AUDIT REPORT

ON

THE ACCOUNTS OF

CDA, CAA, NHA, PAK. PWD,

ESTATE OFFICE, FGEHF,

NCL, PHAF, HEC AND

WWF/BOARDS

GOVERNMENT OF PAKISTAN

AUDIT YEAR 2017-18

AUDITOR GENERAL OF PAKISTAN

TABLE OF CONTENTS

ABBREVIATIONS AND ACRONYMS .............................................................. i

PREFACE ............................................................................................................ vi

EXECUTIVE SUMMARY ................................................................................. ix

SUMMARY TABLES AND CHARTS .......................................................... xxiii

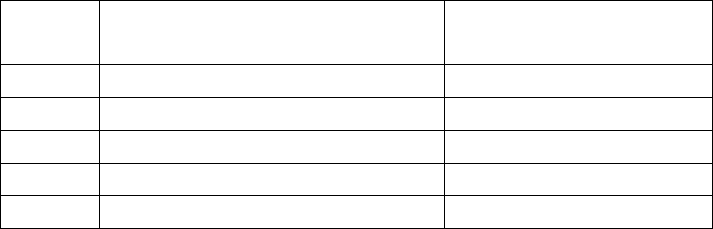

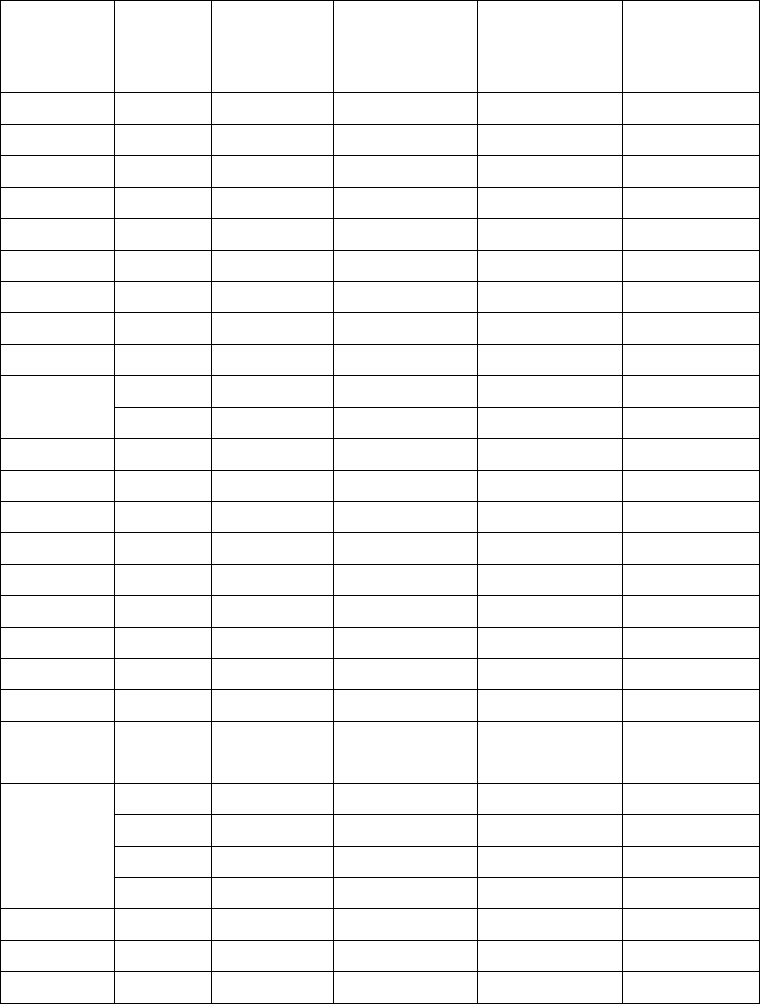

I: Audit Work Statistics ...................................................................... xxiii

II: Audit Observations classified by Categories .................................. xxiv

III: Outcome Statistics .......................................................................... xxiv

IV: Irregularities pointed out .................................................................. xxv

V: Cost-Benefit Ratio ........................................................................... xxv

CHAPTER 1 ......................................................................................................... 1

PUBLIC FINANCIAL MANAGEMENT ISSUES (PAKISTAN

PUBLIC WORKS DEPARTMENT) ................................................................ 1

1.1 AUDIT PARA ................................................................................................. 1

1.1.1 Unauthorized transfer of funds from lapsable PLA-I to non-lapsable

PLA-IV - Rs 1,776.376 million ....................................................................... 1

CHAPTER 2 ......................................................................................................... 4

CAPITAL DEVELOPMENT AUTHORITY ................................................... 4

2.1 Introduction ..................................................................................................... 4

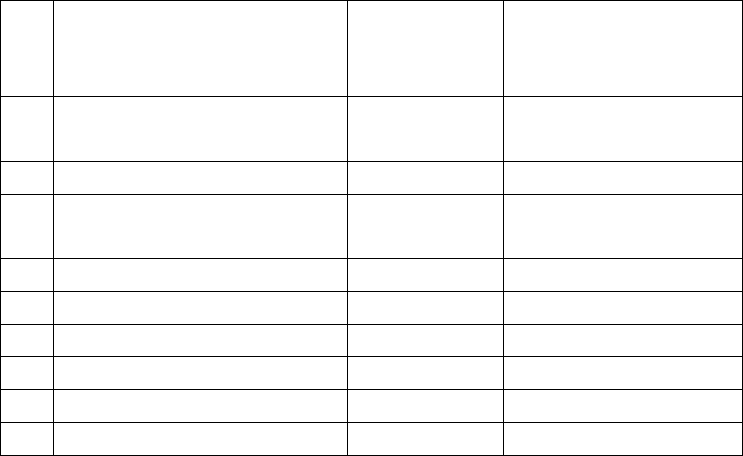

2.2 Comments on Budget and Accounts (Variance Analysis) ............................... 5

2.3 Brief comments on the status of compliance with PAC‟s directives ............. 13

2.4 AUDIT PARAS ............................................................................................. 15

Fraud/Mis-appropriations ........................................................................................... 15

2.4.1 Embezzlement of entry fee in Lake View Park Islamabad - Rs 16.250

million ............................................................................................................ 15

2.4.2 Non-recovery of advances and salary paid to Ex-official dismissed

from service due to fake certificates - Rs 2.145 million ................................ 16

2.4.3 Non-initiation of disciplinary as well as criminal proceedings against

employees having fake degrees ..................................................................... 18

Irregularity and Non-Compliance ............................................................................... 19

2.4.4 Non-cancellation of commercial plots due to non-renewal of lease -

Rs 40,155.648 million .................................................................................... 19

2.4.5 Loss due to un-competitive disposal of plot - Rs 10,527.026 million ............ 20

2.4.6 Overpayment to IESCO due to excessive billing of street lights -

Rs 5,360.991 million ...................................................................................... 23

2.4.7 Non-realization of long outstanding dues of commercial plots -

Rs 5,831.043 million ...................................................................................... 26

2.4.8 Unauthentic approval of Layout Plan of Housing Scheme on the basis

of fake and fictitious documents - Rs 8,198.60 million ................................. 28

2.4.9 Non-imposition of penalty/non-recovery of ground rent from

marquees / wedding halls - Rs 1,032.000 million .......................................... 30

2.4.10 Irregular execution of works without approval by the competent

authority - Rs 341.543 million ....................................................................... 31

2.4.11 Non-mutation/non-taking over possession of land besides payments to

selective land owners - Rs 261.781 million ................................................... 32

2.4.12 Execution of project without PC-I - Rs 228.431 million ............................... 36

2.4.13 Replacement of existing road lights with LED lights without PC-I and

award of work to non-responsive bidder - Rs 363.242 million ...................... 37

