Florida Flood Insurance

Update

Presented By:

HH Insurance Group

Meet your speaker

• Bachelor’s Degree in Risk Management and Insurance – Florida State

University

• Master’s Degree in Risk Management and Insurance – F

lorida State

University

• Chartered Property and Casualty Underwriter (CPCU) Designation

• City of St. Petersburg, City of St. Pete Beach, City of Treasure Island

a

nd Pinellas County Appointed Flood Insurance Advocate

• President of HH Insurance

What is Happening With Flood Insurance?

• What is the NFIP?

• History of the NFIP

• Flood Map Change vs NFIP Rating Change

• 1975 – 2021 NFIP Flood Rates

• 2021 - ? NFIP Flood Rates

• Private Flood Marketplace

• Rate Examples

Flood Maps Changes

• Pinellas County Flood Maps

• All Homes Built 1975 or newer have been built to a flood map requirement

• History of Maps

• First Published – 06/10/1977

• Second Map – 0

9/30/1983

• Third Map – 0

9/03/2003

• Fourth Map

• Preliminary Maps – 07/26/2018

• Fourth Map – 08/

24/2021

• Major Risk Reduction for Coastal Pinellas County

• Risk Rating 2.0

• Soft Launch – 10/01/2021

• Hard Launch – 04/

01/2022

The National Flood Insurance Program (NFIP)

• Most flood insurance coverage is rated in the NFIP program

• The NFIP has a rate for just about every flood policy except for CBRA

f

lood zones

• Prior to October 1, 2021 - F

rom a rate standpoint, the NFIP is the

most competitive option on about 60% of Florida risks and the private

market is the most competitive on about 40% of the market

• After October 1, 2021 over the next 5 years – I

expect that 90% of

flood policies in Florida will be issued in the private market

How did we get here with the NFIP?

This is How

Substantial Flood Events from January 2005 - January 2012

Event Month/Year # Pd Losses Amount Pd $

Hurricane Dennis July – 2005 3,804 $119,703,846

Hurricane Katrina August -2005 167,694 $16,271,802,748

Hurricane Rita September – 2005 9,491 $470,142,386

Hurricane Wilma October -2005 9,615 $365,061,170

PA, NJ, NY Floods June 2006 June – 2006 6,420 $228,414,752

Nor'Easter April 2007 April – 2007 8,637 $225,653,493

Torrential Rain June 2008 June – 2008 3,352 $140,412,289

Hurricane Gustav September – 2008 4,536 $112,049,118

Hurricane Ike September – 2008 46,288 $2,644,120,863

Torrential Rain March 2009 TX March – 2009 3,300 $127,405,094

Torrential Rain Sept 2009 GA September - 2009 2,031 $118,154,178

Tropical Storm Ida VA November – 2009 5,654 $101,500,557

Nor'Easter March – 2010 10,082 $194,252,641

Torrential Rains TN April – 2010 4,091 $225,500,584

Mid-Spring Storms April – 2011 3,427 $114,469,581

Hurricane Irene August – 2011 40,634 $1,111,581,148

Tropical Storm Lee September – 2011 8,961 $360,586,593

Tropical Storm Debbie June – 2012 1,778 $41,539,591

Tropical Storm Isaac August – 2012 11,915 $533,401,256

Superstorm

Sandy October – 2012 126,895 $7,117,422,012

Hurricane Katrina

Hurricane Ike

Hurricane Irene

NFIP Recent Program History

• Biggert-Waters Act of 2012

• Signed into law July 6, 2012

• Intent of the Act

• Phasing out subsidies for many properties;

• Raising the cap on annual premium increases from 10 percent to 20 percent;

• Allowing owners of multifamily properties to purchase NFIP policies;

• Imposing minimum deductibles for flood claims;

• Requiring the NFIP administrator to develop a plan for repaying the debt incurred

f

rom Hurricane Katrina; and

•

Establishing a technical mapping advisory council to deal with map modernization

issues.

