October 2022

I. General Information

01

USERS GUIDE

DOJ Grants

Financial Guide

UNITED STATES DEPARTMENT OF JUSTICE

OFFICE OF JUSTICE PROGRAMS

OFFICE ON VIOLENCE AGAINST WOMEN

COMMUNITY ORIENTED POLICING SERVICES

Last Updated February 2023

Table of Contents

FOREWORD ....................................................................................................................II

I. GENERAL INFORMATION...........................................................................................1

1.1 Users......................................................................................................................................................1

1.2 Resources ............................................................................................................................................. 3

II. PREAWARD REQUIREMENTS ..................................................................................5

2.1 Application Process .............................................................................................................................5

2.2 Acceptance of Award and Award Conditions..................................................................................10

2.3 Standards For nancial Management Systems...............................................................................12

III. POSTAWARD REQUIREMENTS .............................................................................16

3.1 Payments.............................................................................................................................................16

3.2 Period of Availability of Funds...........................................................................................................20

3.3 Matching or Cost Sharing Requirements.........................................................................................25

3.4 Program Income.................................................................................................................................30

3.5 Adjustments to Awards......................................................................................................................35

3.6 Costs Requiring Prior Approval ........................................................................................................39

3.7 Property Standards ............................................................................................................................43

3.8 Procurement Under Awards of Federal Assistance........................................................................50

3.9 Allowable Costs.................................................................................................................................. 56

3.10 OJP/COPS Ofce Conference Approval, Planning, and Reporting .............................................64

3.11 Indirect Costs ...................................................................................................................................87

3.12 OJP’s Condential Funds ................................................................................................................91

3.13 Unallowable Costs ...........................................................................................................................98

3.14 Subrecipient Management and Monitoring .................................................................................102

3.15 Reporting Requirements................................................................................................................109

3.16 Retention and Access Requirements for Records......................................................................113

3.17 Remedies for Noncompliance....................................................................................................... 115

3.18 Closeout .......................................................................................................................................... 117

3.19 Audit Requirements........................................................................................................................121

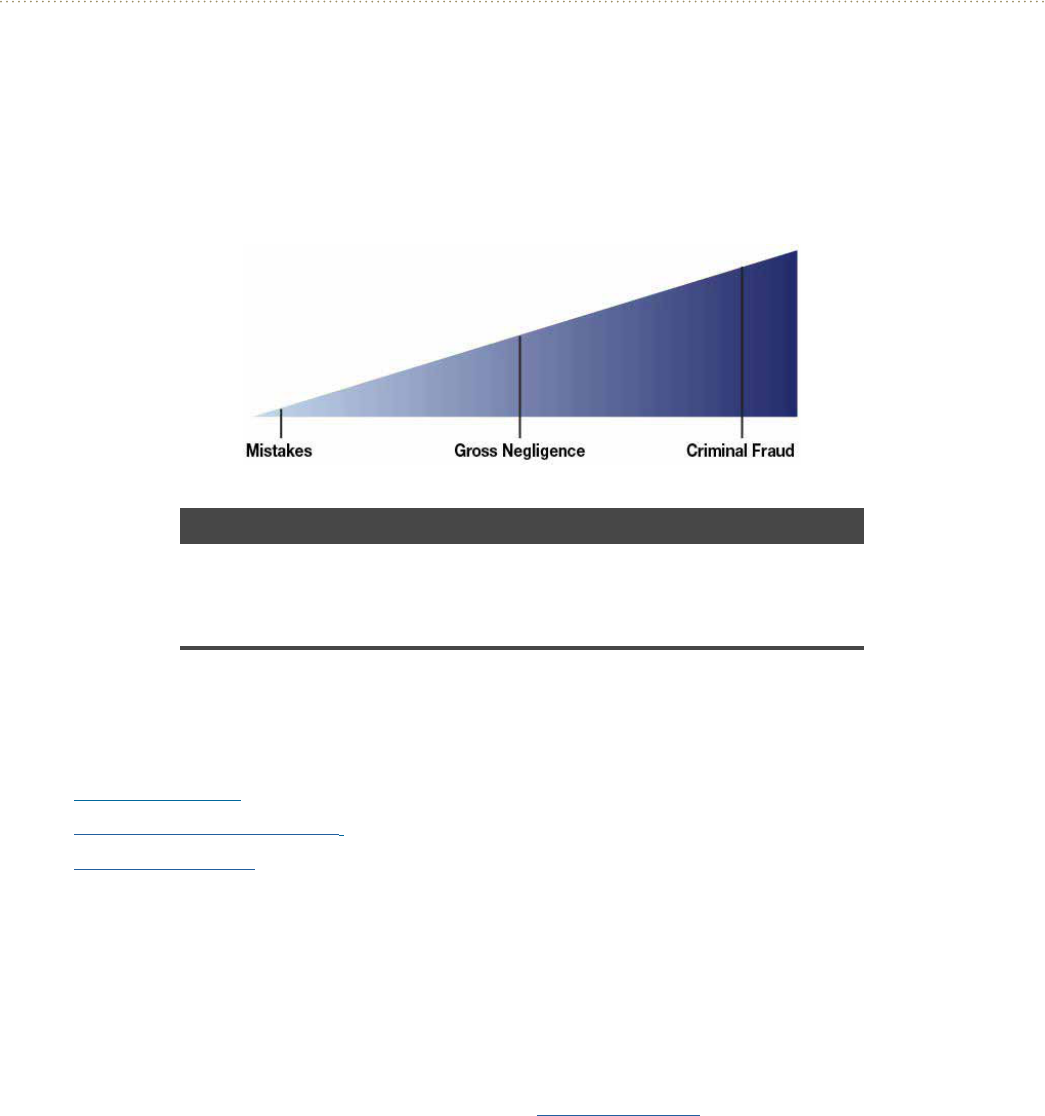

3.20 Grant Fraud, Waste, and Abuse ....................................................................................................127

3.21 OJP’s Payment Programs..............................................................................................................132

3.22 Financial Management Training Requirements ...........................................................................137

IV. ORGANIZATION STRUCTURE..............................................................................138

4.1 Organization Charts .........................................................................................................................138

V. APPENDICES ..........................................................................................................139

5.1 Acronyms ..........................................................................................................................................139

5.2 Glossary of Terms.............................................................................................................................141

5.3 Appendices I and II...........................................................................................................................146

October 2022 i

Welcome to the DOJ Grants Financial Guide

Foreword

We hope you find this guide useful and informative. If you have any questions or comments, please contact your

appropriate DOJ Funding Source.

TOP 10 TOPICS

1. Financial Management Systems 6. Audit Requirements

2. Allowable Costs 7. Conference Costs

3. Unallowable Costs 8. Adjustments to Awards

4. Federal Financial Reports 9. Accounting by Approved Budget Category

5. Performance Reports 10. Subrecipient Monitoring

e Department of Justice (DOJ) has three primary grant-making components, the Office of Justice Programs

(OJP), the Office on Violence Against Women (OVW) and the Office of Community Oriented Policing

Services (COPS Office). e mission of OJP is to provide innovative leadership to federal, state, local, and tribal

justice systems by disseminating state-of-the-art knowledge and practices across America, and providing grants

for the implementation of these crime fighting strategies. e mission of OVW is to provide federal leadership

in developing the national capacity to reduce violence against women, and administer justice for and strengthen

services to victims of domestic violence, dating violence, sexual assaults, and stalking. e mission of the COPS

Office is to advance the practice of community policing by the nation’s state, local, territory, and tribal law

enforcement agencies through information and resources.

ese three grant-making components provide Federal leadership in developing the nation’s capacity to prevent

and control crime, administer justice, and assist crime victims. ey also provide policy guidance, financial

control, and support services to their recipients in the areas of grants, accounting, and financial management.

