Chaddick Institute for Metropolitan Development at DePaul University | Policy Series

THE REMAKING OF THE MOTOR COACH:

2015 Year in Review of Intercity Bus Service in the United States

2015

year-in-review

© Chaddick Institute for Metropolitan Development, DePaul University: January 13, 2016

For additional research on bus travel, visit our website at:

http://las.depaul.edu/centers-and-institutes/chaddick-institute-for-metropolitan-development/

AUTHORS

Joseph P. Schwieterman, Professor, School of Public Service + Director, Chaddick Institute

Brian Antolin, Research Associate, Chaddick Institute

Alexander Levin, Research Associate, Chaddick Institute

Matthew Michel, Research Associate, Chaddick Institute

Heather Spray, Research Associate, Chaddick Institute

CONTACTS

Joe Schwieterman

jschwiet@depaul.edu; 312/362-5732 ofce

Marisa Schulz

mschulz2@depaul.edu; 312/362-5731 ofce

Megabus cover photo by Adam E. Moreira

EXECUTIVE

SUMMARY

-

nological advancement to the intercity bus industry in the United

States. More carriers are introducing new business-class ame-

-

-

1

2

3

4

exemplied by Greyhound’s new OnTouch© system, megabus.com’s re-

served seang program, and BoltBus’ integraon of Uber ridesharing into its mo-

bile app.

35% more than in 2008. The number of seat-miles of service grew at a some-

what faster rate. These esmates are made through analysis of 155 scheduled

carriers to ll a void in the understanding of the sector. Growth has recently slowed

due to low gasoline prices that make driving more aordable.

accentuang com-

peon for major lines, parcularly in the Sunbelt region.

-

These carriers now account for more than

600 daily schedules, heightening compeon for major corporate carriers.

5

much like

Uber and Ly do for urban ridesharing services.

2

INTRODUCTION

notable changes in the intercity bus sector during 2015 and is divided into

The rst part of the report reviews notable product enhancements

and public partnerships.

The second secon focuses on new service oerings in various region

of the United States.

The nal secon highlights the Chaddick Instute’s previously unpub-

lished esmates about the growth of major carriers since 2008

PART I

PART 3

PART 2

3

PRODUCT

ENHANCEMENTS

& PUBLIC

PARTNERSHIPS

-

-

• -

, which has pushed bus service to regions in which prod-

uct awareness is relavely low. To appreciate this growth, please refer

to the map on page 19 showing the most notable intercity hubs created

since 2006. Evidence suggests that it oen takes 3- 5 years for new ser-

vice to achieve nancial self-suciency.

1

•

vehicles. Average gasoline prices across the U.S. fell from $3.68 in July

2014 to less than $2.79 this past July and then to about $2.05 in Decem-

ber. When standard assumpons about fuel eciency are made, these

falling prices have reduced the average cost dierence of operang a

single occupant vehicle on a 250 mile roundtrip by about $25 compared

to a motor coach.

2

•

encouraging carriers to focus on broadening their appeal

among demographic groups that have been reluctant to give bus travel

a try along exisng routes.

New Simplied Fare Structure

on Greyhound.com

4

As summarized below, the most notable steps taken by the country’s largest carriers to enhance service quality have

important implicaons for the passenger experience:

America’s largest schedule bus line, Greyhound Lines, is owned by U.K.-based First Group, Ltd. This historic carrier aract-

ed much favorable publicity in 2014 for reaching its 100th anniversary as a transportaon company.

3

Greyhound reported

North American revenues, inclusive of its BoltBus subsidiary, largely unchanged from 2014 to 2015, slipping from $990.6

million to $986.0. The carrier’s prot margin remained steady at 7%.

The carrier invested heavily in on-board and web-based enhancements, and added routes in Lano-oriented markets

during the year. It also began adversing s, rather than just on Greyhound

Express schedules.

Schedule frequencies mostly held steady, but this carrier took the signicant step of creang Greyhound Mexico, the rst

U.S.-based bus company to operate to Mexico. Greyhound Mexico now oers direct service from Ausn, Dallas, Houston,

San Antonio, and other Texas cies to Nuevo Laredo and Monterrey, MX, with new terminals opened in both Mexican

cies. These streamlined roungs eliminate the need to transfer in Laredo, giving customers a beer travel experience

and advancing the company’s goal of gaining a stronger presence in Mexico’s enormous intercity bus market.

4

Meanwhile,

Greyhound connues to serve Canada, thereby giving the company a presence in North America’s three largest countries.

In an eort create a more pleasant and producve onboard experience for customers, Greyhound launched ,

an onboard online catalog of “desnaon packages” that passengers can access through their Wi-Fi enabled electronic

device, in January of 2015. OnTouch© gives customers the ability to purchase ckets to events and gain informaon on

ground transportaon, popular aracons, and shared rides. This convenience, developed by GuestLogix, is also available

on BoltBus.

5

Greyhound: New Website & Routes to Mexico

• are the lowest price ckets available,

with limited services aached such as one Road Rewards

(Greyhound’s frequent rider program) point given per cket

purchased.

• generally cost a few

dollars more and include priority boarding, free same

day exchange and two Road Rewards points.

• are fully refundable and exchangeable, and

allow addional checked bags. While Flexible and certain

other fares are sll available, they are no longer displayed as

the primary opons

In November, Greyhound completely

com to improve its online communicaon with customers.

Reminiscent of eorts by other carriers to refresh their im-

age, the new website features FAQs; inerary details, such

as rest stops and services; and new ways for users to lter

search results based on the consumer’s preferences. Along

with the new website,

were also introduced. Now, two primary fare types,

Economy and Economy Extra, appear on the screen from cus-

tomer searches, with Flexible fares and others provided as

addional opons.

6

Taking a cue from airlines, the new fare

structure provides addional perks for those buying higher

fares.

