FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

our new york,

our future

fy2025 nys executive budget | january 16, 2024

governor kathy hochul

budget director blake G. washington

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

I

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

3

INTRODUCTION

SECTION I

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

5

I. INTRODUCTION

Table of Contents..........................................................5

Governor’s Message.....................................................7

Director’s Message.......................................................9

Summary of Budget Documents..............................11

II. EXECUTIVE BUDGET FY 2025

Financial Plan Overview.............................................15

Capital Plan Overview...............................................25

Revenue Actions.........................................................33

Federal Aid and Receipts.........................................39

III. POLICY & PROGRESS

Economic Development...........................................47

Education ....................................................................53

Environment, Energy, and Agriculture..................59

General Government.................................................63

Healthcare....................................................................67

Higher Education........................................................77

Human Services..........................................................83

Local Government.....................................................93

Mental Hygiene.........................................................101

Public Safety...............................................................109

State Workforce.........................................................115

Technology..................................................................121

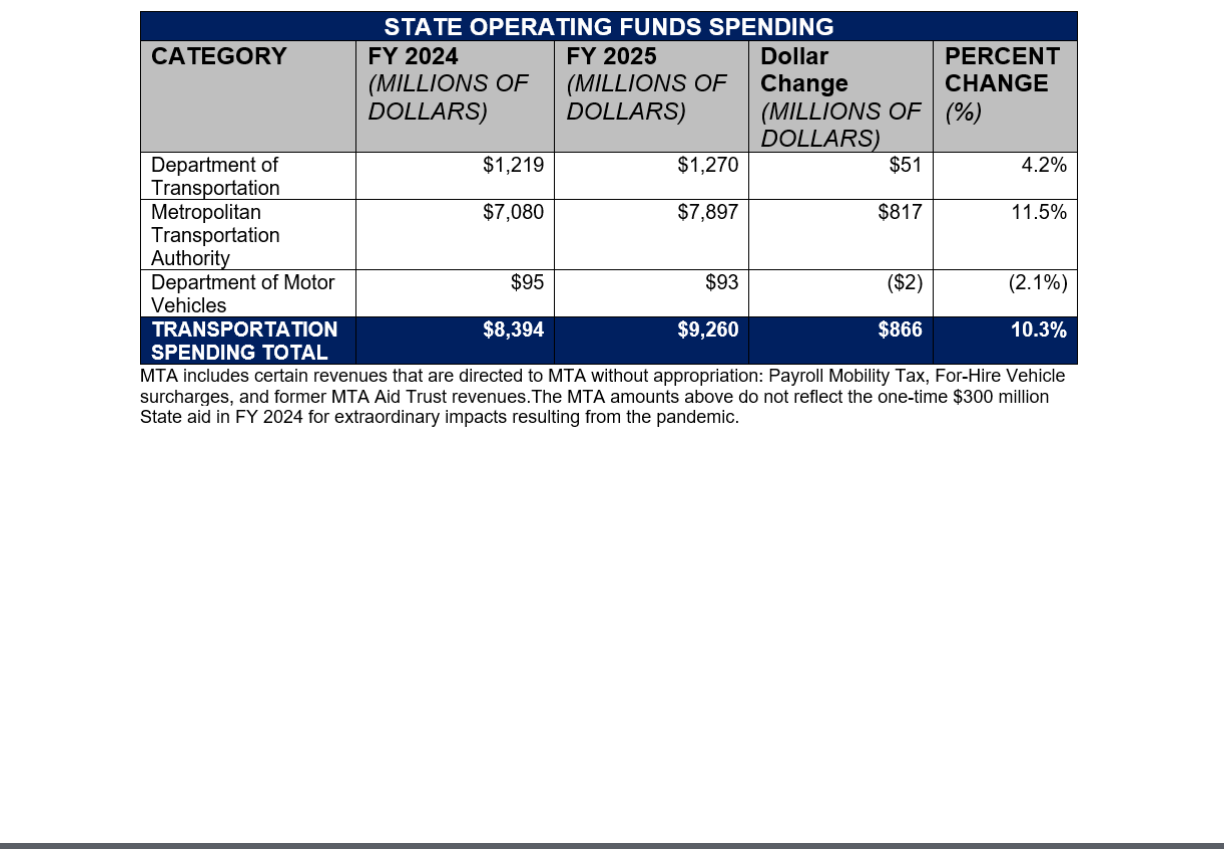

Transportation...........................................................125

IV. SUPPLEMENTAL REFERENCE

INFORMATION

The Executive Budget Citizen’s Guide.................135

Glossary of Acronyms...............................................139

TABLE

OF CONTENTS

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

Governor’s

Message

7

GOVERNOR’S MESSAGE

KATHY HOCHUL

GOVERNOR

In my State of the State, I presented our commonsense vision for the future of New York, to focus on the mental

health crisis, help New Yorkers manage the rising cost of living, and make our state safer.

Through the policies I have laid out in my State of the State and this Budget, my administration will accomplish a

solid, balanced budget without cuts or placing an added burden on taxpayers, all while delivering the programs

and services New Yorkers care about most.

We will do this by taking on categories of crime that remain far too high: like retail theft, domestic violence and

hate crimes. We’ll continue to rebuild our mental health system and keep our young people safe in school and

online. We’re investing in the future leaders of New York by going back to basics with reading, teaching kids to

swim, and focusing on maternal and infant health. We’re also taking steps to make New York more aordable.

This includes decisive action to increase our housing stock, which will help keep New York families in their

homes and reverse the decades long trend of outmigration.

On the heels of two years of incredible growth, this Budget includes transformational investments while

remaining committed to our scally responsible approach. While this budget is the largest in state history, we are

also taking bold steps to control Medicaid spending and ensure our public healthcare programs are sustainable

for the next generation, while also providing assistance for the most vulnerable New Yorkers. We will invest

record resources in our schools and provide aid to New York City as it continues to shelter tens of thousands of

migrants who have arrived in our country over the last two years. We’ll do all of this without raising income taxes

because it isn’t fair to ask New Yorkers to pay any more than they already do. We must continue to be smart and

reasonable during these uncertain times.

We are focused on the areas that will have the highest impact to improve people’s lives, and we will use the

entirety of this responsible yet ambitious budget to address the needs of every New Yorker.

My continued commitment is to ght the right ghts for New Yorkers, and pursue the common good, with

common sense, by nding common ground. Together, we’ll make our New York and our future even stronger.

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

DIRECTOR’s

Message

9

DIRECTOR’S MESSAGE

BLAKE G. WASHINGTON

BUDGET DIRECTOR

The FY 2025 Executive Budget reects Governor Hochul’s unwavering commitment to make New York State

safer and more aordable.

The Executive Budget normalizes growth in state spending after two years of historic, yet necessary investments

in public safety, health and mental hygiene, public schools, colleges and universities, and in our social safety net.

While there is always more work to do, stabilization of tax receipts following post-COVID highs requires the

State to live within its current means and begin to address multi-year budget gaps. The Executive Budget sets

the State on a trajectory to make continued, sound, and sustainable investments. It does not raise taxes and

maintains a historic level of reserves to mitigate the impact of any future economic downturn. This budget allows

for prior year investments to be implemented, to mature, and provide their intended benet.

This budget also continues the Governor’s public safety eorts by investing in initiatives to reduce and

prevent gun violence, prevent and prosecute crimes of domestic violence, stop organized retail theft, secure

communities against hate crimes, and strengthen emergency preparedness and response.

Under Governor Hochul’s leadership, the statewide minimum wage was increased at the start of 2024 to

provide meaningful compensation for a days’ work—and those paychecks are already making their way into

New Yorkers’ pockets. In this budget, Governor Hochul further advances her goal to secure the jobs of tomorrow

by establishing new workforce development centers along the I-90 corridor, and by making key investments

to attract industries that will make New York State the home of advanced manufacturing and technological

innovation. Access to good-paying jobs promotes aordability in every region of our state.