Each grant-making component conducts programmatic monitoring through site visits and desk reviews, and

provides technical assistance and training to recipients. Additionally, OJP’s Office of the Chief Financial Officer

(OCFO) conducts financial monitoring through site visits and desk reviews, and provides training to OJP’s

recipients in the Grants Financial Management Training Seminars.

FINANCIAL MANAGEMENT TIP

The DOJ Grants Financial Management Online Training is available to all DOJ grant-

making component recipients.

e DOJ Grants Financial Guide (the “Guide”) serves as the primary reference manual to assist OJP, OVW, and

COPS Office award recipients in fulfilling their fiduciary responsibility to safeguard grant funds and ensure

funds are used for the purposes for which they were awarded. It compiles a variety of laws, rules and regulations

that affect the financial and administrative management of your award. ere may be instances where the

requirements may differ among the three grant-making components; to the extent possible, those differences are

spelled out throughout this Guide. However, recipients (and subrecipients) should refer to their award terms and

conditions to determine the specific requirements that apply to their award. We have provided references to the

underlying laws and regulations as much as possible.

October 2022 ii

Foreword

is Guide should be the starting point for all recipients and subrecipients of DOJ grants and cooperative

agreements in ensuring the effective day-to-day management of awards.

For additional information on grants management, please visit the website of the Results-Oriented

Accountability for Grants Council on Financial Assistance Reform at https://www.performance.gov/CAP/

grants/. e Government Printing Office also maintains electronic copies of the Code of Federal Regulations at

https://ecfr.federalregister.gov/and e-CFR at https://www.ecfr.gov.

We are pleased to respond to any questions not covered by this Guide and welcome suggestions to improve the

utility of the Guide and its content. Please feel free to contact the OCFO’s Customer Service Center at 1-800-

458-0786, OVW Grants Financial Management Division at 1-888-514-8556, or COPS Office Response

Center at 1-800-421-6770 with any financial management questions or suggested revisions. In addition,

questions and comments can also be directed to the OCFO via e-mail at [email protected], OVW via email at

OVW[email protected], or COPS Office via email at askCopsR[email protected].

Robert E. Chapman Amy Solomon

Acting Director, Principal Deputy Assistant

COPS Office Attorney General, OJP

Allison Randall

Acting Director, OVW

October 2022 iii

October 2022 1

I. General Information

1.1 USERS

is Guide is provided for the use of all recipients and their subrecipients of Federal grant programs

administered by the three primary Department of Justice (DOJ) grant-making components. e Guide

was developed to serve as a compilation of the various laws and regulations governing DOJ grants financial

management and administration. Any individual who works for a recipient or subrecipient should use this

Guide as a reference for financial and administrative management of DOJ-funded grant programs or projects.

ese individuals may include administrators, financial management specialists, grants management specialists,

accountants, and auditors. is Guide also may be used as a training resource for new employees.

Recipients

■ A recipient is an entity, usually but not limited to non-Federal entities, that receives a Federal award directly

from a Federal awarding agency.

■ Recipients are required to adhere to the applicable law of their jurisdiction, and the financial and

administrative rules in this Guide. However, other programmatic and technical requirements (for example, as

set out in award conditions or contained in program-specific guidelines) may also apply.

■ Recipients are required to adhere to all applicable uniform (grants) administrative requirements, cost

principles, and audit requirements set forth in 2 C.F.R. Part 200 and other applicable law.

Subrecipients

■ A subrecipient is an entity, usually but not limited to non-Federal entities, that receives a subaward from

a pass-through entity to carry out part of a Federal award; but does not include an individual that is a

beneficiary of such award.

■ Subrecipients are required to adhere to the applicable law of their jurisdiction and the financial and

administrative rules in this Guide. e pass-through entity may also impose additional financial and

administrative requirements.

■ Subrecipients are also required to adhere to all applicable uniform (grant) administrative requirements, cost

principles, and audit requirements set forth in 2 C.F.R. § 200 and other applicable law.

FINANCIAL MANAGEMENT TIP

When determining whether an entity receiving federal award funds from the

recipient is a subrecipient or a contractor, the legal document executed between the

recipient and the entity receiving federal award funds from the recipient is NOT the

driving determinant. See the denitions of contractor and subrecipient in 2 C.F.R.

§ 200.1. The substance of the activity that has been contracted or subawarded

will be the major factor considered. If program activities are delegated to another

entity that delegation will generally be considered a subaward. On the other hand,

if goods or services are purchased or procured from another entity for the non-

Federal entity’s own use, that activity will generally be considered a contract. For

additional information on this topic, please refer to 2 C.F.R. § 200.331, subrecipient

and contractor determination.

October 2022

I. General Information

1.1 USERS

For-Prot (or Commercial) Entities

In accordance with 2 C.F.R. § 200.101(a)(2), OJP/OVW applies 2 C.F.R. Part 200, subparts A through D

(excluding 2 C.F.R. § 200.317 through 200.327), to for-profit (or commercial) entities. However, for-profit (or

commercial) entities receiving funding through the COPS Office must comply with 2 C.F.R. Part 200, subparts

A through E. In addition, in accordance with 2 C.F.R. § 200.400(g), the recipient may not earn or keep a profit

as a result of the award unless expressly authorized by the specific terms and conditions of the award.

To the extent allowable and consistent with applicable law, and unless expressed explicitly otherwise herein, this

Guide applies to any recipient or subrecipient that is a for-profit (or commercial) entity. As used throughout the

Guide, the term “non-federal entity(ies)” includes for-profit entities.

2

October 2022 3

I. General Information

1.2 RESOURCES

Government-Wide Grants Management Requirements and DOJ Regulatory Adoption

is Guide includes references to the policies and guidance issued by the Office of Management and Budget

(OMB). e largest division of the Executive Office of the President, OMB is responsible for implementing and

enforcing the President’s policies across the entire Federal Government.

On August 13, 2020, OMB issued revisions to sections of the government-wide framework for grants

management (Federal Register, 8/13/2020 and correcting amendments, 2/22/2021), the Uniform

Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (2 C.F.R. Part 200),

also known as the Uniform Guidance. This OMB guidance, first promulgated in 2013, has been implemented by

DOJ via DOJ regulation at 2 C.F.R. Part 2800.

e 2013 guidance superseded the following OMB requirements:

■ OMB Circular A-21, Cost Principles for Educational Institutions;

■ OMB Circular A-87, Cost Principles for State, Local, and Indian Tribal Governments;

■ OMB Circular A-89, Federal Domestic Assistance Program Information;

■ OMB Circular A-102, Grant Awards and Cooperative Agreements with State and Local Governments

(Common Rule);

■ OMB Circular A-110, Uniform Administrative Requirements for Awards and other Agreements, Institutions

of Higher Education, Hospitals and other Non-Profit Organizations;

■ OMB Circular A-122, Cost Principles for Non-Profit Organizations;

■ OMB Circular A-133, Audits of States, Local Governments, and Non-Profit Organizations; and

■ Sections of OMB Circular A-50, Audit Follow-up.

Applicability of the DOJ Grants Financial Guide

Refer to your award conditions for specific applicability of 2 C.F.R. Part 200 and this Financial Guide. In

general, you should follow the requirements in effect at the time of award.

This version of the DOJ Grants Financial Guide reflects the government-wide grant rules that went into effect

(and were implemented by DOJ) on November 12, 2020. These requirements apply to Federal awards made on

or after November 12, 2020.

For Federal awards made before November 12, 2020, absent an agreement otherwise in a Federal award issued

after that date (or other notification by DOJ permitting exceptions), the requirements in place at the time of

award continue to apply.

October 2022

I. General Information

1.2 RESOURCES

Updates to specific provisions between major version updates will be noted in the affected provision, and/or in

a Change History available online. Prior versions of the DOJ Grants Financial Guide are available for reference

online.

e following requirements remain in place:

■ Government-wide Debarment and Suspension (Non-procurement) are codified at 2 C.F.R. Part 180, with

DOJ-specific rules at 2 C.F.R. Part 2867.

