WHITE PAPER

LexisNexis® Risk Solutions Smart Home and

Internet of Things Consumer Research Report

Insights and strategies

for smart home insurance

programs

FEBRUARY 2020

2

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

3

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

Table of Contents

Executive Summary ................................................................................................................. 4

Understanding the implications of smart home device adoption .......................... 5

Key findings ................................................................................................................................ 6

Discounts and data sharing: What they mean to consumers ................................................. 6

Discounts oer some motivation to existing smart home device owners to purchase or install devices ......... 6

Many smart home device owners are willing to connect to their carriers to receive alerts and help file claims 7

Consumers expect discounts for sharing data to assist with underwriting and policy pricing ...................... 9

Privacy concerns about sharing data are not limited to insurance ........................................................... 10

The story behind smart home device adoption....................................................................... 11

No single device is driving overall consumer adoption of smart home technologies .................................. 11

Safety and security is the top reason respondents provide for owning smart home devices,

while cost is a perceived barrier ........................................................................................................ 12

How to engage customers in smart home insurance programs ............................................. 13

Most consumers are unaware of smart home insurance program incentives or discounts ........................... 13

Discounts, alerts and event interventions are valuable components of smart home programs .................... 15

Key strategies for boosting smart home program participation ............................. 17

LexisNexis analysis: In the market ..................................................................................... 18

The ultimate question and beyond .................................................................................... 18

How LexisNexis Risk Solutions can help carriers leverage big data....................... 19

Appendix: Smart home devices........................................................................................... 20

About the author ...................................................................................................................... 21

Key findings include:

• Consumer adoption of smart home devices is

notable. Our study focused on nine smart home

devices (see the Appendix). Close to half of the

respondents own at least one device from one

or more of the nine device categories we studied

and several own many.

• Most consumers who already own one smart

home device are willing to purchase or install

additional devices if their carrier oers them a

discount on their home insurance policy.

• Smart home devices meet varied consumer

household needs, including convenience,

energy savings and a desire to have the latest

technology. Safety and security was the top

motivator for 47% of respondents.

• While smart home device adoption is increasing,

consumer awareness of smart home insurance

programs is low. Only 22% of respondents were

aware that carriers had a program.

• 78% of smart home device owners are open

to sharing their data with their insurer. Privacy

remains the chief concern among reluctant

consumers.

The results also point to specific strategies for

addressing each target area: adoption, program

awareness and engagement, and data sharing.

By gleaning insights from smart home device data,

carriers can oer customers more personalized

experiences, products and services while building

customer loyalty and trust. These same insights

can lead to opportunities to reduce risk, better

manage expenses and identify new areas for

business growth.

Overall, our results indicate that smart home

insurance programs are still in the beginning

stages. Carriers that take strategic steps to

better understand their policyholders’ appetite

and adoption of smart devices can respond

appropriately and create a competitive advantage.

Executive Summary

The Internet of Things (IoT) is reaching into consumers’ homes at an accelerating pace. In response, home

insurance carriers are looking to create strategies around how to engage customers and use IoT data to

unleash new business opportunities.

To help carriers better understand the business implications of smart home devices, LexisNexis® Risk

Solutions commissioned a study of 2,500 U.S. consumers. Our survey addressed smart home device

adoption, smart home insurance program awareness, program engagement incentives and data sharing.

4

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

Understanding the implications of smart home

device adoption

Consumers have a soaring appetite for smart devices to help them navigate their daily lives. At home,

they’re connecting smart home devices to help them conveniently manage their utilities, protect their

families, and minimize or avoid damage to their property and possessions.

Smart devices and new technologies have unlocked new business models from startups and

incumbents that have a vision for their potential value throughout the insurance customer journey. The

devices and the data they generate are also creating opportunities for carriers to develop new strategies

for engaging consumers and managing underwriting and claims workflows.

To take a closer look at these opportunities, we surveyed U.S. consumers about smart home device

adoption, smart home insurance program awareness, program engagement incentives and data

sharing. The results indicate that with the right strategies, consumers and carriers can benefit from

timely, actionable, smart home data-driven insights.

