HILDA User Manual – Release 10

Michelle Summerfield, Ross Dunn, Simon Freidin,

Markus Hahn, Peter Ittak, Milica Kecmanovic, Ning Li,

Ninette Macalalad, Nicole Watson, Roger Wilkins, Mark

Wooden

Last modified 07/09/2012

The HILDA Project was initiated, and is funded, by the Australian Government

Department of Families, Housing, Community Services and Indigenous Affairs

HILDA User Manual – Release 10 - ii - Last modified: 7/09/2012

Acknowledgements

Ross Dunn, Alison Goode, Clinton Hayes, Bruce Headey, Rosslyn Starick and Claire

Sun have also contributed to parts of this manual over time.

Simon Freidin prepared the HILDA Data Files in consultation with Mark Wooden,

Nicole Watson, Roger Wilkins and Bruce Headey. The following people provided

database support: Paul Agius, Ross Dunn, Peter Ittak, Ninette Macalalad, Michelle

Summerfield and Diana Warren. The weighting and imputation system was

developed by Nicole Watson, Clinton Hayes, Ning Li, Rosslyn Starick and Claire Sun

in consultation with the HILDA Technical Reference Group (John Henstridge,

Stephen Horn, Frank Yu, Robert Breunig, Peter Boal and Tim Fry).

Citation

Readers wishing to cite this document should use the following:

Summerfield, M., Dunn, R., Freidin, S., Hahn, M., Ittak, P., Kecmanovic, M., Li, N.,

Macalalad, N., Watson, N., Wilkins, R. and Wooden, M. (2011), ‘HILDA User Manual

– Release 10’, Melbourne Institute of Applied Economic and Social Research,

University of Melbourne.

HILDA User Manual – Release 10 - iii - Last modified: 7/09/2012

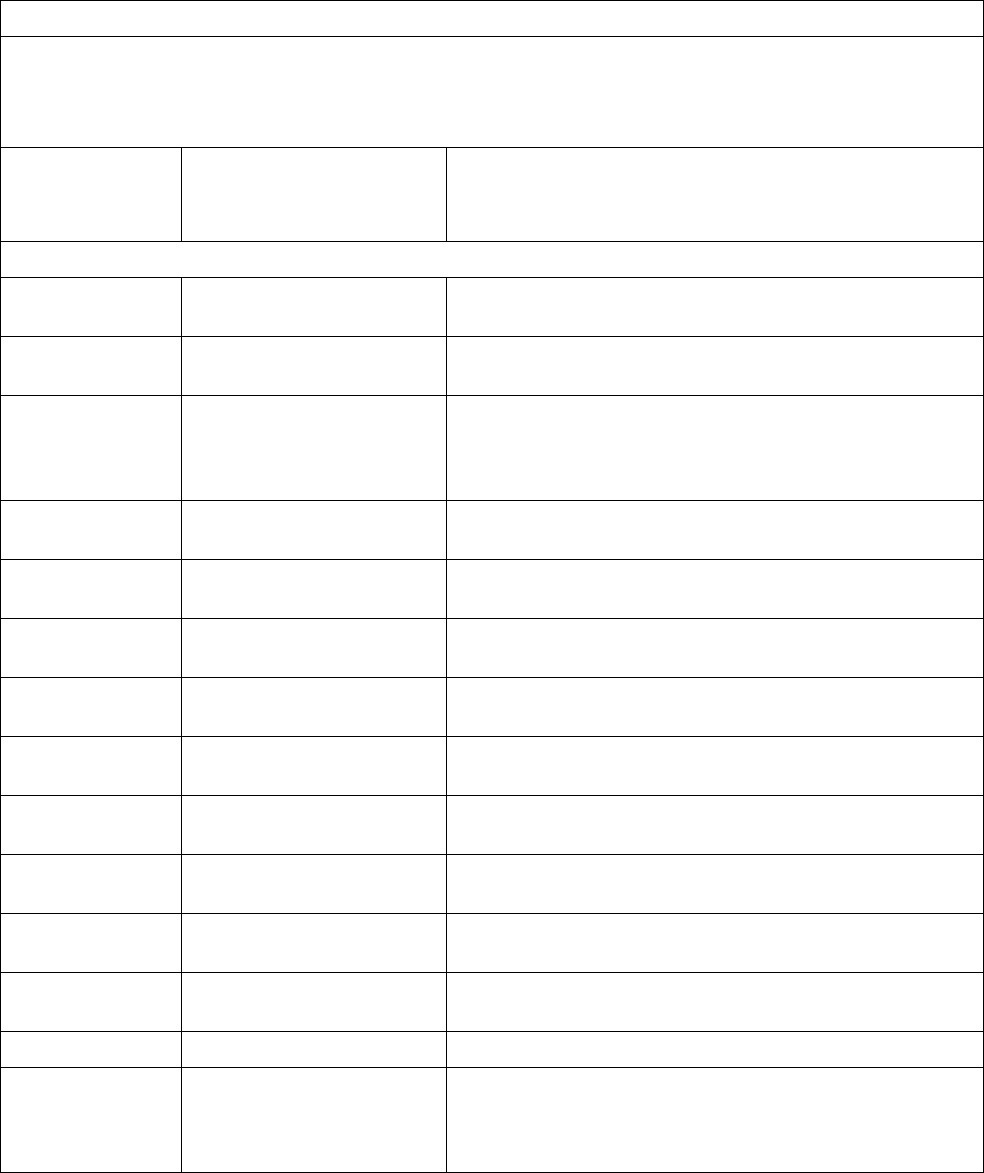

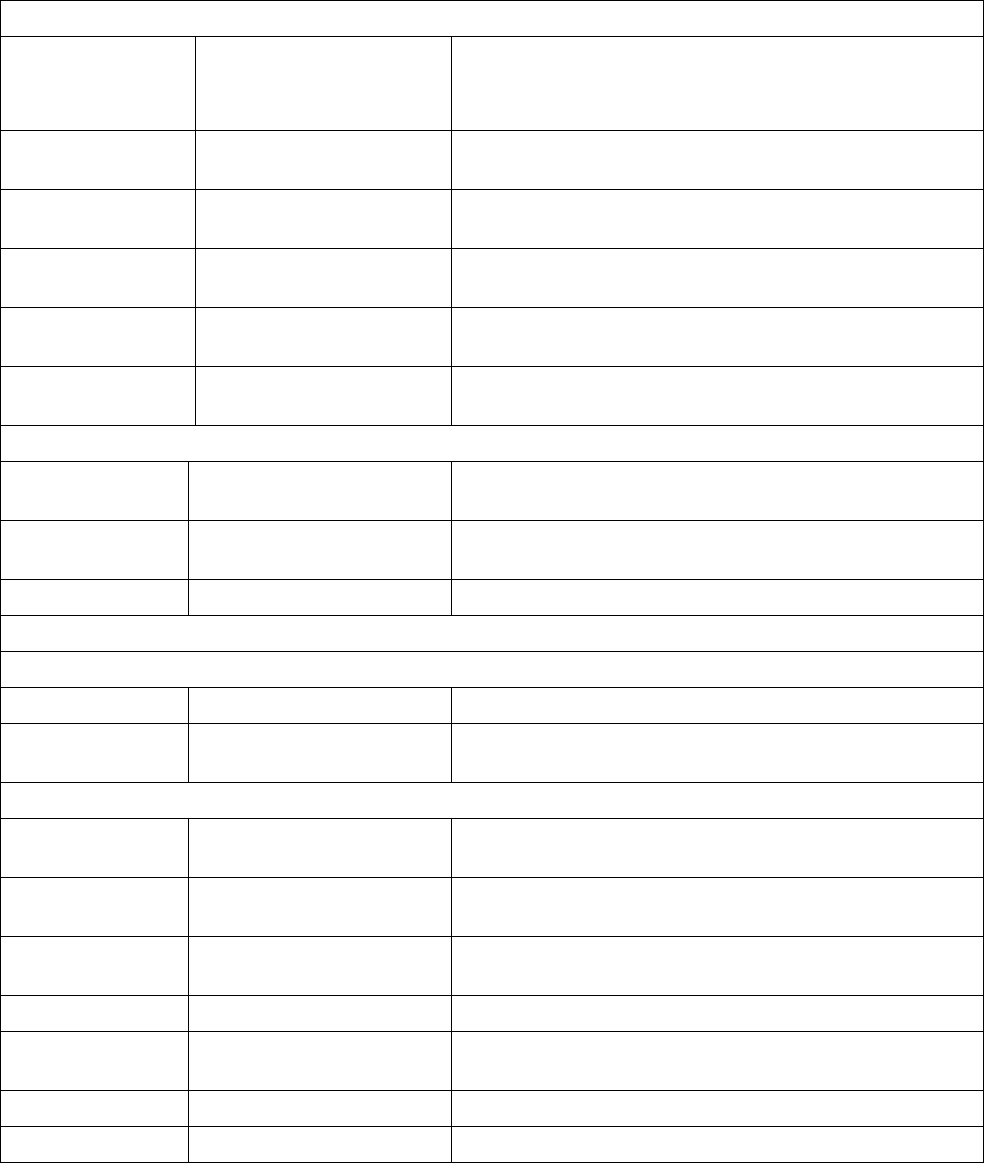

Updates to This Manual

Date

Update

07/09/12

Amended Financial Year Household income graph connector lines

25/11/11

Updated Manual for Release 10

12/08/11

Updated Section 3.10.1 Numeric Variables and Appendix 1b:source

for W1: D1 Attitudes about work and gender roles

16/05/11

Updated Footnote on table 4.2 to say refer to Selected Standard

Classification pdf for framework (following user query).