■ Government-wide Requirements for Drug-Free Workplace (Grants) is codified at 28 C.F.R. Part 83.

■ Restrictions on lobbying are codified at 28 C.F.R. Part 69.

For additional information on grants management, please visit the website of the United States Chief Financial

Officers Council at Financial Assistance (cfo.gov). The most recently updated version of the CFR can be found

at the following link: https://www.ecfr.gov/current/title-2/subtitle-A/chapter-II/Part-200

Ofce of the Inspector General Fraud Hotline

Recipients should report any allegations of fraud, waste, and abuse of grant funds to the appropriate DOJ

grant-making component. In addition to reporting allegations to the grant-making component, allegations are

preferred to be reported to the DOJ Office of the Inspector General online at https://oig.justice.gov/hotline, by

fax (202) 616-9881, or by mail:

U.S. Department of Justice

Office of the Inspector General

Investigations Division

ATTN: Fraud Detection Office

950 Pennsylvania Avenue N.W.,

Washington, DC 20530

Other Available Resources

■ Guide to Procurements Under DOJ Grants and Cooperative Agreements [PDF - 563 Kb]

■ OVW Post Award Instructions available at https://www.justice.gov/ovw/after-receiving-ovw-funds.

■ JustGrants Resources and Training can be found at https//justicegrants.usdoj.gov.

■ e OJP Support Team is available via email at J[email protected] or phone at 838-872-5175.

■ OJP Recipient Resources can be found at https://www.ojp.gov/funding/implement/overview.

■ e OVW JustGrants Helpdesk Support Team is available via email at OVW.JustGrantsS[email protected]

or phone at 1-866-655-4482.

■ e COPS Office Response Center is available at askCopsR[email protected] or phone at 1-800-421-6770.

■ e Federal Funding Accountability and Transparency Act (FFATA) is available at https://www.fsrs.gov.

■ Federal grant information is available at http://www.grants.gov.

■ Federal Government regulation information is accessible at http://www.regulations.gov.

4

October 2022 5

II. Preaward Requirements

2.1 APPLICATION PROCESS

Eligible Recipients

Eligibility requirements for DOJ awards can be found in the notices of funding opportunities, generally referred

to as solicitations, available on awarding agency websites. Eligible applicants vary by program and

may include one or more of the following categories: States (including the District of Columbia and U.S.

territories), units of local government, Indian tribes and tribal organizations, institutions of higher education,

hospitals, nonprofit organizations, for-profit organizations, and (in limited circumstances) individuals.

OVW’s website contains brief descriptions of OVW programs to assist potential OVW applicants in

identifying programs for which they are eligible to apply. OVW program solicitations will provide additional

eligibility information each fiscal year.

Funding Opportunity Announcements

DOJ grant-making components announce funding opportunities via Grants.gov. Applications are submitted

through Grants.gov and JustGrants. A collection of available assistance programs can be found in the Assistance

Listings (formerly the Catalog of Federal Domestic Assistance) available at https://sam.gov/content/assistance-

listing. To view each grant-making component's available funding opportunities, visit the websites below:

■ OJP — Current Funding Opportunities

■ OVW — http://www.justice.gov/ovw/open-solicitations

■ COPS Office — http://www.cops.usdoj.gov/grants

Nondiscrimination Requirements

Non-discrimination assurance: Applicants must assure and certify, on the applicable awarding agency assurance

form, compliance with all civil rights nondiscrimination requirements. ese assurances and certifications are

made by signing an assurances form that addresses various cross-cutting federal requirements, including those

prohibiting unlawful discrimination. e applicable form typically is referenced in the program solicitation, and

signed during the application process (electronically for most programs).

Office for Civil Rights: e DOJ Office for Civil Rights (OCR) ensures that recipients of financial assistance

from OJP, OVW, and COPS Office comply with federal laws that prohibit discrimination in both employment

and the delivery of services or benefits based on race, color, national origin, sex, religion, and disability. In

addition, federal law prohibits recipients of federal financial assistance from discriminating on the basis of

age in the delivery of services or benefits. Recipients of financial assistance from OVW are prohibited from

discriminating on the basis of sexual orientation or gender identity, either in employment or in the delivery of

services or benefits. For more information see the OCR website.

Discrimination findings: In the event of a finding of discrimination, send a copy of the hearing findings to

OCR. is applies to recipients of Federal funds if a Federal or State court or administrative agency finds

through a due process hearing that a recipient, subrecipient, or contractor, has unlawfully discriminated.

October 2022

II. Preaward Requirements

2.1 APPLICATION PROCESS

Other civil rights requirements: Depending on the size of the organization, how much federal funding is

received, and the program under which funds are received, recipients (and subrecipients in certain cases) may be

required to submit an Equal Employment Opportunity Plan to OCR. If awarded Federal funds, more specific

information on civil rights compliance, including requirements regarding submission of Equal Employment

Opportunity Plan will be provided in the award documents. For additional information see Equal Employment

Opportunity Plans.

Intergovernmental Review

Intergovernmental review is a process described in Executive Order 12372 [PDF - 12 Kb], through which

governments at the State and local levels coordinate in the review of proposed Federal financial assistance and

direct Federal development.

For those DOJ grant programs that are subject to Executive Order 12372, applicants must access the

Intergovernmental Review Single Point of Contact List (“SPOC List”) to find out about and, as applicable,

comply with the applicant’s State process under Executive Order 12372. As part of the grant application process,

to complete the SF-424, applicants must make the appropriate selection (and provide any required information)

in response to the question,“Is Application Subject to Review by State Under Executive Order 12372 Process?”

To determine if a DOJ program is subject to Executive Order 12372, look in the notice of funding opportunity

(program solicitation) or program announcement, check the program's Assistance listing (formerly CFDA)

entry, or contact the DOJ awarding agency.

Application Submittal

Applicants for DOJ funding can submit an Application for Federal Assistance (SF-424) and Disclosure of

Lobbying Activities (SF-LLL) online through the federal grants portal Grants.Gov (www.grants.gov) and

submit their full application including attachments in DOJ's JustGrants (https://justgrants.usdoj.gov/). Each

program solicitation will contain detailed technical instructions on how to register and apply for funding, as well

as application submission deadlines for both systems.

Note regarding applicant type on the SF-424: Generally, applicants for DOJ grants are one of the

following types of entities: States, units of local government, Indian tribes, nonprofit organizations, for-profit

organizations, institutions of higher education, and (in limited circumstances) individuals. It is possible to select

other applicant types, as appropriate.

Application Review

DOJ awarding agencies are required to ensure that awards meet certain legislative, regulatory, and administrative

requirements. is requires that each DOJ awarding agency review and assess each application to determine the

following:

■ e applicant is eligible for the specified program.

■ e costs and activities in the application are for allowable, allocable, necessary, and reasonable costs.

■ e applicant possesses the responsibility, financial management, fiscal integrity, and financial capability to

administer Federal funds adequately and appropriately.

6

October 2022

II. Preaward Requirements

2.1 APPLICATION PROCESS

Applicant Type

Examples of types of applicants include, but are not limited to:

■ Nonprofit organization – Some DOJ programs may require that an organization have 501(c)(3) status (as

described in the U.S. Internal Revenue Code)

■ For-profit organization (including organizations designated as small businesses)

■ State

■ Unit of local government

■ Tribe

■ Institution of higher education

■ Courts

■ Individuals (in limited circumstances)

Pre-Award Risk Assessment

DOJ is required to review and assess the potential risks presented by applicants for Federal grants prior to

making an award (2 C.F.R. § 200.206). DOJ will use a variety of factors, which may include financial capabilities

and past performance, in a risk-based approach. To facilitate part of the risk assessment, DOJ applicants (other

than an individual) may be required to complete a questionnaire to assess their financial capability and submit it

to DOJ before they can be approved for an award.

