SPREAD WITH 0.125” BLEED

Consumer Financial

Protection Bureau

May 2019

YOUR MONEY, YOUR GOALS

Focus on Native

Communities

A companion guide to assist tribal

staff and organizations in their work

with community members.

WHAT’S INSIDE? 2

What’s inside?

Introduction ......................................................3

Native Communities and nancial empowerment .....................7

Cultural and emotional inuences on nancial decision making .........9

Using Your Money, Your Goals in Native Communities..................11

Modules: Your Money, Your Goals for Native Communities .............21

Module 1: Setting Goals ...............................................21

Tool: Using values to set goals ......................................24

Module 2: Saving .....................................................28

Tool: Saving and asset limits in Native communities ....................31

.................................34

Tool: Making the most of the IIM.....................................38

Module 4: Paying Bills . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

Module 5: Getting through the Month...................................44

Tool: Annual planner ...............................................46

Module 6: Dealing with Debt...........................................50

Module 7: Understanding Credit Reports and Scores .....................52

Module 8: Choosing Financial Products and Services......................54

Module 9: Protecting your Money.......................................57

Module 10: Financial Empowerment and Elders ..........................59

...........................63

..................66

...........................68

INTRODUCTION 3

Introduction

Focus on Native Communities provides information and

tools to help you meaningfully connect Your Money, Your

Goals to the community members you serve.

The Consumer Financial Protection Bureau (CFPB) is a 21st century agency that helps

consumers to take more control over their economic lives. The CFPB seeks to

Your Money, Your Goals is part of that work. The CFPB launched Your Money, Your

Goals

volunteers in organizations that work with low-income and economically vulnerable

Your Money, Your Goals has been used in nearly

This companion guide —Focus on Native Communities

Communities. Its goal is to meaningfully connect the content and tools in Your Money,

Your Goals to the Native Communities in which you live and work.

The CFPB designed Your Money, Your Goals

community decides how to use Your Money, Your Goals. You can use the entire

serve members of your community. You can also choose to use the program’s issue-

focused booklets and companion guides alone or in combination with the toolkit.

4 FOCUS ON NATIVE COMMUNITIES

Creation of Your Money, Your Goals

thinking about how it could reach the millions of people in this country with low

Its staff saw an opportunity to provide empowering information and tools that

they serve.

Your Money, Your Goals toolkit, user guides, and training materials are

available at consumernance.gov/your-money-your-goals.

To ensure Your Money, Your Goals

in more than two dozen organizations and communities in 2013. Native American

SD trained tribal housing staff and local small business counselors to use the toolkit.

In 2014-2015 a national rollout began taking Your Money, Your Goals to scale. The

thousands of frontline staff and volunteers across the country to use Your Money,

Your Goals. Tribal leaders incorporated traditional practices and storytelling into

the training they offered to tribal and local social and human services staff and at a

national conference.

to share additional information that could assist other Native Communities in

implementing Your Money, Your Goals:

•

Citizen Potawatomi Nation

•

Chippewa Cree Tribe

•

Confederated Tribes of the Colville Reservation

•

Sault Ste. Marie Tribe of Chippewa Indians

•

Seminole Tribe of Florida

•

•

The American Indian Center at the University of North Carolina at Chapel Hill

INTRODUCTION 5

Outcomes of

Your Money, Your Goals

Your Money, Your Goals

helping them:

•

Set goals based on their values.

•

Make plans to reach their goals.

•

•

Get rid of debt.

•

•

•

have been violated.

•

Your Money, Your Goals

by supporting efforts to ensure that:

•

obligations and contribute to the community.

•

Community members are able to make informed decisions about protecting

and growing community assets.

•

•

Community members are able to make informed decisions about balancing

Your

Money, Your Goals they can use as they work toward that goal.

6 FOCUS ON NATIVE COMMUNITIES

Thank you for considering using the Your Money, Your Goals toolkit for your

community. This guide includes the following sections to help you adapt its

content to effectively empower your members and communities:

•

•

•

Using Your Money, Your Goals in Native Communities.

•

Your Money, Your Goals

covered in each module as well as supplemental tools specially designed for use

in Native Communities.

•

NATIVE COMMUNITIES AND FINANCIAL EMPOWERMENT 7

Native Communities and

Financial empowerment ensures people have unbiased

increase self-determination and reach their goals.

Your Money, Your Goals

Your Money, Your Goals

empowerment and the concept of a toolkit.

to build skills. This is the groundwork that equips them to make informed choices

Financial empowerment is about ensuring people know how to see the advantages

reach their goals.

you can better help people in your community face their money issues. You can

8 FOCUS ON NATIVE COMMUNITIES

The Your Money, Your Goals toolkit is designed to do just that—help you enhance

your own knowledge and skills so you can help people in your community.

What is a toolkit?

A toolkit is different from a curriculum. A curriculum helps you learn about a set of

A toolkit has information and tools that can be used in any order based on the

to get the job done.

When you use Your Money, Your Goals, the tool or tools you use will depend on

the issue you’re addressing. You will be equipped with tools to help understand

that moment in their lives. That is the way Your Money, Your Goals can help build

empowerment and self-determination.

CULTURAL AND EMOTIONAL INFLUENCES ON FINANCIAL DECISION MAKING 9

Cultural and emotional

decision making

Financial empowerment can connect traditions of

Your Money, Your Goals includes information for users about the cultural and

. This discussion can take on

even more importance in Native communities where traditional community values

individuals based

American value of viewing assets and resources as shared or communal. This may

understanding that “whatever is mine is yours.”

monthly payment for his car or truck. While this does not mean the person will

and may cost more. It can even affect a person’s ability to get a job.

resource to steward

10 FOCUS ON NATIVE COMMUNITIES

tools can help everyone in the community learn to better steward this resource.

Native Communities have traditions of living in sustainable balance with their

surroundings—a value and skill admired by cultures throughout the world. To

sustainable balance between the needs of today and the needs of tomorrow.

take root. When community members learn to more effectively navigate and use

knowledge and develop these skills. They may be able to contribute their time and

resources more readily because they have taken care of their individual and family

future you’ve envisioned. It is a resource that can provide for community and family

needs today and security and stability for the months and years ahead. If it is well-

USING YOUR MONEY, YOUR GOALS IN NATIVE COMMUNITIES 11

Using Your Money,

Your Goals

in Native

Communities

Your Money, Your Goals can be used in one-on-one

or group settings to provide nancial empowerment

information and tools for anyone in the community.

There are two audiences for Your Money, Your Goals:

•

Case managers, frontline staff, and volunteers in tribal social services or other

government agencies who want to help nancially empower the people they

serve or strengthen their own nancial skills, and

•

Community members that may want or need nancial empowerment

information, skill-building opportunities, and tools.

This guide—Your Money, Your Goals: Focus on Native Communities—complements

the Your Money, Your Goals toolkit. You can use this guide as a primary resource for

working with Native communities and supplement it with the full Your Money, Your

Goals toolkit when you need additional information and tools.

The Your Money, Your Goals toolkit begins with an introduction. This introduction

is for you—the frontline staff members, volunteers, or other individuals who provide

services to Native communities. This information will provide you with a better

understanding of the goals of nancial empowerment and can help you prepare to

use the toolkit.

