2010

NEBRASKA DEPARTMENT

OF BANKING AND FINANCE

DAVE HEINEMAN, GOVERNOR

JOHN MUNN, DIRECTOR

Annual Report

www.ndbf.ne.gov 2010 NDB&F Annual Report

1

Annual Report

July 1, 2009 - June 30, 2010

NEBRASKA DEPARTMENT

OF BANKING AND FINANCE

Commerce Court, Suite 400

1230 “O” Street

Lincoln, NE 68508-1402

Main Office: (402) 471-2171

Consumer Hotline: (877) 471-3445

www.ndbf.ne.gov

2

www.ndbf.ne.gov 2010 NDB&F Annual Report

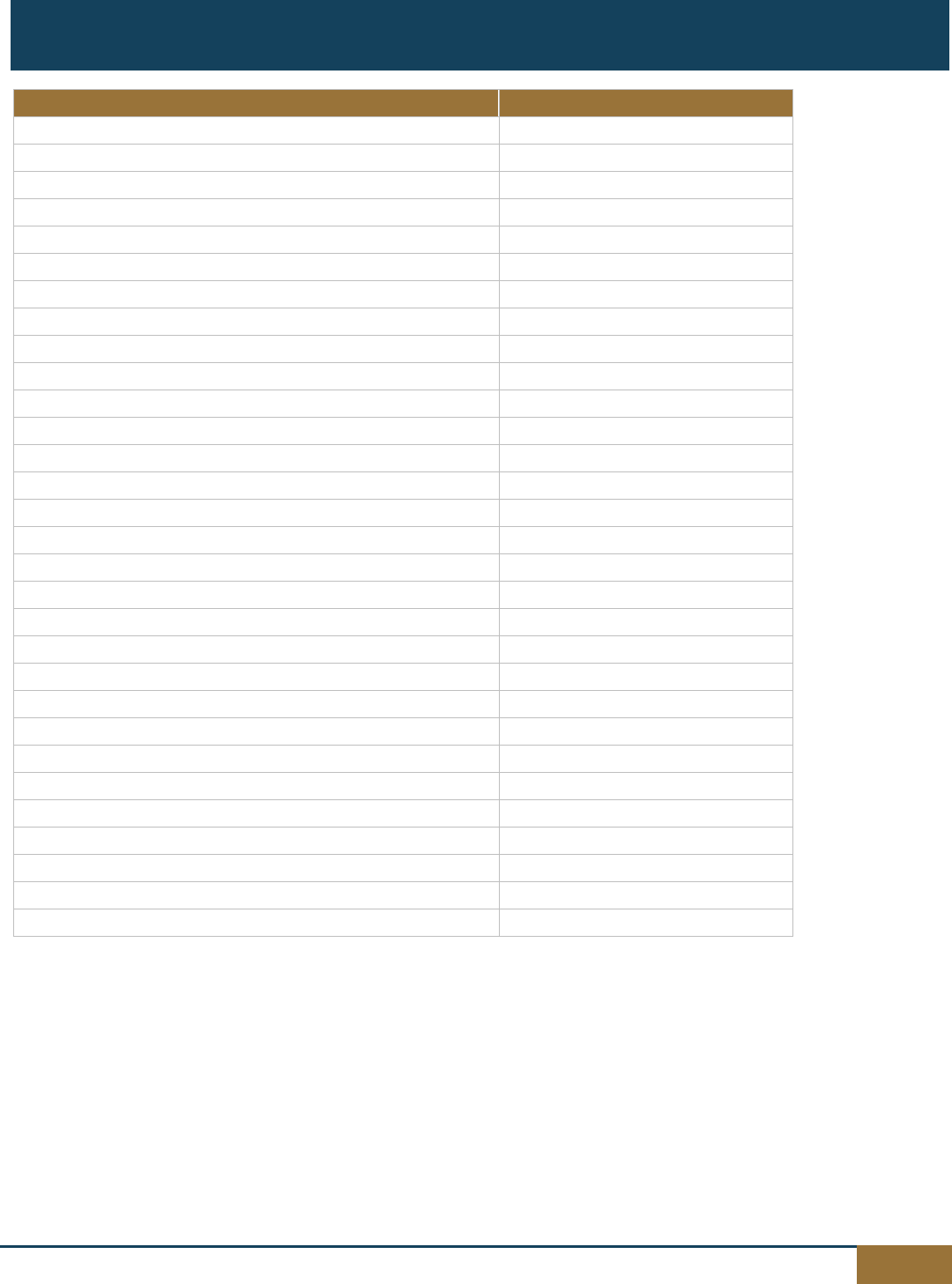

1892 to 1895 Richard H. Townley, Secretary, State Banking Board

1895 to 1901 P.L. Hall, Secretary, State Banking Board

1901 to 1917 Edward Royse, Secretary, State Banking Board

1917 to 1919 J.J. Tooley, Secretary, State Banking Board

1919 to 1925 J.E. Hart, Secretary, State Banking Board

1925 to 1927 Kirk Griggs, Secretary, State Banking Board

1927 to 1931 Clarence G. Bliss, Secretary, State Banking Board

1929 to 1931 George W. Woods, Bank Commissioner

1931 to 1933 E.H. Luikart, Secretary, State Banking Board

1933 to 1935 George W. Woods, Deputy Superintendent

1935 to 1939 B.N. Saunders, Superintendent of Banking

1939 to 1943 Wade R. Martin, Director of Banking

1943 to 1947 J. Fred Peters, Director of Banking

1947 to 1959 J.F. McLain, Director of Banking

1959 to 1961 Edwin N. Van Horne, Director of Banking

1961 to 1964 Ralph E. Misko, Director of Banking

1964 to 1966 Henry E. Ley, Director of Banking

1966 to 1967 Byron Dunn, Director of Banking

1967 to 1969 C.R. Haines, Director of Banking

1969 to 1970 Edwin A. Langley, Director of Banking

1971 to 1975 Henry E. Ley, Director of Banking

1975 to 1978 William H. Riley, Director of Banking & Finance

1979 to 1979 Charles W. Mitchell, Acting Director of Banking & Finance

1979 to 1983 Paul J. Amen, Director of Banking & Finance

1983 to 1984 John P. Miller, Director of Banking & Finance

1984 to 1985 Roger M. Beverage, Director of Banking & Finance

1985 to 1985 Roger W. Hirsch, Acting Director of Banking & Finance

1985 to 1987 James C. Barbee, Director of Banking & Finance

1987 to 1991 Cynthia H. Milligan, Director of Banking & Finance

1991 to 1998 James A. Hansen, Director of Banking & Finance

1998 to 1999 Peter M. Graff, Director of Banking & Finance

1999 to 1999 Ray A. Pont, Interim Director of Banking & Finance

1999 to 2004 Samuel P. Baird, Director of Banking & Finance

2004 to 2005 Ray A. Pont, Interim Director of Banking & Finance

2005 to Present John Munn, Director of Banking & Finance

Leadership Through the Years

www.ndbf.ne.gov 2010 NDB&F Annual Report

3

A Message from the Director

The efforts of Congress to enact federal financial

regulatory reform during fiscal year 2010 were

followed closely by Nebraska financial industries

and financial regulators. A significant result for

state-chartered banks and state regulators was

the preservation of the dual banking system.

The Dodd-Frank legislation retained the state

bank charter and the joint supervision of

state-chartered Nebraska banks by the

Department of Banking and Finance and the

federal regulator chosen by each bank (either the

Federal Deposit Insurance Corporation or the

Federal Reserve Bank). The supervision of

Nebraska’s federal savings banks will be

transferred from the Office of Thrift Supervision,

which is being eliminated, to the Office of the

Comptroller of the Currency, since 1863 the

regulator of nationally-chartered banks.

Of concern to Nebraska’s financial institutions is

the role that a new federal regulatory body, the

Consumer Financial Protection Bureau (CFPB),

will play in its supervision. Congress has given

the new agency authority to write rules for all

financial institutions pertaining to consumer

financial protection, but restricted the agency’s

direct examination authority to those financial

institutions with assets of $10 billion or more.

The CFPB may usurp existing federal and state

regulators in its examination of banks with less

than $10 billion in assets for compliance with the

CFPB’s rules if it deems their examinations to be

ineffective.

A Department activity during the year being

reported which required significant effort was the

implementation of the process for attestation of

citizenship mandated in 2009 Nebraska

legislation. Attestations were required for

individuals to whom the Department has granted

licenses or registrations, allowing them to do

business with Nebraskans. Our Securities

Division contacted more than 75,000 agents and

representatives in obtaining documentation

required in the process of renewal of

registrations.

Efforts in responding to the state’s current fiscal

challenges were shared by the Department. In

the year being reported, the Department reduced

its budgeted expenditures by 2.5%, laid off two

staff positions, and did not fill another position

vacated through attrition. Through these and

other initiatives, the Department was able to

stabilize the Financial Institutions Cash Fund

after several years of decline. The efforts put

forth by staff in absorbing the reductions in staff

are deserving of special note. In the layoff of the

Department’s Public Information Officer, the

Legal, Information Technology, and Securities

areas assumed many responsibilities. With the

reduction of two administrative positions, duties

essential to the operation of the Department were

assumed in a shared manner by other

administrative staff.

John Munn,

Director

4

www.ndbf.ne.gov 2010 NDB&F Annual Report

Department Staff ……………………………………..

