State of California

Trial Court Revenue Distribution

Frequently Asked Questions

April 2019

California State Controller’s Office

and the

Judicial Council of California

1

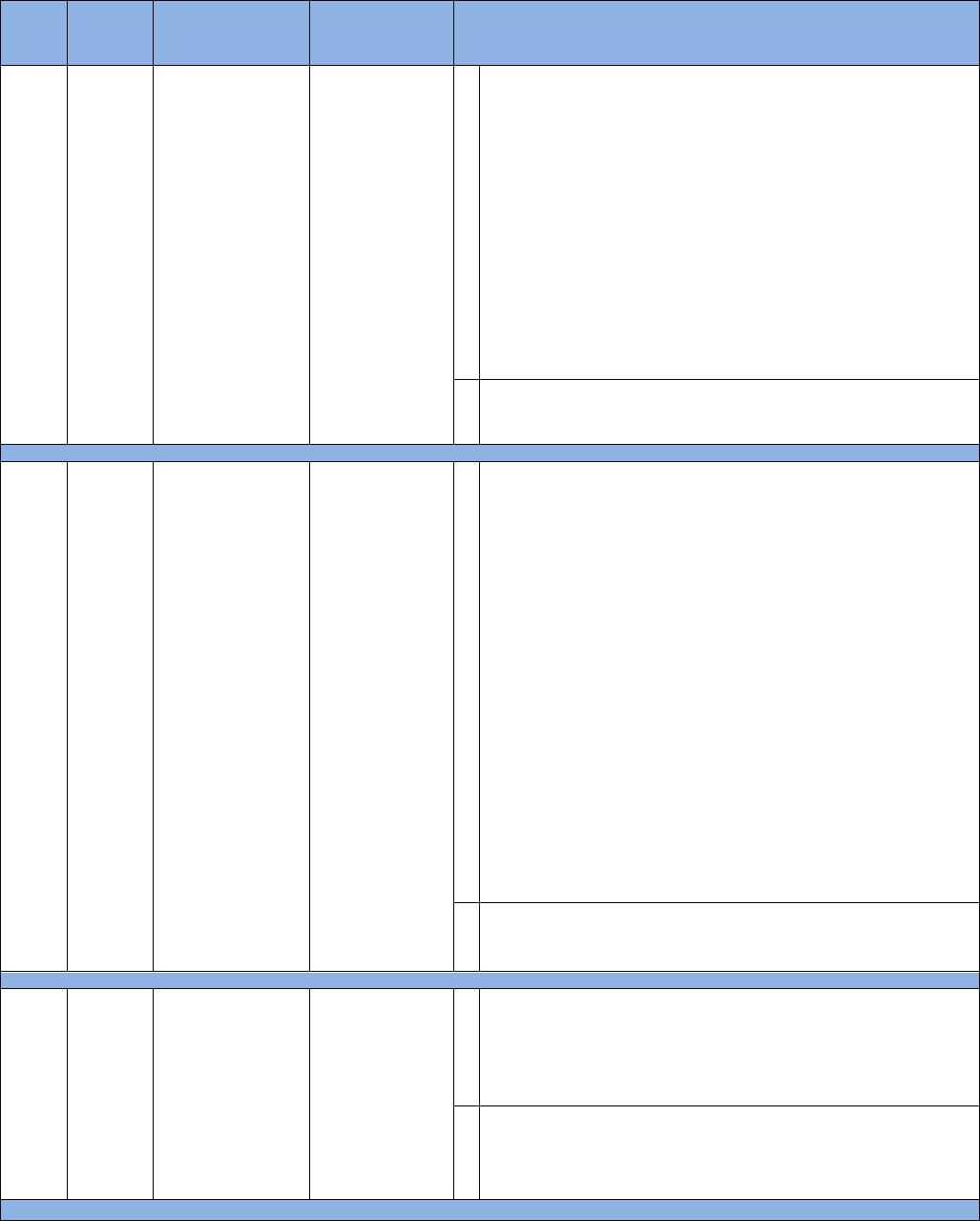

Table of Contents

Contents

How to Navigate the FAQs ................................................................................................................. 2

FAQ Keywords and Categories ......................................................................................................... 3

Category A: General Questions ........................................................................................................ 4

Category B: Trial Court Revenue Distribution Guidelines ......................................................... 27

Category C: Statutes ........................................................................................................................ 28

Category D: Parking ........................................................................................................................ 74

Category E: Collections ................................................................................................................... 78

Category F: Distribution Calculations ........................................................................................... 85

Category G: Distribution Spreadsheets ......................................................................................... 91

Category H: Audits .......................................................................................................................... 92

2

How to Navigate the FAQs

Since 2013, the California State Controller’s Office (SCO) and the Judicial Council of California

(JCC) have jointly facilitated trial court revenue distribution training sessions for personnel of

counties, trial courts, and other entities involved in the assessment, collection, and distribution of

trial court revenue. Questions received from participants of these training sessions have been

compiled to create this frequently asked questions (FAQ) document.

Subsequent questions received by the SCO and JCC will be incorporated as received and researched.

The SCO and JCC will collaboratively review questions as submitted and jointly agree upon

responses. We may take longer to respond to the more complex questions, as they may involve

further research and discussion with legal staff.

Questions are grouped into eight subject categories. The Table of Contents is hyperlinked for your

convenience to provide quick access to each category. A keyword is assigned to each question to

assist with searching for relevant questions and their answers. The table on the next page

summarizes the questions by keyword, category, and quantity.

Submitted questions may have been paraphrased for clarity or parsed into multiple components to

simplify them and their associated responses. If you submitted a question, be sure to review the

response to ensure that you received a complete answer to your inquiry.

It may be necessary to search multiple categories when seeking a response to a specific question, as

more than one category may apply. If you cannot find an answer to a question, are seeking

clarification of responses to prior questions, or have new questions, please submit them to one of the

e-mail addresses noted below. When applicable, please reference an existing question and answer

using the category and question number listed in the current FAQs.

Submit questions to:

The FAQs – along with manuals, worksheets, recorded training sessions, and other training and

revenue distribution materials – are available on the SCO website at

http://www.sco.ca.gov/ard_trialcourt_manual_guidelines.html, or on the JCC website at

http://www.courts.ca.gov/revenue-distribution.htm.

FAQs have an “as of date” associated with each response. Over time, the responses may change

based on new legislation or changes in policy. Items that are no longer applicable may be retained to

provide historical reference where appropriate. New questions and/or updated responses will be

bolded with an “as of date” until the next FAQ document revision.