12 FOCUS ON NATIVE COMMUNITIES

Your Money, Your Goals toolkit has nine content

modules. This guide aligns with the nine modules in the toolkit. It describes each

and elders. The content modules are:

•

Module 1: Setting Goals

•

Module 2: Saving

•

•

Module 4: Paying Bills

•

Module 5: Getting through the Month

•

Module 6: Dealing with Debt

•

Module 7: Understanding Credit Reports and Scores

•

Module 8: Choosing Financial Products and Services

•

Module 9: Protecting your Money

Additionally in this guide

•

Module 10: Financial Empowerment and Elders

Your Money, Your Goals

in one-on-one or group settings

The CFPB designed Your Money, Your Goals to be used in one-on-one settings or

Your Money, Your Goals can support:

•

A tribal social service staff member providing case management to individuals

in the community.

•

An elder mentoring a young adult in the community.

•

A Native Community Development Financial Institution (CDFI) staff member

small business owner.

•

13

Using the toolkit in a one-on-one setting allows staff and volunteers in tribal and

needs of each person or family. Using Tool 1: My Money Picture in Introduction

information and tools are the right starting points. Your Money, Your Goals also

includes tips for starting the money conversation.

Your Money, Your Goals can also be used with small groups or as part of training.

You may be able to use the toolkit in a group-based setting at:

•

Community or organizational meetings

•

Brown bag lunches or a lunch-and-learn series

•

Other community training events

•

Tribal gatherings

Your

Money, Your Goals may be a complementary resource. The toolkit can be used

you can use the Your Money, Your Goals training PowerPoint slide deck.

Participatory activities are included for each module to help make group sessions

Integrating Your Money, Your Goals

The CFPB created Your Money, Your Goals

not to be an add-on program. This means that staff and community volunteers

the work they are already doing with clients and community members.

14 FOCUS ON NATIVE COMMUNITIES

The strongest integration strategies start with the end user in mind:

1. Who will use the toolkit? Who will they use the toolkit with?

2. How will they use the toolkit?

3. What outcomes do you want to achieve though the use of the

4. What content in the toolkit is most important to achieving

these outcomes?

the most strategic points of integration for Your Money, Your Goals. Case

provide these services in your community.

Getting support for Your Money,

Your Goals in your community

By observing organizations that are using Your Money, Your Goals

in from community and tribal leaders.

Each community and organization is unique. You and your organization know the

leadership structure and how decisions are made and implemented. As you invest

Your Money, Your

Goals

15

Implementing Your Money, Your

Goals

in Native Communities

If you decide that you want to implement Your Money, Your Goals in your

consumernance.gov/your-money-your-goals.

The Implementation guide and Creating a referral guide are also downloadable

you can download the PowerPoint training presentation. Simply click on the links on

this page of the CFPB’s website and save them to your computer or print them.

You can also order hardcopy toolkits free of charge online at promotions.usa.gov/

cfpbnemp.html

1.5-inch binders for the toolkits

1

.

Once you have the resources you need to implement Your Money, Your Goals,

consider the following steps to bring the use of the toolkit to your community.

Identify a trainer and provide Your Money, Your

Goals materials

Find a trainer or trainers to facilitate workshops for the staff members and

Your Money, Your

Goals team at YourMoneyYourGoals@consumernance.gov.

16 FOCUS ON NATIVE COMMUNITIES

The trainers will need a copy of Your Money, Your Goals and the PowerPoint slide

deck. The PowerPoint deck includes both slides containing the visual aids for

the training and complete training instructions. You’ll nd these instructions for

the trainer in the notes section of the deck. The facilitator instructions include

everything the trainer will need to plan for and facilitate the training, including:

•

Set up instructions including visual aids, training props, and other

important notes.

•

Instructions for group activities.

•

Question prompts for facilitated discussions.

•

Answers to exercises that are a part of the training.

•

Scripted narrative to provide clear and concise denitions and summaries.

Printing the training PowerPoint slide deck

To print out the training PowerPoint slide deck, be sure to select the PPT le

on the Your Money, Your Goals webpage. Do not select the PDF le.

If you are printing this out for yourself (if you are the trainer) or for the trainer,

make sure you select either the “Notes Page” under the “View” command or

select “Notes” in the print function when asked what you want to print.

17

You may also want to provide the trainer with the Implementation Guide. It

includes steps to help trainers think through planning a training workshop. It also

includes tips to gain leadership buy-in. Its “Creating a referral guide” section

referral guide that staff and volunteers can use to connect the people they serve to

You will also want to provide this supplemental guide—Focus on Native

Communties—to the trainer since it provides content and additional tools for Native

Communities that should be included in the training.

Learn and personalize the materials

As a trainer prepares to deliver the Your Money, Your Goals toolkit training to

•

Using the tools within the toolkit in advance to become familiar with how they work.

•

covered locally and culturally relevant. Storytelling can be an especially effective

way to connect community members to the topics in Your Money, Your Goals.

participants in the training to share stories related to information and tools

within each module.

•

Modifying the training slide deck to make it more culturally appropriate.

Consider adding pictures or images that are meaningful in the community

2

.

2

•

would require a full day or day and a half of training. It’s often not possible

for people to take that much time out of their schedules to attend training.

Organizations have found many ways to organize Your Money, Your Goals

training:

•

In a series of lunch-and-learns

•

In two or three half-day sessions

•

In a series of evening sessions

•

During an all-day session on a weekend

2 If you make any additional changes to the content of the training deck other than adding images

all of the slides.

18 FOCUS ON NATIVE COMMUNITIES

be trained. Perhaps they only want or need training on four of the modules. Use

the Implementation Guide’s Training Planning Tool

33

to help develop a clear plan

and agenda for the training.

Get the equipment, supplies, and space needed to host

a training

General supplies

These basic supplies are used in most Your Money, Your Goals trainings:

•

A training space (more information on room set up follows)

•

Computer

•

LCD projector

•

Projection screen or wall

•

Small table for projector and computer

•

•

Easel

•

Flip chart pad

•

Tape

•

Markers for facilitator and participants

•

Copies of the toolkit for each participant

•

Copies of resource and referral list (use the special guide on Creating a referral

guide to develop this resource for the training)

Supplies needed for specic exercises

•

•

•

Envelopes with role play activity roles for groups of 3 and copies of notes sheets

for the observer

•

3 Your Money, Your Goals: An Implementation Guide can be found at les.consumernance.

gov/f/201504_cfpb_ymyg_implementation-guide.pdf.

19

Training assessments

Some organizations choose to use pre- and post-training assessments. These

surveys can help your organization track the number of people you have trained

and understand its impact on participants. If you would like to use CFPB-

consumernance.gov/your-

money-your-goals.

Room set up

Room set up will depend on the space you are able to secure for the training.

arrangements that do not include a table for participants to work on. The training is

meant to encourage small group work and be highly participative and interactive.

Saving on supplies

Getting creative on meeting the needs of your training can help you minimize costs.

•

Use a chalkboard or whiteboard.

•

Use white board cling. This is a roll of whiteboard-like paper that is reusable

when you use dry erase markers. The material itself clings to most walls that are

not covered with fabric.

•

Project a blank PowerPoint slide on the screen and type in responses to

brainstorming type activities.

•

paper waste.

•

Use paper and tape instead of post-it notes.