Here’s what we learned.

About the study

In September 2019, LexisNexis® Risk Solutions commissioned a web-based survey of 2,500 U.S.

homeowner insurance policyholders between the ages of 25 and 65, with a household income of

at least $25,000. Key demographics were monitored to ensure the characteristics of respondents

match U.S. Census demographic distributions. Participants were asked about their awareness and

ownership of nine smart home devices—smart thermostats, lightbulbs, water leak sensors, whole

home water leak systems, smoke detectors, door locks, external facing/outdoor security cameras,

wireless motion security sensors/alarms and doorbells. For more details about how these smart

home devices were described, see the Appendix. Subsequent questions were based on ownership/

non-ownership of these smart home devices.

5

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

6

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

Key findings

Discounts and data sharing: What they mean to consumers

Discounts oer some motivation to existing smart home device owners to purchase or install

other devices

Most consumers who already own one smart home device are willing to purchase or install additional

devices if their carrier oers them a discount on their home insurance policy. Although their level of

interest is similar across all device types, owners are most interested in discounts for installing smart

smoke detectors (75%) and smart thermostats (70%). Fewer owners are interested in discounts for water

leak systems (57%) and sensors (60%, Figure 1).

Generally, a lower percentage of consumers who do not own smart home devices (non-owners) are

interested in insurance discounts for installing devices across all categories. However, discounts for the

use of smart smoke detectors, doorbells with video and thermostats appear to oer the most potential

for motivating non-owners to purchase smart home devices.

Figure 1. Smart home device owners are most likely to install a smart thermostat or smoke detector if oered a discount on

their home insurance.

Take action

Consumers appear to be willing to purchase new devices if a discount is oered, so as

carriers better understand the value of specific devices, they should build marketing

campaigns to encourage consumer use. Additionally, carriers should seek partnerships

with popular device makers to bolster marketing, discounts and overall adoption.

Definitely would Probably would Definitely/Probably would not

70%

64%

69%

68% 66%

65%

75%

60%

57%

35% 29% 31% 35% 33%

29%

36%

23%

23%

34% 35% 38% 33% 33% 36% 39% 37% 34%

12%

12%

7%

10%

11%

11%

9%10%9%

Smart

Thermostat

Utility Devices Security Devices Protection Devices

Smart

Lightbulbs

Smart External

Facing/Outdoor

Security Camera

Smart Doorbell

with Video

Smart Door

Lock

Smart Home

Wireless

Motion Security

Sensor/Alarm

Smart Smoke

Detector

Smart Water

Leak Sensor

Whole Home

Smart Water

Leak System

Likelihood of purchasing/Installing devices for an insurance discount among owners