Seats available in Megabus reserved seat program on

Chicago – Omaha bus. Prices for highlighted seats are $1 -$7

5

Greyhound’s introducon of , a new real-me GPS tracking system, on Apple and Android devices in June,

provided bus-status updates every one to four minutes. Using several onboard data systems, BusTracker allows passen-

gers to stay abreast of their bus’s locaon and ancipate their arrival me with considerable precision.

7

Only a handful of

operators, most notably Jeerson Lines, Megabus, Peter Pan, and RedCoach, have their own publicly-accessible tracking

programs. Except for RedCoach, however, no other company shows the approximate locaon of the coach in real me,

making Greyhound a trendseer. Although the system provides data on most scheduled trips, addional secons added

to meet demand cannot be tracked this way. BoltBus also launched its own standalone BusTracker.

8

In December, Greyhound , ending its joint eort with the Peter Pan Bus Company

to gain tracon in the Northeast’s Chinatown bus market. Previously, Yo!’s New York–Boston and Philadelphia service had

been cut back and its New York–Washington DC service curtailed. A local partner in New York had facilitated cket sales

and customer relaons, giving this line the aura of a tradional Chinatown carrier.

9

megabus.com: Reserved Seating and Google Maps

No longer a newcomer to the American scene, Megabus

reached its 10th U.S. anniversary in April. Taking a break

from aggressive route expansion, Megabus consolidated its

gains by focusing on its exisng service. This subsidiary of

Stagecoach Ltd. reported North American revenues for s-

cal year 2015 (ending March 31) of $191.4 million, up from

$177.9 million in 2014, a 7.6% increase. Due to the sharp

decline in fuel costs, some analysts expect revenues to hold

relavely steady this scal year.

Megabus connues to invest heavily in features that will

aract new market segments, with its most notable move

being the introducon of its Reserved Seang program, al-

lowing passengers on all company-operated routes to select

parcular seats when purchasing their ckets. Megabus es-

tablished itself as the naonal leader in this area in February

by introducing reserved seang fees of less than $5/cket

for most seat selecons. The choice of reserved seats was

inially conned mostly to the front row of the top level on

the double decker buses and selected lower-level seats with

tables. In July, however, Megabus doubled the number of

seats available for pre-selecon to 20 (see seang chart at

le).

The signicance of this move can be appreciated consider-

ing that, as recently as a decade ago, almost all U.S. bus pas-

sengers were denied even an opon of having a guaranteed

seat on the departure of their choice, much less having a

parcular seat reserved for them. This uncertainty com-

pelled many to arrive at the staon at least an hour ahead

to stand in line and assure they obtained a seat. Having a

reserved seat, of course, allows passengers to arrive at the

last moment with assurance that a prime seat awaits. (Re-

served seang is not available on several routes operated

by contract, such as those by Concord Coach.)

10

Along with the enre Coach USA family of companies, Mega-

bus implemented a new hi-tech eco-driving system that will

help decrease carbon emissions, improve fuel consumpon

rates, and reduce accidents. allows

management to provide real me feedback to bus opera-

tors about their driving style, which can help address issues

with speed, braking, acceleraon, lane-handling, and turn-

ing.

11

The goal of the system is a 3% reducon in fuel con-

sumpon.

Finally, Megabus forged an important partnership with Goo-

. Now, scheduling data appears with map search-

es. In addion to showing bus schedules, travel mes, and

stop locaon data, Google Maps allows customers to com-

pare Megabus service with other modes of transport and

see street views of all stop locaons.

12

New Boltbus app for Uber rides

6

Partnerships with Google Transit, Parking Panda, and Uber

Bus lines forged partnerships with several leading innovators in travel service

during the year. Jeerson Lines is believed to be the rst intercity bus company

to partner with Google Transit to feature schedules and route informaon on this

plaorm, giving customers a new set of tools so that they will no longer have to use

mulple websites and resources to plan their trip.

13

An online and app-based program called , which allows motorists to

nd and reserve parking spots, joined forces with both Greyhound and Megabus.

Users can lock in parking within walking distance of 20 Megabus stop locaons and

50 Greyhound terminals.

14

Uber is part of the mix at BoltBus, which has a new mobile app feature allowing

passengers to easily summon rides upon arrival.

15

The carrier’s app, launched in

2014, was also upgraded to allow passengers to have their

, bypassing the oen tedious and me consuming task

of searching and verifying cket conrmaon codes and passenger names.

Wanderu and Busbud: Leaders in Bus Travel Bookings

A signicant development in intercity bus travel was the

heightened momentum behind the two leading ckeng

aggregator websites for bus ckeng. Enhancements made

to wander.com and busbud.com in 2015 provide height-

ened credibility to the sector that has oen been regarded

“low tech” and gives customers the ability conduct search

for alternaves with reasonable assurance that the carriers

they choose are reputable and safe.

Data shared with us by Wanderu suggests that consumers

are responding in signicant numbers to these enhance-

ments. This Boston-based ckeng aggregator more than

tripled its sales in 2015 from the previous year and now

hosts more than 50 carriers, including all of the largest ma-

jor U.S. brands and Amtrak, giving it truly naonwide cov-

erage. Research by the company suggests that, for most

carriers, more than 20% of the bookings on its site are incre-

mental in nature due its unique features, such as its nearby

staon locator, roung informaon, and mobile apps, which

make searching and buying easier. Incremental bookings are

those that carriers could not get on their own or via another

search tool.

Another major theme for the year was serving mobile users.

Wanderu launched an app that the company is toung as

one of the best in the travel industry, having received an

Apple Best New App award and other recognions. Wande-

ru has also expanded the number of lters that customers

can use to search for amenies, the lowest fare, and other

features.