20 FOCUS ON NATIVE COMMUNITIES

Create a budget

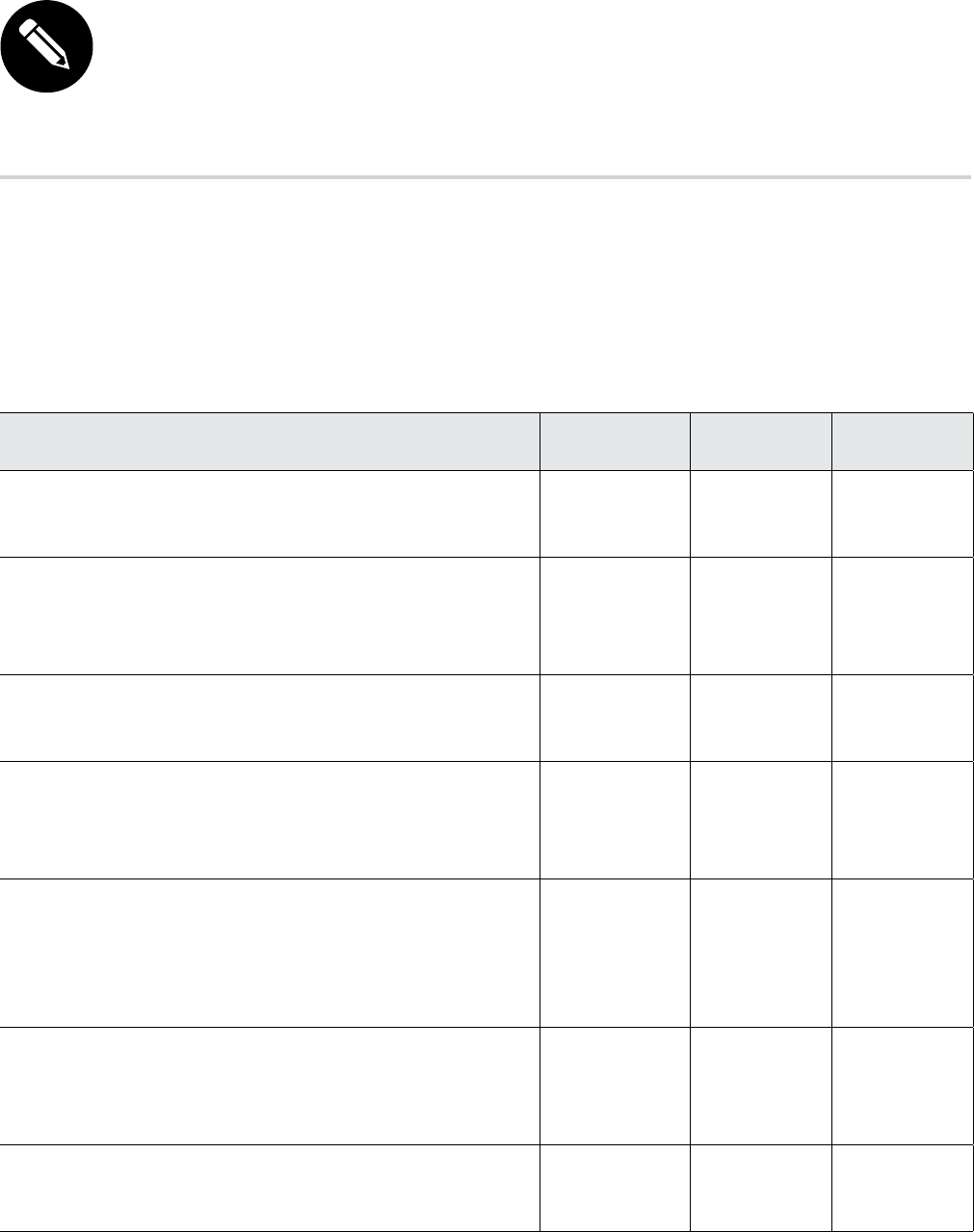

Item Cost Notes

Training location $0

rooms

LCD and

computer

$0 Use organizational equipment or borrow it from

an organization that has one. LCD Projectors can

Easel $0 Borrow or do not use

Flip chart pad $50–$75

for two pads

This will last for 4 - 6 trainings; see options for

Tape $6 - $8/roll A roll of blue painter’s tape will last for 10 or more

trainings

Markers $24–$30 36 markers will last for 10 or more trainings

Large self-

adhesive notes

$10 Pack of three; these will last for up to 3 trainings

Copies of

slides for group

activities

$2.70 total

(Assuming $.05

per copy and 25

participants)

This will vary based on topics chosen and number

of participants. See the instructions for the slides

to copy on slide 1 of the training PowerPoint deck.

Toolkits Order: $0

Photocopy: $12.20/

toolkit (244 pages)

You can order free copies of the toolkit at:

promotions.usa.gov/cfpbnemp.html

Assume a 4–6 week delivery timeframe.

The rate for photocopying assumes $.05/page

cost.

Binder clips $12

Total estimated

costs per training

workshop

$97 to $130

not including the

cost of photocopying

the toolkits

Many of these items will last for multiple trainings.

This can reduce the cost per workshop to $24–$32.

MODULE 1

Setting Goals

setting and achieving goals.

At a glance in the toolkit

Setting SMART goals

Putting goals into action

Planning for life events and large purchases

Revising your goals

Additionally in this guide

Using values to set goals

Overview

Everyone has a different idea of the future they want to build. What do you want to

accomplish in the near future? What do you want for yourself and your family in the

But they don’t just happen on their own. Accomplishing your dreams means

thinking about the money you need to help make them come true.

MODULE 1: SETTING GOALS 21

It’s also important to think about your values, the things that are meaningful to you

and your family. Your values help shape how you prioritize what you do with your

time, energy, and even money. If your goals support your values, you’ll be more

likely to prioritize them, which gives you a greater chance of accomplishing them.

Setting goals along the way is a good strategy to help you achieve your dreams.

Some goals may take a few weeks or months to reach, like saving money to buy

gifts for the holidays or buying a new mattress. These are short-term goals. Others

may take many months or even years to reach, like paying off a large debt. These

are long-term goals.

Focus on Native communities

Setting goals is a foundation for building greater self-determination. When you set

goals about those things in your life that are most important to you, your family,

and your community, they provide direction for how to use your energy and

resources, including your money. Because goals are often based on values, this

guide includes a tool to help people in your community reect on those things that

are most important to them.

This module can help you discuss the importance of goal setting with members of

your community and provide tools to help them understand the value and process

of setting goals.

The information in this module also provides tools to help you discuss anticipating

and planning for life events and large purchases. Life events are circumstances

that many people experience as part of the circle of life, from birth to death. Some

examples are getting a driver’s license and rst job, getting the Individual Indian

Money (IIM)

44

or “18-money,” graduating from high school and possibly a job

training program or college, getting married, having children, dealing with the

death of a family member, and retiring from work.

Large purchases are those things people generally buy once or a few times in their

lives that generally require more money than is available from disposable income.

Examples include automobiles, homes, major appliances, equipment for enterprises

or traditional livelihoods, traditional or cultural dress, or major home repairs. Often

these large purchases or life events are interwoven with people’s goals.

4 IIM (Individual Indian Money) accounts are held in trust and are managed by the Ofce of the

Special Trustee within the U.S. Department of the Interior.