03/05/11

Updated response rates for W10 after final report.

06/12/10

Updated Manual for Release 9.

HILDA User Manual – Release 10 iv Last modified: 6/12/11

Contents

1 USING THIS MANUAL............................................................................................................................. 1

2 OVERVIEW OF THE HILDA SURVEY ................................................................................................. 2

2.1 THE HILDA SAMPLE AND FOLLOWING RULES: A SUMMARY................................................................... 2

2.2 QUESTIONNAIRES ...................................................................................................................................... 3

2.2.1 Household Form ............................................................................................................................. 4

2.2.2 Household Questionnaire ............................................................................................................... 4

2.2.3 Person Questionnaires .................................................................................................................... 4

2.2.4 Self-Completion Questionnaire ....................................................................................................... 5

3 THE HILDA DATA .................................................................................................................................... 7

3.1 ORDERING THE DATA................................................................................................................................ 8

3.2 CROSS-NATIONAL EQUIVALENT FILE (CNEF) .......................................................................................... 8

3.3 A REMINDER OF THE SECURITY REQUIREMENTS FOR THE DATA .............................................................. 8

3.4 HOW THE DATA FILES ARE PROVIDED ...................................................................................................... 9

3.5 STRUCTURE OF THE DATA FILES ............................................................................................................. 10

3.6 IDENTIFIERS AND USEFUL VARIABLES .................................................................................................... 10

3.7 PROGRAM LIBRARY ................................................................................................................................ 12

3.7.1 Match Files ................................................................................................................................... 13

3.7.2 Add Partner Variables .................................................................................................................. 13

3.7.3 Create Longitudinal Files ............................................................................................................. 13

3.7.4 User Provided Programs .............................................................................................................. 14

3.8 PANELWHIZ ............................................................................................................................................ 14

3.9 VARIABLE NAME CONVENTIONS ............................................................................................................ 15

3.10 MISSING VALUE CONVENTIONS ......................................................................................................... 20

3.10.1 Numeric Variables ................................................................................................................... 20

3.10.2 Text Variables .......................................................................................................................... 21

3.11 DATA WITH NEGATIVE VALUES ........................................................................................................ 21

3.12 CONFIDENTIALISATION ...................................................................................................................... 22

4 DERIVED VARIABLES .......................................................................................................................... 23

4.1 AGE AND SEX .......................................................................................................................................... 23

4.2 HISTORY ................................................................................................................................................. 24

4.3 GEOGRAPHY............................................................................................................................................ 28

4.4 CURRENT EDUCATION............................................................................................................................. 30

4.5 CURRENT MARITAL STATUS AND DEFACTO RELATIONSHIPS .................................................................. 31

4.6 CHILDREN ............................................................................................................................................... 31

4.7 CHILD CARE ............................................................................................................................................ 32

4.8 OCCUPATION AND INDUSTRY .................................................................................................................. 37

4.9 OTHER EMPLOYMENT ............................................................................................................................. 40

4.10 CALCULATING HOURLY WAGE RATES ............................................................................................... 42

4.11 EMPLOYMENT AND EDUCATION CALENDAR ...................................................................................... 43

4.12 FAMILY RELATIONSHIPS .................................................................................................................... 43

4.13 HEALTH .............................................................................................................................................. 48

4.14 TIME USE ........................................................................................................................................... 50

4.15 PERSONALITY ..................................................................................................................................... 50

4.16 RELIGION ........................................................................................................................................... 51

4.17 INCOME .............................................................................................................................................. 51

4.17.1 Income, Tax and Family Benefits Model .................................................................................. 51

4.17.2 Imputation Method ................................................................................................................... 61

4.17.3 Imputed Income Variables ....................................................................................................... 63

4.18 WEALTH (SPECIAL TOPIC IN WAVES 2, 6 AND 10) .............................................................................. 66

4.18.1 Wealth Model ........................................................................................................................... 66

4.18.2 Imputation Method ................................................................................................................... 69

4.18.3 Imputed Wealth Variables ........................................................................................................ 71

4.19 EXPENDITURE ..................................................................................................................................... 73

4.19.1 Imputation Method ................................................................................................................... 73

4.19.2 Imputed Household Expenditure Variables ............................................................................. 75

HILDA User Manual – Release 10 v Last modified: 6/12/11

4.20

WEIGHTS ............................................................................................................................................ 77

4.20.1 Cross-Sectional Weights .......................................................................................................... 77

4.20.2 Longitudinal Weights ............................................................................................................... 78

4.20.3 Benchmarks .............................................................................................................................. 78

4.20.4 Replicate Weights ..................................................................................................................... 80

4.20.5 Weights Provided on the Data Files ........................................................................................ 80

4.20.6 Advice on Using Weights ......................................................................................................... 83

5 DOCUMENTATION ................................................................................................................................ 87

5.1 DOCUMENTATION CHOICES .................................................................................................................... 87

5.2 MARKED-UP QUESTIONNAIRES ............................................................................................................... 87

5.3 VARIABLE LISTINGS ................................................................................................................................ 88

5.3.1 Subject Listing .............................................................................................................................. 88

5.3.2 Cross-Wave Variable Listing ........................................................................................................ 89

5.3.3 Selected Standard Classifications ................................................................................................. 89

5.4 FREQUENCIES .......................................................................................................................................... 89

5.5 ON-LINE DATA DICTIONARY ................................................................................................................... 90

6 DATA QUALITY ISSUES ....................................................................................................................... 91

6.1 SUMMARY OF DATA QUALITY ISSUES ..................................................................................................... 91

6.2 MISSING INCOME DATA ........................................................................................................................ 100

6.3 MISSING WEALTH DATA ....................................................................................................................... 104

6.4 MISSING EXPENDITURE DATA ............................................................................................................... 108

7 THE HILDA SAMPLE........................................................................................................................... 111

7.1 SAMPLE DESIGN .................................................................................................................................... 111

7.1.1 Overview ..................................................................................................................................... 111

7.1.2 Reference Population .................................................................................................................. 111

7.1.3 Sampling Units ............................................................................................................................ 112

7.1.4 Sample Selection ......................................................................................................................... 113

7.2 FOLLOWING RULES ............................................................................................................................... 113

8 DATA COLLECTION ........................................................................................................................... 114

8.1 PILOT TESTING ...................................................................................................................................... 114

8.2 DEPENDANT DATA ................................................................................................................................ 114

8.3 QUESTIONNAIRE LENGTH...................................................................................................................... 115

8.4 INTERVIEWERS ...................................................................................................................................... 115

8.5 FIELDWORK PROCESS............................................................................................................................ 116

8.5.1 Data Collection Mode ................................................................................................................. 116

8.5.2 Timeline ...................................................................................................................................... 117

8.5.3 Survey Notification Material....................................................................................................... 118

8.5.4 Respondent Incentives ................................................................................................................. 119

8.5.5 Call Routine, Follow-Up and Refusal Aversion .......................................................................... 119

8.5.6 Foreign Language Interviews ..................................................................................................... 120

8.5.7 Interviewer Monitoring ............................................................................................................... 120

8.6 RESPONSE RATES .................................................................................................................................. 120

8.7 ATTRITION BIAS .................................................................................................................................... 129

9 HILDA USER TRAINING ..................................................................................................................... 132

10 GETTING MORE INFORMATION .................................................................................................... 133

11 REFERENCES ........................................................................................................................................ 134

APPENDIX 1A: SUMMARY OF HILDA SURVEY CONTENT, WAVES 1 – 10 .................................... 138

APPENDIX 1B: SURVEY INSTRUMENT DEVELOPMENT AND SOURCES ...................................... 148

APPENDIX 1C: LIST OF ACRONYMS USED ............................................................................................ 164

APPENDIX 2: IMPUTATION METHODS USED IN THE HILDA SURVEY ......................................... 165

NEAREST NEIGHBOUR REGRESSION METHOD ................................................................................................ 165

LITTLE AND SU METHOD ................................................................................................................................ 165