The other major booking site, Busbud.com, connued to

focus on serving internaonal tourists, as well as passenger

markets not apt to take buses without trustworthy informa-

on. Busbud approximately doubled its worldwide cover-

age during the year. Aer adding Greyhound to its system

in late 2014, GoBuses, Peter Pan, and several other regional

operators came onboard in 2015. The company’s seat se-

lecon feature, now used on internaonal routes, may soon

be available on certain U.S. schedules.

Recognizing that roughly half of its web trac is now mo-

bile devices, Busbud launched Android and iOS booking

apps that simplify the search and booking process. These

apps are intended to make buying a bus cket analogous

to booking an Uber ride, although on some carriers, such

as Greyhound, you must sll print your cket. Busbud also

launched the industry’s rst android and apple watch apps.

7

Long a hotbed of intercity bus compeon,

boasts one of the country’s most well-developed intercity

bus networks. Several compeve developments in this region stand out:

1) The terminal at Boston South Staon has become one of the country’s preeminent connecng intercity bus hubs with

the addion of numerous regional services to and from Boston in the past three years, including those supported by the

Commonwealth of Massachuses’ expansive BusPlus program. All the recent service addions are providing formidable

compeon to Amtrak.

2) A resurgence of Chinatown bus service in the Boston–New York market is lling a void le by the 2013 shutdown of

Fung Wah Bus Lines and the gradual withdrawal of Greyhound-owed Yo! Bus. This expansion is being aided by the growing

sophiscaon of online booking systems, such as gotobus.com and ilikebus.com, which cater to these carriers.

3) Bus passengers are beneng from a growing number of choices from many regional cies to New York. Passengers

traveling from the Boston area to Manhaan, for example, can now choose from six dierent carriers—BoltBus, Coach

Run, Go! Buses, Greyhound, Megabus, and Peter Pan—that have at least a half-dozen daily trips in each direcon. Average

fares on the route remain in the $20 - $30 range.

Jefferson City

Columbus

Duluth

New routes/service additions

Greyhound Lines

New business-class service

Megabus.com service enhancement

Regional carrier services addition

State supported service/Go Bus (Ohio)

Amtrak Thruway route

New stop, Megabus/Greyhound

Chicago

Ft. Wayne

Davenport

Minneapolis

Lima

Wooster

Albany

Scranton

Pittsburgh

Fairfax

Providence

Portland

Toronto

Philadelphia

New York

Springfield

Cleveland

Harrisburg

Dearborn

Cincinnati

Boston

Parkersburg

Kirksville

Ithaca

St. Louis

Fall River

Bed

Athens

Martz

Wash. Deluxe

GoBuses

Akron

Peter Pan

Note A:New Big Red Bullet and Coach USA (Ithaca Platinum) service

Charleston

Morgantown

Pentagon

Rolla

Columbia

Wells

Dover

Sprinter

Rochelle

To Iron Range

Greyhound

NOTABLE SERVICE

CHANGES

BY REGION

NEW

ENGLAND

MIDWEST

MID-ATLANTIC

+ UPSTATE

NEW YORK

S. CENTRAL

+ SOUTHEAST

WESTERN

U.S.

Concord Coach Plus photo showing

execuve-style seang conguraon

8

Several iniaves by individual carriers are also noteworthy:

Concord Coach, a regional carrier primarily serving communies north and east of Boston, launched Portland, ME–New

York City service in November under the new Concord Coach Plus brand. This

express service—the carrier’s rst foray outside of New England—features exec-

uve-level amenies, with just 29 seats for purchase on each coach. Large plush

leather chairs with generous legroom, free snacks, Wi-Fi, and outlets target high-

end clientele to this new once-a-day round trip service.

16

Another highlight is the

New York City–Providence, RI service launched by GoBuses in November, estab-

lishing it as a major regional competor. This carrier, owned by Academy Bus,

had previously been conned to Greater Boston (Alewife & Newton)–New York

routes. Its stop in downtown Providence is near the Amtrak staon and Brown

University. GoBus operates three or four daily round trip express schedules.

17

Peter Pan was awarded a contract to operate a starng in November. Al-

though Peter Pan already provides “pool service” over the route coordinated with Greyhound, this new service focuses

on smaller Massachuses communies along Route 2, such as Deereld and Northampton. Operang twice daily in each

direcon, the service is supported by the MassDOT BusPlus program.

18

to expand its connecvity. Aer an absence of about 10 years it returned to Wells,

serving the city once daily in each direcon on its Boston–Bangor route.

19

Through its Greyhound Connect brand, the com-

pany announced in June that it was partnering with ShuleBus Zoom to provide daily connecons to and from Saco, Old

Orchard Beach, and other points in Maine. Passengers can transfer to Greyhound in Portland and Biddeford.

20

Although less acve in the region than in previous years, in March to its New York–

Providence/New Bedford route, which has three round trips daily.

21

New Hampshire-based

on its New York City–Portsmouth schedules, a route noted for its rst-class style service featuring refreshments and

spacious seang. C&J also added a third round trip (and a second on Saturdays) on this route, which serves Tewksbury,

MA. Although the Ogunquit stop is only seasonal, C&J’s other new service is year-round.

22

This year brought on the Plymouth Brockton Street Railway Company.

These trips, which had been operated twice each weekday under a BusPlus program grant, were terminated in Octo-

ber.

23

NEW

ENGLAND

MIDWEST

MID-ATLANTIC

+ UPSTATE

NEW YORK

S. CENTRAL

+ SOUTHEAST

WESTERN

U.S.

Some of most extensive changes taking place in 2015 were in the

. More express service was introduced here than in any other part of the country, as well as:

1) New premium services linking New York to Ithaca, NY and Washington, DC, became available, reecng a connuing

push by the region’s carriers to dierenate their service. This push also prompted two carriers to add new drop-o points

in northern Virginia on express routes from Midtown Manhaan.

