Copyright (c) 2024 Tokio Marine Holdings, Inc.

Tokio Marine Group Business Strategy

Mid-Term Plan 2026 ~Inspiring confidence. Accelerating progress.~

May 24, 2024

Copyright (c) 2024 Tokio Marine Holdings, Inc.

2

Table of Contents

I. Group Business Strategy (1) Profit Growth .................... P. 4

II. Japan P&C Business Strategy ......................................... P. 7

III. International Business Strategy .................................... P. 17

IV. Solutions Business Strategy ........................................... P. 26

V. Group Business Strategy (2) Capital Policy, etc. ............. P. 28

VI. Reference ......................................................................... P. 43

PHLY

DFG

TMHCC

TMK

TMSR

◆Abbreviations used in this material

TMHD

TMNF

NF

TMNL

◆ “Normalized basis” in the material generally refers to the where natural catastrophes are adjusted to average level

(other adjustments will be stated in the text)

: Tokio Marine Holdings

: Tokio Marine & Nichido Fire Insurance

: Nisshin Fire & Marine Insurance

: Tokio Marine & Nichido Life Insurance

: Philadelphia

: Delphi

: Tokio Marine HCC

: Tokio Marine Kiln

: Tokio Marine Seguradora

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Key messages

Top-tier

EPS and DPS

Growth

Deliver top-tier EPS growth at +8% or more (3Y CAGR) for the new MTP (+16% or more including

capital gains from sale of business-related equities). The driver is attributable to top-tier U/W and

Asset management in each region.

Deliver stable profit growth with our diversified U/W portfolio and our superior investment

returns generated from long-term and predictable liabilities

Deliver top-tier DPS growth in line with EPS growth. Projected DPS is 159 yen (+29% YoY) for

FY2024. Deliver sustainable DPS growth driven by the increasing dividend sources

Adjusted ROE in FY2026 is projected at 14% or higher (20% or higher including capital gains from

sale of business-related equities); increasing ROE to be in line with global peers.

Key measures remain “top-tier EPS growth” and “disciplined capital policy (capital cycle

management)”

Business-related equities outstanding will be “zero*” in six years (JPY3.5tn in market value and

JPY0.4tn in book value as of Mar. 31, 2024) with a three-year reduction of 50%

Current ESR is strong at 140%. Current plan for FY2024 share buyback is JPY200.0bn throughout

the year (as the first step, JPY100.0bn share buyback has been approved)

*: Excluding non-listed stocks (c. JPY22.5bn in market / book value as of Mar. 2024) and investments related to capital and business alliance

Raise ROE

to the level of

Global Peers

Deliver high-quality

management

where growth and

governance coexist

at a high level

Our “ability to be responsive”, which helped overcome numerous challenges in the past, is an

element of our management quality, which is based on our unique strengths of “global risk

diversification “and “globally integrated group management”

Currently, we are steadily implementing initiatives to transform TMNF into a truly trusted

customer-oriented company (“Re-New”) and improve the management quality of each group

company and the entire Tokio Marine Group, while strengthening the Group-level governance

Steadily develop the Solution business, a major strategy for the new MTP, mainly in Japan. Utilize

the new companies established in the “pre- and post-incident” area to develop into a new pillar

of profit growth

3

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Management Quality

Improvement

Shareholder ReturnEffective Use of CapitalEPS Growth

I. Group Business

Strategy

EPS Growth Target

Deliver top-tier EPS growth at +8% or more

*1

EPS growth, when including the impact of the accelerated sale of business-related equities, is projected at

+16% or more

*1

+1-2%

Adjusted EPS

Growth

Adjusted Net Income

Growth

Share Buyback

*4

CAGR

*2

+8% or more

Incl. capital gains from sale of

business-related equities

*3

:

+16% or more

CAGR

*2

+7% or more

Incl. capital gains from sale of

business-related equities

*3

:

+15% or more

*1: KPIs are based on current definitions. Refer to P.38 for review of KPIs after introducing IFRS

*2: FY2023 result, starting point for the MTP, is adjusted (normalized Nat Cats to an average annual level and excluding capital gains

from the sale of business-related equities, capital gains / losses in North America, etc.)

*3: Capital gains from the sale of business-related equities for part of sale exceeded the original plan is excluded from FY2023

*4: Share buyback facilitates EPS growth

4

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Management Quality

Improvement

Shareholder ReturnEffective Use of CapitalEPS Growth

I. Group Business

Strategy

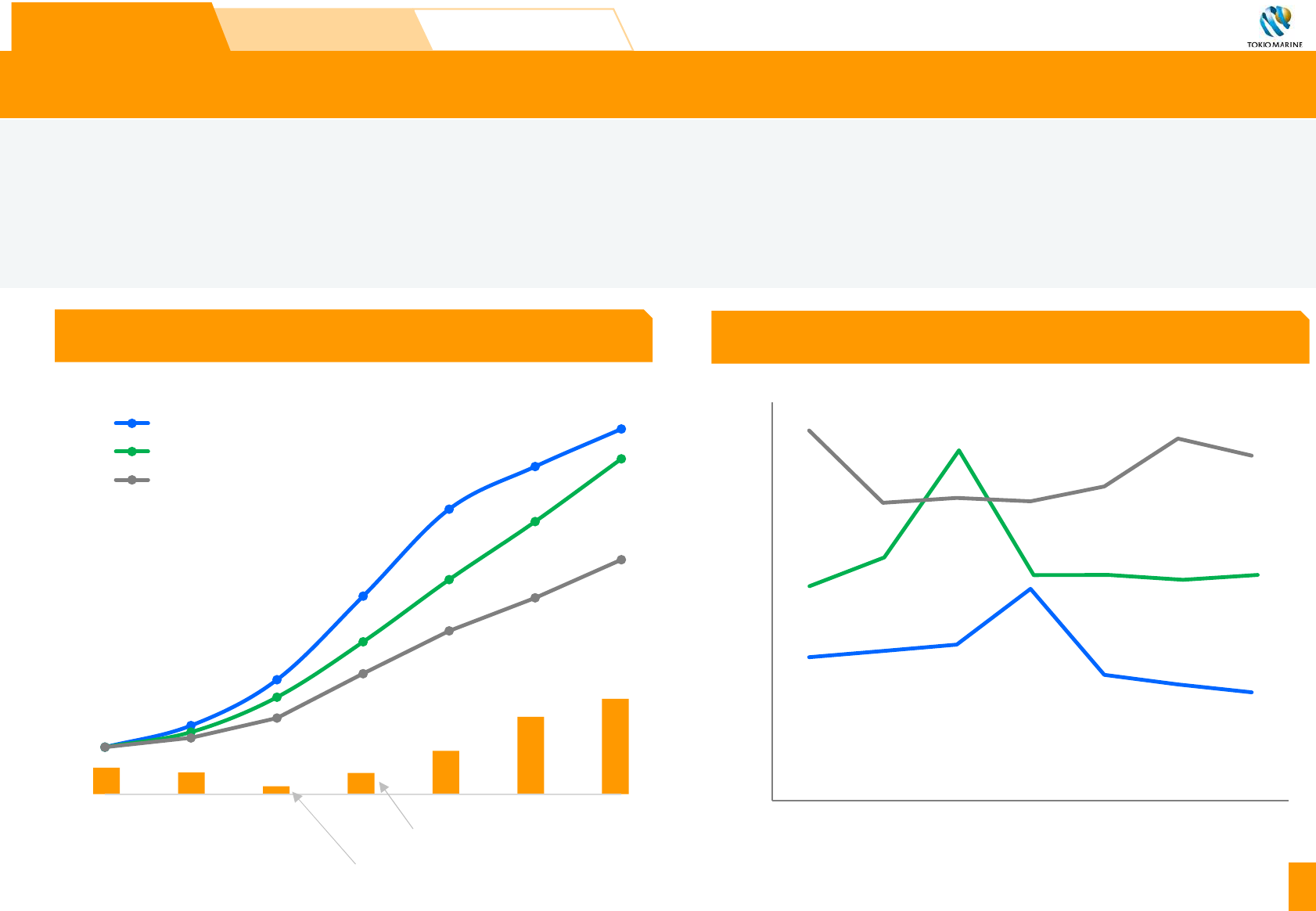

(Ref.) Top-Tier Stable EPS Growth

EPS: Profit in the numerator is adjusted net income for Tokio Marine and KPI for peers

Volatility: Coefficient of variation

Peers: Allianz, AXA, Chubb, Zurich

(Source) Each company data, Bloomberg

3.2

2.3

2.4

1.4

1.7

Tokio Marine Peer 1 Peer 2 Peer 3 Peer 4

EPS Growth

(2013-2023 CAGR)

EPS Growth Volatility

(2013-2023)

+12.8%

+5.3%

+6.3%

+9.2%

+4.8%

Tokio Marine Peer 1 Peer 2 Peer 3 Peer 4

High

Low

We have achieved the top-tier EPS growth while managing volatility

5

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Management Quality

Improvement

Shareholder ReturnEffective Use of CapitalEPS Growth

I. Group Business

Strategy

6

Source of Well-Balanced Profit Growth

Continue delivering top-tier profit growth under the new mid-term business plan (MTP) with a growth rate

of 7% or more through organic growth (3-year CAGR; 15% or more incl. capital gains on business-related

equities)

*1

The growth is a result of our business portfolio with a highly effective risk diversification realized by our

industry leading businesses in each region we operate

*1: KPIs are based on current definitions. Refer to P.38 for review of KPIs after introducing IFRS

*2: FY2023 result, starting point for the MTP, is adjusted (normalized Nat Cats to an average annual level and excluding

capital gains from the sale of business-related equities, capital gains / losses in North America, etc.)

