Annual Report and

2024 Proxy Statement

WestRock 2023 Annual Report and 2024 Proxy Statement

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TIME AND DATE:

9:00 a.m., Eastern Time, on

Friday, January 26, 2024

PLACE:

Online via webcast at

www.virtualshareholdermeeting.com/WRK2024 *

*There will not be a physical location for the 2024 annual meeting

ITEMS OF BUSINESS:

Proposals Board Recommendation

(1) To elect 12 directors named in this Proxy Statement

FOR EACH NOMINEE

(2) To hold an advisory vote to approve executive compensation FOR

(3) To ratify the appointment of Ernst & Young LLP to serve as our independent registered

public accounting firm for fiscal 2024

FOR

In addition, we will transact any other business that properly comes before the meeting or any adjournment or

postponement of the meeting.

WHO MAY VOTE:

You may vote if you were a holder of our common stock as of the close of business on December 4, 2023.

HOW TO VOTE IN ADVANCE OF THE MEETING:

There are three ways for registered stockholders to vote in advance of the meeting:

(1) By Internet: Go to www.proxyvote.com or scan the QR barcode on your proxy card and follow the instructions.

(2) By Phone: Call 1-800-690-6903.

(3) By Mail: Complete, sign and return the proxy card by mail.

Beneficial holders of our stock should review the information provided by their bank, broker or other nominee in order to

provide voting instructions.

To vote during the meeting, go to www.virtualshareholdermeeting.com/WRK2024 and follow the instructions.

DATE THESE PROXY MATERIALS WERE FIRST MADE AVAILABLE:

December 13, 2023

[THIS PAGE INTENTIONALLY LEFT BLANK]

MESSAGE FROM OUR PRESIDENT AND CEO

Dear Fellow Shareholders:

As we reflect on fiscal 2023, I want to thank you for your continued trust in, and support of,

WestRock. The WestRock team remained steadfast and delivered strong results despite

unprecedented market conditions, demonstrating the power and resilience of our diversified

portfolio, solutions and scale.

I’m incredibly proud of the progress we made in the past year as we worked to deliver for our

customers and our shareholders. We improved our integrated packaging revenue and

margins and recently increased our dividend by an additional 10%. Following our acquisition

of the remaining equity interest in our former joint venture in Mexico in D ecember 2022, we

used our strong cash flow to reduce our total debt by $879 million, supporting our

commitment to improve our leverage.

Strategic Transformation Initiatives

We also made significant progress on our transformation journey in fiscal 2023 – investing

in attractive markets and locations, streamlining our footprint and prioritizing capital on the

highest return projects. We exceeded our cost savings expectations compared to fiscal

2022, exiting fiscal 2023 with greater than $450 million in run-rate savings.

Our Mexico acquisition increases our exposure to the attractive Latin America market and brings us closer to our

multinational customers. We also invested $1.1 billion in capital expenditures, including the construction of our new,

state-of-the-art corrugated box plant in Longview, Washington. In parallel, we closed two higher cost mills and two paper

machines at a third facility and sold our uncoated recycled paperboard mills and stakes in multiple non-strategic joint

ventures. These actions are tangible examples of our ongoing efforts to improve our operations and focus on the most

strategic markets for growth in the future.

Leadership in Innovation and Sustainability

Innovation and sustainability are fundamental to our business, and we strengthened our leadership role in these areas

during fiscal 2023. We recently received six Paperboard Packaging Council awards for excellence in packaging design,

sustainability and innovation. We were also recipients of the World Star Global Packaging Award in partnership with Asahi

Breweries and the Asia Star Award together with Singha beer – both for our CanCollar

®

family of multipack can solutions,

which can be designed to enable brands to transition from single-use plastic rings to a recyclable paperboard solution.

In addition, we earned a spot on the coveted Dow Jones Sustainability Index for North America for the third consecutive

year, while also being named by Newsweek as one of America’s Most Responsible Companies and Barron’s 100 Most

Sustainable U.S. Companies. Our most recent Sustainability Report highlights the meaningful progress we’ve made across

a range of sustainability commitments and targets – from advancing sustainable forestry and our science-based target to

reduce greenhouse gas emissions to driving safety and diversity and inclusion efforts in our workforce.

We already have an impressive renewable energy profile with approximately 70% of our total energy needs met with

renewable biomass. In fiscal 2023, we worked to expand our use of renewable energy by entering into two virtual power

purchase agreements with ENGIE North America, a recognized leader in the renewable energy space. The agreements

support two new solar projects based in Texas and are a component of our strategy to achieve our science-based target.

Looking Ahead

In September 2023, we announced a proposed business combination with Smurfit Kappa Group that is designed to create a

company with unparalleled scale and geographic reach in the most attractive packaging markets. I look forward to updating

you on our progress on this business combination in the future.

As this work moves forward, I am confident in WestRock’s strategy and our team, and we remain focused on growing our

company, serving our customers and being an outstanding workplace for our team members.

On behalf of the Board of Directors, thank you for your ongoing partnership.

Sincerely,

David B. Sewell

President and Chief Executive Officer

[THIS PAGE INTENTIONALLY LEFT BLANK]

TABLE OF CONTENTS

PROXY STATEMENT SUMMARY AND

RELATED MATTERS

1

Fiscal 2023 Business Highlights 1

Annual Meeting Information 1

Annual Meeting Agenda 1

Director Nominees 2

Governance Highlights 3

Compensation Highlights 4

Sustainability Highlights 5

BOARD AND GOVERNANCE MATTERS 7

Item 1. Election of Directors

7

Governance Framework 7

Board Composition 8

Board Operations 15

Director Compensation 19

Certain Relationships and Related Person

Transactions 20

Communicating with the Board 21

COMPENSATION MATTERS 22

Item 2. Advisory Vote to Approve Executive

Compensation

22

COMPENSATION DISCUSSION AND ANALYSIS 23

Executive Summary 23

Business Highlights and Key Accomplishments –

Fiscal 2023 23

Compensation Decision-Making Framework 25

Compensation Elements 28

Severance and Change in Control Arrangements 34

Other Compensation Practices and Policies 36

Compensation Committee Report 36

Compensation Committee Interlocks and Insider

Participation 37

EXECUTIVE COMPENSATION TABLES 38

Fiscal 2023 Summary Compensation Table 38

All Other Compensation Table for Fiscal 2023 39

Grants of Plan-Based Awards in Fiscal 2023 40

Outstanding Equity Awards at Fiscal 2023 Year-End 41

Option Exercises and Stock Vested During Fiscal

2023 42

Retirement Plans 42

Fiscal 2023 Nonqualified Deferred Compensation 43

Potential Payments Upon Termination or Change in

Control 43

CEO PAY RATIO 45

PAY VERSUS PERFORMANCE 46

AUDIT MATTERS 51

Item 3. Ratification of Appointment of Ernst &

Young LLP for Fiscal 2024

51

Report of the Audit Committee 51

Fees of the Independent Registered Public

Accounting Firm 52

Pre-Approval Policies and Procedures 52

Other Information 52

OTHER IMPORTANT INFORMATION 53

Beneficial Ownership of Common Stock 53

Stockholder Proposals or Director Nominations for

2025 Annual Meeting 54

Annual Report on Form 10-K 54

Frequently Asked Questions 54

Cautionary Language Regarding Forward-Looking

Statements 57

[THIS PAGE INTENTIONALLY LEFT BLANK]

Proxy Statement Summary and Related Matters

PROXY STATEMENT SUMMARY AND RELATED MATTERS

This summary highlights information contained elsewhere in this Proxy Statement, as well as certain other information that

our stockholders may wish to consider prior to making a voting decision. You should read this entire Proxy Statement

carefully before voting.