HILDA User Manual – Release 10 vi Last modified: 6/12/11

P

OPULATION CARRYOVER METHOD ............................................................................................................... 166

HOTDECK METHOD ........................................................................................................................................ 167

HILDA User Manual – Release 10 vii Last modified: 6/12/11

List of Figures

Figure 2.1: The evolution of the HILDA Survey sample across the first three waves ................... 3

Figure 4.1: Family where a new defacto relationship is formed

.................................................... 45

Figure 4.2: Family where a new child is born

................................................................................... 45

Figure 4.3: Construction of family type description

........................................................................ 46

Figure 4.4: Construction of household type description

................................................................ 46

Figure 4.5: Income units in a family with child under 15, dependent student and non-dependent

children

............................................................................................................................... 47

Figure 4.6: Financial year income model (household-level)

........................................................... 56

Figure 4.7: Financial year income model (enumerated person-level)

........................................... 57

Figure 4.8: Financial year income model (responding-level)

......................................................... 58

Figure 4.9: Wealth model (household-level)

..................................................................................... 68

Figure 5.1: Example of the marked-up questionnaires

................................................................... 88

Figure 5.2:: Example of the subject listing

....................................................................................... 88

Figure 5.3: Example of the cross-wave variable listing (wave 7, 8, 9 and 10 truncated)

............. 89

Figure 5.4: Example of the frequencies

............................................................................................ 89

HILDA User Manual – Release 10 viii Last modified: 6/12/11

List of Tables

Table 2.1: Actual and proposed structure of the HILDA questionnaire modules .......................... 2

Table 2.2: Sections of the Person Questionnaires

............................................................................ 5

Table 2.3: Sections of the Self-Completion Questionnaire

............................................................... 6

Table 3.1: Total number of HILDA data users, Release 1 to 9

.......................................................... 7

Table 3.2: HILDA data users by type, Release 1 to 9

......................................................................... 7

Table 3.3: List of useful variables

..................................................................................................... 12

Table 3.4: Broad subject area naming conventions, characters 2 and 3 (sorted by code)

......... 16

Table 3.5: Different codes for household response status

............................................................ 17

Table 3.6: Different codes for person response status

................................................................... 18

Table 3.7: Different codes for SCQ field response status

.............................................................. 19

Table 3.8: Different codes for household membership

................................................................... 19

Table 3.9: Different codes for new location of mover

..................................................................... 20

Table 3.10: Missing value conventions for numeric variables

....................................................... 20

Table 3.11: Missing value conventions for text variables

............................................................... 21

Table 4.1: History variables

............................................................................................................... 24

Table 4.2: Derived geographic variables

.......................................................................................... 29

Table 4.3: Derived current education variables

............................................................................... 30

Table 4.4: Derived current marital status and defacto relationship variables

.............................. 31

Table 4.5: Derived children variables

................................................................................................ 32

Table 4.6: Child care variables

.......................................................................................................... 34

Table 4.7: Derived occupation and industry variables

.................................................................... 39

Table 4.8: Other derived employment variables

.............................................................................. 41

Table 4.9: Derived employment and education calendar variables

............................................... 43

Table 4.10: Derived family variables

................................................................................................. 47

Table 4.11: Derived health variables

................................................................................................. 49

Table 4.12: Derived time use variables

............................................................................................. 50

Table 4.13: Derived personality variables

........................................................................................ 51

Table 4.14: Australian resident income tax rates, waves 1 to 10

................................................... 55

Table 4.15: Other derived income variables ..................................................................................... 60

Table 4.16: Percentage of missing cases imputed by imputation method (income), waves 1 to 10

............................................................................................................................................. 62

Table 4.17: Imputed income variables

.............................................................................................. 63

Table 4.18: Other derived wealth variables at household-level

..................................................... 69

Table 4.19: Percentage of missing cases imputed by imputation method (wealth), waves 2, 6, and

10

......................................................................................................................................... 71

Table 4.20: Percentage of missing cases imputed by imputation method (home value), waves 1

to 10

..................................................................................................................................... 71

Table 4.21: Imputed wealth variables

................................................................................................ 72

Table 4.22: Percentage of missing cases imputed by imputation method (expenditure), waves 1

to 10

..................................................................................................................................... 75

Table 4.23: Imputed household expenditure variables

................................................................... 76

Table 4.24: Benchmarks used in weighting

..................................................................................... 80

Table 4.25: Weights

............................................................................................................................. 81

Table 4.26: Sample design variables

................................................................................................ 85

Table 6.1: Summary of the data quality issues in the HILDA data

................................................. 91

Table 6.2: Proportion of cases with missing income data, waves 1 to 10 (per cent)

................. 101

HILDA User Manual – Release 10 ix Last modified: 6/12/11

Table 6.3: Mean financial year income ($) (including imputed values) and percent of mean

income imputed, waves 1 to 10 (weighted)

................................................................... 104

Table 6.4: Cases with missing wealth data including and excluding wealth band responses,

waves 2, 6 and 10 (per cent)

........................................................................................... 105

Table 6.5: Households with missing home value data, waves 1 to 10 (per cent)

....................... 107

Table 6.6: Mean wealth value ($) (including imputed values) and percentage of mean value

imputed, waves 2, 6 and 10 (weighted)

......................................................................... 107

Table 6.7: Mean home value ($’000) (including imputed values) and percentage of mean value

imputed, waves 1 to 10 (weighted)

................................................................................ 108

Table 6.8: Households with missing expenditure data, wave 1 – 10 (per cent)

.......................... 108

Table 6.9: Mean expenditure and percentage of mean expenditure imputed, wave 1 – 10

(weighted)

......................................................................................................................... 110

Table 8.1: Average time (minutes) taken to complete questionnaires, waves 1 to 8

................. 115

Table 8.2: Number of interviewers and percentage of new interviewers each wave

................. 116

Table 8.3: Percentage of respondents interviewed by telephone

................................................ 116

Table 8.4: Fieldwork dates and percentage of interviews post December

................................. 117

Table 8.5: Distribution of individual interviews conducted by month, waves 1 to 10

............... 118

Table 8.6: Distribution of individual interviews conducted around the anniversary of the prior

wave’s interview, waves 2 to 10

..................................................................................... 118

Table 8.7: Wave 1 household outcomes

......................................................................................... 121

Table 8.8: Wave 1 person outcomes

............................................................................................... 121

Table 8.9: Wave 2 household outcomes

......................................................................................... 122

Table 8.10: Wave 3 household outcomes

....................................................................................... 122

Table 8.11: Wave 4 household outcomes

....................................................................................... 123

Table 8.12: Wave 5 household outcomes

....................................................................................... 123

Table 8.13: Wave 6 household outcomes

....................................................................................... 124

Table 8.14: Wave 7 household outcomes

....................................................................................... 124

Table 8.15: Wave 8 household outcomes

....................................................................................... 125

Table 8.16: Wave 9 household outcomes

....................................................................................... 125

Table 8.17: Wave 10 household outcomes

..................................................................................... 126

Table 8.18: Wave 2 to 10 person outcomes against wave 1 person outcomes

.......................... 127

Table 8.19: Individual response rates for the HILDA Survey, waves 2 to 10 compared

............ 128

Table 8.20: Self Completion Questionnaire response rate, wave 1 to 10

.................................... 129

Table 8.21: Percentage of wave 1 respondents re-interviewed by selected sample characteristics

........................................................................................................................................... 131

HILDA User Manual – Release 10 1 Last modified: 6/12/11

1 USING THIS MANUAL

The HILDA Survey is a household-based longitudinal survey named the Household,

Income and Labour Dynamics in Australia Survey. This manual has been designed

for the users of the HILDA data.

The manual aims to cover the things that you need to know to use the HILDA data –

such as missing data conventions, an introduction to the derived variables, how to

put the data files together, imputation, weights and how to find your way around the

documentation.

The best way to use this manual is as a reference tool. It is unlikely that you will sit

down and read it cover to cover and take away everything you need to know about

the data. More realistically, you will start to work with the data and will need some

information about certain aspects of the data or the survey – and hopefully you will

be able to find it within this manual fairly easily.

We welcome any feedback you have on this manual. It will be updated as

successive waves are made available to researchers and we are happy to hear how

it could be improved. If there is something that you expected to find in the manual

and didn’t, or if you had difficulty finding or understanding any section, please let us

know (email hilda-inquiries@unimelb.edu.au).