• Actual Act

• October 1, 2013 – Slab on Grade homes have rates skyrocket to $10,000 per year

• Private Market Flood Programs emerge as an affordable alterative

• Removed Grandfathering and the transfer of flood policies

NFIP Recent Program History

• Homeowner Flood Insurance Affordability Act of 2014

• Signed into law March 21, 2014

• Repealed certain parts of Biggert-Waters

• Restoring Grandfathering

• Pu

tting limits on certain rate increases

• Updating the approach to ensuring the fiscal soundness of the fund by applying an

a

nnual surcharge to all policyholders.

• We are still operating under the HFIAA of 2014 in terms flood insurance

regulation

NFIP Renewal

• Separate from Risk Rating 2.0

• Believe it or not – It has been over 9 years since the Biggert-Waters

Act was passed and 5 years since it went to effect. This means that

the NFIP is due for a renewal

• For approximately the last three years, the NFIP has essentially been

r

unning on a month to month basis waiting for a long term extension

• The NFIP is currently authorized to run until September 30, 2021

NFIP Essential Needs

• The essential part of getting the NFIP renewed is a long term bill that

provides 5 to 7 years of protection

•

The second essential part of getting the NFIP renewed is preserving

grandfathering

• Grandfathering is what allows areas where a map change has occurred to

have flood rates in the $1,000 range when the rates should be closer to

$2,500 based on today’s and future maps

Grandfathering

• Built in Compliance

• Any structure built after the municipalities FIRM (Flood Insurance Rate Map) date that

was built in compliance of flood insurance codes at the time of construction is eligible

for grandfathering

• Essentially this means that if a house was built in 2000 to an 8 foot base flood

e

levation, and the map change negatively affects the home, this house is able to

maintain their current flood insurance rate

• Continuous Coverage

• Any structure that has maintained a FEMA flood insurance policy is not subject to

flood zone changes or base flood elevation changes from a flood insurance rating

standpoint if they have maintained continuous flood coverage

• While this does help the pre-

FIRM structures, it does not stop the mandatory 15% to

18% rate increases on pre-FIRM primary homes

Missing Grandfathering

Flood Risk 2.0

• The National Flood Insurance Program (NFIP) has redesigned its risk rating plan to charge more for coastal

risks and less for non-coastal risks through a program called Risk Rating 2.0

•

This the first change to FEMA rating methodology since 1975

• Risk Rating 2.0 fundamentally changes the way FEMA rates a property’s flood risk and prices insurance.

• Risk Rating 1.0 FEMA develops rates based predominantly on Flood Insurance Rate Map zone and Base Flood

Elevation. Risk Rating 2.0 incorporates past and future flood models into projecting a flood insurance rate

• FEMA’s Objective

• Risk Rating 2.0 will help customers better understand their flood risk and provide them with more accurate rates based on

their unique risk. This will include determining a customer’s flood risk by incorporating multiple, logical rating

characteristics–like different types of flood, the distance a building is from the coast or another flooding source, or the cost

to rebuild a home.

• Actual

• Massive rate increases for Tampa Bay homes. The rate increases are the most substantial for lower elevation homes, coastal

homes, high value homes

• Risk Rating 2.0 complies with existing statutory caps on premium increases at 18% to 25% per year

Prior to August 30, 2021 Florida Expectations

Where is Flood Insurance Purchased?

• National Flood Insurance Program (NFIP)

• Risk Rating 1.0

• About 90% of flood insurance is purchased from the NFIP

• The NFIP also has a Write Your Own (WYO) Program where private carriers represent the NFIP

• Wright Flood

• Allstate

• Assurant

• Risk Rating 2.0

• Approximately 10% of Florida flood insurance will be purchased from the NFIP from a long term outlook standpoint

• Private Flood Insurance

• Private flood became a player in 2013 with the Biggert-Waters Act (rate increases from $2,000 to