FISCAL 2023 BUSINESS HIGHLIGHTS

WestRock Company (the “Company” or “we”) provides innovative, sustainable, fiber-based packaging solutions for

consumer and corrugated packaging markets. Our community of more than 55,000 team members supports customers

around the world from locations in North America, South America, Europe, Asia and Australia. Our extensive network of

mills and converting and recycling facilities, our capabilities in automation technology and materials science, and our legacy

in sustainable forestry position us to imagine and deliver on the promise of a sustainable future.

We believe fiber-based packaging, the core of our business and sustainability platform, plays a central role in replacing

plastic and advancing a more circular economy. We partner with customers to deliver real value. We’re a partner that strives

to provide competitive advantages, deliver consistent quality and superior service, and fuel innovation to foster sustainable

growth. We are building on our long history of sustainability leadership and innovation, including breakthroughs that have

revolutionized packaging design and retail solutions. We also remain committed to innovation to support future growth and

sustainability for our business and our customers.

During fiscal 2023, we significantly advanced our strategic transformation initiatives and continued to achieve recognition for

development and commercialization of innovative and sustainable products. We delivered net sales of $20.3 billion, improved

our integrated packaging revenue and margins and generated net cash from operating activities of $1.8 billion, despite

unprecedented market conditions. Following our acquisition of the remaining equity interest in our former joint venture in Mexico

in December 2022 (the “Mexico Acquisition”), we used our strong cash flow to reduce our total debt by $879 million.

Throughout the year, we improved our asset base through the closure of higher cost facilities and paper machines and

other facility consolidation and invested $1.1 billion in capital expenditures, accelerating our asset recapitalization program

to drive productivity. We exceeded our cost-savings target in fiscal 2023 and exited fiscal 2023 with greater than

$450 million in run-rate savings. In addition, the Mexico Acquisition builds capability to capture on-shoring trends and

growth in the attractive Latin America market. Delivering on our commitment to streamline our portfolio and prioritize

profitable growth, we also exited non-core assets and sold our stakes in multiple non-strategic joint ventures. We remain

focused on driving profitable growth and delivering additional cost savings in fiscal 2024.

In mid-September 2023, we announced the proposed business combination of WestRock and Smurfit Kappa Group plc, a

public limited company incorporated in Ireland (“Smurfit Kappa”), to create Smurfit WestRock, a global leader in sustainable

packaging, pursuant to a transaction agreement (the “Transaction Agreement”) with Smurfit Kappa, Cepheidway Limited (to

be renamed Smurfit WestRock plc), a private limited company incorporated in Ireland (“ListCo”), and Sun Merger Sub, LLC,

a Delaware limited liability company and a wholly owned subsidiary of ListCo (“Merger Sub”). The Transaction Agreement

provides, among other things, that subject to the satisfaction or waiver of specified conditions, Smurfit Kappa will become a

wholly owned subsidiary of ListCo and Merger Sub will merge with and into WestRock, with WestRock surviving the

transaction as a wholly owned subsidiary of ListCo (the “Transaction”).

The Transaction is expected to close in the second calendar quarter of 2024, conditional upon regulatory approvals,

stockholder approvals and satisfaction of other closing conditions. Following completion of the Transaction, former Smurfit

Kappa shareholders are expected to hold approximately 50.4% of ListCo and our former stockholders are expected to hold

approximately 49.6% of ListCo, respectively, based on the number of shares outstanding of both Smurfit Kappa and

WestRock as of the announcement date .