We look forward to collaborating with the Legislature, stakeholders, and all New Yorkers to enact a Budget that

maintains the key investments we’ve already made while protecting the aordability of New York: by creating

jobs, aligning spending to actual resources, holding the line on taxes, and resisting the temptation to access

reserves to fuel unsustainable growth.

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

SUMMARY OF

BUDGET

DOCUMENTS

11

OVERVIEW

The Executive Budget process and key Budget

documents are governed by the State Constitution,

with additional details and actions prescribed by

state laws and practices that have been established

over time. The State’s budget process is governed

primarily by Article VII of the New York State

Constitution. Article VII requires the Governor to

submit a budget detailing: a plan of expenditures

and an estimate of revenues for the upcoming scal

year; bills containing all proposed appropriations and

reappropriations; and other legislation needed to

implement the Executive Budget.

Two types of budget bills are necessary for the

Executive Budget:

• Appropriation Bills: Executive Budget

Appropriation bills provide the legal authorization

for all proposed spending from the funds

managed by the State. These bills encompass the

recommended funding for State operations, aid

to localities, capital projects, and debt service, as

well as legislative and judiciary bills.

• Article VII Bills: Article VII bills propose

amendments to, or create new, state laws

governing programs, savings, and revenues,

as the Governor deems necessary. These bills

encompass the recommended changes to

law in the areas of: Education, Labor, Family

Assistance, Health and Mental Hygiene, Public

Protection, General Government, Transportation,

Environment, Economic Development, and

Revenue.

In addition to the bills mentioned above, the

Executive Budget includes the following Budget

documents.

THE BIG FIVE

EXECUTIVE BUDGET BRIEFING BOOK

The Executive Budget Brieng Book presents the

Governor’s overall goals for the upcoming scal

year. It explains the State’s Financial Plan, includes

highlights of major initiatives, and a list of the

legislative proposals needed to implement the

proposed Budget.

FIVE-YEAR FINANCIAL PLAN

The Five-Year Financial Plan summarizes the

Governor’s Executive Budget and describes the

“complete plan” of spending and revenues as

required by the NYS Constitution.

FIVE-YEAR CAPITAL PROGRAM AND FINANCING PLAN

The Five-Year Capital Program and Financing Plan

highlights major capital initiatives and objectives and

describes the approach to nancing the capital program.

ECONOMIC AND REVENUE OUTLOOK

The Economic and Revenue Outlook explains the

specic sources of State revenues and presents an

economic outlook for the nation and the State over

the upcoming scal year.

STATE AGENCY PRESENTATIONS

The State Agency Presentations include links to

the mission and functions of each State agency,

descriptions of major Budget actions, and tables

that summarize the agency’s spending by program

and category. This module also includes the budget

requests of the Legislative and Judiciary branches,

which are submitted without revision as required by

the Constitution.

OPEN BUDGET

All Executive Budget bills and documents are

accessible to the public through the Budget Division’s

ocial website, budget.ny.gov, or in print from the

Senate and Assembly document rooms in Albany, NY.

In addition, the public is encouraged to visit the Open

Budget website, openbudget.ny.gov.

SUMMARY OF BUDGET DOCUMENTS

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

II

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

13

EXECUTIVE

BUDGET

FY 2025

SECTION II

FY 2024 EXECUTIVE BUDGET BRIEFING BOOK

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

FINANCIAL PLAN

OVERVIEW

15

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

Over the past two years, the State’s nancial position

has strengthened signicantly. Reserves have

increased to the highest levels in history, debt levels

remain nearly at at less than 1 percent growth over

the past decade, historic liquidity levels are delivering

high investment returns, and new reserves have

been established for future costs. The extraordinary

inux of resources during the post-COVID-19 period

fueled these nancial achievements and allowed

the State to make historic investments to adequately

fund essential services and programs. These

investments include fully funding the Foundation Aid

formula; expanding access to mental health services;

increasing assistance to hospitals, other health care

providers and workers; addressing the solvency of

the Metropolitan Transportation Authority (MTA);

aiding the City of New York for the provision of care

for thousands of asylum seekers; increasing wages;

supporting health care delivery improvements;

increasing recurring support for the State University

of New York (SUNY) and City University of New York

(CUNY); addressing gun crime and violence; and

expanding access to child care, housing, school

lunches and energy aordability.

Roughly half of the State Operating Funds budget

supports the State’s two largest program areas –

health care and education. Spending for assistance

and grants in FY 2025 is projected to be nearly $23

billion (32 percent) higher than the level recorded

in FY 2022

1

. Roughly two-thirds of the estimated

growth is concentrated in health care and education,

reecting historic, recurring funding increases for

schools and the health care system. While the

State’s investments over the past two years recur,

the elevated levels of tax receipts that initially

supported the increased funding do not. Following

two-years of substantially stronger tax collections,

New York began to experience a precipitous drop

in tax receipts beginning in FY 2024. The updated

projections for tax receipts

2

in the current year are

expected to decline by 7.8 percent from FY 2023

levels, followed by growth of 2.5 percent in FY 2025

from this lower base. This decline in tax receipts was

also experienced by the Federal government and

other states that rely on personal income taxes as a

signicant share of their revenues.

The long-term, historical average annual growth rate

for tax receipts, which support roughly

80 percent of State Operating Funds spending, is

roughly 4 percent. Tax receipts are projected to grow

on average by 4 percent annually over the Financial

Plan period from FY 2024 levels, while spending is

projected to grow by just over 5 percent on average

through FY 2028, resulting in a structural imbalance.

Accordingly, in preparing the FY 2025 Executive

Budget, the structural General Fund budget gaps

required the State to evaluate multi-year growth

assumptions across all programs to ensure long-term

sustainability within projected resources.

The FY 2025 Executive Budget proposal reduces

the multi-year budget gaps and provides for

balanced General Fund operations on a cash basis

in FY 2025, while preserving existing commitments

and funding new investments to address critical

needs. Proposed savings initiatives are intended to

prudently use resources from New York taxpayers

to continue support for investments made over the

past two years in education, physical and mental

health care, public safety, economic stability, and

environmental protection; and continue to ensure

assistance is available for individuals and entities

with demonstratable need. The Executive Budget

also includes new funding for services and initiatives

consistent with announcements made by the

Governor in her State of the State plan presented on

January 9, 2024. In addition, State Medicaid spending

is increased, consistent with the recently approved

1115 Medicaid Waiver Amendment, and expanded

support to assist the City of New York with aiding

asylum seekers.

In this Financial Plan, DOB is increasing the estimate

for tax receipts and other resources in all years

from the levels forecasted in the Mid-Year Update.

The projection for General Fund tax receipts, over

the multi-year Financial Plan, excluding proposed

extensions, is revised upward by $5.9 billion from

the forecast included in the Mid-Year Update. In the

current year (FY 2024), the upward revision in tax

receipts, combined with the reserve for transaction

risk that was set aside for FY 2024, and other

1

Excludes roughly $3 billion in one-time COVID-19 pandemic assistance and grants spending.

2

Tax receipts and General Fund balance are aected by the Pass-Through Entity Tax (PTET); however, DOB expects

that the PTET will, on a multi-year basis, be revenue neutral for the State. The discussion of tax receipts throughout

the Financial Plan Overview exclude the impact of PTET, unless otherwise noted.

17

FINANCIAL PLAN OVERVIEW

revisions, leave an estimated General Fund surplus

of $2.2 billion. The surplus will be used to prepay $1.7

billion in FY 2025 expenses to reduce the budget

year gap, and the remaining $500 million will be set

aside in reserves for future one-time costs related to

assisting asylum seekers.