22 FOCUS ON NATIVE COMMUNITIES

Using the tools

YOUR MONEY, YOUR GOALS TOOLKIT

•

Use “Setting SMART goals” to identify goals that will help you plan for and

attain the things that matter most to you

•

Use “Putting goals into action” to create a plan to achieve your goals

•

Use “Planning for life events and large purchases” to help you develop a plan

•

Use the “Revising goals” handout to update or revise goals as needed

FOCUS ON NATIVE COMMUNITIES

•

Consider “Using values to set goals

MODULE 1: SETTING GOALS 23

GETTING STARTED

Using values to set goals

Values provide a foundation for your goals. Understanding

the values that are most important to you can help you

steward your resources in ways that uphold them.

Values are the things that people consider most important in their lives. They can

be individual principles or shared beliefs within a community or culture. Depending

the information and tools on goal-setting and related topics in Module 1 feel more

relevant.

What to do

•

Think about your community’s values. Understanding how traditional and

your money decisions.

•

Identify the ve values that are most important to you. Did any of them surprise

you?

•

List your goals.

A step further

SMART goals” and “Putting goals into action” tools in the Your Money, Your Goals

toolkit.

consumernance.gov/

practitioner-resources/your-money-your-goals/companion-guides.

MODULE 1: SETTING GOALS 24

priorities by Using values to set

goals

1.

2.

your resources.

What are some traditional values shared by the members of your community?

How do these traditional values inuence you?

How do these traditional values inuence your goals?

MODULE 1: SETTING GOALS 25

from 1 to 5. Put a “1” by the value that is most important

and so on.

Comfortable life

Courage

Culture and traditions

Family and clan

Financial security

Freedom

Happiness

Health

Independence

Inner harmony

Leisure time

Living in harmony with nature

Professional achievement

Respect for and from others

Self-determination

Self-respect

Social recognition or status

Looking at community values can provide insight into those forces

that most affect decision-making. Looking at your personal values

can provide insight into how you use your personal resources and

money.

What were your top ve values? Did these surprise you?

What do these values say about you?

26 FOCUS ON NATIVE COMMUNITIES

What are your goals?

Do your goals reect these values?

How do you think these values affect the way you manage your nancial resources?

MODULE 1: SETTING GOALS 27

MODULE 2

Saving

Saving on a regular basis can help you make progress toward

achieving your goals and better handle unexpected expenses

when they come up.

At a glance in the toolkit

This module can help you create a savings plan with weekly targets to help you reach your

goals.

Savings plan

Saving and asset limits

Finding a place for savings

Saving at tax time

Additionally in this guide

Saving and asset limits in Native communities

Overview

Savings is money you set aside today to use in the future. It could be for something you

need in the next few months or even years from now.

MODULE 2: SAVING 28

People save for many reasons:

•

•

•

•

Focus on Native communities

They only hunted or harvested what was needed to live for today so that resources

would continue to be available in the future.

Saving money is based on the same principle: using the amount you need to live for

and saving for the future are compatible values—it’s about balancing your resources.

income today to cover the months when there is little or no work ensures

sustainability within their household.

There are various kinds of per capita payments that members of Native

but not all

assistance program. These programs include Temporary Assistance for Needy

Supplemental Security

Income, housing assistance programs administered by Housing and Urban

Development,

entitlement. There are also special federal laws that specify how certain payments

•

Payments from income of lands held in trust or from an eligible tribal trust

year cannot be counted as income

5

5

•

Cobellv.

29 FOCUS ON NATIVE COMMUNITIES

Salazar

66

However, federal assistance programs

administered by the Social Security Administration

77

and Housing and Urban

Development

8

,

8

limit how long these payments are excluded from being

considered income or a resource for the purposes of eligibility to one year.

be important for you to show where your income comes from if you are planning

to claim that the income should not be counted as a resource or asset when

applying for a federal assistance program.

Using the tools

YOUR MONEY, YOUR GOALS TOOLKIT

•

Use “Savings plan” to build a weekly savings target that will help you

accomplish your goals

•

Use “Saving and asset limits” to get a clear picture of how much you can save

•

Use “Find a place for savings” to pick a place that’s right for you to keep your

savings

•

Review the “Saving at tax time” handout for tips on how to prioritize saving

FOCUS ON NATIVE COMMUNITIES

•

Complete “Saving and asset limits in Native communities” with information

https://secure.ssa.gov/apps10/poms.nsf/lnx/0500830852

portal.hud.gov/hudportal/documents/huddoc?id=pih2013-30.pdf.

MODULE 2: SAVING 30

GETTING STARTED

Saving and asset limits in

Native communities

off. It’s important to understand these limits to make sure

are applying for.

Assets are things you own that have value. Your money in a savings or checking

Each program has different rules about what counts as an asset and the total value

own rules.

What to do

You can add this worksheet to the “Saving and asset limits” tool in Module 2 of Your

Money, Your Goals.

•

Identify which public or tribal benets the person you’re working with currently

receives or may be applying for in the near future.

•

Use the websites and the “Additional Resources” provided to gure out the specic

asset limit for each program and write it on the tool.

•

consider completing

this tool in advance. Make copies and review it with the people you serve.

consumernance.gov/

practitioner-resources/your-money-your-goals/companion-guides.

MODULE 2: SAVING 31

Learn how Saving and asset limits in

Native communities can affect your

1.

2.

Additional resources

3. Additional resources

Benets and asset limits list for your community

Benet

Contacts for tribal

benet programs

Information about asset limits

specic to your tribe or community

TANF - Temporary

32

Benet

Contacts for tribal

benet programs

Information about asset limits

specic to your tribe or community

Other tribal benet:

Other tribal benet:

Additional resources:

•

To get specic information about the Food Distribution Program on Indian Reservations (FDPIR)

in your community, visit: fns.usda.gov/fdd/food-distribution-contacts

•

To nd out more about your state or tribal TANF program, visit: acf.hhs.gov/programs/ofa/help

•

For a list of tribal TANF program contacts, visit: acf.hhs.gov/programs/ofa/resource/tribal-tanf-

program-contacts

•

To nd your regional ofce for the Department of Housing and Urban Development’s Ofce of

Native Programs, visit: portal.hud.gov/hudportal/HUD?src=/program_ofces/public_indian_

housing/ih/codetalk/tribalhousing#OSD

•

For a list of tribal LIHEAP program contacts, visit: acf.hhs.gov/programs/ocs/liheap-tribal-

contact-listing

•

To nd Indian Health Services in your community, visit: ihs.gov

33 FOCUS ON NATIVE COMMUNITIES

MODULE 3

Tracking Income and

You have to know what’s coming in before you can plan for

At a glance in the toolkit

you’re receiving to better budget your money. It also helps you understand things like

Income and benets tracker

Choosing how to get paid

Increasing income and benets

Additionally in this guide

Making the most of the IIM

Overview

investments. You use income to pay for the things you need and want or can save it to

Focus on Native communities

MODULE 3: TRACKING INCOME AND BENEFITS 34

distributed by the tribal government or money from trust accounts. This money

may come from tribal enterprises including gaming, the sale or lease of land and

other natural resources owned by the tribe, or because of legal settlements to the

tribe.

Called “per capita payments,” these may be distributed in several ways:

•

On a regular basis (once per month, two times a year, or annually)

•

Periodically

•

All at one time (commonly called windfall payments)

As noted in information about savings, some kinds of per capita payments, but

not all, can be excluded as income, a resource, or an asset when determining your

eligibility for a federal assistance program. These programs include Temporary

Assistance for Needy Families, Supplemental Nutrition Assistance Program,

Supplemental Security Income, housing assistance programs administered by

Housing and Urban Development, or the Low Income Home Energy Assistance

Program.