ANNUAL MEETING INFORMATION

Time and Date 9:00 a.m., Eastern Time, on Friday, January 26, 2024

Location Online via webcast at

www.virtualshareholdermeeting.com/WRK2024

Record Date December 4, 2023

ANNUAL MEETING AGENDA

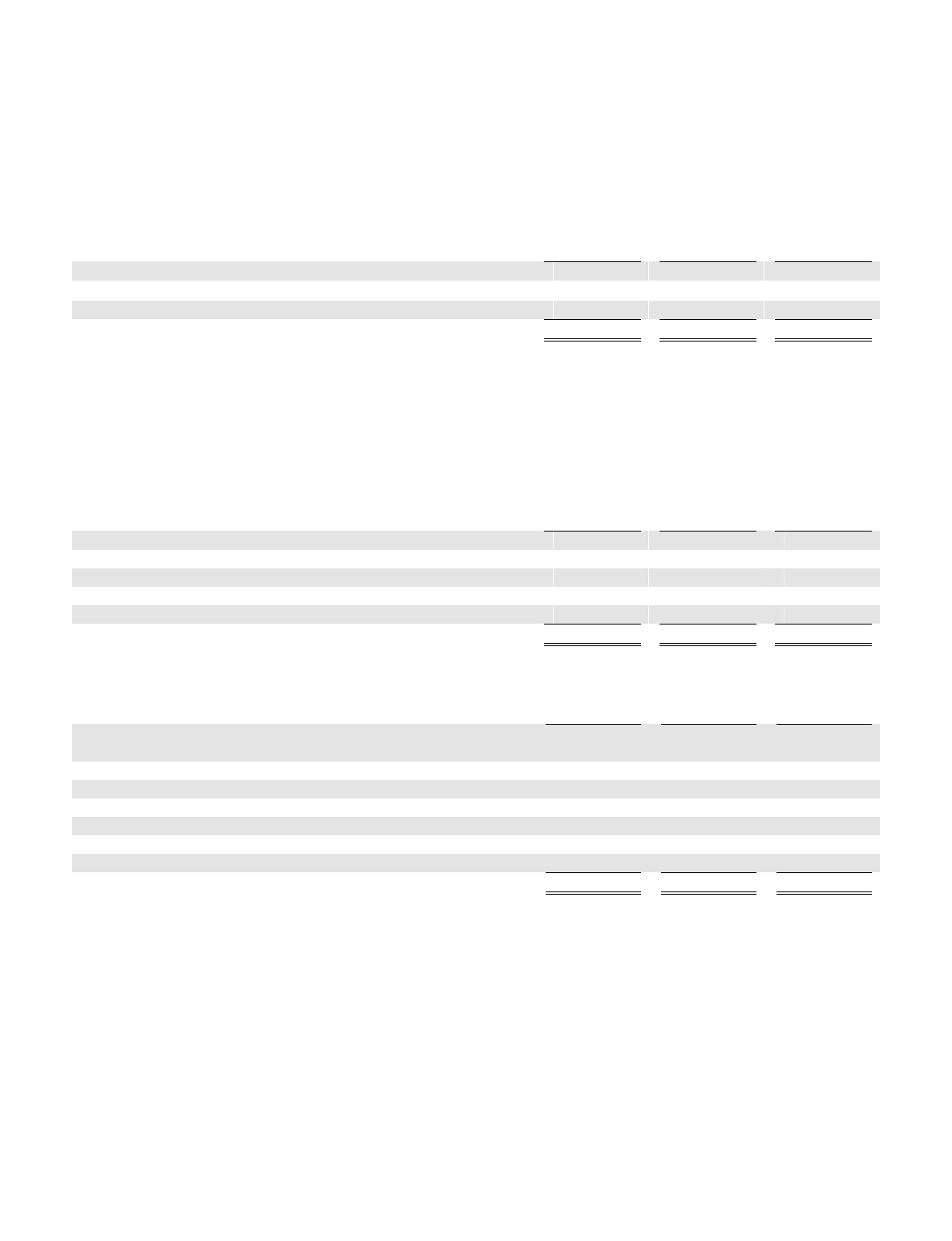

Proposals Board Recommendation Page

(1) Election of 12 Directors Named in this Proxy Statement FOR EACH NOMINEE 7

(2) Advisory Vote to Approve Executive Compensation

FOR 22

(3) Ratification of Appointment of Ernst & Young LLP for Fiscal 2024

FOR 51

WestRock Company 2024 Proxy Statement 1

Proxy Statement Summary and Related Matters

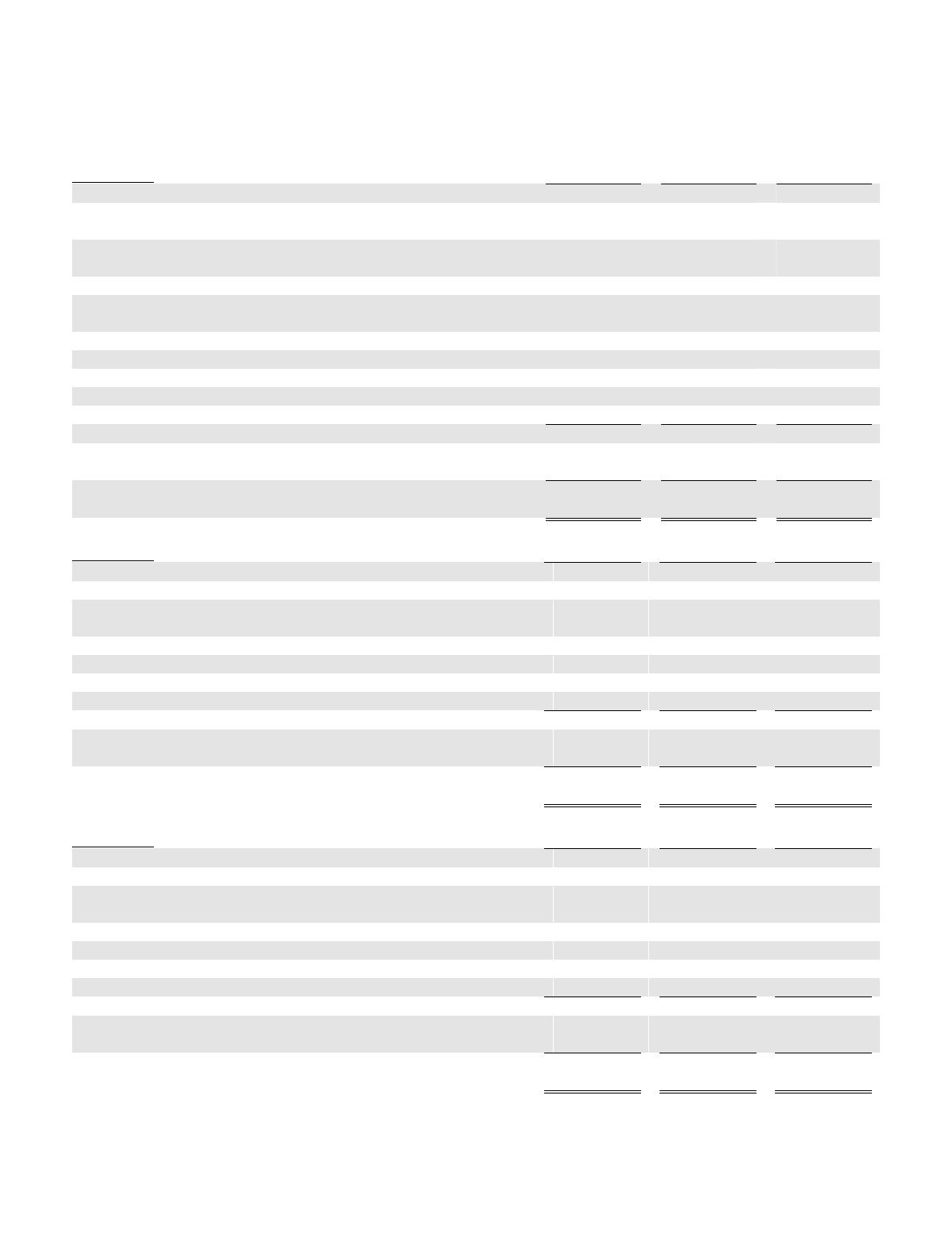

DIRECTOR NOMINEES

Name and Background Age

Director

Since

Other

Public

Boards Standing Committees

COLLEEN F. ARNOLD

Independent Director

Former Senior Vice President, Sales and Distribution,

International Business Machines Corporation

66 2018 0

• Compensation

• Executive

• Finance (Chair)

TIMOTHY J. BERNLOHR

Independent Director

Managing Member,

TJB Management Consulting, LLC

64 2015 1

• Audit

• Compensation (Chair)

• Executive

J. POWELL BROWN

Independent Director

President and CEO, Brown & Brown, Inc.

56 2015 1

• Compensation

• Governance

TERRELL K. CREWS

Independent Director

Former Executive Vice President, CFO,

Monsanto Company

68 2015 1

• Audit (Chair)

• Executive

• Finance

RUSSELL M. CURREY

Independent Director

President, Boxwood Capital, LLC

62 2015 0

• Audit

• Finance

SUZAN F. HARRISON

Independent Director

Former President, Global Oral Care,

Colgate-Palmolive Company

66 2020 2

• Audit

• Governance

GRACIA C. MARTORE

Independent Director

Former President and CEO, TEGNA Inc.

72 2015 2

• Audit

• Finance

JAMES E. NEVELS

Independent Director

Former Chairman, The Hershey Company

71 2015 0

• Compensation

• Executive

• Governance (Chair)

E. JEAN SAVAGE

Independent Director

President and CEO, Trinity Industries, Inc.

59 2022 1

• Audit

• Compensation

DAVID B. SEWELL

President and CEO, WestRock Company

55 2021 1 • Executive

DMITRI L. STOCKTON

Independent Director

Former Senior Vice President and Special Advisor

to the Chairman, General Electric Company

59 2022 3

• Audit

• Finance

ALAN D. WILSON

Independent Chair

Former Chairman and CEO,

McCormick & Company, Inc.

66 2015 1

• Executive (Chair)

• Finance

• Governance

2 WestRock Company 2024 Proxy Statement

Proxy Statement Summary and Related Matters

GOVERNANCE HIGHLIGHTS

We believe good corporate governance supports long-term value creation for our stockholders, and our corporate

governance framework supports independent oversight and accountability. Our Board of Directors (the “Board”) is led by an

independent Chair, Alan D. Wilson.