2) The disrupon of Amtrak service following the derailment of Amtrak train #188 near Philadelphia in May encouraged

many travelers who had previously avoided motor coach travel to give it a try. Most major carriers honored Amtrak ckets

or accepted cket exchanges to help stranded passengers.

3) Due to service addions by convenonal lines and a comeback by Chinatown carriers, consumers can now choose from

eight carriers with ve or more daily departures between New York–Washington, DC.

Ithaca Plaum adversement promong its benets over

“The Bullet”conguraon

9

Some of the most notable iniaves by carriers include:

In upstate New York, -

in September. With two sched-

uled trips in each direcon Sunday through Friday, Red

Bullet touted itself as an aordable luxury alternave to

Cornell University’s exisng Campus 2 Campus shule. Pas-

sengers board at a Midtown Manhaan stop across from

Bryant Park on 6th Avenue.

24

Red Bullet also has a stop in

downtown Ithaca. Defending its turf, Coach USA Shortline

launched Ithaca Planum Service with fast express sched-

ules in December, giving passengers the ability to show

e-ckets on a mobile device in addion to providing Wi-Fi

and power outlets. Going a step further, Ithaca Planum

also features free snacks and drinks and a reduced fare ($50

one way vs. the $53.50 normal price). Unlike Big Red Bul-

let, whose only stop is in the city of Ithaca, the Coach USA

service oers on-campus pick up at Ithaca College and Cor-

nell University. The express service, which saves customers

approximately 30 - 45 minutes compared to the company’s

regular buses, runs Thursday–Sunday, with one or two trips

in each direcon.

25

Service on the New York–Washington, DC area also saw im-

provement.

service in June on one of its morning schedules from New

York. As of yet, there is not a regularly scheduled return

stop. Washington Deluxe is believed to have been the rst

non-Chinatown intercity carrier in the Northeast Corridor in

operaon today to use “curbside” drop-o and pickup.

A luxury operator that launched in 2014 as Royal Sprinter,

renamed -

. The new stop is located at a Hilton Hotel in Tysons

Corner, giving it a foothold in the corporate hub midway

between the Dulles Internaonal Airport and the naon’s

capital. Royal had previously served only the New York–

downtown Washington route. For $110, passengers can

travel in vehicles hosng an inmate eight passenger con-

guraon with plush seang, Wi-Fi, outlets, DirecTV, and

snacks. One schedule is oered in both direcons Monday

through Thursday, with an addional round trip on Fridays

and Sundays.

26

Martz Trailways entered into an agreement with Amtrak

to make its exisng Philadelphia–Scranton–Wilkes Barre–

White Haven, PA service an , allow-

ing the passenger railroad to sell ckets to several new des-

naons. As part of the iniave, started in April, Martz

added a stop at Amtrak’s 30th Street Staon in Philadelphia.

Martz operates two daily round trips on this route, with a

third on Fridays and Sundays.

27

In response to growing demand for service between Phil-

adelphia and Pisburgh, Megabus restructured its in-

tra-Pennsylvania operaon. On Fridays and Sundays, the

corridor is now split into two disnct services, with one op-

erang express via Harrisburg (two schedules)—saving trav-

elers up to 90 minutes. The other operates to State College

via the state capital (one schedule).

28

added a stop at Dover, DE to all of its New

York–Norfolk/Virginia Beach schedules in January. This

stop, located at the Dover Downs Casino, came in response

to requests from passengers in the Old Dominion State for

service to Delaware casinos.

29

Greyhound, meanwhile, add-

ed a Morgantown, WV stop on the West Virginia University

campus to its Washington DC-Pisburgh, PA route.

Chinatown carrier service also expanded, with parcular-

ly heavy frequency on major routes from New York. We

esmate that about 400 scheduled Chinatown buses now

arrive in and depart from Manhaan daily on routes of 80

miles or more, not including smaller operators that do not

use online booking systems—a considerable increase from

several years ago. The largest carriers include Eastern Trav-

el (an esmated 30 daily arrivals/departures), Focus (34),

and HG Bus (18). On the New York – Atlanta route and oth-

er corridors to the South, Rockledge Coach is a dominant

carrier (34).

Our research on the recovery of Chinatown service remains

in an early stage. Nevertheless, evidence suggests that

carriers have found ways to more eecvely comply with

federal safety rules following the crackdowns by the Fed-

eral Motor Carrier Safety Administraon in 2012 and 2013.

This federal iniave included an “Operaon Quick Strike”

squad that helped idenfy unsafe Chinatown bus drivers

and resulted in shutdowns of several prominent lines, in-

cluding Apex, Fung Wah, and Lucky Star. Our impression

is that Chinatown carriers have adjusted business pracces

and have diversied into longer-distance routes, including

overnight runs from New York to the Midwest and South,

parally due to heavy compeon in the Northeast Corri-

dor. Lucky Star, having reemerged, is once again one of the

largest Chinatown lines.

10

NEW

ENGLAND

MIDWEST

MID-ATLANTIC

+ UPSTATE

NEW YORK

S. CENTRAL

+ SOUTHEAST

WESTERN

U.S.

Service on major corridors throughout changed lile during the year, but much acvity occurred in

smaller markets:

1) The network feeder routes supported by state governments connues to blossom in Illinois, Indiana, Missouri, and

Ohio. All but Missouri’s new services are linked to Greyhound’s Chicago hub.

2) The Midwest connues to be dominated by Greyhound and its aliates, as well as Megabus, with comparavely less

compeon on short-distance corridors from ethnically-oriented lines than in other regions. Unlike the other regions fea-

tured in this report, luxury or business-class services have not yet emerged, perhaps to the hesitaon of business travelers

to take the bus.

