Financial Report

KANSAS CITY BOARD OF PUBLIC UTILITIES

Kansas City Board of Public Utilities

Kansas City, Kansas

Annual Comprehensive Financial Report

For the Fiscal Years Ended

December 31, 2022 and 2021

2022 Board of Directors

President – Mary L. Gonzales Jeff Bryant

Vice President – Rose Mulvany Henry Robert L. Milan, Sr.

Secretary – Tom Groneman David Haley

General Manager

William A. Johnson

An Enterprise Fund of the:

Unified Government of Wyandotte County, Kansas City, Kansas

Prepared by: Office of Accounting & Office of Corporate Communications

Kansas City Board of Public Utilities

Annual Comprehensive Financial Report

For the Fiscal Years Ended December 31, 2022 and 2021

Table of Contents

Page

INTRODUCTORY SECTION

Letter of Transmittal ........................................................................................................................................... 1

Certificate of Achievement for Excellence in Financial Reporting ..................................................................... 7

President’s Message ............................................................................................................................................ 8

Board of Directors Profiles - 2022 .................................................................................................................... 10

General Manager’s Message ............................................................................................................................. 14

Senior Management Profiles - 2022 .................................................................................................................. 16

Organizational Chart ......................................................................................................................................... 18

FINANCIAL SECTION

Independent Auditor’s Report ........................................................................................................................... 19

Management’s Discussion and Analysis (Unaudited) ....................................................................................... 22

Financial Statements

Statements of Net Position ............................................................................................................... 28

Statements of Revenues, Expenses and

Change in Net Position ............................................................................................................. 30

Statements of Cash Flows ................................................................................................................ 31

Notes to Financial Statements .......................................................................................................... 32

Required Supplementary Information

Schedule 1 – Schedule of Changes in Net Pension Liability and Related Ratios ............................. 72

Schedule 2 – Schedule of Employer 10 Year Contributions ............................................................ 75

Schedule 3 – Schedule of Changes in Total OPEB Liability and Related Ratios ............................. 77

Supplementary Information

Schedule 4 – Combining Statements of Net Position ....................................................................... 79

Schedule 5 – Combining Statements of Revenues, Expenses and

Change in Net Position .......................................................................................... 81

STATISTICAL SECTION (Unaudited)

Table of Contents ............................................................................................................................................ 82

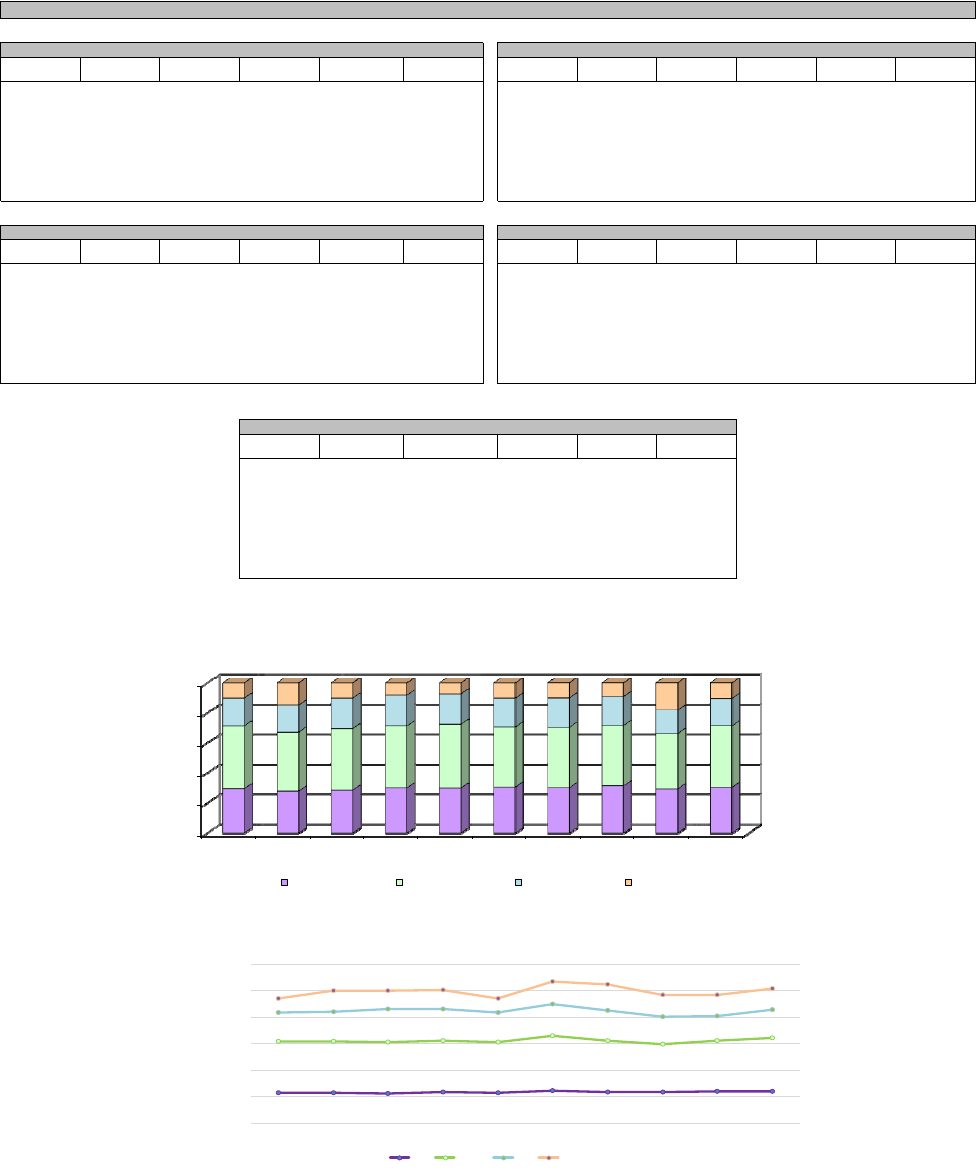

Financial Trends

Net Position by Component .............................................................................................................. 83

Combined Operating Statements ....................................................................................................... 84

Revenue Capacity

Electric Utility Systems Sales ........................................................................................................... 85

Water Sales ....................................................................................................................................... 86

Debt Capacity

Utility System Revenue Bonded Indebtedness .................................................................................. 87

Ratios of Outstanding Debt ............................................................................................................... 88

Debt per Customer ............................................................................................................................ 89

Table of Contents (cont’d)

Page

STATISTICAL SECTION (Unaudited) cont.

Demographic and Economic Information

Electric Load Statistics in Megawatts ................................................................................................ 90

Principal Customers ........................................................................................................................... 91

Employee Data ................................................................................................................................... 92

Demographic and Economic Statistics ............................................................................................... 93

Principal Employers ........................................................................................................................... 94

Operating Information

Electric Rates Schedules .................................................................................................................... 95

Water Rates Schedules ....................................................................................................................... 99

Capital Operating Indicators ............................................................................................................ 100

Staffing by Division ......................................................................................................................... 101

Independent Auditor’s Report on Internal Control Over Financial

Reporting and on Compliance and Other Matters Based on an

Audit of Financial Statements Performed in Accordance with

Government Auditing Standards ............................................................................................ 102

INTRODUCTORY

SECTION

1

June 8, 2023

Members of the Board of Directors

Kansas City Board of Public Utilities

The Charter Ordinance of the Unified Government of Wyandotte County/Kansas City, Kansas requires the

Kansas City Board of Public Utilities (BPU) publish within six months of the close of each fiscal year an

Annual Comprehensive Financial Report (ACFR). This report is presented in conformity with Generally

Accepted Accounting Principles (GAAP) and audited by a certified public accounting firm. This report is

published to fulfill that requirement for the fiscal year ended December 31, 2022.