3

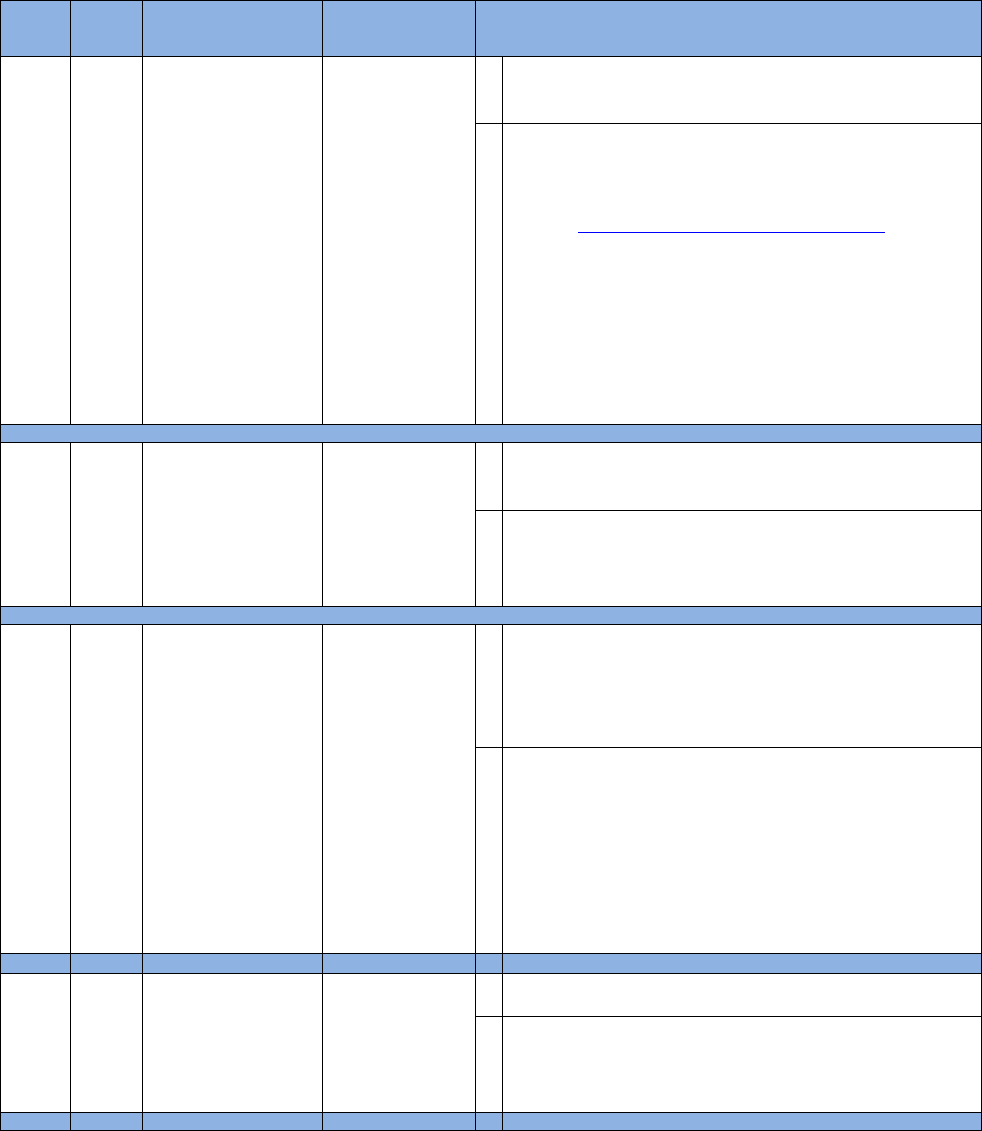

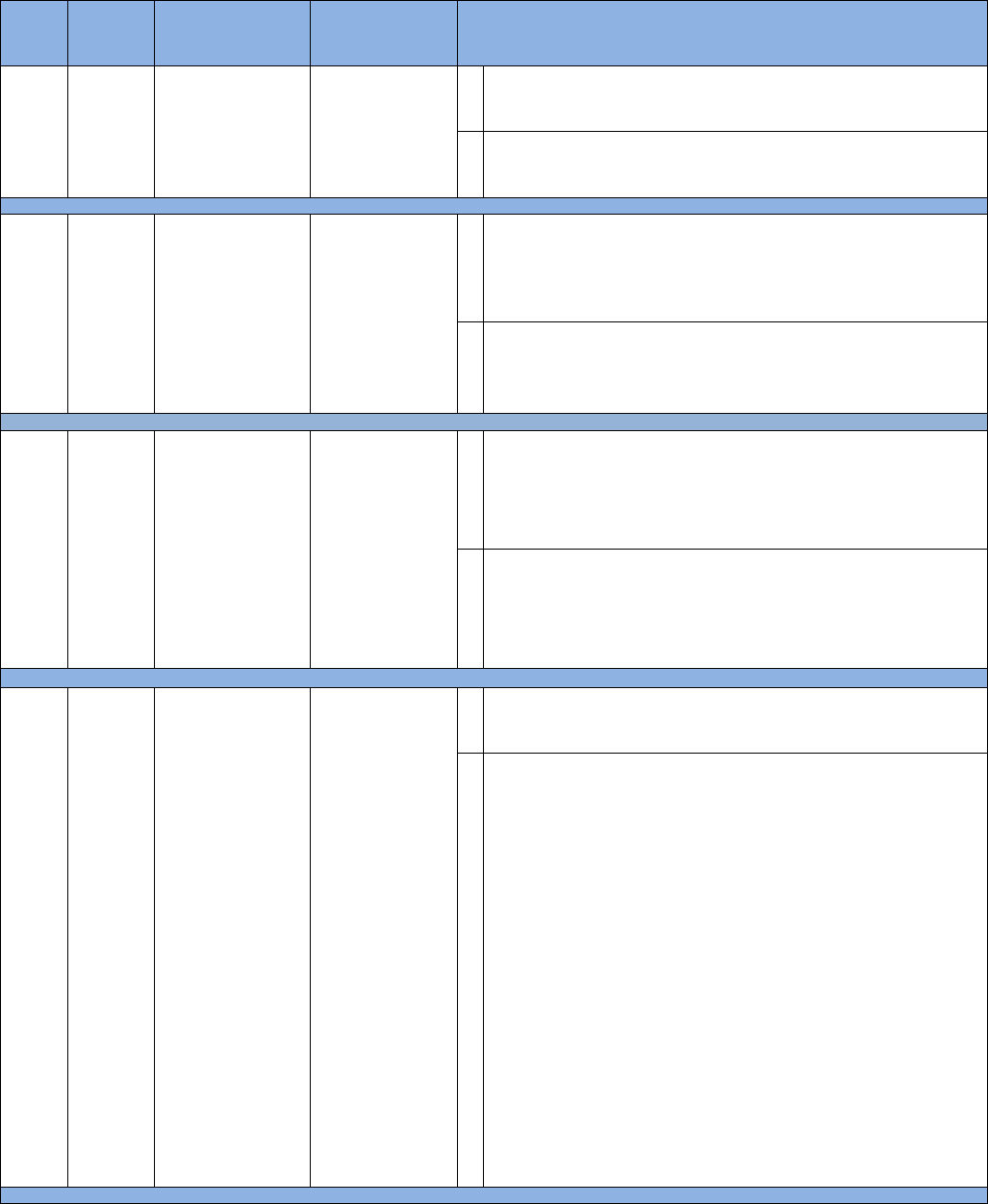

FAQ Keywords and Categories

Categories

Keywords A B C D E F G H Total

2% Automation 2 1

3

50/50 MOE 6

6

Audit Reports 1

1

Bail Bond Forfeitures 2

2

Bail Schedule 5

5

Base Fine 1

1

Board of Supervisors 5

5

Bond Indebtedness 1

1

Calculation 1

1

Civil Assessment 1 5

6

Community Service/Custody Credit 1 3

4

Cost Analysis 1

1

Court Minute Record 3

3

Court Operations Fee 2

2

Court Ordered Debt 2

2

Distribution 5

5

Distribution Guidelines 5 1

6

DNA 1

1

Document Retention 5

5

DUI Assessments 3

3

EMAT 1

1

Enhancements 3 10

13

Escheated Funds 2

2

Facilities 2

2

GC 76000 Local Penalty 1

1

GC 76000.3 Parking Penalty 2

2

Installment Payment Fee 18

18

Jurisdiction 6

6

Juvenile 5 2

7

Late Charge 5 1 2

8

Late Penalty Under VC 40310 4

4

Legislation 3

3

Mandatory Assessments 2

2

Moving Violations 1

1

Night Court Fee 2

2

Overpayment 1 1

2

Parking Assessments 2

2

Parking Remittances 3

3

Penalty Assessments 3

3

Priority 10 1

11

Priors Assessment VC 40508.6 8

8

Priors Enhancement 1

1

Probation 7

7

Proof of Correction 2

2

Proof of Financial Responsibility 1

1

Proof of Insurance 1

1

Railroad Crossings 1

1

Remittances 1

1

Resources 4

4

Restitution 4

3

Spreadsheets 4

4

Statute of Limitations 2

2

TC-31 16

16

Top Down Distribution 5

5

Traffic Assistance Program F 1

1

TVS 7 1

8

VC 40225 2

2

VC 40226 1

1

Violation Date vs. Conviction Date 4

4

Total 60 5 104 14 20 13 4 9 229

4

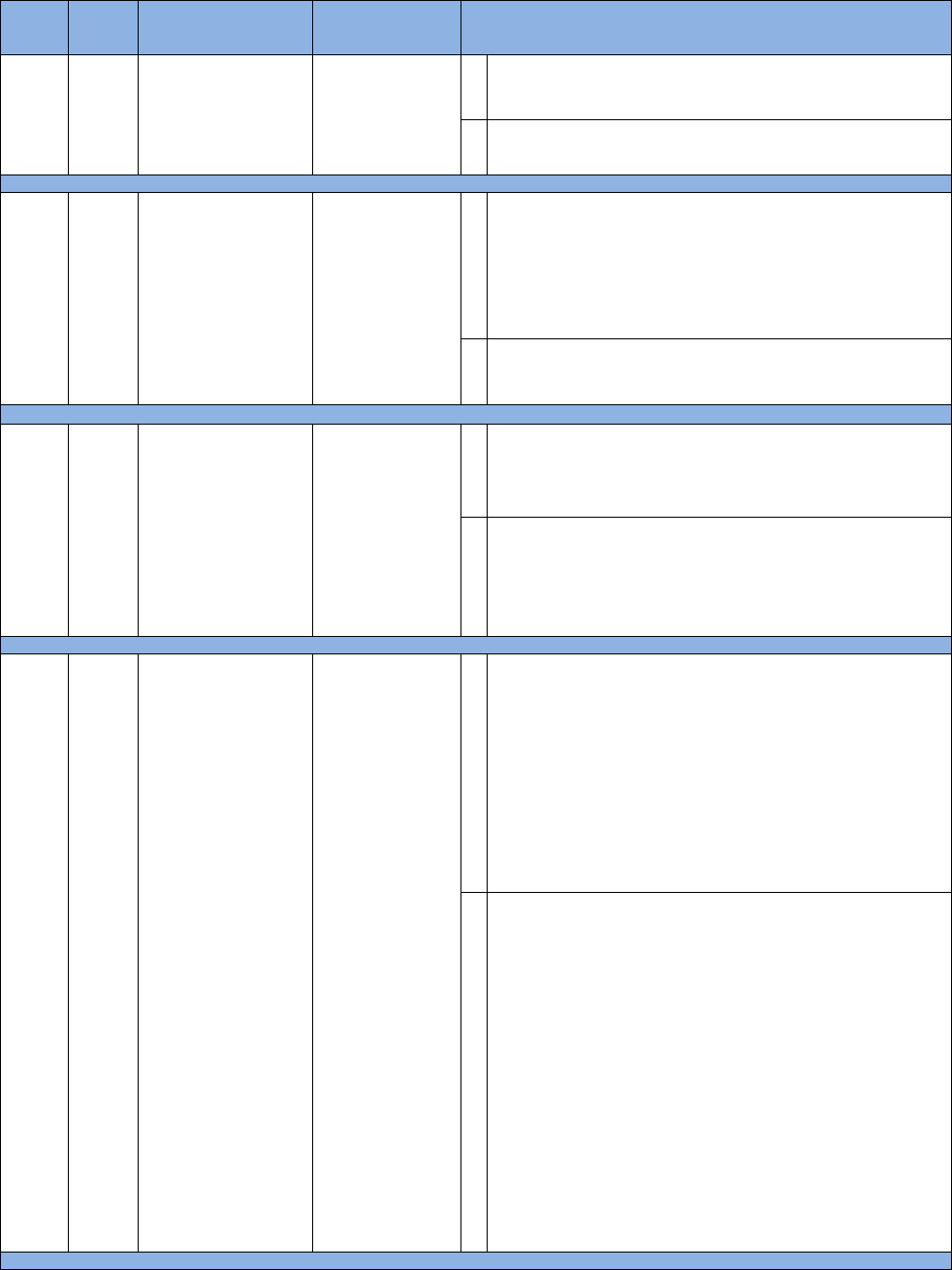

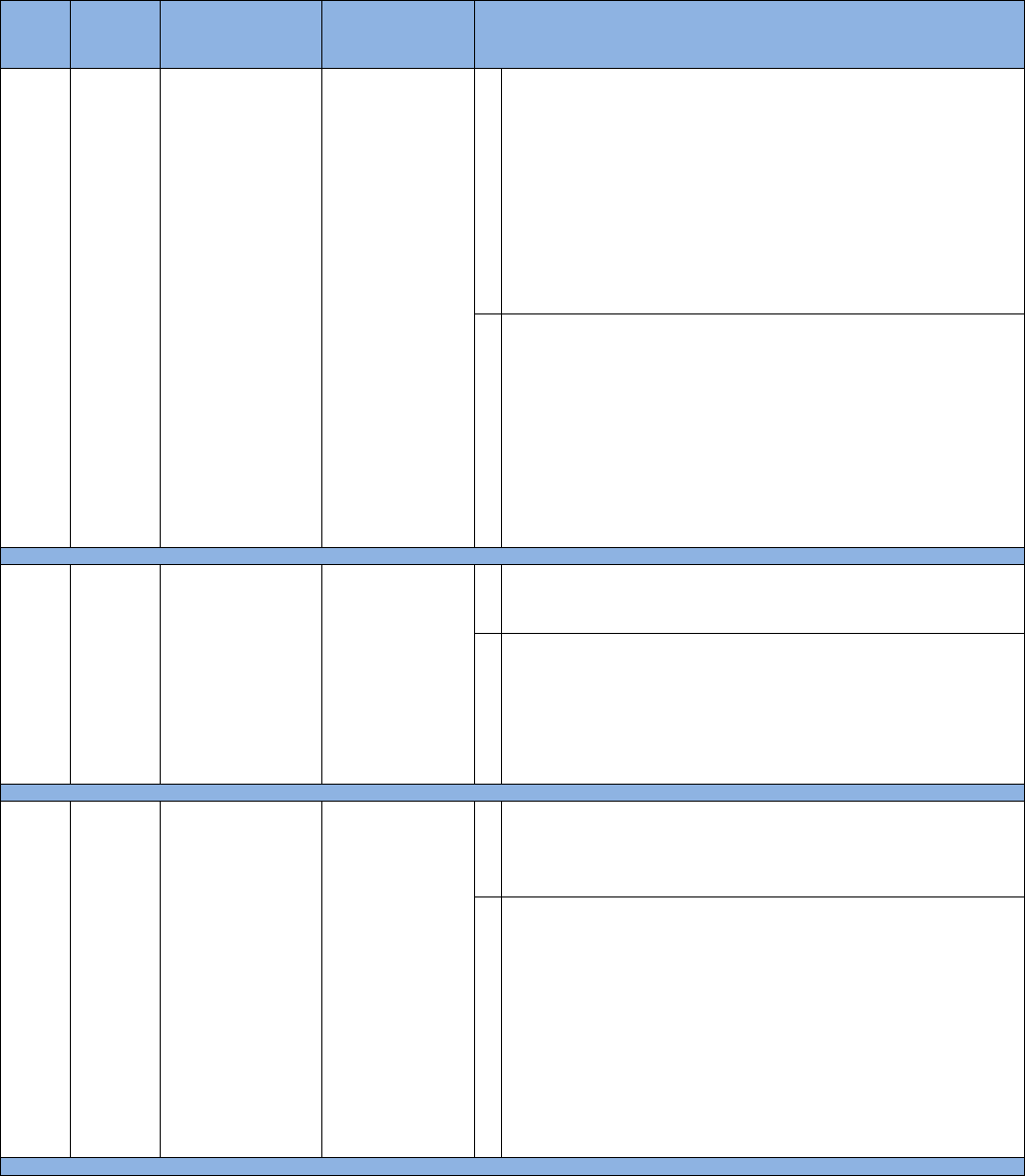

Category A: General Questions

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 1 Bail Schedule January 6,

2017

Q Where or to whom at the Judicial Council

should local courts send their annual updates to

the Local County Bail Schedule?