The Executive Budget maintains Principal Reserves

at 15 percent of State Operating Funds spending to

protect essential services in the event of an economic

downturn, as well as other reserves for dedicated

purposes to manage risks to the Financial Plan and

future costs.

DOB expects that the General Fund will have

sucient liquidity in FY 2025 to make all planned

payments as they become due, and the General Fund

balance will continue to benet the State by providing

high levels of investment income due to elevated

market interest rates. DOB continues to reserve

money on a quarterly basis for debt service payments

that are nanced with General Fund resources.

Money to pay debt service on bonds secured by

dedicated receipts, including PIT bonds and Sales Tax

bonds, continues to be set aside as required by law

and bond covenants.

FY 2025 Executive Budget Financial

Plan Summary

This Financial Plan Update reects the Governor’s FY

2025 Executive Budget proposal and accompanying

legislation introduced on January 16, 2024, as well as

revisions to the projections of receipts and spending in

all years based on results to date, updated forecasts,

and adjustments to programmatic assumptions. DOB

estimates that the General Fund is balanced on a cash

basis in FY 2025, should the Legislature adopt the

Governor’s proposal without modication.

DOB expects the General Fund to end FY 2025

with a balance of nearly $44 billion. Approximately

half of the balance consists of Principal Reserves to

protect essential services in the event of an economic

downturn. The remaining balance is comprised of

other reserves that were previously pledged to

reduce outyear gaps, manage risks and support

future costs that include tax refunds and liabilities,

capital projects, and potential labor agreements.

The Budget supports the implementation and

expansion of various initiatives laid out in the

Governor’s State of the State plan presented to

the Legislature on January 9, 2024, and continues

funding for existing commitments, including increased

funding for Foundation Aid, support for Medicaid and

distressed hospitals, increases in the minimum wage,

and expanded access to aordable child care.

The Executive Budget proposal increases FY 2025

State Operating Funds spending by $5.9 billion (4.5

percent) compared to the prior year, adjusted for

the routine management of resources, execution

of prepayments, and uctuations in the timing of

transactions across scal years that impact reported

spending growth. Nearly two-thirds of the proposed

growth is driven by increased spending on School Aid

and Medicaid.

School Aid

The State provides a substantial amount of nancial

support for public schools through State formula aids

and grants. For over a decade, New York has ranked

the highest in the nation for per pupil spending. In

school year (SY) 2021, New York spent $26,571 per

pupil, 85 percent more than the national average of

$14,347 per pupil

3

. In SY 2024, approximately 2.4

million kindergarten through 12th grade students

are enrolled in the State’s public schools, including

182,000 students enrolled in charter schools.

Compared to SY 2014 levels, enrollment in the

State’s public schools has declined by roughly 10

percent (268,000 students). Despite these enrollment

declines, State aid has continued to increase each

year. From SY 2021 to SY 2024, total School Aid

grew by an average of $2.3 billion (7.7 percent) per

year (excluding the SY 2022 Pandemic Adjustment

restoration), driven primarily by the three-year phase-

in of full funding of the Foundation Aid formula. In

addition to State aid, school districts have continued

to raise revenue through local property tax increases,

3

Based on U.S. Census Bureau,

2021 Annual Survey of School System Finances

.

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

4

Excludes District of Columbia. Based on U.S. Census Bureau data and the 2021 Centers for Medicare and Medicaid

Services Financial Report, Expenditure Reports From MBES/CBES.

which when combined with State aid increases and

Federal COVID-19 pandemic related assistance, have

aorded many districts the ability to amass substantial

reserves and surplus balances.

Adding to the historic increases in funding over the

past three years, the Executive Budget includes $35.3

billion for School Aid in SY 2025, an increase of

approximately $921 million (2.7 percent), inclusive of

the State’s full takeover of funding for prekindergarten

expansion grants previously supported with Federal

American Rescue Plan Act of 2021 (ARP) funds.

Excluding the State funds needed to support this

takeover, the School Aid increase for SY 2025 totals

$825 million (2.4 percent). This growth reects a $507

million (2.1 percent) Foundation Aid increase.

Since SY 2022, State-funded School Aid will have

increased by over $6 billion (21 percent), inclusive of

the Executive Budget's proposed increase.

Medicaid

The New York State Medicaid Program provides

health and long-term care coverage to lower-income

children, pregnant women, adults, seniors, and

people with disabilities, and is nanced jointly by the

Federal, State, and Local governments. New York

receives the minimum Federal Medicaid matching

share of roughly 50 percent. Local districts’ costs

have been capped at calendar year 2015 levels,

shifting the increased costs to the State and saving

the City of New York and counties an estimated $7.4

billion in FY 2025. The State oers some of the most

comprehensive and extensive Medicaid benets

in the nation, including optional services such as

coverage for pharmacy and personal care services,

spending $3,582 per capita based on the latest CMS

data (Federal Fiscal Year 2021) , which was more than

an any other state. New York’s per capita spending

was 10 percent higher than the next highest state,

New Mexico which spent $3,245 per capita. Nearly

7.6 million (39 percent) New Yorkers are currently

covered by Medicaid. When combined with other

public insurance coverage, New York has the highest

percent of people covered by publicly funded medical

insurance (Medicaid, Child Health Plus (CHP) and

Essential Plan (EP)) in the nation.

The Medicaid program is also a large contributor

of funding to hospitals and nursing homes through

various supplemental programs. Medicaid spending

growth continues to escalate as utilization of

the system, primarily Managed Long Term Care

(MLTC), rises with an aging population. In FY 2025,

Department of Health Medicaid spending is projected

to total $30.9 billion, an increase of $3 billion (10.9

percent) from the revised FY 2024 levels, including

over $1 billion in savings proposals.

State-share Medicaid spending, including

administrative costs, is projected to be $8.6 billion

(39 percent) higher in FY 2025 than the levels

recorded three years prior in FY 2022.

Other Spending Growth

The Executive Budget also proposes spending

increases to support agency operations and

addresses the State’s many continuing challenges,

including access to mental health care, public safety,

the stability of the State’s health care system, and

an extension and expansion of extraordinary State

funding to continue to assist the City of New York with

providing services and assistance to asylum seekers.

In addition to signicant investments made in the past

two years, the FY 2025 Budget provides funding to

expand mental health services for children and teens

through school and pediatric health care settings;

increases pregnant and postpartum services; grants

the Department of Financial Services (DFS) authority

to hold insurers accountable for mental health

coverage; addresses the opioid epidemic; advances

a plan consistent with the recent Federal government

waiver approval to improve health care delivery; adds

funding for law enforcement activities; increases

access to swimming and instruction; and funds other

program enhancements and initiatives.

The Budget also adds substantial new capital funding

for Articial Intelligence (AI) research and innovation;

economic development initiatives; energy aordability

improvements; incentives for communities to

grow their housing stock; and storm and ood risk

remediation and protection.

19

FINANCIAL PLAN OVERVIEW

State Spending

The Executive Budget proposal drives FY 2025

State Operating Funds spending to $136.2 billion,

an increase of $5.9 billion (4.5 percent) compared to

the current FY 2024 estimate, excluding the routine

management of resources, execution of prepayments,

and uctuations in the timing of transactions and

reimbursements across scal years.

FY 2025 spending growth is largely driven by

Medicaid, School Aid and increased operational

funding for all branches of State government as

agencies continue to strive to restore service capacity

and workforce levels to pre-COVID-19 pandemic

levels.

Medicaid spending is driven largely by elevated

enrollment relative to pre-COVID-19 pandemic levels;

expansion of benets; increases in reimbursement

rates; and growing utilization of the State’s MLTC

program by the State’s aging population.

Spending for assistance and grants has grown

from $72 billion in FY 2022, adjusted to exclude

for COVID-19 pandemic assistance and recovery

spending, to nearly $95 billion of projected spending

in FY 2025. The $23 billion (32 percent) increase

reects historic investments over the preceding years

in education, health care and other assistance and

program growth.