The ACFR consists of management’s representation concerning the finances of the BPU. As a result,

responsibility for this report for the fiscal year ended with respect to both the accuracy of the data and the

completeness and fairness of the presentation, including all disclosures, rests with the BPU. To the best of

our knowledge and belief, the enclosed data is accurate in all material respects and are reported in a manner

designed to present fairly the financial position and results of operations of the BPU. As management, we

assert that, to the best of our knowledge and belief, this financial report is complete and reliable in all

material respects. To enhance the reader’s understanding of theses financial statements, note disclosures

have been included as an integral part of this document.

The BPU’s financial statements have been audited by FORVIS, LLP (FORVIS). The goal of the

independent audit was to provide reasonable assurance that the financial statements of the BPU are free of

material misstatement. The independent audit involved examining, on a test basis, evidence supporting the

amount and disclosures in the financial statements; assessing the accounting principles used and significant

estimates made by management; and evaluating the overall financial statement presentation. FORVIS

concluded, based upon the audit, the financial statements present fairly, in all material respects, the financial

position of the BPU as of December 31, 2022, and the results of BPU’s operations and cash flows for the

year then ended in conformity with GAAP. The independent auditor’s report is presented as the first

component of the financial section of this report.

GAAP requires that management provide a narrative introduction, overview, and analysis to accompany

the basic financial statements in the form of Management’s Discussion and Analysis (MD&A). This letter

of transmittal is designed to complement MD&A and should be read in conjunction with it. The BPU’s

MD&A can be found immediately following the report of the independent auditors.

Profile

The Utility System is comprised of the electric and water utilities and is, by statute and charter ordinance,

under the operational control and administration of the Board of Directors for the BPU. The Unified

Government of Wyandotte County/KCK, as authorized by state statutes, reserves the right to incur debt on

2

behalf of the BPU. However, the statutes vest the BPU with exclusive day-to-day control of the utility

system. The Utility presently serves approximately 65,000 electric customers and 53,000 water customers.

The Electric Utility has two active electric power generating stations, a 17% ownership interest in a

combined cycle power generating station, and seven purchase power agreements to provide the capacity

and energy needed by its retail customers. The active generating stations are the Nearman Creek Power

Station (“Nearman Station”) and the Quindaro Power Station (“Quindaro Station”), and the 17% ownership

interest is in the Dogwood Generating Facility (Dogwood) described herein. Purchased power agreements,

which are also described herein, have been executed and include renewable low impact hydro power from

Bowersock Mills and Power Company, the only hydro project in the State of Kansas as well as wind from

the Cimarron Bend Wind Project, Smoky Hills Wind Farm and Alexander Wind Farm, all in Kansas.

The Nearman Station has two units; the first is a coal-fired steam electric generating station. Commercial

operation of the Nearman coal-fired unit began in 1981. The second unit is a simple cycle combustion

turbine which can be fired on either natural-gas or No. 2 fuel oil. The combustion turbine plant, known as

the Nearman CT4, functions as a peaking plant and was placed in service during February of 2006.

The Quindaro Station currently has two units; all of the units are combustion turbines, which function as

peaking units. The units were placed in commercial operation in 1974 and 1977 respectively and are

designed to burn No. 2 fuel oil. In October, 2019, the Utility made the decision to cease operations of

Quindaro Station Units 1 & 2 as the units are not efficient to operate. The assets were permanently impaired

and recorded as a Regulatory Asset of $73.6 million that will be amortized through 2040.

In December, 2012, the Utility acquired an undivided 17% ownership interest in the assets of Dogwood, a

natural gas-fired combine cycle generating plant. The Utility’s share is approximately 110 MW.

Generation and operating expenses from Dogwood are allocated to the utility based on the 17% interest.

The Utility is also required to provide its share of financing any capital additions.

The Utility generating stations are interconnected by a network of 161 kV and 69 kV transmission lines.

The Utility’s transmission and distribution network includes 61.20 miles of 161 kV line, 60.03 miles of 69

kV line, and over 3,000 miles of overhead line and 313.70 miles of underground cable. The system has 29

electric distribution substations and four industrial substations. The Utility is interconnected with one other

area utility, Evergy Inc.

The Utility System is a member of the Southwest Power Pool (SPP), which is a Regional Transmission

Operator (RTO), located in Little Rock, Arkansas. SPP’s primary purpose is to facilitate the movement of

power throughout the RTO’s footprint through an integrated marketplace. The integrated marketplace is

intended to provide for the reliable movement of power during all times but especially during emergency

events while providing cost savings to those load serving utilities through a more efficient process of

resource dispatch. Many of the efficiencies are driven by SPP becoming the balancing authority for the

region. SPP’s current footprint covers much of the south-central portion of the United States.

The Utility has contracts with the Southwestern Power Administration (SPA) entitling the Utility to

annually purchase 38.6 MW of hydroelectric peaking capacity, and 5 MW of hydroelectric power from the

Western Area Power Administration (WAPA). The Utility also has entered into seven Renewable Energy

Purchase Agreements. BPU’s agreement with TradeWind Energy is to receive 25% of the energy output

of Phase 1 of the Smoky Hills Wind Farm. Phase I of the project has a name plate of approximately 100

MW of wind capacity. The wind farm was built approximately 25 miles west of Salina, Kansas in Lincoln

and Ellsworth Counties in Kansas. In March 2017, also through TradeWind Energy, the BPU began

receiving 200 MW of energy generated by wind turbines from the Cimarron Bend Wind Project. The wind

3

farm is located just south of Minneola, Kansas. BPU also has an agreement with Oak Grove Power

Producers to provide 3.5 MW of landfill gas from Arcadia, Kansas. The BPU maintains a contract with the

Bowersock Mills & Power Company (“Bowersock”) to purchase the capacity and energy of an existing

2.15 MW run of the river hydroelectric facility on the Kansas River in Lawrence, Kansas and 4.70 MW of

capacity from an expansion of Bowersock’s existing hydroelectric facilities. BPU also receives 25 MW of

energy generated by wind turbines from OwnEnergy, Inc. The wind farm is located south of Alexander,

Kansas in Rush County in Kansas. Lastly, in November 2016, BPU along with MC Power, a solar

developer, agreed to install a 1 MW alternating current solar photovoltaic facility at the Nearman Creek

Power facility. The project is intended to be a community solar project where customers can license panels

to reduce their monthly electric expenses and support greener initiatives.

The Water Utility serves approximately 53,000 water customers in the service area of approximately 152

square miles. This service area includes Kansas City, Kansas, Edwardsville, southern Leavenworth County,

parts of Bonner Springs and a small section of northern Johnson County. BPU’s current average day is 30

million gallons of water a day (MGD) with the maximum day average over the last 5 years of 40 MGD.

The historical max day is 49 MGD. The water utility utilizes the state-of-the-art Nearman Water Treatment

Plant (NWTP) and has the capacity to pump 72 MGD, including one water treatment facility; three major

pump stations; 1,000 miles of water pipes and two of the nation’s largest horizontal collector wells.

The Water distribution system consists of a network of underground mains, reservoirs, and a series of

booster district systems. The water transmission network consists of 72.5 miles of primary and trunk lines

ranging in size from 24 to 48 inches. From these mains, water is delivered through a system of 900 miles

of secondary water mains. The Utility has approximately 32.5 million gallons of water stored in reservoirs

and elevated tanks at various locations in the distribution system. There are three booster-pumping stations,

which increase water pressure to higher elevations and through the 1,000 miles of water pipes.

The Utility’s annual budget represents the plan for providing electric and water services for each fiscal year.

An annual budget consisting of operating and maintenance expenses as well as a five-year capital plan is

submitted by the General Manager and Executive Directors to the Board of Directors. The Board of

Directors adopts the budget no later than December of each year. Budgetary control is maintained at the

departmental level by comparing budgeted expenses with actual expenses on a periodic and year-to-date

basis.

Economic Conditions

The Unified Government is the government for both Wyandotte County and the City of Kansas City, KS.

Wyandotte County accounts for a large number of manufacturing, transportation and distribution, including

rail, and health care jobs in the metropolitan area. Many of these jobs are high paying and contribute to the

positive statistics regarding gross payroll and gross sales. Development remains an important priority for

the Unified Government.