A In accordance with the California Rules of

Court 4.102, after a court adopts a countywide

bail and penalty schedule under Penal Code

section 1269b, the court must, as soon as

practicable, mail a copy of the schedule to the

Judicial Council with a report stating how the

revised schedule differs from the council’s

uniform bail and penalty schedule. These

should be sent to:

Criminal Justice Services

Judicial Council

455 Golden Gate Avenue

San Francisco

CA 94102-3688

A 2 Bail Schedule May 13,

2013

Q Where can I find the details/rules/requirements

for public notice of the Local County Bail

Schedule?

A Refer to the California Rules of Court (CRC)

Rule 10.613, which can be found at

http://www.courts.ca.gov/cms/rules/index.cfm?

title=ten&linkid=rule10_613. The CRC

provides public notice requirements for the

adoption of local rules, including the adoption

of a local county bail schedule.

5

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 3 Bail Schedule July 9,

2014

Q If the Vehicle Code only mandates fine

amounts, is the Uniform Bail and Penalty

Schedule just a suggested amount?

A No. Under Vehicle Code section 40310 and

Penal Code (PC) section 1269b(c), courts are

required to follow the Judicial Council’s bail

schedule for traffic infractions unless there are

reduced penalties that apply in the county.

Option counties, as defined by Section 77004

of the Government Code, may elect to increase

the bail under PC section 1463.28; or a judicial

officer may exercise discretion in sentencing

for an individual case. The Judicial Council’s

bail schedules for traffic misdemeanors and

non-traffic violations provide

recommendations for courts to follow in

adopting county bail schedules under

PC section 1269b.

California Rules of Court, Rule 4.102, requires

courts to give consideration to the Uniform

Bail and Penalty Schedules approved by the

Judicial Council when adopting local county

bail schedules. Under Rule 4.102, after

adoption of a local county bail schedule, a

court is required to mail a copy of the local bail

schedules to the Judicial Council with a report

stating how the schedules differ from the

schedules approved by the council. This Rule

can be found at

http://www.courts.ca.gov/cms/rules/index.cfm?

title=four&linkid=rule4_102.

A 4 Bail Schedule June 13,

2017

Q Why does the Uniform Bail and Penalty

Schedule not apply to all counties?

A Penal Code section 1463.28 allows for

specified counties to adopt a bail schedule that

exceeds the Uniform Bail and Penalty

Schedule.

6

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 5 Bail Schedule May 15,

2018

Q If the base fine of an infraction violation is not

stated in the Uniform Bail and Penalty

Schedule or in any statute code, what base fine

amount should we impose? Is there a statute

code associated with that?

A The Uniform Bail and Penalty Schedule

contains the most common violations, but it

does not include all violations.

However, pursuant to Penal Code section 19.8,

infractions are punishable by a fine not to

exceed $250, unless a different punishment is

prescribed.

A 6 Civil

Assessment

January 6,

2017

Q When notice of Failure to Appear or Failure to

Pay is sent to a defendant, is the civil

assessment already included, or is the civil

assessment added after 20 days?

A Under Penal Code section 1214.1(b)(1), the

civil assessment is imposed by the court to be

effective 20 calendar days after mailing of a

notice of the assessment. If the defendant

appears within the 20 days and shows good

cause for the failure to appear or failure to pay,

the court must vacate the assessment.

A 7

Community

Service/

Custody Credit

May 13,

2013

Q

When judges order community service in lieu

of a fine, they are ordering the service for the

total amount of the fine. Should judges be

ordering community service for the fine

amount, and then waiving the assessment fees

separately on the record?

A The court operations assessment (previously

known as a court security fee) under Penal

Code section 1465.8 and the criminal

conviction assessment under Government Code

section 70373 are mandatory fees that must be

imposed for each conviction (People v. Woods

(2010) 191 Cal.App.4th 269). No authorities

expressly authorize a court to convert these

assessments to community service or to waive

the assessments after imposition when a

defendant is referred to community service for

the underlying fine.

7

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 8 Cost Analysis July 6,

2017

Q How often should cost studies be updated?

A We are not aware of a statute or policy that

addresses how often to update cost studies.

Nevertheless, cost studies should reflect the

current actual operating costs for performing a

specific activity. As the major component of

operating costs will likely come from labor

costs, entities should consider preparing a new

cost study whenever a material change in labor

cost or the level of effort associated with the

specific activity occurs.

A 9 Court Minute

Record

May 15,

2013

Q When fines and fees are ordered, is the

judge/commissioner required to state each one

on the record?

A Yes. For penalty assessments and the 20% state

surcharge, it is an acceptable practice for bench

officers to use a shorthand reference to

“penalty assessments” and rely on the trial

court clerk to specify the penalties and

surcharge in appropriate amounts in the

minutes and the abstract of judgment (People

v. Sharret (2011) 191 Cal.App.4th 859).

For criminal conviction and court operation

assessments, the trial court is required to orally

impose the assessments for each of the counts

of which defendant is convicted, including the

stayed counts (People v. Sencion (2012) 211

Cal.App.4th 480, 484).

A 10 Court Minute

Record

May 12,

2015

Q If there are more than three convictions for

violation of the Health and Safety Code, but

only a $150 county drug program fee is

ordered, can a clerk add fees for the other two

convictions?

A Unless delegated authority to the clerk is

clearly outlined in a standing order, the clerk

should charge only the amount ordered, as

stated on the minute order.

8

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 11 Court Minute

Record

May 12,

2015

Q Is it acceptable for a judge to state “plus all

penalties and assessments” or must the judge

cite each one?

A Pursuant to People v. High (2004), 119 Cal.

App. 4

th

1192, it is necessary for a judicial

officer to verbally cite all fines and fees and

abstract them as separate fines, fees, penalties,

assessments, and/or surcharges to prevent

mistakes or ambiguity.

A 12 Distribution

April 18,

2013

Q If our court finds an error in a distribution or

various distributions, we make the changes in

the distributions going forward. How far back

must we go to make the corrections to the

distributions? The current fiscal year? Or as far

back as the last audit?

A The corrections must be made as far back as

the last SCO audit.

A 13 Distribution July 15, 2013 Q If a citation is issued pursuant to the California

Code of Regulations, how do I determine

distribution?

A Unless the regulation or the statute that it

enforces specifies a distribution method, the

citation will be distributed pursuant to

Penal Code section 1463.001.

9

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 14 Distribution June 3, 2016 Q Are fines for violations of California Code of

Regulations chapters, which are based on the

Fish and Game Code (F&G), distributed as

F&G fines or as basic criminal fines?

A F&G section 13003 governs these

distributions, and states, in part:

Unless otherwise provided by law, all fines and

forfeitures imposed or collected in any court of

this state for violations of any of the provisions

of this code or regulation made pursuant

thereto, or any other law providing for the

protection or preservation of birds, mammals,

fish, reptiles, or amphibia, shall be deposited as

soon as practicable after the receipt thereof with

the county treasurer of the county in which the

court is situated…..

A 15 Distribution June 3, 2016 A Does the additional penalty per Fish and Game

Code (F&G) section 12012 apply to CCR Title

14 Fish and Wildlife violations?

Q Yes. F&G section 12012 states:

In addition to any assessment, fine, penalty, or

forfeiture imposed pursuant to any other

provision of law, an additional penalty of

fifteen dollars ($15) shall be added to any fine,

penalty, or forfeiture imposed under this code

for a violation of this code or a regulation

adopted pursuant thereto.

A 16 Distribution June 3, 2016 Q How do county/city local ordinances apply to

specific fine and forfeiture distributions? For

example, Food and Agriculture Code (F&A)

section 31663 applies to violations of

F&A sections 31601 through 31683. Should

we include county/city local ordinances on

dangerous or vicious dogs with this type of

distribution?

A Local ordinances do not supersede

distributions listed in statute; they can only

complement the distributions directed in

statute. As to fines, when permitted by statute,

local ordinances may specify fine amounts

when they are not specified by statute.

10

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 17 Enhancements May 13,

2013

Q What is the statute or basis for the base fine

enhancement for “priors” noted in Bail

Schedule section VII of the Uniform Bail and

Penalty Schedule?

A Under Vehicle Code section 40310, the

Judicial Council is authorized to establish a

uniform traffic penalty schedule that is

applicable to all non-parking Vehicle Code

infractions. Section 40310 provides the council

with the authority to establish uniform penalty

enhancements for prior Vehicle Code

infraction convictions where the code does not

specify an amount.

A 18 Enhancements May 15,

2018

Q Must the $15 penalty pursuant to

Fish and Game Code (F&G) section 12021 be

assessed on fishing-without-a-license cases?

Years ago, our court was informed that it must

be added on all F&G violations except fishing

without a license.

A F&G section 12021 states that the $15 penalty

shall apply to all Fish and Game Code

violations except F&G section 12002.1(b) and

F&G section 12002.2(b), which govern cases

where persons charged with failure to display

or possess a required license, tag, seal, or

stamp, produce a valid license, tag, seal, or

stamp in court. In addition, the penalty does

not apply to violations of regulations governing

wearing or displaying a fishing license.

However, the penalty would apply if the

violator does not have the appropriate license.

A 19 Enhancements May 16,

2018

Q Is there an enhanced fine for Vehicle Code

violations in a school zone? We often receive

violations in a school zone, but could not find

any information governing them in the

Uniform Bail and Penalty Schedule or statutes

on additional enhancement.

A No, there are no enhanced fines for violations

in school zones.

11

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 20 Jurisdiction April 1,

2013

Q How should we handle distribution of “out of

county” citations?

A The arresting agency’s jurisdiction would

receive the funds (53 Ops. Cal. Atty. Gen. 29

(1969)).

A 21 Jurisdiction April 1,

2013

Q When a police officer who is employed by one

city writes a ticket in another city, which city

has jurisdiction?

For example, when a police officer of City A

writes a ticket in City B, which city gets the

money—City A, as that officer’s employer, or

City B, in whose jurisdiction the officer wrote

the ticket?

Please clarify whether we should distribute

based on the location of an arrest when

distributing per Penal Code section 1463.001.

We have agencies that frequently do traffic

enforcement in jurisdictions other than their

own.

A Unless otherwise specified by law, the

arresting agency. In the example above,

distribution would be to the arresting agency,

City A (53 Ops.Cal.Atty.Gen. 29 (1969)).

12

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 22 Jurisdiction April 1,

2013

Q If the city has a police department and the

California Highway Patrol (CHP) writes a

citation in that city, is the county exempt from

sending the city revenue under

Penal Code section 1463.002?

In other words, when the city has its own

police department, does all the revenue go to

county?

A The location that the CHP officer writes on the

citation determines whether the arrest is

considered a “city arrest” or a “county arrest,”

as defined in Penal Code (PC) section 1463. If

the CHP officer cites the location of the

violation as occurring within city limits, then

the arrest is considered a “city arrest;”

otherwise, the arrest is considered a “county

arrest.” Distribution will follow

PC section 1463.001 and PC section 1463.002.