Spending growth is routinely impacted by planned

prepayments and timing-related transactions and

reimbursements. In FY 2025, spending growth

reects the planned payment of

FY 2025 pension expenses in FY 2024; delayed

recoupment from providers of excess payments

attributable to State-only Medicaid payments that

were previously advanced and are now expected in

FY 2025; the expiration of the temporary enhanced

Federal Medical Assistance Percentage (eFMAP)

that lowers Medicaid costs in FY 2024; COVID-19

pandemic related Federal Emergency Management

Agency (FEMA) reimbursements that are expected

to lower spending to oset costs accounted for in

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

prior years; and the impact of prior year debt service

prepayments. Accounting for these transactions, State

Operating Funds spending is projected to total $129.3

billion, an increase of $2.7 billion (2.1 percent).

Including spending for capital projects and spending

supported by the Federal government, All Funds

spending is estimated to total $232.7 billion in FY

2025, an increase of $1 billion

(0.5 percent), from the current scal year estimate.

The increase in All Funds spending is attributable

to the end of COVID-19 pandemic related recovery

and assistance provided through increased Federal

funding and reimbursements, which is partly oset

by signicant increases in capital projects spending

consistent with approved and proposed capital

commitments.

21

Outyear Budget Gaps

The FY 2025 Executive Budget Financial Plan

proposal provides savings that reduces the outyear

budget gaps to $5 billion in FY 2026, $5.2 billion in

FY 2027, and $9.9 billion in FY 2028 in comparison

to the Mid-Year Update. If the FY 2026 Budget is

balanced with recurring savings, the budget gap for

FY 2027 would be nearly eliminated and the FY 2028

gap would be reduced to roughly $5 billion.

The outyear budget gaps are the result of a structural

imbalance between the forecasted levels of spending

growth and available resources. The gaps include

Medicaid spending projections that exceeds the

global cap beginning in FY 2026, which is partly

due to $1.7 billion in additional State spending over

the multi-year Financial Plan to leverage roughly $6

billion in additional Federal Medicaid funding, as well

as upward revisions reecting sustained enrollment

levels and spending for MLTC. The projected budget

gaps do not reect the use of any principal reserves

to balance operations but do include the use of prior

year surpluses carried forwarded into future years

and the one-time use of a portion of the Reserve for

Economic Uncertainties to fund additional assistance

to the City of New York to alleviate scal pressures

from asylum seekers in FY 2026.

In addition, the projected budget gap for FY 2027

includes a one-time acceleration of between

$3 and $4 billion in estimated PIT tax receipts due

to the scheduled expiration of the Federal SALT Cap

at the end of 2025 and expectation that taxpayers

will seek to benet from unlimited SALT deductibility

beginning in tax year 2026. If the Federal government

extends or revises the SALT Cap, the acceleration

would likely be substantially less, which would reduce

tax receipts and increase the budget gap for FY 2027

by a concomitant amount.

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

Lastly, the FY 2028 projected budget gap reects

the initial impact of the current law sunset at the

end of tax year 2027 of higher tax rates for high

income lers, reverting the schedule to a single top

rate of 8.82 percent. If the current rate schedule

were extended, DOB estimates that PIT withholding

receipts would increase by an amount in the range

of $750 million to $1 billion in the last quarter of FY

2028.

Reserves and Risks

The Financial Plan faces looming economic risks,

including: slowing economic growth; continued price

ination; geopolitical uncertainties; programmatic

cost pressures; uncertainty about the scal conditions

of outside entities relying on State assistance; risks

due to the State’s dependance on Federal funding

and approvals; and uncertainty about the timing and

feasibility of implementing cost savings actions.

While the DOB forecast of receipts and spending is

based on current law and reasonable assumptions

as of the time it was prepared, the timing and impact

of an economic slowdown or downturn is highly

unpredictable, and thus necessitates a prudent level

of reserves to hedge against these risks.

In October 2021, the Governor committed to building

the State’s reserves to 15 percent of State Operating

Funds spending by FY 2025 to ensure that it could

honor its commitments through good and bad

times. This commitment was met two years ahead

of schedule in FY 2023 with a nearly $11 billion

deposit. The FY 2025 Executive Budget preserves

these critical investments and utilizes a portion of the

projected current year surplus to add $500 million for

future costs.

23

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

CAPITAL PLAN

OVERVIEW

25

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

Governor Hochul continues to make signicant

infrastructure investments across the State that will

play a critical role in building New York’s future:

creating jobs, growing the economy, increasing

mobility, and keeping New York residents

healthy and safe. The Executive Budget builds

on major investments made over the last two

years in transportation; aordable and supportive

housing; economic and community development;

environmental initiatives; increased access to care

and housing opportunities for individuals with mental

health issues; health care transformation; public

safety; and investments in higher education.

MAJOR INFRASTRUCTURE

INVESTMENTS UNDERWAY

Governor Hochul is committed to delivering

transformative infrastructure projects that are

supported by the State, local governments,

public authorities, private entities, and the

Federal government. The State budget includes

investments in projects that will improve the State's

transit systems, modernize airports, and rebuild

infrastructure to upgrade the State's transportation

network in a timely manner and prepare for future

generations. Major infrastructure investments

currently underway include:

Gateway Hudson Tunnel Project. The rail tunnels

under the Hudson River used by Amtrak play a critical

role as the connection for New England rail trac to

the rest of the eastern seaboard, giving this project

national signicance. These aging tunnels were

seriously damaged by Superstorm Sandy and are in

dire need of repair and expansion. Upon completion,

this project will revitalize existing rails and tunnels,

and add a new, two-track tunnel under the Hudson

River. Project costs are estimated at $16.1 billion.

Pennsylvania Station Area Civic and Land Use

Improvement Project. The State has completed

the transformation of the James A. Farley Post

Oce building into the Moynihan Train Hall and

opened a new, state-of-the-art expanded West End

Concourse at Penn Station. The concourse provides

direct access to 17 of the station’s 21 tracks for Long

Island Rail Road (LIRR) commuters and intercity rail

passengers, oering an underground connection

between the Moynihan Train Hall and Penn Station

via 33rd Street with a direct link to the 8th Avenue

Subway (A/C/E Trains).

Expanding on this vision, Governor Hochul plans

to create a commuter-rst Penn Station. The

reconstructed Penn Station will create a double-

height, light-lled train hall that more than doubles

27

CAPITAL PLAN OVERVIEW

passenger space from 123,000 square feet to

250,000 square feet and nearly doubles the number

of entrances from 12 to 20. The station reconstruction

complements a station expansion that will increase

track and train capacity by 40 percent to more

eectively accommodate the service needs of

travelers and commuters at the busiest transit hub in

the Western Hemisphere. Project costs are estimated

at $22 billion.

MTA 2020-2024 Capital Program. The $52.1 billion

capital program represents the largest investment

in MTA infrastructure in State history, at almost

70 percent larger than any previous program.

The program prioritizes critical investments to

revitalize the subway system, including improving

signal technology, increasing accessibility, and

improving quality of life issues. The capital program

also makes investments in LIRR and Metro North

Railroad commuter rail and bus service upgrades.

The FY 2025 Executive Budget includes funding to

further eorts to expand the MTA’s transit networks,

including:

• The Interborough Express. The Executive Budget

includes $45 million in funding to advance

design and engineering for this project, which will

connect neighborhoods along a 14-mile existing

freight right-of-way from Bay Ridge, Brooklyn,

to Jackson Heights, Queens. The Interborough

Express planning and environmental linkages

study recommended light rail as the preferred

option for providing fast, frequent service

connecting the Interborough with up to 17

dierent subway lines and the LIRR.