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

7

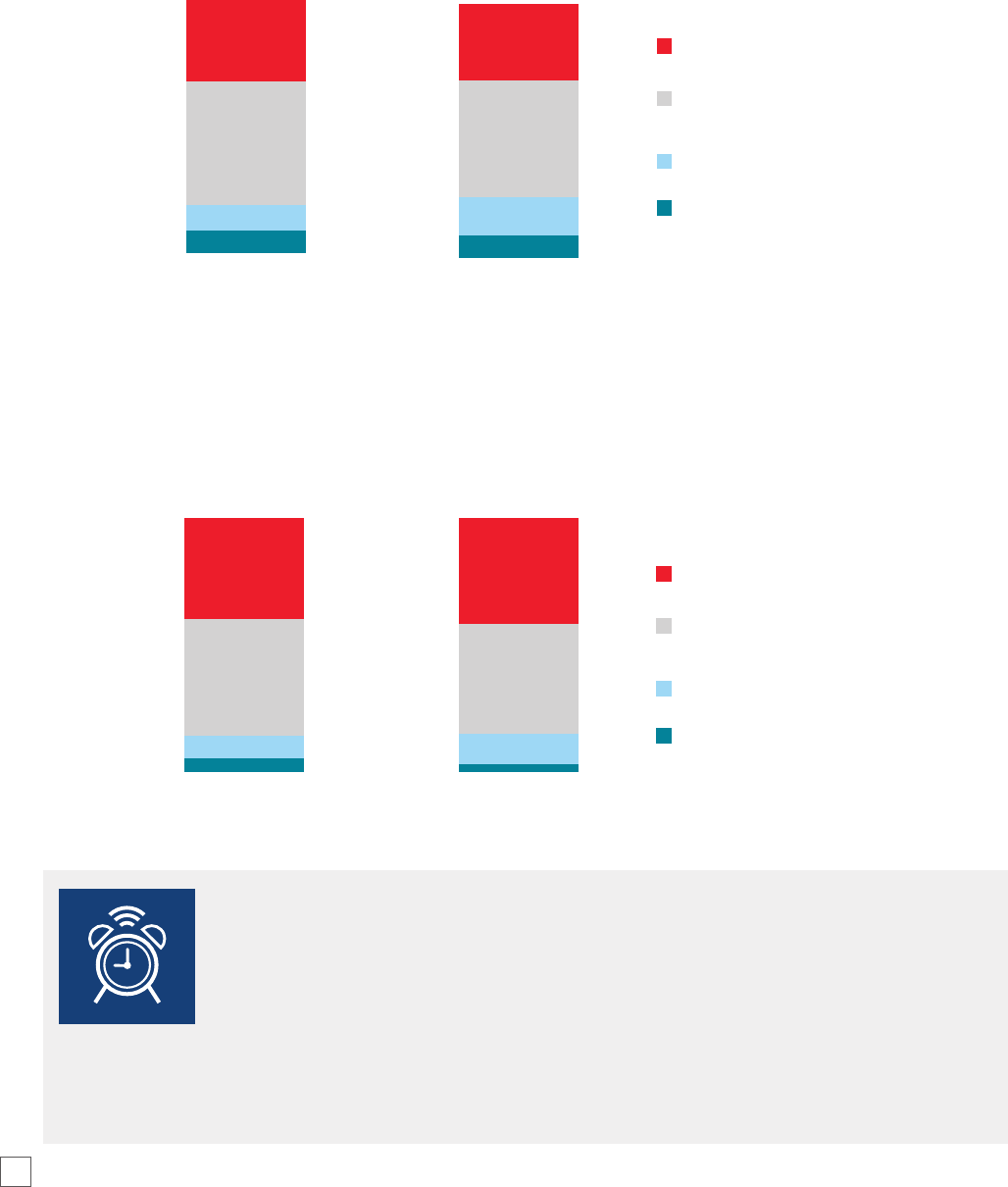

Figure 2. Most smart home device owners are willing to share data with their carriers, but many have concerns.

Many smart home device owners are willing to connect to their carriers to receive alerts and help

file claims

The majority of smart home device owners are willing to connect their device to their carrier to

provide information to aid claims (79%) and for alerts and event prevention (76%, Figure 2). Notably,

very few smart device owners (less than 10%) said they would not share their data.

For Alerts and Event Prevention

For Alerts and Event Prevention To Provide Information to Aid Claims

To Provide Information to Aid Claims

Willingness to connect smart home devices to carriers is even higher among smart device owners with recent

claims. For example, smart device owners who have recently filed a claim are willing to connect their devices

in exchange for alerts and event protection (86%) and to provide information to aid claims (86%, Figure 3).

In addition, four out of 10 say they are definitely willing to connect to a carrier—representing a significant

opportunity for carriers.

Take action

Consumers are willing to let their insurer see and use their data for insurance

purposes. However, they also expect companies to keep their data safe. Carriers

need to address consumer privacy concerns openly and directly. Best practices

include explaining how customer data is collected, protected and used, and complete

transparency about what data is shared, with whom and when. For more than 20

years, insurance carriers have trusted LexisNexis Risk Solutions as a steward of

consumer data—and a trusted partner to safeguard, protect and use consumer data

within regulatory requirements.

Very positive/definitely willing

Somewhat positive/willing but have

some concerns

Somewhat negative/not very willing

Very negative/not at all willing

Very positive/definitely willing

Somewhat positive/willing but have

some concerns

Somewhat negative/not very willing

Very negative/not at all willing

31%

48%

8%

13%

30%

46%

9%

15%

40%

46%

4%

10%

41%

45%

2%

12%

Figure 3. Consumers who have recently filed a claim are more willing to share data with their carrier to receive alerts or get help

filing a claim.