$20,000

• Typical private flood carriers

• TypTap

• Lloyds of London

• Endorsement to the homeowners policy

Rate Example 1

63

rd

St and 30

th

Ave N, 33710

• Coverage

• Total Dwelling Value - $350,000

• Dwelling - $250,000

• Contents - $100,000

• Deductible - $5,000

• NFIP Risk Rating 1.0

• $3,663

• Coverage

• Total Dwelling Value - $350,000

• Dwelling - $250,000

• Contents - $100,000

• Deductible - $5,000

• NFIP Risk Rating 1.0

• $3,663

• NFIP Risk Rating 2.0

• $1,755

• Private Flood

• $446.26

Rate Example 2

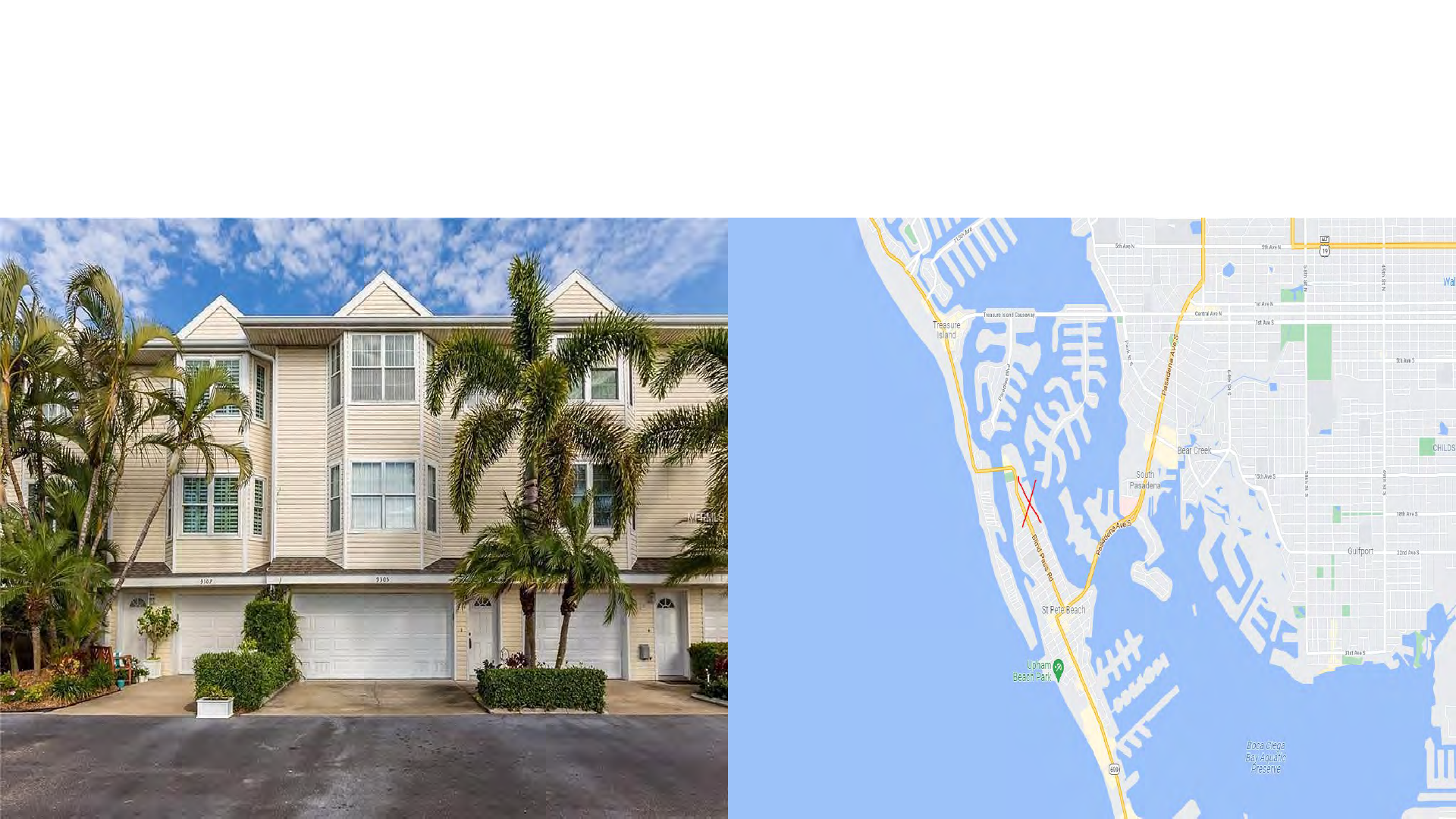

• E Vina Del Mar Blvd, St Pete Beach 33706

• Coverage

• Total Dwelling Value - $1,500,000

• Dwelling - $250,000

• Contents - $100,000

• Deductible - $5,000

• NFIP Risk Rating 1.0

• $636

• Coverage

• Total Dwelling Value - $1,500,000

• Dwelling - $250,000

• Contents - $100,000

• Deductible - $5,000

• NFIP Risk Rating 1.0

• $636

• NFIP Risk Rating 2.0

• $11,628

• Private Flood

• $1,942.50

Rate Example 3

• FeatherSound, Clearwater, 33762

• Coverage

• Total Dwelling Value - $450,000

• Dwelling - $250,000

• Contents - $100,000

• Deductible - $5,000

• NFIP Risk Rating 1.0

• $1,658

• Coverage

• Total Dwelling Value - $450,000

• Dwelling - $250,000

• Contents - $100,000

• Deductible - $5,000

• NFIP Risk Rating 1.0

• $1,658

• NFIP Risk Rating 2.0

• $3,450

• Private Flood

• $4,465.65

Rate Example 4

• Symphony Isles, Apollo Beach, 33572

• Coverage

• Total Dwelling Value - $995,000

• Dwelling - $250,000

• Contents - $100,000

• Deductible - $5,000

• NFIP Risk Rating 1.0

• $824

• Coverage

• Total Dwelling Value - $995,000

• Dwelling - $250,000

• Contents - $100,000

• Deductible - $5,000

• NFIP Risk Rating 1.0

• $824

• NFIP Risk Rating 2.0

• $10,578

• Private Flood

• $2,508.45

Rate Example 6

• Ballast Point, Tampa, 33611

• Coverage