5

Table of Contents

Consumer Lending

Delayed Deposit Services Statement…………………….… 34

Delayed Deposit Services Businesses……………………... 35

Installment Loan Companies Statement………………….... 38

Installment Loan Companies………………………………… 39

Sales Finance Companies…………………………………… 40

Sale of Checks/Funds Transmission Licensees…………… 43

Mortgage Lending Companies………………………………. 44

General Information

Licensees/Registrants by the Numbers …..…..................... 51

New Registrations .............................................................. 51

Loan Brokers ...................................................................... 51

Enforcement Actions .......................................................... 51

Securities Registrations and Exemptions.......................... 52

Securities Act Cash Fund .............................................. 53

Issuer Applications ........................................................ 55

Registration of Broker-Dealers and Agents ………......... 56

Historical Data

Table of Contents

Bureau of Securities

Department Staff ….………………………………….. 5

Year in Review ……………………………………….. 6

Department Budget & Funding ………………….….. 9

Financial Institutions Division

General Information

State-Chartered Institutions & Licensees/Registrants

by the Numbers ………………………............…….. 10

Activity by the Numbers ………………….…..…..… 10

Activity by the Institution ……………….…….…….. 10

Financial Institutions Total Resources …….….….. 11

Banks

State-Chartered Commercial Banks

Balance Sheet Statement …………...…….…….… 12

State-Chartered Banks …………………....……….. 13

Historical Data

State-Chartered Banks………………..….….….…… 18

Registered Bank Holding Companies .….….…… 21

Commercial Bank Members of the

Federal Reserve System ……………..………….. 27

Trusts

State-Chartered Banks Authorized

to Operate with Trust Powers …….……………….. 28

State-Chartered Trust Companies

Comparative Statement …….…….………….….… 33

Credit Unions

State-Chartered Credit Unions …….………..…..... 29

Credit Unions Comparative Statement …......….… 30

Savings & Loans

State-Chartered Savings & Loan Associations

Comparative Statement ……………………......….. 32

www.ndbf.ne.gov 2010 NDB&F Annual Report

5

Director……………………………………….……. John Munn

Deputy Director .............................................. Ray A. Pont

Review Examiners ........................ Amy Greenwood-Field

Gregory G. Freese

Kelly J. Lammers

Nick Lenzen

Kent W. Plummer

Senior Examiner/Central Scheduler ................. Tony Kriz II

Credit Unions/Savings & Loans Examiner…. Steve Wohleb

Information Technology Examiner ............ Micheal Rafferty

Omaha District Bank Examiners

Tony Kopf, Supervising Examiner

Paul E. Carpenter

Jennifer Durow

John Erbynn

Caroline Funk

*Kelsi Hewitt

James P. McTygue

Xun Wang

Lincoln District Bank Examiners

Joel D. Fanders, Supervising Examiner

Matthew Beying

Neil T. Butler

Mike Cornelius

Brian Nielsen

Darcy Tinney

Kearney District Bank Examiners

Michael Miller, Supervising Examiner

*Sarah Auld

Rhonda Johnson

Jaunita Koerner

Tony Kriz II

Perry T. Neill

Rachel Newell

Steven D. Schepers

*Lisa Sigman

Trust Examiners

Steven K. Spady, Supervising Examiner

Kenneth B. Spellmeyer

Consumer Credit and Delayed Deposit Services Examiners

*John Flores

Scott Peter

Steve Wohleb

Examiner Trainer ...............................................Tony Kopf

Administrative Assistant................................ Bobbi J. Irons

Kathy Sparks

*Pam Wilson

Staff Assistant ...................................... Sharon Christensen

Typist....................................................... *Betty L. Fogerty

Assistant Director ...................................... Jack E. Herstein

Legal Counsel ........................................... Sheila J. Cahill

Examiner III ................................................ Jackie L. Walter

Office Clerk ........................................... Pamela S. Burnham

Investigation & Compliance (Investigations)

Unit Supervisor ..................................... Thomas A. Sindelar

Securities Analyst ....................................... Karen Reynolds

Investigation & Compliance (Registration and Compliance)

Unit Supervisor ........................................ Rodney R. Griess

Securities Analyst ...................................... Jerry McFarland

Staff Assistants ........................................... Ashley Heitman

Amy Gagner

General Counsel .................... Patricia A. Humlicek Herstein

Legal Counsel-Financial Institutions...Michael W. McDannel

Legal Counsel-Consumer Finance…........ Michael Cameron

Staff Attorneys …………………………..…… Katherine Kuhn

William Troshynski, Jr.

Paralegals ............................................................ Pam Flott

Beth Wanek

Administrative Assistant ............................ Lou A. Meisinger

Staff Assistant II ......................................... Debbie L. Yost

Staff Assistant .................................................... Cindy Faris

Business Manager.......................................... Margo Sawyer

Administrative Assistant ................................... Anita Bietz

Accounting Clerk ............................................* Pam Wilson

Secretary/Receptionist ......................................... Julie Foral

Public Information Officer.......... *Patricia Saldana-Neumann

Human Resources Manager .............................. Jill Staberg

Secretary ........................................................... Sara Kinney

Information Technology Administrator ....... Kelly J. Lammers

Infrastructure Support Analyst Senior........ Deborah A. Caha

Infrastructure Support Analyst Senior……………. Rick Miller

Infrastructure Support Analyst .............................Chris Voss

* Staff who left the Department during the fiscal year.

Staff

Financial Institutions Division

Information Systems Division

Human Resources Division

Communications/Outreach

Business/Accounting Division

Legal Division

Bureau of Securities

6

www.ndbf.ne.gov 2010 NDB&F Annual Report

A Year in Review

FINANCIAL INSTITUTIONS

Ray A. Pont, Deputy Director

A significant undertaking of the Financial Institutions

Division during this report year has been the licensing of

Mortgage Loan Originators (MLOs). This responsibility

was given to the Department by the State Unicameral in

2009 in response to federal legislation (commonly known

as the SAFE Act) which mandated individual state

licensing of MLOs or federal licensing if a state chooses

not to do so. MLOs that need to be licensed are those

individuals that work with consumers in arranging

residential mortgage loans and work for entities other

than banks or bank holding companies. Licensing is

accomplished via the Nationwide Mortgage Licensing

System (NMLS), which the Department joined January 1,

2008 and has used subsequently to license mortgage

banker entities. The deadline for the initial licensing of

MLOs was July 31, 2010. The Department dealt with 996

MLO applications during this cycle. Preparing for the

licensing process, and actually completing the licensing

process, involved a herculean effort on the part of

numerous staff members.

There has been much written at the national level about

the poor condition of the banking industry. This seems

like a good time to highlight how well Nebraska

state-chartered banks are doing vs. all U.S. commercial

banks. As of 12-31-09, our banks were faring quite well

in the areas of profitability, non-performing assets, and

core funding, as depicted in the following chart:

To a certain degree we may thank the recent stability of

the agricultural economy, and the basic

conservativeness of Nebraska bankers.

In my last annual report, I wrote about the charter

conversion of national banks to state banks. Those

numbers were four in 2005, three in 2006, one in 2007,

one in 2008, and as of that writing, one in 2009. During

calendar year 2009, a total of five banks converted, and

through June 30, 2010 three converted. Again, no

clear pattern is emerging.

Finally, I began last year’s report with information about

the hiring and training of new bank examiners. I am

pleased to report their progress continues, with all those

who remain on staff having been promoted to Junior

Examiner from Examiner Trainee.

Nebraska

US

Number of banks at report date

179

6,839

Annualized % return on assets

1.00

0.09

Percentage of unprofitable

institutions

11.17

29.38

Percentage of non-performing

assets to assets

1.41

3.36

Percentage of core deposits to

total liabilities

73.46

56.08

Left to Right:

Sara Kinney, Secretary; Anita Bietz, Administrative

Assistant; Julie Foral, Secretary/Receptionist

www.ndbf.ne.gov 2010 NDB&F Annual Report

7

BUREAU OF SECURITIES

Jack E. Herstein, Assistant Director

Bureau of Securities

The Nebraska Bureau of Securities regulates the offer

and sales of investments to Nebraska residents. This

is accomplished using a variety of regulatory and

enforcement tools, including registration requirements

for securities. The Bureau also licenses and

examines securities broker-dealers and investment

advisers firms licensed to do business in Nebraska.

The Bureau provides technical assistance to small

businesses, responds to consumer complaints,

undertakes investigations based upon complaints and

undercover work, and brings appropriate

administrative and civil actions and refers criminal

cases for prosecution. Over 80,000 individuals and

firms provided securities investments and advice to

Nebraska citizens. Currently there are approximately

74,970 broker dealer agents, 1,425 broker dealer

firms, 1,115 investment advisers and notice filers, and

3,273 investment adviser representatives registered to

conduct business with Nebraska residents. More

than $17 billion of securities products were offered to

Nebraska investors last fiscal year.

The Division of Enforcement and Compliance provides

protection for investors under the Securities Act of

Nebraska. The two divisions of the Securities Bureau

employ examiners, investigators and administrative

staff who pursue claims against registered

broker-dealers and investment advisers as well as

non-registrants and those who sell unregistered

securities.

Members of the Enforcement staff continuously monitor

newspaper ads, radio and television ads, e-mail and online

ads in order to uncover investment scams targeting

Nebraskans on a real-time basis. Early action prevents

investor losses.

The Bureau works directly with entities it regulates through

examinations and market surveillance activity in an effort

to assure the public of adequate protection for their

investments. A total of 41 enforcement actions were

taken this year, and the Bureau assisted in the preparation

of two criminal referrals.

The Bureau administers and enforces the following

Nebraska statutes:

* Securities Act of Nebraska

* Nebraska Loan Broker Act

* Nebraska Commodity Code

* Seller-Assisted Marketing Plan Act

* Consumer Rental Purchase Agreement Act

The Bureau investigates alleged violations of these

statutes as well as initiating administrative proceedings

and forwarding case referrals to other law enforcement

agencies to prosecute persons who have violated these

statutes.

The total budget appropriated for the Bureau for the time

period of July 1, 2009 to June 30, 2010 was

$1,662,601.90, with total expenditures of $1,291,930.62.

Total revenue by the Bureau for the same time period was

$24,829,283.00. For every dollar spent, the Bureau

generated $19.21 in return.

The Bureau also actively engages in providing consumer

education presentations and distributing basic personal

finance and investor educational materials.