The County of Wyandotte County covers 155.7 square miles. It is located on the eastern border of the State

and along with three other Kansas counties and eight Missouri counties, comprise the Kansas City

Metropolitan Statistical Area with a population of approximately 2 million.

According to the U.S. Census Bureau, Wyandotte County’s estimated population was 169,245 in 2021.

Compared to population trends in the prior decades, the current estimates indicate a more stable population.

The median age is 34 versus a national average of 38 years. Approximately, 39% of the population is

greater than 50 years old.

4

In recent years, efforts have been directed toward the development of a 1,600-acre tract of land located

directly northwest of the intersection of Interstate Highways I-70 and I-435. The Unified Government

attracted the Kansas Speedway as the economic catalyst for development of this tract using the STAR Bond

financing incentive. The speedway project, totaling more than $280 million, is a 1.5-mile tri-oval on

approximately 1,100 acres of land, with 72 luxury hospitality suites and grandstand seating for 82,000.

Joining Kansas Speedway at Village West are major destination retailers and entertainment businesses that

attract approximately 12 million visitors and shoppers annually. The initial anchor businesses and

attractions include: Cabela’s, Nebraska Furniture Mart, Great Wolf Lodge and Resort, Hollywood Casino,

Children’s Mercy Park, home of the Kansas City MLS soccer team Sporting KC Soccer Club and Field of

Legends Field (formerly CommunityAmerica Ballpark), home of the American Association’s Kansas City

Monarchs Baseball Club. An additional development north of I-70 and east of I-435, just east of the Village

West area include the headquarters for the Dairy Farmers of America which is the area’s largest private

employer in terms of revenue. In 2018, the U.S. Soccer National Training and Coaching Development

Center, named Compass Minerals, opened which will house the elite athlete training and performance

analytics campus and national youth soccer development programs. In 2020, a multi-sport athletic complex

known as Homefield, Homefield Outdoor and Homefield Youth Baseball Complex is being developed

within Village East.

Industrial growth has resulted from the General Motors $600 million investment in its Kansas City plant.

The redevelopment of two adjacent industrial parks has occurred in this area as well. This building is

occupied by Inergy and is a supplier to the General Motors automotive plant. In 2018, General Motors

announced a $265 million investment to support production of the new Cadillac XT4 Crossover SUV.

General Motors also produces the Chevy Malibu. Additional industrial development was the construction

of the Amazon Fulfillment Center. The facility is on 134 acres and approximately 4,000 employees

currently work at the fulfillment center. An additional Amazon fulfillment center was completed in 2021.

This is a 1.08 million square-foot logistics facility with approximately 1,000 employees.

In 2020, the Kansas City Kansas region was selected by Urban Outfitters to build an 880,000 square foot

distribution and fulfillment center. The facility will be located near the Kansas Speedway and will be a

$403 million capital investment with up to 2,000 jobs. Operations began in 2022 with estimated completion

of 4

th

quarter 2023. Additionally, in 2018, the Unified Government was awarded $13.8 million to replace

the existing I-70 and Turner Diagonal interchange. This allowed for the development of the $155 million

Turner Logistics Industrial Park on a site adjacent to I-70. The site will include 2.7 million square feet of

distribution/warehouse space and will create 1,800 jobs. As of December 2022, there has been five

buildings completed.

Adjacent to Kansas University Medical Center is are the Hudson Apartments, which is the demolition and

construction of a new $48 million, 5-story multifamily housing complex. It will consist of 228 1–2-bedroom

units and studios with amenities. This will provide much needed housing space in this area. Completion

date is expected to be Fall 2024.

Long Term Financial Planning

BPU’s goals for the future include meeting the needs of the community as development continues within

the county. BPU utilizes a five-year capital improvement program to prioritize projects, which will be

scheduled over a number of years as financial resources are available. The electric capital improvement

plan identifies approximately $180 million in generation, transmission, and distribution projects. The

electric capital plan is projected to be 50% bond financed over the years. The water capital improvement

plan identifies approximately $118 million in projects, of which 60% are projected to be financed.

5

Cash Management and Investment Policy

The Utility’s cash management practice encourages investment of all cash not needed for immediate

expenditures. It is the policy of the Utility to invest public funds in a manner that provides the highest

investment return with the maximum security while complying with all Kansas statutes governing the

investment of public funds. The Utility’s investment policy was adopted by the Board of Directors.

Internal Control

Management of the Board of Public Utilities (BPU) is responsible for establishing and maintaining internal

controls to ensure that assets of the BPU are protected from loss, theft, or misuse, and to ensure that adequate

accounting data are compiled to allow for the preparation of financial statements in conformity with

accounting principles generally accepted in the United States. The internal controls are designed to provide

reasonable, but not absolute, assurance that these objectives are met. The concept of reasonable assurance

recognizes that (1) the cost of a control should not exceed the benefits likely to be derived, and (2) the

evaluation of costs and benefits requires estimates and judgements by Management.

Major Initiatives

The Board of Public Utilities is currently investing in significant capital improvements to update and

improve service to our customers. Projects underway include electric substation, transmission and

distribution improvements in the Rosedale, Armourdale, and Piper areas as well as replacing a 7MG Water

Reservoir in Argentine and the upgrading of the water distribution valves and mains throughout the

community.

The electric utility has completed the construction of the new Rosedale substation and has decommissioned

the Fisher substation. The new substation will support the expansion of the University of Kansas Medical

Center which constructed a $75 million medical education building as well as a $280 million patient tower

which will be a seven-story facility. Work continues throughout 2023 to build out and enhance the

distribution facilities in this area. With the Urban Outfitters development, the electric utility will be

providing the distribution facilities to support the new growth in that area over the next several years.

The water utility has increased efforts to replace aging infrastructure in the water distribution system over

the next several years. The water utility plans to replace approximately 3-5 miles of water mains each year.

The utility received a federal grant of $10 million to help in replacing water mains within the distribution

system. In addition, a 7-million-gallon reservoir will be designed and constructed over the next two years

within the Argentine water system. The new reservoir will provide more water storage for the area and give

an emergency backup to the Fairfax Industrial area in the Northeast section of our service territory.

GFOA Certificate of Achievement Award

The Government Finance Officers Association of the United States and Canada (GFOA) awarded a

Certificate of Achievement for Excellence in Financial Reporting to the Kansas City Board of Public

Utilities for its annual comprehensive financial report for the year ended December 31, 2021. This was the

forty-first consecutive year that the BPU achieved this prestigious award. In order to be awarded a

Certificate of Achievement, BPU must publish an easily readable and efficiently organized annual

comprehensive financial report. This report must satisfy both generally accepted accounting principles and

applicable legal requirements.

6

A Certificate of Achievement is valid for a period of one year only. We believe this 2022 annual

comprehensive financial report continues to meet the Certificate of Achievement Program’s requirements

and we are submitting it to the GFOA to determine its eligibility for a certificate for the forty-second

consecutive year.

Acknowledgements

In closing, I would like to thank the Accounting staff for their efforts in preparing and providing the

financial information. Special thanks to David Mehlhaff, Chief Communications Officer, in coordinating

the comments for the President’s and General Manager’s messages.

Respectfully submitted,

Lori C. Austin

Chief Financial Officer/Chief Administrative Officer

7

Government Finance Officers Association

Certificate of

Achievement

for Excellence

in Financial

Reporting

Presented to

Kansas City Board of Public Utilities

Kansas

For its Annual Comprehensive

Financial Report

For the Fiscal Year Ended

December 31, 2021

Executive Director/CEO

8

PRESIDENT’S MESSAGE

The Kansas City Board of Public Utilities (BPU) has been providing electric and water services to Wyandotte County

for more than 100 years. As a non-profit organization, its mission remains the same as it has always been – to provide

quality dependable utility services to the community at the lowest possible price.

Despite challenges, BPU and the community made significant accomplishments in 2022. The Board of Directors,

management, and BPU staff worked hard to help customers and the community better manage issues like rising

inflation and the lingering impacts of COVID, while remaining focused on ensuring reliable, quality electric and

water service – not only today, but in the future as well.