DOJ High-Risk Grantee Designation

e DOJ's High-Risk Grantee Policy was adopted by its three-primary grant-making components: the Office

of Justice Programs (OJP), the Office of Community Oriented Policing Services (COPS), and the Office on

Violence Against Women (OVW). OJP's Office of Audit, Assessment, and Management (OAAM) is charged

with administering the high-risk grantee (recipient) process on behalf of DOJ. When a recipient is designated as

high-risk, all DOJ grant-making components must consider the recipient as high-risk.

e purpose of the high-risk policy is to provide DOJ with a means of continuing to fund much needed criminal

justice programs benefiting communities across the U.S., while maintaining proper stewardship of Federal funds

and mitigating risk in the administration of DOJ-funded grant programs. It is important to note that high-risk

recipients are not prohibited from applying for or receiving new awards from DOJ. However, high-risk recipients

are managed and monitored closely, and any new awards these recipients receive are subject to additional

restrictions, typically imposed through the inclusion of high-risk award conditions. Such conditions may be

imposed not just at the beginning of an award, but at any time throughout the period of the award, if appropriate.

In general, a recipient may be designated as high-risk if any of the following apply to the recipient:

■ Has a history of unsatisfactory performance;

■ Is not financially stable;

■ Has a management system that does not meet the standards set forth in 2 C.F.R. Part 200 (Subpart D-Post

Federal Award Requirements (Standards for Financial and Program Management));

■ Has not conformed to the terms and conditions of previous awards; or

■ Is otherwise not responsible.

7

October 2022

II. Preaward Requirements

2.1 APPLICATION PROCESS

Under DOJ's policy, recipients may be designated as high-risk automatically, or as a result of a referral from

sources such as a DOJ grant-making component or other federal grant-making organization.

■ High-risk referrals can be made by any DOJ personnel who work with grants, and can result from a wide

variety of reasons, including, but not limited to:

X issues identified during grant programmatic or financial monitoring reviews, budget reviews, financial

capability reviews, etc.;

Xconcerns noted during the routine administration of grants;

Xaudits/investigative issues;

Xcomplaints by recipient personnel, third parties, and/or the media, etc.

■ Automatic high-risk designations are made by DOJ if any of the following conditions apply:

XRecipient has open audit reports (OIG and Single Audit) with recommendation(s) that have been open for

more than one year, and has not submitted documentation adequate to close the recommendation(s).*

XRecipient has not provided a corrective action plan to the DOJ within 105 days of transmission of the

audit report to the recipient.*

XRecipient has audit reports with questioned costs in excess of $500,000 (regardless of the amount of time

the audit report has been open).

XRecipient has been referred to the Department of Treasury for collection because of their failure to timely

repay funds owed on a DOJ award.

XRecipient has been placed on the COPS Restricted Grantees List due to non-compliance with a previous

COPS award(s).

XRecipient has been recommended for government-wide suspension or debarment by a DOJ office or

component.

e “*” associated with bullets 1 and 2, is that “Exceptions” to time-related automatic designations may

be granted in limited circumstances (e.g. delays resulting from circumstances beyond grantee’s control), if

appropriately justified and documented.

If high-risk recipients do not comply with the additional conditions/restrictions imposed, or fail to make timely

progress in addressing the issues that resulted in their high-risk designation, DOJ can consider more substantial

sanctions, such as: withholding payments on current DOJ awards; suspension or termination of existing

awards; barring the recipient from receiving future DOJ awards; and/or recommending the recipient for (non-

procurement) government-wide suspension or debarment.

Audit Issues

■ DOJ may choose not to approve an applicant for an award if the applicant has an overdue audit report,

an open audit report that has not been responded to, or if the applicant has not tried to resolve the issues

identified in the audit.

■ Failure to comply with audit requirements may cause an application to be rejected, or funds to be withheld

until audit compliance is achieved.

8

October 2022

II. Preaward Requirements

2.1 APPLICATION PROCESS

Review of Applicant Federal Debt

e SF-424 asks if the applicant is delinquent on any Federal debt.

■ e applicant is the organization that is requesting Federal assistance, not the person who signs the

application as the authorized representative of the organization.

■ Federal debt includes delinquent audit disallowances, loans, taxes, and any outstanding debts with the

Tr ea s ury.

Unique Entity Identier

Unless an exception applies, all applicants and recipients must have a unique entity identifier when applying

for Federal awards and cooperative agreements (initial or supplemental awards) (2 C.F.R. Part 25 - Universal

Identifier and System of Award Management). Refer to the applicable solicitation for requirements and

instructions on how to obtain a unique entity identifier.

Maintaining an Active Registration in System for Award Management

e System for Award Management (SAM) is the Official U.S. Government system that collects, validates,

stores, and disseminates data on organizations to help agencies in their acquisition missions, including Federal

agency contract and assistance awards. e term "assistance awards" includes grants, cooperative agreements, and

other forms of Federal assistance. Organizations must maintain an "active" registration in www.SAM.gov for the

entire period of the award, which requires an annual update.

Financial Analysis

DOJ will complete a financial review of the grant application to ensure that recipients are financially capable and

have the financial integrity to administer Federal funds. As part of this review, each grant-making component

will take all of the following steps:

■ Perform a cost analysis of the project (may not be applicable to some formula programs).

■ Obtain cost breakdowns, verify cost data, evaluate specific elements of cost, and examine data to determine

the necessity, reasonableness, allowability, allocability, and appropriateness of the proposed cost.

■ Review indirect cost rates and calculations if applicable. See Chapter 3.11 indirect costs.

■ Determine the adequacy of the accounting system and operations to ensure that Federal funds, if awarded,

will be expended in a reasonable manner.

■ Non-Federal entities that have not received an award within the past 3 years may require an additional

financial review.

■ Review the status of any Federal debt that the applicant may have to ensure the debt is not delinquent, and

other prescreening information, including checking SAM to ensure the organization is not suspended or

debarred from receiving Federal funds.

9

October 2022

II. Preaward Requirements

2.2 ACCEPTANCE OF AWARD AND AWARD CONDITIONS

Award Notication and Acceptance Procedures

After applications have gone through the review process and have been approved, the next step in this process is

award notification. Here are the details:

■ An email notification will be sent to the Application Submitter, the Authorized Representative(s) and the

Entity Administrator to sign and accept their award.

■ e entity must successfully set up their JustGrants account and enroll in the Automated Standard

Application for Payments (ASAP) in order to manage their award.

■ e email notification includes detailed instructions on how to access and accept the award in JustGrants.

ACTION ITEM

Recipients have 45 days from the award date to accept the award or the award may

be rescinded.

Prior to accepting an award, the Entity Administrator must assign a Financial

Manager, a Grant Award Administrator and an Authorized Representative with

the authority to accept on behalf of the organization for each award (COPS Ofce

recipients must assign two Authorized Representatives). Additional instructions

regarding accepting an award and assigning or changing roles in JustGrants can

be found on the JustGrants Training page.

For Law Enforcement agencies, COPS Ofce awards require that both the top

law enforcement executive (e.g., chief of police, sheriff, or equivalent) and the

top government executive (e.g., mayor, board chairman, or equivalent) accept the

Award Package. The top law enforcement executive must be assigned the role of

Authorized Representative 1 and the top government executive must be assigned

the role of Authorized Representative 2 in JustGrants.

For non-Law Enforcement agencies (institutions of higher education, school

districts, private organizations, etc.), COPS Ofce awards require that both the

programmatic ofcial, (e.g., executive director, chief executive ofcer, or equivalent)

and nancial ofcial (e.g., chief nancial ofcer, treasurer, or equivalent) sign the

application, and (if awarded funding) accept the Award Package. These two ofcials

must have the ultimate signatory authority to sign contracts on behalf of your

organization. The programmatic ofcial must be assigned the role of Authorized

Representative 1 and the nancial ofcial must be assigned the role of Authorized

Representative 2 in JustGrants.

Federal funds will not be disbursed to a recipient until the award is accepted. To

decline the award, please contact the program manager identied in the award to

discuss the reasons for this decision

Direct questions concerning award notication and acceptance to the appropriate

DOJ contact(s).