Qualication for government benets varies by program. Individuals seeking to

receive benets under them should review the qualications carefully to determine

their entitlement. There are also special federal laws that specify how certain

payments are treated for purposes of eligibility for federally-assisted programs.

For example:

•

Payments from income of lands held in trust or from an eligible tribal trust

account: The rst $2,000 you receive from these types of payments in a given

year cannot be counted as income.

9

•

Payments from legal settlements with the U.S. government, such as the Cobell v.

Salazar settlement, cannot be counted.

10

However, federal assistance programs

administered by the Social Security Administration

11

and Housing and Urban

Development

12

limit how long these payments are excluded from being

considered income or a resource for the purposes of eligibility to one year.

•

If you receive payments like these, it is important to make sure you keep good

9 Pub. L. No. 93-134 as amended by 97-458, 98-64 & 103-6625, 25 U.S.C. § 1408

10 Claims Resolution Act of 2010, Pub. L. No. 111-291, 42 U.S.C. § 1305

11 SSA, TN114 (10-11), https://secure.ssa.gov/apps10/poms.nsf/lnx/0500830852

12 Claims Resolutions Act of 2010, Pub. L. No. 111-291; see also HUD Notice PIH2013-30, 2,

portal.hud.gov/hudportal/documents/huddoc?id=pih2013-30.pdf.

35 FOCUS ON NATIVE COMMUNITIES

be important for you to show where your income comes from if you are planning to

claim that the income should not be counted as a resource or asset when applying for

a federal assistance program.

Per capita payments may also be deposited into Individual Indian Money (IIM) accounts

within the U.S. Department of the Interior.

1313

it. The “Making the most of the IIM” tool is designed to help you help young people

consider how to make the most of their 18-money.

Module 3 in Your Money, Your Goals covers managing and tracking income and

an advantage to someone whose other income is seasonal or irregular (does not come

in at a predictable time or in a predictable amount).

individuals may miss the chance to build and grow family and community resources for

the future. A plan can help someone use their irregular or annual per capita payments

when there is little or no income. All of these activities build family and community

wealth and security. These funds can also be used to invest in assets that can help

garnishing (commonly called “attaching”) their wages. There are federal limits on how

much can be garnished from your wages. States and tribal governments may have

established laws further limiting garnishment. Tribal payments may be eligible for

garnishment if you owe money and have been sued by a creditor. For more information

Your Money, Your Goals.

13 See bia.gov/cs/groups/mywcsp/documents/collection/idc010124.pdf

MODULE 3: TRACKING INCOME AND BENEFITS 36

Using the tools

YOUR MONEY, YOUR GOALS TOOLKIT

•

Complete the “Income and benets tracker” to see how much money you’re bringing

home each month

•

Review “Choosing how to get paid” to see the pros and cons of different payment

methods and pick what works best for you

•

Use “Increasing income and benets” to think about ways you can boost the amount of

money you’re making

FOCUS ON NATIVE COMMUNITIES

•

Use “Making the most of the IIM” to help young adults and others who are receiving

values and helps achieve their goals

37 FOCUS ON NATIVE COMMUNITIES

GETTING STARTED

Making the most of the IIM

A lump sum payment can help you reach your goals if you

make a plan for how to use it. This tool can help you build a

plan that’s based on the things that are most important to

you.

You can give the tool to someone to complete or you can use the questions and

sections within the tool as the basis for a dialogue.

What to do

Use this tool with anyone that is going to receive their IIM or 18-money. Provide

them the opportunity to think through the pros and cons of spending and saving this

money and how their use of this lump sum relates to their values and goals.

•

Start with the facts about the IIM payment. How much will you receive? When will

you receive it? Will it be received all at one or in a series of payments?

•

Think about the pros and cons of spending or saving the money. Review these

pros and cons and make an initial decision about what to do with the money.

•

List your goals using the SMART goals framework.

•

Think about whether your plan for your IIM will help you achieve your goals.

Consider whether your plan could make it easier or harder to reach your short-term

and long-term goals.

consumernance.gov/

practitioner-resources/your-money-your-goals/companion-guides.

MODULE 3: TRACKING INCOME AND BENEFITS 38

Plan for your future by Making the

most of the IIM

1. Answer the questions about your IIM or 18-money.

2. Evaluate the pros and cons of spending or saving the money you’re receiving.

3. List your goals and consider how your plan for your money will help you reach them.

How much do you think you are getting from your IIM or 18-money account?

When will you get it?

How will you get your IIM or 18-money? (Check one.)

One-time or windfall payment?

Regular recurring payments?

MODULE 3: TRACKING INCOME AND BENEFITS 39

Spending your IIM

List below the pros and cons you see of spending all the money you receive. Consider these

questions when making your list.

•

What if you spent all of the IIM money you are about to receive right away?

•

What would you buy with it?

•

How would that affect your future?

•

How would that affect members of your family?

PROS CONS

Saving your IIM

List below the pros and cons you see of saving some or all the money you receive. Consider

these questions when making your list.

•

What if you saved some or all of the IIM money you are about to receive?

•

How would that affect your future?

•

How would that affect members of your family?

PROS CONS

40 FOCUS ON NATIVE COMMUNITIES

Evaluating your choice

Review your pro and con lists. How do you plan to use your IIM?

List three of your goals

Don’t forget to make your goals SMART (Specic, Measurable, Able to be achieved, Relevant, and

Time-bound.) Your Money, Your Goals has tools that can help you do this.

1.

2.

3.

Things to think about or discuss with someone

•

Does your planned use of your IIM help you achieve your goals?

•

Does your planned use of your IIM help make a better future for yourself? Your family?

Your community?

•

Will your planned use of your IIM bring you short-term happiness or long-term happiness?

•

Will your planned use of your IIM help you earn money in the future?

•

Will your family, friends, and community elders respect your choice?

MODULE 3: TRACKING INCOME AND BENEFITS 41

MODULE 4

Paying Bills

At a glance in the toolkit

This module can help you better understand where your money is going and learn

Spending Tracker

Bill calender

Choosing how to pay bills

Cutting expenses

Prioritizing bills

Overview

weeks when you’re not.

Focus on Native communities

provide family members with assistance or invest in helping your community.

reward or penalize you based on whether you pay your bills on time and repay

MODULE 4: PAYING BILLS 42

you with less money to spend on things you value more highly.

with your personal or cultural values that may emphasize sharing with others.

Using the tools

YOUR MONEY, YOUR GOALS TOOLKIT

•

Use the “Spending tracker” to get a clear picture of where you’re using your

•

Use the “Bill calendar” to visually organize all of your bills in a monthly calendar

•

Use “Choosing how to pay bills” to learn about all of the payment options you

have for paying your bills

•

Use “Cutting expenses

budget

•

Use “Prioritizing bills and spending” to make decisions about which bills to pay

when you can’t make ends meet

43 FOCUS ON NATIVE COMMUNITIES

MODULE 5

Getting through

the Month

Tracking when your money comes in and goes out can

help you understand if you’ll have enough each week or

month.

At a glance in the toolkit

into and out of your household. It also provides suggestions for how to improve

Creating a cash ow budget

Improving cash ow

Adjusting your cash ow

Additionally in this guide

Annual planner

Overview

advance. That’s why monthly budgets sometimes don’t work out from week to

week.