Willingness to connect smart home devices to an insurance company among owners

Willingness to connect smart home devices to an insurance company among recent claim filers

“Data breaches are becoming more and more

common. While it may not be the initial intent, the

data could be used to penalize (raise premium

rate outside of any initial reduced cost incentive)

homeowners for behaviors, occurrences or other

data type the company does not agree with.”

- Concerned Consumer

8

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

9

Consumers expect discounts for sharing data to assist with underwriting and policy pricing

While many consumers are positive about sharing data with their carrier to receive discounts and alerts,

the majority of smart home device owners (65%) say they would require a discount to share smart home

device data for policy pricing purposes (Figure 4). Notably, 13% of owners would be willing to share data

with their carrier, even without a discount or incentive.

Take action

If carriers want customers to share their data for underwriting and policy pricing

purposes, oering a discount is a strong requirement. However, to avoid a “race

to the bottom,” carriers should also adopt complementary strategies, such as

emphasizing how data sharing could save consumers money by preventing

catastrophic leaks and flooding.

Figure 4. Many smart home device owners are willing to share data with their carrier to assist with underwriting and policy

pricing, but only if oered a discount.

Figure 5. Consumers who have recently filed a claim are more willing to share data with their carrier to assist with underwriting

and policy pricing.

Among all respondents, those who have filed a claim within the past five years are more willing to share

their data than those who haven’t or who have never filed a claim (Figure 5).

57%

10%

33%

55%

13%

32%

64%

14%

22%

65%

13%

22%

I would share my data with my insurer but only

if they oered me a discount or incentive

I would share my data with my insurer and

wouldn’t need a discount or incentive

I would not share my data with my insurer

regardless of a discount or incentive

I would share my data with my insurer but only

if they oered me a discount or incentive

I would share my data with my insurer and

wouldn’t need a discount or incentive

I would not share my data with my insurer

regardless of a discount or incentive

Recent claim Non-recent claim Never had claim

Willingness to share data with an insurance company for a discount or incentive

Willingness to share data with an insurance company among claim filers

10

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

Video capabilities aect how concerned consumers are about privacy violations (Figure 7). Among smart

home device owners, privacy concerns are significantly higher for devices with video (71%) than for those

without video (60%).

Privacy concerns are the main barrier to consumers’ willingness to share smart home data with their

carrier, even if oered a discount. Their main concerns are privacy of their personal information and

concerns about how the information will be used.

Figure 6. Many smart home device owners have privacy concerns about sharing data with their carrier.

Figure 7. Privacy concerns are significantly higher for smart home devices with video included.

Privacy concerns about sharing data are not limited to insurance

Many smart home device owners are concerned about the privacy of their personal information.

However, that concern is not unique to the insurance industry. Respondents expressed concerns about

privacy across industries (Figure 6). In fact, concerns are even greater for other categories such as social

media and banking—which many consumers interact with on a daily basis. Still, it’s an issue that carriers

must address in their smart home insurance programs.

Take action

For many consumers, a discount is not enough to entice them to share data.

Carriers need to bake consumer privacy into smart home initiatives. In addition,

given consumer concerns over video, carriers may consider initiating customer

engagement eorts with smart home devices that lack video capabilities.

Very/Somewhat concerned

Neutral

Not very/Not at all concerned

82%

12%

6%

71%

20%

9%

70%

18%

12%

69%

19%

12%

62%

23%

15%

Social media Mobile/Cell

phone service

providers

Banks/Credit

card companies

Online retailers Insurance

companies

Very/Somewhat concerned

Neutral

Not very/Not at all concerned

71%

19%

10%

60%

23%

17%

Smart home

devices that

monitor with

the use of video

Smart home

devices that

monitor without

the use of video

Level of privacy concerns across categories

Level of privacy concerns for video-enabled devices

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

11

Figure 8. Homeowners use a wide variety of smart home devices, with no clear frontrunner.