HILDA User Manual – Release 10 2 Last modified: 6/12/11

2 OVERVIEW OF THE HILDA SURVEY

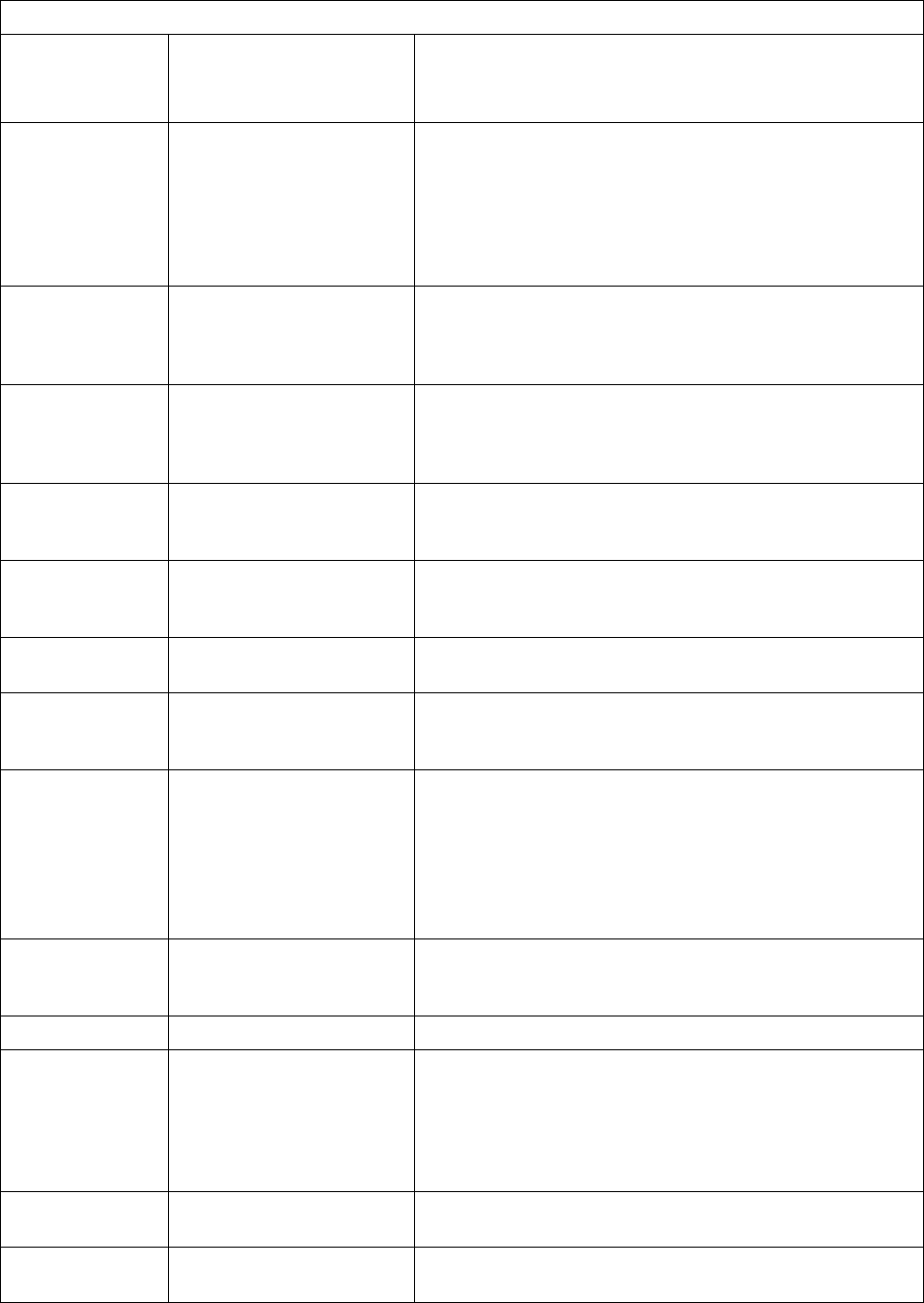

The HILDA Survey is a broad social and economic longitudinal survey, with

particular attention paid to family and household formation, income and work. As the

HILDA Survey has a longitudinal design, most questions are repeated each year.

Nevertheless, within each survey wave, scope exists for asking questions on topics

that will not be covered every year. The major modules included in the HILDA

Survey are listed in Table 2.1.

Table 2.1: Actual and proposed structure of the HILDA questionnaire modules

Wave

2 3 4 5 6 7 8 9 10 11

1

12

1

Major modules

Wealth X X X

Fertility X X X

Health X

Education / Human capital X

Minor modules

Retirement X X X

Intentions and plans X X X

Non co-residential partners X X X

Non—co-residential parents,

siblings and adult children

X X

Health insurance X X

Youth X

Literacy and numeracy X X

Diet X X

1. The content for waves 11 and 12 is under discussion.

2.1 The HILDA Sample and Following Rules: A Summary

The HILDA Survey began with a large national probability sample of Australian

households occupying private dwellings. All members of the households providing at

least one interview in wave 1 form the basis of the panel to be pursued in each

subsequent wave. The sample has been gradually extended to include any new

household members resulting from changes in the composition of the original

households. From wave 9, new household members that arrived in Australia for the

first time after 2001 were also added to the sample.

Continuing Sample Members (CSMs) are defined to include all members of wave 1

households. Any children subsequently born to or adopted by CSMs are also

classified as CSMs. Further, all new entrants to a household who have a child with a

CSM are converted to CSM status. CSMs remain in the sample indefinitely. All other

HILDA User Manual – Release 10 3 Last modified: 6/12/11

people who share a household with a CSM in wave 2 or later are considered

Temporary Sample Members (TSMs). TSMs are followed for as long as they share a

household with a CSM. The variable hhsm on the master file identifies TSMs while

the CSMs are split into two groups: OSMs (original sample members from wave 1)

and OPMs (other permanent sample members, i.e. ‘new’ CSMs).

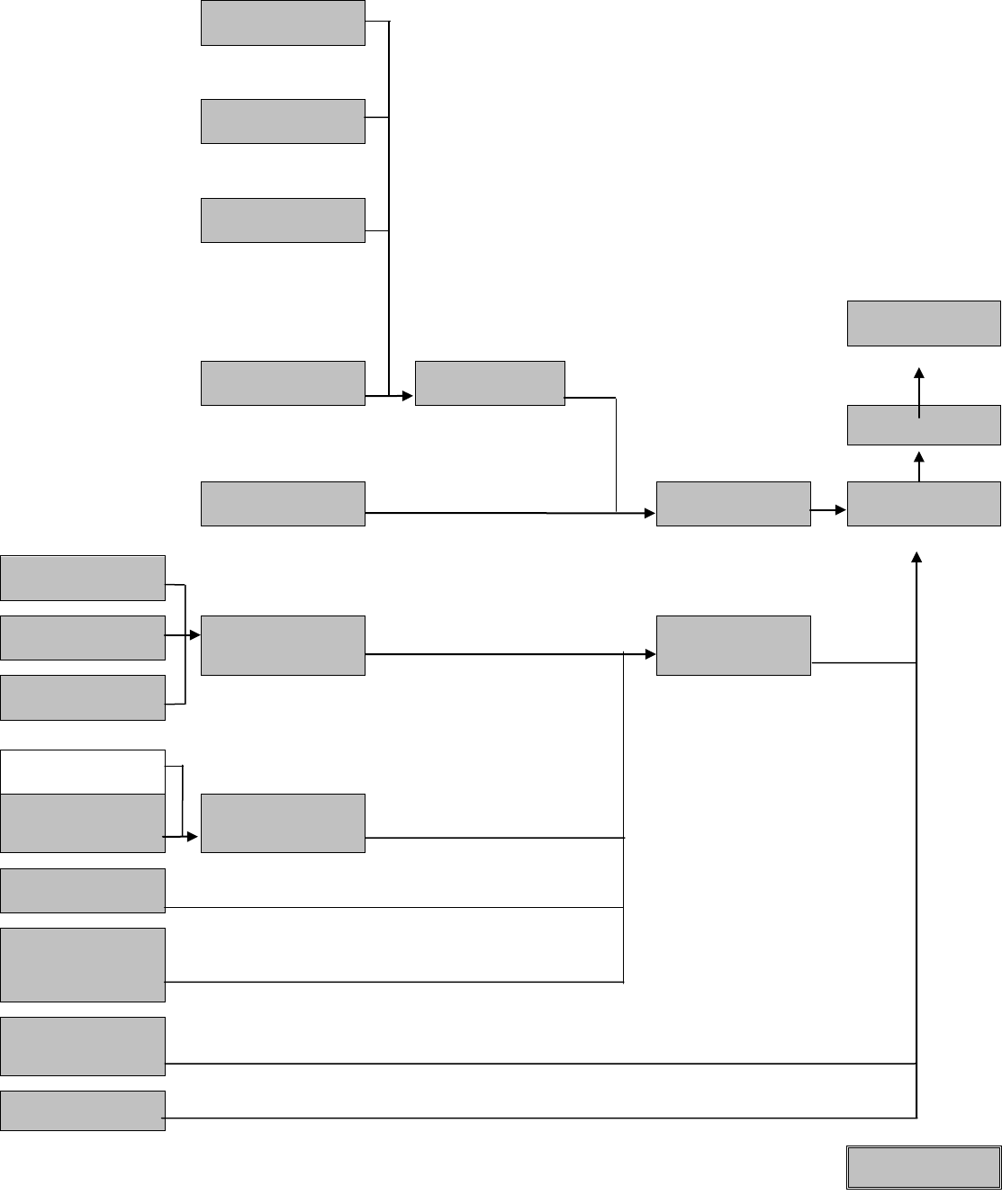

Figure 2.1 shows an example of how the sample evolved across the first three

waves. In wave 1, the sample consisted of 19,914 people. A further 442 births and

54 parents of newborns who were not originally CSMs have been added to the

sample in waves 2 and 3. A total of 177 deaths have been identified across the two

follow-up waves and 256 people have moved overseas, though 24 returned after

being away for one wave. Of the TSMs joining the sample in wave 2, a third had

moved out by wave 3.