2.4.14 Deployment of staff in excess of sanctioned strength resulting in

excess expenditure - Rs 73.085 million ......................................................... 42

2.4.15 Enhancement of work beyond the original scope - Rs 58.113 million........... 44

2.4.16 Non-remittance of Government receipt in Federal Treasury -

Rs 104.465 million ......................................................................................... 46

2.4.17 Appointment of consultant without registration with PEC and payment

of consultancy fee without proper performance - Rs 46.825 million ............ 48

2.4.18 Execution of work without insurance guarantee saving inbuilt cost of

premium - Rs 40.018 million ......................................................................... 49

2.4.19 Non-recovery of expenditure incurred in excess of the deposits

received from sponsors - Rs 35.956 million .................................................. 51

2.4.20 Award of work without technical evaluation - Rs 30.408 million ................. 53

2.4.21 Non-accounting of excavated rock material - Rs 27.835 million ................... 54

2.4.22 Award of works without open competition - Rs 24.834 million .................... 55

2.4.23 Payment of President‟s House Allowance, Fuel and Electricity

Subsidy to non-entitled officers - Rs 24.474 million ..................................... 56

2.4.24 Payment without recording detailed measurement in log/work books -

Rs 22.113 million........................................................................................... 58

2.4.25 Non-auction of advertisement sites/non-maintenance of record of open

spaces for licenses - Rs 20.350 million .......................................................... 59

2.4.26 Theft of electric transformers, electric cable, street light poles, etc. -

Rs 15.165 million........................................................................................... 60

2.4.27 Award of work in violation of procurement rules - Rs 17.536 million .......... 62

2.4.28 Non-recovery of mobilization advance - Rs 7.723 million ............................ 66

2.4.29 Extra payment due to incorrect rate - Rs 6.531 million ................................. 67

2.4.30 Procurement of vehicles and equipment without provision in TS

Estimate - Rs 9.600 million ........................................................................... 68

2.4.31 Overpayment due to non-deduction of earth available from roadway

excavation - Rs 4.855 million ........................................................................ 71

2.4.32 Award of works at higher rates - Rs 2.852 million ........................................ 73

Performance ................................................................................................................. 74

2.4.33 Non-development of sectors despite receipt of funds from allottees -

Rs 63,413.335 million .................................................................................... 74

2.4.34 Inordinate delay in completion of project despite sufficient funds ................ 75

2.4.35 Procurement of sub-standard alum sulphate - Rs 1.287 million .................... 76

2.4.36 Non-taking of remedial measures for the treatment of polluted water ........... 78

Internal Control Weaknesses....................................................................................... 80

2.4.37 Non-revision of rates of property tax, water and conservancy charges.......... 80

2.4.38 Non-recovery of outstanding property tax - Rs 1,901.553 million ................ 83

2.4.39 Carpeting of roads without obtaining NOC from MPO - Rs 845.232

million ............................................................................................................ 85

2.4.40 Non-completion of work despite incurring expenditure of Rs 295.00

million ............................................................................................................ 87

2.4.41 Non-recovery on account of Operation & Maintenance Charges of

Water Treatment Plant from beneficiaries - Rs 195.327 million .................. 88

2.4.42 Non-adjustment of advance payment - Rs 94.902 million ............................. 89

2.4.43 Overpayment to the contractors due to higher estimation - Rs 30.253

million ............................................................................................................ 90

2.4.44 Delay in completion of water supply scheme due to non-removal of

encroachment - Rs 27.274 million ................................................................. 92

2.4.45 Non-recovery of secured advance - Rs 15.109 million .................................. 93

2.4.46 Non-recovery of room rent and utility charges of hostels/lodges -

Rs 11.097 million........................................................................................... 94

2.4.47 Award of work at higher rates without assessment of reasonability of

rates - Rs 7.115 million .................................................................................. 95

2.4.48 Payment of overtime allowance over and above the approved rates -

Rs 6.602 million............................................................................................. 96

2.4.49 Procurement of imported electrical items without ensuring

genuineness of the items supplied - Rs 6.069 million .................................... 97

2.4.50 Non-imposition of penalty for non-compliance of Fire Prevention and

Life Safety Regulations - Rs 5.210 million .................................................... 99

2.4.51 Non-auction of kiosks and non-revision of license fee - Rs 5.040

million .......................................................................................................... 101

2.4.52 Non-recovery of advance income tax - Rs 4.436 million............................. 102

2.4.53 Overpayment due to non-adjustment of prices of specified material -

Rs 8.521 million........................................................................................... 104

2.4.54 Award of licenses of kiosks without open auction - Rs 3.636 million ......... 105

2.4.55 Non-acceptance of highest bid of car parking license - Rs 3.506

million .......................................................................................................... 106

2.4.56 Overpayment due to duplication and calculation mistake - Rs 3.42

million .......................................................................................................... 108

2.4.57 Non-deduction of General Sales Tax - Rs 2.250 million ............................. 111

2.4.58 Non-cancellation/ vacation of Government accommodation allotted to

ineligible employees .................................................................................... 112

2.4.59 Payment of Capital Allowance, Special Allowance and Danger

Allowance etc. without approval of Finance Division ................................. 113

2.4.60 Non-imposition of fine - Rs 2.405 million ................................................... 114

CHAPTER 3 .................................................................................................. 116

CIVIL AVIATION AUTHORITY ................................................................ 116

3.1 Introduction ................................................................................................. 116

3.2 Comments on Budget and Accounts (Variance Analysis) ........................... 117

3.3 Brief comments on the status of compliance with PAC‟s directives ........... 121

3.4 AUDIT PARAS ............................................................................... 123

Irregularity and Non-compliance .............................................................................. 123

3.4.1 Procurement without approval of ECNEC - Rs 1,144.068 million .............. 123

3.4.2 Award of work to an ineligible contractor - Rs 842.145 million ................. 124

3.4.3 Irregular acquisition of land for airport without feasibility study -

Rs 450.389 million ....................................................................................... 126

3.4.4 Irregular award of additional works in violation of procurement rules -

Rs 304.429 million ....................................................................................... 128

3.4.5 Procurement of works through different formations instead of project

management resulting in understatement of project cost - Rs 237.972

million .......................................................................................................... 130

3.4.6 Non-utilization of residential building - Rs 144.633 million ....................... 131

3.4.7 Award of contract on doubtful bidding documents - Rs 17.387 million ...... 132

3.4.8 Mis-procurement due to award of work on quotation basis - Rs 15.198

million .......................................................................................................... 134

Performance ............................................................................................................... 136

3.4.9 Loss of revenue due to non-completion of the project within stipulated

period - Rs 9,675 million ............................................................................. 136

Internal Control Weaknesses..................................................................................... 137

3.4.10 Procurement of imported equipment and materials without

authentication of the authorized manufacturers / from other than

approved manufacturer - Rs 6,508.716 million ........................................... 137

3.4.11 Non-recovery of outstanding dues on account of licence fee, rent and

electricity charges - Rs 2,159.481 million ................................................... 140

3.4.12 Non-maintenance of Measurement Books - Rs 1,217.443 million .............. 143

3.4.13 Non-recovery from the defaulting contractor - Rs 580.786 million ............ 144

3.4.14 Transfer of funds as deposit work instead award of work through

competitive bidding - Rs 260.000 million ................................................... 145

3.4.15 Loss due to non-encashment of bank guarantees - Rs 171.771 million ....... 147

3.4.16 Undue financial aid due to allowing inadmissible secured advance -

Rs 85.55 million........................................................................................... 148