*3: Capital gains from the sale of business-related equities for part of sale exceeded the original plan is excluded from

FY2023

*4: Drop of the negative impact of FX (increase in provision for foreign currency denominated loss reserves and losses on

FX derivatives at Japan P&C due to depreciation of the yen in FY2023) in FY2023 (c. +JPY46.0bn) and business unit

profits of Japan Life and other entities

Adjusted

Net Income

*1,2

CAGR+7% or more

Japan P&C

+1pt

International

+4pt

Others

*4

+2pt

+5% or more

+5% or more

(Excl. prior year loss reserves:

+7% or more)

Approx. +60%

(Ref.)

Business-related

equities

*3

New MTP

Contribution to the Group CAGR

New MTP

CAGR by business

*1,2

incl. business-related

equities

*3

+15% or more

Copyright (c) 2024 Tokio Marine Holdings, Inc.

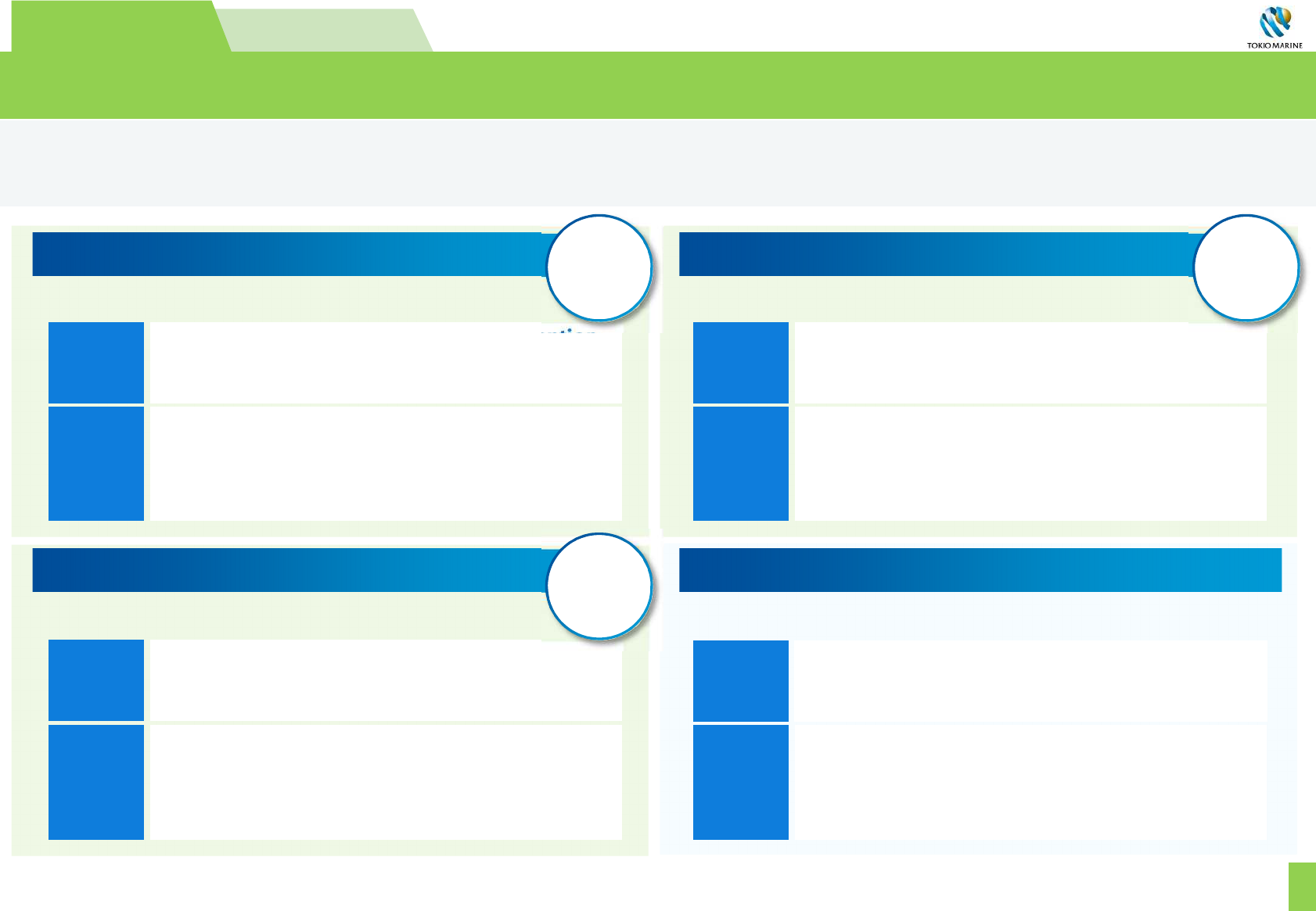

New MTP Profit TargetRe-New

II. Japan P&C

Business Strategy

Vision/Business model TMNF Aspires to Achieve Through “Re-New”

The vision is to 1) accurately analyze customers’ risks, 2) not only hedge these risks but also avoid and reduce

damage itself, and 3) provide insurance with affordable price through the reduction of loss costs and thereby

increasing the number of customers. TMNF will offer insurance and solutions through diverse, high-quality

and specialized distribution channels

This is unprecedented in the industry and will allow TMNF to help build a safe and secure society. As a result,

TMNF continues improving its corporate value

Commission system reflecting

value provided (low E/R)

7

Diverse distribution

channels

Agents with high quality and

expertise

Direct model

Embedded Insurance

Customers

TMNF

Prevent accidents and

reduce damage using

TMNF’s solutions

Lower L/R

following reduction in

accidents and damage

Able to interact with TMNF at

convenient touchpoints

Accurate risk analysis

Appropriate coverage

Insurance Solutions

Accurate risk analysis

Pre-/Post-incident solutions

Improve competitiveness of TMNF’s insurance / services

Lower E/R

following an

increase in top-line

Vision/Business model TMNF aspires to achieve

Able to purchase TMNF’s

insurance sustainably at

competitive and affordable prices

Copyright (c) 2024 Tokio Marine Holdings, Inc.

New MTP Profit TargetRe-New

II. Japan P&C

Business Strategy

8

“Re-New” (1) Build a competitive environment based on the value of insurance

Change the reason why customers select us Key success factors under the new business model

Providing

sophisticated program

(Appropriate coverage at low cost)

Ability to provide

solutions

(Mitigation of the risk itself)

Ability to develop new products and provide

coverages globally leveraging close cooperation

as the Group (E.g.: Global programs, Specialty U/W)

Disciplined U/W based on the data/insights

accumulated through extensive track record

Ability to obtain reinsurance under the Group

reinsurance strategy (mainly based in London)

Ability to offer loss prevention / control service

based on sophisticated data analysis

Ability to develop / offer solutions in cooperation

with external partners such as CORE

P76

U/W capabilities

(Set rates corresponding to risks)

Select insurance

company with more

focus on the “intrinsic

value of insurance”

Before

After Reform

Intrinsic value of insurance

・ Business-related equities

・ Record of cooperation in

customer’s business, etc.

Zero business-related

equities

*

Eliminate excessive

cooperation in

customer’s business

*: Excluding non-listed equities and investments through capital / business alliances

P50

Toward an appropriate and efficient

competitive environment

Ability to offer intrinsic value

Group’s unique strengths

Offer intrinsic value of insurance by leveraging our unique “strengths” to further enhance our partnerships with

customers, thereby increasing the number of customers

Ability to offer the intrinsic value of insurance

= the Group’s strength and the area we excel

Ending deep-rooted practices of Japanese P&C industry will lead to an efficient and appropriate competitive

environment. In this environment, an ability to offer the intrinsic value of insurance will become the key

This is the area where we excel and we will increase the number of customers by leveraging our unique

strengths

Copyright (c) 2024 Tokio Marine Holdings, Inc.

New MTP Profit TargetRe-New

II. Japan P&C

Business Strategy

9

“Re-New” (2) Focus on bottom-line growth to sustainably offer value

We sustainably offer appropriate coverages at appropriate rates corresponding to customers’ risks and needs.

To continue fulfilling this duty as an insurance company, we will refocus our priority on bottom-line growth

and exercise more disciplined underwriting

Build an internal structure to continue offering

correct intrinsic value of insurance

Review award system

Overhaul the current system that places a large

weight on NPW targets to value customer-

oriented business operation

(Ref.) Results of initiatives for unprofitable contracts

*1

in FY2023

(incl. non-renewal)

Profit contribution

c +JPY4.0bn

*2

More disciplined U/W

Excessive focus on M/S

(At times prioritizing contract

retention / expansion)

Focus on

bottom-line growth

(More disciplined U/W)

Some contracts continue

providing capacity at low

rates (unprofitable)

Secure appropriate rates /

decline renewal for low-rate

(unprofitable) contracts

Profitability

deterioration

Profitability

improvement

Before

After Reform

*1: Specific contracts that TMNF considers to be needing improvement in underwriting terms and rates.

*2: After tax / estimation.