Figure 2.1: The evolution of the HILDA Survey sample across the first three waves

2.2 Questionnaires

In wave 1, the HILDA survey comprised four different instruments. These were:

HILDA User Manual – Release 10 4 Last modified: 6/12/11

• the Household Form (HF);

• the Household Questionnaire (HQ);

• the Person Questionnaire (PQ); and

• the Self-Completion Questionnaire (SCQ).

In subsequent waves, the PQ was replaced with two instruments:

• the Continuing Person Questionnaire (CPQ), for people who have been

interviewed in a previous wave, and

• the New Person Questionnaire (NPQ), for people who have never been

interviewed before (which collects family background and personal history

information along with the regular content).

Appendix 1a provides a guide to topics covered in the HILDA Survey across the

waves. Appendix 1b provides a list of sources used in constructing survey questions.

The questionnaires can be downloaded from the HILDA website:

http://www.melbourneinstitute.com/hilda/questionnaires/default.html or you can view

the questionnaires provided with the data files which have been marked up with the

associated variable names (see the documentation section later in this manual).

2.2.1 Household Form

The HF is designed to record basic information about the composition of the

household immediately after making contact. The HF is the ‘master document’ used

by interviewers to decide who to interview, how to treat joiners and leavers of the

household, and to record call information and non-interview reasons. The date the

HF is completed is provided in _hhcomps. The number of interviews completed in

the household is given in _hhivws.

2.2.2 Household Questionnaire

The HQ collects information about the household rather than about individual

household members per se, and is only administered to one member of the

household. In practice, however, interviewers are encouraged to be flexible. If more

than one household member wishes to be present at the interview this is perfectly

acceptable. Further, interviewers are given the flexibility to deliver part of this

interview to one household member and part to another. Indeed, this was often

required, with questions on child care needing to be asked of the primary care giver.

The date the HQ is completed is provided in _hhhqivw.

The HQ mainly covers child care arrangements, housing, household spending (until

wave 5) and, in waves 2 and 6, household wealth.

2.2.3 Person Questionnaires

The PQs are administered to every member of the household aged 15 years and

over. The CPQ is for people who have ever been interviewed before and the NPQ is

for those who have never been interviewed before. Parental consent is sought

before interviewing persons aged under 18 years who are still living with their

parents. _hhpq states which type of interview was applicable and _hgwsli indicates

how many weeks have elapsed since the respondent’s last interview (if they are

completing a CPQ). The date the PQ is completed is provided in _hhidate.

HILDA User Manual – Release 10 5 Last modified: 6/12/11

The sections of the person questionnaires are shown in Table 2.2 together with the

letter used to identify the section. These will help you locate questions on the

questionnaires (for example, if you wanted to find questions on education, look in

section C of the wave 1 Person Questionnaire and section A of the Continuing

Person Questionnaire and New Person Questionnaire from wave 2 onwards).

The PQ in wave 1 is distinctive from that used in the later waves as it collected

biographical data that only needs to be asked once. These questions are spread

throughout the survey and include questions about country of birth and language,

family background, educational attainment, employment history, and marital history.

In addition, at later waves further biographical information about visa category for

immigrants (wave 4) and parents’ education (wave 5) was collected.

The NPQ differs from the CPQ in the inclusion of these additional biographical

history questions.

Table 2.2: Sections of the Person Questionnaires

Topics

Section

Wave 2 onwards Wave 1

Country of birth AA (NPQ only, except in wave 4

1

) A

Family background BB (NPQ only) B

Education A C

Employment status B D

Current employment C E

Persons not in paid employment D D, F

Annual activity calendar E FG

Income F G

Family formation G H

Partnering/relationships H J

Health, life satisfaction, moving K K

Tracking information T T

Interviewer observations Z Z

Special Topics

Wealth (wave 2, 6 and 10) J

Retirement (wave 3 ,7 and 10) L

Private health insurance (wave 4 only) J

Youth issues (wave 4 only) L

Fertility and partnering (wave 5 and 8) G, H

Intentions and Plans (wave 5 and 8) L

1. Immigration Status asked in wave 4 in section AA

2.2.4 Self-Completion Questionnaire

Finally, all persons completing a person questionnaire are asked to complete a Self-

Completion Questionnaire which the interviewer collects at a later date, or failing

that, is returned by mail. This questionnaire comprises mainly attitudinal questions,

many of which cover topics which respondents may feel slightly uncomfortable

answering in a face-to-face interview. The date that the SCQ is completed is not

HILDA User Manual – Release 10 6 Last modified: 6/12/11

collected for waves 1 to 8 (but is included from wave 9). The variable _hhmpid

indicates whether an SCQ has been matched to the PQ.

Table 2.3 shows the sections of the SCQ together with the letter used to identify the

section.

Table 2.3: Sections of the Self-Completion Questionnaire

Topics Wave 1 W5 and 8 Other waves

General health and well-being (SF-36) A A A

Lifestyle and living situation B B B

Personal and household finances C C C

Attitudes and values D D -

Job and workplace issues E E D

Parenting F F E

Sex and age - G F

HILDA User Manual – Release 10 7 Last modified: 6/12/11

3 THE HILDA DATA

The HILDA Survey has already developed a sizeable community of users. Table 3.1

and Table 3.2 show the total number of individuals who have been approved access

to at least one of the data releases and the composition of our user community.

There are also 82 users of the HILDA-Cross-National Equivalent File (HILDA-CNEF).

Table 3.1: Total number of HILDA data users, Release 1 to 9

Release Total data orders Orders by new users Cumulative no. of users

Release 1 204 204 204

Release 2 265 169 373

Release 3 279 157 530

Release 4 329 176 706

Release 5 387 196 902

Release 6 401 176 1078

Release 7 455 199 1277

Release 8 430 124 1401

Release 9 486 131 1532

Table 3.2: HILDA data users by type, Release 1 to 9

Release

Type of user 1 2 3 4 5 6 7 8 9

Academic – Australia 84 112 126 142 169 178 205 199 238

Academic –

Overseas

5 15 18 19 24 25 37 24 52

Students – Honours

year

3 13 16 15 13 7 13 17 13

Students –

Postgraduate

9 16 18 31 42 41 41 44 55

Government –

Australian

87 87 82 103 120 134 137 119 104

Government –

State/Local

8 14 8 11 8 5 10 6 8

Other 8 8 11 8 11 11 12 21 18

Total 204 265 279 329 387 401 455 430 488

HILDA User Manual – Release 10 8 Last modified: 6/12/11

3.1 Ordering the Data

Access to the data can be gained by an Organisational Licence or an Individual

Licence. You MUST be a registered user to use the data. Organisations that are

likely to have more than four individuals who wish to use the HILDA data should

consider signing up to an Organisational Licence as this would provide quicker

access to the data (and at a lower cost) once the Organisational Licence is signed.

Details of how to order the data are provided on the HILDA website:

http://www.melbourneinstitute.com/hilda/data/default.html

3.2 Cross-National Equivalent File (CNEF)

The Cross National Equivalent File originated from a Cornell University project to

create an equivalent set of income measures for the German SOEP and the

American PSID. It has since expanded to include data from many other countries

which are undertaking longitudinal household panels (Australia, Canada, Germany,

Great Britain, Korea, Switzerland and the United States), and the range of data has

expanded to include employment, health and psychological measures. The HILDA-

CNEF files are included on the HILDA DVD, but the password must be obtained from

Cornell.

The current CNEF-HILDA codebooks and details of how to order the CNEF data can

be found at

3.3 A Reminder of the Security Requirements for the Data

http://www.melbourneinstitute.com/hilda/cnef.html.

The Deed of Licence and the Deed of Confidentiality stipulates numerous security

requirements for the data, some of which are outlined below:

• You CANNOT provide the data to any unauthorised individual (to be

authorised, you must have an Individual Deed of Licence countersigned by

the FaHCSIA delegate or have a Deed of Confidentiality countersigned by

your organisation’s approved Data Manager).