10

October 2022

II. Preaward Requirements

2.2 ACCEPTANCE OF AWARD AND AWARD CONDITIONS

Award Conditions

Award conditions are terms and conditions that are included with the award. Award conditions may include

additional requirements covering areas such as programmatic and financial reporting, prohibited uses of Federal

funds, consultant rates, changes in key personnel, and proper disposition of program income.

Some award conditions may be based on the program or the nature of the award itself. Regardless of the grant-

making component or the award, there are several mandatory award conditions that will be included on any

DOJ award. A list of all the mandatory award conditions for each DOJ grant-making component is available at

the following links.

FINANCIAL MANAGEMENT TIP

■ OJP – https://ojp.gov/funding/Explore/SolicitationRequirements/MandatoryTermsConditions.htm

■ OVW – https://www.justice.gov/ovw/award-conditions

■ e COPS Office - standard award conditions are available at the COPS Office website.

FINANCIAL MANAGEMENT TIP

Failure to comply with award conditions may result in remedial action, which

may include (but is not limited to) withholding award funds, disallowing costs, or

suspending or terminating the award. DOJ also may take other legal action as

appropriate.

11

October 2022

II. Preaward Requirements

2.3 STANDARDS FOR FINANCIAL MANAGEMENT SYSTEMS

Accounting System

All recipients and subrecipients are required to establish and maintain adequate accounting systems and financial

records and to accurately account for funds awarded to them. Recipients must have a financial management

system in place that is able to record and report on the receipt, obligation, and expenditure of grant funds. Keep

detailed accounting records and documentation to track all of the following information:

■ Federal funds awarded

■ Federal funds drawn down

■ Matching funds of State, local, and private organizations, when applicable

■ Program income

■ Subawards (amount, purpose, award conditions, and current status)

■ Contracts expensed against the award

■ Expenditures

Please consult Subpart D of 2 C.F.R. Part 200, including 2 C.F.R. § 200.302, for more information.

OJP SPECIFIC TIP

For the OVC Victim Compensation Program, there is no nancial requirement to

identify the source of individual payments to crime victims as either federal or state

dollars, nor is there any requirement that restitution recoveries or other refunds be

tracked to federal or state dollars paid out to victims. However, the state agency

administering funds under this program must have in place an adequate accounting

system to capture and track all nancial transactions related to the victim

compensation grant; and upon request, must provide authorized representatives

with access to and the right to examine all records, books, paper or documents

related to the victim compensation grant per the VOCA Victim Compensation

Program Guidelines [ PDF - 162 Kb] – 66 Fed. Reg. 27158 (May 16, 2001), Sections

V.G and IX.A.

What Is An Adequate Accounting System?

■ An adequate accounting system can be used to generate reports required by award and Federal regulations.

e system must support all of the following:

XFinancial reporting that is accurate, current, complete, and compliant with all financial reporting

requirements of the award or subaward.

XRecipients must establish reasonable procedures to ensure the receipt of reports on subrecipients’ cash

balances and cash disbursements in sufficient time to enable them to prepare complete and accurate cash

transactions reports to the awarding agency.

XAccounting systems must be able to account for award funds separately (no commingling of funds).

■ An adequate accounting system allows recipients to maintain documentation to support all receipts and

expenditures and obligations of Federal funds.

■ An adequate accounting system collects and reports financial data for planning, controlling, measuring, and

evaluating direct and indirect costs.

12

October 2022

II. Preaward Requirements

2.3 STANDARDS FOR FINANCIAL MANAGEMENT SYSTEMS

■ e system should have all of the following capabilities:

XInternal control. e system must allow for effective control and accountability for all award and subaward

cash, real and personal property, and other assets. Recipients and subrecipients must adequately safeguard

all such property and assure that it is used solely for authorized purposes. Please consult 2 C.F.R. §

200.303 for additional information.

XBudget control. e system must compare actual expenditures or outlays with budgeted amounts for

each award and subaward. It also must relate financial information to performance or productivity data,

including the development of unit cost information whenever appropriate or specifically required in the

award or subaward agreement.

XAllowable cost. e system must support making sure that Federal cost principles, agency program

regulations, and the terms of award and subaward agreements are followed in determining the

reasonableness, allowability, and allocability of costs.

XSource documentation. e system must require support for accounting records with source

documentation (e.g., cancelled checks, paid bills, payrolls, time and attendance records, and contract and

subaward documents).

XCash management. An adequate system must require following procedures for minimizing the time

between the transfer of funds from the U.S. Department of the Treasury and disbursement by recipients

and subrecipients whenever advance payment procedures are used.

■ An adequate accounting system for a recipient must be able to accommodate a fund and account structure to

separately track receipts, expenditures, assets, and liabilities for awards, programs, and subrecipients.

e adequacy of the financial management system may be reviewed as part of the application process or at any

time subsequent to the award. For additional information see Subpart D of 2 C.F.R. Part 200.

Separate Tracking of Awards

To properly account for all awards, recipients should establish and maintain program accounts which will enable

separate identification and accounting for:

■ Award funds expended through subrecipients

■ Formula funds utilized to develop a State plan and to pay that portion of expenditures necessary for

administration

■ Receipt and disposition of all funds (including program income)

■ Funds applied to each budget category included within the approved award

■ Expenditures governed by any specific and/or general requirements

■ Non-Federal matching contribution, if required

For additional information see Subpart D of 2 C.F.R. Part 200.

Project Cost Budgeting and Accounting

To ensure adequate fiscal administration, accounting, and auditability of all awards, recipients must maintain

records to track the total project costs, which include the following types of funding sources:

13

October 2022

II. Preaward Requirements

2.3 STANDARDS FOR FINANCIAL MANAGEMENT SYSTEMS

■ Federal funds

■ State funds

■ Match

■ Program income

■ Any other funds received for the project

In addition, recipients must maintain records to track project cost by budget category. If the recipient's or

subrecipient's automated general ledger accounting system cannot comply with this requirement, a system should

be established to adequately track funds according to each budget category.

Budgets should be based upon the total estimated costs for the project including all funding sources. List

anticipated expenditures according to the funding source from which they will be paid.

Preventing Commingling of Funds

Although separate depository accounts for award funds generally are not required, the accounting systems of all

recipients and subrecipients must track funds received, obligated, and expended under each award:

■ Recipients and subrecipients must account for each award separately.

■ Funds received for one award may not be used to support a different award unless specific policy guidance

directs otherwise (e.g. AEAP funds).

FINANCIAL MANAGEMENT TIP

Some programs, such as the Justice Assistance Grant program, require the deposit

of funds into a trust fund. In addition, a high-risk designation may require a recipient

to segregate awards into separate bank accounts.

If the recipient's or subrecipient's accounting system does not make it possible

to identify funds and expenditures with a particular award (with the identication

supported by source documentation), those costs will be questioned or may be

disallowed.

Supplanting

Recipients that receive awards under programs that prohibit supplanting by law must ensure that federal funds

do not supplant funds that have been budgeted for the same purpose through non-federal sources.

■ Supplanting will be reviewed during post-award monitoring and audit.

■ If reviewers think that supplanting may have occurred, then the recipient will be required to supply

documentation demonstrating that the reduction in non-Federal resources occurred for reasons other than

the receipt or expected receipt of Federal funds.

■ For certain programs, a written certification may be requested by the awarding agency or recipient agency

stating that Federal funds will not be used to supplant State or local funds.

14

October 2022

II. Preaward Requirements

2.3 STANDARDS FOR FINANCIAL MANAGEMENT SYSTEMS

Example

To help clarify the difference between supplementing and supplanting, we provide the following example:

Supplementing: State funds are appropriated to hire 50 new police officers, and Federal funds are awarded to

hire 60 new police officers. At the end of the year, the State has hired 50 new officers with State funds and 60

new police officers with Federal funds. Under this scenario, there is no supplanting violation because the State

used the Federal funds to supplement (rather than to supplant) the hiring of the new police officers

Supplanting: State funds are appropriated to hire 50 new police officers, and Federal funds are awarded to hire

60 new police officers. At the end of the year, the State has hired 60 new police officers with Federal funds and

none with State funds. Under this scenario, it may be considered a supplanting violation because the State used

the Federal funds to supplant (rather than to supplement) the hiring of new police officers.