3) Lano-oriented carriers, such as El Expreso, Tornado, and Turimex, have extensive operaons linking Chicago to the

South, but are not a major force on busy regional routes served by Greyhound Express and Megabus.

Among the most notable moves by carriers include:

Greyhound partnered with Amtrak to create an in August. The ser-

vice aords train travelers greater access to desnaons in Ontario, including London and Windsor. Trains connect with

this service at Chicago Union Staon and the new John D. Dingell Transit Center in Dearborn, Michigan. Two to three buses

operate each way daily.

30

In Minnesota, in October, increasing its service to thrice daily in

each direcon, with selected buses serving the Mall of America and the Minneapolis-St. Paul Internaonal Airport. The

expansion allows for beer-med connecons from the northern part of the state to places west and south of Minneap-

olis. Other enhancements include a later outbound departure on the Duluth–Iron Range route and a new stop providing

beer connecvity with Duluth’s public transit system.

31

Operated with federal funds through the State of Ohio, , including a new

daily Cleveland–Athens service under contract by Barons Bus Lines, which runs via Akron, Parkersburg, WV, and Mariea.

Barons also operates a new daily Cleveland - Charleston, WV bus to serve smaller communies on its Chicago–Columbus–

Cleveland route operang via Kenton and Lima, OH (this route is not branded a Go Bus route but under contract as well).

Barons’ established Athens–Cincinna and Columbus routes also saw added service.

32

Another new route, under contract

with Lakefront Lines, runs twice daily from Columbus and Wooster with several stops, including Newark and Mt. Vernon.

With assistance from Lee County and the State of Illinois, a Greyhound

. This

twice daily service calls on smaller communies on the I-88 corridor,

including DeKalb, Moline, Naperville, and Rochelle, and connects to

the naonal network at both ends.

33

Megabus also added Davenport to its route map, generang addional

patronage for its Chicago–Omaha service, with two daily departures operang in each direcon. Due to declining rider-

ship, however, , marking the only me in the past ve

years it has withdrawn enrely from a top-50 U.S. market. Previously, the carrier had aempted to adjust its Chicago–Kan-

sas City service to boost ridership.

35

In this same region, however, Greyhound started two new services from St. Louis, MO

through a partnership with the State of Missouri. The northern route serves Columbia, Moberly, and Kirksville, while the

southern route serves Columbia, Jeerson City, and Rolla. The services were created in part due to travel paerns recog-

nized by Greyhound. Each route has one daily round trip.

36

Promoon for the Go Bus network supported by

the State of Ohio

11

Major convenonal and city-to-city express carriers held steady in aer

the aggressive expansion of the recent past:

1) As described in the previous secon, Texas is the focal point of the new Greyhound Mexico brand. More cross-border

routes by Greyhound and facility enhancements may be just around the corner (Figure 2).

2) Both Greyhound and Megabus face heightened compeon from Lano carriers in the Lone Star State with El Expreso,

Tornado Bus, and Turimex Internaonal being parcularly formidable competors.

3) Carriers faced added compeon from both Chinatown lines in Florida, including Emmanuel Coach and Javax. Lano

compeon in the Sunshine State, however, remains relavely weak.

Among the most notable developments in this region are:

Greyhound launched new service under its “Quicklink” brand on New Orleans–Baton Rouge, LA service in July. Quicklink

is provided in partnership with the State of Louisiana and features addional express schedules and local service via Gon-

zales and LaPlace. These new schedules ll a void le by the demise of the

LA Swi service.

37

Aer garnering aenon in 2014 for its new luxury service between Dallas

and Ausn, Vonlane began service in April to Houston, where it operates its

16-passenger buses from a parking lot facility located near Houston’s George

H. Bush Interconnental Airport. Two trips each way from Dallas operate

Monday - Friday, while one roundtrip operates on weekends.

38

Turimex has begun selling its ckets on Wanderu.com, allowing customers to compare its service with major U.S. brands.

The carrier connues to be available on Busbud.com.

Luxury-operator Vonlane’s triangular route map

showing expansion to Houston

`vs

Dallas

Gonzales

Houston

New Orleans

Greyhound

Mexico

crossborder

service

Vonlane

existing

new

San Antonio

new terminal

Monterey

new terminal

Laredo

Austin

Nuevo Laredo

Baton Rouge

Greyhound

Quicklink

NEW

ENGLAND

MIDWEST

MID-ATLANTIC

+ UPSTATE

NEW YORK

S. CENTRAL

+ SOUTHEAST

WESTERN

U.S.

12

NEW

ENGLAND

MIDWEST

MID-ATLANTIC

+ UPSTATE

NEW YORK

S. CENTRAL

+ SOUTHEAST

WESTERN

U.S.

Compeon connues to intensify in as large, established carriers bale smaller ones on major

routes, parcularly in Southern California:

1) The paerns of intercity travel in the Mountain States connue to create challenges for bus lines specializing in premium

high-frequency service. Unlike in the Coastal Region and southern Nevada, most major corridors involve distances outside

the 100 - 250 mile range considered ideal for this service (see map on page 19). As a result, public agencies are oering

enhanced funding to support new services.

2) On intra-California and the Los Angeles–Las Vegas routes, compeon is growing ercer, with BoltBus, Megabus, and

Greyhound facing rising compeon from Chinatown lines—such as American Lion and Pacic Coast—as well as the Lano

operator Tufesa.

3) BoltBus and Greyhound remain the key players on major routes in the Pacic Northwest, beneng from the absence

of Megabus and the limited presence of ethnic-based carriers.

The year 2015 saw two notable developments by individual carriers:

in September through the introducon of daily through-trip service be-

yond Portland to Seale. Travelers in these communies now have the benet of four round trips to Oregon’s largest city.

BoltBus also added new service between Portland and Seale, bringing its daily total on many days to eight.