The story behind smart home device adoption

No single device is driving overall consumer adoption of smart home technologies

Overall consumer adoption of smart home devices is notable. Almost half of the respondents (46%)

have one of the nine devices we asked about in their household—and that doesn’t include consumers

who own other smart devices, such as smart speakers, which are big sellers. Further, consumers who

own one device oen own multiple devices. However, of the devices we surveyed, no single device is

leading the way.

Utility devices such as smart thermostats and lightbulbs are a popular choice, allowing consumers to

control the heating and lighting of their homes remotely using their laptops or smartphone apps (Figure

8). Many consumers own smart security devices (59%), including security cameras, wireless motion

sensors and doorbells with videos, which can also be controlled with smartphone apps and, in some

cases, virtual assistants such as Alexa and Google Assistant. A smaller number of owners have installed

protection devices to alert them to smoke and water leaks.

In nearly all cases (89% or more), owners use these devices as “smart” devices, meaning they access and

control the devices remotely from apps or websites, particularly the device’s app.

Take action

Knowing which devices their customers own can help carriers design the right

programs and incentives. Given the wide range of devices in use, we recommend

carriers work with a trusted partner to gain actionable insights from these connected

devices—freeing them up to focus on their core business, selecting and underwriting

risk, and managing claims.

26%

20% 20% 20%

19%

12%

16%

7%

6%

Smart

Thermostat

Utility Devices Security Devices Protection Devices

Smart

Lightbulbs

Smart External

Security Camera

Smart Doorbell

with Video

Smart Door

Lock

Smart Wireless

Motion Sensor

Smart Smoke

Detector

Smart Water

Leak Sensor

Whole Home

Smart Water

Leak System

Ownership of smart home devices in nine categories

12

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

Figure 9. Safety, security and convenience are the reasons provided most oen for owning smart home devices.

Figure 10. Cost is the highest barrier to owning smart home devices.

Take action

While carriers don’t have control over the cost of smart devices, they could

use this information to build programs around specific types of devices that

consumers are already buying. They could also encourage more widespread

adoption by highlighting the core benefits of owning certain smart home devices.

This includes personal and property safety and energy savings, all three of which

have a cost factor.

Safety and security is the top reason respondents provide for owning smart home devices, while cost

is a perceived barrier

When asked for the main reasons why they have a smart home system/device, almost half of the

respondents (47%) revealed they are motivated by safety and security (Figure 9). Other reasons include

the convenience of being able to manage devices remotely (31%) and the opportunity to reduce energy

bills or save money (25%).

Some respondents reported being curious about how smart home technology works (24%) or wanting

to have the most up-to-date systems in their homes (17%).

Consumers who do not own a smart home device are deterred by the cost of devices (58%), by already

having traditional systems that meet their needs (42%) or privacy concerns (26%, Figure 10).

47%

31%

25%

24%

17%

Safety/Security

Convenience of being able to manage/

control while away from home for

routine reasons

Reduce energy bills/save money

Interested in the technology/wanted to

see how it works

Always want to have the latest most up-

to-date systems/devices in my home

58%

42%

26%

Cost too much

Have traditional systems that meet

my needs

Concerned about invasion of privacy

Reasons for owning smart home devices

Reasons for not owning smart home devices

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

13

How to engage customers in smart home insurance programs

Most consumers are unaware of smart home insurance program incentives or discounts

Consumer awareness of smart home insurance programs is low. More than three-quarters (78%) of

respondents were unaware of incentives or discounts for installing smart home devices or weren’t sure

if they knew about them (Figure 11).

Figure 11. Awareness of smart home insurance programs and discounts among respondents is low.

Program awareness among smart home device owners is higher than among non-owners (Figure 12).

More than one-third (34%) of smart home device owners are aware of programs oered by insurance

companies that include incentives or discounts for having the device, whereas only 12% of non-owners

are aware carriers oer similar incentives.

Figure 12. Awareness of smart home insurance programs and discounts is significantly higher among smart home

device owners.