• You MUST include the following paragraph in any work written that use the

HILDA data:

This paper uses unit record data from the Household, Income and

Labour Dynamics in Australia (HILDA) Survey. The HILDA Project was

initiated and is funded by the Australian Government Department of

Families, Housing, Community Services and Indigenous Affairs

(FaHCSIA) and is managed by the Melbourne Institute of Applied

Economic and Social Research (Melbourne Institute). The findings and

views reported in this paper, however, are those of the author and

should not be attributed to either FaHCSIA or the Melbourne Institute.

• If you plan to change employers and you have an Individual Deed of

Licence, you MUST contact FaHCSIA before doing so to discuss suitable

arrangements for the data. Under certain conditions you may be able to

take the data with you. Otherwise, you will need to delete any data files

HILDA User Manual – Release 10 9 Last modified: 6/12/11

and destroy the CD/DVD and notify FaHCSIA

(longitudinalsurveys@fahcsia.gov.au) and the Melbourne Institute (hilda-

inquiries@unimelb.edu.au) that you have done so.

• If you plan to change employers and your organisation has an

Organisational Deed of Licence, you MUST contact your organisation’s

Data Manager to resolve your user obligations to the security of the

dataset.

• If you change your research project you MUST first seek permission for

the new project from FaHCSIA.

• The HILDA CD/DVD MUST be kept secure in a locked filing cabinet or

other secure container when not in use.

• The keys or combinations for the filing cabinet or other secure container

must be kept secure and not given to any unauthorised user.

• The HILDA data (and any derivatives of the HILDA data) must be stored

on a password protected computer or network and must not be given to

any unauthorised user.

• Your password MUST be at least 7 characters long, include a mixture of

upper and lowercase characters, contain numbers and some non-

alphanumeric characters such as # ; * or !.

• Any printed unit record output MUST be stored in a locked filing cabinet or

other secure container when not in use. Any printed unit record output

MUST be shredded if no longer required.

• There MUST be a means of limiting access to the work area where the

data is kept and tamper evident barriers to access (i.e., if there were a

break-in, it would be obvious from broken glass, damaged lock, etc).

3.4 How the Data Files are Provided

All data are provided in SAS, SPSS

1

and STATA (Version 10 and 11)

2

The DVD also includes extensive documentation of the data, including coding

frameworks, marked-up questionnaires and variable frequencies. The files and the

documentation are discussed in detail in later sections. Changes to the data files

between Releases can be found at:

formats.

http://www.melbourneinstitute.com/hilda/doc/previous_releases.html.

The data files can be transferred to other statistical packages using StatTransfer or

any other data conversion package of your choice.

3

1

SPSS portable files can be obtained by special request to

You may need to restrict the

number of variables to be included in your transferred datasets due to the limitations

on the number of variables imposed by some statistical packages.

hilda-inquiries@unimelb.edu.au.

2

You will need to use STATA SE as there are more than 2047 variables in the datasets. Suitable

memory and maxvar values are provided in “Readme 100.pdf” on the DVD.

3

A trial copy of StatTransfer Version 10 can be downloaded from www.stattransfer.com or purchased

online at

www.stattransfer.com/html/store.html.

HILDA User Manual – Release 10 10 Last modified: 6/12/11

3.5 Structure of the Data Files

For each wave, there are four files:

• Household File – containing information from the HF and HQ.

• Enumerated Person File – listing all persons in all responding households

and contains limited information from the HF (includes respondents, non-

respondents and children).

4

• Responding Person File – containing all persons who provided an

interview and contains CPQ/NPQ and SCQ information.

5

• Combined file – this is a combined file of the three files above. The

household information and responding person information is matched to

each enumerated person.

In addition, a master file and a longitudinal weights file are provided. The master file

contains all persons enumerated at any wave, their interview status in each wave

and limited information about the individual. You can convert the master file to a long

format if you use the rest of the data in long format. The longitudinal weights file

contains weights for all sequential balanced panel combinations and all balanced

pairs of waves.

3.6 Identifiers and Useful Variables

Household and person level files within a wave can be merged by using _hhrhid (i.e.

ahhrhid for wave 1, bhhrhid for wave 2, etc).

6

Information from enumerated or responding person files can be linked across waves

by using either:

Note that where we use the

underscore ‘_’ in the variable name, you will need to replace it with the appropriate

letter for the wave, ‘a’ for wave 1, ‘b’ for wave 2, etc. Enumerated and responding

person files within a wave can be merged by using the cross-wave identifier xwaveid

or the wave specific person identifier _hhrpid. In wave 1, the first six characters of

_hhrpid is the household identifier and the last two characters of the person identifier

is the person number within the household. In wave 2 onwards, the first five

characters are the household identifier and the next two are the person number.

• the cross-wave identifier xwaveid; or

4

The variable _hgenum indicates whether the person belonged to a responding household each

wave and this may be useful when selecting those who have been tracked over the entire study

irrespective of whether they were interviewed (enumerated at all waves).

5

The variable _hgint indicates whether the person completed an interview and this is one way to select a

balanced responding panel (_hgint

=1 at all waves), or to reduce the Combined files into “interviewed adult

only” files (this removes the person level records for children or “non-responding adults from responding

households” which are included to describe the whole Australian population when calculating measures

such as the poverty rate or gini coefficient)..

.

6

Users of the In-confidence Release files can alternatively use _hhid to match the household and

person files, and _hhpid to match the person files. In wave 1, the household identifier is six digits long,

corresponding to area (three digits), dwelling number (two digits) and household number (one digit).

The person identifier in wave 1 is then eight digits long – the first six are the household identifier,

followed by two digits for the person number. In subsequent waves, the household identifier is five

digits long, and the person identifier is seven digits long.

HILDA User Manual – Release 10 11 Last modified: 6/12/11

• the master file which shows the identifiers for each person each wave.

Note that while xwaveid is the unique identifier to match each person across all

waves, _hhrhid and _hhrpid are specific identifiers to match each person within a

wave. As _hhrhid and _hhrpid are randomly assigned each wave, the same person

will have a different _hhrhid and _hhrpid from wave to wave. Persons in the same

household in each wave will share the same _hhrhid and the same first 5 digits in

_hhrpid (or the same first 6 digits in ahhrpid in the case of wave 1).

Partners within the household are identified by their cross-wave identifier (_hhpxid)

or by their two digit person number for the household (_hhprtid). These variables are

provided on both the enumerated and responding person files and are derived using

the HF relationship grid. Partners are either married or de-facto and include same

sex couples. _hhprtid is the person number for the household (for example, if person

02’s partner is person 05, the partner identifier for person 02 will contain ‘05’ and for

person 05 it will contain ‘02’). You will need to concatenate the household identifier

with the partner identifier before you can match on partner characteristics to the

person file. Using the partner’s cross-wave identifier (_hhpxid) will be much easier.

Parents within the household are similarly identified in _hhfxid and _hhmxid (father’s

and mother’s crosswave identifiers) or _hhfid (father’s person number) and _hhmid

(mother’s person number). A parent may be natural, adopted, step or foster (a

parent’s de facto partner also counts as a parent).

Listed below in Table 3.3 are some useful socio-demographic variables. These are

provided to help new users get started with using the HILDA data.

HILDA User Manual – Release 10 12 Last modified: 6/12/11

Table 3.3: List of useful variables

Variable Description Variable Description

xwaveid Cross wave person identifier _hhfty Family type

_hhrhid Random household identifier _hhiu Income unit

_hhrpid Random person identifier _hhpxid Partner’s cross-wave identifier

hhsm Sample member type _hhfxid Father’s cross-wave identifier

_hhresp Household response status _hhmxid Mother’s cross-wave identifier

_fstatus Person response status (master file) _hhstate State

_hhpers Number of persons in household _hhsos Section of state

_hhtype Household type _hhmsr Major statistical region

_hhyng Age of youngest person in HH _ancob Country of birth

_hhold Age of oldest person in HH _hgage Age

_hhrih Relationship in household _hgsex Sex

_hhfam Family number _mrcurr Marital status

_esbrd,

_esdtl

Employment status (broad, detail) _losat Life satisfaction

_jbhruc

Combined per week usually worked

in all jobs

_edhigh Highest education level achieved

_jbmo62 Occupation code 2-digit ANZSCO _edfts Full-time student

_wscei

Imputed current weekly gross

wages and salary – all jobs

_edagels Age left school

_wsfei

Imputed financial year gross wages

and salary

_edhists

Highest year of school completed/currently

attending

_hifdip,

_hifdin

Household disposable income

(positive and negative)

_edtypes Type of school attended/attending

_hhda10

SEIFA decile of socio-economic

disadvantage

_helth

Long term health

condition/disability/impairment from PQ

3.7 Program Library

Several programs have been provided on the HILDA website in SAS, SPSS and

Stata to help you get started with the HILDA data. These files are found on

http://www.melbourneinstitute.com/hilda/doc/programlibrary.html

HILDA User Manual – Release 10 13 Last modified: 6/12/11

3.7.1 Match Files

The programs showing how to match files are:

• Program 1 – SAS program to match wave 1 household and responding

person files

• Program 2 – SPSS program to match wave 1 household and responding

person files

• Program 3 – Stata program to match wave 1 household, enumerated and

responding person files

3.7.2 Add Partner Variables

Some users may want to include variables for a respondent’s partner in their

analyses. The programs showing how to utilise the partner’s cross-wave identifier

_hhpxid to add partner variables onto the responding person file are:

• Program 4 – SAS program to add partner variables

• Program 5 – SPSS program to add partner variables

• Program 6 – Stata program to add partner variables

3.7.3 Create Longitudinal Files

There are a number of ways users might want to create a balanced longitudinal file:

• Wide file of responding persons – this is where we keep only people

responding in all waves and put the variables for each wave next to each

other (that is, there is one row of data for each person).