Independent Oversight Accountability

• Eleven of 12 director nominees are independent, with three

independent directors added in the last five years

•

Independent Chair with clearly delineated responsibilities

• All independent standing committees (other than Executive

Committee)

• Regular executive sessions for Board and committee

meetings

• Director retirement age of 72, which the Board has waived in

exceptional circumstances

• Annual election of all directors

• Majority voting in uncontested elections

• Annual Board and committee self-evaluations

• Annual advisory vote on executive compensation

• Robust stock ownership and retention guidelines for Board

and designated executives; anti-hedging and anti-pledging

policy in place

• Over-boarding policy with numerical limits that are regularly

reviewed and publicly disclosed in our Corporate Governance

Guidelines (the “Governance Guidelines”)

Board Refreshment

The Board is composed of experienced members who are diverse with respect to background, skills, experiences, gender,

race and ethnicity, which facilitates the effective oversight of our strategy and management.

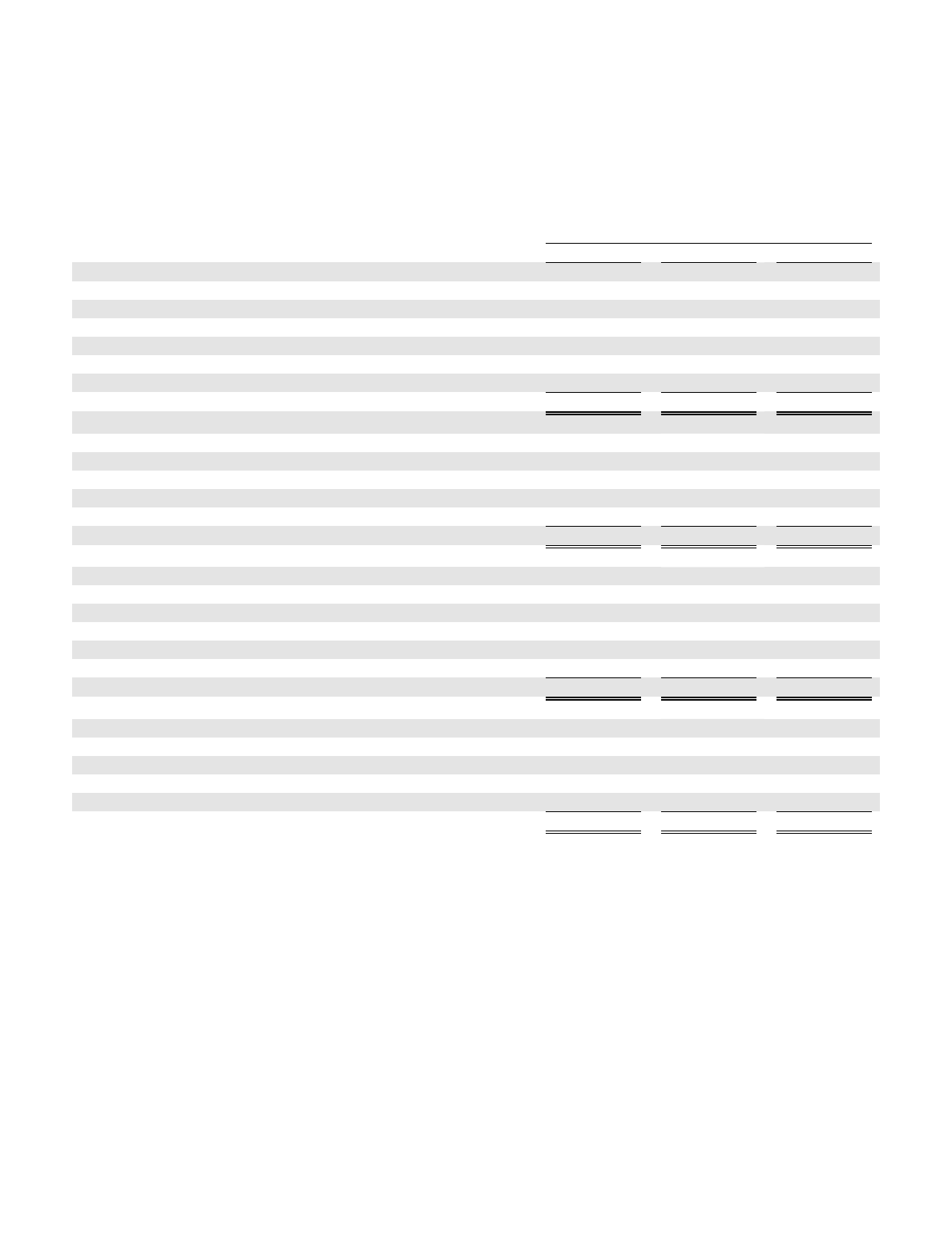

Global Business Experience

10

Capital Allocation Experience

11

Consumer Packaged

Goods Experience

5

M&A Experience

11

Paper & Packaging Experience

4

Enterprise Risk

Management Experience

9

Financial Expertise

10

Manufacturing Experience

8

Experience with Scale

7

Public Company CEO Experience

5

Sustainability Experience

6

Public Company Board Experience

11

Innovation Experience

6

We recognize the importance of board refreshment. As a result of the Board’s robust refreshment process, the Board

currently includes four directors with less than five years of service on the Board (two of whom joined the Board in 2022).

These additions demonstrate the Board’s commitment to refreshment with independent nominees who provide perspectives

and experience to advance our business strategy.

We also recognize and value the importance of board diversity. In 2020, the Board adopted the WestRock Company

Diversity Search Policy, pursuant to which we include qualified female and racially or ethnically diverse candidates on the

initial lists of candidates from which new management-supported director nominees recruited from outside the Company are

chosen by the Board.

WestRock Company 2024 Proxy Statement 3

Proxy Statement Summary and Related Matters

Pursuant to the Governance Guidelines, directors must retire when they reach age 72, provided that they may continue to

serve thereafter until the next annual or special meeting of stockholders at which directors are to be elected. However, the

Board, on the recommendation of the Nominating and Corporate Governance Committee (the “Governance Committee”),

has determined it is appropriate to waive the retirement age with respect to Ms. Martore until our 2025 annual meeting of

stockholders after considering her extensive qualifications and valuable, ongoing contributions to the Board. As the former

chair of the Audit Committee and the chair of the independent Transaction Committee created expressly to oversee all

aspects of the Transaction, Ms. Martore has played and continues to play a crucial leadership role on the Board. Her

ongoing service will enable the Board to continue to function efficiently and effectively over the next year as we prepare for

the Transaction.

Human Capital Management

The Board believes that effective talent development and human capital management are important to our success, and our

Governance Guidelines expressly identify the Board’s oversight role with respect to our strategies related to human capital

management. In fiscal 2023, the Board and its committees engaged with senior management, including our Chief Human

Resources Officer, across a broad range of human capital management topics, such as safety, culture, succession planning

and development, compensation and benefits, employee recruitment and retention and diversity, equity, inclusion, and

belonging (“Diversity and Inclusion”).

Environmental, Social and Governance Oversight

The charter of the Governance Committee provides that one of its principal duties and responsibilities is to oversee our

policies, strategies and programs related to environmental, social and governance (“ESG”) matters, including sustainability.