Don’t know/

Not sure

Yes

No

16%

22%

62%

Smart device

owners

Smart device

non-owners

34%

12%

Overall awareness of smart home insurance programs

Awareness of smart home insurance programs among owners and non-owners

In addition, program awareness is higher among smart home device owners who’ve filed a home

insurance claim within the past five years. Almost one-third (31%) of recent claims filers know carriers

oer smart home incentives and discounts (Figure 13). Those who have not recently filed a claim or who

have never filed a claim (22% and 18%, respectively) have much lower awareness levels.

Figure 13. Awareness of smart home insurance programs and discounts is higher among smart home device owners who have

recently made a home insurance claim.

Take action

The first step to increasing adoption is to make sure customers know about smart

home insurance programs and incentives. As a starting point, carriers should be

documenting at point of quote, claim and renewal whether policyholders have smart

home devices. Newsletters, marketing campaigns and personal consultations are all

ways to inform customers of the advantages of smart home devices.

Non-recent

insurance claim

Never had a

claim

Recent

insurance claim

31%

22% 18%

Awareness of smart home insurance programs among claim filers

14

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

15

Discounts, alerts and event interventions are valuable components of smart home programs

When it comes to the specific components of smart home programs, the majority of smart home device

owners (81%) value discounts/alerts (Figure 14). However, many consumers find other interactions

similarly valuable, including their carrier:

• Alerting them when sensors detect water leaks (76%)

• Contacting authorities if a person is detected outside or inside their home (75%)

• Alerting them when sensors detect someone outside or inside their home (74%)

• Automatically receiving incident-related information to speed up claims processing (73%)

While smart home device owners are more receptive to discounts, interactions and other insurance value

delivered through their devices than non-owners, that’s not to say non-owners don’t see the value. More

than two-thirds of non-owners are interested in discounts on their homeowners policy (compared to 81%

of owners), 64% would like to receive alerts about water leaks (76% of owners) and 62% would like their

carrier to take action if there’s an intruder (75% of owners, Figure 15).

Figure 14. Discounts and alerts are seen as the most valuable, but other smart home insurance program components aren’t

far behind.

Figure 15. Smart home device owners see value in a variety of smart home insurance program components.

50%

31%

43%

33%

43%

32%

42%

32%

36%

37%

43%

28%

81%

76% 75% 74%

73% 71%

Discount for

information/alerts

from your smart

home devices

Receive alerts from

insurance company

about water leak in

your home

Insurance company

contacts authorities

to respond to

persons detected

outside/in your

home

Receive alerts from

insurance company

if security sensors

detect persons

outside/in your

home

Insurance company

automatically has

information about

incident in your

home making claims

process faster/easier

Insurance company

turns water o if

water leak detected

Very valuable

Somewhat valuable

81%

67%

76%

64%

75%

62%

74%

60%

71%

59%

73%

57%

Receive discount on homeowners insurance for connecting insurance

company with information or alerts from smart home devices

Insurance company automatically has information about date and

time of incident in home for which you would file a claim making the

claims process faster and/or easier

Insurance company remotely turns water o at your home if water

leak is detected

Receive alerts from your insurance company if security sensors detect

persons outside or in your home

Insurance company contacts police or authorities to respond to

persons detected outside or in your home

Receive alerts from your insurance company about a water leak in

your home

Smart device owners Smart device non-owners

Perceived value of components in a smart home insurance program

Perceived value of components in a smart home insurance program

Take action

Carriers can expect their communications to be well-received by smart device

owners—but communications about savings or extended coverage are likely to have

the biggest impact. They should also experiment with other approaches, such as

tips, alerts and customized reminders, to identify the most desired messages and

their frequency.

Did you know that LexisNexis®

Current Carrier® Property includes

a field to contribute information

on smart home devices?

Current Carrier Property helps you quote and

underwrite more eectively by identifying key

household data, including the use of smart

home devices, and specific risk factors.

16

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

17

Key strategies for boosting smart home program

participation

Consumer awareness of smart home insurance programs is low, but smart home device adoption is

growing. That creates an opportunity for carriers to educate and inform the market to further boost

adoption, provide valuable benefits to customers and drive engagement, loyalty and retention.

Increasing marketing eorts around existing programs can help drive participation—particularly among

those consumers who already own a smart home device.