Highlights for the year included participating in NET’s

Television production of “Smart Investing, Safe Investing”

program by staff members taping a show regarding

questions on basic investor education; continuing to give

support to the Nebraska Council on Economic Education

for use in helping to sponsor economic courses and

workshops for teachers, and the Nebraska Stock Market

Game; and teaming with AARP in Nebraska to launch the

Free Lunch Seminar Monitor program to determine if older

investors are being pressured into purchasing investments

that are not suitable for them.

8

www.ndbf.ne.gov 2010 NDB&F Annual Report

LEGAL DIVISION

Patricia A. Humlicek Herstein, General Counsel

Much of the financial sector was impacted by legislation

introduced on behalf of the Department in the 2010

legislative session. The Department is most appreciative

of the efforts of Senator Rich Pahls and Senator Pete

Pirsch, the Chair and Vice Chair, respectively, of the

Legislature’s Banking, Commerce, and Insurance

Committee, and Committee Counsel Bill Marienau for

passage of the Department’s three financial institution and

entity bills, and those of Senator Mike Gloor who

spearheaded the agency’s securities legislation.

LB 890 updated laws relating to depository financial

institutions. Included in the changes were the

strengthening of the penalties for lending limit violations; a

more efficient method of notifying institutions of the filing of

applications; a delineation of how capital for mutual

savings banks is to be calculated; the providing of

authority to the Department to take corrective

administrative action when a bank holding company’s

officer or director is engaging in detrimental actions; an

additional exception to bank and trust company change of

control applications; and a date revision for the three

wild-card laws.

LB 891 provided the authority for a conditional state bank

charter that may be used to acquire a financial institution

that has been determined to be failing or troubled by its

primary state or federal regulator. The conditional charter

could then be converted to full bank charter status if such

an acquisition occurs. The Federal Deposit Insurance

Corporation, which conducts the bidding and acquisition

process for failed banks and savings associations, does

not allow individuals to participate in the process. The

conditional bank charter is necessary to facilitate

participation

LB 892 updated and clarified provisions of the

Residential Mortgage Licensing Act and the Installment

Loan Act in relation to mortgage loan originators and

reverse mortgages. Substantive provisions in the bill

provided an extension of the deadline for registration of

mortgage loan originators employed by financial

institutions; a reinstatement of language relating to

notifications of material developments by licensees; a

bar against hiring a person who has had a mortgage

loan originator license revoked by any state; and the

expansion of reverse mortgage loan requirements to all

non-depository home mortgage lenders doing business

in Nebraska.

LB 814 addressed Section 8-1111(9), a transactional

exemption from registration under the Securities Act of

Nebraska. The law was amended to provide that once

an issuer raises one million dollars, or the exemption is

continuously claimed for five years (whichever comes

first), a sales report and audited financials must be filed

with the Department. Subsequently, the sales report

and audited financials would need to be repeated after

every additional million dollars is raised or after five

more years of continuous filing (again, whichever occurs

first). The bill addressed a recent instance where

affiliated companies made continuous repeat filings

under this exemption, generating sales to many

persons. Dishonest business practices led to eventual

business failure and large losses for investors.

Left to Right:

Debbie Yost, Staff Assistant; Katherine Kuhn, Staff

Attorney; Rod Griess, Investigation & Compliance

Supervisor

www.ndbf.ne.gov 2010 NDB&F Annual Report

9

Bureau of Securities

Revenues

Beginning Balance

$24,719,989

Securities and Registration Fees

$17,213,135

Private Offering Fees

$64,400

Broker-Dealer/Broker-Dealer

Agents/Investment Advisor Fees

$4,469,270

Interest Income

$864,249

Cost of Investigations

$2,199,150

Miscellaneous

$34,096

Unregistered Securities or Firms

$0

Total Revenues for Fiscal Year

$24,844,300

Expenditures

Employee Salaries & Benefits

$1,080,757

Operating Expenses

$211,157

Capital Expenditures

$17

Total Expenditures

for Fiscal Year

$1,291,931

Contribution to State

Monies transferred to the State of

Nebraska General Fund

$24,286,041

ENDING BALANCE

$23,986,318

Enforcement Actions

Fines/Penalties

$79,600

The Department is fully funded from fees received from the

industries it regulates. Fees are deposited in two funds with

one used for supervision by the Financial Institutions

Division and the other by the Bureau of Securities.

The Financial Institutions fund receives most of its revenue

from an annual assessment based on assets and

examination fees. The Bureau of Securities is funded through

fees from the registration of securities and the licensing of

securities industry personnel.

Department Budget & Funding

Fiscal Year July 1, 2009 – June 30, 2010

Financial Institutions

Revenues

Beginning Balance

$1,645,255

Banking & Trusts Companies

$4,150,591

Credit Unions &

Savings and Loan

$105,264

Mortgage Lending

$365,391

Sale of Checks &

Funds Transmission

$19,250

Delayed Deposit Services

$320,682

Consumer Lending

$47,295

Total Revenues for Fiscal Year

$5,008,474

Expenditures

Employee Salaries & Benefits

$3,908,723

Operating Expenses

$811,481

Capital Expenditures

$1,658

Total Expenditures

for Fiscal Year

$4,721,862

ENDING BALANCE

$1,931,867

Enforcement Actions

Total fines and penalties collected

from enforcement cases

$175,894

Monies secured for the Permanent

School Fund.

$333,950

10

www.ndbf.ne.gov 2010 NDB&F Annual Report

Numbers include main offices only.