3.4.17 Non-recovery of advance income tax - Rs 20.022 million .......................... 150

3.4.18 Unjustified expenditure of Rs 32.000 million involving excess beyond

provision in revised PC-I of Rs 19.200 million ........................................... 152

3.4.19 Non-imposition and recovery of liquidated damages for delay in

completion of work - Rs 22.286 million ...................................................... 154

3.4.20 Unauthorized up-gradation of staff without authentication of

qualification certificates - Rs 17.655 million ............................................... 155

3.4.21 Overpayment due to inclusion of machinery/equipment component in

the rate analysis beyond technical requirement of site - Rs 17.435

million .......................................................................................................... 157

3.4.22 Overpayment due to non-deduction of shrinkage allowance -

Rs 15.596 million......................................................................................... 158

3.4.23 Non-recovery of dues from the ex-licencee - Rs 12.608 million ................. 160

3.4.24 Award of licence at lesser rate - Rs 12.013 million ..................................... 161

3.4.25 Overpayment due to difference in rates - Rs 17.299 million ....................... 163

3.4.26 Acceptance of high rates due to bid tempering - Rs 11.328 million ............ 164

3.4.27 Overpayment to the contractor due to inadequate tender/bid evaluation

- Rs 9.295 million ........................................................................................ 166

3.4.28 Overpayment due to excessive measurement of height of drain -

Rs 4.322 million........................................................................................... 167

3.4.29 Overpayment due to allowing higher component of labour in the non-

BOQ rate - Rs 3.924 million ........................................................................ 169

3.4.30 Overpayment due to non-adjustment of prices as a result of de-

escalation - Rs 3.398 million ....................................................................... 170

3.4.31 Incorrect enhancement in the bid amount by the Evaluation Committee

- Rs 3.117 million ........................................................................................ 171

3.4.32 Overpayment due to deviation from the contract agreement - Rs 1.892

million .......................................................................................................... 173

CHAPTER 4 ..................................................................................................... 175

NATIONAL HIGHWAY AUTHORITY ...................................................... 175

4.1 Introduction ................................................................................................. 175

4.2 Comments on Budget and Accounts (Variance Analysis) ........................... 177

4.3 Brief comments on the status of compliance with PAC‟s directives ........... 180

4.4 AUDIT PARAS ........................................................................................... 182

Irregularity and Non-Compliance ............................................................................. 182

4.4.1 Award of contract on rates 59.95% higher than the approved PC-I ............. 182

4.4.2 Award of contract without forming of joint venture by Chinese

Companies with Pakistani Firms ................................................................. 184

4.4.3 Major change in approved scope of work in violation of approved

PC-I.............................................................................................................. 187

4.4.4 Award of work to unqualified firm .............................................................. 190

4.4.5 Mis-procurement of consultancy contract - US$ 3,849,460 and

Rs 1,112.618 million .................................................................................... 192

4.4.6 Award of construction of motorways on Build Operate and Transfer

(BOT) basis without adhering Government‟s interest ................................. 195

4.4.7 Award of work to technically unqualified contractor - Rs 7,410.794

million .......................................................................................................... 201

4.4.8 Mis-procurement of consultancy services as Assistant to Employer‟s

Representative - US$ 3.552 million and Rs 460.724 million ...................... 202

4.4.9 Undue amendment in the contract resulting into financial aid to the

contractor - Rs 8,770.800 million ................................................................ 205

4.4.10 Award of toll operation contracts to the defaulters - Rs 6,542.899

million .......................................................................................................... 207

4.4.11 Award of Routine Maintenance works relating to AMP 2016-17

without detailed quantities in BOQ - Rs 4,730.38 million ........................... 209

4.4.12 Appointment of Design Review Consultant by the contractor in

violation of contract agreement involving Rs 2,085.986 million ................. 211

4.4.13 Revival of works by extending undue favour to the contractors .................. 214

4.4.14 Award of work to a disqualified firm due to non-adherence to

condition of bidding documents - Rs 715.455 million ................................. 217

4.4.15 Unauthorized execution of the work without approval and without re-

rating on excess quantity - Rs 515.829 million ............................................ 218

4.4.16 Excess expenditure due to deviation from approved scope of work

resulted in utilization of saving - Rs 240.882 million .................................. 220

4.4.17 Irregular transfer of work from N-70 to N-50 - Rs 198.156 million ............ 222

4.4.18 Loss due to non-taking over the possession of toll plazas from

defaulters - Rs 156.267 million and non-encashment of performance

bonds of defaulting operators - Rs 39.597 million ....................................... 224

4.4.19 Payment without approval from competent authority and overpayment

due to allowing enhanced rate - Rs 39.370 million ...................................... 227

4.4.20 Mis-procurement of Rs 19.064 million and irregular payment -

Rs 5.338 million........................................................................................... 229

Performance ............................................................................................................... 231

4.4.21 Non-mutation of land in the name of NHA - Rs 37,415.00 million ............. 231

Internal Control Weaknesses..................................................................................... 232

4.4.22 Irregular/unauthorized investment of surplus funds in Zarai Taraqiati

Bank - Rs 9,700.00 million .......................................................................... 232

4.4.23 Mismanagement of NHA resulting into accumulated toll income

receivable - Rs 7,968.409 million ................................................................ 235

4.4.24 Abnormal defective engineer‟s estimation due to high estimation of

rates in CSR 2014 - Rs 5,104.01 million ..................................................... 238

4.4.25 Violation of contract provision due to non-hiring of design and

supervisory consultants by the contractor - Rs 4,616.210 million ............... 240

4.4.26 Non-recovery due to non-provision of evidence for payments of

financial charges/premium against bank guarantees/ insurance -

Rs 3.986 billion ........................................................................................... 242

4.4.27 Loss on account of land acquisition and compound interest -

Rs 2,958.00 million and non-finalization of inquiry .................................... 244

4.4.28 Unjustified hiring of consultant for monitoring resulted in extra

expenditure of Rs 1,112.618 million and US$ 3.849 million ....................... 246

4.4.29 Loss of revenue due to short receipt of toll collection than reserved

prices - Rs 2,173.873 million ....................................................................... 248

4.4.30 Excess payment due to less execution of work - US$ 25.213 million ......... 250

4.4.31 Non-provision of construction performance bond by the

concessionaire - Rs 1,831.75 million ........................................................... 251

4.4.32 Non-recovery due to non-rectification/repair of defective road work -

Rs 1,631.519 million .................................................................................... 252

4.4.33 Unauthorized/Irregular payment of claims through Variation Orders -

Rs 1,371.328 million .................................................................................... 254

4.4.34 Unauthorized payment of escalation due to change in Factor-C

through Post bid change - Rs 1,338.369 million .......................................... 256

4.4.35 Overpayment due to non-deduction of de-escalation - Rs 1,127.831

million .......................................................................................................... 257

4.4.36 Loss to Government due to payment of work in dollars and fixation of

exchange rate through addendum - US$ 10.675 million .............................. 260

4.4.37 Grant of additional Mobilization Advance through post-bid

amendment - Rs 695.151 million ................................................................. 262

4.4.38 Borrow areas within 250 meters of right of way in violation of

contract provisions - Rs 631.300 million ..................................................... 263

4.4.39 Unjustified expenditure on closed projects - Rs 606.56 million .................. 264

4.4.40 Overpayment due to higher rates of earthworks - Rs 581.292 million......... 266

4.4.41 Loss due to arriving at reserve price of lesser amounts by the NTRC

without taking actual price escalation based on effective traffic

counting on toll plazas - Rs 501.70 million ................................................. 268

4.4.42 Non-recovery of rental charges from licensee - Rs 442.958 million ........... 269

4.4.43 Non-recovery of cost of stone obtained from hard rock excavation -

Rs 388.239 million ....................................................................................... 270