The Governance Committee increased the cadence of its meetings to four times per year beginning in fiscal 2023, which

has expanded the frequency with which ESG and sustainability topics are discussed with the Governance Committee. In

addition, the Governance Committee continues to identify sustainability experience as one of the important areas of

experience for directors to possess collectively in light of our business strategy.

6/12 directors have

sustainability experience

In addition to Board-level oversight, we have robust management-level oversight of sustainability matters. WestRock’s

executive leadership team is responsible for establishing our sustainability strategy, including with respect to climate-related

issues. Our Senior Vice President of Strategy and Sustainability, who reports to our President, Global Paper, is responsible

for providing guidance on our sustainability approach, helping to link our sustainability and business initiatives and driving

implementation of our sustainability strategy throughout the organization in collaboration with other executives. Our Vice

President, Sustainability, manages day-to-day implementation of this strategy. In addition to our sustainability executives,

we have established cross-functional groups within the organization to facilitate ongoing refinement and execution of our

sustainability strategy, develop plans to achieve our sustainability targets and embed our sustainability targets into our

operations. These groups include representatives from our product stewardship, environmental, innovation, engineering,

manufacturing, finance, legal and communications groups.

Stockholder Engagement

Stockholder engagement is a key pillar of our corporate governance framework. We conduct year-round, proactive

stockholder engagement to ensure that management and the Board understand and consider the issues that matter most to

our stockholders. We provide regular updates regarding our financial performance and strategic actions to the investor

community through our participation in investor conferences, earnings calls, one-on-one meetings and educational investor

and analyst conversations. We also communicate with stockholders and other stakeholders through our filings with the

Securities and Exchange Commission (the “SEC”), sustainability reports, press releases and website.

In addition to our regular engagement initiatives, we conducted an outreach program in the summer and fall of 2023. As part

of this process, we met virtually or initiated contact with stockholders representing more than 60% of our outstanding

shares. These discussions included various members of our senior management team. The topics discussed included our

approach to human capital management, including Diversity and Inclusion, and compensation, corporate governance,

sustainability and various related goals and initiatives.

COMPENSATION HIGHLIGHTS

Our executive compensation policies and programs are a strategic tool designed to drive stockholder value creation by

attracting, retaining and motivating highly effective leaders committed to the successful execution of our business strategy.

We believe our short-term and long-term incentive programs are aligned to the competitive market and appropriately

balanced, reinforcing both near-term and longer-term results, while also encouraging prudent decision-making and effective

risk management.

4 WestRock Company 2024 Proxy Statement

Proxy Statement Summary and Related Matters

Pay for Performance

Our executive compensation program is based on a pay-for-performance model. In fiscal 2023:

100% of our named executive officers’ (“NEOs”) short-term incentive program (“STIP”) goals were tied to

Company performance, as measured by Consolidated Adjusted EBITDA, Adjusted Revenue and Adjusted Free

Cash Flow Per Share metrics; and

75% of our NEOs’ long-term incentive program (“LTIP”) award value was tied to Company performance, as

measured by Adjusted Earnings per Share (“EPS”), Adjusted Return on Invested Capital (“ROIC”) and relative

Total Shareholder Return (“TSR”) metrics over a three-year performance period.

Pay at Risk

The Compensation Committee structures our NEOs’ compensation such that a significant portion is at-risk. We believe this

allocation of variable target compensation aligns with our pay-for-performance philosophy and motivates our executive

officers to focus on business growth and the creation of long-term value for our stockholders. As noted below, in fiscal 2023,

90% of target total compensation for Mr. Sewell was at-risk, and only 10% of his compensation was fixed, providing a strong

link between his target total compensation and our financial and operating results. An average of 76% of target total

compensation for the other NEOs was at-risk in fiscal 2023.

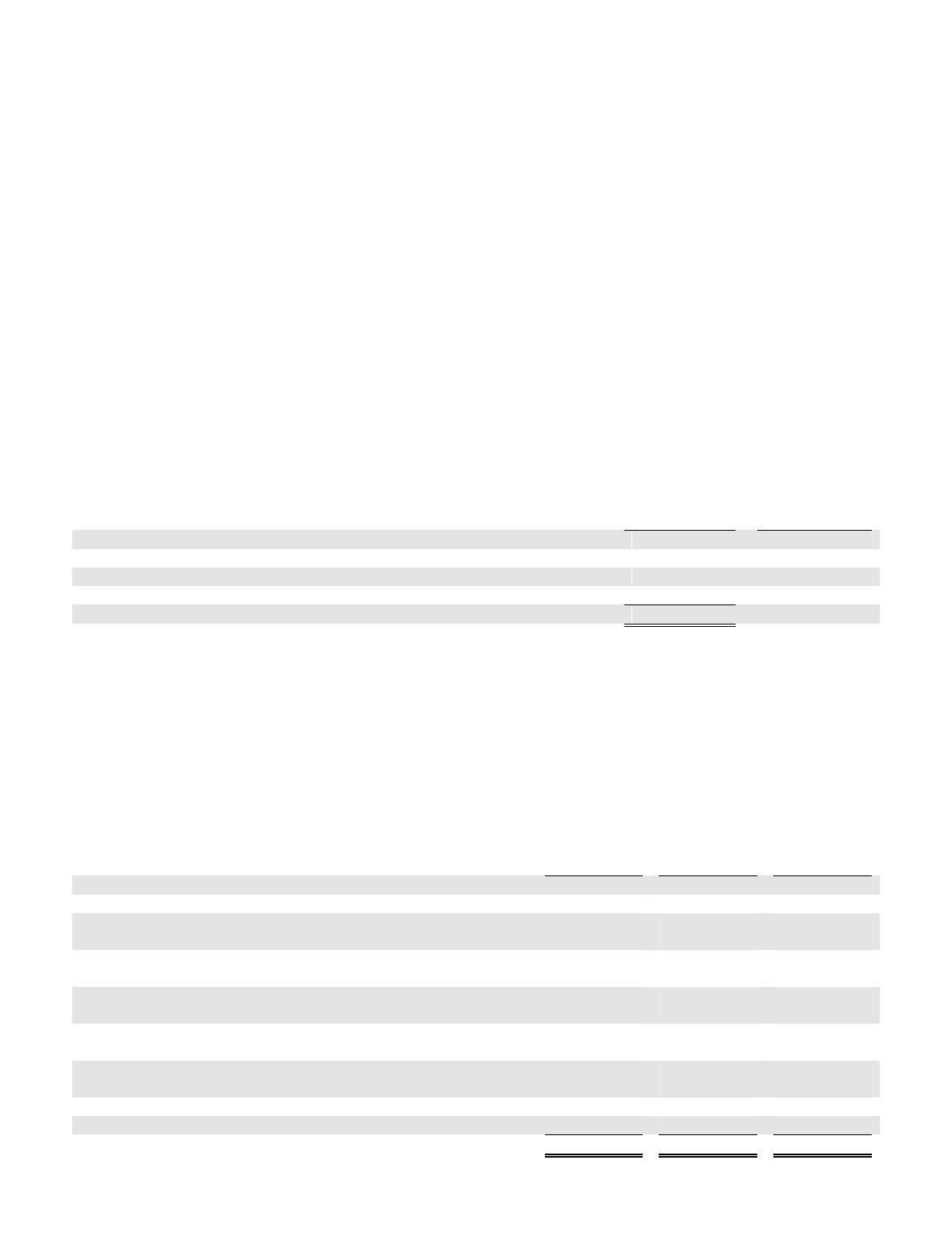

FISCAL 2023 CEO COMPENSATION MIX FISCAL 2023 AVERAGE OTHER NEO

COMPENSATION MIX

56%

PSUs

19%

RSUs

10%

Base Salary

15%

STIP

90%

Pay at Risk

40%

PSUs

14%

RSUs

24%

Base Salary

22%

STIP

76%

Pay at Risk

SUSTAINABILITY HIGHLIGHTS

Sustainability has long been an important aspect of our business, and we have increased our sustainability ambitions in

alignment with customer and market trends. We organize our efforts around three sustainability pillars: Innovating for Our