Specific 2022 accomplishments included:

Customer Service Convenience Improvements – Providing more convenience and accessibility options, and

expanded communications tools. This included promotions and resources for several unique programs

including a new Service Outage and Customer Billing Alert text capability, the Energy Engage Portal, an

online Self-Service tool, a mobile-friendly Electric Outage Reporting Map, an Equal Pay Plan alternative,

and additional bill payment kiosk locations bringing added payment options to local neighborhoods.

Renewable Energy Leader – BPU remained a leader in renewable energy, with more than 48% of its

generation today coming from wind, hydropower, and landfill gas. One of the “greenest” public utilities in

the nation, our diverse generation mix allows the utility to be less reliant on only coal and gas which

experiences price fluctuations, with the community, the environment, and public health also benefiting from

this “clean power” approach. Promotion of its Community Solar Farm, the first in the state, continued to

both residential and commercial customers. In total, BPU has the capacity to power 135,000 local homes

from its carbon-free renewable energy portfolio.

Energy Efficiency and Conversation – Continued promoting energy and water efficiency and savings

initiatives through customer education and outreach.

Transparency and Communications – Continued working on initiatives to make information more readily

accessible, while ensuring the use of industry best practices in achieving this. To ensure public input, the

utility continued making all board meetings accessible online and virtually via Zoom, and utilized social

media, direct mailings, and earned media placements as a tool for continued engagement with customers and

the community.

Continuing to champion strategic alliances and support expansion opportunities that benefit the utility as

well as the community. Supporting economic development, business retention and growth in the service area

with other community partners.

A continued focus on employee training and development, and improved utility recruiting efforts to improve

employee qualifications and performance.

9

BPU provided and contributed far more than just electricity and water service to the community in 2022. The Board

of Directors, as well BPU employees who all live and work in Wyandotte County, understand that the utility’s

mission is to ensure reliable and affordable electric and water service, while working hard to improve the quality of

life for our entire community.

Mary L. Gonzales

Board President

June 8, 2023

10

Board of Directors – 2022

The Board of Directors is composed of six members, three of whom are elected at large and three of whom are

elected by district. Every two years three members are elected for four-year terms. The Board chooses a president,

vice president, and secretary from its own membership. The Board meets twice a month, on the first and third

Wednesdays. Members receive a monthly salary of $950. The treasurer of the Unified Government of Wyandotte

County/Kansas City, Kansas is the ex-officio treasurer of the Board. The Board is charged with the duty to hire a

General Manager, who serves as BPU’s chief executive officer, and who administers the day-to-day operations of

the utility.

Mary L. Gonzales

President

Member at Large

Elected 2001-2005

Re-elected 2005-2009

Re-elected 2009-2013

Re-elected 2013-2017

Re-elected 2017-2021

Re-elected 2021-2025

Ms. Gonzales retired from teaching school in 2006 after a 33-year career. For many of those years she was an

eighth-grade language arts teacher at Piper Middle School. Ms. Gonzales has a Bachelor of Arts degree in

Education from the University of Montevallo in Montevallo, Alabama, and a Master’s degree in Curriculum

and Instruction from Emporia State University. She is currently the BPU’s Board President and has previously

served as Board President from 2005 to 2007 and previously as vice president and secretary of the BPU Board.

Besides her BPU Board and other community activities, she is a member of the American Public Power

Association and the American Water Works Association. A graduate of Leadership 2000, she serves on the

board for the Rosedale Development Association and also on the advisory board for the Civic Leadership

Academy for Olathe, Kansas schools. Mary was also District 5 Coordinator in the successful effort to

consolidate the Wyandotte County/City governments and served on the advisory board of the Wyandotte

County Library. In addition, she is past President of Delta Kappa Gamma International Educational Society

and is a former board member for both El Centro and City Vision Ministries.

Rose Mulvany Henry

Vice President

Member at Large

Elected 2019-2023

Ms. Mulvany Henry is a native of Kansas City, Kansas, where she attended Bishop Ward High School. She

furthered her education and received her B.A. in English from the University of Kansas (1990), and her J.D.

from Washburn University School of Law (1993). Rose is currently admitted to practice in Kansas. Rose is

currently the Vice President of Regulatory & Legislative Affairs for Metronet, the largest privately held fiber-

11

Board of Directors – 2022 – (continued)

to-the-premise company in the United States. Prior to joining Metronet in 2021, Rose has over 30 years of utility

industry experience representing many companies in the technology and communication industries and then with

her own private practice in Kansas City, Kansas. Rose is currently the BPU’s Board Vice President.

Tom Groneman

Secretary

Member,

Second

District

Elected 2013-2017

Re-Elected 2017-2021

Re-Elected 2021-2025

Mr. Groneman is a lifelong Wyandotte County resident, graduating from Wyandotte High School in 1965.

He has served as BPU’s Board President from 2016 to 2017. In 1969 he graduated from Bethany College,

Lindsborg, KS with a Bachelor’s degree in Business/Economics.

Following college, he entered the United States Navy and was trained as a Vietnamese linguist. He was

stationed for 15 months at the Naval Communications Station, Philippines where he was assigned to

temporary active duty with the Commander of Carrier Division 5/Task Force 77 aboard the USS Enterprise,

USS Kitty Hawk and USS Constellation. He finished his tour at the National Security Agency, Ft. Meade,

MD.

After the military he returned to Wyandotte County and worked briefly as a probation officer for the 29

th

Judicial District. In 1975 he was appointed Register of Deeds to fill out the unexpired term of Jack Reardon

who had been elected mayor. He was subsequently elected to seven consecutive four-year terms as Register

of Deeds. In 2003, Mr. Groneman joined the staff of Governor Kathleen Sebelius to become the Director of

Alcoholic Beverage Control for the State of Kansas. He commuted for nearly eight years between Kansas

City and Topeka until the change in administrations in 2011.

During his public service, Tom has served in numerous positions on various state and national organizations.

Jeff Bryant

Member, Third

District

Elected 2011-2015

Re-elected 2015-2019

Re-elected 2019-2023

Mr. Bryant is the Lead Estimator/Job Cost Analyst for Plastic Packaging Technologies in Kansas City,

Kansas. He has been with the company for over 40 years serving in a variety of roles.

12

Board of Directors – 2022 – (continued)

He is a past member of the Armourdale Renewal Association, the Turner Lions Club and the Kansas City

Chapter of the NAACP. He served a two-year term on the Schlagle Sit Council, which is committed to

increasing the graduation rate of local students. He has served on the Unified Government’s (UG) Finance

Standing Committee and previously served on the Public Works and Safety Committee. He is Leadership

2000 Class XX graduate and has served on the Board of Directors of Leadership 2000. Mr. Bryant is a graduate

of Turner High School and attended Donnelly College.

Jeff has also served as BPU’s Board President in 2017 and previously as Vice President and Secretary of the

BPU Board.

Robert L. Milan, Sr.

President

Member, First District

Elected 1991-1995

Re-elected 1995-1999 Re-elected 2011-2015

Re-elected 1999-2003 Re-elected 2015-2019

Re-elected 2003-2007 Re-elected 2019-2023

Re-elected 2007-2011

Mr. Milan has served on the BPU Board for over 30 years, having been first elected in 1991. He has served as

President five times previously. In 2007, BPU recognized Mr. Milan’s dedication to the utility by naming a

new Water Division facility in his honor, the Robert L. Milan, Sr. Pump Station and Reservoir.

Mr. Milan worked at the U.S. Department of Labor for 32 years, retiring as a Federal Representative. He is

active in the Northeast Optimist Club and NAACP. In 2001 he served as State President of AARP. In 2010,

the Directors of the Heritage Registry of Who’s Who announced the inclusion of Mr. Milan. He has received

many awards including being selected by the Kansas City Globe as one of the 100 most influential people in

1998.

A native of Kansas City, Kansas, he owned Milan's Roller Arena and Bowling establishment for many years.