Corporate fire/

specialty

contracts

Target consideration

system

KPI will exclude the decline in revenue resulting

from profit improvement efforts, elimination of

business-related equities and excessive

cooperation in customer’s business, etc.

Revise performance

evaluation system

Review goal-setting and performance

evaluation that could place a focus on top-line

<Systems, etc. to end excessive focus on top-line>

Ensure more disciplined underwriting to sustainably offer high-quality insurance and solutions

to our customers

(U/W profit for all fire / specialty

insurance: c JPY68.0bn

*2

)

Copyright (c) 2024 Tokio Marine Holdings, Inc.

New MTP Profit TargetRe-New

II. Japan P&C

Business Strategy

10

“Re-New” (3) Expand trusted and specialized distribution channels

Eliminate two-tier structure

*

with agents

Secure / improve agents’ quality and expertise

Create and expand new direct contact points

Initiative

Have dialogues and take quality assurance measures for agents that are

truly struggling to improve quality, which include limiting the services

offered by them and forming partnerships with other agents

Build a new “direct model”

Increase embedded insurance

Roll out and expand a diverse range of fully digitalized (embedded)

insurance products utilizing platforms and services of partner

companies

P79

Build agent commission system that better

reflects the value agents provide

Build a commission system (that reflects the value agents provide) in

accordance with their quality and level of independence (FY2026 system

: measurement period from April 2025)

Initiative

Initiative

Initiative

Initiative

Deliver the intrinsic value of insurance to customers tailored to their diverse needs by achieving the above,

and as a result, increase the number of customers

*: Excessive support for agents with poor quality

Organize structures / tools to provide agent with highly specialized

support in a more productive manner to accelerate agents’ quality /

expertise improvement (consolidate sales support for agent by area; handle

inquiries through an AI contact center, etc.)

Upgrade support for agent

Build a direct platform that completes the entire contract procedures

from making applications to insurance premium estimate calculation

Offer more tailored services through agents, such as free

consultations, upon request by customers

Expand and diversify distribution channels with the quality and expertise, selected based customers’ needs

and upgrade our support for agents to accelerate this, thereby increasing the number of customers

Build an agent commission system that better reflects the degree of independence of agents and their value

Copyright (c) 2024 Tokio Marine Holdings, Inc.

New MTP Profit TargetRe-New

II. Japan P&C

Business Strategy

11

(Ref.) Progress of “Re-New”

Steadily implementing specific initiatives under the business improvement plan submitted at the end of

February based on the analysis of root causes

Thoroughly implement “Re-New” (incl. preventing recurrence of inappropriate acts) and take the lead in

promoting business improvement efforts to help transform the entire industry

Progress Status (as of May 2024) Future Policy (Time frame)Areas / Items

Key Initiative (1): Build a competitive environment based on the value of insurance (P.8)

Sale of business-related

equities

Implementing 50% reduction within the three-year period of the new MTP

as a milestone

*1

Eliminate excessive

cooperation in customer’s

business

Review operational rules for cooperation in customer’s business

(Including a revision of contracts requiring cooperation in their business as

a condition for insurer selection; starting in April 2024)

Developing new secondment requirements

Organize structures to focus

on bottom-line

Introduce new sales target scheme (abolish target allocation / introduce

target consideration system, etc.)

Review the award system (starting in April 2024)

Zero holding

*1

(end of FY2029)

Embed new core rules (continue from FY2024)

Investigate all cases based on new requirements; send

secondments based on the investigation results (from

June 2024)

Expand / embed target consideration system (continue

from FY2024)

Key Initiative (3): Expand trusted and highly specialized distribution channels (P.10)

Upgrade agent support

system

Launch AGS

*2

in multiple sales departments to consolidate contract process

operations and to start specialized agent support

Review Agency Commissions

System

Revision to focus on quality and value provision items (Gradually implement

from FY2024 system : measurement period from April 2023)

Build a direct model

Complete a trial for online automated application / agent consultation

booking system

Promote operation consolidation at all departments, in

principle (by end of FY2024); expand AGS

*2

business

areas to sales promotion (from FY2025)

Expand quality items and significantly increase their

evaluation weighting (FY2026 system measurement

period: from April 2025)

Full deployment of the system (from Aug. 2024);

develop / trial a platform prototype (by FY2025)

*1: Excluding non-listed equities and investments through capital / business alliances. *2: Agent Support Team: a dedicated centralized organization for agent support

Key Initiative (2): Focus on bottom-line growth to continue offering value (P.9)

Copyright (c) 2024 Tokio Marine Holdings, Inc.

New MTP Profit TargetRe-New

II. Japan P&C

Business Strategy

Nat Cats budget

increase

Approx. -12.0

12

Profit Target for Japan P&C Business

Driver of business unit profit (CAGR: +5%) is the underwriting profit growth (CAGR: +10%)

Realize growth trajectory with confidence by achieving product / rate revision for auto / fire and “Re-New”

*1: After tax, estimation

*2: Normalized Nat Cats to an average annual level and excluded the impact of FX. JPY83.0bn before tax (wide-area Nat Cats at JPY73.0bn +

small Nat Cats at JPY10.0bn) is deemed an average annual level here. For the new MTP, the Nat Cats budget is increased and JPY100.0bn

(before tax) is used as an annual average level.

TMNF Business Unit

Profit

Of which, Underwriting

Profit

*1

(billions of JPY)

(Normalized

*2

)

99.8

(P.13)

(P.14)

(P.15)

Auto

Approx. +20.0

Fire

Approx. +20.0

Specialty, etc.

Approx. +7.0

155.9

*3: Net premiums written (private insurance)

*4: Private insurance E/I basis, estimation *1-4 applies to Japan P&C part (P13-16)

Top-line

*3

C/R

*4

2,219.4

95.5% Approx. 92%

CAGR approx. +2%

Breakdown

CAGR +10% or more

CAGR +5% or more

Investment, etc.

2023

2026

(P.90)

Copyright (c) 2024 Tokio Marine Holdings, Inc.

New MTP Profit TargetRe-New

II. Japan P&C

Business Strategy

Loss cost status and outlook

95

100

105

110

115

120

2019 2020 2021 2022 2023 2024

80

85

90

95

100

105

2019 2020 2021 2022 2023 2024

2023 2026

(1) Auto Insurance Profitability Improvement

(billions of JPY)

■Jan. 2025

revision (plan)

■Jan. 2024

revision

35.0

Inflations, Nat

Cats budget

increase, etc.

Top-line

C/R

Approx. +10.0

1,135.5

95.7%

Stably below

95%

Impact

of rate

revision

CAGR approx.+2%

Impact of a post-COVID driving surge has been

declining after peaking in mid-FY2023 and is expected to

gradually taper off

The ongoing upward trend mainly due to sophistication

of devices is accelerated by the impact of inflation.

A similar trend is expected to continue in the future

*1: Normalized the impact of Nat Cats to an average annual level and excluded the impact of smaller accident frequency due to COVID-19

*2: Based on FY2019 as 100

Approx. +2% (YoY)

*Approx. +3pt vs Nov. 2023 forecast

Accident

frequency

*1,2

Unit price

*2

(vehicle / property

liability)

Approx. -4%

(YoY)

Underwriting

profit

(after tax)

Approx. +3% (YoY)

*Approx. -1% vs Nov. 2023 forecast

Approx. +4%

(YoY)

Approx. +20.0 excl. Nat

Cats budget increase

Overcome the difficult environment (resulting from inflation, a post-COVID driving surge, and escalating Nat

Cats), with initiatives to raise operation efficiency as well as further rate / product revisions scheduled

in Jan. 2025

In FY2024, the C/R is expected to deteriorate due to large Nat Cats, including the April hails in Hyogo. Aim to

stably keep C/R under 95% by closely monitoring the loss cost and proactively revising rates when needed

13

Copyright (c) 2024 Tokio Marine Holdings, Inc.

New MTP Profit TargetRe-New

II. Japan P&C

Business Strategy

2023 2026

Other than above

Underwriting profit

(2) Fire Insurance Profitability Improvement

Achieve profitability commensurate to capital cost (RoR > 7%) by FY2026 through more disciplined

underwriting exercised as part of “Re-New,” in addition to the constant rate / product revisions.

Next rate / product revision is scheduled for Oct. 2024

92.2%

417.6

Disciplined underwriting for

unprofitable policies

Improving underwriting terms

and conditions

Accelerate bottom-line focused

initiatives

Approx. +15.0

0

Contribution from continuous

rates/ products revisions

Oct. 2024 rate / product revision

(billions of JPY)

CAGR approx. +4%

28.0

Top-line

C/R

+α

■Oct. 2024 revision ■2022 revision

■2021 revision ■2020 revision

■2019 revision

Rate / product revision impact

Rate / product revision impact

* Given the huge risk volume of large-scale Nat Cats in fire

insurance, we need C/R to be below the range of 80-89%

at normal times to ensure an RoR exceeding 7%

Aim below 89%

*

(80-89%range)

Corresponds to RoR>7%

Approx. 43.0

Claim cost increase

Reinsurance cost increase

Nat Cats budget increase, etc.

Underwriting

profit

(after tax)

Approx. +20.0 excl. Nat

Cats budget increase

Additional

improvement to

underwriting profit

14

Copyright (c) 2024 Tokio Marine Holdings, Inc.