15

October 2022

III. Postaward Requirements

3.1 PAYMENTS

e Automated Standard Application for Payments (ASAP) has replaced the Grant Payment Request System

(GPRS) for Department of Justice award payments. ASAP allows organizations to drawdown funds securely

from pre-authorized accounts established by the agency issuing the payment.

Because ASAP is used by many U.S. Government agencies, recipients can leverage their single ASAP profile to

access funds from other agencies. For questions related to the use of the ASAP system, please contact the DOJ

grant-making component:

■ ovw.g[email protected] or by phone: (888) 514-8556

■ Ask.OCFO@usdoj.gov or by phone: (800) 458-0786

■ askcopsr[email protected] or by phone: (800)421-6770

ASAP is a completely electronic system for requesting payment of award funds. It is a system that allows viewing

of active award balances and history of drawdowns to date (only drawdowns made in ASAP). e ASAP Point

of Contact (POC) is the entity’s Electronic Business POC (E-Biz POC) designated in the System for Award

Management (SAM). ASAP can be accessed at http://www.asap.gov. For additional instructions on how to navigate

the ASAP, please refer to the ASAP User Guide.

Some benefits of ASAP:

■ No fees to use the system.

■ Easy online access to all accounts in ASAP.

■ Ability to view current balances, account history and status of payments.

■ Rapid payment processing times, including same or next-day payment options.

■ Self-service banking allows the ability to request and receive payments online.

■ Secure electronic processes which offer both security and efficiency.

■ Electronic funding return options which reduce cost and time compared to paper-based return processes.

The ASAP Process and Timeline for Payment Transactions

e ASAP process and timeline for payment transactions is as follows:

■ Recipients access ASAP via the web to request payment of funds.

■ Once a request has been made, ASAP disburses the funds either the same day or next day (based on the

option selected on the payment request.

■ Payment is electronically deposited into the recipient's bank account the same day (if requested before 2:30

pm and selected during the payment request, or next day).

In order to timely close out financial records at the end of each month, DOJ will temporarily suspend all

open ASAP accounts in order to meet the federal financial statement reporting requirements for the Office of

Management and Budget. For each month except September, access will not be available for the last 3 business

days. For September (fiscal year end) access will not be available for the last 5 business days. All DOJ recipients

should withdraw necessary funds prior to the cutoff day each month.

Prior to using ASAP award recipients will need to register by completing the following steps as outlined in the

ASAP Registration Checklist.

16

October 2022

III. Postaward Requirements

3.1 PAYMENTS

Drawing Only What is Needed

Organizations should request funds based upon immediate disbursement/reimbursement requirements. Funds

will not be paid in a lump sum, but rather disbursed over time as project costs are incurred or anticipated.

Draw down requests should be timed to ensure that Federal cash on hand is the minimum needed for

disbursements/reimbursements to be made immediately or within 10 days. If not spent or disbursed within 10

days, funds must be returned to the awarding agency.

Fund requests from subrecipients create a continuing cash demand on award balances of the recipient.

Recipients should keep in mind that idle funds in the hands of subrecipients will impair the goals of effective

cash management.

Develop written procedures for cash management of funds to ensure that Federal cash on hand is kept at or near

zero. DOJ periodically conducts financial reviews to ensure that this requirement is met.

OJP SPECIFIC TIP

Award funds under a few grant programs may be drawn down or paid out in a

lump sum. Program examples include the Byrne Justice Assistance Grant [JAG]

Program, and State Criminal Alien Assistance Program [SCAAP] awards.

The Debt Collection Improvement Act of 1996 states that all eligible recipients of

Federal payments must receive funds electronically. In addition to the payment, the

bank also receives what is called an addendum record which provides payment

information and gives details necessary for accurate posting into the correct

amount.

e Cash Management Improvement Act of 1990 (Public Law No. 101-453) was an amendment to the

Intergovernmental Cooperation Act of 1968 (31 USC § 6503). Under the CMIA, States are no longer exempt

from returning interest to the Federal Government for drawing down funds prior to the need to pay off

obligations incurred. Rather, States are required to pay interest in the event that the State draws down funds

before the funds are needed to pay for program expenses.

Managing Interest Earned

Both recipients and subrecipients should minimize the time elapsed between receiving Federal funds and the

disbursement of those funds to pay for program expenses. Various laws and regulations affect how interest

income earned on Federal funds should be accounted for, used, and returned to the Federal Government.

Interest earned amounts up to $500 per year may be retained by the non-Federal entity for administrative

expense. Any additional interest earned on Federal advance payments deposited in interest-bearing accounts

must be remitted annually to the Department of Health and Human Services Payment Management System

(PMS) through an electronic medium using either the Automated Clearing House (ACH) network or a

Fedwire Funds Service payment.

Please refer to the How to Manage Interest Income table on the next page.

17

October 2022

III. Postaward Requirements

3.1 PAYMENTS

How to Manage Interest Income

Award

Type

Regulatory

Reference

How to Manage

Interest Income

Where to Send Interest Income

Non Federal Entities

All 2 C.F.R. § 200.305 Up to $500 in interest

U.S. Department of Health and

Entities may be retained for

administrative purposes.

Return interest income in

excess of $500.

Human Services.

For ACH Returns:

RN: 051036706

Acct. #: 303000

Bank Name and Location:

Credit Gateway—ACH Receiver

St. Paul, MN

For FedWire Returns:

RN: 021030004

Acct. #: 75010501

Bank Name and Location:

Federal Reserve Bank

Treasury NYC/Funds

Transfer Division New York, NY

(Organizations may incur a charge

for this time of payment)

Non electronic remittance capability /

make check payable to:

The Department of Health and

Human Services

HHS Program Support Center

P.O. Box 530231

Atlanta, GA 30353-0231

JAG 31 U.S.C. 6503

Account for and report as

Ofce of Justice Programs

State (reecting the

Cash Management

Improvement Act

of 1990); 2 C.F.R.

200.305(a); 31 C.F.R. part

205.

program income.

Use for program

purposes.

Return unused interest

income.

Ofce of the Chief Financial Ofcer

Attn: Accounting Control Branch

Washington, D.C. 20531

Byrne Justice

Assistance

Grants

(states and

units of local

government;

OJP only)

34 U.S.C. 10158 Account for and report as

program income. Use for

program purposes.

Ofce of Justice Programs

Ofce of the Chief Financial Ofcer

Attn: Accounting Control Branch

Washington, D.C. 20531

18

October 2022

III. Postaward Requirements

3.1 PAYMENTS

Frequently Asked Questions

Frequently Asked Questions

Q What is meant by the term “draw down”?

A “Draw down" is the term used to describe the process when a recipient requests and receives money under

an award agreement.

Q How does the money reach our organization?

A Electronic funds transfer from the U.S. Department of the Treasury based on the information you provided in

ASAP.

Q How do I request payment for my organization’s award?

A Through the Automated Standard Application for Payments (ASAP).

Q I tried to draw down funds but the system will not let me. What do I do?

A We suggest that you follow up in one or more of the following ways:

• Check for any error messages you may have received in ASAP and document the error message.

Sometimes minor data entry errors will cause error messages. Also, if you need to call Customer Service,

having the error messages will assist us in determining how to resolve your issues.

• Check to see if all award conditions, including high-risk award conditions, if applicable, have been met.

Many award conditions lead to the withholding of funds until the conditions have been met and cleared.

• Check to see that all Federal Financial Reports (FFRs) and performance reports have been submitted. The

system has automatic verication features in place that prevent drawdowns if all the required reports have

not been submitted.