For more information on distribution of

PC section 1463.001 collections, refer to

SCO’s Trial Court Revenue Distribution

Guidelines.

13

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 23 Jurisdiction May 12,

2015

Q When schools issue DUI and speeding

citations, are they enforceable by the court, or

must fines collected be remitted to the local

court/county?

A Statutes that govern citations for infractions

and Vehicle Code violations authorize peace

officers to issue Notices to Appear to be filed

with the court.

As defined under both the Education Code

(sections 38000 et seq.; 72330 et seq.; 89560 et

seq., and 92600 et seq) and the Penal Code

(sections 830 et seq.), peace officers include:

1) persons employed and compensated as

members of a police department of a school

district, when duly sworn; 2) members of a

California Community College police

department; 3) any peace officer employed by

a K-12 public school district who has

completed training as a school police officer;

and 4) members of the University of California

Police Department or the California State

University Police department. Citations issued

by these peace officers should be treated in the

same manner as citations issued by local peace

officers.

A 24 Jurisdiction June 3, 2016 Q Are arrests made by the University of

California (UC) and California State

University (CSU) police departments

considered “city” arrests or “county” arrests?

A Penal Code (PC) section 830.2 indicates that

UC and CSU police personnel qualify as

“state” officers. PC section 1463 states that an

arrest by a state officer (other than a California

Highway Patrol officer within city limits)

would be a “county” arrest.

14

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 25 Jurisdiction June 13,

2017

Q When cities disband their police agencies and

establish contracts with the County Sheriff for

patrol services, who is entitled to the revenue

distribution? If the city pays the Sheriff for

services, should the city receive the

distribution in these contractual circumstances?

A

Unless agreed to otherwise, the Sheriff, as

contracted law enforcement, should be paid the

amount stipulated in the contract for the

specified services. Any revenue collected from

citations issued by the contracted law

enforcement within city limits should be

distributed to the city.

A 26 Juvenile May 13,

2013

Q Do fines and penalties apply to juveniles?

A Courts may impose fines, penalty assessments,

and the state surcharge on juvenile offenses.

However, the $40 court operations assessment

imposed pursuant to

Penal Code section 1465.8, the criminal

conviction assessment imposed pursuant to

Government Code (GC) section 70373, and the

Emergency Medical Air Transportation penalty

imposed pursuant to GC section 76000.10 may

only be imposed with a conviction.

Therefore, these three assessments may not be

imposed for juvenile violations that do not

result in convictions when they are adjudicated

in Informal and Juvenile Traffic Court under

Welfare and Institutions Code section 255.

(See Egar v. Superior Court (2004) 120

Cal.App.4th 1306, which held that juvenile

court’s adjudications of misdemeanors were

not convictions for a criminal offense within

meaning of statute imposing court security fee,

the predecessor to the court operations

assessment.)

A 27 Juvenile May 12,

2015

Q How does distribution differ between juvenile

and adult cases?

A There is no difference between the distribution

of fines from adult court and fines from

juvenile cases that are heard in adult court.

15

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 28 Juvenile May 12,

2015

Q On a juvenile DUI, which fees are not

applicable?

A The Criminal Conviction Assessment and

Court Operations Assessment are imposed

upon conviction and are applicable to juvenile

DUI cases only if the case was heard in adult

court and resulted in a conviction.

A 29 Juvenile June 3, 2016 Q Does the mandatory State Penalty per Vehicle

Code section 40310 apply to juveniles

processed in juvenile court because it applies

to infractions?

A Yes. The mandatory state penalty in

Penal Code section 1464 is not contingent

upon conviction per se;, therefore, according to

Welfare and Institutions Code section 258, a

juvenile may be subject to the same fine as an

adult, except as specified.

A 30 Juvenile June 12,

2017

Q Are penalties and assessments required for

juvenile traffic offenses? The court currently

imposes only the adult base fine, distributed

per Penal Code section 1463.002.

A Generally, penalties and assessments are

required for juvenile cases. The difference

between juvenile and adult assessments is that

only those assessments imposed upon

conviction, such as the criminal conviction and

court operations assessments, are not assessed

on juveniles unless their cases are adjudicated

in adult court.

A 31 Late Penalty

under

VC 40310

April 18,

2013

Q How long has the 50% late penalty listed in

Vehicle Code (VC) section 40310 been

required?

A The language requiring the 50% late fee was

first added to VC section 40310 effective

September 15, 1992.

16

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 32 Late Penalty

under

VC 40310

April 18,

2013

Q Where is the 50% late penalty distributed?

A The 50% late penalty is distributed

proportionately to the same funds as the initial

penalty. For more information on the

distribution of VC section 40310 collections,

refer to SCO’s Trial Court Revenue

Distribution Guidelines.

A 33 Late Penalty

under

VC 40310

July 9, 2014 Q The late penalty imposed pursuant to

Vehicle Code (VC) section 40310

(50% late penalty) applies 20 days after a

notice is sent. What happens if no notice is

sent?

A If the court has not mailed a notice that the

traffic penalty has been assessed by the court,

then a late charge cannot be added.

Under VC section 40310, a 50% late charge is

due from the defendant after 1) the court has

mailed a notice informing the defendant that

the court has assessed a traffic penalty; and

2) the defendant fails to pay the traffic penalty

within 20 days of the mailing of this notice.

A 34 Late Penalty

under

VC 40310

June 3, 2016 Q Does the 50 % late penalty authorized by

Vehicle Code (VC) section 40310 apply to

non-adjudicated traffic cases (FTAs)?

A No, the 50% late penalty does not apply to

FTAs. In traffic cases, if a case is adjudicated

and payment is not made within 20 days of

notice of a judgement, then the mandatory 50%

late charge under VC section 40310 applies.

17

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 35 Legislation January 6,

2017

Q How will we be notified about statutory

changes that affect distributions?

A The California Legislative Information website

provides useful tools to keep track of statutory

changes. An example is the My Subscriptions

tab on http://leginfo.legislature.ca.gov/.

In addition to the annual revision of SCO’s

Trial Court Revenue Distribution Guidelines,

the SCO also posts addenda to the Guidelines,

including any changes in court revenue

distribution statutes that would take effect

before the next revision of the Guidelines.

A 36 Legislation April 1,

2013

Q How can the probation department receive

notification of distribution changes?

A Refer to A-33, immediately above. Probation

departments may also ask courts to provide

them with updates to distribution tables.

A 37 Legislation January 6,

2017

Q Do any resources exist that list the sunset dates

(other than the individual code sections) for all

fines/fees/penalty assessments that have end

dates?

A The Trial Court Revenue Distribution

Guidelines, found on the SCO website,

highlights the sunset dates of some code

sections that have specified them. However, it

is important that you check current code, as

more recent legislation may have taken effect

since the last update.

A 38 Mandatory

Assessments

April 1,

2013

Q When must a court assess a fine or fee?

A When the statute requires the fine or fee

(mandatory language such as must, shall, will)

and/or it is a minimum mandatory amount.

18

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 39 Mandatory

Assessments

July 9,

2014

Q If a fine is mandatory (e.g., County Drug), is

the penalty assessment also mandatory?

A Yes. Applicable penalty assessments are

mandatory for criminal fines.

See People v. Castellanos (2009) 175

Cal.App.4th 1524. If a fine is imposed and

suspended, Penal Code section 1464(b)

requires that penalty assessments be reduced in

proportion to the fine suspension.

A 40 Priority January 6,

2017

Q How should we apply payments to traffic

citations if a defendant owes many citations?

A The priority level applies to installment

payments and is not determined by the type of

crime, but rather the purpose to which the

funds will be applied.

For more information on the priority of a

specific court revenue distribution, refer to

SCO’s Trial Court Revenue Distribution

Guidelines (pages 5-6). A column is solely

dedicated to indicating the priority of

distribution.

A 41 Priority April 18,

2013

Q If there are multiple court orders, including

restitution and non-restitution charges, in what

order should a defendant make payments?

Should the defendant 1) pay restitution first to

all the court orders, and then pay all the non-

restitution charges; or 2) pay restitution to the

oldest court order first, then pay the associated

non-restitution charges, before paying

restitution to the next court order?

A The defendant should pay restitution first to all

the court orders.

A 42 Priority April 18,

2013

Q Is there a payment priority for Vehicle Code,

Penal Code, Health and Safety Code, etc. for

multiple offenses?

A No, these payments follow regular distribution.

19

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 43 Priority April 18,

2013

Q Should a defendant pay the monthly work fee

or restitution to victims first?

A The defendant should pay restitution to victims

first.

A 44 Priority April 18,

2013

Q In the installment payment priority, must all

payments be applied to court-ordered fines

before they can be applied to county-imposed

fees (such as probation supervision fees and

reports costs)?

A Yes. Fines fall within priority 3, and fees

typically fall within priority 4.

A 45 Priority April 18,

2013

Q How long have distributions per

Penal Code section 1463.18(a)(1) been the top

priority in Priority 3?

A Distributions per this section have been the top

priority since AB 3000, which established the

priority of installment payments, was enacted

in 2002.

A 46 Priority May 14,

2013

Q What priority level should these penalties/

assessments be:

A. Government Code (GC) section 70372(a)

– State Court Construction Penalty – the

portion distributed to the Immediate and

Critical Needs Account; and

B. GC section 70373 – Criminal Conviction

Assessment

AA. The state court construction penalty is

included in priority 3. Per Penal Code

section 1203.1d(b)(3), priority 3 applies to

any fines, penalty assessments, and

restitution fines ordered pursuant to

subdivision (b) of Section 1202.4 of the

Penal Code. Payment of each of these

items shall be made on a proportional

basis to the total amount levied for all of

these items.

B. The criminal conviction assessment is a

non-punitive fee, and therefore is included

in priority 4.