• Wide file of enumerated persons – this is where we keep only those

people who were in responding households in all waves and the variables

for each wave are put next to each other.

• Long file of responding persons – this is where we keep only people

responding in all waves and the information for each wave is stacked

together (that is, there is a separate row of data for each wave of

information for each person).

• Long file of enumerated persons – this is where we keep only those

people who were in responding households in all waves and the

information for each wave is stacked together.

Most users will probably want to restrict the files to only include respondents or

people from responding households. A few users may also want to add people who

have died or moved out of scope (depending on the research question they are

answering).

The programs showing how to create balanced long files of responding persons are:

• Program 7 – SAS program to create long longitudinal files

• Program 8 – SPSS program to create long longitudinal files

The wide files are created by matching the responding or enumerated files for each

wave together using xwaveid. An alternative way to strip off the first letter of the

variable names in SAS is provided in

HILDA User Manual – Release 10 14 Last modified: 6/12/11

• Program 9 – SAS macro to strip the first letter from the variable name

Some users may want to create an unbalanced panel – where you take all

respondents or enumerated persons available at each wave (not just those that

consistently respond or are consistently in responding households). An example

Stata program to create a balanced or unbalanced panel is provided in

• Program 10 – Stata program to create long longitudinal files

7

Example programs to create wide files are provided in:

• Program 11 – SAS program to create wide longitudinal files

• Program 12 – SPSS program to create wide longitudinal files

• Program 13 – Stata program to create wide longitudinal files

The longitudinal weights on the enumerated person file and the responding person

file are for the full balanced panel of respondents and enumerated persons from

wave 1 (i.e., across the first two, three, … ten waves). If you are constructing a

balanced panel with different specifications, you should find a suitable weight in the

longitudinal weights file. Out of scopes (deaths and moves overseas) are treated as

acceptable outcomes, so these people have weights applied as well.

3.7.4 User Provided Programs

Users of the HILDA data can also contribute code to this library if they believe it may

be beneficial to other users. Please send your code to hilda-

inquiries@unimelb.edu.au.

3.8 PanelWhiz

PanelWhiz is a collection of Stata/SE Add-On scripts to make using panel datasets

easier. PanelWhiz simplifies finding, retrieving and managing variables from multiple

waves (without the need to refer to external documentation or type long lists of

complicated variable names), selecting appropriate weights, matching partner

information and a variety of other common tasks that occur in panel research. By

allowing you to save variable ‘sets’ it also simplifies replacing your working files at

subsequent releases of HILDA data. The package creates a long longitudinal file.

The interface only runs in Stata/SE, but you can export the created datasets into

SPSS, SAS, LIMDEP, GAUSS, and Excel.

For HILDA, PanelWhiz is only available for the General Release Stata files. It uses

the Combined *c.dta file from each wave of the release, plus these files from the

Stata zip: Master_h100c.dta, Longitudinal_weights_h100c.dta; and _version. The

General Release Stata Combined files have PanelWhiz metadata pre-loaded.

PanelWhiz is charityware, requiring the user to make a direct donation to UNICEF.

Details of how to order PanelWhiz can be found at www.panelwhiz.eu.

7

This program requires at least 1.3gb memory to run. If your computer does not have this much

memory then you will need to restrict the datasets to only the subset of variables you need.

HILDA User Manual – Release 10 15 Last modified: 6/12/11

3.9 Variable Name Conventions

Variable names have been limited to eight characters (so that the files can be read in

older versions of SPSS and SAS). The variable name is divided into three parts and

attempts to provide information on the content of the variables:

• First character – wave identifier, with ‘a’ being used for wave 1, ‘b’ for

wave 2, ‘c’ for wave 3, etc.

• Second and third character – general subject area (see Table 3.4) for the

conventions).

• Fourth to eighth character – specific subject of data item.

Excluding the first character, variable names are the same across waves if the

question, question routing (population asked) and response options are the same. If

the question or response options have significantly changed, the variable name will

also be modified. There are, however, a few (fieldwork) variables where we have

decided to vary from this convention:

• Household response status;

• Person response status;

• SCQ in-field response flag;

• Household membership; and

• New location of mover.

For these variables, it was thought more important to keep the same variable names.

These variables are used for survey administration purposes by the HILDA Survey

team at the Melbourne Institute. Many users will not use the detail in these variables.

Table 3.5 to Table 3.9 show how the response categories differ for these variables

across waves.

HILDA User Manual – Release 10 16 Last modified: 6/12/11

Table 3.4: Broad subject area naming conventions, characters 2 and 3 (sorted by code)

Code Broad Subject Area Code Broad Subject Area Code Broad Subject Area

AL Leave

AN Ancestry

AT Attitudes and values

BA Bank accounts

BI Business income

BF Business

BM Body mass index

BN Benefits

BS Brothers and sisters

CA Calendar

CC Child care general

CD Children - deceased

CH Child care during school

holidays

CN Non-employment related

child care

CP Child care for children not

yet at school

CR Credit cards

CS Child care during school

terms

DO Dwelling observations

DT Personal debt

ED Education

EH Employment history

ES Employment status

FA Financial assets

FF Food frequency and diet

FI Attitudes to finances

FM Family background

GB Government Bonus

GC Grandchildren

GH General health and well-

being

HB Household bills

HC Children’s Health

HE Health

HG Household enumeration

grid

HH Household information,

identifiers and cross-

sectional weights

HI Household income

HS Housing

HW Household wealth

HX Household expenditure

IC Intentions to have children

IO Interviewer observation

IP Intentions and plans

JB Job characteristics of

employed

JD Job discrimination

JO Opinions about job

JS Job search of those not

employed

JT Job Training

LE Major life events

LN Longitudinal weights

LO Life opinions

LS Lifestyle

LT Literacy

MH Moving house

MO Mutual obligations

MR Marital relationships

MS Marital Status

MV Motor vehicles

NC Non-resident children

NL Not in labour force

NM Numeracy

NP Non-employment related

child care for children not

yet at school

NS Non-employment related

child care for children at

school

NR Non co-residential de

facto relationship

OA Other assets

OI Other income

OP Other property

OR Other relationships

PA Parenting

PD Kessler-10

PH Private health insurance

PJ Previous job

PN Personality

PR Partnering / relationships

PS Parent status

PW Personal wealth

RC Resident children

RE Religion

RG Relationship grid

RP Residential property

RT Retirement intentions

RW Replicate weight

SA Superannuation

TA Training aims

TC Total children

TI Total income

TS Time stamps

TX Taxes

UJ Job history of those not in

paid employment

WC Workers compensation

WS Wage and salaries

XP Expenditure reported by

individual

YE Youth - employment

YH Youth - education

YI Youth - importance

YP Youth - property

YS Youth - life satisfaction

HILDA User Manual – Release 10 17 Last modified: 6/12/11

Table 3.5: Different codes for household response status

Description

(applies to final _hhresp, initial _hhrespi

1

, follow-up

_hhrespf

1

)

Codes used

Wave 1 Wave 2 Wave 3 Wave 4+

Full Response

Every eligible member of current HH interviewed

62

62

62

62

Part Response

Part refused

63

63

63

63

Part non-contact

64

64

64

64

Part contact made with all non-response

65

65

65

65

Part away for workload period

66

66

66

66

Part language problem

67

67

67

67

Part incapable/death/illness

68

68

68

68

Non-Response

Refusal

69

Refusal - PSMs still live there

69

69

69

Refusal - Don’t know if PSMs still live there

70

70

70

Address occupied - no contact with a sample member

70

71

71

71

Contact made and all calls made 71 72 72 72

All residents away for workload period

72

73

73

73

HH does not speak English

73

74

74

74

HH incapable/illness

74

75

75

75

Refusal to Nielsen via 1800 number 75 76 76 76

Terminate (no PQs)

76

77

77

77

HH deceased

N/A

78

78

78

HH moved out of scope

N/A

79

79

79

All PSMs moved in with another PSM N/A N/A 80 80

All PSMs non-respondents in last 2 waves

N/A

N/A

81

81

Not in area/no phone number

82

Untraceable

2

N/A

99

99

99

Not issued this wave N/A N/A 100 100

Deceased at previous wave

N/A

N/A

101

101

TSM no longer living with PSM at previous wave

102

Dwelling out of scope

Dwelling vacant for workload period 77 N/A N/A N/A

Non-private dwelling - place of business

78

N/A

N/A

N/A

Used for temporary accommodation only

79

N/A

N/A

N/A

Institution with no private HH usually resident

80

N/A

N/A

N/A

1. _hhrespi and _hhrespf are only on the In-confidence Release files. For initial response status _hhrespi, subtract 60 from all

codes except 98 and 99. For follow-up response status _hhrespf, subtract 30 from all codes except 98 and 99.