Q What is my ASAP ID (ROID)?

A Your ASAP ID is a 7-digit number that you received when you enrolled in ASAP.

Q What if I forget my user ID or my password?

A On the ASAP.gov login screen, click on the option you need:

• Forgot User ID

• Forgot Password

Follow the instructions on the screens that appear.

Q Why are my funds withheld?

A Under certain circumstances, an award recipient may be unable to access or draw down funds on an award.

The awarding agency may withhold funds from the organization if any of the following conditions exist:

• Program or project goals have not been timely met.

• Cash has been drawn down in excess of immediate needs for disbursement.

• Award terms and conditions or guidelines have not been met.

• Programmatic/nancial monitoring, Ofce of the Inspector General Audits, or single audits revealed

serious concerns regarding the administration of the award, subawards, or contracts.

• FFRs, Performance Reports, OIG, and/or Single Audit reports have not been submitted by the due date.

• A closeout of the award has not been initiated within 120 days of the end of the project period.

• The recipient has been designated as a DOJ high-risk grantee.

• When a closeout is submitted funds are frozen

19

October 2022

III. Postaward Requirements

3.2 PERIOD OF AVAILABILITY OF FUNDS

Availability of Funds

e Department of Justice (DOJ) makes awards for a specified period of time, usually referred to as the

“Period of performance”, also known as “award period” or “project period”. See 2 C.F.R. § 200.1. e period of

performance is established for each award and is included in the award package.

Periods of performance generally range from 12 to 36 months (the period can be shorter or longer depending on

the specific program). Review the award document in detail and pay particular attention to the project start and

end dates. In some cases, periods of performance may be extended if specific criteria are met. See the discussion

of no-cost extensions in the Criteria for Award Extension section for more information.

OJP SPECIFIC TIP

Some formula awards administered by the Bureau of Justice Assistance (BJA) are

awarded for the federal scal year of the appropriation plus two additional federal

scal years.

Some grants administered by the Ofce for Victims of Crime (OVC) are available

for the federal scal year of the award plus the following three scal years. The

Victims of Crime Act (VOCA) of 1984 states that VOCA funds are available during

the federal scal year in which the award is actually made, plus the following three

scal years. At the end of this period, VOCA funds will be deobligated. (E.g., VOCA

funds awarded in FY 2021, are available until the end of FY 2024). Extensions

beyond the statutory period may be granted at the discretion of DOJ, and may be

requested in accordance with OJP processes, but are not assured.

Obligation of Funds

Financial obligations, when referencing a recipient's or subrecipient's use of funds under a Federal award, means

orders placed for property and services, contracts and subawards made, and similar transactions that require

payment.

Financial obligations must occur during the period of performance stated on the award document. A financial

obligation occurs when there is a binding agreement, such as in a valid purchase order or requisition, that covers

the cost of purchasing an authorized item on or after the begin date and up to the last day of the period of

performance. See 2 C.F.R. § 200.1 (definition of “Period of Performance”).

FINANCIAL MANAGEMENT TIP

Financial obligations must occur during the period of performance. If funds are

obligated (e.g., enter into a contract) prior to the start of the period of performance,

that nancial obligation may not be an allowable expense, unless the award recipient

noties the awarding agency in advance in writing and receives prior written approval

from the awarding agency.

20

October 2022

III. Postaward Requirements

3.2 PERIOD OF AVAILABILITY OF FUNDS

If the funds are not used within statutory or other time limits, or any funds not obligated and expended by the

recipient by the end of the period of performance will lapse and revert to the awarding agency. e financial

obligation deadline is the last day of the period of performance unless otherwise stipulated. No additional

financial obligations can be incurred after the end of the period of performance. For example, if the period of

performance is October 1, 2021 to September 30, 2023, the financial obligation deadline is September 30, 2023.

Expenditure of Funds

An expenditure is a charge made by a recipient or subrecipient to a project or program for which a Federal award

was received. Expenditures may be reported on a cash or accrual basis as long as the methodology is disclosed

and consistently used. See 2 C.F.R. § 200.1 (definition of “Expenditures”).

All financial obligations properly incurred by the end of the period of performance for the Federal award must

be liquidated no later than 120 days after the end date of the award. If the award has been properly obligated,

the full liquidation period is available for remaining expenditures. Any funds not liquidated at the end of the

120-day period will revert to the awarding agency. See 2. C.F.R. §200.344.

e liquidation period exists to allow projects time to receive ordered goods and make final payments. No new

financial obligations may be made during the liquidation period.

Disbursements made by recipients or subrecipients after the end of the period of performance but within

the liquidation period MUST have documentation to demonstrate that the financial obligation was incurred

BEFORE the end of the period of performance. For example, an invoice paid 25 days after the end of the period

of performance must have an invoice date, purchase order date, or other documentation showing the date

services were rendered prior to the end of the period of performance.

OJP SPECIFIC TIP:

OJP recipients and subrecipients must complete performance during the award or

obligation period. Performance evaluations as a result of a contract under a formula

award may be completed during the liquidation period not to exceed 120 days after

the end date of the award.

Example of Obligation, Expenditure, and Liquidation Periods

Period Example

Award/Obligation Period

Recipient’s Books

Federal Books

Liquidation Period

(120 days after award end date)

10/01/21 - 9/30/23

10/01/21 – 9/30/23

12/01/21 (Award Date)

10/01/23 – 1/28/24

21

October 2022

III. Postaward Requirements

3.2 PERIOD OF AVAILABILITY OF FUNDS

FINANCIAL MANAGEMENT TIP

Automated Standard Application for Payments automatically freezes funds 120

days after the end of the award!

Criteria for Award Extension

Requests for a no-cost extension of a period of performance must be submitted through JustGrants. Recipients

are to use the Grant Award Modification (GAM) to request the extension.

Recipients may request an extension to receive additional time to achieve the goals and objectives of the grant

program. ese extensions do not provide additional funding. All extension requests will be evaluated on a case-

by-case basis.

ACTION ITEM

For OJP/OVW awards, recipients may request a no-cost extension by submitting a

GAM at least 30 calendar days prior to the end of the award.

For COPS awards, recipients may request a no-cost extension by submitting a GAM

prior to the last day of the award period of performance. To request an extension

at least 30 calendar days prior to the end of the award, the recipient submits the

request in JustGrants. For extension request in the nal 30 days of the award, the

recipient must request the extension via email to their COPS Grant Manager.

The recipient should act as soon as possible to obtain their organization’s approval

to submit an extension request and ensure that they submit the GAM via JustGrants

at least 30 days prior to the end of the award period, allowing the program ofce

sufcient time to process the GAM.

22

October 2022

III. Postaward Requirements

3.2 PERIOD OF AVAILABILITY OF FUNDS

OJP SPECIFIC TIP

Most awards are eligible to be considered for an extension of the award period in

response to a GAM request. The request for extension must justify the need for the

extension and indicate the additional time required. The grant-making component’s

ability to grant an extension may be limited by statute for some programs. For

example: Awards funded by the Ofce for Victims of Crime (OVC) (or any other OJP

bureau/program ofce) under the provisions of the Victims of Crime Act (VOCA) of

1984, are available during the federal scal year in which the award is actually made,

plus the following three scal years. At the end of this period, VOCA funds will be

deobligated. (E.g., VOCA funds awarded in FY 2021 are available until the end of FY

2024). Extensions beyond the statutory period may be granted at the discretion of

DOJ, and may be requested in accordance with OJP processes, but are not assured.

e criteria for extending the period of performance include the following:

■ All applicable Federal Financial Reports and Performance Reports must be on file and current.

■ All award conditions attached to the award must be satisfied. is also includes the performance and

resolution of audits in a timely manner.

■ A narrative justification must be submitted with the extension request. Complete details must be provided,

including the justification and the circumstances which require the proposed extension. e recipient must

explain the effect a denial of the request will have on the project.