• Second Avenue Subway–Expanding West.

With Phase 2 underway, the next major potential

phase of this project is extending the Q line west

along 125th Street, with three new stops at Lenox

Avenue, St. Nicholas Avenue and Broadway in

Manhattanville. The Executive Budget includes

$16 million in funding to advance a feasibility

study, environmental review and preliminary

engineering for this project.

Transforming John F. Kennedy Airport. The State

is proceeding with a historic $19.5 billion plan to

transform John F. Kennedy International Airport

(JFK) into a modern, 21st century airport through

an overhaul of the airport’s eight disparate terminal

sites into one unied JFK Airport. Work will include

demolishing old terminals, utilizing vacant space,

and modernizing infrastructure, while incorporating

the latest in passenger amenities and technological

innovations. This record investment includes $15.6

billion in private sector funding and will increase the

airport’s capacity by at least 15 million passengers

annually. The rst new facilities apart of this

transformation opened in 2023.

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

FIVE-YEAR CAPITAL PLAN & BUDGET

The State’s Five-Year Capital Plan includes $95 billion

in projected capital spending over a ve-year period.

Funding for the plan will include State bonds, State

PAYGO (Pay-As-You-Go, e.g., taxes and fees); and

Federal funding. The table below outlines capital plan

spending by function and includes funding source.

FY 2025 EXECUTIVE BUDGET CAPITAL

PLAN HIGHLIGHTS

Major initiatives added or continued in FY 2025

include:

Five-Year Department of Transportation Capital

Plan. The Executive Budget includes approximately

$7.6 billion for the third year of a ve-year, $32.9

29

CAPITAL PLAN OVERVIEW

billion Department of Transportation (DOT) Capital

Plan. The DOT Capital Plan leverages Federal funding

commitments made in the Infrastructure Investment

and Jobs Act to support the nal phases of major

infrastructure projects, including the Hunts Point

Interstate Access Improvement and the replacement

of I-81 in Syracuse. The plan also supports new

large-scale projects, including: modernizing the

Livingston Avenue Bridge in Albany; reconnecting

neighborhoods across the Kensington Expressway

in Bualo; converting Route 17 to I-86 in Orange and

Sullivan Counties; and assessing ways to improve

road capacity at the Oakdale Merge in Suolk County.

The DOT Capital Plan also includes an additional $1

billion for the “Bridge NY” program and $1 billion for

the Pave Our Potholes (POP) program, and continues

funding commitments to local highway and bridge

programs at planned levels.

Five-Year Housing Plan. The Executive Budget

continues a $25 billion, ve-year housing plan to

create and preserve 100,000 aordable homes,

including 10,000 homes with support services for

vulnerable populations, and electrify an additional

50,000 homes as part of the State’s plan to

electrify 1 million homes and make another 1 million

electrication-ready. Funding includes $5.7 billion

in State capital resources, $8.8 billion in State and

Federal tax credits and other Federal allocations,

and $11 billion to support the operation of shelters

and supportive housing units and to provide rental

subsidies. Additionally, the FY 2025 Executive

Budget establishes a $500 million fund to support

infrastructure upgrades on State sites and properties

that could be repurposed to create up to 15,000 units

of housing.

Mental Health Capital Investments. The Executive

Budget continues to build on the Governor’s

investments in expanding capacity to care for people

with mental illness by funding an additional 200

new psychiatric inpatient beds. The funding covers

125 State-operated inpatient beds, including 15 for

children and adolescents, 85 for adults, and 25

forensic; and 75 Transition to Home beds.

Empire AI Consortium. The FY 2025 Executive

Budget includes $250 million to create the Empire

AI Consortium, a partnership of New York’s public-

and private-research institutions, that will establish a

state-of-the-art articial intelligence computing center

to promote research and development. In addition

to capital grant funding proposed in the Executive

Budget, Empire AI will be supported with $125 million

from private partners and $25 million from the State

University of New York (SUNY).

High-Technology Research and Development. The

Executive Budget supports continued investment

in high-tech semiconductor manufacturing and

innovation, including:

• $1 billion in new and existing resources to

construct a new 50,000 sq. ft. facility to

support the High NA Extreme Ultraviolet (EUV)

Lithography Center and procure a High NA

EUV tool. This initiative partners with leaders in

the semiconductor industry to establish a next-

generation research and development center at

NY CREATES’ Albany NanoTech Complex.

• $110 million to create One Network for Regional

Advanced Manufacturing Partnerships (ON-

RAMP), an initiative that will construct new

workforce development centers in upstate New

York and provide training opportunities related to

advanced manufacturing.

• $100 million to continue investing in shovel-ready

sites to attract high-tech manufacturing to New

York.

Create Access to Swimming. The Executive

Budget proposes $150 million to create the New

York Statewide Investment in More Swimming (NY

SWIMS), an initiative that will support equitable and

widespread access to safe swimming opportunities.

NY SWIMS includes $60 million to build 10 new

swimming pools in underserved communities, $60

million to develop and install oating pools in natural

waterways, and $30 million for pop-up swimming

pools that can be deployed to communities that

would otherwise not have access to outdoor pools.

Climate and Flood Resiliency. The Executive Budget

includes funding for investments to mitigate damage

from major ooding events, including: $250 million

from the 2022 Clean Water, Clean Air and Green Jobs

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

Environmental Bond Act to promote voluntary home

buyouts in communities most vulnerable to ooding;

$130 million for Green Resiliency Grants to support

ood control infrastructure projects; and $40 million

to launch the Resilient and Ready program, which will

support low and moderate income homeowners with

resiliency improvements and assist with repairs in the

event of a catastrophic event.

Clean Water Infrastructure. The Executive Budget

adds $500 million over two years to support

clean water infrastructure, raising the State’s total

investment to $5.5 billion. This funding will support

local construction projects to improve municipal

drinking water distribution, ltration systems, and

wastewater treatment infrastructure.

Clean Water, Clean Air, and Green Jobs Bond Act.

In November 2022, voters approved a $4.2 billion

bond act that will support: capital improvements and

enhancements in ood risk reduction/restorations;

open space, working lands conservation, and

recreation; climate change mitigation; and water

quality improvement and resilient infrastructure.

The Environmental Bond Act supports various

initiatives within the FY 2025 Executive Budget,

including resiliency and land improvement eorts.

In September 2023, Governor Hochul released a

roadmap for P-12 schools to transition bus eets to

zero-emission vehicles funded, in part, with $500

million from the Environmental Bond Act.

Local Capital Grants. In addition to traditional capital

grant programs, the Executive Budget proposes

$135 million for new County Partnership Grants to

support public safety and infrastructure investments.

Additionally, the Budget includes $14.7 million for

grants to local Boards of Election to replace and

upgrade electronic polling equipment, as well as

$15 million for municipalities to purchase equipment

needed to respond to emergency weather events,

including regional ooding.

Public Safety Investments. The Executive Budget

proposes an additional $35 million for the Securing

Communities Against Hate Crimes program, $10

million for Securing Reproductive Health Centers

capital grants, and $50 million of funding for

communities most impacted by gun violence.

Economic and Community Development. The

Executive Budget provides $880 million in new

economic and community development funding

across a number of programs, including $150 million

for the Regional Economic Development Council

(REDC) program; $200 million for the Downtown

Revitalization Initiative, including NY Forward

funding to increase support for rural communities;

$400 million for the New York Works Economic

Development Fund; $50 million for the Restore-NY

Communities program; and $82.5 million for the

Olympic Regional Development Authority (ORDA).

State Parks. The Executive Budget allocates $300

million in capital funding to the Oce of Parks,

Recreation and Historic Preservation, including

investments in public swimming facilities that support

the State’s initiative to provide expanded access

to safe swimming opportunities. Additionally, the

Executive Budget funds the installation of security

equipment in all State Parks.