Customers and Their Customers, Bettering the Planet and Supporting People and Communities. In May 2023, we released

our Sustainability Report for fiscal 2022. Below, we summarize our targets and important progress related to them as of the

end of fiscal 2022.

• Innovating for Our Customers and Their Customers – We root our innovation efforts in megatrends and key forces

that will shape our industry and business over the next decade, including replacing plastic with fiber-based solutions,

driving more efficient use of materials through automation and design, and increasing recyclability, compostability

and reusability of our packaging formats.

Target: 100% of our packaging products to be recyclable, compostable or reusable by 2025

Progress: 97.8% of our packaging products were recyclable, compostable or reusable at the

end of fiscal 2022

•

Bettering the Planet – We aim to champion sustainable forestry and act as responsible stewards of the environment.

We seek to execute on this vision in many aspects of our business, including greenhouse gas emissions (“GHG”)

reduction, responsible fiber sourcing, and water stewardship.

Target: Achieve a validated science-based target to reduce our Scope 1, Scope 2 and certain

Scope 3 GHG emissions by 27.5% by 2030 against a fiscal 2019 baseline, aligned to a well

below two-degree Celsius ambition

Progress: 5.6% total reduction in Scope 1 and Scope 2 GHG emissions from fiscal 2019

baseline and collecting data for Scope 3 emissions inventory

WestRock Company 2024 Proxy Statement 5

Proxy Statement Summary and Related Matters

Target: Lead in water stewardship by (i) committing $15 million to community projects that

protect and benefit freshwater resources, working forests and biodiversity through 2030, (ii)

enhancing water management systems at all mills by the end of 2030, as part of an effort to

reduce our water intake by 15% by 2030 from a fiscal 2019 baseline, and (iii) launching a global

employee education campaign in 2023 emphasizing the importance of responsible water use

Progress: Vetting partners for proposed community projects while reducing water intake by

1.1% from a fiscal 2019 baseline and establishing a project plan for the 2023 water

stewardship campaign

Target: Promote sustainable forestry by (i) sourcing 100% of virgin fiber from responsibly

managed forests, (ii) investing in the future of sustainable forestry by supporting certification

of 1.5 million acres of forestland to recognized forest management standards by 2030, and

(iii) engaging with 10,000 private landowners and their stakeholders to provide education,

guidance and support for sustainable management of their forestlands by 2030

Progress: In addition to sourcing 100% of virgin fiber from responsibly managed forests, we

have supported certification of more than 457,000 acres of forestland and engaged with

5,550 private landowners since fiscal 2019

• Supporting People and Communities – Our community of more than 55,000 team members lives and works in more

than 300 locations in 30 countries around the world. We seek to be the employer of choice, with a culture that puts

people first, emphasizes safety and fosters a diverse, inclusive and engaged workplace. We strive to create an

environment where all team members feel a sense of belonging and can do their best work.

Target: Strive to eliminate life-changing events and achieve a year-over-year reduction in

severe injuries as measured by lost workday rate

Progress: Reduced life-changing events at WestRock from four in fiscal 2021 to two during

fiscal 2022, while lost workdays increased 0.8% through the end of fiscal 2022*

Target: Invest in programs and systems to advance our leadership in Diversity and Inclusion

for our team members, customers, industry and communities

Progress: Expanded partnerships with historically black colleges and universities and

continued investments in diversity-focused external professional programs, with emphasis on

women and people of color; improved gender and ethnic diversity representation in executive

and management positions*; spent more than $1 billion with small and diverse-owned

businesses in fiscal 2022

Target: Invest to reduce barriers to technical education and skills, inspiring careers in modern

manufacturing by providing access to training for one million individuals by 2030

Progress: Supported more than 330,000 learners since fiscal 2019

These targets and our work to advance them are described in more detail in our 2022

Sustainability Report, published in May 2023, which we prepared in accordance with

the Global Reporting Initiative (“GRI”) 2021 Universal Standards and relevant Topic

Standards Option. The topics discussed above and within our 2022 Sustainability

Report may not be considered material for SEC reporting purposes. The report

includes a crosswalk to relevant Sustainability Accounting Standards Board (“SASB”)

disclosure topics and an index of climate information informed by the Task Force on

Climate-related Financial Disclosures (“TCFD”) framework and is available through

our website at https://www.westrock.com/sustainability. Neither the report nor any

portion of our website, including our conso lidated EEO-1 Reports, is incorporated by

reference into this Proxy Statement and should not be considered part of this or any

other report that we file with or furnish to the SEC.

As part of our commitment to

transparency, and based on

feedback from external stakeholders,

we publish in the sustainability

section of our website our

consolidated EEO-1 Reports as

submitted to the U.S. Equal

Employment Opportunity

Commission.

* For information regarding progress with respect to this target in fiscal 2023, see “Compensation Matters – Compensation Discussion and

Analysis – Compensation Elements – Short-Term Incentive Program”.

6 WestRock Company 2024 Proxy Statement

Board and Governance Matters

BOARD AND GOVERNANCE MATTERS

ITEM 1. ELECTION OF DIRECTORS

What am I voting on? Stockholders are being asked to elect each of the 12 director nominees named in this Proxy

Statement to hold office until the annual meeting of stockholders in 2025 and until his or her successor is elected and

qualified

Voting Recommendation:

FOR the election of each of the 12 director nominees named in this Proxy Statement

Vote Required: A director will be elected if the number of shares voted FOR that director nominee exceeds the

number of shares voted AGAINST that director nominee

Broker Discretionary Voting Allowed? No, broker non-votes have no effect

Abstentions: No effect

GOVERNANCE FRAMEWORK

Our governance framework facilitates independent oversight and accountability. All of our corporate powers are exercised

by or under the authority of the Board, and our business and affairs are managed under the direction of the Board, subject

to limitations and other requirements in our charter documents or in applicable statutes, rules and regulations, including

those of the SEC and the New York Stock Exchange (the “NYSE”).