Here are some things you can do to get started:

Talk to customers.

Begin asking about smart home devices at time of quote, service and renewal.

Our research uncovered a small group of carriers that are already asking about the

presence of smart home devices, and many are oering discounts. Carriers that

gather data about the devices policyholders own, even in an anecdotal way, can

gain insights they can use to develop loss trends and target customers who might

be interested in specific programs or initiatives. In addition, given that smart home

device programs are still in the beginning stages, even small investments in smart

marketing campaigns can help carriers create a competitive advantage.

Oer meaningful incentives.

Many smart home device owners appear willing to purchase additional devices if

they’re oered an insurance discount. In fact, when asked about connecting their

smart home devices with carriers and sharing their data, many respondents said they

would do so—for the right incentive. We recommend testing a range of incentives,

such as gi cards, discounts and deductible forgiveness.

However, discounts alone may not be enough to persuade non-owners to purchase a

smart home device. For these consumers, you should fully demonstrate the benefits

of the devices and oer other insurance program incentives to get them on board.

Educate yourself on the value of smart devices.

When your organization has a better understanding of the value of specific smart

home devices, you have a clear opportunity to design marketing campaigns that

appeal to consumers.

18

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

LexisNexis analysis: In the market

Beyond our research, we’re encouraged to see the following market trends:

Carriers are actively involved in smart home device pilots.

As part of these pilots, they’re testing ailiate device bundling strategies, primarily

with a focus on loyalty and engagement.

Carriers are eyeing IoT platforms to help them optimize

customer engagement.

They’re also interested in aligning smart home initiatives with consumer buying

preferences around security, energy management and entertainment.

Carriers are gathering data about smart home devices.

They’re asking customers at the time of quote if they own a smart home device—

a good starting point. The next step is to talk about devices with customers at

every touchpoint.

The ultimate question and beyond

Our research uncovers the good news and bad news around how insurance policyholders are adopting

smart home devices. The bad news: consumer awareness of existing smart home insurance programs is

low. The good news: That means putting marketing eort toward programs that are already in place can

help drive participation.

Our research also shows that consumers are willing to share data for the right incentive. Carriers

should experiment with dierent ideas, from gi cards to discounts, deductible forgiveness to “gis”

of incentives to purchase new smart home devices. Consumers also appear to be willing to purchase

new devices if discounts are oered—and existing device owners appear to be more open to purchasing

additional devices. In other words, the right marketing message could help carriers foster ongoing

relationships with smart home device owners.

Similarly, consumers indicate that they’re open to receiving communications of all kinds through

smart home devices. Carriers should be researching and testing dierent messages, frequencies and

approaches, as well as dierent channels—whether smart home device apps or their own.

Finally, carriers should be asking about smart home devices at time of quote, service and renewal. Even

anecdotal evidence about adoption or the types of devices being used can help them develop loss trends

and target customers for discounts, benefits and cross-promotion.

How LexisNexis Risk Solutions can help

carriers leverage big data

The massive amount of data contained in this new ecosystem can be overwhelming for

carriers focused on the core business of insuring risk. It’s hard to know what questions

to ask and where the value lies. That’s why, in the near-term we intend to apply our

tried and true platform skills to tap into the wealth of data from connected devices—

and to deliver insights from that data to our customers.

Using our resources, we’ll identify which data from these devices is most predictive so

that insurers can decide where and how to incorporate it into their existing workflows

and transactions. We’re currently working with device makers to conduct loss

performance studies of common devices pre- and post-installation, and will publish

some of those results in 2020.

To understand how smart home engagement drives insurance shopping behavior

and loyalty, and which devices matter most to loss prevention, we’ll carry out further

research. And of course, we’ll continue to act as a trusted steward of consumer data—

something our business is built on, so that our customers can execute their strategies

with confidence, and their customers can know their private data is safe.

Smart home and IoT device adoption is a win for both consumers and insurance

carriers. As the technologies evolve, consumers will enjoy more streamlined and useful

interactions with their carriers, as well as enhanced personal and property safety

and security. In return, carriers that can leverage digital assets will establish a more

complete view of their customers, enabling them to oer more personalized products

and services, reduce risk, better manage expenses and identify new areas for profitable

business growth.