Mr. Milan is a Sumner High School graduate and attended Kansas City Kansas Community College, the

University of Kansas extension, Donnelly College, the Univ of Colorado, Temple Univ. and Pioneer College.

13

Board of Directors – 2022 – (continued)

David B. Haley

Member at Large

Elected 2021-2025

Mr. Haley has served the community in several capacities having been first elected to the Kansas House of

Representatives beginning in 1994 and then the Kansas Senate since 2000 where he was re-elected to a 6

th

term

in the Kansas Senate in 2020.

He serves as the Ranking Minority member of the Senate Judiciary Committee and also served on the Senate’s

Ethics; Elections & Local Government; public Health & Welfare; Federal & State Affairs; Assessment &

Taxation and Redistricting Committees among other leadership positions.

Mr. Haley graduated from Morehouse College (Atlanta, GA) and Howard University Law School (Washington,

D.C.). He is a public affairs counselor and real estate developer and an active member of the National Black

Caucus of State Legislators.

14

GENERAL MANAGER’S MESSAGE

As a non-profit municipal utility, BPU maintains customer-focused principles including Accountability,

Appreciation, Customer Focus, Innovation, Integrity, Respect and Transparent Communication. The utility has

provided quality dependable utility service to the community and residents of Wyandotte County since 1909. Today

BPU services nearly 65,000 commercial, industrial, and residential customers over a 150 sq. mile area. BPU’s

primary goal remains providing quality dependable services to ratepayers at the lowest possible price.

BPU continually looked for ways to meet the needs of all its customers, from individual residents to the largest

businesses, and became a more adaptive, efficient, and focused organization as a result in 2022. Throughout the year,

BPU managed existing and introduced several new programs and initiatives to better service utility customers, and

the community, while maintaining a stable financial position and remaining prepared to meet future electric and

water requirements for the entire community. These included, among other things:

Providing cost effective, safe, and reliable utility services, including efficient operation of electric and water

production facilities.

Payment Assistance Programs – BPU maintained several programs administered by the United Way,

including the Utility Assistance Program which disbursed funds to eight local non-profit agencies, and the

Customer Hardship Payment Service program, which helped offset utility expenses related to changes in

employment, income status, health emergencies, etc.

A Stable Financial Position – In addition to meeting the needs of the community, BPU has been able to do

so while reducing its annual budget and spending over the last five years. From $495 million in 2016 to

$350.6 million in 2022, BPU has cut its annual budget by more than 30% in recent years.

Ensuring continued fiscal sustainability by effectively managing debt service coverage, cash-on-hand,

and credit ratings through open and transparent fiscal and budget policies. In achieving this, BPU was

recognized with the Certificate of Achievement for Excellence in Financial Reporting Award by the

Government Finance Officers Association (GFOA) in 2022. The utility was also assigned a

profile/rating of ‘A’ and ‘Stable Outlook’ by national rating service companies Fitch Ratings and S&P

Global Ratings.

Working to ensure that electric transmission and distribution systems continued operating in a safe and

reliable manner.

Identifying and encouraging usage of innovative technologies, implementation of utility wide reliability

standards, and the development of a safety-conscious workplace.

Continuing to focus on corporate reporting programs including data analytics and operational performance

metrics. Ensure utility compares favorably with other peer municipal utilities within the region.

On-going evaluation and improvements to maintain and upgrade BPU’s aging utility system and

infrastructure, while maintaining and exceeding all environmental regulations.

BPU was named a 2022 Silver Stevie Award recipient by the American Business Awards (ABA) for its

community response to the pandemic, received the 2022 Sue Kelly Community Service Award from the

American Public Power Association (APPA), and was named the PR News 2022 Nonprofit Awards

winner in the Social Responsibility category for its efforts to assist the community and customers

impacted by COVID. This included the 2022 Annual BPU Charity Golf Tournament which raised over

15

$49,000 for children’s charities, the BPU Summer Youth Program which helps provide mentoring and

jobs for local youth, and the BPU Employee Foundation that gathers donations and volunteers

throughout the community, among other things.

BPU and its employees continued working to provide reliable, safe, and affordable utility services to the community

in 2022 despite various challenges, simultaneously refining some operational and customer-oriented strategies as

necessary.

Moving forward, BPU will continue working to: 1) ensure production and delivery systems meet demand; 2)

champion renewable energy; 3) offer residential customers flexible and easy payment options; 4) utilize new

technology to improve customer service; 5) promote energy and water efficiency; 6) ensure compliance with federal

and state rules and regulations; and 7) ensure fiscal sustainability by managing debt, cash-on-hand, and credit ratings

through open and transparent fiscal and budget policies.

BPU and its employees remain committed to improving the overall quality of life in the community it service, just

as it has for more than a century.

Respectfully,

William A. Johnson

General Manager

June 8, 2023

16

Senior Management – 2022

William A. Johnson

General Manager

William A. (Bill) Johnson has worked at the

Kansas City Board of Public Utilities for more

than forty (42) years. Mr. Johnson earned an

MBA from Ottawa University in 2007.

He began his career at BPU in an entry-level

position and worked his way up through the

ranks into an executive level position prior to

being appointed General Manager. His

previous position included directing BPU

Electric Operation & Technology division

activities; including but not limited to, Electric

Transmission and Distribution, Electric

Engineering, Information and Technology,

Telecommunications, and Fleet Maintenance.

Over his career, he has sponsored many large

utility projects including modernizing BPU’s

electric infrastructure and he has played a key

role in introducing some of the utility’s most

advanced enterprise technology systems

designed to improve utility operations.

Jeremy Ash

Chief Operating Officer

Lori C. Austin

Chief Financial Officer/Chief

Administrative Officer

Steve Green

Executive Director

Water Operations

Johnetta M. Hinson

Executive Director

Customer Services

Darrin McNew

Acting Executive Director

Electric Operations

He is past President of Kansas Municipal

Utilities, a current board member for the

Kansas City Kansas United Way, and past

board member of the Boys & Girls Club. He

is a member of the American Public Power

Association (APPA) and the Rocky Mountain

Electric League (RMEL). He is also past

President of the Kansas-Missouri chapter of

the American Association of Blacks in

Energy. He received the distinguished “Black

Achievers Award” from the Southern

Christian Leadership Council and the “Black

Man of Distinction Award” from the Friends

of Yates.

David E. Mehlhaff

Chief Communications

Officer

Maurice Moss

Executive Director

Corporate Compliance

Jerin Purtee

Executive Director

Electric Supply

Dong T. Quach

Executive Director

Electric Production

Jerold T. Sullivan

Chief Information

Officer

17

Executive Staff and Department Heads

2022

Becky Aldinger, Director

Purchasing & Supply Chain

Glen Brendel, Director

Electric Production Operations/Maintenance

Andrew Coffelt,

NERC Compliance Officer

Dennis Dumovich, Director

Human Resources

Michael Fergus, Director

Electric Distribution & Service

Andrew Ferris, Director

Financial Planning

Jody Franchett, Director

Administrative Services

Brian D. Laverack, Director

Network Operations

Dustin Miller, Director

Applications Information Technology

Patrick J. Morrill, Director

Electrical Engineering

Tung Nguyen, Director

Electric Production Engineer

Steve Nirschl, Director

Water Processing

Randy J. Otting, Director

Accounting

Scott Paramore, Acting Director

Electric Substations Eng & Ops

Clifford Robinett, Acting Director

Water Distribution

Ingrid Setzler, Director

Environmental Services

Chris D. Stewart, Director

Civil Engineering

Patrice Townsend, Director

Utility Services

18

KansasCityBoardofPublicUtilities

2022OrganizationalChart

Accounting

Civil Engineering

Cash Operations and Collections

Corporate Compliance

Customer Service

Electric Metering & Services

Electric Production Engineering

Electric Production Maintenance

Electric Production Operations

Electric Supply Planning

Electric System Control

Electric Transmission & Dist

Electrical Engineering

Employee Relations

Employment

Environmental Services

Grounds Maintenance

Information Technology

Network Support

OH / UG Lines

Production Support Services

Purchasing

Radio / Telecom & Cable

Stores

Street Lights

Substations

Traffic Signal

Transportation

Utility Services

Water Metering & Services

Water Distribution

Water Processing

Water System Support

FINANCIAL

SECTION

Independent Auditor’s Report

The Board of Directors

Board of Public Utilities

Kansas City, Kansas

Report on the Audit of the Financial Statements

Opinion

We have audited the financial statements of the Board of Public Utilities of Kansas City, Kansas (the

BPU), an enterprise fund of

the Unified Government of Wyandotte County/Kansas City, Kansas, as of and

for the years ended December 31, 2022 and 2021, and the related notes to the financial statements,

which collectively comprise the BPU’s basic financial statements as listed in the table of contents.