Agriculture. The Executive Budget proposes new

investments to support New York’s agriculture

industry, including $55 million in capital grants for

on-farm milk storage technologies and processing

infrastructure, $5 million to reinvigorate New

York’s aquaculture industry through the Blue Food

Transformation, and $5 million to grow New York’s

bioeconomy. The Executive Budget also continues a

multi-year $50 million investment to support kitchen

facilities that prepare meals for K-12 schools from New

York State farm products.

Higher Education. The Executive Budget proposes

$1.2 billion in new capital funding for SUNY and

CUNY, including $1.05 billion to maintain and preserve

campus facilities and make strategic investments, and

$154 million for community colleges.

Arts and Education. The Executive Budget supports

investments in cultural arts and education, including

$34 million for library construction grants, $50 million

for capital grants administered by the New York State

Council on the Arts (NYSCA), and $28 million for

State-owned schools.

31

CAPITAL PLAN OVERVIEW

CAPITAL PLAN OVERVIEW

COMMITTED TO DEBT AFFORDABILITY

Governor Hochul is using a disciplined approach

to control and target new borrowing to keep debt

aordable and within the State’s debt limit. The

Capital Plan includes $9 billion of cash resources

for pay-as-you-go capital spending, which is being

used in place of higher cost taxable debt issuances.

This proactive management of the State’s debt costs

will enable the aordable delivery of infrastructure

investments.

State debt will continue to remain aordable as

evidenced by the following debt metrics:

• Over the past decade the State has been

disciplined in its use of debt, while making

signicant investments in the State’s

infrastructure. From FY 2015 to FY 2024, debt

outstanding has increased from $54.2 billion to

$55.9 billion (projected), or an average of 0.3

percent annually. By comparison, in the prior 10

year period, debt grew by 1.6 percent annually.

• State-supported debt is projected to remain

within the statutory debt caps throughout the

Five-Year Capital Plan as a result of the strategic

cash contribution of $9 billion over multiple years

to reduce debt issuances.

• State-related debt outstanding as a percentage

of personal income is expected to remain below

historical levels across the Five-Year Capital Plan

and is projected at 4.8 percent in FY 2029.

• Debt service costs are estimated at $6.4 billion

in FY 2025, after adjusting for debt service

prepayments, which is an increase of 7 percent

from FY 2024.

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

REVENUE

ACTIONS

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

The FY 2025 Executive Budget continues to build on

the accomplishments of the FY 2024 Budget by:

• Repealing the Cannabis Potency Tax and

replacing it with a weight-based tax to ease tax

compliance for distributors.

• Giving the Tax Department new tools and

extending longstanding provisions that bolster tax

compliance.

• Supporting local governments by creating tax

parity between hotels and the vacation rental

industry.

• Addressing the Supreme Court ruling on local

property tax foreclosures to ensure Counties

can continue to take action on property tax

delinquencies in an appropriate manner.

ECONOMIC BACKGROUND AND

OUTLOOK

At the onset of 2023, the economic outlook was

pessimistic. Elevated ination, rising interest rates,

weak industrial production growth, and consumer and

business expectations pointed to a recession in 2023.

Despite the warning signs, U.S. economic growth

has been strong, continuing to create new jobs and

expand incomes. The downturn expected by many

has been avoided and economic forecasts have been

revised to reect a likely “soft landing.” There are still

challenges ahead. While far below its peaks in 2022,

ination is persistent and the impacts of the restrictive

monetary policy designed to address it are being felt

in nancial markets, the real estate sector (residential

and commercial), and the overall economy. High

interest rates are likely to curb spending, investment,

and employment in the near term.

35

REVENUE ACTIONS

U.S. real Gross Domestic Product (GDP) growth is

expected to slow from an average pace of 2.4 percent

in 2023 to 1.3 percent in 2024. The U.S. economy

should be able to weather the forces inhibiting growth

in the short term and avoid a contraction. Currently

the New York State Division of the Budget does

not foresee a sustained downturn in the levels

of employment, industrial production, retail and

wholesale trade, and personal income, but this

year’s growth rate points to an economy growing

below its long-term potential. In such an economic

environment, an unforeseen economic shock or a

policy mistake could still spur an economic downturn

in the rst half of 2024. If that happens, the recession

is likely to be relatively short-lived and mild compared

to previous recessions in 2001 and 2008-09.

New York State's economy is still on a recovery path

from the impact of the COVID-19 pandemic. As of

November 2023, the State employment was 98.9

percent of its pre-pandemic level, though the nation

as a whole had regained all its job losses by June

2022. The State’s labor market recovery slowed in

2023 due to labor shortages, high interest rates,

and slowing global growth. On average, the State

only gained 6,100 jobs per month in the rst eleven

months of 2023, compared to 26,200 average

monthly job gains in 2022. State employment growth

is projected to decelerate from an estimated growth

of 1.8 percent in 2023 to only 0.1 percent in 2024 due

to the expected slowdown of the national economy

and the continued decline of the State population.

New York State's total wage growth is expected

to decelerate from 5.1 percent for FY 2023 to 3.2

percent growth for FY 2024 due to the slowdown of

the national economy, softening labor markets, and

the continued decline in bonus growth. Total State

wage growth is projected to be 3.8 percent for FY

2025 as the outlook for bonus growth improves. State

personal income is estimated to grow by 3.5 percent

in FY 2024 due to an anticipated 3.6 percent decline

in total bonuses. New York State personal income

growth should pick up somewhat to 4 percent in FY

2025 due to the projected improvement of bonuses

later in the year despite slowing employment growth.

PROVIDING TAX RELIEF TO NEW YORK:

REFORM, SIMPLIFICATION AND OTHER

ACTIONS

Establish the Commercial Security Tax Credit. To

help business owners oset the costs of retail theft

prevention measures, the Executive Budget proposes

to create a $3,000 tax credit for small businesses

that spend more than $12,000 on such measures

and join an anti-prevention partnership. The program

is capped at $5 million annually and is available for

2024 and 2025.

Permanently Extend Authorization to Manage

Delinquent Sales Tax Vendors. The Executive Budget

makes permanent certain provisions concerning

the segregated sales tax account program. In eect

since 2011, these provisions have improved vendor

compliance and reduced the need to pursue costly

collection actions when sales tax collected by

vendors is not remitted in a timely manner to the

Department.

Extend Certain Sales Tax Exemption Related to

the Dodd-Frank Protection Act for Three Years.

The Dodd-Frank Wall Street Reform and Consumer

Protection Act required certain nancial institutions

to create subsidiaries and then transfer property or

services to those subsidiaries. In order to continue

to address the unintended consequences of the

Federal Act as it pertains to “separate legal entities,”

the Executive Budget extends for three years the tax

exemption, rst provided in 2015, that excludes these

required transfers from taxable sales.

Extend the Sales Tax Vending Machine Exemption

for One Year. The Executive Budget continues to

incentivize an industry shift to cashless vending

machines that can collect sales tax at the point of

sale by extending for one year, the existing sales tax

exemption for certain food and drink purchased from

vending machines ($1.50 or less for items purchased

from vending machines that only accept coin or

currency and $2.00 or less from vending machines

that can accept cashless payments). The current

exemption is scheduled to expire May 31, 2024.

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

Modernize Tax Law to Include the Vacation Rental

Industry. In order to create a level playing eld

between the growing vacation rental sector and

traditional hospitality industry participants such as

hotels or motels, the Executive Budget subjects all

vacation rentals to State and local sales taxes, as

well as the daily NYC Convention Center hotel fee

of $1.50 per unit. Under these new provisions, any

vacation rental marketplace provider that facilitates

the occupancy of a vacation rental will be responsible

for collecting and remitting the State and local sales

taxes, in addition to the NYC hotel unit fee.