New MTP Profit TargetRe-New

II. Japan P&C

Business Strategy

Potential market in 5 priority areas

*”Resilience” is added to the 4 priority areas of previous MTP

15

(3) Growth of Specialty Insurance

Capture promising markets focusing on five priority areas to achieve approx. JPY7.0bn profit increase

(approx. +JPY100.0bn premium increase). During the previous MTP, we achieved a nearly +JPY100.0bn

premium increase contributing to steady profit growth

596.9

90.7%

(billions of JPY)

0

100

200

300

400

500

600

2023 2026

40.0

Approx. +7.0

Providing

sophisticated

program

/ U/W

capabilities

Ability to provide

solutions

Arrange cutting-edge insurance programs in collaboration with

international Group companies (e.g.: cyber, D&O, offshore wind)

Expand dedicated products / coverages for SMEs, make

consulting-type proposals

Expand insurance areas utilizing knowhow / data of domestic

Group companies incl. TdR (e.g.: presymptomatic / prevention

areas in healthcare)

Offer 24x7 emergency hotline service (cyber)

Offer loss prevention service using TdR’s data analysis abilities

Capture market leveraging the Group’s “strengths”

*1: Japanese market size (Source) TMHD estimate

*2: Global offshore wind insurance market as of 2030 (Source) TMHD estimate

*3: Market for group medical insurance / cancer insurance / GLTD (Source) Japan Institute of Life

Insurance, Rosei Jihou

Priority Area Market Size Penetration Rate

SME JPY1.3tn

*1

20-30%

*1

GX (offshore) JPY200.0bn

*2

ー

Healthcare JPY1.7tn

*3

75%

*3

Cyber JPY180.0bn

*4

Less than 10%

*5

Resilience JPY300.0bn

*6

ー

Infrastructure / facility preservation: Propose insurance together with

solutions for preservation plan optimization to address clients' challenges in

managing their facilities

Supply chain: Provide services for visualization of corporate risks and

solutions including ESG responses, integrated with cargo insurance, etc.

Top-line

C/R

Underwriting

profit

(after tax)

*4: Japanese market size (Source) Research company

*5: (Source) Cyber Risk Awareness and Countermeasure Survey 2020, General Insurance

Association of Japan

*6: Repair costs of industrial facilities / housing in retail, manufacturing and other industries

(Source) TMHD estimate

Approx. 90%

Approx. +100.0

Copyright (c) 2024 Tokio Marine Holdings, Inc.

New MTP Profit TargetRe-New

II. Japan P&C

Business Strategy

16

(4) E/R Improvement

Track Record and Future Direction

TMNF E/R

*1

32.1%

31.8%

28%

30%

32%

34%

36%

2012 2022

TMNF Domestic P&C1 Domestic P&C2

31% mark

2023 2026

Outlook

Medium- to

long-term

*1: Private insurance *2: vs 2019; equivalent to the saving of JPY30 to JPY50bn/ year; calculated virtually *3: vs 2023: after tax, estimation. vs 2019 (at the start of the project): approx. -JPY13.0bn

Aim below

30%

Current E/R maintains an efficiency advantage against other Japanese P&C companies

Aim for E/R at the 31% mark during the new MTP period and below 30% in the mid- to long-term without

shrinking the size of business (the main driver is top-line growth and reviewing the agent commissions

system)

Measures for 2023→2026

Raise business

efficiency

through top-

line growth

Further increase activity

volume in growth areas mainly

through use of generative AI, in

addition to the ongoing

administration volume

reduction (-25% by the end of

FY2026

*2

)

Agent

commission

system with

clear priorities

Big shift to an agent

commission system to better

reflect the values they offer

such as the quality of operations

and level of independence

Rigorously

reduce

business and

personnel

expenses

Implement cost containment

without exceptions even in an

environment of IT cost and wage

increases

Make workload reduction

project real

(Approx. -JPY9.0bn

*3

by end of FY2026)

Accelerate a shift to

agent commission

system that better

reflects value provision

”Re-New”

Additional improvement

impact

+α

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Investment IncomeUnderwriting Profit

III. International

Business Strategy

17

Profit Target for International Business

International business profit growth target is CAGR of +7% or more (excl. past reserves takedown)

Realize growth driven by strong underwriting while factoring in a certain level of softening

448.9

*2

CAGR +7% or more

(excl. past reserves takedown)

*2

International Business Unit Profit

*1

Top-line

*1

3,079.5

CAGR approx. +5%

Includes a rebound in life insurance

which posted a loss in 2023

C/R

*3

(2023

→2026)

91.8%

→91.5%

92% range

91.8%

→94.1%

92.3%

Profit will shrink compared to 2023 when

Brazil performed very strongly. We plan to

secure high levels of revenue by maintaining

C/R at low to mid-90%

Underwriting

profit (CAGR)

Approx. +8% Approx. -1%

Approx. +7%

(billions of JPY)

International

Business Unit Profit

(excl. past reserves takedown)

+7% or more

Underwriting

*North American underwriting

Approx. +7%

*Approx. +10%

Investment

*Investment income

Approx. +8%

*Approx. +8%

Developed

market

Emerging

market

*1: FX as of Mar. 31, 2024. Business Unit Profit for 2023 is on a normalized basis excluding the impact of past reserves takedown

*2: 2023 result is JPY478.2bn (FX as of Mar. 31, 2024) including past reserves takedown. CAGR of the 2026 plan based on this result is +5% or more (2026 plan does not factor in change in past reserves)

*3: Figures include estimates.

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Investment IncomeUnderwriting Profit

III. International

Business Strategy

18

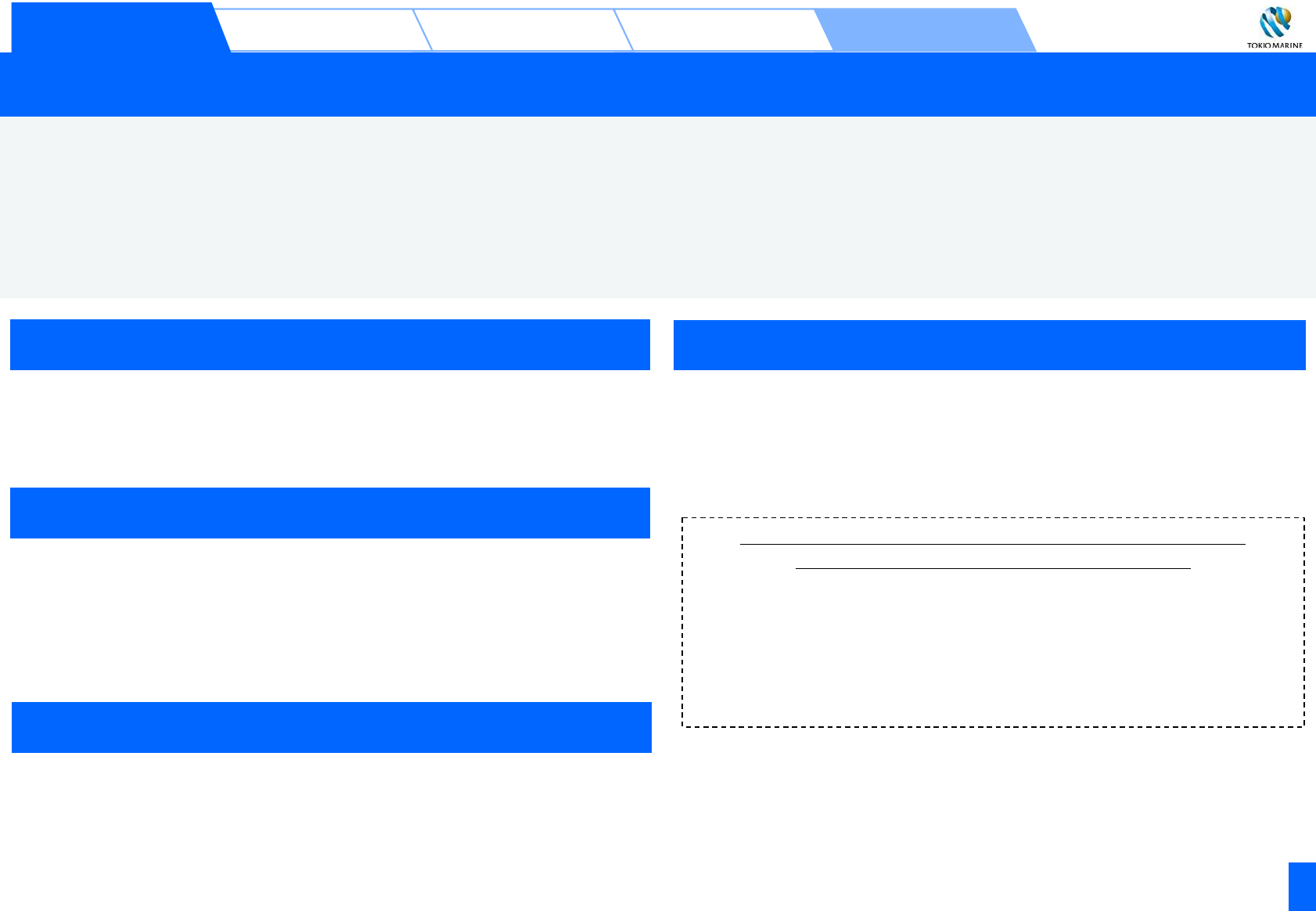

Top-class Underwriting Growth (Comparison with North American Peers)