In our opinion, the accompanying financial statements referred to above present fairly, in all material

respects, the financial position of the BPU as of December 31, 2022 and 2021, and the changes in

financial position and its cash flows for the years then ended in accordance with accounting principles

generally accepted in the United States of America.

Basis for Opinion

We conducted our audits in accordance with auditing standards generally accepted in the United States

of America (GAAS); the Kansas Municipal Audit and Accounting Guide (the Guide); and the standards

applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller

General of the United States (Government Auditing Standards). Our responsibilities under those

standards are further described in the “Auditor’s Responsibilities for the Audit of the Financial Statements”

section of our report. We are required to be independent of the BPU, and to meet our other ethical

responsibilities, in accordance with the relevant ethical requirements relating to our audits. We believe

that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit

opinion.

Emphasis of Matters

As discussed in Note 1 to the financial statements, the financial statements present only the BPU and do

not purport to, and do not, present the financial position of the Unified Government of Wyandotte County,

Kansas City, Kansas as of December 31, 2022 and 2021, the changes in its financial position, or, where

applicable, its cash flows thereof for the years then ended in conformity with accounting principles

generally accepted in the United States of America.

As discussed in Note 1 to the financial statements, on January 1, 2021, the BPU adopted Governmental

Accounting Standards Board Statement No. 87, Leases.

Our opinion is not modified with respect to these matters.

The Board of Directors

Board of Public Utilities

Page 2

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in

accordance with accounting principles generally accepted in the United States of America, and for the

design, implementation, and maintenance of internal control relevant to the preparation and fair

presentation of financial statements that are free from material misstatement, whether due to fraud or

error.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are

free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that

includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance

and therefore is not a guarantee that an audit conducted in accordance with GAAS and Government

Auditing Standards will always detect a material misstatement when it exists. The risk of not detecting a

material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve

collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

Misstatements are considered material if there is a substantial likelihood that, individually or in the

aggregate, they would influence the judgment made by a reasonable user based on the financial

statements.

In performing an audit in accordance with GAAS and Government Auditing Standards, we:

Exercise professional judgment and maintain professional skepticism throughout the audit.

Identify and assess the risks of material misstatement of the financial statements, whether due to

fraud or error, and design and perform audit procedures responsive to those risks. Such

procedures include examining, on a test basis, evidence regarding the amounts and disclosures

in the financial statements.

Obtain an understanding of internal control relevant to the audit in order to design audit

procedures that are appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of the BPU’s internal control. Accordingly, no such opinion is

expressed.

Evaluate the appropriateness of accounting policies used and the reasonableness of significant

accounting estimates made by management, as well as evaluate the overall presentation of the

financial statements.

We are required to communicate with those charged with governance regarding, among other matters,

the planned scope and timing of the audits, significant audit findings, and certain internal control-related

matters that we identified during the audits.

The Board of Directors

Board of Public Utilities

Page 3

Required Supplementary Information

Accounting principles generally accepted in the United States of America require that the management’s

discussion and analysis, pension and other postemployment information as listed in the table of contents

be presented to supplement the basic financial statements. Such information is the responsibility of

management and, although not a part of the basic financial statements, is required by the Governmental

Accounting Standards Board, who considers it to be an essential part of financial reporting for placing the

basic financial statements in an appropriate operational, economic, or historical context. We have applied

certain limited procedures to the required supplementary information in accordance with GAAS, which

consisted of inquiries of management about the methods of preparing the information and comparing the

information for consistency with management’s responses to our inquiries, the basic financial statements,

and other knowledge we obtained during our audit of the basic financial statements. We do not express

an opinion or provide any assurance on the information because the limited procedures do not provide us

with sufficient evidence to express an opinion or provide any assurance.

Supplementary Information

Our audits were conducted for the purpose of forming an opinion on the financial statements that

collectively comprise the BPU’s basic financial statements. The Combining Statements as listed in the

table of contents are presented for purposes of additional analysis and are not a required part of the basic

financial statements. Such information is the responsibility of management and was derived from and

relates directly to the underlying accounting and other records used to prepare the basic financial

statements. The information has been subjected to the auditing procedures applied in the audits of the

basic financial statements and certain additional procedures, including comparing and reconciling such

information directly to the underlying accounting and other records used to prepare the basic financial

statements or to the basic financial statements themselves, and other additional procedures in

accordance with GAAS. In our opinion, the information is fairly stated, in all material respects, in relation

to the basic financial statements as a whole.

Other Information

Management is responsible for the other information included in the annual comprehensive financial

report. The other information comprises the Introductory and Statistical sections but does not include the

basic financial statements and our auditor’s report thereon. Our opinion on the basic financial statements

does not cover the other information, and we do not express an opinion or any form of assurance

thereon.

In connection with our audits of the basic financial statements, our responsibility is to read the other

information and consider whether a material inconsistency exists between the other information and the

basic financial statements, or the other information otherwise appears to be materially misstated. If,

based on the work performed, we conclude that an uncorrected material misstatement of the other

information exists, we are required to describe it in our report.

The Board of Directors

Board of Public Utilities

Page 4

Other Reporting Required by Government Auditing Standards

In accordance with Government Auditing Standards, we have also issued our report dated June 8, 2023,

on our consideration of the BPU’s internal control over financial reporting and on our tests of its

compliance with certain provisions of laws, regulations, contracts and grant agreements, and other

matters. The purpose of that report is solely to describe the scope of our testing of internal control over

financial reporting and compliance and the results of that testing, and not to provide an opinion on the

effectiveness of the BPU’s internal control over financial reporting or on compliance. That report is an

integral part of an audit performed in accordance with Government Auditing Standards in considering the

BPU’s internal control over financial reporting and compliance.

Kansas City, Missouri

June 8, 2023

This page has been left intentionally blank.

Board of Public Utilities

Management’s Discussion and Analysis

December 31, 2022 and 2021

(Unaudited)

22

Overview of the Financial Statements

This discussion and analysis is intended to serve as an introduction to the Board of Public Utilities of

Kansas City, Kansas’s (BPU) financial statements. The BPU’s financial statements comprise two

components: 1) financial statements and 2) notes to the financial statements. Other required

supplementary information is provided in addition to the financial statements.

Financial Statements

The financial statements are designed to provide readers with a broad overview of the BPU’s finances in a

manner similar to a private-sector business.

The statement of net position presents information on BPU’s assets, deferred outflows of resources,

liabilities and deferred inflows of resources, with the difference between these reported as net position.

Over time, increases/decreases in net position may serve as a useful indicator of whether the financial

position of the BPU is improving/deteriorating.

The statement of revenues, expenses and changes in net position presents information showing how

BPU’s net position changed during the most recent fiscal year. All changes in net position are reported as

the underlying event giving rise to the change occurs, regardless of the timing of the cash flows. Thus,

revenues and expenses reported in this statement for some items will only result in cash flows in future

fiscal periods (for example, uncollected payments-in-lieu of taxes and earned but unused vacation leave).

Notes to the Financial Statements

The notes provide additional information essential to a full understanding of the data provided in the

financial statements.

Other Information

In addition to the financial statements and accompanying notes, this report also presents certain required

supplementary information concerning the BPU’s progress in funding its obligation to provide pension

and postretirement benefits to its employees.