4.4.44 Extra expenditure due to unjustified revision of rates - Rs 350.01

million .......................................................................................................... 271

4.4.45 Overpayment due to incorrect payment of Foreign Exchange

difference - Rs 342.675 million ................................................................... 273

4.4.46 Unjustified application of current and base rates for steel resulting in

less recovery of de-escalation calculations - Rs 331.661 million ............... 275

4.4.47 Non-remittance of income tax in government treasury - Rs 290.267

million .......................................................................................................... 277

4.4.48 Non-recovery of secured and escrow advance - Rs 280.885 million ........... 279

4.4.49 Loss due to inclusion of cost of stone - Rs 248.299 million ........................ 279

4.4.50 Overpayment due to enhancement of agreed rates through post tender

change - Rs 239.689 million ........................................................................ 281

4.4.51 Loss of revenue due to award of contracts below reserved prices -

Rs 200.130 million ....................................................................................... 282

4.4.52 Non-rationalization of cost of vehicles as per the current market prices

resulted in excess cost - Rs 156.865 million ................................................ 285

4.4.53 Inadmissible payments of price escalation - Rs 156.156 million ................. 286

4.4.54 Overpayment of escalation through post bid amendment by enhancing

factor C - Rs 139.484 million ...................................................................... 287

4.4.55 Inadmissible provision of expenditure on Control & Monitoring Office

in the contract - Rs 134.159 million ............................................................. 288

4.4.56 Unjustified extra provision of training in China by the contractor

without provision in the tender documents - Rs 121.393 million ............... 289

4.4.57 Undue financial burden on the public exchequer on account of storage

charges - Rs 117.14 million ......................................................................... 291

4.4.58 Loss to the government due to non-rectification of the damaged work

at contractor‟s expense - Rs 116.766 million ............................................... 293

4.4.59 Excess payment on account of escalation beyond the provision of PC-I

- Rs 94.396 million ...................................................................................... 295

4.4.60 Irregular payment due to allowing escalation on disputed value of

work - Rs 93.186 million ............................................................................. 296

4.4.61 Grant of additional mobilization advance through post-bid amendment

- Rs 107.594 million and non-recovery of balance amount - Rs 86.902

million .......................................................................................................... 297

4.4.62 Unjustified expenditure of pay and allowances - Rs 77.464 million............ 299

4.4.63 Unjustified change in scope of work through Variation Orders -

Rs 64.483 million......................................................................................... 301

4.4.64 Non-recovery of ROW dues from filling stations and other business

operators - Rs 53.636 million....................................................................... 303

4.4.65 Unauthorized expenditure on construction of service road outside

Motorway fence on NHA Land for the benefit of Private Housing

Societies - Rs 53.331 million ....................................................................... 304

4.4.66 Non-completion of works by contractor - Rs 10.230 million and non-

imposition of liquidated damages - Rs 7.800 million .................................. 306

4.4.67 Unauthentic execution of work against day-work - Rs 40.099 million ........ 307

4.4.68 Excess percentage of overheads than the salary cost in violation of

RFP resulted in excess payment of Rs 34.704 million and US$

170,599 ........................................................................................................ 308

4.4.69 Un-authorized change in rate and quantities after rationalized bid and

approved PC-I resulted in extra benefit to the contractor - Rs 30.590

million .......................................................................................................... 310

4.4.70 Non-deduction of sales tax from the consultant‟s payments -

Rs 27.092 million......................................................................................... 311

4.4.71 Overpayment due to allowing enhanced rate - Rs 25.364 million ............... 313

4.4.72 Loss due to toll operation departmentally on interim basis - Rs 24.242

million .......................................................................................................... 314

4.4.73 Overpayment due to paying excavation cost twice - Rs 21.399 million ...... 315

4.4.74 Overpayment due to allowing escalation on provisional sum items -

Rs 18.362 million......................................................................................... 317

4.4.75 Non-forfeiture of performance bond due to non-commencement of

work - Rs 17.748 million ............................................................................. 318

4.4.76 Overpayment due to incorrect implementation of revised rates -

Rs 15.312 million......................................................................................... 319

4.4.77 Overpayment due to non-reduction in quoted rate of BOQ item -

Rs 14.547 million......................................................................................... 321

4.4.78 Less recovery from the toll plaza contractor - Rs 9.561 million .................. 322

4.4.79 Overpayment due to price adjustment - Rs 9.540 million ............................ 323

4.4.80 Unjustified and irregular lease of commercial land without

competition and at lesser rent - Rs 8.996 million ......................................... 324

4.4.81 Overpayment due to allowing price escalation on un-justified

weightage - Rs 8.395 million ....................................................................... 326

4.4.82 Less recovery of Income Tax on consultant payments - Rs 5.512

million .......................................................................................................... 327

4.4.83 Overpayment due to measurement of steel weight on higher side as

compared to the steel actually used in the work - Rs 4.369 million ............ 328

4.4.84 Non-recovery of sales tax - Rs 5.410 million .............................................. 329

4.4.85 Non-finalization of the matter regarding embezzlement of GPF

amount - Rs 2.837 million ........................................................................... 330

4.4.86 Wasteful/irrelevant expenditure from project account - Rs 2.064

million .......................................................................................................... 332

CHAPTER 5 ..................................................................................................... 334

PAKISTAN PUBLIC WORKS DEPARTMENT AND ESTATE OFFICE ............... 334

5.1 Introduction ................................................................................................. 334

5.2 Comments on Budget and Accounts (Variance Analysis) ........................... 335

5.3 Brief comments on the status of compliance with PAC‟s directives ........... 338

5.4 AUDIT PARAS ........................................................................................... 340

Irregularity and Non-compliance .............................................................................. 340

5.4.1 Award of works at higher rates - Rs 229.216 million .................................. 340

5.4.2 Non-recovery of Mobilization Advance - Rs 95.968 million ...................... 341

5.4.3 Irregular award of work - Rs 94.799 million ............................................... 343

5.4.4 Unjustified advance payment - Rs 53.758 million ....................................... 344

5.4.5 Irregular award of work due to excess over PC-I - Rs 25.533 million ........ 346

5.4.6 Unjustified payment - Rs 27.113 million ..................................................... 348

5.4.7 Unauthentic payment without recording detailed measurement of work

in Measurement Book - Rs 10.196 million .................................................. 349

Internal Control Weaknesses..................................................................................... 350

5.4.8 Overpayment due to non-application of price adjustment clause -

Rs 716.623 million ....................................................................................... 350

5.4.9 Unjustified payment of escalation beyond the provision of PC-I

/agreement - Rs 462.811 million .................................................................. 352

5.4.10 Irregular expenditure on work charged establishment - Rs 429.269

million .......................................................................................................... 354

5.4.11 Non-deduction of income tax - Rs 416.818 million ..................................... 356

5.4.12 Excess payment due to taking excessive measurement - Rs 364.881

million .......................................................................................................... 357

5.4.13 Wasteful expenditure due to abandoned work/non-completion of

works - Rs 271.342 million .......................................................................... 367

5.4.14 Unjustified inclusion of diesel in the component of asphaltic base

course & wearing course worth - Rs 261.006 million .................................. 369

5.4.15 Excess payment due to violation of approved design in revised PC-I -

Rs 173.189 million ....................................................................................... 370

5.4.16 Loss due to non-execution of work through original contractor -

Rs 160.057 million ....................................................................................... 371

5.4.17 Overpayment due to inclusion of higher rate of equipment in rate

analyses - Rs 153.364 million ...................................................................... 374