North American underwriting profit is expected to grow at CAGR +10%, representing top tier growth

vs. peers

2023 2024 2025 2026

北⽶Peers 当社北⽶事業

CAGR approx. +8%

CAGR approx. +10%

Underwriting profit

No

Peer’s data

■

North American peers

*1

TMHD North American business

*2

*1: Peers: AIG, Chubb, Travelers, W. R. Berkley (Source: D&P) *Estimates by normalizing the impact of past reserves and Nat Cats to an average year level

*2: Normalized basis (excl. the impact of past reserves takedown for 2023)

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Investment IncomeUnderwriting Profit

III. International

Business Strategy

0

500

1,000

1,500

80%

85%

90%

95%

100%

105%

2017 2018 2019 2020 2021 2022 2023

2017 2018 2019 2020 2021 2022 2023

TMHCC

PHLY

マーケット

19

Rate Increases

Rate Increase

(% represent YoY rate increase)

+5%

+9%

+16%

+14%

+6%

+3%

+7%

+11%

+11%

+9%

+2%

+4%

+9%

+8%

+6%

(Indexation based on 2017)

+6%

+9%

+5%

*2

*3

TMHCC

*4

U.S. P&C market average

*5

PHLY

*4

C/R

*1: See P.20 for details

*2: Excl. A&H・Surety・Credit *3: (Source)Willis Towers Watson

*4: Local management accounting basis. Temporary increase in PHLY due to increase in past reserve provision

*5: (Source)S&P Capital IQ

*4

Achieve growth while maintaining C/R at low levels, leveraging the competitive advantage built through

strategic focus on niche markets and specialty insurance

*1

and carrying out rate increases exceeding forward-

looking loss cost projections

Market hardening is expected to continue throughout 2024, and achieve steady profit growth through risk

selection and a strong bottom-line focus to contain the impact of the market cycle

Due to Covid-19

Due to past reserve provision

■ [Ref.] North America U/W profit (USD mn)

Market

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Investment IncomeUnderwriting Profit

III. International

Business Strategy

RLI

American

Financial

W.R.

Berkley

Travelers

Cincinnati

Financial

Markel

Old

Republic

CNA

Hartford

Hanover

HCC

Factors for Growth Exceeding the Market (1) TMHCC & PHLY

Our specialty focus and nimble management structure allow us to quickly implement strategic decisions and

maintain stable, profitable growth that outperforms the market

High customer loyalty and risk sensitivity

*1: (Source) Created by each company report and Dowling & Partners Analysis (based on data through Dec. 31, 2023)

*2: Takedowns have been made since 2020 *3: Over 90% of umbrella insurance that tend to have high limit policies have limits ≤ $5M

*4: Compared to 2020 Q2 when PHLY started its claim settlement initiative *5: (Source) NICE Satmetrix 2023, Consumer Net Promoter Benchmark Study

Built strong relationship with leading agents / brokers by strategically

focusing on niche customer segments, while achieving strong

customer loyalty by providing high quality customer services

Proactively strengthened reserves in 2019 anticipating the impact of

social inflation

*2

, and maintained high profitability with rigorous risk

control including with significant reduction of high limit policies

*3

and

reduction of litigation claims (-60%

*4

)

(See P.71 for details)

Smallest

Largest

C/R volatility

Risk diversification and strong bottom-line focus

Underwrite various lines of specialty insurance, rigorously refined the

highly specialized U/W and claims service expertise

Built profitable and diversified portfolio through bolt-on M&As,

acquisition of underwriting teams, and launch of new business lines

Also, through maintaining low C/R and focusing on bottom-line

including efficient operations and strong enterprise risk management

control, lead to constantly achieving strong performance

Net Promoter Score*

5

32

67

39

PHLY

<Market composition (FY2023)>

<Strong customer loyalty>

<Stable low C/R

*1

>

Lowest

Highest

CEO/Susan Rivera

CEO/John Glomb

Human services

33%

Real estate 16%

Public services

9%

Non-profit organization

D&O E&O 15%

Sports&

Recreation 9%

Other 11%

Auto 6%

10Y C/R average

Home Insurance

Industry

Average

Auto

Industry

Average

20

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Investment IncomeUnderwriting Profit

III. International

Business Strategy

85%

90%

95%

100%

105%

110%

2019 2020 2021 2022 2023

15.9%

7.6%

Factors for Growth Exceeding the Market (2) RSL

*1

& Pure

*1: Reliance Standard Life (DFG group life insurance company)

*2: DFG group third party administrator providing leave management services. Brand was integrated with RSL in 2023 as “reliancematrix,” accelerating collaboration.

*3: Long Term Disability *4: Hartford, MetLife, Unum, Voya, Lincoln, Prudential, Principal

*5: Group life insurance L/R deteriorated in 2021 due to the impact of COVID-19

*6: (Source) D&P *7: Pure’s top-line shows the premiums under management company Market: (Source) S&P Capital IQ

Ability to implement rigorous profit improvement

RSL

*1

rigorously implemented profit improvement initiatives (including

non-renewal of high-risk policies, disciplined U/W, business efficiency

improvement using AI) under the leadership of CEO Chris Fazzini

appointed in 2017

RSL deepened collaboration with Matrix

*2

to take advantage of market

leading “absence management” product offering to generate sales of

insurance products, especially mainstay LTD

*3

product

Consequently, succeeded in substantially improving and maintaining

profitability, supporting DFG’s strong performance

<C/R>

*5

CEO/Chris Fazzini

Capture the strong growth potential of HNW market

Earned strong customer loyalty and high M/S by focusing on U.S. High

Net Worth (HNW) market, providing high-quality services that match

the customers’ needs (including specifically designed products for HNW

individuals, a detailed risk management consultation, and loss prevention

services)

Maintained significant top-line growth by leveraging the strong brand

loyalty, while paying attention to U/W discipline including nat cat risks.

With its operating effectiveness, PURE increased profits along with the

top-line growth

<HNW M/S

*6

>

<Top-line

*7

>

2019-2023 CAGR

Pure

Market

CEO/Martin Leitch

Peers average

*4

RSL

10.4%

5.1%

RSL

Peers

average

*4

2019-2023 CAGR

<Top-line>

Company Rank M/S

Chubb 1 15%

Pure 2 5%

AIG 3 3%

Cincinnati 4 2%

Nationwide 5 1%

21

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Investment IncomeUnderwriting Profit

III. International

Business Strategy

85%

90%

95%

100%

2019 2020 2021 2022 2023

100

130

160

190

220

2019 2020 2021 2022 2023

80%

85%

90%

95%

100%

105%

2019 2020 2021 2022 2023

Factors for Growth Exceeding the Market (3) TMK & TMSR

Leverage cutting-edge digital capabilities

Brazil market average

*4

TMSR

*1

<C/R>

TMSR

*1

CAGR

+20.6%

CAGR

+12.3%

Growth rate of gross premium with 2019 set as 100

Brazil market average

*4

<Top-line>

*1: Local accounting basis *2: (Source) Lloyd’s Annual Report *3: Excludes the impact of COVID-19 *4: (Source) SUSEP

In a challenging market dominated by brokers and volatile economy in

Brazil, TMSR, rigorously leverages cutting-edge Digital and IT

capabilities

Under a disciplined U/W policy, TMSR frequently revises rate based on

timely and precise data analysis. Also, by promoting operational

efficiency and product enhancements, TMSR achieves a balance of

competitive pricing and operational excellence, resulting in strong

support from customers and brokers

Executing these initiatives, TMSR achieves significant top-line growth

and profitability improvements that exceed the market

Top Class Profitability in Lloyd’s Market

<C/R>

TMK(Syndicate 510)

*1

FY2023: 86%

*3

Lloyd’s market average

*2

CEO/Matthew Shaw

CEO/Jose Ferrara

Fully focused on “profitability” with the clear goal of “constantly

achieving C/R of low 90% range”

Maintaining high profitability through business portfolio optimization

and further diversification.

Working with strategic Broker partners to increase shares of wallet in

preferred classes.

Consider new lines of business including through active involvement in

research and new product development in innovative areas with

Lloyd’s

22

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Investment IncomeUnderwriting Profit

III. International

Business Strategy

(Ref.) External Evaluation of Our North American GCs

Scored the highest favorability rating in the Americas

*

*: A survey for risk managers in large companies with 250 or more employees by FT Commercial Insurance GIST 2024 Survey (Nov. 2023-Feb. 2024)

(Source) P&C Specialist: Big Commercial Insurers with the Highest Favorability Ratings

https://commercial.pandcspecialist.com/c/4491854/587354

23

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Investment IncomeUnderwriting Profit

III. International

Business Strategy

Stable Increase in Investment Income

Stable growth in investment income on the back of an increase in long-term and predictable insurance

cashflows (AUM), yields maintained by investing in asset class with attractive RoR

Source of investment capital is a long-term,

predictable cashflows stream

Increase AUM while controlling risks

Investment

income

(DFG +

managed

*

)

AUM

(DFG +

managed

*

)

Income

Return

(DFG +

managed

*

)

<2023 Results> <New MTP>

<Increase in AUM on the back of growing business>

$3,379mn

3Y CAGR

approx. +8%

$49.8bn

Increase in AUM

on the back of

growing business

6.8%

Maintain stable

yield

(Ref.)