The combining statements for the BPU’s electric and water utilities are presented immediately following

the required supplemental information.

The BPU is an administrative agency of the Unified Government of Wyandotte County/Kansas City,

Kansas (Unified Government).

The electric and water departments are reflected as an enterprise fund on the Unified Government’s

financial statements consisting of the statement of net position; statement of revenues, expenses and

changes in net position; and statement of cash flows. This management’s discussion and analysis of the

BPU’s financial report presents the discussion and analysis of the BPU’s financial performance for the

years ended December 31, 2022 and 2021 with selected comparative information of the year ended

December 31, 2020. This analysis should be read in conjunction with the financial statements and notes

thereto.

Board of Public Utilities

Management’s Discussion and Analysis

December 31, 2022 and 2021

(Unaudited)

23

The following tables summarize the financial condition and operations of the BPU as of December 31,

2022, 2021 and 2020 and for each of the years then ended (the financial information for 2020 has not

been adjusted for the impacts of the BPU’s implementation of GASB 87 during 2021):

Statements of Net Position Summary

2022

2021

(As Restated)

2020

Assets and deferred outflows of resources:

Current assets $ 169,411,971 $ 143,143,157 $ 145,468,946

Capital assets, net 1,076,701,899 1,072,433,104 1,069,848,798

Other noncurrent assets 102,532,815 91,687,867 90,560,353

Total assets 1,348,646,685 1,307,264,128 1,305,878,097

Deferred outflows of resources 45,488,357 65,686,229 32,555,985

Total assets and deferred outflows

of resources $ 1,394,135,042 $ 1,372,950,357 $ 1,338,434,082

Liabilities, deferred inflows of resources, and

net position:

Current liabilities $ 93,845,110 $ 85,836,241 $ 84,780,351

Noncurrent liabilities 649,039,876 678,989,714 717,779,584

Total liabilities 742,884,986 764,825,955 802,559,935

Deferred inflows of resources 82,980,183 89,204,318 51,799,811

Net position:

Net investment in capital assets 451,012,342 427,959,301 397,769,293

Restricted 45,992,834 22,594,388 29,543,724

Unrestricted 71,264,697 68,366,395 56,761,319

Total net position 568,269,873 518,920,084 484,074,336

Total liabilities, defe rred inflows of

resources and net position $ 1,394,135,042 $ 1,372,950,357 $ 1,338,434,082

Board of Public Utilities

Management’s Discussion and Analysis

December 31, 2022 and 2021

(Unaudited)

24

Statements of Revenues, Expenses and Changes in Net Position Summary

Operating revenues:

2022

2021

(As Re stated)

2020

Residential $ 110,391,146 $ 98,837,029 $ 99,892,366

Commercial 126,967,366 104,869,840 107,334,998

Industrial 57,733,185 45,213,319 52,532,941

Other 40,445,684 66,416,518 25,444,106

Energy rate component recovery 12,468,276 2,312,998 —

Payment-in-lieu of taxes 37,073,894 31,715,220 32,687,316

Total operating revenues 385,079,551 349,364,924 317,891,727

Operating expenses:

Fuel 55,754,914 47,845,256 28,727,073

Purchased power 67,452,166 58,012,729 57,067,042

Production 42,442,507 39,990,738 43,602,858

Transmission and distribution 46,245,007 46,294,841 45,129,256

General and administrative 26,629,022 29,722,913 31,199,101

Depreciation and amortization 41,253,137 39,056,593 37,473,398

Total operating expenses 279,776,753 260,923,070 243,198,728

Operating income 105,302,798 88,441,854 74,692,999

Nonoperating income (expense):

Interest expense (22,029,289) (23,513,227) (27,887,268)

Payment-in-lieu of taxes (37,073,894) (31,715,220) (32,687,316)

Other 1,787,862 679,899 108,300

Total nonoperating expense, net (57,315,321) (54,548,548) (60,466,284)

Contributions and transfers:

Contributions from developers and others 1,362,312 952,442 1,075,471

Change in net position 49,349,789 34,845,748 15,302,186

Net position, beginning of year 518,920,084 484,074,336 468,772,150

Net position, end of year $ 568,269,873 $ 518,920,084 $ 484,074,336

Total revenue $ 388,229,725 $ 350,997,265 $ 319,075,498

Total expense 338,879,936 316,151,517 303,773,312

Financial Highlights

2022 Compared to 2021

Net capital assets increased by $4.3 million in 2022. The increase is attributed to additions

associated with electric and water transmission and distribution assets, as well as additions to

general plant assets.

Debt service coverage ratio for 2022 increased to 2.83 times in comparison with 2.45 for the year

ended 2021.

Deferred outflows of resources decreased by $20.2 million due to pension recognition.

Net position increased by $49.3 million during 2022.

Board of Public Utilities

Management’s Discussion and Analysis

December 31, 2022 and 2021

(Unaudited)

25

In 2022, the BPU’s operating revenues were approximately $385.1 million, with the Electric Utility

recognizing revenues of $332.3 million and the Water Utility recognizing revenues of $52.8 million. The

average number of customer accounts remained stable from the prior year.

The BPU’s total operating revenue increased by approximately $35.7 million to $385.1 million in 2022.

The Electric Utility experienced increased electric sales of $33.8 million compared to 2021. Residential,

Commercial, and Industrial were more than prior year.

The Water Utility experienced an increase of $1.9 million in water sales compared to 2021. In

comparison to the 2022 budgeted revenue, overall, the BPU collected 110% of the projected Energy and

Water sales and 113% of total operating revenue.

Operating expenses for 2022 and 2021 were approximately $279.8 million and $260.9 million,

respectively. The Electric Utility represented $244.1 million and $224.6 million for 2022 and 2021,

respectively, while the Water Utility represented $35.7 million and $36.3.3 million for 2022 and 2021 in

operating expenses, respectively. The largest components of operating expenses are fuel, purchased

power and production expense. Overall, in 2022, fuel, purchased power and electric production costs

totaled $165.6 million which is $19.8 million more than 2021. The BPU’s power supply mix for fiscal

years 2022 and 2021 was 22% and 22% coal, 55% and 55% net power purchases, 16% and 16% gas, and

7% and 7% oil, respectively.

2021 Compared to 2020

Net capital assets increased by $2.6 million in 2021. The increase is attributed to additions

associated with electric and water transmission and distribution assets, as well as additions to

general plant assets.

Debt service coverage ratio for 2021 increased to 2.45 times in comparison with 2.15 for the year

ended 2020.

Deferred outflows of resources increased by $33.1 million due to pension recognition.

Net position increased by $34.8 million during 2021.

In 2021, the BPU’s operating revenues were approximately $349.4 million, with the Electric Utility

recognizing revenues of $298.5 million and the Water Utility recognizing revenues of $50.9 million. The

average number of customer accounts remained stable from the prior year.

The BPU’s total operating revenue increased by approximately $31.5 million to $349.4 million in 2021.

The Electric Utility experienced increased electric sales of $33 million compared to 2020. Residential,

Commercial, and Industrial and Wholesale sales were less than prior year. Wholesale sales were up

compared to prior year due to Winter Storm Uri in February of 2021.

The Water Utility experienced a decrease of $1.5 million in water sales compared to 2020. In comparison

to the 2021 budgeted revenue, overall, the BPU collected 99% of the projected Energy and Water sales

and 112% of total operating revenue.

Board of Public Utilities

Management’s Discussion and Analysis

December 31, 2022 and 2021

(Unaudited)

26

Operating expenses for 2021 and 2020 were approximately $260.9 million and $243.2 million,

respectively. The Electric Utility represented $224.6 million and $207.9 million for 2021 and 2020,

respectively, while the Water Utility represented $36.3 million and $35.3 million for 2021 and 2020 in

operating expenses, respectively. The largest component of operating expenses is fuel, purchased power

and production expense. Overall, in 2021, fuel, purchased power and electric production costs totaled

$145.8 million which is $16.4 million more than 2020. The BPU’s power supply mix for fiscal years

2021 and 2020 was 22% and 23% coal, 55% and 66% net power purchases, 16% and 8% gas, and 7% and

3% oil, respectively.