Repeal and Replace the Cannabis Potency Tax.

To promote and support the expansion of the legal

adult-use cannabis market, the Executive Budget

simplies, streamlines, and reduces the tax collection

obligations and burden for cultivators, processors,

and distributors by repealing the wholesale THC

potency tax, and replacing it with a wholesale excise

tax of 9 percent, while maintaining the State retail

excise tax rate of 9 percent and the local retail

excise tax rate of 4 percent. For vertically-integrated

entities such as the Registered Organizations and

microbusinesses where an arm’s length transaction

between the distributor and the retailer is non-

existent, the new wholesale excise tax will accrue on

the nal retail sale to consumers and be imposed on

75 percent of the nal retail sales price.

Provide for the Filing of Amended Sales Tax

Returns. Amended sales tax returns are not

contemplated in Sales Tax Law, so there are no clear

rules regarding the process or timeline for ling

amended returns. The Executive Budget addresses

this by clarifying that amended sales tax returns are

subject to similar limitations as other tax lings and

creating clear process standards.

Permanently Extend the Itemized Deduction

Limit on High Income Filers. Since 2010, itemized

deductions for taxpayers with New York adjusted

gross income of more than $10 million have been

limited to 25 percent of the allowed Federal

charitable contribution deduction. The Executive

Budget permanently extends this long-standing limit.

Make Technical Corrections to the Metropolitan

Commuter Transportation Mobility Tax. Legislation

enacted as part of the FY 2024 Enacted Budget

inadvertently repealed the Metropolitan Commuter

Transportation Mobility Tax for self-employed

individuals within suburban Metropolitan Commuter

Transportation District counties. The Executive Budget

corrects this erroneous repeal.

Return Tax Foreclosure Surplus to Property Owner.

When a delinquent property taxpayer experiences

a loss of their property through a foreclosure

proceeding, any equity that has been accumulated

during their ownership has been forfeited in the

past. However, on May 25, 2023, the Supreme

Court unanimously ruled that it is unconstitutional

for localities to unilaterally retain the surplus monies

from a foreclosure. To implement the Supreme Court’s

holding, the Executive Budget provides that when

a tax delinquent property is foreclosed upon by the

county and sold, any money the county receives

that exceeds the liability amount (e.g., overdue

taxes, penalties, interest, mortgage liens, etc.) will

be returned to the property owner, or lienors, as

appropriate.

Clarify Taxable Status of Telecommunications

Property. Under current statute, telecommunications

property is not taxable if it is “used in the transmission

of news or entertainment radio, television or cable

television signals for immediate, delayed or ultimate

exhibition to the public.” The Executive Budget would

clarify that properties are excluded from the denition

of real property, and therefore not taxable, only if

the property is primarily or exclusively used in the

transmission of radio, television, or cable signals.

Permanently Extend the Tax Shelter Provisions. The

Executive Budget permanently extends various tax

shelter provisions that were originally established

in 2005. These include various PIT and Corporate

Tax penalties that promote abusive tax shelters and

the failure to disclose certain transactions, and the

substantial understatement of tax liability.

37

REVENUE ACTIONS

Close the Amended Return Loophole for Personal

Income and Corporation Franchise Taxes. By

changing the limitation on petitions led to the

Division of Tax Appeals, this proposal would allow

the Department of Taxation and Finance to act on

amended returns that are led during or after the

appeals process and aid in their enforcement of

withholding ling and billing processes.

GAMING INITIATIVES

Extend Pari-Mutuel Tax Rates and Simulcast

Provisions for One Year. To maintain the current pari-

mutuel wagering structure in the State, the Executive

Budget extends various expiring Racing, Pari-Mutuel

Wagering, and Breeding Law provisions for an

additional year, as was done in the FY 2024 Enacted

Budget.

Extend Authorized Use of Capital Funds by a

Certain O-Track Betting Corporation for One Year.

To provide nancial exibility, the Executive Budget

extends Capital O-Track Betting Corporation’s ability

to use up to $1 million of its capital acquisition fund for

operational expenses for an additional year, provided

certain conditions are met, as was proposed in the FY

2024 Executive Budget.

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

FEDERAL AID

& RECEIPTS

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

Governor Hochul’s FY 2025 Executive Budget

continues the State’s commitment to responsibly

administering Federal funds and is integral to

managing the complex scal relationship between

the State and the Federal government. The Executive

Budget seeks to ensure Federal funds meant to

support the most vulnerable New Yorkers are

eectively utilized and recent Federal investments in

energy, infrastructure, and advanced manufacturing

are leveraged to meet State goals.

OVERVIEW

Federal funds account for nearly 40 percent of the

New York State budget in FY 2024 and are expected

to fall to about 38 percent in FY 2025. This decrease

in the share of Federal funds expended illustrates the

expiration of one-time Federal COVID relief funds.

The Department of Health is the largest recipient of

Federal funds, primarily due to Medicaid. In addition

to health care, Federal resources are utilized to fund

transportation, education, public protection, human

services, and a number of other services.

FEDERAL FUNDING

Federal funds are predominantly targeted at

programs that support the most vulnerable New

Yorkers and those living at or near the poverty

level, such as Medicaid, Temporary Assistance for

Needy Families (TANF), Elementary and Secondary

Education Act (ESEA) Title I grants, and Individuals

with Disabilities Education Act (IDEA) grants. Other

Federal resources are directed at infrastructure and

public protection.

The Federal resources expected to be utilized in FY

2025 include:

• Medicaid ($52 billion). Federal Medicaid dollars

help support health care for more than 9 million

New Yorkers, including more than 2 million

children. Medicaid is the single largest category

of Federal funding, representing 59 percent of

Federal resources anticipated in the FY 2025

Executive Budget.

• Other Health and Human Services Programs

($20.7 billion). Support from the Federal

government provides for a variety of other health

programs administered by the Department of

Health (DOH), as well as programs administered

41

FEDERAL AID & RECEIPTS

by the Oce of Temporary and Disability

Assistance (OTDA), the Oce of Children and

Family Services (OCFS), Homes and Community

Renewal (HCR), and the Department of Labor

(DOL), among others.

° Specic programs include the Essential

Health Plan, TANF-funded public assistance

benets, Flexible Fund for Family Services,

Home Energy Assistance Program (HEAP)

benets, Supplemental Nutrition Assistance

Program (SNAP) administrative costs, Child

Support Enforcement, Foster Care, and the

Unemployment Insurance Program.

• Education ($8.6 billion). K-12 education, special

education, and higher education receive Federal

support. Similar to Medicaid and other human

service programs, much of Federal education

funding received is directed toward vulnerable

New Yorkers, such as students in high poverty

schools, those with disabilities, and college

students with exceptional need.

• Transportation ($2.8 billion). Federal resources

support infrastructure investments in highway and

transit systems throughout the state, including

funding participation in ongoing transportation

capital plans.

• Public Protection ($2.8 billion). Federal funding

supports various programs and operations of

the State Police, the Department of Corrections

and Community Supervision, the Oce of Victim

Services, the Division of Homeland Security and

Emergency Services, and the Division of Military

and Naval Aairs. Federal funds are also passed

on to municipalities to support a variety of local

and regional public safety programs.

• All Other Funding ($1.2 billion). Several other

programs in the economic development, mental

hygiene, parks and environmental conservation,

and general government program areas are also

supported by Federal resources.

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

CORONAVIRUS STATE AND LOCAL

FISCAL RECOVERY FUNDS

In 2021, New York State and its localities were

allocated $23.5 billion through the State and Local

Fiscal Recovery Funds (SLFRF) implemented by the

U.S. Department of Treasury (U.S. Treasury) under the

American Rescue Plan Act (ARP). Of the total funding,

New York State received $12.7 billion in aid, and

nearly $800 million in additional aid to distribute to

localities in the State that did not receive aid directly

from the U.S. Treasury.