Financial Institutions

6/30/2005

6/30/2006

6/30/2007

6/30/2008

6/30/2009

6/30/2010

State-Chartered Banks

184

187

187

182

180

178

Savings & Loan Associations

2

1

1

1

1

1

Credit Unions

25

22

22

21

19

19

Trust Companies

4

4

4

4

4

3

Delayed Deposit Services

106

129

136

139

127

116

Installment Loan Companies

39

38

39

35

16

14

Sales Finance Companies

188

180

172

178

126

106

Mortgage Bankers

596

663

589

402

343

282

Activity by the Numbers

Conversion to State-Chartered Bank

7

Branch Relocations Approved

0

Mergers Approved

7

Name Changes

2

Branch Acquisitions Approved

0

Bank Closings

0

New Bank Branch Offices Approved

10

Loan Production Office Notices Received

13

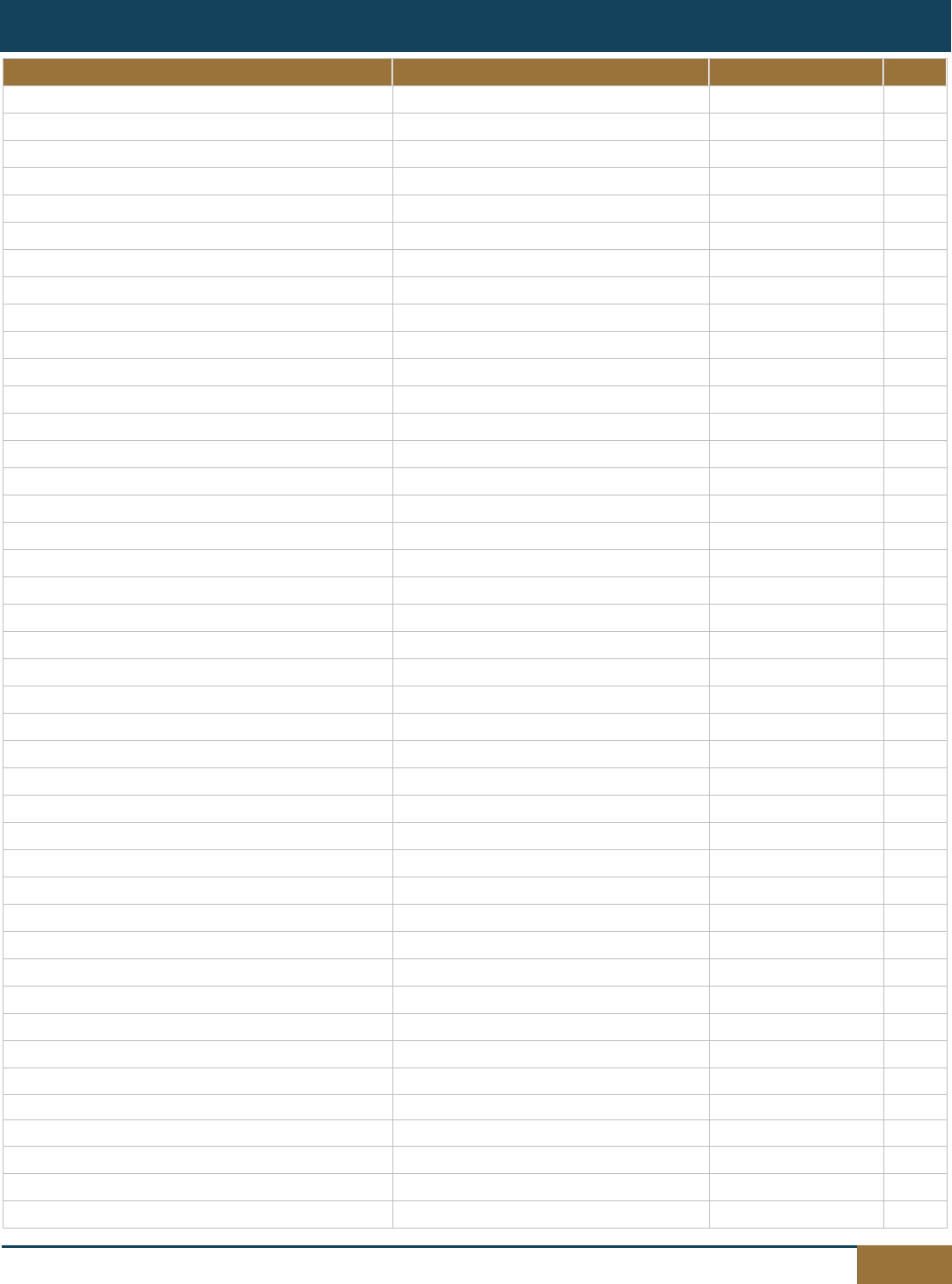

Conversion to State-Chartered Bank

Former Institution

Current Institution

City

Date of

Conversion

The City National Bank of Greeley

CNB Community Bank

Greeley

11/16/2009

Citizens National Bank of Wisner

Citizens State Bank

Wisner

12/7/2009

The Farmers & Merchants National Bank

of Ashland

Farmers & Merchants Bank of Ashland

Ashland

12/15/2009

The Stanton National Bank

Stanton State Bank

Stanton

12/21/2009

F & M Bank, National Association

F & M Bank

West Point

6/1/2010

First National Bank

First Community Bank

Beemer

6/10/2010

First National Bank & Trust

First Bank & Trust of Fullerton

Fullerton

6/28/2010

Mergers Approved

Institution

City

Acquired

Date of

Merger

Citizens Bank & Trust Company

St. Paul

Citizens Bank, Loup City

10/9/2009

The Tilden Bank

Tilden

Citizens State Bank, Clearwater

7/29/2009

Citizens Bank & Trust Company

St. Paul

Central Bank, Central City

11/2/2009

Security First Bank

Lincoln

The First National Bank of Valentine, Valentine

1/6/2010

Cornerstone Bank

York

Harvard State Bank, Harvard

3/19/2010

First State Bank

Lincoln

DeWitt State Bank, DeWitt

4/21/2010

First State Bank

Lincoln

The Farmers Bank, Lincoln

4/21/2010

Financial Institutions Division

By the Numbers

Branch Acquisitions Approved

Institution

City

Branch Acquired

Date Acquired

None

Activity by Institution

Financial Institutions Division

www.ndbf.ne.gov 2010 NDB&F Annual Report

11

New Bank Branch Offices Approved

Institution

City

Branch Location

Date of Approval

First State Bank

Lincoln

Filley

7/28/2009

Union Bank and Trust Company

Lincoln

Leawood, KS

9/21/2009

Foundation First Bank

Waterloo

Omaha

10/5/2009

First State Bank

Lincoln

Lincoln

10/16/2009

Bank of Doniphan

Doniphan

Grand Island

10/19/2009

Bruning State Bank

Bruning

Holdrege

11/12/2009

Frontier Bank

Madison

Lincoln

12/7/2009

Nebraska State Bank and Trust Company

Broken Bow

Callaway

12/10/2009

Citizens State Bank

Wisner

West Point

5/10/2010

Heritage Bank

Aurora

Broken Bow

6/9/2010

Loan Production Office Notices Received

Institution

City

Location

Date Received

Bruning State Bank

Bruning

Holdrege

8/21/2009

First State Bank

Lincoln

Valley

10/1/2009

Frontier Bank

Madison

Lincoln

10/5/2009

Citizens State Bank

Wisner

West Point

11/5/2009

Cornhusker Bank

Lincoln

Lincoln

11/9/2009

Centennial Bank

Omaha

Bellevue

11/25/2009

State Bank of Riverdale

Riverdale

Ord

1/11/2010

Heritage Bank

Aurora

Broken Bow

4/15/2010

Sandhills State Bank

Bassett

Harrison

4/23/2010

Sandhills State Bank

Bassett

North Platte

4/23/2010

The Tilden Bank

Tilden

Madison

4/29/2010

Sandhills State Bank

Bassett

Valentine

5/14/2010

State Bank of Riverdale

Riverdale

Kearney

6/23/2010

Branch Office Relocations Approved

Institution

City

Branch Relocation

Date Opened

None

Name Changes

Prior Name of Institution

Current Name

City

Date of Approval

The Bank of Madison

Frontier Bank

Madison

10/2/2009

Commercial Bank

Sandhills State Bank

Bassett

5/3/2010

Bank Closing

Name of Institution

Location

Date Closed

None

Institutions

Number

6/30/2009

Number

6/30/2010

Assets 6/30/2009

Assets 6/30/2010

Gain (Loss)

State-Chartered Commercial Banks

180

178

$22,570,676,000

$26,080,785,000

$3,510,109,000

Savings & Loan Associations

1

1

$1,148,064

$1,127,764

($20,300)

Credit Unions

19

19

$570,898,443

$598,022,945

$27,124,502

Trust Companies

4

3

$2,192,297

$2,444,389

$252,092

Institutions Total Financial Resources

12

www.ndbf.ne.gov 2010 NDB&F Annual Report

State-Chartered Commercial Banks Balance Sheet Statement

June 30, 2008

June 30, 2009

June 30, 2010

Number of Institutions

182

180

178

ASSETS: (Dollar amounts in thousands)

Non-Interest Bearing Balances

679,063

565,511

563,244

Interest Bearing Balances

261,460

666,450

1,113,540

Securities

3,208,768

3,583,311

4,307,466

Federal Funds Sold & Securities Purchased to Resell

336,077

751,916

324,322

Loans and Leases

14,723,951

16,059,818

18,808,672

Allowance for Loan Losses

213,212

237,619

348,421

Loan and Leases, Net

14,510,739

15,822,199

18,460,251

Assets held in Trading Accounts

22,169

26,218

0

Premises and Fixed Assets

356,559

355,796

368,335

Other Real Estate Owned

39,984

55,652

83,234

Intangible Assets

134,534

141,510

145,876

Other Assets, Net

592,101

602,113

714,517

Total Assets & Losses Deferred

$20,141,454

$22,570,676

$26,080,785

LIABILITIES: (Dollar amounts in thousands)

Deposits

Domestic Non-interest Bearing Deposits

1,742,873

1,903,808

2,107,766

Domestic Interest Bearing Deposits

14,196,907

16,271,281

17,354,272

Total Domestic Deposits

15,939,780

18,175,089

19,462,038

Federal Funds Purchased & Securities Sold

460,184

368,849

388,935

Other Borrowed Money

1,400,518

1,425,350

3,356,778

Mortgage Indebtedness

0

0

0

Notes and Debentures

0

38,200

10,397

Other Liabilities

218,126

233,187

244,764

Total Liabilities

$18,018,608

$20,240,675

$23,462,912

EQUITY CAPITAL

Perpetual Preferred Stock

4,527

8,844

8,029

Common Stock

131,224

131,992

131,095

Surplus

1,038,491

1,125,660

1,314,532

Undivided Profits

948,604

1,063,484

1,164,217

Other Equity Capital Components

21

Total Equity Capital

2,122,846

2,330,001

2,617,873

Total Liabilities & Equity Capital

$20,141,454

$22,570,676

$26,080,785

Aggregate Deposit Totals – Deposit Limitation

Please refer to the Department’s Web site at www.ndbf.ne.gov for total deposits for all banks

and savings and loan associations in Nebraska as of June 30, 2010.

www.ndbf.ne.gov 2010 NDB&F Annual Report

13

Banks are listed in the order of the city in which the main office is located and include full service branches, mobile branches

and loan production offices. Unless otherwise noted, locations are in Nebraska.

Institution

Main Offices

(Nebraska)

Branch offices, loan production offices (LPO) and

mobile branches (Mobile).

Adams State Bank

Adams

Community Bank

Alma

Stamford

Security State Bank

Ansley

Dundee Bank, Omaha; Dunning (LPO)

Farmers and Merchants Bank of Ashland

Ashland

Ashland

Ashton State Bank

Ashton

Auburn State Bank

Auburn

Farmers & Merchants Bank

Axtell

Parker, CO (LPO)

State Bank of Bartley

Bartley

Stockmens Bank, Colorado Springs, CO

Sandhills State Bank

Bassett

Valentine (LPO), North Platte (LPO), Harrison (LPO)

Battle Creek State Bank

Battle Creek

First State Bank

Beaver City

First Community Bank

Beemer

Bancroft; Homer

Bank of the Valley

Bellwood

David City; Platte Center

Heartland Community Bank

Bennet

Avoca; Nebraska City; Weeping Water

Bank of Bennington

Bennington

Douglas County (mobile); Omaha

Bank of Bertrand

Bertrand

Two Rivers Bank

Blair

Arlington

Washington County Bank

Blair

Tekamah

Farmers and Merchants State Bank

Bloomfield

South Yankton; Center; Crofton; Hartington; Niobrara

The Boelus State Bank

Boelus

Nebraska State Bank

Bristow

Nebraska State Bank and Trust Company

Broken Bow

Mason City; Merna; Octonto; Callaway

Bruning State Bank

Bruning

Hebron; Holdrege; Bank of Broken Bow, Broken Bow

Brunswick State Bank

Brunswick

Winnetoon

Butte State Bank

Butte

Spencer

Byron State Bank

Byron

Pathway Bank

Cairo

Grand Island; Burwell; Ord

First Central Bank

Cambridge

Arapahoe; Edison

South Central State Bank

Campbell

Blue Hill; Franklin; Oxford

Citizens State Bank

Carleton

Farmers State Bank

Carroll

Commercial State Bank

Cedar Bluffs

Cedar Rapids State Bank

Cedar Rapids

CerescoBank

Ceresco

Chambers State Bank

Chambers

State-Chartered Banks (for the period ending June 30, 2010)

State-Chartered Banks (for the period ending June 30, 2010)

14

www.ndbf.ne.gov 2010 NDB&F Annual Report

Institution

Main Office

(Nebraska)

Branch offices, loan production offices (LPO) and

mobile branches (Mobile).