39

Colorado’s newest intra-state carrier,

routes in July, establishing it as one of the most signicant new startups of

the year. Funded by the state’s transportaon department, Bustang began

with weekday service linking Denver to Colorado Springs, Fort Collins, and

Glenwood Springs (via Vail) with intermediate stops. Since its launch, Friday

and Sunday service to Colorado State University and weekend service to Glenwood Springs has been added.

40

Bustang will

be supported by about $10 million in public funds for the rst year and $3 million annually thereaer.

41

The Fort Collins

and Colorado Springs routes are in the 50-70 mile range, making them heavily commuter-oriented.

Bustang joins a growing list of intercity services that recently commenced with public nancing in the West. Other notable

examples are Colorado’s Road Runner Stage Lines, Nevada’s Silver State Trailways, and Utah’s Elevated Transit—all of which

are featured in our 2014 report.

“Low fuel prices have made driving more affordable, encouraging major bus

carriers to shift their orientation from expanding their schedules by rolling out

new value-added conveniences on a relatively large scale.”

Joseph P. Schwieterman

13

-

-

-

The esmates presented are supply-driven, derived by looking at the amount of service provided and then applying

load-factor esmates to various categories of bus lines. Computaons made by evaluang the amount of service are made

separately for the four dierent types of companies: i) convenonal bus lines, ii) city-to-city express lines, iii) Chinatown

bus lines, and iv) Lano (Hispanic) carriers. (See denions in Appendix A). Our esmates do not include charter bus

operaons, casino runs, local transit operaons, and airport–shule operators. Similarly, they exclude public transit and

commuter-bus operaons on most routes less than 50 miles.

Readers should recognize that the gures provided are approximaons that are subject to change as we connue our

research. Please refer to the Appendix for a general summary, or email us at [email protected] to learn more about

our methodology.

This chart shows the esmated number of daily schedules, i.e., unique bus operaons, by the largest intercity bus lines in

the U.S. Bus schedules, like airline ights, are idenable on many carriers by a unique number in a company’s metable.

Greyhound (1,088 daily schedules) is the largest, followed by Megabus (422), Coach USA’s (e.g., Shortline) operaon cen-

tering on New York (420), Peter Pan (261), and BoltBus (208). These gures represent Friday schedules at the end of the

year. They include cross-border services but exclude the esmated number of extra secons operated during periods of

peak demand, which may add upwards of 8% to daily acvity on some lines.

THE CHANGING

SCALE OF THE

INDUSTRY

1088

422

420

208

120

0

200

400

800

1000

1200

Greyhound Megabus Coach USA

Peter Pan BoltBus

FIGURE 3

Largest Carriers by No. of Daily Schedules in U.S.

Not Including Extra sections

Not Including Extra Secons

422

1088

420

208

120

(NJ/NY Short Line)

14

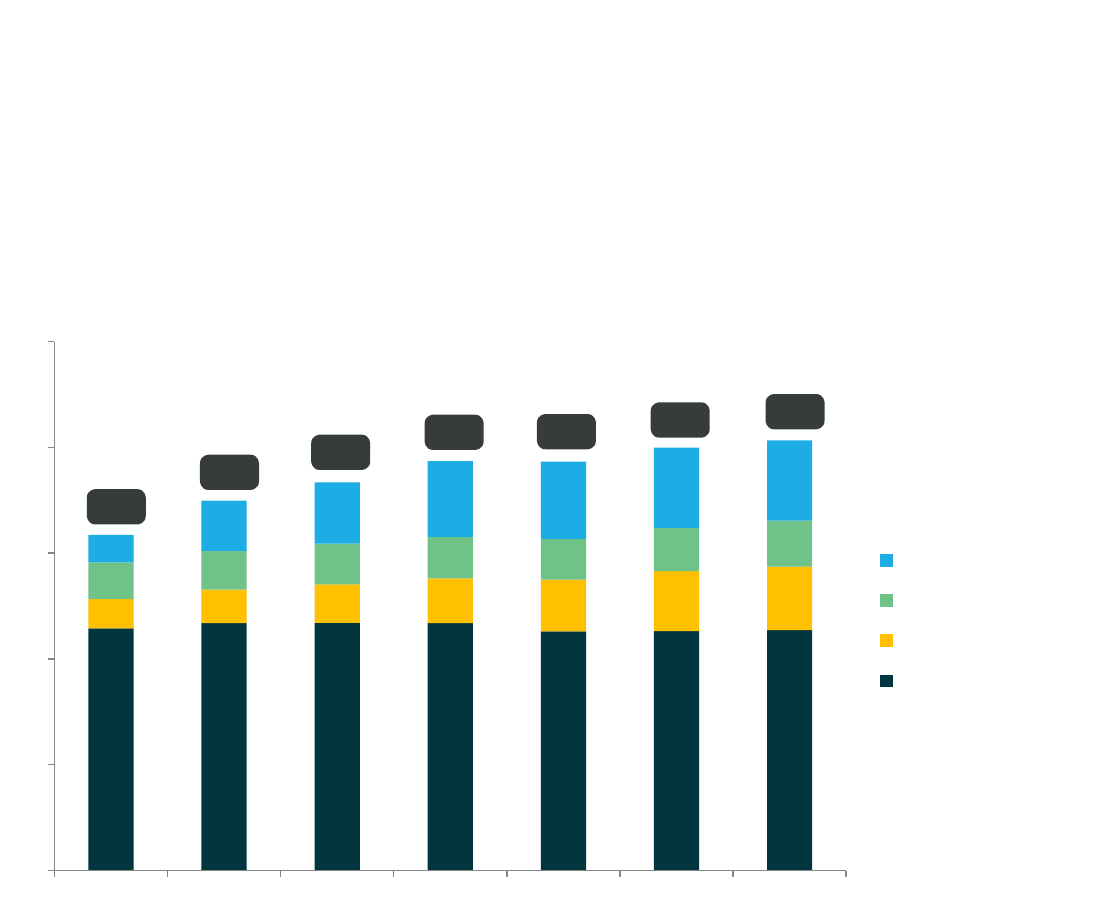

The number of passengers that have traveled on intercity bus lines rose from about 45 million in 2008 to 61.6 million in

2015. This analysis shows that buses handle about twice as many passengers as Amtrak (which carried 30.8 million in FY

2015).