Focus on Native communities

Planning the use and conservation of resources is something Native Communities

MODULE 5: GETTING THROUGH THE MONTH 44

hunted in the late winter and early spring. They stopped hunting during the spring

birthing season and switched to preparations for planting crops. Such careful

a sustainable resource in the future. It also ensured there were crops to harvest in

the late summer and early fall.

Module 5 provides information and tools to help people make plans to get through

the community.

are due. These week-by-week shortfalls can be missed in a static monthly budget.

Using the tools

YOUR MONEY, YOUR GOALS TOOLKIT

•

Complete “Creating a cash ow budget

line up

•

Use “Improving cash ow” to learn about strategies and habits you can change

•

Use “Adjusting your cash ow

FOCUS ON NATIVE COMMUNITIES

•

Use the “Annual planner” as a supplement to help people plan if their sources

sporadic.

45 FOCUS ON NATIVE COMMUNITIES

GETTING STARTED

Annual planner

It can be hard to build a budget when your income and

help you plan how to use your resources to support your

family and your community.

someone think through when their income may come in and when they may have

What to do

•

Think about your income over the course of a year.

summer and low in the winter?

•

Think about your expenses during the year. Do you spend more during holidays

for gifts and food or always help grandchildren with back-to-school clothes? Are

•

complete the

annual planning calendar. Consider putting it in a place you’ll see it as a reminder

consumernance.gov/

practitioner-resources/your-money-your-goals/companion-guides.

MODULE 5: GETTING THROUGH THE MONTH 46

with the Annual planner

1. Fill in the chart with the amount and timing of income and lump-sum payments you receive

during the year.

2.

times a year.

3.

Sources of income Amount expected Date and how often it’s received

Do you get per capita or other

tribal payments?

Do you generally receive a

Do you get any tribal or public

time or a few times per year?

Do you earn income from

seasonal work?

Do you earn income

sporadically by working on

contract or through some

other kind of work?

Are there any other sources

you receive one-time or a few

times per year?

Other:

MODULE 5: GETTING THROUGH THE MONTH 47

Sources of spending Typical cost Anticipated date

Do you have children attending school

and expenses related to school like back-

to-school shopping after summer break?

Do you generally attend reunions,

powwows, or other gatherings?

Do you anticipate making any

investments in regalia or other items

needed for reunions, powwows,

traditional celebrations, or gatherings

including giveaways?

Do you regularly provide support for

family or community members?

Do you generally celebrate or observe

any religious or cultural holidays?

Do you owe and make quarterly self-

employment or other income tax

payments?

Do you pay for insurance on a quarterly,

semi-annual, or annual basis?

Do you pay property, vehicle, or other

taxes on a quarterly, semi-annual, or

annual basis?

Do you travel to see family (besides

reunions, powwows, or gathering) or go

on vacations?

Do you anticipate making any major

purchases like gardening supplies, home

repairs, or appliances?

Other:

48 FOCUS ON NATIVE COMMUNITIES

Use your answers from the sources of income and spending charts to

summarize your projections for each month. You will be able to use this

each month as you create a cash ow budget to ensure you don’t miss

sources and uses of income and nancial resources that are not regular.

Month Estimated sources of income Estimated spending

January

February

March

April

May

June

July

August

September

October

November

December

MODULE 5: GETTING THROUGH THE MONTH 49

MODULE 6

Dealing with Debt

Learn about ways to tackle your debt to help you feel less

overwhelmed. The more you know about how debt works,

the easier it will be to make choices that are right for you.

At a glance in the toolkit

This module will help you get a picture of what you owe, get a handle on your

payments, and cut down on stress from growing debt.

Debt log

Debt-to-income calculator

Debt action plan

Comparing auto loans

Repaying student loans

When debt collectors call

Avoiding medical debt

Overview

What is debt? Debt is money you owe to another person or business. Whether you

took out a loan, used a credit card, or got behind on a bill payment, that’s debt. Debt

can be hard to face when it feels like a barrier to your goals, but it’s important to

remember that there are resources you can use to help you take control of your debt.

Even small steps toward paying down debt can make a big difference in making it feel

more manageable.

MODULE 6: DEALING WITH DEBT 50

Focus on Native communities

For Native Communities that embrace a perspective based on living in harmony

with the world and people around you having or even discussing debt may create

that harmony. Debt obligates future resources to cover decisions made today.

Using the tools

YOUR MONEY, YOUR GOALS TOOLKIT

•

Complete the “Debt log” to gain an understanding of all the debt you owe

•

Use the “Debt-to-income calculator” to discover how much stress debt is

putting on your budget

•

Fill out the “Debt action plan

works for you

•

Bring “Comparing auto loans” with you when you shop for an auto loan to help

•

Use “Repaying student loans” to understand what repayment plans are

available to you

•

Review “When debt collectors call” if you’re having a problem with debt

•

Review the “Avoiding medical debt” handout if you’re dealing with high medical

bills to learn about ways to handle medical debt

51 FOCUS ON NATIVE COMMUNITIES

MODULE 7

Understanding Credit

Reports and Scores

Building a positive credit history (which is measured

through credit reports and scores) can help you when

getting a job or approval for housing or a loan.

At a glance in the toolkit

to improve and maintain your credit history.

Requesting your free credit reports

Reviewing your credit reports

Disputing errors on your credit reports

Getting and keeping a good credit history

Overview

The concept of “credit” can be complicated. People sometimes confuse the words

debt and credit because they both have to do with borrowing money.

you’ve used credit.You can have credit available to use without having debt.For

available to use but don’t owe any debt.

When you take out a credit card or other loan, you create (or add to) your credit

history.

have “good credit” or “bad credit.” This usually refers to their credit history.

Credit reporting companies gather information from your credit history into a credit

MODULE 7: UNDERSTANDING CREDIT REPORTS AND SCORES 52

report.

public record information and a record of how often you have applied for credit.

debt collectors have reported that they’re attempting to collect debt that you owe.

The information in your credit report is used to create credit scores. Many lenders

use credit scores to decide how much money they can lend you and how much

terms may be.

Focus on Native communities

Financial issues can be tough to talk about in some Native Communities because so

no situation is this clearer than when discussing credit reports and scores.

your auto loan payment could mean a negative entry on your credit report and a

able to secure a better paying job or buy a home or other asset.

their credit report and scores.

Using the tools

YOUR MONEY, YOUR GOALS TOOLKIT

•

Complete “Requesting your free credit reports” to plan when you’re going to

order your free annual credit reports

•

Complete “Reviewing your credit reports” to make sure all the information in

them is correct and up to date

•

Review the “Disputing errors on your credit reports” handout to learn how you

can dispute mistakes on your reports

•

Use “Getting and keeping a good credit history” to pick strategies you can

implement to improve your credit scores

•

Complete all four items described above to make sure the information on your

credit reports is correct

53 FOCUS ON NATIVE COMMUNITIES

MODULE 8

Choosing Financial

Products and Services

At a glance in the toolkit

Finding nancial products and services

Comparing nancial service providers

Opening a checking or savings account

Avoiding checking account fees

Evaluating your prepaid or payroll card

Knowing your prepaid card rights

Sending money abroad

Overview

for purchases over time. They include things like checking and savings accounts;

transfers; bill payment services; and loans.