5.4.18 Unjustified payment due to changing mode of hard rock excavation

from blasting to hammering/chiseling - Rs 127.817 million ........................ 376

5.4.19 Overpayment due to non-adjustment of sorting and stacking cost -

Rs 127.134 million ....................................................................................... 378

5.4.20 Overpayment due to payment of certain quantity of gravelly soil and

soft rock excavation under hard rock excavation item beyond the

classified proportion - Rs 105.724 million ................................................... 379

5.4.21 Non-confiscation of security deposits - Rs 163.330 million ........................ 381

5.4.22 Undue retention of balance funds of PWP-II (placed under PLA-I and

PLA-III) after completion/handing over of respective schemes to the

TMAs - Rs 47.603 million ........................................................................... 383

5.4.23 Overpayment of escalation due to inclusion of inadmissible weightage

of coefficient - Rs 24.383 million ................................................................ 385

5.4.24 Overpayment/ undue benefit to contractor due to inadmissible

execution of higher rate - Rs 18.778 million ................................................ 387

5.4.25 Irregular/unauthentic payment -Rs 19.907 million and overpayment

due to non-deduction of crust - Rs 11.319 million ....................................... 390

5.4.26 Excess payment due to higher rates - Rs 16.803 million ............................. 392

5.4.27 Overpayment due to inadmissible cartage - Rs 12.804 million.................... 393

5.4.28 Blockage of Government funds - Rs 10.989 million ................................... 394

5.4.29 Overpayment due to non-adjustment of price of bitumen less used in

tack coat - Rs 10.299 million ....................................................................... 395

5.4.30 Non-recovery - Rs 10.282 million ............................................................... 396

5.4.31 Loss due to non-fulfillment of contractual obligation - Rs 9.814

million .......................................................................................................... 400

5.4.32 Unjustified payment - Rs 7.750 million and non-deduction of rock

filling from formation of embankment quantity - Rs 3.201 million ............ 401

5.4.33 Loss to Government - Rs 7.650 million ....................................................... 402

5.4.34 Excess payment of supervision charges - Rs 7.353 million ......................... 403

5.4.35 Overpayment due to avoidable/unnecessary item - Rs 7.213 million .......... 404

5.4.36 Overpayment on account of supervision charges - Rs 5.944 million ........... 405

5.4.37 Non-adjustment of structural excavated material - Rs 3.796 million .......... 407

5.4.38 Execution of defective/substandard work of Steel Reinforcement due

to utilization of steel having yield/ultimate strength less than normal -

Rs 2.765 million........................................................................................... 408

5.4.39 Overpayment due to non-adjustment of cost of excavated material -

Rs 2.736 million........................................................................................... 409

5.4.40 Excess payment due to non-deduction of GST – Rs 1.939 million and

non-deduction of Tax on Services - Rs 4.159 million .................................. 410

5.4.41 Overpayment of price escalation due to application of incorrect base

rate of HSD - Rs 1.377 million .................................................................... 411

5.4.42 Unauthorized expenditure - Rs 1.117 million .............................................. 412

5.4.43 Undue burden over government exchequer of millions of rupees by

cutting the hard rock with excessive slope beyond the technical

requirements of site ...................................................................................... 413

ESTATE OFFICE ....................................................................................................... 415

Irregularity and Non-compliance .............................................................................. 415

5.4.44 Irregular allotments/possession and improper maintenance of General

Waiting Lists (GWLs) and non-uploading of GWLs on website in

violation of Accommodation Allocation Rules ............................................ 415

5.4.45 Irregular allotment of government owned accommodation/ house of

higher category in violation of Accommodation Allocation Rules .............. 419

5.4.46 Irregular allotment of government owned accommodation ......................... 422

5.4.47 Irregular allotments to Provincial government employees ........................... 423

Internal Control Weaknesses..................................................................................... 425

5.4.48 Non-ejecting retired employees / unauthorized occupants and non-

recovery of government dues from defaulters - Rs 13.314 million .............. 425

5.4.49 Recurring loss to government due to lack of interest on account

of non-recovery of rent from the allottees of shops and petrol pumps -

Rs 164.415 million ....................................................................................... 427

5.4.50 Loss to government due to non-recovery of ceiling rent from

unauthorized occupants of government accommodation - Rs 5.433

million .......................................................................................................... 429

5.4.51 Non-recovery of rental ceiling of government accommodation –

Rs 4.877 million........................................................................................... 432

5.4.52 Non-ejectment / non-recovery of rent - Rs 1.448 million ............................ 435

5.4.53 Non-recovery of government dues from the ex-allottee - Rs 26.672

million .......................................................................................................... 438

5.4.54 Irregular retention of double accommodation and non-recovery of

dues - Rs 6.607 million ................................................................................ 440

5.4.55 Irregular/inauthentic issuance of NOC without recovery of outstanding

dues - Rs 3.445 million ................................................................................ 441

5.4.56 Non-retrieval of 78.17 Acres government land from unauthorized

occupants ..................................................................................................... 443

5.4.57 Non-cancellation of house / non-recovery of rental ceiling -

Rs 827,487 and less recovery of 5% HRA - Rs 171,800 ............................. 444

5.4.58 Non issuance of final No Demand Certificate, non-vacation of

government accommodation and non-clearance of government dues.......... 445

CHAPTER 6 ..................................................................................................... 448

FEDERAL GOVERNMENT EMPLOYEES HOUSING

FOUNDATION ............................................................................................. 448

6.1 Introduction ................................................................................................. 448

6.2 Comments on Budget and Accounts (Variance Analysis) ........................... 450

6.3 Brief comments on the status of compliance with PAC‟s directives ........... 451

6.4 AUDIT PARAS ........................................................................................... 452

Irregularity and Non-Compliance ............................................................................. 452

6.4.1 Execution of projects without appointment of Project Director ................... 452

6.4.2 Award of contract to an ineligible firm ........................................................ 453

6.4.3 Purchase of land from an ineligible firm - Rs 4,250 million ........................ 456

6.4.4 Loss to allottees due to purchase of land at higher rates - Rs 1,725

million .......................................................................................................... 457

6.4.5 Irregular payment of mobilization advance - Rs 756.250 million................ 459

6.4.6 Launching of housing scheme without mutation of 100 kanals of raw

land as Performance Security in the name of FGEHF - Rs 42.500

million .......................................................................................................... 460

Performance ............................................................................................................... 462

6.4.7 Non-development of housing scheme due to poor performance .................. 462

Internal Control Weaknesses..................................................................................... 463

6.4.8 Excess payment due to execution of quantities more than contract

agreement - Rs 805.566 million ................................................................... 463

6.4.9 Overpayment due to application of higher rate for similar item -

Rs 152.197 million ....................................................................................... 466

6.4.10 Overpayment of price escalation - Rs 99.215 million .................................. 468

6.4.11 Unjustified inclusion of item of Street Lights in BOQ of Infrastructure

Development Works in G-13 - Rs 83.113 million ....................................... 470

6.4.12 Non-recovery of defective work from the Design Consultants/

Contractor - Rs 69.825 million .................................................................... 471

6.4.13 Overpayment due to non-deduction of earth available from structural

excavation - Rs 55.078 million .................................................................... 474

6.4.14 Overpayment due to non-adjustment of prices because of de-escalation

- Rs 2.745 million ........................................................................................ 476

CHAPTER 7 ..................................................................................................... 479

NATIONAL CONSTRUCTION LIMITED ................................................. 479

7.1 Introduction ................................................................................................. 479

7.2 Comments on Audited Accounts ................................................................. 479

7.3 Brief comments on the status of compliance with PAC‟s directives ........... 487

7.4 AUDIT PARAS ........................................................................................... 489

Performance ............................................................................................................... 489