19

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

20

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

Appendix: Smart home devices

Function like programmable thermostats in controlling a

home’s temperature throughout the day but have Wi-Fi

connectivity. Can be controlled remotely using an Internet-

connected device such as a smartphone or laptop.

Provide control of lighting from a centralized location

via an Internet-connected hub or remotely using a

smartphone or laptop.

Allow video to be transmitted and stored on a built-

in storage device or cloud storage. Can be controlled

remotely by smartphone apps or virtual assistants such as

Alexa or Google Assistant.

Operate like traditional security alarm systems, but are

wireless and can be armed, alarmed and managed from a

companion smartphone app.

Capture video and notify a homeowner’s smartphone

or other electronic device when a visitor arrives at the

door. Activate when the visitor presses the button of the

doorbell or when the doorbell senses a visitor with its

built-in motion sensors.

Allow access to a home using a smartphone or key fob

to verify wirelessly and mechanically unlock the door

without requiring a traditional key.

Connect to a home’s wireless network and can send

notifications to a smartphone when the alarm is triggered,

when the battery gets low or if there is a problem with the

sensors in the unit.

Credit card-sized, Internet-connected sensors placed near

high-risk leak areas to alert a homeowner of water leaks

quickly. Can be programmed to send a text message or

push notification when water is detected.

Connect directly to a water pipe to measure flow rate,

temperature and water pressure. Some systems can shut

o water before major leaks occur.

Utility devicesProtection devices Security devices

Our research focused on nine smart home devices:

Smart thermostats

Smart lightbulbs

Smart external facing/

outdoor security

cameras

Smart home wireless

motion security

sensors/alarms

Smart doorbells

Smart door locks

Smart smoke

detectors

Smart water leak

sensors

Whole home smart

water leak systems

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

21

Dan Davis

Director, IoT and Emerging Markets, LexisNexis Risk Solutions

Dan Davis serves as Director, Vertical Markets (IoT), Insurance. Dan has been with LexisNexis

Risk Solutions since 2016, where he leads the creation of the value proposition, strategy and

positioning for the LexisNexis IoT platform across Life, Home and Commercial. His insurance

experience includes leadership roles in claims, business development and strategic technology

initiatives in the P&C market. Dan has also served LexisNexis through strategic partnership

management in the emerging markets and soware platform space. Dan has a bachelor’s degree

in Business from Louisiana State University.

About the author

22

LexisNexis® Risk Solutions Smart Home and IoT Consumer Research Report

LexisNexis and the Knowledge Burst logo are registered trademarks of RELX Inc. Other products and services may be trademarks or registered

trademarks of their respective companies. © 2020 LexisNexis Risk Solutions. NXR14240-00-0120-EN-US

For more information, call 800.458.9197 or email

insurance.sales@lexisnexisrisk.com

About LexisNexis Risk Solutions

LexisNexis® Risk Solutions harnesses the power of data and advanced analytics to provide insights that help businesses and governmental

entities reduce risk and improve decisions to benefit people around the globe. We provide data and technology solutions for a wide range

of industries including insurance, financial services, healthcare and government. Headquartered in metro Atlanta, Georgia, we have oices

throughout the world and are part of RELX (LSE: REL/NYSE: RELX), a global provider of information-based analytics and decision tools for

professional and business customers. For more information, please visit www.risk.lexisnexis.com and www.relx.com.

LexisNexis can help carriers derive value from

smart home insurance programs

Want to leverage smart home technology to enhance your customer experience, sharpen business

intelligence and improve loss performance? We will use our platform skills to validate the presence

of smart home devices in a household in real time, so you truly understand the end-to-end impact of

smart home devices.

At LexisNexis Risk Solutions, we’re putting the power of our platform behind data from smart

home technologies. We are conducting loss correlation studies to identify claims trends before and

aer smart home devices are installed. And we overlay research like this with our own property

characteristic data to help you better understand the profiles of consumers, households and

properties adopting these devices.

How can we help you?