42

Much of the increase in passenger boardings is due to the rising use of city-to-city express lines, such as BoltBus

and Megabus, and a bevy of Chinatown and Lano carriers. (See Appendix for a denion of carrier types). Our analysis

suggests the number of passengers remained relavely at between 2014 and 2015, in part due to the drop in gasoline

prices. Parcular uncertainty exists regarding the numbers for city-to-city express and Lano lines, however, due to the

absence of credible published informaon about their trac. Esmates for Lano carriers are based on the number of

buses in service rather than detailed schedule analysis.

in Millions/Year

38.5

40.0

2.3

2.8

3.4

4.0

5.0

4.2

4.4

4.8

5.0

5.3

2.3

10.8

-

10.0

20.0

30.0

40.0

50.0

60.0

70.0

2008 2010 2011 2012 2013 2014 2015

FIGURE YY

Estimated Passenger Trips on U.S. Intercity Bus Lines

in millions/year.

City-to-City Express

Chinatown

Latino

Conventional

45.2

58.3

38.5 40.0

15

228.5

234.3

234.5

234.2

31.8

42.0

48.3

58.4

38.5

43.8

45.4

48.5

-

50.0

100.0

150.0

200.0

250.0

300.0

350.0

400.0

450.0

2008 2010 2011 2012 2013 2014 2015

FIGURE YY

Bus Miles of Service by Type of Carrier

In Millions

City-to-City Express

Chinatown

Latino

Conventional

This chart shows the esmated growth in bus-miles of service on weekdays provided by U.S. intercity bus lines. The anal-

ysis suggests the sector is approaching 400 million miles for the rst me in at least a decade. The majority of mileage is

accounted for by convenonal lines such as Greyhound, Peter Pan, and various Trailways units, which oer a “baseline” of

service held relavely steady since 2008. Nevertheless, city-to-city express and Lano operators, and most recently, Chi-

natown lines, have all grown sharply. Each of these more specialized sectors now account for between 48 and 60 million

bus miles per year.

In Millions

318.5

228.5

234.3

234.5 234.2

16

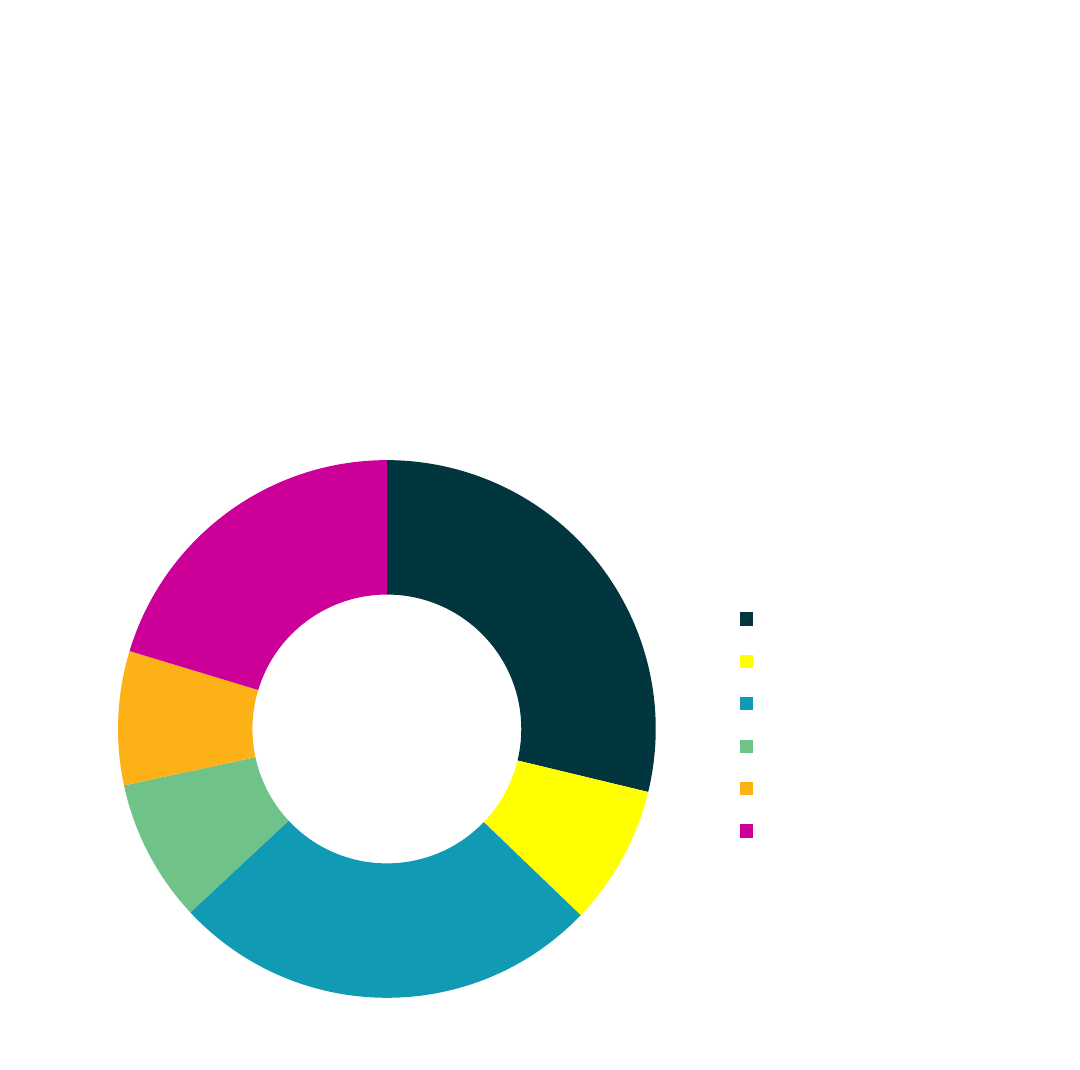

This chart shows the approximate number of riders (unlinked trips) by various ownership groups of U.S. intercity bus lines

in 2015. Greyhound and its subsidiaries (including BoltBus, Yo! , and other units owned by First Group), Greyhound Pool