7.4.1 Slow execution/progress in execution of project - Rs 168.934 million ...... 489

7.4.2 Unjustified execution of Joint Venture beyond the company‟s

objectives depriving NCL from its legitimate revenue ................................ 491

CHAPTER 8 ..................................................................................................... 494

PAKISTAN HOUSING AUTHORITY FOUNDATION ............................. 494

8.1 Introduction ................................................................................................. 494

8.2 Comments on Budget and Accounts/Financial Statements (Variance

Analysis) ...................................................................................................... 495

8.3 Brief comments on the status of compliance with PAC‟s directives ........... 497

8.4 AUDIT PARAS ........................................................................................... 498

Irregularity and Non-Compliance ............................................................................. 498

8.4.1 Irregular award/implementation of development schemes without

approval of PC-I of the schemes .................................................................. 498

8.4.2 Non-determination of weightages of specified items violating standard

procedures and parameters of the PEC standard formula ............................ 500

8.4.3 Excess payment due to execution of items of work beyond BOQ

quantities - Rs 17.05 million ........................................................................ 503

8.4.4 Overpayment due to allowing payment for the excavated material /

soil used in filling - Rs 31.588 million......................................................... 504

8.4.5 Overpayment due to allowing higher rate of substituted / Non-BOQ

item - Rs 7.604 million ................................................................................ 506

8.4.6 Overpayment due to allowing transportation deemed included in

another pay item of work - Rs 12.029 million ............................................. 509

8.4.7 Excess payment due to non-deduction of compaction factor from

filling in area development - Rs 2.104 million ............................................ 510

8.4.8 Irregular construction of residential buildings without prior approval

of building plans from CDA ........................................................................ 511

8.4.9 Non-appointment of Project Directors in violation of Guidelines for

Project Management for proper execution of housing projects.................... 513

Performance ............................................................................................................... 515

8.4.10 Non-realization of receipt from allottees as per schedule of payment -

Rs 3,429.436 million .................................................................................... 515

8.4.11 Loss sustained by allottees due to non-completion/handing over of

apartments - Rs 529.920 million .................................................................. 516

Internal Control Weaknesses..................................................................................... 518

8.4.12 Loss due to delay in implementation/award of work - Rs 3,886.120

million .......................................................................................................... 518

8.4.13 Loss due to delay in implementation/award of works - Rs 409.492

million .......................................................................................................... 520

8.4.14 Acceptance of tenders having same scope, specifications, estimated

cost, location of work and date of tender, at different rates -

Rs 256.440 million ....................................................................................... 521

CHAPTER 9 ..................................................................................................... 526

HIGHER EDUCATION COMMISSION ......................................................... 526

9.1 Introduction ................................................................................................. 526

9.2 Comments on Budget and Accounts (Variance Analysis) ........................... 527

9.3 Brief comments on the status of compliance with PAC‟s directives ........... 530

9.4 AUDIT PARAS ........................................................................................... 531

Irregularity and Non-Compliance ............................................................................. 531

9.4.1 Construction of building without prior approval of Building Plan from

CDA resulting in imposition of fine/penalty - Rs 6.903 million ................. 531

9.4.2 Irregular procurement of equipment through quotations instead of

calling tenders - Rs 9.357 million ................................................................ 532

Internal Control Weaknesses..................................................................................... 534

9.4.3 Excess expenditure over and above the approved components in PC-I -

Rs 69.378 million......................................................................................... 534

9.4.4 Acceptance of tender beyond the permissible limit of PC-I - Rs 48.598

million .......................................................................................................... 535

9.4.5 Upward correction in bid rates in violation of tender instructions -

Rs 36.081 million......................................................................................... 536

9.4.6 Execution of plastering work below the agreed specification -

Rs 32.785 million......................................................................................... 539

9.4.7 Overpayment due to non-adjustment of prices of specified material -

Rs 6.717 million........................................................................................... 541

9.4.8 Undue benefit to contractor through extra item - Rs 3.405 million ............. 542

9.4.9 Overpayment due to acceptance of higher rates - Rs 1.101 million ............. 544

9.4.10 Overpayment due to excessive excavation - Rs 1.106 million ..................... 544

9.4.11 Overpayment due to allowing excessive weight of steel - Rs 1.003

million .......................................................................................................... 546

CHAPTER 10 ................................................................................................... 547

WORKERS WELFARE FUND/BOARDS .................................................. 547

10.1 Introduction ................................................................................................. 547

10.2 Comments on Budget and Accounts (Variance Analysis) ........................... 548

10.3 Brief comments on the status of compliance with PAC‟s directives ........... 549

10.4 AUDIT PARAS ........................................................................................... 550

Irregularity and Non-Compliance ............................................................................. 550

10.4.1 Unjustified payment of scholarships to children of employees of non-

entitled units/industries - Rs 58.037 million ................................................ 550

10.4.2 Non-recovery on account of rent of flats and shops - Rs 4.334 million

and non-revision of rates of shops ............................................................... 551

10.4.3 Non-allotment of 2040 completed flats - Rs 3,916.57 million .................... 552

10.4.4 Loss to the shelterless workers due to non-completion of project

within stipulated period and extending undue benefit to the sponsor -

Rs 869.050 million ....................................................................................... 554

10.4.5 Unauthentic payment to contractor without detailed measurement of

works - Rs 440.469 million .......................................................................... 556

10.4.6 Non-recovery of contribution and penalty from defaulting firms -

Rs 300.48 million......................................................................................... 557

10.4.7 Inadmissible payment on account of price adjustment for extended

period of contract - Rs 44.766 million ......................................................... 559

10.4.8 Award of Talent Scholarship to ineligible employees - Rs 14.943

million .......................................................................................................... 560

10.4.9 Payment on account of award of marriage/death grants to ineligible

employees - Rs 13.660 million .................................................................... 562

10.4.10 Inadmissible payment due to violation of specification/drawing -

Rs 5.289 million........................................................................................... 564

10.4.11 Payment on account of removal of debris in violation of contract

agreement - Rs 4.631 million ....................................................................... 566

10.4.12 Procurement of vehicles without provision in BOQ - Rs 4.074 million ...... 567

10.4.13 Payment of excessive quantities without approval - Rs 17.810 million

and overpayment due to separate payment of scaffolding - Rs 3.333

million .......................................................................................................... 568

10.4.14 Overpayment due to application of incorrect rate - Rs 3.040 million .......... 569

10.4.15 Hiring of Legal Advisor in violation of rules - Rs 2.683 million ................. 571

10.4.16 Non-mutation of land in the name of Workers Welfare Fund (2,119

Kanal 10 Marla) ........................................................................................... 572

Annexure-1: MFDAC ....................................................................................... 574

Annexure-2: Comments on Internal Controls ................................................... 575

i

ABBREVIATIONS AND ACRONYMS

ACWC

Asphaltic Concrete Wearing Course

ADA

Airport Development Agency

ADB

Asian Development Bank

ADP

Annual Development Programme

AER

Assistant to Employer Representative

AGPR

Accountant General Pakistan Revenues

AGR

Annual Ground Rent

AIIAP

Allama Iqbal International Airport

AIMS

Airport Information Management System

AMP

Annual Maintenance Plan

APM

Airport Manager

ASF

Airport Security Force

BBIAP

Benazir Bhutto International Airport

BCS

Building Control Section

BOD

Board of Directors

BOQ

Bill of Quantities

BOT

Build, Operate and Transfer

BUP

Build up Property

CAA

Civil Aviation Authority

CATI

Civil Aviation Training Institute

CBA

Collective Bargaining Agent

CCD

Central Civil Division

CDA

Capital Development Authority

CDR

Call Deposit Receipt

CDL

Cash Deposit Loan

CDWP

Central Development Working Party

Cft

Cubic Foot

CGA

Controller General of Accounts

CoC

Condition of Contract

CPEC

China-Pakistan Economic Corridor

CPWA

Central Public Works Accounts

CPWD

Central Public Works Department

CSR

Composite Schedule of Rates

cu.m

Cubic Meter

D.G.