State Bank of Chester

Chester

Bank of Clarks

Clarks

Silver Creek

Clarkson Bank

Clarkson

State Bank of Colon

Colon

Columbus Bank & Trust Company

Columbus

Columbus

Farmers Bank of Cook

Cook

Liberty; Peru; Syracuse; Tecumseh; Virginia; Wymore

Homestead Bank

Cozad

St. Paul; Wolbach

First Bank and Trust Company

Cozad

Clay Center; Eustis; Imperial; Mountain View Bank, Colorado

Springs, CO; Plum Creek Bank, Lexington

The Culbertson Bank

Culbertson

Curtis State Bank

Curtis

Frontier Bank

Davenport

Omaha (LPO)

Jefferson County Bank

Daykin

Farmers State Bank

Dodge

Bank of Doniphan

Doniphan

Grand Island; Hastings

Eagle State Bank

Eagle

Bank of Elgin

Elgin

American Interstate Bank

Elkhorn

Omaha

American Exchange Bank

Elmwood

Eagle

Ericson State Bank

Ericson

Farmers State Bank

Ewing

Farmers State Bank

Fairmont

Richardson County Bank & Trust Company

Falls City

Stella

First State Bank

Farnam

Holbrook; Medicine Creek Bank, Cambridge

Cedar Security Bank

Fordyce

Hartington; Wynot

Franklin State Bank

Franklin

First State Bank & Trust Company

Fremont

Fremont (3); Fremont (Mobile)

First Bank & Trust of Fullerton

Fullerton

St. Edward

Geneva State Bank

Geneva

Geneva (2); Grafton; Hastings; Kearney; Shickley

Exchange Bank

Gibbon

Grand Island (2)

First State Bank

Gothenburg

Gothenburg; LaVista; Omaha (2); Englewood, CO (LPO);

Ralston; Lincoln (LPO)

The Gothenburg State Bank and Trust

Company

Gothenburg

Brady

Five Points Bank

Grand Island

Grand Island (5); Kearney (2); Sumner

CNB Community Bank

Greeley

The Guide Rock State Bank

Guide Rock

Edgar

Banner County Bank, Inc.

Harrisburg

Bank of Hartington

Hartington

Hartington

Five Points Bank of Hastings

Hastings

Hastings (2)

Hastings State Bank

Hastings

Fairfield; Hastings; Roseland; HS Bank, Lincoln (3)

Thayer County Bank

Hebron

Henderson State Bank

Henderson

Greeley; York

Hershey State Bank

Hershey

North Platte (LPO); Sutherland (LPO)

The State Bank of Hildreth

Hildreth

www.ndbf.ne.gov 2010 NDB&F Annual Report

15

Institution

Main Office

(Nebraska)

Branch offices, loan production offices (LPO) and

mobile branches.

First State Bank

Hordville

Farmers State Bank

Humphrey

Platte Valley State Bank & Trust Company

Kearney

Grand Island; Kearney (2); Kearney (Mobile)

Adams County Bank

Kenesaw

Juniata

Bank of Keystone

Keystone

Arthur; Hyannis; Commercial State Bank, Elsie

FirsTier Bank

Kimball

Elm Creek; Holdrege; Kearney; Lincoln (LPO); Cheyenne, WY;

Upton, WY

Bank of Nebraska

LaVista

Bellevue; LaVista; Omaha (2); Papillion (LPO)

Bank of Lewellen

Lewellen

City Bank & Trust Co.

Lincoln

Crete; Lincoln (2)

Cornhusker Bank

Lincoln

Lincoln (8); Lincoln (LPO)

First State Bank

Lincoln

Cortland; Dorchester; Firth; Hallam; Hickman; Lincoln (4); Wilber;

Yutan; Valley (LPO); Filley; DeWitt; Pickrell; Waverly, Western

Nebraska Bankers’ Bank

Lincoln

Pinnacle Bank

Lincoln

Abilene, KS (3); Arnold; Aurora (2); Beatrice (2); Central City;

Columbus (3); Columbus (Mobile); Crete; Elkhorn; Elwood;

Grant; Gretna; Imperial; Lake Lotawana, MO; LaVista; Lexington

(2); Lincoln (12); Lincoln (Mobile); Madison; Neligh (2); O’Neill;

Ogallala; Omaha (6); Osceola; Page; Palmer; Papillion (2);

Schuyler (2); Shelby; Verdigre; Waverly; Wisner; Olathe, KS

(LPO)

Security First Bank

Lincoln

Beatrice (4); Blue Springs; Clatonia; Cody; Cozad (2); Crawford

(2); Elwood; Harrison; Hay Springs; Lincoln (5); Lincoln (Mobile);

Lincoln (LPO); Martell; Martin, SD (2); Merriman; Omaha (LPO);

Overton; Rapid City, SD; (4); Rushville (3); Sidney; Sidney

(Mobile); Thedford; Cortland

Union Bank and Trust Company

Lincoln

Ainsworth; Auburn; Bonner Springs, KS; Crete; David City;

Fairbury; Grand Island; Kansas City, KS; Leawood, KS; Lincoln

(17); Omaha (2); Overland Park, KS; Pawnee City; Seward;

Taylor; Valentine; Wahoo; York; Beatrice (LPO); Columbus

(LPO); Kearney (LPO); Lincoln (LPO); Logan, IA (LPO); Norfolk

(LPO); Syracuse (LPO)

West Gate Bank

Lincoln

Lincoln (6); Lincoln (Mobile)

Bank of Lindsay

Lindsay

Lisco State Bank

Lisco

First State Bank

Loomis

Alma

Home State Bank

Louisville

Nebraska State Bank

Lynch

Frontier Bank

Madison

Lincoln; Norfolk; Omaha (LPO)

Security Home Bank

Malmo

Bank of Marquette

Marquette

Farmers State Bank

Maywood

Big Springs; Trenton

First Central Bank McCook

McCook

Curtis (LPO)

Bank of Mead

Mead

Mead

Farmers and Merchants Bank

Milford

Beaver Crossing; Firth; Jansen; Kearney (2); Lawrence; Palmyra;

Panama; Superior; Weeping Water; Wilber

Farmers and Merchants Bank

Milligan

First Bank and Trust Company

Minden

16

www.ndbf.ne.gov 2010 NDB&F Annual Report

Institution

Main Office

(Nebraska)

Branch offices, loan production offices (LPO) and

mobile branches (Mobile).

Minden Exchange Bank & Trust Company

Minden

Upland

Corn Growers State Bank

Murdock

Murray State Bank

Murray

Arbor Bank

Nebraska City

Oakland; Omaha (LPO)

Farmers Bank and Trust Company

Nebraska City

The Nehawka Bank

Nehawka

Union

Commercial Bank

Nelson

Bank of Newman Grove

Newman Grove

BankFirst

Norfolk

Columbus (2); Norfolk (2); O’Neill; Ord; Wayne; Lincoln (LPO)

Elkhorn Valley Bank & Trust

Norfolk

Hoskins; Norfolk (4); Pierce

Platte Valley Bank

North Bend

North Loup Valley Bank

North Loup

State Bank of Odell

Odell

Diller

Adams Bank & Trust

Ogallala

Berthoud, CO (2); Brule; Chappell; Colorado Springs, CO (3);

Firestone, CO; Fort Collins, CO; Grant; Imperial; Indianola;

Lodgepole; Madrid; North Platte; Sutherland

Access Bank

Omaha

Omaha (mobile)

Centennial Bank

Omaha

Ashland (1); Ashland (Mobile); Omaha (2); Omaha (Mobile);

Bellevue (LPO)

First Westroads Bank, Inc.

Omaha

Omaha (2); Omaha (Mobile)

Mid City Bank, Inc.

Omaha

Bellevue; Omaha (8)

Omaha State Bank

Omaha

Omaha (4); Omaha (Mobile)

United Republic Bank

Omaha

Bank of Orchard

Orchard

Nebraska State Bank

Oshkosh

Alliance (LPO); Broken Bow (LPO); Curtis (LPO); Shelton (LPO)

Pender State Bank

Pender

Omaha (LPO); Sioux Center, IA (LPO)

Petersburg State Bank

Petersburg

Cass County Bank, Inc.

Plattsmouth

Plattsmouth

Plattsmouth State Bank

Plattsmouth

Plattsmouth (2)

Bank of Dixon County

Ponca

Jackson; Newcastle

The Potter State Bank of Potter

Potter

Bank of Prague

Prague

Purdum State Bank

Purdum

First State Bank

Randolph

Town & Country Bank

Ravenna

Kearney; Litchfield; Pleasanton

Peoples-Webster County Bank

Red Cloud

Republican Valley Bank, Orleans

Commercial State Bank

Republican City

State Bank of Riverdale

Riverdale

Kearney (LPO); Ord (LPO)

State Bank of Scotia

Scotia

First State Bank

Scottsbluff

Colorado Springs, CO; Gering

Platte Valley Bank

Scottsbluff

Bridgeport, Minatare, Morrill, Scottsbluff (2)

Valley Bank and Trust Company

Scottsbluff

Bayard; Gering (2); Grant; Ogallala; Scottsbluff; Wauneta;

Western States Bank, Fort Collins, CO (2); Western States Bank,

Loveland, CO

www.ndbf.ne.gov 2010 NDB&F Annual Report

17

Institution

Main Office

(Nebraska)

Branch offices, loan production offices (LPO) and

mobile branches (Mobile).