Barclays Aggregate︓3.5%

<Maintain stable yield>

Maintain higher return than the benchmark by continued

focus on assets with attractive RoR

Investment income including

funding cost for annuity

business, etc.: approx. +3%

0%

1%

2%

3%

4%

5%

6%

7%

8%

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

DFG+GCs Barclays Aggregate

*: Assets managed by DFG for key GCs (TMNF, TMNL, NF, PHLY, TMAIC, TMHCC)

24

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Investment IncomeUnderwriting Profit

III. International

Business Strategy

25

Features and Track Record of DFG’s Investment

DFG’s strength of specialized investment team and strong collaboration with outside asset managers enable

establishment / execution of flexible investment strategies corresponding to the investment environment,

realizing higher returns than the market (maintained positive returns during past financial crises)

-2.0%

0.0%

2.0%

4.0%

6.0%

8.0%

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Market

*2

DFG

Strength of DFG’s ability to manage

highly specialized asset management

Team achieved stable returns through a series of market volatility

and cycles including COVID-19 and collapse of Lehman Brothers

Execute agile asset allocation according to the investment

environment by data gathering and analysis leveraging broad

network

Control credit risk of the entire portfolio within a certain limit within

a certain threshold in collaboration with TMHD

Donald Sherman

DFG CEO

Vincent Kok

DFG CIO

Stephan Kiratsous

DFG CFO & COO

Investment framework with highly reproducible returns

<Investment Return

*1

>

DFG investment performance (investment income + realized gains /

losses) remained positive during the collapse of Lehman Brothers

Strong collaboration with external asset managers

Achieve higher returns than the market

Track Record of DFG Investment Income

In addition to selecting capable managers, hands-on approach,

including development of investment strategies and individual

underwriting, is taken when considered necessary

Able to flexibly rebalance portfolio corresponding to the changes in

the market by utilizing expertise and network of both

internal members and external managers

*1: Calculated as “(Income + capital gains/losses + impairment) / AUM”

*2: Average for US P&C insurance companies (market capital of $20bn or more)

Source: S&P Capital IQ, Factset

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Solutions Business

IV. Solutions

Business Strategy

26

Progress Update

Insurance business will not be the sole driver of our growth. Promote commercialization in multiple fields

to make them grow into pillars of income by 2035

Disaster prevention / mitigation

Oct. 2022: Founded a joint venture company with

Kokumin Kyosai co-op

Mobility

Claim ServiceDecarbonization

Nov. 2023: Launched Tokio Marine Resilience

Realize a comprehensive disaster prevention

and mitigation solution

Support disaster prevention measures by comprehensive disaster

management solutions

*2

Vision

Nov. 2023: Launched Tokio Marine Smart Mobility

Realize mobility solutions for corporations

Mitigating risks and avoidable costs associated with

transportation and logistics

Vision

Feb. 2024: Establishment of Preparatory Company

Realize decarbonization solutions

for domestic SMEs

Promote “know, measure, reduce” to support decarbonization

Vision

Progress

Update

Began PoC to offer decarbonization solutions to Japanese

SMEs that face the challenge of decarbonization

Decarbonization concierge service

Renewable energy supply service

Build a business utilizing intellectual properties

and knowhow in in-claim service

Support more customers in times of needs beyond

the boundaries of mutual aid and insurance

Vision

Progress

Update

Develop and offer mutual aid money payment system by

FY2025 and perform some operations related to damage

investigations of automotive mutual aid

Expect an impact equivalent to up to +JPY6.0bn a year on the

bottom line for the entire Group

*3

Progress

Update

Launched multiple solutions in the disaster prevention and

aftercare areas

Supply chain risk management system

Liquefaction damage reduction service (response to the

Noto Peninsula earthquakes)

Response package that can offer a total of 35 services, etc.

Progress

Update

Developing solutions for industry-level optimization such as joint

deliveries, in addition to company-level efficiency improvement

such as vehicle management

Full-scale sale of fleet management system, MIMAMO DRIVE

Expanding the lineup to include labor management, health

management, etc.

Estimated

target

market

*1

JPY1.5tn

Estimated

target

market

*1

JPY1tn

Estimated

target

market

*1

JPY1tn

See P.76 for details

See P.77 for details

See P.78 for details

*1: Estimated market size from 2030

*2: Providing comprehensive solutions for disaster prevention and mitigation, encompassing all phases of the disaster prevention and

mitigation value chain (assessment, preparedness, evacuation, recovery / reconstruction) and address the causes of damage (perils)

*3: Bottom line impact by collecting

labor and IT related costs

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Solutions Business

IV. Solutions

Business Strategy

World to be Realized in Disaster Resilience Field

Enhancing the value chain in disaster resilience will increase the benefit for the customers and local

community and lead to economic value (profits) for us

Our economic value

increased through social value

Social value created

by our business

Insurance

payment

Post-

incident

area

etc.

Business

area

Services that mitigate /

prevent natural disasters

(LC and LP *)

Rebuild with insurance

payment

(Build Back Better)

Early recovery by

shortening the time for

insurance payment

Early recovery of affected

buildings and facilities to

support quick business

resumption

Prevent recurrence

Disaster resilience field

value chain and our business

Solutions

Solutions

Insurance

Reduce L/R

Reduce business

expenses

Reduce

insurance payout

cost

Reduce disaster

and accident

rate

Lower E/R with increased top-line

Increase

Solutions

revenue

Increase policyholders

(Price competitiveness

supported by quality

policy portfolio)

Improve top-line

Business continuity / early

recovery

Improve customers’ capital

efficiency with insurance risk

hedging

Strengthen at rebuild

Avoiding Human Damage

Prevent property damage

* : LC/LP are abbreviations for Loss Control (accident mitigation) and Loss Prevention (accident prevention)

27

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Management Quality

Improvement

Shareholder ReturnEffective Use of CapitalEPS Growth

V. Group Business

Strategy

Disciplined Capital Management

Capital generated is allocated to risk-taking and business investment that will contribute to improving the

ROE. In the absence of good opportunities, share buybacks are executed. We will continue to implement

disciplined capital management.

The sale of business-related equities realizes unrealized gains originally included in net assets. We will raise

our corporate value through disciplined capital management (”capital circulation cycle”)

P.35 Reduction of

Business-Related Equities

P.36 DPS Growth

P.37 Disciplined Capital Management

(Share Buyback)

P.30 Global Risk Diversification

and Profit Growth

P.31 Disciplined In / Out Strategy

P.32 Track Record of Large-scale M&A

P.33 Track Record of Bolt-on M&A

ESG for sustainable growth

Capital

generation

Capital

adjustment

- Strategic capital release

- Appropriate risk control

- Disciplined strategic

M&A

- Disciplined risk

taking

Business

investment

- Dividend increase

- Flexible capital level

adjustment

Shareholder

return

- Sustained stable profit base

in Japan

- Enhanced on specialty in

advanced countries

- Capture growth potential

in emerging countries

+

Organic

growth

Portfolio review

28

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Management Quality

Improvement

Shareholder ReturnEffective Use of CapitalEPS Growth

V. Group Business

Strategy

Track Record of ROE Improvement and MTP Quantitative Targets

2012 2022

2023

15.0%

15.1%

Peer 1 15%

【2024Target】

●

Peer 2 28%

【2026Target】

●

Peer 4 23%

【2025Target】

●

2025

2026

●

Peer3 19%

【Next few years】

18.1%

(11.0%)

(13.0%)

2024

(projection)

*1: Based on current definition of ROE

*2: Adjusted Nat Cats to an average annual level and excluded the impact of COVID-19 for 2020 and after, and capital gains/losses in North America, etc. and capital gains from sale of business-related equities (for part of sale

exceeding the original projection of each fiscal year) for 2021 and after. Also excluded the impact of war and South African floods for 2022

*3: Peers: Allianz, AXA, Chubb, Zurich. For Peers, disclosed ROE as their KPI is adjusted to the tangible basis to align it with TMHD’s adjusted ROE. (Source) Estimated by TMHD using company data.

Adjusted ROE

*2,3

Excl. sale of business-related

equities in the parentheses

Cost of

capital: 7%

Achieve ROE

equivalent to global peers

Peers’ ROE

Target range

FY2026

*1

20% or higher

(14% or higher)

FY2023 ROE is at the same level

as the previous year, mainly due

to an increase in adjusted NAV

notably from a rise in stock

prices and the JPY depreciation

Our profit increased due to the rebalance of risk portfolio based on ERM, without unnecessary capital increase.

Consequently, FY2023 adjusted ROE reached 15.0%

With the “top-tier EPS growth” and “disciplined capital policy (capital circulation cycle)”, FY2026 ROE target is

20% or higher

*1

(excl. sale of business-related equities : 14% or higher

*1

)

29

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Management Quality

Improvement

Shareholder ReturnEffective Use of CapitalEPS Growth

V. Group Business

Strategy

20%

30%

8%

27%

15%

26%

35%

9%

19%

11%

30

Global Risk Diversification and Profit Growth

We have achieved profit growth by allocating capital to businesses with high ROR and risk diversification

effects

This trend will accelerate by achieving zero* business-related equities

*Excl. non-listed equities and investments for capital / business alliances

Global risk diversification

FY2024

Diversification

effects

43%

■ Japan P&C(underwriting)

■ International

■ Japan P&C(investment)

■ Japan Life

■ Others

Before

JPY4.4tn

FY2014

Diversification

effects

29%

*Risk excl. business-related equities is

JPY5.9tn before diversification and JPY3.1tn after diversification

Before

JPY7.6tn

Risk after diversification

JPY3.1tn

Risk after diversification

JPY4.3tn

*1: Profit is Business Unit Profit of each business (original plan). Figures include estimates

*2: TMNL’s financial accounting profit.