MODULE 8: CHOOSING FINANCIAL PRODUCTS AND SERVICES 54

One important key to nding the right nancial product or service is rst thinking

about the reason you need one. You may want a secure place to put the money

you’re saving for your goals, unexpected expenses, or emergencies. You may want

a convenient way to pay your bills or to use your mobile phone to access your

nancial accounts. You may be looking for a loan to buy a car. Or you may want to

repair or build your credit history to improve your credit scores.

Focus on Native communities

Historically, many Native Communities lacked access to nancial products,

services, and providers. While access is not yet universal, access to a number of

nancial products and services has improved because of:

•

Native Community Development Financial Institutions (Native CDFIs) including

credit unions and community banks.

•

Increased awareness among banks and credit unions to better serve Native

Communities.

•

The emergence of online bank and credit union products and services.

Many types of nancial products and services can help people protect their

money and nancial resources, better manage their money, more efciently pay

for their current living expenses, and set aside money for their goals or for future

generations.

Protecting what you have as a community ensures it will be there not only today,

but also tomorrow and in future generations.

Your Money, Your Goals takes a nancial empowerment approach to nancial

products and services. Rather than directing people to a particular type of

provider or service, this module starts with an assessment of your needs or

priorities and—based on those needs—helps you choose from among your options.

With this information, you can make the choices that are best for you and your

family.

Using the tools

YOUR MONEY, YOUR GOALS TOOLKIT

•

Use “Finding nancial products and services” to nd out about products that

may meet your needs and learn about how they work and where to get them

•

Use “Comparing nancial service providers” to compare companies that offer

the products or services you need and choose the one that’s right for you

•

Complete “Opening a checking or savings account” to make sure you have all

the documentation and answers you need

55 FOCUS ON NATIVE COMMUNITIES

•

Review “Avoiding checking account fees” to choose strategies you can use to

lower or eliminate fees

•

Complete “Evaluating your prepaid or payroll card” to make sure you

understand the details and fees associated with using the card

•

Review the “Knowing your prepaid card rights” handout before you buy or use a

prepaid card so you know about your rights and responsibilities

•

Review the “Sending money abroad” handout to learn about your rights and

responsibilities when sending money to another country

MODULE 8: CHOOSING FINANCIAL PRODUCTS AND SERVICES 56

MODULE 9

Protecting your Money

Learn about ways you can protect yourself and your

money with practical tips and information about your

At a glance in the toolkit

This module can help you understand your rights and responsibilities within the

Protecting your identity

How to handle identity theft

Spotting red ags

Submitting a complaint

Overview

products and services. It’s the Bureau’s job to enforce these laws and handle

Knowing what your rights are can help prevent you from being taken advantage of

can help you avoid late fees or problems with an account.

information from fraud or theft. There are things you can do to be proactive about

keeping your information safe.

MODULE 9: PROTECTING YOUR MONEY 57

Focus on Native communities

One important job of tribal leaders is to protect the assets that belong to the

tribe. These assets could be land or the natural resources that come from the land.

from settlements with the U.S. government or corporations. They could also be

but also for tomorrow and future generations.

that give you rights. Module 9: Protecting your money provides an introduction to

some of these laws as well as an overview of how to protect your identity and how

most complicated complaints within 60 days. You’ll be able to review the response

The CFPB also shares complaint data with state and federal agencies that oversee

complaint information so the public knows what kinds of complaints we receive

and how companies respond. These complaints also help identify areas of

attention for our supervisory/enforcement actions.

Using the tools

YOUR MONEY, YOUR GOALS TOOLKIT

•

Read the “Protecting your identity” handout for ways to guard yourself against

identity theft

•

Review the “How to handle identity theft” handout to learn what steps to take if

your identity has been stolen

•

Study the “Spotting red ags” handout to see some of the warning signs that a

sales deal might be a scam

•

Learn how “Submitting a complaint” can help you if you’ve had a problem with

58 FOCUS ON NATIVE COMMUNITIES

MODULE 10

Financial Empowerment

and Elders

The risks people may face change throughout their lives.

Elders can be especially vulnerable because they may

from working throughout their lives.

At a glance in this guide

Identifying elder nancial exploitation

Getting help for elder nancial exploitation

Preventing elder nancial exploitation

Overview

1414

But that value can be used to encourage community members

to learn about all types of elder abuse and empower everyone to take action to

prevent and report these crimes.

This module is new to Your Money, Your Goals

community.

2004. See ncea.acl.gov/Resources/WEAAD.aspx#Abuse.

MODULE 10: FINANCIAL EMPOWERMENT AND ELDERS 59

Focus on Native communities

The following circumstances or conditions can make an elder a target of

1515

•

Having regular income and accumulated assets.

•

Being trusting and polite.

•

judgment.

•

pressure the elder.

•

Being lonely and socially isolated.

•

or pet.

•

someone they depend on.

•

Being dependent on support from a family member or caregiver to remain

independent.

•

•

•

•

making capacity.

While cons and scams perpetrated by strangers are commonly highlighted as risks

elders commit these offenses.

15 The following list is from Money Smart for Older Adults. See les.consumernance.

gov/f/201306_cfpb_msoa-participant-guide.pdf

60 FOCUS ON NATIVE COMMUNITIES

Strategies for building safer communities

many follow-up steps. You may want to consider organizing a group or task force to develop and

implement a plan for your community.

Goal First steps Follow-up actions

Identify existing

resources in your

community.

Talk to tribal government and

resources are available to

help elders who are victims of

Work to identify key players or

interested partners in and outside

of tribal government who share your

concerns and desire for community

change. Ask if they will help set

up a Tribal Elder Protection Team

to work to develop a coordinated

community response.

Work with your

tribal police force.

Meet with your tribal police

importance of documenting

identity theft and other individual

meeting with the leadership of

your tribal police force to discuss

community concerns about elder

identity theft).

Once you’ve built a relationship

with partners in the tribal police

your efforts. Here are some ideas

you can discuss with your law

enforcement partners:

•

Training for responders

•

Agency collaboration in the

development of a Tribal Elder

Protection Team

•

Creating a protocol for response

to crimes against elders.

Raise awareness

of elder nancial

exploitation.

Encourage all community

members to take care of elders

target elders.

Use community and cultural events

to educate community members

about the risks to elders and

Order copies of MoneySmart for

Older Adults, Managing someone

else’s money

publications at promotions.usa.gov/

cfpbpubs.html.

MODULE 10: FINANCIAL EMPOWERMENT AND ELDERS 61

PowerPoint presentation. The Federal Deposit Insurance Corporation (FDIC) and

the CFPB jointly developed this information. It is available free-of-charge at:

fdic.gov/consumers/consumer/moneysmart/olderadult.html.

Using the tools

•

Use “Identifying elder nancial exploitation

•

Use the “Getting help for elder nancial exploitation” handout to help people

community.

•

Use “Preventing elder nancial exploitation” to help people help elders in their

62 FOCUS ON NATIVE COMMUNITIES

GETTING STARTED

Elders are a valued and respected community resource. If you

help protect vulnerable elders in your community.

family relationship. Family members or close friends may be unaware of the situation

checklist can help you or the individual you are working with get assistance.

What to do

•

Review the warning signs

•

Record the status of the warning sign

A step further

consumernance.gov/

practitioner-resources/your-money-your-goals/companion-guides.

MODULE 10: FINANCIAL EMPOWERMENT AND ELDERS 63

Recognize warning signs by

Identifying elder nancial

exploitation.

1.