20

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

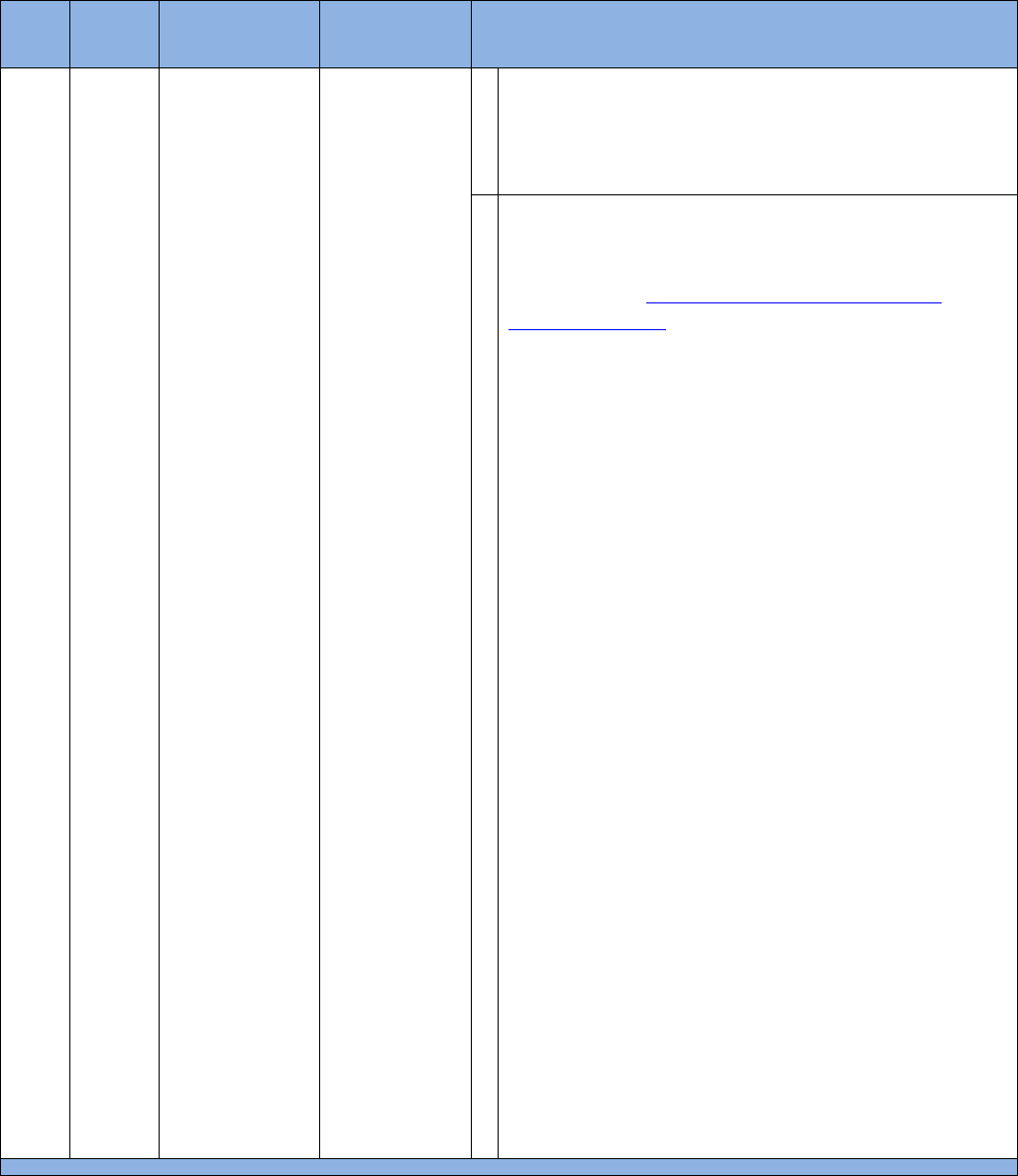

A

47

Priority

July 16, 2013

Q If payments are made via installments, is

distribution with proration by priority correct?

For example, if an account receivable (A/R)

has the following:

20% Surcharge (Priority 2): $20

Base Fine (Priority 3): $100

County Penalty Assessment (PA)

(Priority 3): $30

State Courthouse Construction

(Priority 3): $50

State PA (Priority 3): $70

Court Operations Assessment

(Priority 4): $40

Criminal Conviction (Priority 4): $35

The defendant pays $50, which is distributed as

follows:

The 20% Surcharge ($20) is paid in full, as

it has the highest priority.

The remaining $30 is then distributed

among the Priority 3 items. We use a

percent to total to distribute the monies

equitably. In this case, Priority 3 items

total $250 ($100 + $30 + $50 + $70). The

distribution is as follows:

o The Base Fine is 40% of $250; that

percentage is applied to the $30

balance, with a result of $12.

o The County PA is 12% of $250; that

percentage is applied to the $30

balance, with a result of $3.60.

o The State CHC is 20% of $250; that

percentage is applied to the $30

balance, with a result of $6.

o The State PA is 28% of $250; that

percentage is applied to the $30

balance, with a result of $8.40.

21

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 47

(cont.)

Priority July 16, 2013 A In general, there are no priorities within a

priority level, and the installment payment

would be equitably distributed between the

various penalties and assessments. However,

there is an exception within Priority 3,

regarding distribution pursuant to Penal Code

section 1463.18 for DUI violations. After

priorities 1 and 2 have been paid, this

distribution must occur before the remaining

Priority 3 distributions are made.

A 48 Priority May 16,

2018

Q When there are multiple court orders, including

orders to pay restitution to victims and orders

to pay other non-victim restitution amounts,

what should the priority of the payments be?

A Constitutional and statutory authority require

that restitution orders, or parts of orders, be

given first priority of distribution. When

money is collected from a defendant for

multiple orders, the restitution orders, or parts

of orders, are to be paid first. Only when the

restitution orders have been satisfied may

money be disbursed to pay the defendant’s

other court debts in the order set forth for those

amounts.

Therefore, even if a defendant has an older

case without a restitution order and a more

recent case with a restitution order, the victim’s

restitution order must be paid first. In cases

with multiple victims, the restitution orders, or

parts of orders, should be paid before other

non-victim restitution amounts.

However, payments made and distributed prior

to the imposition of the restitution order do not

have to be redistributed.

22

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 49 Priority June 3, 2016 Q Are distributions to cities, the

Maddy Emergency Medical Services Fund, and

the Criminal Justice Facilities Fund under

Vehicle Code 42007 a priority 4 or a priority 3

for installment payments?

A All distributions of Traffic Violator School

fees pursuant to Vehicle Code section 42007

are Priority 4.

A 50 Probation May 17,

2013

Q Should fines and penalties be assessed

separately for probation?

A Fines and penalties are always assessed

together. For probation, non-punitive court fees

may be assessed separately from fines and

penalties. The court operations assessment

imposed pursuant to Penal Code section 1465.8

and the criminal conviction assessment for

court facilities imposed pursuant to

Government Code section 70373 are non-

punitive fees that are not part of probation.

See People v. Shiseop Kim (2011) 193

Cal.App.4th 836, ruling that the court facilities

(conviction) assessment imposed on a

conviction should be separately imposed and

not made a condition of probation;

People v. Pacheco (2010) 187 Cal.App.4th

1392, holding that a trial court could not make

payment of court security fee (court operations

assessment) a condition of the defendant’s

probation because the fee had a non-punitive

purpose and was collateral to the defendant’s

crimes; and People v. Woods (2010) 191

Cal.App.4th 269, holding that there was no

authority that allowed a court facilities

(conviction) assessment, restitution fine, and

court security fee to be stayed when the

defendant was placed on probation.

23

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 51 Probation April 18,

2013

Q If Probation uses a vendor-operated phone-in

reporting system, the vendor charges the

offender a $4 fee, and Probation increases that

fee to $10, can the excess $6 be applied to

Penal Code (PC) section 1203.1b – cost of

probation fee before it is applied to the Priority

distribution?

NOTE: Probation would discount the court-

ordered PC section 1203.1b fee by an amount

equal to that charged for phone-in reporting.

A No; the excess must be distributed pursuant to

the priorities outlined in PC section 1203.1d,

and would fall under priority 4.

A 52 Probation January 1,

2016

Q Under Penal Code section 1203.9, if a

defendant owes court-ordered debt to both a

transferring county and a receiving county,

how is that money collected and disbursed?

A Effective January 1, 2016, the Transferring

Court is responsible for the collection and

distribution of any payments made by the

defendant. However, with approval from the

Transferring Court, the Receiving Court may

collect unpaid court-ordered debt and remit to

the Transferring Court for distribution. See

“Intercounty Fiscal Procedures” at

http://www.courts.ca.gov/partners/455.htm.

A 53 Probation May 12,

2015

Q Can the court order probation service fees?

A The court may order probation service fees

only on formal probation cases.

24

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A. 54 Probation May 12,

2015

Q Are Penal Code (PC) section 1463.001

distributions, in cases of formal probation with

fines owed, exempt from the city-county split

(unlike summary probation cases)?

A All fines and forfeitures imposed and collected

for crimes other than parking offenses are

distributed pursuant to PC section 1463.001.

Base fines without specific distributions are

distributed 100% to the county for county

arrests, and are split between the city and

county for city arrests, pursuant to

PC section 1463.002.

A 55 Probation May 12,

2015

Q If probation expires but fines are outstanding,

who is responsible for pursuing collection?

A Whichever agency is responsible for pursuing

collection of delinquent court-ordered fines,

depending on the arrangements made by each

county and court.

A 56 Probation January 1,

2018

Q When a defendant is terminated from deferred

entry of judgment (DEJ) and placed on formal

probation with fines and fees ordered, must the

defendant pay DEJ fees in addition to new

fines and fees on the same case?

A Penal Code section 1000.3(e) states:

Prior to dismissing the charge or charges or

terminating pretrial diversion, the court shall

consider the defendant’s ability to pay and

whether the defendant has paid a diversion

restitution fee pursuant to Section 1001.90, if

ordered, and has met his or her financial

obligation to the program, if any. As provided

in Section 1203.1b, the defendant shall

reimburse the probation department for the

reasonable cost of any program investigation or

progress report filed with the court as directed

pursuant to Sections 1000.1 and 1000.2.

Based on this language, the defendant is

responsible for the new fines and fees as well

as the DEJ fees, but the court must consider the

defendant’s ability to pay.

25

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

A 57 Resources April 18,

2013

Q Where can I find information on the

percentages of a fine distribution to the county,

city, etc.?

A The Trial Court Revenue Distribution

Guidelines document on the SCO website

provides this information; it is available at

http://sco.ca.gov/ard_trialcourt_manual_guidelines.

html. Refer to current legislation to verify

accuracy.

A 58 Resources December 9,

2015

Q Where can we find a list of what is defined as a

“fee” vs a “fine?” We have heard different

courts define the terms differently.

A Unfortunately, there is no separate list that

specifies those amounts treated as fees vs.

those treated as fines.

However, the Trial Court Revenue Distribution

Guidelines, located on the SCO website, do

indicate when an assessment labeled as a fee is

to be treated as a fine, as well as the reverse.

Refer to specific entries in the Guidelines for

additional information.

A 59 Resources December 9,

2015

Q Where can we find a list of current fines/fees

that have sunset dates?

A There is no separate list of sunset dates for

fines and fees. However, the Trial Court

Revenue Distribution Guidelines do indicate

the sunset date for individual code sections,

where appropriate.

26

Cat.

Q

No.

