.

• Student loans appear to combine with other aid, or in isolation, help

students confront rising costs.

Student Loans: Opportunity vs. Burden

35

• Student borrowing increased during the recession but has

flattened.

Annual borrowing increased at a faster rate in the community colleges.

• The volume of student loans and number of borrowers has

increased over time.

However, private loan borrowing has decreased significantly due to

changes in the credit market.

• Washington is considered a “low debt” state for cumulative debt

upon graduation.

• Washington default rates are below the national average.

Summary of borrowing trends in Washington

36

• How should the role of savings be considered?

• How much work should be considered reasonable for students?

• Can accelerated degree options offset student debt?

• What are affordability gaps for middle-income students?

• What is a reasonable amount of student debt by income level

and sector?

State Policy Considerations Related to Student Debt

37

Affordable Debt Concept

“Affordable debt” assumptions

• No more than 10% of future annual earnings will repay the loan*

• Ten years of repayment at 5% interest

*For earnings at the 20th percentile of those with bachelor’s degrees in Washington.

Source: Fridley JL, Kumar G, Sung K and Sharpe R. Washington Interactive Affordability Model. 2017. https://affordability-model.css.uwb.edu/proto2/Washington.

38

Continue the Conversation

Rachelle Sharpe rachelles@wsac.wa.gov

Becky Thompson beckyt@wsac.wa.gov