Scribner Bank

Scribner

First State Bank

Shelton

World’s Foremost Bank

Sidney

Dakota County State Bank

South Sioux City

South Sioux City (2)

Iowa-Nebraska State Bank

South Sioux City

Hornick, IA; Onawa, IA; Sioux City, IA (3); South Sioux City;

Wakefield; Wilcox

Spencer State Bank

Spencer

Springfield State Bank

Springfield

Citizens Bank & Trust Company in St. Paul

St. Paul

Loup City; Central Bank, Central City

Stanton State Bank

Stanton

Norfolk

Bank of Stapleton

Stapleton

North Platte

The Bank of Steinauer

Steinauer

The Tri-County Bank

Stuart

Atkinson; Bassett; Newport (LPO)

First Tri County Bank

Swanton

Plymouth

State Bank of Table Rock

Table Rock

Dubois; Humboldt; Pawnee City; Roca; Lincoln (LPO)

Tri Valley Bank

Talmage

The Tilden Bank

Tilden

Creighton; Madison (LPO); Citizens State Bank, Clearwater

Countryside Bank

Unadilla

Burr; Syracuse

First Bank of Utica

Utica

Cordova

First Nebraska Bank

Valley

Arcadia; Brainard; Columbus; Decatur; Emerson; Stanton

Oak Creek Valley Bank

Valparaiso

Wahoo State Bank

Wahoo

Wahoo

Farmers State Bank

Wallace

North Platte

Foundation First Bank

Waterloo

Omaha

Commercial State Bank

Wausa

Bellevue (LPO); Elkhorn (LPO); Nebraska City; Bloomfield (LPO)

Horizon Bank

Waverly

McCook; Superior; Waverly

Farmers & Merchants State Bank

Wayne

F & M Bank

West Point

Gretna

Winside State Bank

Winside

Citizens State Bank

Wisner

Belden; Creston; Laurel; Leigh; Spaulding; West Point (LPO)

Heritage Bank

Wood River

Adams County (mobile); Aurora (3); Broken Bow; Buffalo County

(mobile); Doniphan; Grand Island; Hall County (mobile); Hastings

(2); Kearney (2); Loup City; Neligh; St. Paul; Stromsburg

Cornerstone Bank

York

Albion; Aurora; Bartlett; Bradshaw; Central City; Clay Center;

Columbus (3); Geneva; Grand Island (3); Hampton; Henderson;

McCool Junction; Monroe; Polk; Rising City; St. Edward;

Stromsburg; Sutton (2); Waco; York (5); Harvard

York State Bank and Trust Company

York

Geneva; Gresham; York (2)

18

www.ndbf.ne.gov 2010 NDB&F Annual Report

Year

In

Operation

Total Capital

And Reserves

Total

Deposits

Total

Assets

1897

320

$ 9,321,526

$ 13,902,940

$ 23,670,864

1898

324

9,112,456

18,225,180

27,680,475

1899

339

8,215,314

22,499,021

30,683,955

1901

381

8,555,074

27,634,116

36,297,246

1902

429

9,987,372

31,279,615

41,350,747

1903

459

9,986,483

33,596,040

44,678,440

1904

482

10,649,382

36,764,743

48,608,440

1905

530

11,926,588

49,047,081

62,193,973

1906

563

12,257,299

54,113,470

67,977,826

1907

601

13,625,641

60,783,452

73,167,880

1908

615

14,376,722

62,583,790

78,719,474

1909

659

15,727,371

71,647,454

89,134,446

1910

664

16,581,971

70,172,423

88,836,697

1911

669

17,134,008

72,192,000

91,893,258

1912

695

18,602,383

80,631,192

102,569,968

1913

715

19,479,801

89,228,696

112,791,202

1914

765

21,463,151

91,393,643

117,634,172

1915

805

23,523,191

111,119,961

141,703,258

1916

845

25,802,915

158,240,184

193,208,902

1917

923

29,365,323

204,175,998

256,277,509

1918

942

31,401,671

231,560,771

277,394,621

1919

1002

36,079,610

270,505,130

325,554,901

1920

1022

38,266,672

246,604,458

309,707,591

1921

987

34,705,961

210,627,624

268,017,163

1922

955

33,244,250

231,582,121

285,249,243

1923

937

32,883,200

237,552,204

284,897,103

1924

920

32,814,742

262,132,117

310,734,386

1925

879

30,767,239

272,564,233

320,826,854

1926

837

30,288,177

267,390,928

313,407,077

1927

855

29,212,913

266,707,861

310,318,622

1928

726

27,976,756

244,660,162

284,070,749

1929

647

25,875,885

187,394,417

222,769,134

1930

580

23,487,536

138,105,586

167,722,915

1931

472

16,727,262

86,421,090

109,621,464

1932

430

15,140,042

62,867,165

84,517,404

1933

381

14,298,072

57,563,987

72,505,998

1934

309

11,324,328

66,540,391

78,269,301

1935

302

11,307,447

69,116,798

80,831,084

1936

301

11,809,016

74,919,950

87,084,090

1937

296

11,466,639

69,261,285

81,639,898

1938

293

11,621,199

65,573,363

78,140,675

1939

288

12,143,888

69,971,473

81,196,369

1940

284

12,339,843

77,092,644

89,525,065

1941

285

12,884,569

84,936,767

99,040,764

Historical Data – State-Chartered Commercial Banks

Historical Data - - State-Chartered Commercial Banks

www.ndbf.ne.gov 2010 NDB&F Annual Report

19

Year

In

Operation

Total Capital

And Reserves

Total

Deposits

Total

Assets

1942

273

$13,224,408

$134,614,352

$147,895,224

1943

275

14,271,379

195,819,709

210,153,432

1944

278

15,439,463

232,311,061

248,027,844

1945

279

16,330,905

261,960,097

278,379,583

1946

282

18,007,659

334,006,685

352,474,541

1947

282

19,839,672

374,999,948

395,523,900

1948

283

21,741,533

367,447,421

389,682,165

1949

283

24,092,119

354,590,644

379,227,765

1950

287

26,510,366

352,452,505

379,771,197

1951

288

28,772,019

375,394,337

404,909,136

1952

287

30,140,895

392,552,248

425,581,807

1953

289

32,934,902

411,170,139

447,965,252

1954

290

37,042,727

414,773,669

453,268,269

1955

292

39,647,391

408,991,675

451,091,638

1956

293

42,536,145

390,189,854

434,790,998

1957

292

44,944,995

394,979,382

443,503,815

1958

293

48,447,514

415,986,871

467,411,647

1959

295

51,525,789

471,421,079

526,906,743

1960

299

56,723,400

465,951,000

528,210,800

1961

300

60,069,000

500,059,000

564,145,000

1962

301

65,255,000

548,373,000

618,917,000

1963

300

68,980,000

601,454,000

679,710,000

1964

303

77,105,000

654,189,000

741,548,000

1965

304

79,705,803

665,398,095

755,454,341

1966

305

85,584,536

724,470,433

821,238,073

1967

308

92,030,994

791,340,315

893,556,155

1968

308

99,159,681

895,981,916

1,007,600,518

1969

311

109,021,675

1,042,536,046

1,176,376,874

1970

312

121,707,930

1,121,140,134

1,275,660,872

1971

312

134,227,083

1,296,993,158

1,465,787,359

1972

316

151,449,647

1,477,030,337

1,673,205,709

1973

322

171,160,456

1,792,977,624

2,015,843,534

1974

324

196,611,779

2,018,984,528

2,341,434,558

1975

328

221,199,058

2,314,527,530

2,604,661,952

1976

329

250,786,000

2,553,728,000

2,844,966,000

1977

322

280,084,000

2,781,804,000

3,122,977,000

1978

335

313,575,000

3,191,859,000

3,550,011,000

1979

336

353,489,000

3,462,379,000

3,895,422,000

1980

340

406,851,000

3,774,973,000

4,268,013,000

1981

340

457,124,000

4,238,958,000

4,817,262,000

1982

340

504,329,000

4,679,017,000

5,366,954,000

1983

340

554,134,000

5,221,468,000

5,905,803,000

1984

340

591,872,000

5,579,833,000

6,337,343,000

1985

332

602,369,000

5,767,917,000

6,519,664,000

Historical Data – State-Chartered Commercial Banks (continued)

Historical Data - - State-Chartered Commercial Banks (continued)

20

www.ndbf.ne.gov 2010 NDB&F Annual Report

Year

In

Operation

Total Capital

And Reserves

Total

Deposits

Total

Assets

1986

316

$587,630,000

$5,836,576,000

$6,553,386,000

1987

311

593,326,000

5,948,616,000

6,689,535,000

1988

299

633,724,000

6,155,482,000

6,941,344,000

1989

294

673,878,000

6,413,373,000

7,246,867,000

1990

278

719,166,000

6,850,454,000

7,740,897,000

1991

281

775,507,000

7,516,829,000

8,511,052,000

1992

274

835,334,000

7,860,795,000

8,920,189,000

1993

258

871,730,000

8,024,940,000

9,117,993,000

1994

253

900,979,000

8,066,120,000

9,301,831,000

1995

239

997,652,000

8,423,851,000

9,752,609,000

1996

234

1,026,867,000

8,705,436,000

10,100,663,000

1997

229

1,086,698,000

9,238,326,000

10,804,157,000

1998

225

1,110,796,000

9,453,453,000

11,114,113,000

1999

216

1,141,079,000

9,795,909,000

11,670,911,000

2000

204

1,219,339,000

10,542,428,000

12,811,435,000

2001

198

1,340,662,000

11,273,003,000

13,730,070,000

2002

196

1,422,794,000

11,815,637,000

14,486,025,000

2003

192

1,568,094,000

12,933,354,000

15,878,215,000

2004

188

1,869,032,000

13,302,372,000

16,662,927,000

2005

184

1,972,713,000

13,375,402,000

16,859,175,000

2006

187

2,034,579,000

14,142,596,000

17,785,286,000

2007

187

2,168,497,000

14,761,492,000

18,508,808,000

2008

182

2,336,058,000

15,939,780,000

20,141,454,000

2009

180

2,567,620,000

18,175,089,000

22,570,676,000

2010

178

$2,617,873,000

$19,462,038,000

$26,080,785,000

Historical Data – State-Chartered Commercial Banks (continued)

Historical Data - - State Chartered Commercial Banks (continued)

www.ndbf.ne.gov 2010 NDB&F Annual Report

21

Registered Bank Holding Companies (for the period ending June 30, 2010)

Registered Bank Holding Companies (continued)

Bank Holding Companies

Bank Holding Companies

Owned by Holding Companies

Cabela's Ventures, Inc. - Sidney, NE

Cabela's Lodging, LLC - Sidney, NE

Great Wolf Lodge of KC, LLC - Sidney, NE

Three Corners, LLC - Sidney, NE

Cabela's Wholesale - Sidney, NE

TS Manufacturing, LLC

Cabelas.com, Inc.