Capital Assets

2022 Compared to 2021

Net capital assets increased by $4.3 million in 2022. Capital asset additions were offset by approximately

$41.3 million of depreciation and amortization expense.

Refer to Note 5 to the financial statements for additional information.

2021 Compared to 2020

Net capital assets increased by $2.6 million in 2021. Capital asset additions were offset by approximately

$39.1 million of depreciation and amortization expense.

Refer to Note 5 to the financial statements for additional information.

Debt Administration

2022 Compared to 2021

Noncurrent liabilities outstanding as of December 31, 2022 and 2021 were $649.0 million and

$679.0 million, respectively.

The BPU maintains a debt ratio that is consistent with the current provisions in the bond indenture

document. This debt service ratio is a measure of the adequacy of cash to pay debt service and is the

minimum amount necessary to prevent bond default. The BPU must maintain debt coverage of 1.2. The

coverage requirement imposed by the bond indenture is that operating revenues be at least 120% of the

maximum annual debt service.

The BPU also has a mandatory provision in its bond indentures for a debt service trigger when debt

coverage is 1.3 times or below the annual debt service payment amounts.

As of December 31, 2022 and 2021, the BPU had debt coverage of 2.83 times and 2.45 times,

respectively.

Board of Public Utilities

Management’s Discussion and Analysis

December 31, 2022 and 2021

(Unaudited)

27

In 2022, the BPU’s utility system bonds for both electric and water debt are rated A from both Fitch and

Standard & Poor’s Rating Services and A2 from Moody’s Investors Service. The interest rate on the

BPU’s outstanding debt ranges from .69% to 5.00%. Interest on debt expense for 2022 and 2021 was

$22.0 million and $23.5 million, respectively.

Refer to Note 6 to the financial statements for additional information.

2021 Compared to 2020

Noncurrent liabilities outstanding as of December 31, 2021 and 2020 were $679.0 million and

$717.8 million, respectively.

The BPU maintains a debt ratio that is consistent with the current provisions in the bond indenture

document. This debt service ratio is a measure of the adequacy of cash to pay debt service and is the

minimum amount necessary to prevent bond default. The BPU must maintain debt coverage of 1.2. The

coverage requirement imposed by the bond indenture is that operating revenues be at least 120% of the

maximum annual debt service.

The BPU also has a mandatory provision in its bond indentures for a debt service trigger when debt

coverage is 1.3 times or below the annual debt service payment amounts.

As of December 31, 2021 and 2020, the BPU had debt coverage of 2.45 times and 2.15 times,

respectively.

In 2021, the BPU’s utility system bonds for both electric and water debt are rated A from both Fitch and

Standard & Poor’s Rating Services and A2 from Moody’s Investors Service. The interest rate on the

BPU’s outstanding debt ranges from .69% to 5.20%. Interest on debt expense for 2021 and 2020 was

$23.5 million and $27.9 million, respectively.

Refer to Note 6 to the financial statements for additional information.

Board of Public Utilities

Statements of Net Position

December 31, 2022 and 2021

See Notes to Financial Statements (Continued) 28

Assets and Deferred Outflows of Resources 2022

2021

(As Restated)

Current assets:

Cash and cash equivalents $ 24,755,891 $ 44,337,909

Investments 19,808,027 —

Cash and cash equivalents – restricted 11,110,952 27,173,589

Investments – restricted 16,330,560 —

Accounts receivable – customers and other 32,455,283 26,861,877

Accounts receivable – unbilled 16,024,229 14,211,636

Allowance for doubtful accounts (221,529) (325,091)

Inventories 30,464,844 24,645,614

Regulatory assets 14,781,274 2,312,998

Prepayments and other current assets 3,902,440 3,924,625

Total current assets 169,411,971 143,143,157

Noncurrent assets:

Capital assets:

Property, plant, and equipment 1,930,344,381 1,870,778,928

Less accumulated depreciatio

n

(939,398,338) (902,505,513)

Plant in service, net 990,946,043 968,273,415

Construction work in progress 85,755,856 104,159,689

Capital assets, net 1,076,701,899 1,072,433,104

Restricted assets:

Cash and cash equivalents 2,773,016 9,774,250

Investments 249,000 249,000

Net pension asset 23,267,891 —

Total restricted assets 26,289,907 10,023,250

System development costs, net 699,929 561,973

Regulatory assets 62,526,966 66,205,022

Lease receivables 13,016,013 14,897,622

Total noncurrent assets 1,179,234,714 1,164,120,971

Total assets 1,348,646,685 1,307,264,128

Deferred outflows of resources:

Deferred loss on bond refunding 5,006,986 6,126,495

Deferred outflows - Pension 40,481,371 59,559,734

Total deferred outflows of resources 45,488,357 65,686,229

Total assets and deferred outflows of resources $ 1,394,135,042 $ 1,372,950,357

Board of Public Utilities

Statements of Net Position

December 31, 2022 and 2021

See Notes to Financial Statements 29

Liabilities , Deferred Inflows of Resources, and Net Pos ition 2022

2021

(As Res tated)

Liabilities:

Current liabilities :

Current maturities of revenue bonds $ 27,500,000 $ 26,360,000

Current maturities of government loans 3,226,196 3,126,122

Accrued interes t 6,828,161 7,208,432

Customer depos its 7,316,569 7,179,201

Accounts payable 31,715,133 25,915,522

Payroll and payroll taxes 2,376,781 2,778,998

Accrued claims payable 794,053 1,034,053

Workers compens ation 1,860,005 1,489,381

Public liability reserve 620,546 703,659

Other accrued liabilities 8,307,274 7,289,790

Payment-in-lieu of taxes 3,041,625 2,510,289

Cons truction contract retainage payable 258,767 240,794

Total current liabilities 93,845,110 85,836,241

Noncurrent liabilities :

Long-term debt – revenue bonds 574,353,768 603,633,966

Government loans 23,659,817 24,932,056

Total long-term debt 598,013,585 628,566,022

Total other postemployment benefit liability 43,584,221 42,856,226

Compens ated abs ences 7,442,070 7,205,898

Net pension liability — 361,568

Total noncurrent liabilities 649,039,876 678,989,714

Total liabilities 742,884,986 764,825,955

Deferred inflows of resources :

Deferred gain on bond refunding 738,339 830,608

Deferred inflows - pension 58,448,089 60,145,000

Deferred inflows - OPEB 9,038,998 11,495,040

Deferred inflows - leas es 14,754,757 16,733,670

Total deferred inflows of resources 82,980,183 89,204,317

Net position:

Net inves tment in capital as s ets 451,012,342 427,959,301

Res tricted - debt s ervice 22,724,943 22,594,388

Res tricted - net pension as s et 23,267,891 —

Unrestricted 71,264,697 68,366,395

Total net pos ition 568,269,873 518,920,084

Total liabilities , deferred inflows of res ources,

and net pos ition $ 1,394,135,042 $ 1,372,950,357

Board of Public Utilities

Statements of Revenues, Expenses and Changes in Net Position

Years Ended December 31, 2022 and 2021

See Notes to Financial Statements 30

2022

2021

(As Restated)

Operating revenues:

Residential $ 110,391,146 $ 98,837,029

Commercial 126,967,366 104,869,840

Industrial 57,733,185 45,213,319

Other 40,445,684 66,416,518

Energy rate component recovery 12,468,276 2,312,998

Payment-in-lieu of taxes 37,073,894 31,715,220

Total operating revenues 385,079,551 349,364,924

Operating expenses:

Fuel 55,754,914 47,845,256

Purchased power 67,452,166 58,012,729

Production 42,442,507 39,990,738

Transmission and distribution 46,245,007 46,294,841

General and administrative 26,629,022 29,722,913

Depreciation and amortization 41,253,137 39,056,593