2.

been reported to tribal authorities.

Check the box if suspected, observed, or reported.

Situation Suspected Observed Reported

responsibilities of the home and/or property.

A live-in caregiver refuses to leave or to leave the

elder alone with visitors.

Caregivers or family members caring for the elder

A caregiver refuses to spend the elder’s money on

appropriate medical care.

the elder.

The elder transfers title of home or other assets to

someone else for no apparent reason.

MODULE 10: FINANCIAL EMPOWERMENT AND ELDERS 64

Situation Suspected Observed Reported

The elder’s personal belongings, important papers,

credit cards, or identication documents go missing.

Changes are made to the elder’s will that are

unexplainable or made when the elder is ill or

otherwise incapacitated.

Frequent checks are made out to “cash” from the

elder’s account.

The caregiver’s name is added to the accounts of

the elder or the caregiver becomes an authorized

user on credit card accounts belonging to the elder.

Unusual bank or credit card activity is reported.

Bills go unpaid or overdue when someone else has

been charged with paying them for the elder.

The elder does not know how much income she

receives. The caregiver is unwilling to share that

information when asked by other family members.

The elder seems suddenly more fearful and

becomes reluctant to talk about topics that were

once routine conversations.

Signatures on checks, legal documents, or other

communications do not match the elder’s signature.

The elder takes out a large, unexplained loan or

reverse mortgage.

Unusual information in a tax return is spotted.

65 FOCUS ON NATIVE COMMUNITIES

Getting help for elder nancial

exploitation

•

unreported.

•

Many people don’t know what to do if they

resources can help.

•

abuse is occurring to report it. It is up to the

professionals to take action if you suspect

abuse.

AGING SERVICE PROVIDERS

•

Find out if your community has a Tribal Elder

Protection Team or similar entity in place. This

want to contact your tribal social services

•

If you are unsure of the tribal entity that

the Eldercare Locator at 1-800-677-1116.

Trained information specialists are available

You can also search for a local adult

protective services agency at eldercare.gov.

•

Contacting your local Area Agency on Aging.

Locator at 1-800-677-1116 or search at

eldercare.gov.

•

If you live outside an area covered by a tribal

Protective Services and/or local police.

LAW ENFORCEMENT

•

You may want to contact your tribal police

special agent in charge in your district:

bia.gov/bia/ojs/contact-us.

•

tribal government and/or your state’s

naag.org/naag/

attorneys-general/whos-my-ag.php.

LEGAL ASSISTANCE

•

You may feel you need legal assistance

back money or property that was taken

or to protect the elder from additional

legal assistance program for people 60

programs. Title IIIB legal services programs

can provide legal assistance on issues such

•

Legal assistance in these programs is

targeted towards older individuals in social

and economic need. Each program has

its own priorities and eligibility guidelines

regarding case acceptance and areas of

representation.

MODULE 10: FINANCIAL EMPOWERMENT AND ELDERS 66

•

Legal assistance for seniors may be located

within your local legal services program. You

programs by using:

•

Legal Services Corporation legal aid

locator at lsc.gov/what-legal-aid/nd-

legal-aid

•

Pine Tree Legal Assistance’s list of legal

services links—including Indian legal

services—by state at ptla.org/legal-

services-links.

•

National Indian Legal Services at judicare.

org/content.cfm?PageID=52.

CONSUMER COMPLAINTS

•

If you’re having a problem with a bank

you can submit a complaint with the CFPB at

cfpb.gov/complaint.

•

telemarketing through the FTC website:

ftccomplaintassistant.gov.

IDENTITY THEFT

•

you can report this to the Federal Trade

Commission (FTC) at ftc.gov/idtheft or by

calling 1-877-IDTHEFT (438-4338).

•

The FTC has an online toolkit that includes

a detailed guide for protecting your

letters to help spot and respond to identity

theft: Taking Charge: What to Do If Your

consumer.ftc.gov/articles/pdf-0009-taking-

charge.pdf.

67 FOCUS ON NATIVE COMMUNITIES

GETTING STARTED

working together to prevent it.

Use this tool and to start engaging community members in protecting elders. The

tool contains both strategies for communities to use and actions for elders and their

trusted family members to take. Taking action at both levels will contribute to a safer

community for elders.

What to do

•

Identify the steps you can take to prevent elder nancial exploitation. These steps

•

Check the step when it’s completed.

consumernance.gov/

practitioner-resources/your-money-your-goals/companion-guides.

MODULE 10: FINANCIAL EMPOWERMENT AND ELDERS 68

Identify steps for Preventing elder

nancial exploitation

1.

2.

protect an elder or elders in your community.

3. Check the action when it has been completed.

Actions for elders and their trusted family members

There are many steps elders can take to protect themselves if they act early. The list below includes

Check when completed

Encourage advance planning for diminished capacity. Provide elders with resources to help them

determine how they want to manage their money and property in the event they become unable to

do so for themselves. Advance planning may include making a power of attorney or trust.

Help people understand powers of attorney and tailor them to the elder’s needs. A power

of attorney is a legal document authorizing someone to make decisions about money and

need be sure to name someone they trust as their agent. It is important to communicate that

powers of attorney can include built-in protections. Legal professionals can help people tailor

attorney or other trusted third party.

Use automatic bill paying. Routine bills can be set up on automatic bill pay from the elder’s

checking or savings account. Alternatives include paying by check or credit card. All of these

money went.

Involve several people.

MODULE 10: FINANCIAL EMPOWERMENT AND ELDERS 69

Have checks directly deposited.

still at risk if the abuser is a joint owner on the account.

Communicate with the bank or credit union and review statements. Banks and credit unions

service providers monthly.

Check your credit reports regularly. This is one of the primary ways people discover their

identity has been stolen and accounts have been fraudulently set up in their names.

Check references. Anyone hired to provide care—including relatives who are being paid—should

be thoroughly screened.

Reduce isolation.

Protect all documents related to identity and nancial information.

someone from stealing sensitive information from the trash.

Remember that if it’s too good to be true, it probably is.

•

•

Someone leads elders to believe that other elders or leaders are investing in the opportunity

being presented.

•

Someone “guarantees” wealth from an investment.

•

Someone creates a sense of urgency by stating that there is a limited time to act or a limited

number of opportunities.

•

Someone is offering a product or service but requires a large upfront payment.

•

70 FOCUS ON NATIVE COMMUNITIES

FOCUS ON NATIVE COMMUNITIES 71

Goals” toolkit online at cfpb.gov/your-money-your-goals

CFPB at cfpb.gov/complaint

For answers to commonly asked questions you might have about other money

cfpb.gov/askcfpb

Mail

Consumer Financial Protection Bureau

Email

YourMoneyYourGoals@consumernance.gov

Toll-free phone

855.411.2372

Monday–Friday

8:00 a.m.–8:00 p.m. (EST)

TTY/TDD phone

855.729.2372

Communities companion guide as a resource for the public. This material is provided for educational and information

you received the CFPB educational materials. The CFPB’s educational efforts are limited to the materials that CFPB has

prepared.

The tools may ask you to provide sensitive information. The CFPB does not collect this information and is not responsible

information.

does not control or guarantee the accuracy of this outside information. The inclusion of links or references to third-party

products or services they may offer. There may be other possible entities or resources that are not listed that may also

serve your needs.

72 FOCUS ON NATIVE COMMUNITIES

SPREAD WITH 0.125” BLEED