To date, the State has utilized $6.85 billion of its

award and completed the distribution of the nearly

$800 million to qualifying localities across FYs 2021

and 2022. The State is scheduled to expend the

remainder of its $12.7 billion award by FY 2025 in

accordance with the table below.

This Federal funding plays a critical role in maintaining

the State’s scal position as New York continues to

recover from the COVID-19 pandemic.

The funds have been used to provide essential

government services and support the individuals,

businesses, and communities that suered during the

COVID-19 pandemic. Pandemic-recovery programs

that utilized SLFRF in FY23 include Restaurant

Resiliency ($750 thousand), Small Business Recovery

Grants ($221 million), Pandemic Rental Assistance

Grants ($149 million) and the Substantially Dedicated

Public Health and Safety Workforce ($1.375 billion).

Additionally, $604 million was used to continue the

provision of critical government services. Through

these eorts, SLFRF assisted 9,944 small and

micro businesses, 14,671 low-income or minority

households, 22,390 full-time public health and safety

workers, and helped to distribute 1 million meals to

those in need across the State.

In FY 2024, New York State will utilize $2.25 billion

to continue critical government services central to

supporting the State’s recovery from the COVID-19

pandemic.

In addition to the SLFRF, New York continues

to centrally manage FEMA reimbursement for

COVID-19 related expenses for State agencies,

departments, and public authorities and maintains

strong internal controls and processes to mitigate the

risk of inappropriately claimed expenses and audit

disallowances.

RECENT FEDERAL ACTIONS

Infrastructure Investment and Jobs Act

The Infrastructure Investment and Jobs Act (IIJA), also

known as the Bipartisan Infrastructure Law (BIL) was

signed into law on November 15, 2021. Nationwide,

the BIL/IIJA provides $550 billion in Federal funding

for infrastructure projects and is expected to fund

an estimated two million jobs per year. Across the

United States, BIL/IIJA is providing increased funding

for infrastructure in cities and villages. New York

State’s local governments will use this funding to

support overdue infrastructure projects – including

transportation networks, water systems and

broadband capabilities.

New York expects to receive more than $13.5 billion

for Federal-aid highway apportioned programs and

bridge replacement and repairs, $9.8 billion over ve

years for improvements to public transportation, $175

million to build a network of electric vehicle charging

stations (EV chargers), and $2.6 billion to improve

water infrastructure to ensure clean, safe drinking

water is available in all communities, among other

fundamental infrastructure projects.

43

FEDERAL AID & RECEIPTS

Ination Reduction Act

The Ination Reduction Act (IRA) was signed into law

on August 16, 2022, providing funding to address

the climate crisis, lower utility costs, and develop

solutions to help New York and other states achieve

lower emissions. IRA funding is expected to be

used for domestic manufacturing of clean energy

technologies, providing more aordable and cleaner

energy. IRA funding is helping New York State tackle

climate change for future generations through lower

energy costs for households and businesses across

New York communities.

To lower energy costs, the IRA includes rebates on

installing new appliances and making household

improvements, tax credits for installing solar panels,

and solar grants to help state and local governments

adopt the latest building energy codes.

CHIPS and Science Act

The Creating Helpful Incentives to Produce

Semiconductors (CHIPS) and Science Act was signed

into law on August 9, 2022, providing over $50 billion

in Federal investment, as well as additional tax credits

for semiconductor manufacturing, research, and

development.

The Executive Budget continues the State’s

successful investments in the semiconductor industry

across Upstate New York and leverages CHIPS

and Science Act investments to further develop

the industry. For example, $40 million was recently

awarded by the U.S. Department of Defense to

an Albany Nanotech led consortium to create the

Northeast Regional Defense Technology Hub through

the Microelectronics Commons program.

NEW YORK’S BALANCE OF

PAYMENTS WITH THE FEDERAL

GOVERNMENT

Each year, the Rockefeller Institute of Government

(RIG) completes a Balance of Payments report that

measures the dierence in total value between each

state’s contributions to and expenditures from the

Federal budget. Initial estimates from RIG indicate that

New York State had a negative balance of payments

in Federal Fiscal Year (FFY) 2022, contrasting the

prior two-years’ net-positive balance of payments. The

COVID-19 pandemic and resulting Federal spending

was the key driver of the State’s positive balance of

payments in prior years. However, Federal spending

in response to the COVID-19 pandemic dropped in

FFY 2022 and the State appears likely to resume its

pre-COVID role as a perennial net-donor state.

Federal Funds Management

New York State maintains robust controls on

spending, and these extend to the receipt and

expenditure of Federal funds. End-to-end Federal

funds management allows the State to monitor the

Federal landscape, advocate for necessary aid, and

centrally manage risk.

New York State regularly monitors key Federal

activities to identify and mitigate risks to the State and

its Financial Plan. Federal action in a wide array of

policy areas can have signicant implications for the

State, its economy, and the Financial Plan. Notable

near-term risks to the Financial Plan include:

• Final FFY 2024 appropriations and the return

of discretionary spending limits. Despite being

more than three months into FFY 2024, Congress

has yet to nalize appropriations for the Fiscal

Year. Cuts to signicant programs on which

the State relies could force the State to make

corresponding cuts to such programs.

• Expiration of the temporary suspension of the

Federal debt limit on January 1, 2025. The

Federal debt limit and the potential for a Federal

Government default are a recurring risk to the

Financial Plan due to the potential implications

for the national economy and the municipal bond

market.

• Expiration of short-term extensions to the Farm

bill and FAA authorizations. The Executive

Budget continues the State’s investments in

airport infrastructure, agriculture, and food

security. Long term reauthorizations without cuts

to programs will provide certainty for the State to

continue its investments going forward.

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

• Impending cuts to the Medicaid

Disproportionate Share Hospital (DSH) program.

Cuts to Medicaid DSH would have a signicant

impact on New York’s safety net hospitals. These

cuts are already in law and require legislative

action to be repealed or delayed.

• Asylum seeker and migration response. New

York is actively working to address the current

humanitarian crisis by providing temporary

housing and expanding access to employment

authorization for eligible migrants and asylum

seekers. The State will continue to partner with

the Federal government to secure the resources

necessary to appropriately respond to the

situation.

45

FEDERAL AID & RECEIPTS

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

ECONOMIC

DEVELOPMENT

FY 2025 EXECUTIVE BUDGET BRIEFING BOOK

The FY 2025 Executive Budget will continue to invest

in New York’s economic recovery, the promotion of

job creation, job retention, workforce development,

and the revitalization of every region of the State.

The Executive Budget proposes investing in key

capital projects, emerging and high-impact industries,

and regionally-balanced economic development

strategies.

Governor Hochul’s economic development vision

will focus on industries where innovation is the key

to success leading to the advancement of regional

economic priorities through strategic investments in

communities across the State.

OFFICES AND RESPONSIBILITIES

Together, the Empire State Development

Corporation (ESDC) and the Department of

Economic Development (DED) nance key economic

development projects and provide policy direction to

strengthen New York businesses and industries, and

overall economic growth throughout the state. This

also includes the newly-created Oce of Workforce

Development which leads Governor Hochul’s

comprehensive eort to strengthen the skills and

talents of New York’s workforce. Other State agencies

and public authorities also oversee programs and

investments that support economic development

throughout the State.

CREATING JOBS AND GROWING THE

ECONOMY

A key component of the State’s strategy for

investment and economic development has been the

Regional Economic Development Council initiative,

which is rooted in a bottom-up approach that partners

with local leaders to utilize regional strengths to

support community revitalization and business

growth.

The State also utilizes performance-based programs,

such as the Excelsior Jobs program, to attract

businesses to New York State that require them

to achieve specic employment and investment

goals before they benet from tax credits and other

incentives.