Independent Oversight Accountability

• Eleven of 12 director nominees are independent, with three

independent directors added in the last five years

• Independent Chair with clearly delineated responsibilities

• All independent standing committees (other than Executive

Committee)

• Regular executive sessions for Board and committee

meetings

• Director retirement age of 72, which the Board has waived in

exceptional circumstances

• Annual election of all directors

• Majority voting in uncontested elections

• Annual Board and committee self-evaluations

• Annual advisory vote on executive compensation

• Robust stock ownership and retention guidelines for Board

and designated executives; anti-hedging and anti-pledging

policy in place

• Over-boarding policy with numerical limits that are regularly

reviewed and publicly disclosed in our Governance

Guidelines

Our governance framework is described in the key governance documents listed below, each of which is reviewed by the

Board at least annually, except for our Bylaws (as defined below) and certificate of incorporation, which are reviewed

periodically:

• Amended and Restated Certificate of Incorporation

• Second Amended and Restated Bylaws (our “Bylaws”)

• Governance Guidelines

• Charters of the Audit Committee, Compensation Committee, Governance Committee and Finance Committee

• Code of Conduct

• Code of Business Conduct and Ethics for Directors

• Code of Ethical Conduct for CEO and Senior Financial Officers

Copies of these documents are available on the investor relations page of our website, https://ir.westrock.com, or upon

written request sent to our Corporate Secretary. The information on our website is not part of, or incorporated by reference

into, this Proxy Statement.

WestRock Company 2024 Proxy Statement 7

Board and Governance Matters

BOARD COMPOSITION

The Board currently consists of 12 directors, each of whom is a nominee for election at our annual meeting of stockholders

scheduled for January 26, 2024 (the “2024 Annual Meeting”).

Director Nomination Process

The Governance Committee is responsible for evaluating and recommending director nominees to the Board for

consideration and approval.

Candidates

recommended to

Governance Committee

Governance Committee

considers candidates’

qualifications

Governance Committee

recommends candidates

to Board

Board determines

nominees for election

The Governance Committee periodically assesses the Board to ensure that it has the right mix of experience, qualifications

and skills. A list of the skills and experiences that the Governance Committee considers important in light of our current

business strategy and structure, along with an indication of the director nominees that possess each category of skill or

experience, appears on page 9. The director nominees’ biographies beginning on page 11 include each director nominee’s

key experience, qualifications and skills.

The Governance Committee also periodically assesses the appropriate size of the Board and any vacancies that are

expected due to retirement or otherwise. If no vacancies are anticipated, the Governance Committee considers the

qualifications of incumbent directors. If vacancies arise or are anticipated, it considers potential director candidates who

may come to the attention of the Governance Committee through current directors, professional search firms and advisors

or other individuals, including stockholders. The Governance Committee’s evaluation of potential director candidates does

not vary based on the source of the recommendation. To nominate a candidate for next year’s annual meeting of

stockholders, a stockholder must deliver or mail its nomination submission to WestRock Company, 1000 Abernathy Road

NE, Atlanta, Georgia 30328, Attention: Corporate Secretary, in accordance with the timing and other requirements included

in our Bylaws as specified in “Other Important Information — Stockholder Proposals or Director Nominations for 2025

Annual Meeting.”

The Governance Committee evaluates potential candidates against the standards and qualifications set forth in the

Governance Guidelines, as well as other relevant factors it deems appropriate. In addition, each candidate must:

• Be free of conflicts of interest and other legal and ethical issues that would interfere with the proper performance of

the responsibilities of a director (recognizing that a director may also be an executive officer of the Company).

• Be committed to discharging directors’ duties in accordance with the Governance Guidelines and applicable law.

• Be willing and able to devote sufficient time and energy to carrying out the director’s duties effectively and be

committed to serving on the Board for an extended period of time.

• Have sufficient experience to enable the director to meaningfully participate in deliberations of the Board and one or

more of its committees, and to otherwise fulfill the director’s duties.

The Board strives to select candidates for Board membership who represent a mix of diverse experience, background and

thought at policy-making levels that are relevant to our strategy, as well as other characteristics that will contribute to the

overall ability of the Board to perform its duties and meet changing conditions. In 2020, the Board adopted the WestRock

Company Diversity Search Policy, pursuant to which we include qualified female and racially or ethnically diverse

candidates on the initial lists of candidates from which new management-supported director nominees recruited from

outside WestRock are chosen by the Board.

To ensure that the Board continues to evolve in a manner that serves our changing business and strategic needs, the

Governance Committee evaluates whether incumbent directors collectively possess the requisite skills and perspective

before recommending a slate of incumbent directors to the Board for re-nomination.