Keywords

Response as

of Date

Questions and Responses

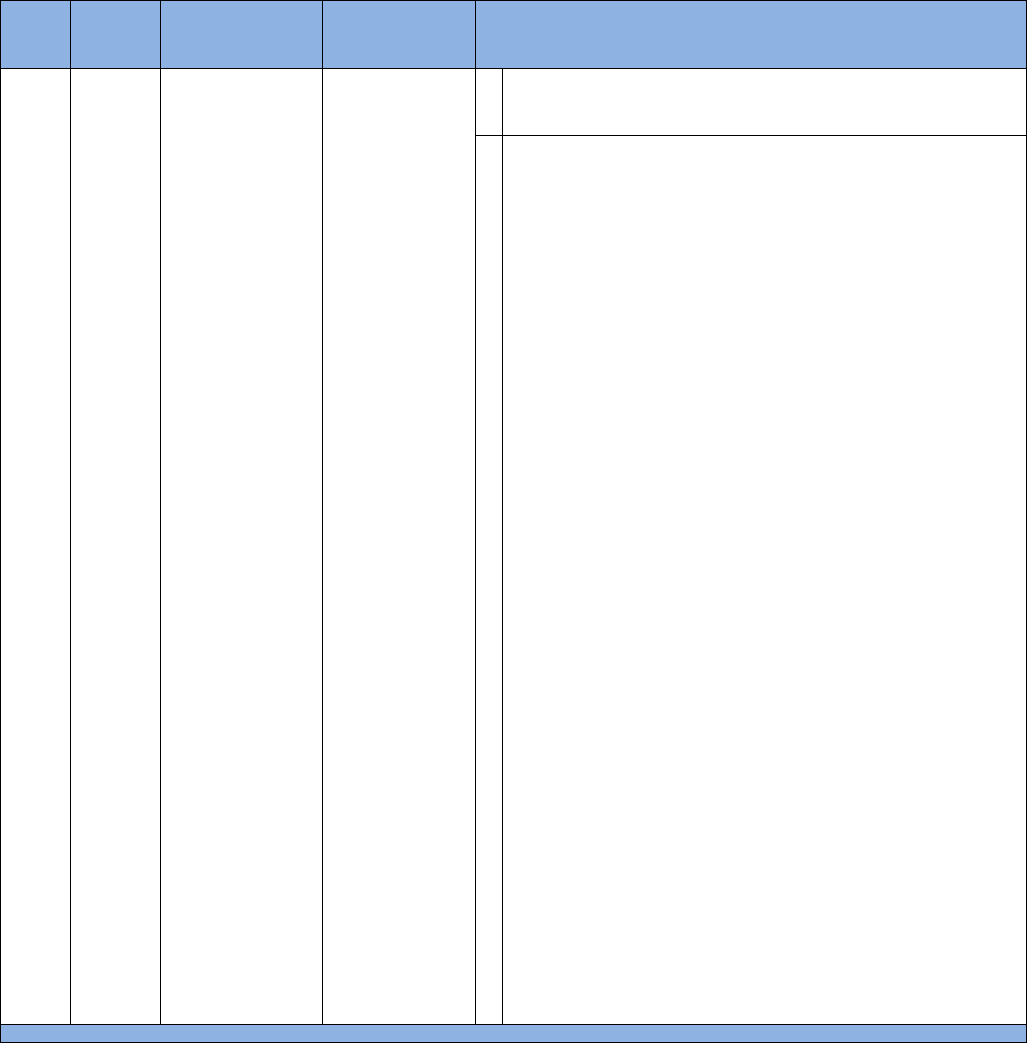

A 60 Resources June 3, 2016 Q Who do we contact at the SCO for questions

about 50/50 Maintenance of Effort (MOE)

excess, and to acquire the electronic version of

the annual report?

A Questions regarding the distribution of trial

court revenue, including the calculation and

distribution of MOE excess, may be submitted

Questions related to the TC-31 may be

submitted to [email protected].

The annual report is from the Judicial Council

of California, and may be requested from

27

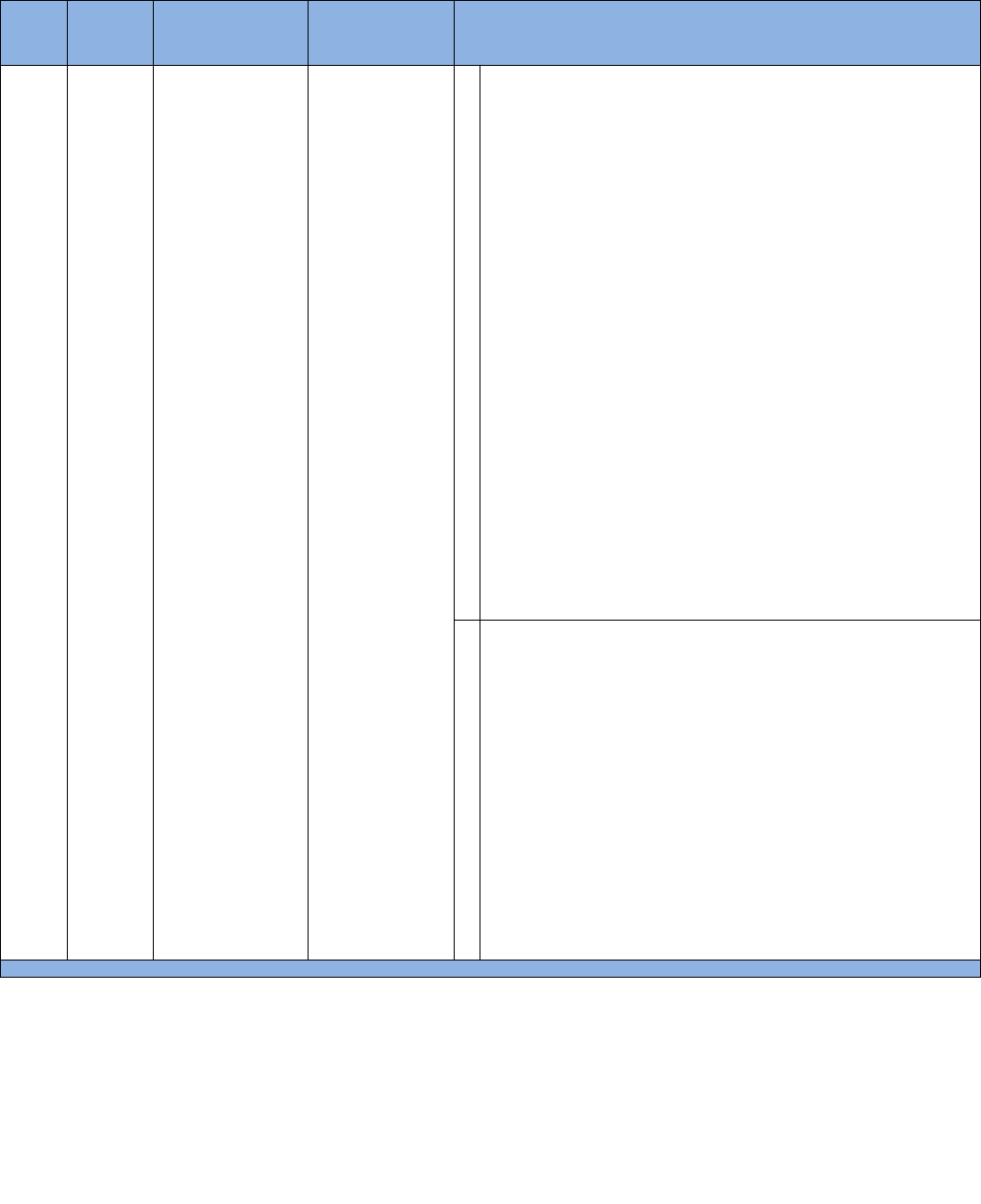

Category B: Trial Court Revenue Distribution Guidelines

Cat. Q No. Keywords

Response

as of Date

Questions and Responses

B 1 Distribution

Guidelines

April 18,

2013

Q When will the SCO issue an updated version of the

Trial Court Revenue Distribution Guidelines?

A We anticipate that the Guidelines will be updated in

January of each year.

B 2 Distribution

Guidelines

April 18,

2013

Q Why do the Guidelines separate the tables?

A The Guidelines are categorized into tables to address

code sections that share similar exceptions,

conditions, or distributions. Surveys for feedback on

the Guidelines were provided at training sessions

and on the SCO website. Based on the responses

from these surveys, the layout and organization of

the Guidelines may change in future revisions.

B 3 Distribution

Guidelines

April 18,

2013

Q Do the Trial Court Revenue Distribution Guidelines

include discretionary/mandatory language?

A The SCO intends to add this language to future

revisions of the Guidelines.

B 4 Distribution

Guidelines

April 1,

2013

Q When Revision 22 came out in 2010, it appeared that

any changes from the previous version were in bold

font. I just noticed a change that is not in bold font;

should it not be there?

A If you believe that you have found a mistake in the

Guidelines, please contact the SCO at

B 5 Distribution

Guidelines

June 3,

2016

Q Does any single worksheet have all of court/county

codes, penalties, and fine amounts?

A No. Local ordinances, fines, penalties, and fees

differ from county to county. Refer to your local

countywide bail schedule, which courts must adopt

annually to set bail per the requirements that apply to

their jurisdictions.

28

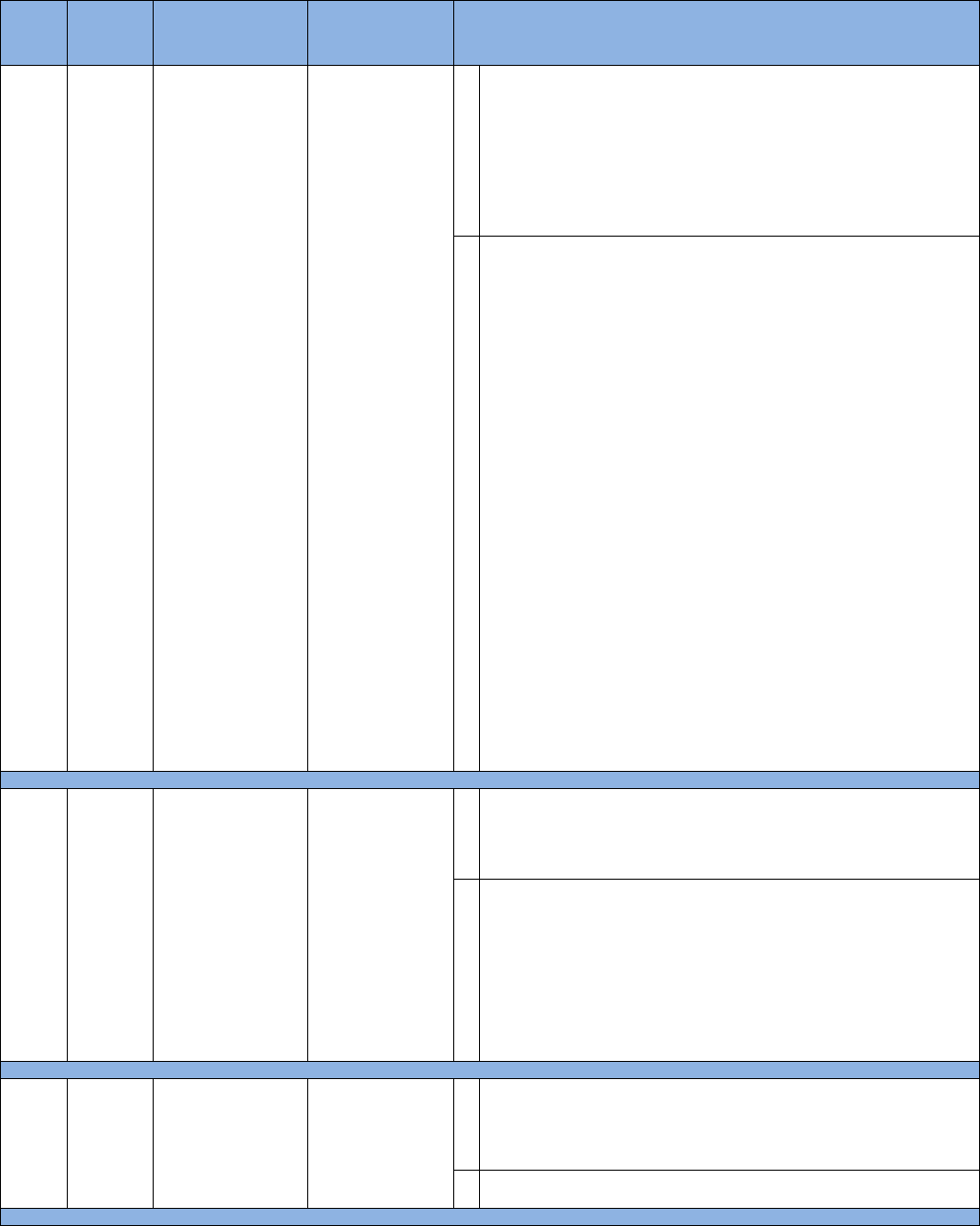

Category C: Statutes

Cat. Q No. Keywords

Response as

of Date

Questions and Responses

C 1 2%

Automation

May 17,

2013

Q Does 2% automation apply to the penalty

assessment imposed pursuant to

Penal Code section 1463.25?