• Total Dwelling Value - $300,000

• Dwelling - $250,000

• Contents - $100,000

• Deductible - $5,000

• NFIP Risk Rating 1.0

• $3,663

• Coverage

• Total Dwelling Value - $300,000

• Dwelling - $250,000

• Contents - $100,000

• Deductible - $5,000

• NFIP Risk Rating 1.0

• $3,663

• NFIP Risk Rating 2.0

• $5,737

• Private Flood

• $3,588

District 1 Example

• Coverage

• Total Dwelling Value - $550,000

• Dwelling - $250,000

• Contents - $100,000

• Deductible - $5,000

• NFIP Risk Rating 1.0

• $552

• Coverage

• Total Dwelling Value - $550,000

• Dwelling - $250,000

• Contents - $100,000

• Deductible - $5,000

• NFIP Risk Rating 1.0

• $552

• NFIP Risk Rating 2.0

• $8,327

• Private Flood

• $1,950

District 2 Example

• Coverage

• Total Dwelling Value - $400,000

• Dwelling - $400,000

• Contents - $100,000

• Deductible - $5,000

• NFIP Risk Rating 1.0

• $25,513

• Coverage

• Total Dwelling Value - $400,000

• Dwelling - $400,000

• Contents - $100,000

• Deductible - $5,000

• NFIP Risk Rating 1.0

• $25,513

• NFIP Risk Rating 2.0

• $9,879

• Private Flood

• $6,791.40

District 3 Example

• Coverage

• Total Dwelling Value - $600,000

• Dwelling - $250,000

• Contents - $100,000

• Deductible - $5,000

• NFIP Risk Rating 1.0

• $3,663.00

• Coverage

• Total Dwelling Value - $600,000

• Dwelling - $250,000

• Contents - $100,000

• Deductible - $5,000

• NFIP Risk Rating 1.0

• $3,663

• NFIP Risk Rating 2.0

• $11,455

• Private Flood

• $4,470.90

District 4 Example

• Coverage

• Total Dwelling Value - $2,000,000

• Dwelling - $250,000

• Contents - $100,000

• Deductible - $5,000

• NFIP Risk Rating 1.0

• $445

• Coverage

• Total Dwelling Value - $2,000,000

• Dwelling - $250,000

• Contents - $100,000

• Deductible - $5,000

• NFIP Risk Rating 1.0

• $445

• NFIP Risk Rating 2.0

• $11,628

• Private Flood

• $1,950