International 56%

(Of which, North America: 36%, Europe 9%,

South & Central America: 1%)

Japan P&C: 36%

(excl. profit related to business-related equities)

International 83%

(Of which, North America: 67%, Europe: 7%,

South & Central America: 5%)

Japan

Life 6%

*2

Japan

Life 8%

FY2024

Original

projection

JPY1tn

FY2014

Original

projection

JPY271.0bn

Japan P&C: 10%

(excl. profit related to business-related equities)

Capital gains 87%

+

=

=

Core business

JPY188.0bn

Business-related

equities

JPY449.0bn

Dividend 13%

Business-

related

equities

JPY83.0bn

+

Dividend 48%

Capital gains 52%

Will become nominal from FY2030

Core business

JPY551.0bn

Global profit portfolio

*1

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Management Quality

Improvement

Shareholder ReturnEffective Use of CapitalEPS Growth

V. Group Business

Strategy

31

Disciplined In / Out Strategy

Our large-scale M&A track record (ROI) is +21.5%. Successful track record makes Tokio Marine an attractive

acquirer for the next M&A

Valuations are currently high, and we need to continue being patient with large-scale M&As, but we will

seize opportunities for bolt-on M&As and continue to implement the In / Out strategy with discipline

Feb. 2024

Saudi Arabia

Life/Non-life

*1: ROI is calculated by using the sum of business unit profits under FY2024 projection as numerator and the sum of

acquisition amounts as denominator (Different formula from ROE (=RoR / ESR) which reflects risk diversification effect, etc.)

*2: Gulf Guaranty Employee Benefit Services, Inc.

A managing general underwriter that handles group gap medical insurance for small and mid-sized businesses.

*3: Agent handling construction insurance in the Tokio Marine Highland (former WNC) group owned by TMK

Cultural fit

High profitability

Solid business model

Target

(Three

principles

of M&A)

Cost of capital (7%)

+ Risk premium

+ Country interest rate

spread

Hurdle

rate

Strict acquisition criteria

“In” strategy (M&A, new establishment)

“Out” strategy (divestment, run-off)

Mar. 2008

Dec. 2008

May 2012

Oct. 2015

Feb. 2020

Mar. 2019

Aug. 2022

Highland

*3

Dec. 2023

Guam TMPI

ROI

*1

of our large-scale M&As is 21.5%, significantly

exceeding our capital cost (7%)

We have been steadily implementing bolt-on M&As. Most

recently, TMHCC completed acquisition of GGEBS

*2

We are implementing the “Out” strategy also with

discipline by determining the future of the business in a

forward-looking manner

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Management Quality

Improvement

Shareholder ReturnEffective Use of CapitalEPS Growth

V. Group Business

Strategy

32

(Ref.) Track Record of large-scale M&A

Five subsidiaries acquired with large-scale M&A have continually outperformed market growth

ROI is significantly above TMHD capital cost (7%) at 21.5%

5.3%

7.0%

5.9%

6.6%

>

7%

Capital cost

21.5%

Growth after joining the Group

*1

ROI of large M&As

*2

7.3%

5.7%

17.4%

12.8%

DFG

2011-2023 CAGR

Market

9.7%

6.1%

5.4%

3.1%

TMHCC

2014-2023 CAGR

Market

15.9%

7.6%

2019-2023 CAGR

Pure

Market

2007-2023 CAGR

PHLY

Market

2007-2023 CAGR

TMK

Market

<Top-line> <Bottom-line*

3

> <Top-line> <Bottom-line> <Top-line> <Bottom-line>

<Top-line> <Bottom-line> <Top-line>

DFG

TMHCC

PHLY

TMK

Market

Market

Market

Market

▲189.8%

*1: TMHD top-line / bottom-lines are local financial accounting basis, Pure’s top-line is the premiums

under management company

Market for TMK: all Lloyd’s companies, Other: North American non-life insurance

(Source) Lloyd’s Annual Report, S&P Capital IQ

*2: ROI is calculated by using the sum of business unit profits under FY2024 initial projection as

numerator and the sum of acquisition amounts as denominator

(Different formula from ROE (=RoR / ESR) which reflects risk diversification effect, etc.)

*3: TMK proactively increased past reserve provision for some business lines

(However, Syndicate 510 C/R was good level at 86%)

6.4%

4.2%

4.1%

1.9%

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Management Quality

Improvement

Shareholder ReturnEffective Use of CapitalEPS Growth

V. Group Business

Strategy

33

(Ref.) Track Record of Bolt-on M&A

Room for bolt-on M&A based on in-depth understanding of mutual business

Leverage the experience and expertise of TMHCC as our strength and steadily execute transactions

*: Construction insurance agency, part of Tokio Marine Highland (former WNC) Group owned by TMK

High success rate

Accumulated know-how

Disciplined M&A

Advantages

of bolt-on

M&A

: In-depth understanding based on a long-term business relationship

: Experience of executing over 60 bolt-on M&As

: Strategic portfolio adjustment taking the future business environment into consideration

In

Out

2015-2017

Pro Ag

(Crop

Insurance)

January 2015

AJF

(P.A.)

June 2015

International

Ag

(Crop Insurance)

April 2017

AmTrust Ag

(Crop

Insurance)

May 2019

AIG business

acquisition

(Medical stop-loss)

October 2017

Midlands

(Excess W/C)

December 2018

NAS

(Cyber / liability)

April 2019

WNC

(Property /

flood)

January 2018

On Call

International

(Assistance service)

January 2016

Bail USA

(Surety)

Divested in April 2019

Qdos

(Liability)

October 2018

BCC

(Surety /

credit)

April 2019

Colors represent the acquiring companies

TMHCC PHLY DFG TMMA (Australia)TMK

2018-2020

Bail USA

(Surety)

February 2016

A&H

International

(P.A.)

June 2019

GCube

(Renewable energy)

May 2020

2021-

Life Trac

(Medical Service)

Divested in January

2020

WWS business

acquisition

(Insurance for temporary

staffing industry)

December 2020

SSL

(Paid family leave)

April 2021

Will find high

quality

transactions

Highland

*

(Construction insurance)

Divested in August

2022

GGEBS

(Gap medical

insurance)

July 2023

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Management Quality

Improvement

Shareholder ReturnEffective Use of CapitalEPS Growth

V. Group Business

Strategy

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

34

(Ref.) Rate Cycle and M&A Opportunities

-10%

-5%

0%

5%

10%

15%

Valuations remain high for high-quality M&A transactions, requiring patience

The market is cyclical and attractive M&A opportunities increase when the market softens;

we will remain diligent

*1: U.S. Commercial market (Source) WTW, “Commercial Lines Insurance Pricing Survey”

*2: Global deals announced between 2003 and 2023 in P&C sector with transaction amount of $100MM or more (Source) Dealogic

*3: Dates listed are the announcement dates of the acquisition

Total transaction amount

*2

(right axis)

Rate Cycle

*1

(left axis)

(M$)

0

10,000

20,000

30,000

40,000

50,000

60,000

(Ref.) Overseas business

expansion track record

*3

July 2008

Dec. 2011

June 2015 Oct. 2019

Dec. 2007

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Management Quality

Improvement

Shareholder ReturnEffective Use of CapitalEPS Growth

V. Group Business

Strategy

35

Reduction of Business-Related Equities

Business-related equities outstanding will be “zero

*1

” in six years (JPY3.5tn in market value as of Mar. 31, 2024

and JPY0.4tn in book value) with a three-year reduction of 50%.

We will not merely reclassify them as pure investments (expected sale for FY2024 is JPY600.0bn in market

value as of Mar. 31, 2024 and JPY53.0bn in book value)

Business-related equities ratio compared to IFRS net assets will be approx. 20% by end of FY2026

Timeline and amount of sale of

business-related equities

Ratio to net assets

*2

0%

10%

20%

30%

40%

50%

60%

2023 2026 2029

2020 2021 2022 2023 2024 2025 2026 2027 2028 2029

売却額 保有時価 保有簿価

売却時価額

(億円)

0

Increase in

market value

due to higher

share prices

500.0

250.0

保有額

(兆円)

0

2.0

1.0

3.0

*1: Excluding non-listed stocks (market value as of Mar. 31, 2024, c. JPY22.5bn in book value) and

investments related to capital and business alliance, etc.

*2: Based on share prices as of March 31, 2024. Net assets at the end of FY2024 onwards are estimates.