FINANCIAL MANAGEMENT TIP

NOTE: The period of performance will not be extended merely for the purpose of

using unobligated funds.

OJP SPECIFIC TIP

To avoid the need to make a request to extend the obligation or expenditure

deadline of a formula program, it is recommended that all subawards should be

completed at least six months prior to the end of the obligation deadline for the

award. Justice Assistance Grant ( JAG) Program awards, in which the total period

of performance does not exceed 4 years, have specific requirements for requesting

no-cost extensions. e recipient should contact the BJA grant manager for the

additional requirements.

Project Extension Guidance *

Generally, the following shall apply to all grants and cooperative agreements:

■ no more than one no-cost extension may be made to an award;

■ a no-cost extension may not exceed 12 months;

■ a no-cost extension may be made only if the period of performance has not expired;

■ a no-cost extension may be made only for award recipients that have no significant performance or

compliance issues;

23

October 2022

III. Postaward Requirements

3.2 PERIOD OF AVAILABILITY OF FUNDS

■ a no-cost extension may be made only if supported by a robust narrative justification establishing that the

extension is for the benefit of the Federal government, and contains a plan and timeline for completion within

the period of the no-cost extension;

■ a no-cost extension may not be made merely for the benefit of the recipient or for the purpose of the enabling

the recipient to use unobligated balances; and

■ any provisions of the DOJ Grants Financial Guide relating to no-cost extensions shall be complied with (e.g.,

a no-cost extension must be requested via a Grant Award Modification (GAM) in the grant system of records

at least 30 calendar days before the project end date); and

■ extension of the liquidation period may be allowable for awards if approved by the awarding agency (this

includes the OVC State Victim Assistance Formula Grant Program and State Victim Compensation Formula

Grant Program).

Periods of Performance for Research, Evaluation, and Statistics Awards

Due to the nature of the work to be carried out by the recipient, the usual periods of performance may not

routinely be appropriate for research, evaluation, and statistics awards. (For example, long-term research or

data collection efforts require sufficient time for activities such as institutional review board and Office of

Management and Budget reviews (as appropriate), staff training, field work, data collection and analysis,

presentation of findings, archiving of data, and dissemination of findings.) Accordingly, a research, evaluation, or

statistics award may exceed a 3-year initial period of performance (and/or a 5-year total period of performance,

and more than two continuations awards), when appropriate under the particular circumstances of that project

*Note: not applicable to COPS Office and OVW awards.

24

October 2022 25

III. Postaward Requirements

3.3 MATCHING OR COST SHARING REQUIREMENTS

Match Requirements

Matching or cost sharing means the portion of project costs not paid by Federal funds (unless otherwise

authorized by Federal statute). See 2 C.F.R. § 200.1 (definition of “cost sharing or matching”). Matching

requirements vary across the different Department of Justice (DOJ) programs. Recipients should read the award

announcement and award notice carefully to understand the specific match requirements applicable to their

award. Recipients unclear about the match requirements for their awards should contact their grant manager.

For general government-wide rules regarding match, see 2 C.F.R. § 200.306.

Any departure from the program guidelines must receive prior written approval from the DOJ grant-making

component.

FINANCIAL MANAGEMENT TIP

Matching funds are restricted to the same use of funds as allowed for the Federal

funds. If it is not allowable under the Federal award, it is not allowable as match.

OVW SPECIFIC TIP

The OVW STOP Program matching requirements are available under the Resources

section at: https://www.justice.gov/ovw/grantees.

Frequently Asked Questions (FAQs) are available under the Frequently Asked

Questions section at: https://www.justice.gov/ovw/grantees.

Types of Match

Match requirements are typically stated as a percentage of the total project costs for an award. For example, a

20 percent (20%) match on a $100,000 project would be $20,000, where $80,000 is provided by the Federal

Government and $20,000 is provided by the recipient.

ere are two kinds of match:

■ Cash match (hard) includes cash spent for project-related costs. An allowable cash match must include costs

which are allowable with Federal funds, except acquisition of land, when applicable.

■ ird party in-kind match (soft) includes, but is not limited to, the valuation of non-cash contributions.“In-

kind” may be in the form of services, supplies, real property, and equipment.

For example, if in-kind match is permitted by law, then the value of donated services can be used to comply with

the match requirement. Also, third party in-kind contributions may count toward satisfying match requirements,

provided the recipient of the contributions expends them as allowable costs.

October 2022

III. Postaward Requirements

3.3 MATCHING OR COST SHARING REQUIREMENTS

Documentation supporting the market value of in-kind match must be maintained in the award recipient files.

Valuation of in-kind match may take one of the following forms:

■ Valuation of donated services. Volunteer services furnished by third-party professional and technical

personnel, consultants, and other skilled and unskilled labor may be counted as cost sharing or matching if the

service is an integral and necessary part of an approved project or program.

XVolunteer services. Recipient or subrecipient rates for third-party volunteer services must be consistent

with those rates ordinarily paid for similar work in the recipient’s or subrecipient’s organization. If the

recipient or subrecipient does not have employees performing similar work, the rates will be consistent

with those ordinarily paid by other employers for similar work in the same labor market. In either case, a

reasonable amount for fringe benefits may be included in the valuation.

XEmployees of other organizations. When an employer other than a recipient or subrecipient furnishes

free of charge the services of an employee in the employee’s normal line of work, the services will be valued

at the employee’s regular rate of pay plus an amount of fringe benefits, but exclusive of overhead costs. For

additional guidance on cost sharing or matching, please review 2 C.F.R. § 200.306.

■ Valuation of third party donated supplies, equipment, or space.

XIf a third party donates supplies, equipment, or space, the value must not exceed the fair market value of

the property at the time of donation.

■ Valuation of third party donated equipment, buildings, and land.

XIf a third party donates equipment, buildings, or land, and title passes to a recipient or subrecipient, the

treatment of the donated property will depend upon the purpose of the Federal award.

XAwards for capital expenditures. If the purpose of the award is to assist the recipient or subrecipient

in the acquisition of equipment, buildings or land, the aggregate value of the donated property may be

counted as cost sharing or matching.

XIf the purpose of the award is to support activities that require the use of the property, normally only

depreciation can be charged. However, the fair market value may be allowed, provided that the grant-

making component has approved the charges.

Please refer to 2 C.F.R. § 200.306 for more information about types of match and match requirements.

How to Calculate Match

Formula

Step 1 Award Amount ÷ % of Federal Share = Total

(Adjusted)

Project Cost

Step 2 Total (Adjusted)

Project Cost

x % of Recipient’s Share = Required

Match

Example

Match Requirement - 80/20 (Federal/Recipient)

Federal Award = $100,000

Step 1 $100,000 ÷ 80% Federal Share = $125,000

Step 2 $125,000 x 20% Recipient’s Share = $25,000

26

October 2022

III. Postaward Requirements

3.3 MATCHING OR COST SHARING REQUIREMENTS

COPS OFFICE SPECIFIC TIP

Recipients of COPS Hiring Program and School Violence Prevention Program

grants are required to contribute a local match of at least 25% toward the total cost

of the approved grant project, unless waived in writing by the COPS Ofce.

The local match must be a cash match from funds not previously budgeted for law

enforcement purposes and must be paid during the grant award period.

Source and Type of Funds

Cash match (hard) may be applied from the following sources:

■ Funds from States and units of local government that have a binding commitment of matching funds for

programs or projects (meaning the State or unit of local government has legally appropriated and obligated

the funds).

■ Housing and Community Development Act of 1974, 42 U.S.C. 5301, et seq. (subject to the applicable

policies and restrictions of the U.S. Department of Housing and Urban Development).

■ Appalachian Regional Development Act of 1965, 40 U.S.C. 214.

■ Equitable Sharing Program, 21 U.S.C. §881(e) (current guidelines developed by the U.S. Department of

Justice Asset Forfeiture Office apply). Forfeited assets used as match from the Equitable Sharing Program