2. For _hhrespi only: Untraceable is coded 89.

HILDA User Manual – Release 10 18 Last modified: 6/12/11

Table 3.5: (c’td)

Description

(applies to final _hhresp, initial _hhrespi

1

, follow-up

_hhrespf

1

)

Codes used

Wave 1 Wave 2 Wave 3 Wave 4+

Not a main residence (eg holiday home)

81

N/A

N/A

N/A

All people in household out of scope

82

N/A

N/A

N/A

Derelict dwelling/demolished/to be demolished

83

N/A

N/A

N/A

Dwelling under construction/unliveable renovations

84

N/A

N/A

N/A

Listing error

85

N/A

N/A

N/A

Table 3.6: Different codes for person response status

Description

(applies to _fstatus, initial _hgri and _hgri1

to hgri16; follow-up _hgrf and hgrf1 to

hgrf16; final _hgivw and _hgivw1 to

_hgivw16

1

)

Codes used

Wave 1 Wave 2 Wave 3+

Interview in person 1 1 1

Interviewed by telephone 2 2 2

Ineligible for interview

Less than 15 years old at 30

th

of June 3 3 3

Overseas for more than 6 months N/A 4 4

In prison N/A 5 5

TSM no longer living with PSM N/A N/A 6

Not part of the household NFI 4

Refusal

Too busy 12 6 7

Too invasive 11 7 8

Other reasons 13 8 9

Refusal via 1800 number/email 14 9 10

Interview terminated 15 10 11

Other non-interview

Deceased N/A 11 12

Moved to another HF N/A 12 13

Language problem 6 13 14

Incapable/illness/infirmity 5 14 15

Home but unable to contact 9 15 16

Away for workload period 8 16 17

Away at boarding school/university 7

Other reasons 10

Household non-contact N/A 17 18

Household contact made no interviews N/A 18 19

1. _hgri, _hgri1 to hgri16, hgrf and hgrf1 to hgrf16 are only on the In-confidence Release. Variables for persons 15 and 16 are

only included from wave 6 onwards.

HILDA User Manual – Release 10 19 Last modified: 6/12/11

Table 3.6: (c’td)

Description

(applies to _fstatus, initial _hgri and _hgri1

to hgri16; follow-up _hgrf and hgrf1 to

hgrf16; final _hgivw and _hgivw1 to

_hgivw16

1

)

Codes used

Wave 1 Wave 2 Wave 3+

Household not issued to field – persistent

non-respondent

N/A N/A 20

Overseas permanently N/A 21

Household all PSMs non-responding in last

2 waves

N/A N/A 22

Permanently incapable from previous wave N/A 23

Household out of scope NFI N/A 19

Untraceable overseas N/A 27

Overseas and aged < 15 N/A 20 28

Untraceable from prior waves N/A N/A 29

Untraceable determined this wave N/A 99 99

Table 3.7: Different codes for SCQ field response status

Description

(applies to _hgsi, _hgsi1 to _hgsi16, _hgsf

,_hgsf1 to _hgsf16, _hgscq, _hgscq1 to

_hgscq16

1

)

Codes used

Wave 1 Wave 2+

Picked up 1 1

To be sent 3 2

Refused 2 3

Not given 4 4

1. _hgsi, _hgsi1 to _hgsi16, _hgsf, and _hgsf1 to _hgsf16 are only on the In-confidence Release. Variables for persons

15 and 16 are only included from wave 6 onwards.

Table 3.8: Different codes for household membership

Description

(applies to _hghhm, _hghhm1 to _hghhm16

1

)

Codes used

Wave 1 Wave 2 Wave 3+

Listed

Resident

N/A

1

1

Absent for workload

N/A

2

2

No longer member of household

N/A

3

3

Deceased N/A 4 4

Not listed

Re-joiner/merger

N/A

5

New resident

N/A

5

6

Absent for workload new resident N/A 6 7

1. For _hghhm, the value labels are quite different, but the meaning of many of the codes are the same. Wave 3 value labels

are listed in this table. Variables for persons 15 and 16 are only included from wave 6 onwards.

HILDA User Manual – Release 10 20 Last modified: 6/12/11

Table 3.9: Different codes for new location of mover

Description

(applies to _hgnlc1 to _hgnlc16

1

)

Codes Used

Wave 1 Wave 2 Wave 3-6 Wave 7+

Within Australia – new local address N/A 2 1 1

Within Australia – new non-local address N/A 3 2 2

Address unknown N/A 4 3 3

Deceased N/A 5 4 4

Overseas permanently N/A 5

Overseas but not permanently N/A 6

Overseas N/A 1 5

1. Variables for persons 15 and 16 are only included from wave 6 onwards.

3.10 Missing Value Conventions

Global codes are used throughout the dataset to identify missing data. These codes

are not restated for each variable in the coding framework.

3.10.1 Numeric Variables

All missing numeric data are coded into the following set of negative values shown in

Table 3.10.

When performing mathematical operations (sum, mean, product etc.) or running a

procedure which summarises the data, researchers must first assign or program for

the missing values. Failure to do so will give inaccurate or distorted results.

Table 3.10: Missing value conventions for numeric variables

Code Description

-1 Not asked: question skipped due to answer to a preceding question

-2 Not applicable

-3 Don’t know

-4 Refused or not answered

-5 Invalid multiple response (SCQ only)

-6 Value implausible (as determined after intensive checking)

-7 Unable to determine value

-8 No Self-Completion Questionnaire returned and matched to individual record

-9 Non-responding household

-10 Non-responding person (Combined File only)

Note that the SPSS files have these global missing values (-10 to -1) set to SPSS

user-defined missing. To turn off this setting for an individual variable use:

HILDA User Manual – Release 10 21 Last modified: 6/12/11

missing values varname1 ().

To turn off this setting for all variables (for example, if you need to include those who

are coded as -1 'Not asked') use the following code:

set errors=none.

do repeat x=all.

missing values x ().

end repeat.

set errors=listing.

execute.

3.10.2 Text Variables

Text variables with missing values will typically contain the following text (as shown

in Table 3.11).

Table 3.11: Missing value conventions for text variables

Text Description

[blank] Missing information (no reason specified)

-1 Not asked

-2 Not applicable

-3 Don’t know

-4 Refused

-7 Unable to determine value

-9 Non-responding household

3.11 Data With Negative Values

Data items that can have both negative and positive values, such as business

income, total household income, etc, are provided as two variables:

• the variable for positive amounts; and

• the variable for negative amounts.

If the overall value is not missing and is positive, then the negative variable will be

zero and the positive variable will hold the actual value. If the overall value is not

missing and is negative, then the positive variable will be zero and the negative

variable will hold the absolute value of the amount. For example, if we have a person

with a business income loss of $20,000 in the last financial year, then the positive

variable of business income will be zero and the negative variable will be $20,000.

Missing data information will be provided in both variables following the negative

conventions described above.

HILDA User Manual – Release 10 22 Last modified: 6/12/11

Therefore, after handling the missing data, you can create your own variable by

subtracting the negative variable from the positive variable. For example, you might

set the missing values of business income to system missing and then create a new

business income variable as follows:

abifp-abifn

or for the imputed version of business income (which has no missing cases but

follows the same convention of splitting positive and negative values):

abifip-abifin

3.12 Confidentialisation

The HILDA datasets released have been confidentialised to reduce the risk that

individual sample members can be identified.

8

• withholding some variables (such as postcode);

This has involved:

• aggregating some variables (for example, occupation has been provided at

the two digit level while it is collected at the four digit level); and

• top-coding some variables (such as age, income and wealth variables).

Top-coding substitutes an average value for all the cases which are equal to or