Amount

Sold

Portfolio

Market Value

Portfolio

Book Value

Transition to IFRS at

end of FY2025

(net assets will increase)

50% in

3 years

Market value

(trillions of JPY)

Sold amount

(billions of JPY)

End of FY2023

Market value: c. JPY3.5tn

End of FY2029

“Zero

*1

” holding

Re-post from Q4 Conference

Call on May 20, 2024

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Management Quality

Improvement

Shareholder ReturnEffective Use of CapitalEPS Growth

V. Group Business

Strategy

Top-tier DPS Growth

DPS growth trajectory with confidence in line with EPS growth can be maintained for the next three years

DPS for FY2024 is projected at JPY159 (+29% YoY). We will continue to increase DPS (we are committed not

to cut dividends, in principle) (Review planned in FY2026 for various indicators and definitions considering

the impact of introduction of IFRS / ICS)

400.0

485.0

625.0

(50)

50

150

250

350

450

-1,000

1,000

3,000

5,000

7,000

9,000

11,000

2022 2023 Result 2024 Projections 2025 2026

FY2024 Projections (+29% YoY)

13th consecutive dividends increase

expected

5Y average

adjusted net

income

(billions of JPY)

Gray indicates

single year profit

DPS

*

(JPY)

309.9

399.6

578.3

0

50

100

150

200

250

300

0

1000

2000

3000

4000

5000

6000

7000

8000

2012 2021

123

100

85

17

444.0

711.6

159

1,000.0

+36

(+29%)

+23

(+23%)

Review planned in

FY2026 for various

indicators/definitions

vs original

projections:

+2 yen

2011

*: DPS is calculated by 5Y average adjusted net income X payout ratio / number of shares

Re-post from Q4 Conference

Call on May 20, 2024

36

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Management Quality

Improvement

Shareholder ReturnEffective Use of CapitalEPS Growth

V. Group Business

Strategy

Strong Capital Stock and Disciplined Capital Management (Share Buyback)

Strong ESR

*1

as of March 31, 2024 at 140%. Current plan for FY2024 share buyback is JPY200.0bn throughout

the year, comprehensively considering the current M&A pipeline, etc. (approx. +2% effect on EPS Growth. As

the first step, JPY100.0bn share buyback has been approved )

ESR

*1

Target Range

Sep. 2023 Mar. 2024

31,857 yen

Nikkei Stock

Average

40,369 yen

1.62%

30Y JPY interest

rate

1.73%

(Reference)

Before restricted capital

deduction

1.21%

Credit Spread

0.90%

180% 181%

*2

Risk

3.7

trillion

yen

Net asset

value

4.9

trillion

yen

Risk

4.3

trillion

yen

Net asset

value

6.0

trillion

yen

140%

*2

*1: Economic Solvency Ratio (under the current definition, risk is calculated using a model based on 99.95%VaR

(AA credit rating equivalent)). Net asset value of overseas subsidiaries shows the balance as of three months

earlier (Jun. 30, 2023, and Dec. 31, 2023) See P.80 for sensitivity.

*2: ESR after the JPY200bn share buyback is 135% (176% before restricted capital deduction)

Implement:

Further business investment, and/or

Additional risk-taking and/or

Shareholder returns

Flexibly consider:

Further business investment, and/or

Additional risk-taking, and/or

Shareholder returns

Aim to recover capital level through

accumulation of profits

Control risk level by reducing risk-taking

activities

De-risking

Consideration of capital increase

Review of shareholder return policy

140%

100%

ESR

*1

Target

Range

133%

Re-post from

Q4 Conference Call

on May 20, 2024

37

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Management Quality

Improvement

Shareholder ReturnEffective Use of CapitalEPS Growth

V. Group Business

Strategy

Review of Indicators for Introduction of IFRS / ICS

IFRS / ICS to be introduced at the end of FY2025

Considering the impact of the introduction and comparability with peers (who revised various KPI indicators

upon introduction of IFRS 9 and 17), review of various indicators and definitions is planned in FY2026

・・・

FY2025 FY2026

Planned

introduction

of IFRS / ICS

*2

Profit indicators

Nov. 2025

Planned to provide

guidelines for various

KPIs based on

the new definition

ROE

Adjusted Net Income / Business Unit Profits

Adjusted ROE

Based on new

definitions

(Reference)

Europe

Peers

Dividend Policy

Adjusted net income (5Y average) x Dividend payout ratio (currently 50%)

ESR

Current ESR (confidence level: 99.95% VaR)

Target

100-140%

Revision of various

KPIs

*1

upon

introduction of

IFRS 9 and 17

FY2022

Planned ICS

*2

introduction

<Current KPIs / Definition> <From FY2026>

TMHD

*1: Profit indicators, etc.

Europe Peers: Allianz, AXA, Zurich

Source: Company data

*2: Insurance Capital Standard. International Association of Insurance Supervisors is expected to introduce a prescribed capital

requirement for Internationally Active Insurance Groups by the end of FY2025

In Japan, it is expected to be introduced as the “Economic Value-based Solvency Framework”

Re-post from Q4 Conference

Call on May 20, 2024

38

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Management Quality

Improvement

Shareholder ReturnEffective Use of CapitalEPS Growth

V. Group Business

Strategy

39

Globally Integrated Group Management

Continue to promote “integrated group management” that leverages global talent and knowledge to decide

and implement important management actions

Tap into global wisdom with steady succession of overseas management and enrichment of global committees

to further enhance the quality, confidence, and speed of management decisions

Appropriate application of expertise on global basis

Leverage global talent and knowledge to decide and

implement important management actions

International top management

Donald Sherman

Vice President

Executive Officer

Co-CIO

Christopher Williams

Vice President Executive Officer

Co-Head of Int’l Business

(up to Mar. 2024)

José Adalberto

Ferrara

Caryn Angelson

Randy Rinicella Gus Aivaliotis

Robert Pick

Deputy CxO

John Glomb

Deputy

CLCO

Deputy

CITO

Deputy

CDO

Group CDIO

Executive Officers

PHLY

TMSR

Key Management

Matters

Key Global Committees

ERM • ERM Committee

M&A • International Executive Committee

Underwriting • Global Retention Strategy Committee

Reserving

• International P&C Reserving Actuary

Committee

Investment • Investment Executive Roundtable

Risk

Management

• International Risk Committee

IT / Digitalization

Security

• Global IT Committee

• Digital Round Table

Sustainability

• Sustainability Committee

• GX Round Table

Diversity • Diversity Council

Internal Audit • International Internal Audit Committee

Susan Rivera

Managing Executive

Officer

Co-CRSO

Brad Irick

Managing Executive Officer

Co-Head of Int’l Business

Apr. 2024

Apr. 2024

Apr. 2024

Continue to support the international business

as the Chairman of International Business

Deputy

CRSO

Deputy

CAO

Dawn Miller

Barry Cook

Apr. 2024

Apr. 2024

Senior General Manager

Daniel Thomas

Risk

Management

Daljitt Barn

U/W

Apr. 2024

Steady succession

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Management Quality

Improvement

Shareholder ReturnEffective Use of CapitalEPS Growth

V. Group Business

Strategy

40

Expansion of Group Synergies

Group synergies are our unique strength and steadily expanding to USD618mn as a result of

Globally Integrated Group Management

Investment

Leverage DFG’s asset

management

capabilities

Revenue

Leverage our

global network

Cost

Leverage group

resources and economies

of scale

Capital

Optimize retention /

reinsurance at group

level

Group

Synergies

Annual profit

contribution:

USD

618mn

(Dec. 31, 2023)

Group Synergies

609

646

757

799

971

906

*

2018 2019 2020 2021 2022 2023

(USD mn)

Example of revenue synergies

Cross-selling

Cross-sell reference to customers in

other group entities

Joint approach for mega-events and large

corporations

Joint Approach

Lateral expansion of specialty products

Regional

Expansion

Leverage group capital, intellectual /

human capital, and network

Strategic Use of

Group Assets

Revenue synergy (DWP)

*: DWP rose YoY excl. impact of loss of synergy from specific projects due to sale of Highland in 2022 (ref. P.33)

Copyright (c) 2024 Tokio Marine Holdings, Inc.

Management Quality

Improvement

Shareholder ReturnEffective Use of CapitalEPS Growth

V. Group Business

Strategy

41

Enhancement of Governance and Risk Management

Further enhancement of governance at Group-level is set as one of key strategies in the new MTP and will be

executed rigorously through the newly established “Group Audit Committee” and full utilization of external

perspectives. We are steadily implementing the "measures" presented at FY2023 Interim IR Conference in

Nov. 2023

Strengthen direct instruction / supervision by TMHD for domestic and overseas entities and further develop

the Global integrated group management

Themes to be deliberated by Group Audit Committee

utilizing “external perspective” (example)

Review of the gap from the common sense of the society (re-inspection of

our common sense)

Review our situation in response to the possible scenarios similar to incidents

at other companies / industries (“draw a lesson”)

Preventive measures for past incidents at group companies will be considered

to implement at other group companies

Consolidation of governance functions such as the second and

third lines of group companies for further direct instruction /

supervision by TMHD

Enhancement of direct audit by TMHD (conducted as necessary

from FY2024)

Utilization of external perspectives

[Japan] Consolidate governance functions, enhance internal audit

Established “Group Audit Committee” in April 2024. External

members including the Chair comprise majority of the Committee

Utilize “external perspectives” to review the appropriateness of our

business process, culture etc.

Completed the formulation of action plans after evaluating the

framework of each group company, and in the process of

monitoring its progress. Promote enhancement of group

companies’ framework thorough the PDCA cycle

[Int’l] Enhance internal control and further supports aligned with

the maturity level of each group company

Utilization of industry leading experts

Continue recruitment / development of experts for risk

management, legal & compliance, internal audit etc., and