Director General

ii

DAC

Departmental Accounts Committee

DBA

Directorate of Budget and Accounts

DCO

District Coordination Officer

DDO

Drawing and Disbursing Officer

DDWP

Departmental Development Working Party

DLP

Defect Liability Period

DMA

Directorate of Municipal Administration

DP

Draft Para

DST

Double Surface Treatment

DWP

Department Working Party

EALS

Environment Afforestation Land and Social

E&M

Electrical and Mechanical

ECC

Economic Coordination Committee

ECNEC

Executive Committee of the National Economic Council

EIA

Environmental Impact Assessment

EO

Estate Office

EOBI

Employees Old-age Benefit Institution

EOI

Expression of Interest

EOT

Extension of Time

EPC

Engineering, Procurement and Construction

EPC

Escalation Payment Certificate

ETTM

Electronic Traffic Toll Management

FA

Financial Advisor

FBR

Federal Board of Revenue

FGEHF

Federal Government Employees Housing Foundation

FIA

Federal Investigation Agency

FIDIC

Federation Internationale Des Ingenieurs-Conseils

(International Federation of Consulting Engineers)

FOR

Free on Rail

FWO

Frontier Works Organization

FY

Financial Year

GB

Gilgit-Baltistan

GFR

General Financial Rules

GPF

General Provident Fund

GVM

Gross Vehicle Mass

GVW

Gross Vehicle Weight

iii

GWL

General Waiting List

HEC

Higher Education Commission

HQ

Headquarters

HSD

High Speed Diesel

HVAC

Heating, Ventilating and Air-conditioning

IB

Instructions to Bidders

ICAO

International Civil Aviation Organization

ICB

International Competitive Bidding

ICT

Islamabad Capital Territory

IEE

Initial Environmental Examination

IPC

Interim Payment Certificate

IPDF

Infrastructure Project Development Facility

ITS

Intelligent Transport System

JCR

Japan Credit Rating

JIAP

Jinnah International Airport

JV

Joint Venture

KIBOR

Karachi Interbank Offered Rate

KKH

Karakoram Highway

KLM

Karachi Lahore Motorway

KP

Khyber Pakhtunkhwa

LAC

Land Acquisition Collector

LED

Light Emitting Diodes

MB

Measurement Book

MCI

Metropolitan Corporation Islamabad

MES

Military Engineering Service

MFDAC

Memorandum for Departmental Accounts Committee

MoC

Ministry of Communications

MoU

Memorandum of Understanding

MPO

Machinery Pool Organization

MSSR

Monopulse Secondary Surveillance Radar

NAM

New Accounting Model

NCB

National Competitive Bidding

NCL

National Construction Limited

NDC

No Demand Certificate

NESCOM

National Engineering and Scientific Commission

NESPAK

National Engineering Services of Pakistan

iv

NGIA

New Gwadar International Airport

NHA

National Highway Authority

NHC

National Highway Council

NHEB

National Highway Executive Board

NHIP

National Highway Improvement Programme

NIIAP

New Islamabad International Airport Project

NIT

Notice Inviting Tender

NLC

National Logistics Corporation

NOC

No Objection Certificate

NTRC

National Transport Research Centre

O&M

Operation and Management

P&CA

Procurement and Contract Administration

PAC

Public Accounts Committee

PACRA

Pakistan Credit Rating Agency

PAO

Principal Accounting Officer

PAR

Performance Audit Report

PCC

Plain Cement Concrete

PC-I

Planning Commission (Proforma-I)

PCFC

Pak-China Friendship Centre

PD&R

Planning, Development and Reform

PDP

Proposed Draft Para

PEC

Pakistan Engineering Council

PHA

Pakistan Housing Authority

PHAF

Pakistan Housing Authority Foundation

PIAC

Pakistan International Airline Corporation

PLA

Personal Ledger Account

PM

Periodic Maintenance

PMC

Present Management Consultants

PMDC

Pakistan Medical and Dental Council

PMO

Project Management Office

PMU

Project Management Unit

POL

Petroleum, Oil and Lubricants

PPRA

Public Procurement Regulatory Authority

PPWD

Pakistan Public Works Department

PSDP

Public Sector Development Programme

PSO

Pakistan State Oil

v

PSR

Primary Surveillance Radar

MT

Motor Transport

PWD

Public Works Department

PWP

Peoples Works Programme

PWWB

Punjab Workers Welfare Board

RCC

Re-inforced Cement Concrete

RCB

Rawalpindi Cantonment Board

RDA

Rawalpindi Development Authority

RFP

Request for Proposal

Rft

Running Foot

RM

Routine Maintenance

RMA

Road Maintenance Account

ROW

Right of Way

SAR

Special Audit Report

SBD

Standard Bidding Documents

SDGs

SECP

Sustainable Development Goals

Securities and Exchange Commission of Pakistan

SH

Sub-Head

SOP

Standard Operating Procedure

SP

Special Provisions

SRO

Statutory Regulatory Order

TST

Triple Surface Treatment

VO

Variation Order

WBM

Water Bound Macadam

WWB

Workers Welfare Board

WWF

Workers Welfare Fund

vi

vii

Preface

Articles 169 and 170 of the Constitution of the Islamic Republic of

Pakistan 1973, read with Sections 8 and 12 of the Auditor General

(Functions, Powers and Terms and Conditions of Service) Ordinance,

2001 require the Auditor General of Pakistan to conduct audit of the

accounts of the Federal and of the Provincial Governments and the

accounts of any authority or body established by, or under the control of,

the Federal or a Provincial Government.

The report is based on audit of the accounts of CDA, CAA, NHA,

Pak. PWD, EO, FGEHF, NCL, PHAF, HEC and WWF/Bs for the

financial year 2016-17 and also contains some audit observations for the

financial years 2013-14, 2014-15 and 2015-16. The Directorate General

Audit Works (Federal), Islamabad conducted audit during 2017-18 on a

test check basis with a view to reporting significant findings to the

relevant stakeholders. The main body of the Audit Report includes only

the systemic issues and audit findings carrying value of Rs 1 million or

more. Relatively less significant issues are listed in the Annexure-1 of the

Audit Report. The audit observations listed in Annexure-1 shall be

pursued with the Principal Accounting Officers at the DAC level and in all

cases where the PAO does not initiate appropriate action, the audit

observations will be brought to the notice of the Public Accounts

Committee through the next year‟s Audit Report.

Audit findings indicate the need for adherence to the regularity

framework besides instituting and strengthening the internal controls to

avoid recurrence of similar violations and irregularities.

Audit observations included in this Audit Report have been

finalized after due consideration of written responses of the audited

entities and discussions in DAC meetings.

The Audit Report is submitted to the President of Pakistan in

pursuance of Article 171 of the Constitution of the Islamic Republic of

Pakistan 1973, for causing it to be laid before the Parliament.

Sd/-

Islamabad

(Javaid Jehangir)

Dated: 12

th

February, 2018

Auditor General of Pakistan

viii

ix

EXECUTIVE SUMMARY

The Directorate General Audit Works (Federal), Islamabad, carried

out audit of the Federal Government entities engaged in construction

works, namely, Capital Development Authority, Civil Aviation Authority,

National Highway Authority, Pakistan Public Works Department, Estate

Office, Federal Government Employees Housing Foundation, National

Construction Limited, Pakistan Housing Authority Foundation, Higher

Education Commission (PSDP/Infrastructure development works executed

by federally chartered universities/institutions), Workers Welfare

Fund/Boards and Ministry of Planning, Development and Reform (Special

Project Cell/Afghan Projects). These entities function under the

administrative control of various Principal Accounting Officers and

consume major portion of the funds provided under the Public Sector

Development Programme.