Van Dyke Supply Co. - Sidney, NE

Legacy Trading Company

Original Creations - Sidney, NE

World's Foremost Bank - Sidney, NE

Campbell State Company - Campbell, NE

South Central State Bank - Campbell, NE

Carleton Agency, Inc. - Carleton, NE

Citizens State Bank - Carleton, NE

Cass County State Company - Plattsmouth, NE

Cass County Bank, Inc. - Plattsmouth, NE

Cattle Crossing, Inc. - Seward, NE

The Cattle National Bank & Trust Company - Seward, NE

Cedar Bancorp. - Hartington, NE

Bank of Hartington - Hartington, NE

Cedar Financial Holding, Inc. - Fordyce, NE

Cedar Security Bank - Fordyce, NE

Cedar Rapids State Company - Cedar Rapids, NE

Cedar Rapids State Bank - Cedar Rapids, NE

Central Bancshares, Inc. - Cambridge, NE

First Central Bank McCook - McCook, NE

First Central Bank - Cambridge, NE

Ceresco Bancorp - Ceresco, NE

CerescoBank - Ceresco, NE

Chambanco, Inc. - Chambers, NE

Chambers State Bank - Chambers, NE

Ewing Agency, Inc. - Chambers, NE

Farmers State Bank - Ewing, NE

Chester Insurance Agency, Inc. - Chester, NE

State Bank of Chester - Chester, NE

Citizens National Corporation - Wisner, NE

Citizens National Bank - Arlington, KS

Citizens State Bank - Wisner, NE

Republic Corporation - Omaha, NE

United Republic Bank - Omaha, NE

City National Bancshares, Inc. - Greeley, NE

The City National Bank of Greeley - Greeley, NE

Clark Bancshares, Inc. - Clarks, NE

Bank of Clarks - Clarks, NE

Clarkson Management Company - Clarkson, NE

Clarkson Bank - Clarkson, NE

CLC Enterprises, Inc. - Nelson, NE

Commercial Bank - Nelson, NE

Commerce Bancshares, Inc. - Kansas City, MO

Commerce Bank, National Association - Omaha, NE

Commercial Investment Company, Inc. - Ainsworth, NE

Commercial National Bank - Ainsworth, NE

Commercial State Holding Company, Inc. - Republican City, NE

Commercial State Bank - Republican City, NE

COMMfirst Bancorporation, Inc. - South Sioux City, NE

Iowa-Nebraska State Bank - South Sioux City, NE

Bank Holding Companies

Owned by Holding Companies

304 Corporation - Omaha, NE

Mid City Bank, Inc. - Omaha, NE

3MV Bancorp, Inc. - Omaha, NE

Access Bank - Omaha, NE

Adbanc, Inc. - Ogallala, NE

Adams Bank & Trust - Ogallala, NE

Ambage, Inc. - Las Vegas, NV

First National Bank and Trust Company - Falls City, NE

American Banc Corporation - Fremont, NE

American National Bank of Fremont - Fremont, NE

American Exchange Company - Elmwood, NE

American Exchange Bank - Elmwood, NE

American Interstate Bancorp., Inc. - Omaha, NE

American Interstate Bank - Elkhorn, NE

American National Corporation - Omaha, NE

American National Bank - Omaha, NE

AmeriGroup, Inc. - Hershey, NE

Hershey State Bank - Hershey, NE

AmeriWest Corporation - Omaha, NE

First Westroads Bank, Inc. - Omaha, NE

Antelope Bancshares, Inc. - Elgin, NE

Bank of Elgin - Elgin, NE

Arlington State Banc Holding Company - Blair, NE

Two Rivers Bank - Blair, NE

Armstrong Financial Company - Minden, NE

Minden Exchange Company - Minden, NE

Minden Exchange Bank & Trust Company - Minden ,NE

Arsebeco, Inc - Falls City, NE

Richardson County Bank & Trust Company - Falls City, NE

Ashland Bancshares, Inc. - Omaha, NE

Centennial Bank - Omaha, NE

Bancook Corporation - Cook, NE

Farmers Bank of Cook - Cook, NE

Bank Management, Inc. - Wahoo, NE

The First National Bank of Wahoo - Wahoo, NE

Banner County Ban Corporation - Harrisburg, NE

Banner County Bank, Inc. - Harrisburg, NE

Battle Creek State Company - Battle Creek, NE

Battle Creek State Bank - Battle Creek, NE

BBJ, Incorporated - Ord, NE

First National Bank in Ord - Ord, NE

Bellwood Community Holding Company - Bellwood, NE

Bank of the Valley - Bellwood, NE

Bradley Bancorp. - Columbus, NE

Columbus Bank & Trust Company - Columbus, NE

Bruning Bancshares, Inc. - Bruning, NE

Bruning State Bank - Bruning, NE

BSB Bancshares, Inc. - Brunswick, NE

Brunswick State Bank - Brunswick, NE

Butte State Co. - Butte, NE

Butte State Bank - Butte, NE

Byron State Inc. - Byron, NE

Byron State Bank - Byron, NE

C.S.B. Co. - Cozad, NE

First National Bank - Chadron, NE

Homestead Bank - Cozad, NE

Cabela's Incorporated - Sidney, NE

World's Foremost Bank - Sidney, NE

Campbell State Company - Campbell, NE

South Central State Bank - Campbell, NE

Carleton Agency, Inc. - Carleton, NE

Citizens State Bank - Carleton, NE

Cass County State Company - Plattsmouth, NE

Cass County Bank, Inc. - Plattsmouth, NE

Cattle Crossing, Inc. - Seward, NE

The Cattle National Bank & Trust Company - Seward, NE

Cedar Bancorp. - Hartington, NE

Bank of Hartington - Hartington, NE

Cedar Financial Holding, Inc. - Fordyce, NE

Cedar Security Bank - Fordyce, NE

Cedar Rapids State Company - Cedar Rapids, NE

Cedar Rapids State Bank - Cedar Rapids, NE

Central Bancshares, Inc. - Cambridge, NE

First Central Bank McCook - McCook, NE

First Central Bank - Cambridge, NE

BANK HOLDING COMPAINES

OWNED BY HOLDING COMPANIES

Registered Bank Holding Companies (for the period ending June 30, 2010)

Indentation implies some ownership. Banks are italicized.

22

www.ndbf.ne.gov 2010 NDB&F Annual Report

CLC Enterprises, Inc. - Nelson, NE

Bank Holding Companies

Owned by Holding Companies

Ceresco Bancorp, Inc. - Ceresco, NE

CerescoBank - Ceresco, NE

Chambanco, Inc. - Chambers, NE

Chambers State Bank - Chambers, NE

Ewing Agency, Inc. - Chambers, NE

Farmers State Bank - Ewing, NE

Chester Insurance Agency, Inc. - Chester, NE

State Bank of Chester - Chester, NE

Citizens National Corporation - Wisner, NE

Citizens National Bank - Arlington, KS

Citizens State Bank - Wisner, NE

Republic Corporation - Omaha, NE

United Republic Bank - Omaha, NE

City National Bancshares, Inc. - Greeley, NE

CNB Community Bank - Greeley, NE

Clark Bancshares, Inc. - Clarks, NE

Bank of Clarks - Clarks, NE

Clarkson Management Company - Clarkson, NE

Clarkson Bank - Clarkson, NE

CLC Enterprises, Inc. - Nelson, NE

Commercial Bank - Nelson, NE

Commercial Investment Co., Inc. - Ainsworth, NE

The Commercial National Bank of Ainsworth - Ainsworth, NE

Commercial State Holding Company, Inc. - Republican City, NE

Commercial State Bank - Republican City, NE

COMMfirst Bancorporation, Inc. - South Sioux City, NE

Iowa-Nebraska State Bank - South Sioux City, NE

Cornhusker Growth Corporation - Lincoln, NE

Cornhusker Bank - Lincoln, NE

Johnstown Charter Bank - Johnstown, IA

Country Bank Shares, Inc. - Milford, NE

Farmers and Merchants Bank - Milford, NE

Curtis Bancorporation, Inc. - Curtis, NE

Curtis State Bank - Curtis, NE

Doniphan Bancshares, Inc. - Doniphan, NE

Bank of Doniphan - Doniphan, NE

DS Holding Company, Inc. - Omaha, NE

DB Holding Company, Inc. - , NE

Omaha State Bank - Omaha, NE

Duroc Investment Company - Table Rock, NE

State Bank of Table Rock - Table Rock, NE

Eagle Capital Co. - Eagle, NE

Eagle State Bank - Eagle, NE

Eberly Investment Company - Stanton, NE

Stanton State Bank - Stanton, NE

Enevoldsen Limited Partnership - Potter, NE

Enevoldsen Management Company - Potter, NE

The Potter State Bank of Potter - Potter, NE

Enterprise Holding Company - Omaha, NE

Enterprise Bank NA - Omaha, NE

Exchange Company - Grand Island, NE

Exchange Bank - Gibbon, NE

First National Bank &Trust Company of Junction -

Junction City, KS

Nebraska National Bank - Kearney, NE

Fairmont Farmers State Company - Fairmont, NE

Farmers State Bank - Fairmont, NE

Farm & Home Insurance Agency, Inc. - Lyons, NE

First National Bank Northeast - Lyons, NE

Farmers & Merchants Financial Corporation - Ashland, NE

Farmers and Merchants Bank of Ashland - Ashland, NE

Registered Bank Holding Companies (continued)

Indentation implies some ownership. Banks are italicized.