A Yes. As Government Code section 68090.8 states,

the 2% automation transfer applies to fines,

penalties, and forfeitures collected in criminal

cases.

C 2 2%

Automation

June 3, 2016 Q Which fines are subject to the 2% automation

charge?

A Government Code section 68090.8 states that the

2% automation transfer applies to “all fines,

penalties, and forfeitures collected in criminal

cases.” It does not apply to civil cases, or to fees

imposed in criminal cases.

C 3 50/50 MOE April 18,

2013

Q What will the Excess Maintenance of Effort (MOE)

payment per Government Code (GC) section 77205

be when the total excess MOE is negative, or the

total eligible revenue collection is less than required

MOE payment under GC section 77201.1?

A If the total qualified revenues used to calculate the

50/50 MOE is under the threshold, then no

additional payment is needed.

C 4 50/50 MOE April 18,

2013

Q Why is the threshold amount for calculating the

Maintenance of Effort payment based on fiscal year

1998-99?

A That is what is required in statute

(Government Code section 77205).

29

Cat. Q No. Keywords

Response as

of Date

Questions and Responses

C

5

50/50 MOE

July 22, 2013

Q

Regarding the $2 Traffic Violator School (TVS)

allocation from county’s share: what statute clearly

states that the $2 TVS fee –

$1 per Government Code (GC) section 76100 and $1

per GC section 76101 – should come from county’s

share?

A

Pursuant to GC section 77205, the 50/50 split of court

revenue growth should be calculated based on what

would have been remitted to the State pursuant to all

applicable statutes as they read on December 31,

1997.

As of December 31, 1997, Vehicle Code (VC) section

42007(b)(1) stated that the 77% of revenues derived

from TVS fees should be deposited into the State

General Fund before distribution to local construction

funds.

As of December 31, 1997, VC section 42007(b)(2)

stated that the remaining amount collected under

subdivision (a) should be deposited in the county’s

general fund—provided that, in any county in which a

fund was established pursuant to

Chapter 12 of Title 8 of the Government Code, the

sum of one dollar ($1) for each fund so established

was deposited with the county treasurer and placed in

that fund.

In summary, the total distributions to the local

construction funds came out of the county’s 23%

portion of the fee. Therefore, the Maintenance of

Effort calculation should be based on 77% of the total

fee, not 77% of the fee net of local construction

distributions.

C 6 50/50 MOE July 9,

2014

Q

On a red-light violation in the county, is the 30%

distribution to the ticketing agency part of

Government Code (GC) section 77205(a)?

A

The 30% distribution to the ticketing agency is not

part of GC section 77205(a) money.

The 30% allocation is made prior to the Penal Code

section 1463.001 distribution to the county general

fund, so it is separate from the distributions that are

used in the GC section 77205 maintenance of effort

calculations. This means that the 30% distribution is

not a GC section 77205(a) revenue.

30

Cat. Q No. Keywords

Response as

of Date

Questions and Responses

C 7 50/50 MOE July 9,

2014

Q Are the Courthouse Construction Fund and

Criminal Justice Facilities Fund subject to the 77%

listing on the 50/50 Maintenance of Effort (MOE)

calculation at Vehicle Code section 42007?

A No. The 77% listing is derived from Government

Code section 77205, which details how to calculate

the 50/50 split from the excess revenue of eight

penalty assessments (including VC section 42007)

based on how the code read on December 31, 1997.

At that time, 77% of VC section 42007 collections

went to the State’s General Fund, pursuant to VC

section 42007(b)(1); the remaining 23% went to the

county’s general fund and local construction funds,

pursuant to VC section 42007(b)(2).

The 77% of the VC section 42007 collections

distributed to the State’s General Fund does not

include distributions from the Courthouse

Construction Fund and the Criminal Justice

Facilities Construction Fund.

The $1 to the Courthouse Construction Fund and

the $1 to the Criminal Justice Facilities

Construction Fund should be deducted only from

the remaining 23% of the VC section 42007

collections.

31

Cat. Q No. Keywords

Response as

of Date

Questions and Responses

C 8 50/50 MOE December 9,

2015

Q Please clarify exactly how Traffic Violator School

(TVS) fees should be reported, given the

prohibition on reducing the calculation basis for the

Maddy Emergency Medical Services Fund,

Courthouse Construction Fund, Criminal Justice

Facilities Fund, and cities. There is a FAQ that

discusses the Construction Fund impacts, but

nothing that explains Maddy and cities. Could you

show how the TVS fees get reported on the ROR,

and the 50/50 split calculation for the Construction

funds, Maddy, and cities?

A Pursuant to Government Code section 77205, the

50/50 split of revenues is calculated based on what

would have been remitted to the State General Fund

pursuant to all applicable statutes as they read on

December 31, 1997.

Prior to 1998, Vehicle Code section 42007 required

that 77% of the TVS fee revenue be deposited into

the State General Fund. The remaining amount

collected was to be deposited in the county’s

general fund. There were no provisions for the

Maddy EMS penalties or distributions to cities for

city arrests. Therefore, the MOE calculation should

be based on 77% of the total TVS fee collected and

deposited into the county general fund, with no

reduction for any distributions from TVS fees.

C 9 Bail Bond

Forfeitures

July 22, 2013 Q What is the correct distribution of bail bond

forfeitures? Are they subject to state/county penalty

assessments, 2% automation, etc.? This seems to be

a common SCO audit finding.

A Health and Safety Code bail bond forfeitures are

subject to 2% automation, pursuant to Government

Code section 68090.8, and the remainder is

distributed 75% to the State General Fund and 25%

to the issuing agency, pursuant to Health and Safety

Code section 11502.

Penal Code (PC) bail bond forfeitures are subject to

2% automation and the remainder is distributed

pursuant to PC sections 1463.001 and 1463.002.

All bail bond forfeitures are exempt from penalty

assessments.

32

Cat. Q No. Keywords

Response as

of Date

Questions and Responses

C 10 Bail Bond

Forfeitures

July 9,

2014

Q Is there a Penal Code section that provides guidance

on how to distribute criminal bail bond summary

judgments and cash bail forfeitures?

A Summary judgment on bail bond forfeitures is

generally governed by Penal Code (PC) sections

1305, 1306, and 1307. The only special distribution

requirement for summary judgment on forfeiture of

bail bonds for Penal Code or Health and Safety

Code violations is under PC section 1463.009 for

certain Penal Code sex crimes.

Health and Safety Code bail bond forfeitures are

subject to the 2% state court automation distribution

per Government Code (GC) section 68090.8 and

per Health and Safety Code section 11502. The

remainder is generally distributed 75% to state and

25% to the city, if the offense occurred in the city.

If the offense occurred outside the city, then the

25% is distributed to the prosecuting county.

Penal Code bail bond forfeitures are also subject to

the 2% per GC section 68090.8, and the remainder

is generally distributed per PC section 1463.001 and

PC section 1463.002. Bail bond forfeitures are not

subject to penalty assessments.

For further information, see Tables 1, 2, and 3 of

the SCO Trial Court Revenue Distribution

Guidelines. They provide further distribution

guidance for forfeitures, including distribution

pursuant to PC sections 1463.001 and 1463.002,

special distributions prior to PC section 1463.001

distribution, and specific distributions required for

certain violations.

C 11 Base Fine May 13,

2013

Q Why isn’t the base fine simply $40 instead of $35,

so we don’t have to consider “portion thereof?”

A The Judicial Council adopted the $35 base bail/fine

amount for Vehicle Code moving violations before

the various penalty assessment formulas were

enacted. The base bail/fine amount has not been

raised to avoid increasing the total bail in addition

to the higher penalties and fees enacted by the

Legislature.

33

Cat. Q No. Keywords

Response as

of Date

Questions and Responses

C 12 Board of

Supervisors

April 1,

2013

Q Per Government Code section 76000, regarding the

county’s distribution of the $7 on $10 penalty, the

court gives the county $7 and the county distributes.

Would the court need a resolution in this case?

A No, it would not. However, it is advisable to request

a copy of the resolution for documentation purposes

to support the assessments and distributions that are

made.

C 13 Board of

Supervisors

July 9,

2014

Q Please clarify Government Code (GC) 70402(a)(2)

in relation to GC 76000(a)(2) and the bond

indebtedness date. If the bond indebtedness

occurred after January 1, 1991, but the Board of

Supervisors issued a resolution to remit to the Local

Courthouse Construction Fund, does the Board’s

resolution prevail?

A No. Statutes would prevail.

C 14 Board of

Supervisors

July 9,

2014

Q How frequently must the Board of Supervisors

update resolutions? Only when statute changes?

Annually? Never?

A The Board of Supervisors should update resolutions

as statutes change or when local circumstances

change.

C 15 Board of

Supervisors

May 12,

2015

Q When an amount imposed differs from statute, or it

is not updated on a Board of Supervisor (BOS)

resolution, should the amount be listed in a

resolution?

A If the amount being imposed differs from statute,

then the amount should be referenced in a BOS

resolution or outlined in local policy or rule of court

that states “reference statutory change.”

34

Cat. Q No. Keywords

Response as

of Date

Questions and Responses

C 16 Board of

Supervisors

June 3, 2016 Q Is it mandatory for counties to break down the

Government Code (GC) section 76000 penalty

assessment ($7 for every $10) in their board

resolutions as it is presented in the distribution

worksheets?

A Yes; funds collected pursuant to GC section 76000

may be allocated only pursuant to resolutions

adopted by the Board of Supervisors, as stated in

GC section 76106:

With respect to any fund established pursuant to

this chapter, the penalty amounts to be deposited in

the fund shall be specified by resolution adopted by

the board of supervisors of each county consistent

with the authorizations set forth in this article and

Article 3 (commencing with Section 76200). The

resolution shall set forth the amounts to be placed

in the fund and shall instruct the clerk of the board

of supervisors to transmit, on the next business day

following the adoption of the resolution, a copy of

the resolution to the clerk of each court in the

county.

35

Cat. Q No. Keywords

Response as

of Date

Questions and Responses

C 17 Civil

Assessment

April 1,

2013

Q How is the civil assessment assessed and

distributed?

A Penal Code (PC) section 1214.1 authorizes a court

to impose a civil assessment of up to $300 against

any defendant in an infraction, misdemeanor, or

felony case who fails, after notice and without good

cause, to appear at an authorized proceeding or to

pay a court-ordered fine (PC section 1214.1(a)).

Before any such assessment becomes effective, a

court must give the defendant at least a 20-day

warning, during which time the defendant may

appear and show good cause for his or her prior

failure to appear or pay a fine. If such a showing is

made, the court must vacate the assessment

(PC section 1214.1 (b)).

Government Code (GC) section 68085.1(b) requires

each superior court to deposit specified fees and

fines into a JCC-established bank account “as soon

as practicable after collection and on a regular

basis.” If a county collects civil assessments, it must

deposit those amounts into the same

JCC-established bank account

(GC section 68085.1(b)). All sums deposited into

the bank account are transmitted to the JCC and

reported on the TC-145. Under a policy it adopted

in August 2007, the Judicial Council allocates net

civil assessment revenue to the court that imposed

the civil assessment.

C 18 Civil

Assessment

May 12,

2015

Q If a civil assessment is the only fine or fee ordered

by the judge, can we add it to the state restitution

fine even if the restitution fine is delinquent?

A Yes. The civil assessment may be added to

delinquent fines.

36

Cat. Q No. Keywords

Response as

of Date

Questions and Responses

C 19 Civil

Assessment

July 6,

2017

Q Can we add a civil assessment for Failure to Pay

when a defendant has not agreed to a payment plan?