Partners (Adirondack Trailways, New York Trailways, and Peter Pan, which coordinate service with this legacy carrier in the

Northeast), and Stagecoach Ltd. (owner of various Coach USA units and Megabus.com) together account for well over half

of all U.S. intercity ridership. Megabus has grown parcularly fast since 2008, more than doubling the number of trips on

Stagecoach-owned units since 2008.

In Millions

5.2

5.3

5.0

12.5

FIGURE YY

Estimated Bus Miles of Service

by Ownership Category (in millions)

Greyhound & subsidiaries

Greyhound pool partners

Other Carriers

Chinatown

Latino

Stagecoach/Megabus

17

This chart shows the rising number of seat-miles of service by type of carrier since 2008. City-to-city express lines show

parcularly dramac gains, in part due to Megabus’ rapid expansion and nearly universal adopon of double deck coaches,

which have 81 seats, giving the average bus much higher capacity than single deckers, which typically have 45 – 50 seats.

The share of seat miles accounted for by Lano carriers is larger than its share of passengers, as shown on Figure 8, due to

the tendency for their schedules to operate much longer distances than the average intercity bus route.

11.4

11.3

11.3

11.4

1.4

1.8

2.1

2.4

2.8

3.0

1.8

2.0

2.0

2.2

1.3

2.4

3.8

3.8

0

5

10

15

20

25

2008 2010 2011 2012 2013 2014 2015

FIGURE 9

Seat Miles of Service by Type of Carrier

In billions

City-to-City Express

Chinatown

Latino

Conventional

In Billions

15.8

18.4

20.2

22.0

18

This chart shows the approximate share of passengers by major ownership growth in dierent regions of the U.S. These

gures are derived from allocang each of the 166 carriers in the Intercity Bus Data Set across the regions their coaches

serve. Note that there is a broader spectrum of compeon in the East/Mid-Atlanc Region than in other parts of the

country. The Central/Mountain region has approximately an equal amount of Greyhound and Lano service, but essen-

ally no Chinatown service. Cauon should be exercised in interpreng these results due to the many assumpons made

regarding average passenger loads and other variables that will be evaluated further in the months ahead. Nevertheless,

they oer a previously unavailable perspecve on regional compeon.

30%

15%

35%

31%

15%

13%

3%

13%

1%

10%

5%

11%

32%

24%

12%

5%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

East/Mid South/SE Midwest Central/Mntn West Coast

FIGURE YY

Estimated Passenger Market Share by Region

SGC Megabus

Latino

Chinatown

Other Carriers

Greyhound pool partners

Greyhound & subsidiaries

19

This map shows the approximate geographic range of hubs created by Megabus between 2006 and 2015. The earliest

hubs were in Chicago, New York, and other densely populated cies with extensive heavy-rail (metro) systems. The cre-

aon of Megabus’ hub service in Atlanta and Pisburgh in 2011 marked a signicant shi away from this paern. The

Northern Great Plains/Rocky Mountain states remain the most signicant regions that have yet to be served by these city-

to-city express lines.

with Approximate Geographic Range of Service

Pacific Northwest 2012

Expansion 2013

California 2013

New York 2008

Newark 2011

with Approximate Geographic Range of Servicehgc

20

APPENDIX

DEFINITIONS OF CARRIER TYPES

Bus lines focused on express downtown-to-downtown service between major cies,

which rely on internet ckeng and oen use a mix of terminal and curbside drop-o and pickup locaons. Discount op-

erators do not parcipate in “interline” arrangements with Greyhound or other bus companies. Unlike many convenonal

bus companies, the carriers oer guaranteed seang and are not oriented toward serving airports. Examples include Best-

Bus, Boltbus, Megabus, and Vamoose.

Carriers operang tradional services over xed routes, and primarily use tradional terminals

in larger cies. This category includes luxury operators, regional operators, and rural transit companies that operate with

public subsidies. Examples of carriers in this category include Greyhound (including Greyhound Express), Jeerson Lines,

Peter Pan, Trailways, and Coach USA’s Shortline services operang to and from New York’s Port Authority Bus Terminal

Typically Asian- or Asian American-owned lines operang from Chinatown districts in major cies.

These carriers typically do not invest in clearly idenable brand names and do not interline with major bus companies.

Operate primarily to service Lano/Hispanic populaons and typically have staons in neighborhoods

with high concentraons of these populaons. Most of these companies’ informaonal and markeng materials are in

Spanish.

21

APPENDIX

SOURCE OF DATA FOR TIME SERIES ANALYSIS

• The Chaddick Instute’s Intercity Bus Data Set, which includes esmates of the amount of bus service that is provided

naonwide by convenonal and discount city-to-city carriers. Presently, this has data on 155 intercity carriers oerings

scheduled service.

• Chaddick Instute esmates on daily operaons of Chinatown and Hispanic oriented bus lines that are not included in

the Data Set.

• Chaddick Instute analysis of extra secons and average loads. The Instute has monitored announcements about the

numbers extra secons added to meet demand.

v2