www.ndbf.ne.gov 2010 NDB&F Annual Report

23

Bank Holding Companies

Owned by Holding Companies

Farmers & Merchants Investment, Inc - Lincoln, NE

Union Bank and Trust Company - Lincoln, NE

Farmers BancShares, Inc. - Nebraska City, NE

Farmers Bank and Trust Company - Nebraska City, NE

Farmers State Investment Company - Dodge, NE

Farmers State Bank - Dodge, NE

FEO Investments, Inc. - Hoskins, NE

Elkhorn Valley Bank & Trust - Norfolk, NE

Financial Bancshares, Inc. - LaVista, NE

Bank of Nebraska - LaVista, NE

First Beemer Corporation - Beemer, NE

First Community Bank - Beemer, NE

First Central Nebraska Company - Broken Bow, NE

Nebraska State Bank and Trust Company - Broken Bow, NE

First Express of Nebraska, Inc. - Gering, NE

Valley Bank and Trust Co. - Scottsbluff, NE

First Holdrege Bancshares, Inc. - Holdrege, NE

First National Bank of Holdrege - Holdrege, NE

First Kenesaw Company, Inc. - Kenesaw, NE

Adams County Bank - Kenesaw, NE

First Laurel Security Company - Laurel, NE

Security National Bank - Laurel, NE

First National Agency, Inc. - Wayne, NE

First National Bank - Wayne, NE

First National Fairbury Corporation - Fairbury, NE

First National Bank - Fairbury, NE

First National Johnson Bancshares, Inc. - Johnson, NE

First National Bank - Johnson, NE

First National Utica Company - Utica, NE

First Bank of Utica - Utica, NE

First Nebraska Bancs, Inc. - Sidney, NE

First National Bank of Sidney - Sidney, NE

Points West Community Bank - Julesburg, CO

First Newman Grove Bankshares Corp. - Newman Grove, NE

Bank of Newman Grove - Newman Grove, NE

First State Bancorp., Inc. - Randolph, NE

First State Bank - Randolph, NE

First State Bancshares, Inc. - Scottsbluff, NE

First State Bank - Scottsbluff, NE

Security First Bank - Cheyenne, WY

First State Fremont, Inc. - Fremont, NE

First State Bank & Trust Company - Fremont, NE

First York Ban Corp. - York, NE

Cornerstone Bank - York, NE

Firstand Co. - Hordville, NE

First State Bank - Hordville, NE

Firstier II Bancorp - Cheyenne, WY

FirsTier Bank - Kimball, NE

FM Co. - Milligan, NE

Farmers and Merchants Bank - Milligan, NE

FNB Financial Services, Inc - Cambridge, NE

First National Bank - Cambridge, NE

FNS, Inc. - Schuyler, NE

First National Bank - Schuyler, NE

Foundation First Corporation - Omaha, NE

Foundation First Bank - Waterloo, NE

Franklin State Bancshares, Inc. - Franklin, NE

Franklin State Bank - Franklin, NE

Frontier Holdings, LLC - Omaha, NE

Frontier Bank - Davenport, NE

Frontier Bank - Madison, NE

Pender State Bank - Pender, NE

Geneva State Company - Geneva, NE

Geneva State Bank - Geneva, NE

Graff Family, Inc. - McCook, NE

MNB Financial Group, Inc. - McCook, NE

McCook National Bank - McCook, NE

Great Western Bancorporation, Inc. - Omaha, NE

Great Western Bank - Sioux Falls, SD

Hassenstab Management Company, Inc. - Humphrey, NE

Farmers State Bank - Humphrey, NE

Hastings Bancorp, Inc. - Hastings, NE

Hastings State Bank - Hastings, NE

Henderson State Company - Henderson, NE

Henderson State Bank - Henderson, NE

Heritage Group, Inc. - Aurora, NE

Heritage Bank – Wood River, NE

Hildreth State Company, Inc. - Hildreth, NE

The State Bank of Hildreth - Hildreth, NE

Hilltop Bancshares, Inc. - Bennington, NE

Bank of Bennington - Bennington, NE

Hohl Financial, Inc. - Wahoo, NE

Wahoo State Bank - Wahoo, NE

Indentation implies some ownership. Banks are italicized.

Registered Bank Holding Companies (continued)

Registered Bank Holding Companies (continued)

Indentation implies some ownership. Banks are italicized.

24

www.ndbf.ne.gov 2010 NDB&F Annual Report

Bank Holding Companies

Owned by Holding Companies

Hometown Banc Corporation - Grand Island, NE

Five Points Bank of Hastings - Hastings, NE

Five Points Bank - Grand Island, NE

Howard County Land & Cattle Company - Spearfish, SD

Citizens Bank & Trust Company in St. Paul - St. Paul, NE

Isham Management Company - Gordon, NE

First National Bank - Gordon, NE

JDJ Banco, Inc. - Lynch, NE

Nebraska State Bank - Lynch, NE

Jefferson County Bancshares, Inc. - Daykin, NE

Jefferson County Bank - Daykin, NE

Jones National Corporation - Seward, NE

The Jones National Bank and Trust Company of S - Seward, NE

Keystone Investment, Inc. - Keystone, NE

Bank of Keystone - Keystone, NE

Kingsbury BDC Financial Services, Inc. - Ponca, NE

Bank of Dixon County - Ponca, NE

Korell Family Limited Partnership - McCook, NE

AmFirst Financial Services,Inc.-McCook, NE

Amfirst Bank, National Association - McCook, NE

Lauritzen Corporation - Omaha, NE

First National of Nebraska, Inc. - Omaha, NE

First National Bank & Trust Company of Columbus –

Columbus, NE

First National Bank of Kansas - Overland Park, KS

First National Bank of Omaha - Omaha, NE

First National Bank of South Dakota - Yankton, SD

First National Bank - North Platte, NE

First National of Colorado, Inc. - Fort Collins, CO

First National Bank - Fort Collins, CO

First National of Illinois, Inc. - Omaha, NE

Castle Bank, National Association-Dekalb, IL

Platte Valley State Bank & Trust Company -

Kearney,NE

The Fremont National Bank &Trust Company -

Fremont, NE

Houghton State Bank - Red Oak, IA

Shelby County State Bank - Harlan, IA

Washington County Bank - Blair, NE

York State Bank and Trust Company - York, NE

Lauritzen Investments Incorporated - Omaha, NE

Farmers and Merchants State Bank - Bloomfield, NE

Lewellen National Corp. - Lewellen, NE

Bank of Lewellen - Lewellen, NE

Lindsay State Company - Lindsay, NE

Bank of Lindsay - Lindsay, NE

Lisco State Company - Lisco, NE

Lisco State Bank - Lisco, NE

Loomis Company - Omaha, NE

First State Bank - Loomis, NE

Louisville Company - Louisville, NE

Home State Bank - Louisville, NE

Loup Valley Bancshares, Inc. - North Loup, NE

North Loup Valley Bank - North Loup, NE

Mackey BanCo, Inc. - Ansley, NE

Security State Bank - Ansley, NE

Malmo Bancorp., Inc. - Malmo, NE

Security Home Bank - Malmo, NE

Marquette National Company - Marquette, NE

Bank of Marquette - Marquette, NE

McCabe Investments, Inc. - Exeter, NE

First National Bank in Exeter - Exeter, NE

McHugh Investment Co. - Murdock, NE

Corn Growers State Bank - Murdock, NE

Midwest Banc Holding Co. - Pierce, NE

Midwest Bank, NA - Pierce, NE

Midwest Banco Corporation - Cozad, NE

First Bank and Trust Company - Cozad, NE

Indentation implies some ownership. Banks are italicized.

Registered Bank Holding Companies (continued)

Indentation implies some ownership. Banks are italicized.

Registered Bank Holding Companies (continued)

Registered Bank Holding Companies (continued)

Indentation implies some ownership. Banks are italicized.

www.ndbf.ne.gov 2010 NDB&F Annual Report

25

Bank Holding Companies

Owned by Holding Companies

Midwest Independent Bancshares, Inc. - Jefferson City, MO

Nebraska Bankers' Bank - Lincoln, NE

NationWide BancShares, Inc. - West Point, NE

Charter West National Bank - West Point, NE

Nebanco, Inc. - Wallace, NE

American Mortgage Company - North Platte, NE

Farmers State Bank - Wallace, NE

Nebraska Bankshares, Inc. - Farnam, NE

First Gothenburg Bancshares, Inc. - Gothenburg, NE

First State Bank - Gothenburg, NE

First State Bank - Farnam, NE

NebraskaLand Financial Services, Inc. - North Platte, NE

NebraskaLand National Bank - North Platte, NE

O & F Cattle Company - Oshkosh, NE

Nebraska State Bank - Oshkosh, NE

Oakland Financial Services, Inc. - Oakland, IA

Arbor Bank - Nebraska City, NE

First Community Bank - Sidney, IA

Southwest Company Investments, LLC - , IA

Orchard Bancorp - Orchard, NE

Bank of Orchard - Orchard, NE

Pathway Bancorp. - Cairo, NE

Pathway Bank - Cairo, NE

Peoples Bancorp. - Red Cloud, NE

Peoples-Webster County Bank - Red Cloud, NE

Pinnacle Bancorp, Inc. - Central City, NE

Bank of Colorado - Fort Collins, CO

Pinnacle Bank - Keene, TX

Pinnacle Bank - Wyoming - Torrington, WY

Pinnacle Bank - Lincoln, NE

Platte Valley Bancorp, Inc - North Bend, NE

Platte Valley Bank - North Bend, NE

Platte Valley Cattle Company - Grand Island, NE

Town & Country Bank - Ravenna, NE

Platte Valley Financial Service Companies, Inc - Scottsbluff, NE

Platte Valley Bank - Scottsbluff, NE

Platte Valley Bank - Torrington, WY

Tri County Bank - Cheyenne, WY

Prague Company - Omaha, NE

Bank of Prague - Prague, NE

Rae Valley Financials, Inc. - Petersburg, NE

Petersburg State Bank - Petersburg, NE

Riverdale Bancshares, Inc. - Riverdale, NE

State Bank of Riverdale - Riverdale, NE

S & S Investment Company, Inc. - Odell, NE

State Bank of Odell - Odell, NE

Sandhills Financial Services, LLC - Fremont, NE

Sandhills State Bank - Bassett, NE

Schneider Bancorporation - Plattsmouth, NE

Plattsmouth State Bank - Plattsmouth, NE

Scribner Banshares, Inc. - Scribner, NE

Scribner Bank - Scribner, NE

Security National Corporation - Omaha, NE

Security National Bank of Omaha - Omaha, NE

Selko Banco, Inc. - Mead, NE

Bank of Mead - Mead, NE

Shelton Enterprises, Inc. - Shelton, NE

First State Bank - Shelton, NE

Siouxland National Corporation - South Sioux City, NE

Siouxland National Bank - South Sioux City, NE

Southwick Bancorp - Friend, NE