We have many defendants who send partial

payment in response to the courtesy notice stating

the fine for a ticket, then fail to pay the

balance. There is no payment plan or agreement.

May we accept the underpayment and also civilly

assess a $300 fee?

A The court may accept the partial payment, but may

impose a civil assessment for failure to pay only

after a conviction and imposition of a fine or a

written agreement to pay bail under Vehicle Code

(VC) section 40510.5 (Penal Code section 1214.1).

VC section 40510.5(a)(4) requires a written

agreement. Nevertheless, the court may impose a

civil assessment for failure to appear in the cases

described, assuming that the defendant did not

appear as promised or post and forfeit the full bail

when an appearance was not mandatory.

When a defendant fails to appear in court or fails to

contact the court by the due date on the citation or

notice, the court may adjudicate a traffic case by

proceeding with a Trial by Declaration in Absentia

pursuant to VC section 40903. The cases are

submitted to the judicial officer , and, upon review,

the judicial officer finds the defendant guilty or not

guilty based on information in the Notice to

Appear. A decision notice is sent to the defendant;

if the defendant does not respond within 25 days, a

$300 failure to pay civil assessment is imposed

pursuant to Penal Code section 1214.1.

C 20 Civil

Assessment

June 3, 2016 Q When a defendant becomes guilty of misdemeanor

for Failure to Pay, should we automatically impose

the $300 civil assessment in addition to the $50

base fine plus penalty assessments per

Vehicle Code section 40508(b)?

A No. Imposing the civil assessment is a discretionary

act by the court.

37

Cat. Q No. Keywords

Response as

of Date

Questions and Responses

C 21 Civil

Assessment

June 3, 2016 Q Can we assess more than one civil assessment? For

example, the defendant received notice for Failure

to Appear. Civil Assessment was entered, the

defendant Failed to Pay, and the case turned to

collection. Can we assess another civil assessment?

A Penal Code section 1214.1 allows for civil

assessments to be imposed for failure to appear in

court or for failure to pay a fine or installment of

bail, as specified. Provided that the assessment is

levied for separate actions, it may be imposed on

more than one occasion.

38

Cat. Q No. Keywords

Response as

of Date

Questions and Responses

C 22 Community

Service/

Custody

Credit

January 6,

2017

Q Can work service or jail time be applied to State

Restitution, the Criminal Assessment, and the Court

Operations assessment in lieu of the fine? If not,

would you indicate the relevant statute?

A Jail time credits may not be applied to either the

criminal conviction assessment for court facilities

or court operations assessment, which are non-

punitive. (See People v. Robinson (2012) 209

Cal.App.4th 401, ruling that a defendant's

presentence custody credits that exceeded the

maximum term of imprisonment available for the

offense could not be used to offset the court

facilities assessment for conviction, since the

assessment is non-punitive.)

Penal Code (PC) section 2900.5(a) provides that jail

time credits for misdemeanor and felony

convictions are first applied to the term of

imprisonment imposed and the remaining days are

applied to the base fine.

PC section 1205, which authorizes the jailing of

defendants until the fine owed is satisfied, excludes

the conversion of restitution fines to custody

credits.

No cases directly address whether the criminal

conviction assessment or court operations

assessment may be converted to community

service. The answer may depend on whether the

violation is an infraction or a convicted offense with

probation.

For infractions, PC section 1209.5 allows

conversion to community service of all

“assessments, penalties, and additional monies to be

paid by the defendant.” When probation is granted

for an offense, PC section 1205.3 authorizes the

conversion of fines (including restitution fines) to

community service, but does not authorize the

conversion of fees to community service.

39

Cat. Q No. Keywords

Response as

of Date

Questions and Responses

C 23 Community

Service/

Custody

Credit

January 6,

2017

Q If a defendant is ordered to do community service

on the whole fine amount but completes only partial

community service, what part is community service

and what part is paid?

A Under Penal Code section 1205.3, community

service is performed as a condition of probation.

If community service work is performed in place of

fines, then the amount of the base fine shall be

reduced on a proportional basis. The penalties and

state surcharge will be recalculated on the basis of

the remaining base fine. Any non-punitive

assessments shall not be reduced, if the violation is

a felony or misdemeanor

C 24 Community

Service/

Custody

Credit

December 9,

2016

Q AB 2839 requires that custody credits be reduced

from the base fine for criminal offenses. Do custody

credits also reduce the additional fees per

Health and Safety Code sections 11372.5 and

11372.7 that are added to the base fine for health

and safety violations; and the fees pursuant to

Penal Code sections 1463.14(a), 1463.16, and

1463.18 that are taken from the base fine on DUI

violations?

A Yes. Everything that goes into a base fine is

reduced by the new credit, and then the additional

fines, fees, penalties and assessments are

recalculated at the rate of the new lower base fine.

C 25 Court

Operations

Assessment

July 23, 2013 Q Can the county enact its own Court Security Fee?

Even after Realignment, the State is still paying the

counties but more research is needed.

A Currently, the Court Security Fee (which has been

renamed the Court Operations Assessment per

Penal Code section 1465.8) is distributed to the

Trial Court Trust Fund to fund trial court

operations. For the county to enact its own

assessment, legislation must be enacted authorizing

counties to make this specific assessment.

40

Cat. Q No. Keywords

Response as

of Date

Questions and Responses

C 26 Court

Operations

Assessment

May 15,

2013

Q Should we assess the Court Operations Assessment

on each violation, including those that are

dismissed?

A Yes, unless the charge is dismissed upon acquittal.

The court operations assessment (formerly the court

security fee) under Penal Code section 1465.8 and

the criminal conviction assessment under

Government Code section 70373 are mandatory

assessments that must be imposed for each

conviction (People v. Woods (2010) 191

Cal.App.4th 269).

A trial court is required to orally impose the

assessments as to each count for which a defendant

is convicted, including those stayed under statutes

prohibiting multiple punishments (People v.

Sencion (2012) 211 Cal.App.4th 480).

Several cases have ruled on the mandatory nature of

the assessments for each conviction. Assessments

are mandated for each of the defendant's

convictions, even when the sentence on a count is

stayed; and also for crimes that were committed

prior to the operational date of the assessment

statutes. Thus, the Court of Appeal could modify

the judgment to reflect the imposition of the

assessments and amend the abstract of judgment to

reflect the modified judgment (People v. Crabtree

(2009) 169 Cal.App.4th 1293.).

A trial court imposing the assessments on a

defendant must impose the assessments for each of

defendant's convictions. (People v. Walz (2008) 160

Cal.App.4th 1364.) Moreover, a defendant who

pleaded guilty to nine separate offenses charged in

five different cases was subject to nine assessments,

one for each conviction (People v. Schoeb (2005)

132 Cal.App.4th 861).

41

Cat. Q No. Keywords

Response as

of Date

Questions and Responses

C 27 Court Ordered

Debt

April 1,

2013

Q What is a clear definition of “court-ordered debt”

relating to traffic and criminal offenses?

A Court-ordered debt is defined as fees, fines,

forfeitures, penalties, restitution, and assessments

related to criminal offenses, including traffic

offenses, by adults and juveniles, as well as status

offenses by juveniles. (Note that parking offenses

cited as an administrative offense on parking tickets

that are not filed with the court are not included.)

The following items are required to be reported on

the Report of Revenues (ROR), but are not court-

ordered debt: fee for recording/indexing documents

(Government Code [GC] section 27361(b));

additional parking penalty on parking tickets that

are not filed with the court (GC section 76000(b));

“900” telephone numbers (GC section 77211);

dissolution of marriage fee (GC section 26859); and

surcharges on parking tickets that are not filed with

the court (GC section 70372(b)).

Report the gross amount of court-ordered debt

collected by the court and/or county. The gross

amount is the total amount collected before any

distributions or adjustments for cost-of-collection

activities (Penal Code section 1463.007). In

situations where only the net amount after

distributions and adjustments can be determined, it

is acceptable to report the net amount. In such

cases, note in the footnotes tab of the ROR that the

net amount is being reported.

Much of the court-ordered debt collected is also

required to be reported by line item elsewhere on

the ROR, but the total amount collected should be

reported on this line. It is anticipated that the total

amount reported on this line will include amounts

not reported elsewhere on the ROR.

42

Cat. Q No. Keywords

Response as

of Date

Questions and Responses

C 28 Court Ordered

Debt

April 1,

2013

Q Is a traffic ticket (moving violation) a court-ordered

debt?

A A traffic ticket by itself does not create a court-

ordered debt. A traffic ticket results in a court-

ordered debt after a defendant has signed an

agreement to pay or the court has adjudicated the

violation and imposed a sentence.

C 29 Distribution

Guidelines

July 21, 2017 Q In the Guidelines, the distinction of fine vs. fee in

Penal Code (PC) section 1463.14(b) is unclear.

Could you provide a clear definition of each?

A PC section 1463.14(b) is collected as a fine,

because it is identified as a penalty. However, as it

is not subject to state and local penalty assessments,

and is used to pay for the costs of performing blood,

breath, or urine analysis for alcoholic content, it is

distributed as a fee, under Priority 4

C 30 DNA May 15,

2013

Q Is the DNA penalty ($1/$10) assessed as of

violation or conviction date?

A The DNA penalty and other criminal penalties are

assessed as of the violation date. Increasing the

penalty for a crime at the time of sentencing, which

would be after the crime was committed, would

violate ex post facto prohibitions.

(See People v. Voit (2011) 200 Cal.App.4th 1353,

ruling that the defendant’s crimes took place before

enactment of statutes authorizing additional

penalties to fund emergency medical services, the

DNA Fingerprint, Unsolved Crime and Innocence

Protection Act, and Department of Justice forensic

laboratories, and thus the defendant was not subject

to those penalties under ex post facto principles.)

C 31 DUI

Assessments

May 12,

2015

Q Should fees per Penal Code (PC) section 1463.14(a)

and PC section 1463.16 be assessed on all

violations of Vehicle Code (VC) sections 23103

and 23104? If so, when?

A Yes, both fees should be assessed upon conviction

of a violation of VC sections 23103 and 23104; and

$50 of each fine collected should be deposited for

alcoholism program and services.

43

Cat. Q No. Keywords

Response as

of Date

Questions and Responses

C 32 DUI

Assessments

June 12,

2017

Q Regarding credit for time served on DUI, what are

the effects on distribution (specifically Penal Code

[PC] sections 1463.14, 1463.16, and 1463.18)?

According to the revenue distribution workbook,

once the base fine is reduced past a certain amount,

negative numbers are populated in the lines for the

PC section 1463.001 base fines distribution. This is

because the lines for PC sections 1463.14, 1463.16,

and 1463.18 are hard-coded as $50/$50/$20.

Shouldn’t these be reduced as well? Which has

priority? Should we be reducing them all

proportionately or should we reduce

PC section 1463.001 first and then reduce the base

reduction fines?

A The distribution worksheets are not set up to

calculate distributions after applying custody

credits.

PC section 1463.18 specifies that the “first $20” of

any amount collected shall be deposited in the

Restitution Fund. Both PC section 1463.14(a) and

PC section 1463.16(a) specify that $50 of each fine

collected shall be deposited in the designated

accounts.

Reductions to the base fine should come first from

PC section 1463.001 until the amount is $120 or

less; then equally from PC section 1463.14(a) and

PC section 1463.16(a) until the amount is $20 or

less; at which point the remaining reduction would

be from PC section 1463.18.

C 33 DUI

Assessments

June 13,

2017

Q Penal Code (PC) section 1463.14(b) is subject to

the defendant’s ability to pay. If a judge reduces a

DUI fine due to credit for time served or judicial