The Directorate General Audit Works (Federal), Islamabad, has

existing human resource of 155 personnel including officers and staff. The

annual budget of the Directorate General for the current financial year is

Rs 160.350 million. The Directorate General is mandated to conduct

Financial Attest Audit, Compliance with Authority Audit and Performance

Audit of civil works including mega projects of Federal Government. As

part of its Audit Plan (2017-18), for the Compliance with Authority Audit,

the Directorate General Audit Works (Federal) conducted audit of 85

formations, out of the 264 under its audit jurisdiction during Phase-I of the

Audit Plan, by deputing fifteen (15) Field Audit Teams with an input of

3,582 man-days. Moreover, regularity audit of ten (10) formations relating

to CDA, NHA, PHAF and PD&R were conducted in Phase-II of Audit

Plan of 2016-17 and audit observations have been included in this Audit

Report. One (01) Special Audit and nine (09) Performance Audits are also

under process, reports of which would be published separately.

x

The objectives of audit were to:

i. ascertain whether or not the moneys shown as expenditure

in the accounts were authorized for the purpose for which

they were spent;

ii. observe whether the expenditure incurred is in conformity

with the laws, rules and regulations framed to regulate the

procedure for expending public money;

iii. ascertain whether every item of expenditure is incurred

with the approval of the competent authority in the

Government for expending the public money;

iv. examine propriety of transactions to ascertain whether due

vigilance has been exercised in respect of expenditure

incurred from public moneys;

v. review, analyze and comment on impact and implications

of various government policies relating to the audited

entities;

vi. review, analyze and comment on budget, accounts,

financial statements, balance sheet, etc. and

vii. verify that rules and procedures were followed in

assessment and collection of revenues.

i. Scope of Audit

Auditable expenditure under the jurisdiction of Directorate General

Audit Works (Federal), Islamabad for the year 2016-17 was

Rs 419,483.449 million covering 264 formations under eight (08)

PAOs. Out of this, the Directorate General Audit Works (Federal)

audited an expenditure of Rs 118,445.660 million under the

category of compliance audit, which in terms of percentage is

28.24% of auditable expenditure. In addition, as part of its Audit

Plan (2017-18), the Directorate General Audit Works (Federal)

conducted a financial attest audit of the accounts of Pakistan Public

Works Department (Government of Pakistan) and nine (09)

Foreign Aided Projects executed by NHA. The Financial Attest

xi

Audit Report of Pak. PWD has been published separately. The

Financial Attest Audit Reports of Foreign Aided Projects have

been sent to the stakeholders/development partners through

Economic Affairs Division. The significant issues of financial

governance and project management relating to Foreign Aided

Projects are also included in this Audit Report.

The audit coverage also includes the revenue collection amounting

to Rs 142,692.513 million against estimates of Rs 176,867.477

million by the audited entities.

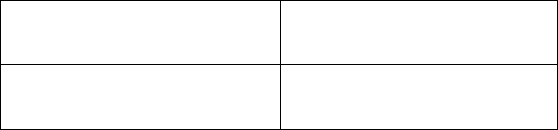

ii. Recoveries at the instance of audit

The Directorate General Audit Works (Federal), Islamabad pointed

out „overpayments‟ and „recoverables‟ amounting to Rs 11,303.53

million. The management accepted the stance of Audit to the

extent of Rs 5,638.62 million. Recovery amounting to Rs 238.97

million was made by the audited entities and verified by Audit till

the finalization of this Audit Report. Recovery of Rs 174.21

million out of Rs 231.97 million was not in the notice of the

executives before audit.

In addition to the above stated recoveries, a sum of Rs 782.23

million was recovered by audited entities in relation to audit

observations pertaining to previous years. Total recovery of

Rs 1,021.20 million was verified by Audit during 2017-18 till the

finalization of this Audit Report. The sum included Rs 594.34

million pertaining to overpayments and Rs 426.86 million on

account of revenue receipt expedited.

iii. Holding of Departmental Accounts Committee meetings

Para 5 (f) of System of Financial Control and Budgeting, 2006

issued by Finance Division, Government of Pakistan provides that

the Principal Accounting Officer/Additional Secretary or

equivalent shall regularly hold meetings of DAC as Chairperson,

xii

with Financial/Deputy Financial Adviser and Director General

(Audit) as Members and Chief Finance and Accounts Officer as

Member/Secretary to watch the processing of Audit & Inspection

Reports and decide upon appropriate measures so as to aid and

accelerate the process of finalization of Audit Report.

The Principal Accounting Officers are regularly requested to

convene DAC meeting to discuss Audit Reports. During the period

from 1

st

July, 2017 till the finalization of this Audit Report, thirty-

one (31) DAC meetings were convened by various PAOs. Audit

paras included in this Audit Report have been discussed in DAC

meetings. However, PAOs of certain departments/authorities have

not convened DAC meetings to discuss audit paras included in this

Audit Report despite requests made by Audit.

iv. Audit Methodology

Desk audit was carried out to understand systems, procedures and

control environment of audited entities. Permanent files of the

audited entities were updated and utilized for understanding the

institutional framework. Detailed planning, documentation of

findings and quality assurance was conducted. The desk audit also

included in-house meetings of Field Audit Teams for experience

sharing and reviewing potential risk areas. A Risk Area Digest

earmarking potential risk areas was prepared for guidance of the

Field Audit Teams. Audit methodology included:

i. Updating the understanding of the business processes with

respect to control mechanism.

ii. Identification of key controls on the basis of prior years‟

audit experience/special directions from the Auditor

General‟s office.

iii. Prioritizing risk areas by determining significance and risks

associated with the identified key controls.

iv. Design/update audit programmes for testing the identified

risk conditions.

xiii

v. Selection of audit formations on the basis of:

a. Materiality/significance

b. Risk assessment

vi. Selecting samples as per sampling criteria/high value

items/key items.

vii. Execution of audit programmes.

viii. Identification of weaknesses in internal controls and

development of audit observations and recommendations

relating to non-compliance of rules, regulations and

prescribed procedures.

ix. Evaluating results.

x. Reporting.

xi. Follow-up.

v. Audit Impact

There has been a positive change in the responsiveness of audited

entities towards audit due to continuous functioning of Public

Accounts Committee in the recent years. The viewpoint of Audit

on financial/technical issues has been acknowledged by DAC/PAC

and administrative departments which is a healthy sign for the

financial and regulatory discipline in the audited entities.

Following are instances of major audit impact:

i. While discussing Para 3.4.4 of Audit Report on the

accounts of CAA for the year 2016-17, PAC in its meeting

held on 7.11.2017, issued directions to all PAOs that tender

documents should not be issued to any participating

firm/JV unless it has a valid registration with the Pakistan

Engineering Council. PAC also directed that PEC should

devise a mechanism for prompt processing of registration

of firms/JVs particularly of foreign firms. (National

Assembly Secretariat O.M. No. F.10(1)/2016-17/2017-PAC

dated 8

th

November, 2017)

ii. Pakistan Public Works Department accounted for receipts

on account of Federal Lodges in the Summary of

xiv

Appropriation Accounts so as to depict actual picture of

recovery adjusted in reduction of expenditure.

iii. CAA agreed that in future rate running contracts will be

executed through open tenders. (DP.30)