8 WestRock Company 2024 Proxy Statement

Board and Governance Matters

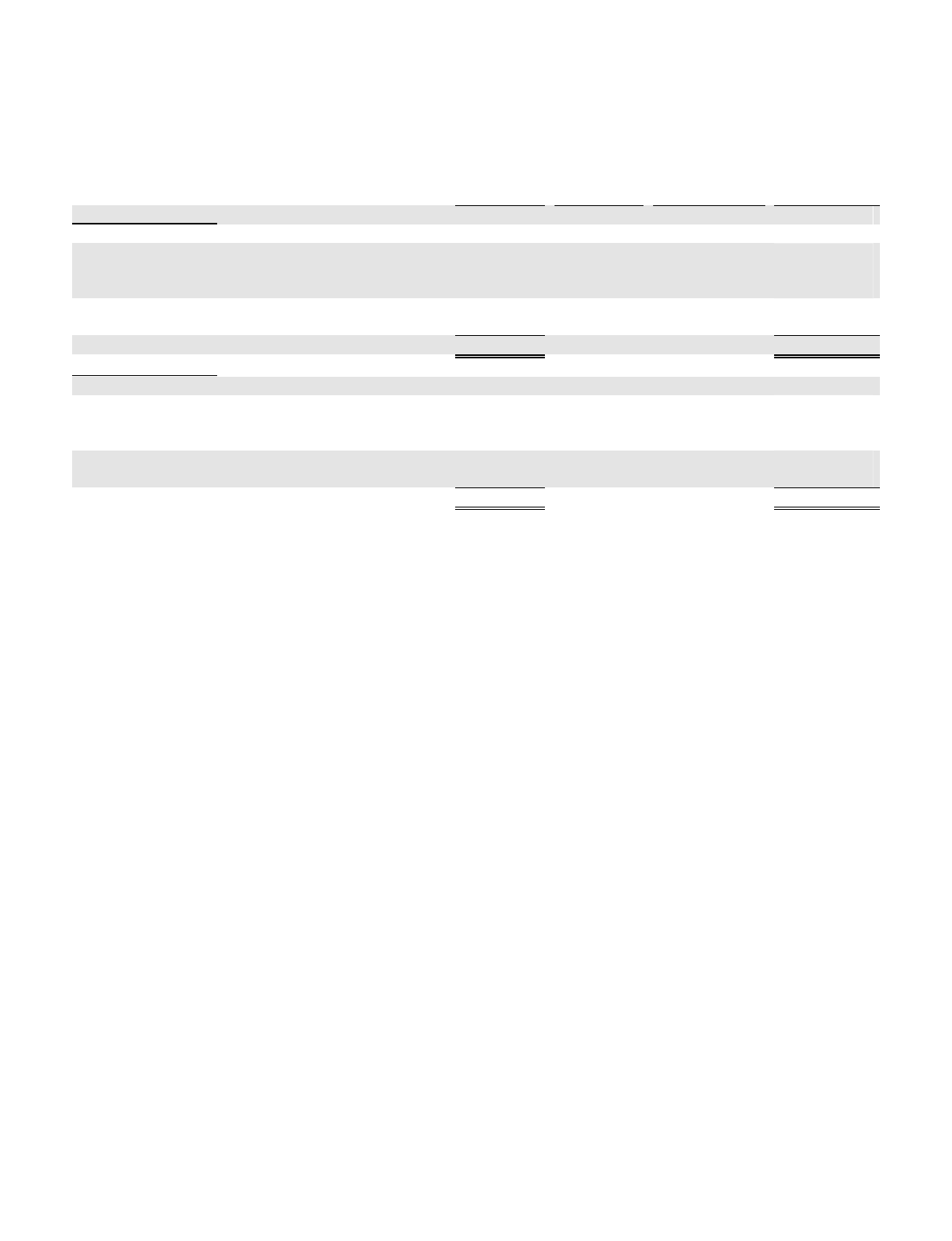

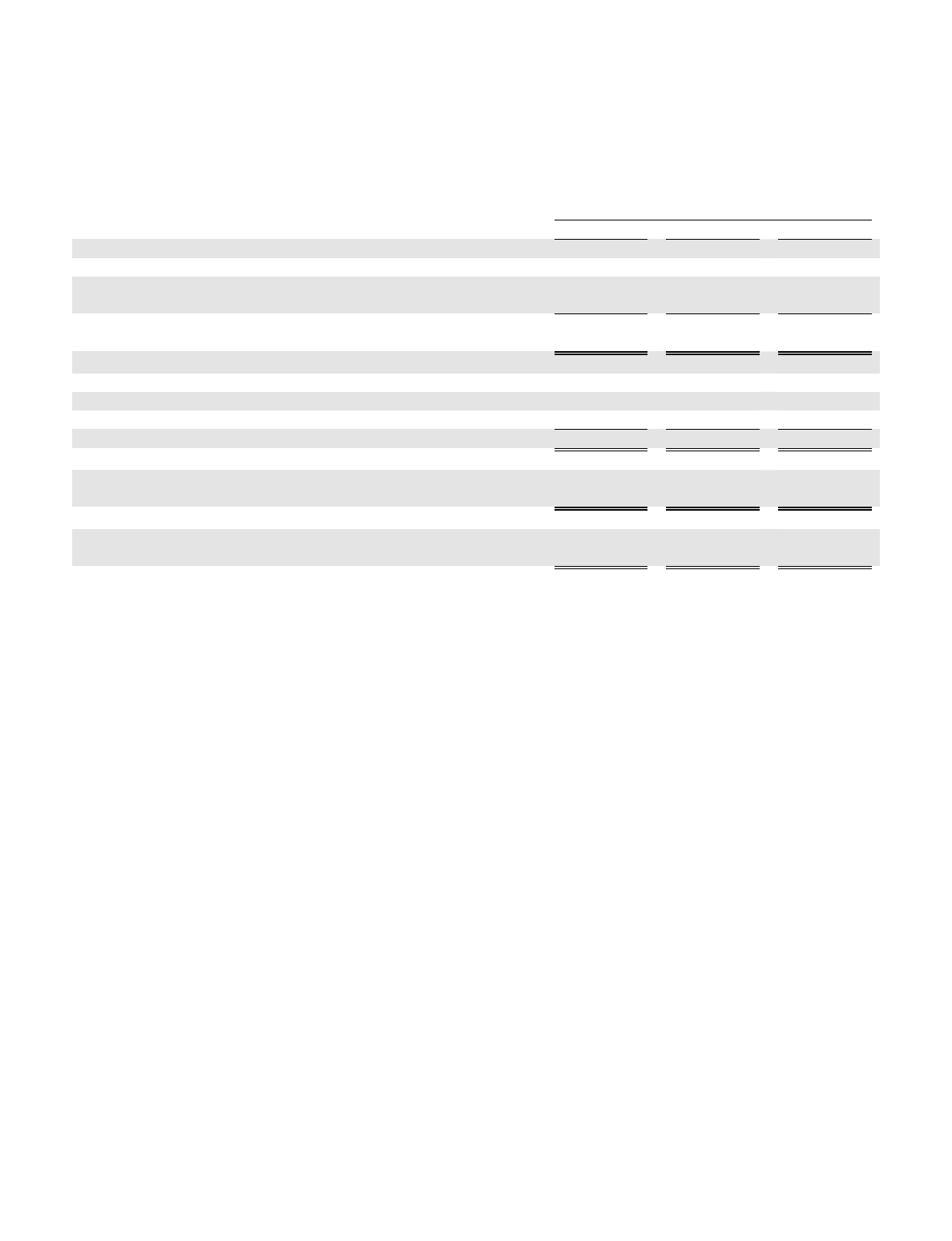

The table below identifies the skills and experiences that the Board and the Governance Committee consider important for

directors collectively to possess for effective governance of WestRock in the current business environment. It also provides

a high-level summary of the diverse skills and experience of our nominees to the Board, which contribute to the sound

governance of WestRock, although it is not an exhaustive list of each nominee’s contributions to the Board.

C. Arnold

T. Bernlohr

P. B r o w n

T. Crews

R. Currey

S. Harrison

G. Martore

J. Nevels

J. Savage

D. Sewell

D. Stockton

A. Wilson

Global Business Experience to help oversee the management of global operations

ŠŠ Š ŠŠŠŠŠŠŠ

Mergers and Acquisitions Experience to provide insight into developing and implementing strategies

for growing our businesses

ŠŠŠŠ ŠŠŠŠŠŠŠ

Financial Expertise

to help drive our operating and financial performance

ŠŠ ŠŠ ŠŠŠŠŠŠ

Public Company CEO Experience to help us drive business strategy, growth and performance

ŠŠŠŠŠ

Public Company Board Experience to help us oversee an ever-changing mix of strategic, operational

and compliance related matters

ŠŠŠŠ ŠŠŠŠŠŠŠ

Capital Allocation Experience

to help us allocate capital efficiently

ŠŠŠŠŠ ŠŠŠŠŠŠ

Paper and Packaging Experience to help us deepen our understanding of the markets within which we

compete

ŠŠŠ Š

Manufacturing Experience

to help us drive operating performance

Š ŠŠ ŠŠŠŠ Š

Sustainability Experience to assist us in delivering sustainable packaging solutions for our customers

and achieving our sustainability goals

Š Š ŠŠŠ Š

Innovation Experience

to assist us in building our global innovation capabilities, in particular with

respect to packaging design, machinery and automation, materials science and digitalization of

packaging

Š Š ŠŠŠŠ

Consumer Packaged Goods Experience to assist us to better understand and anticipate our

customers’ needs and the changing dynamics of our industry

Š ŠŠŠŠ

Enterprise Risk Management Experience

to assist us in our oversight and understanding of significant

areas of risk to the enterprise and in implementing appropriate policies and procedures to effectively

manage risk

ŠŠŠŠ ŠŠ ŠŠŠ

Experience with Scale to help us drive transformation, performance and culture in a large organization

Š Š ŠŠŠ ŠŠ

The Board is committed to having a membership that reflects diversity, including with respect to gender, race, ethnicity and

other personal attributes. This commitment is illustrated by the fact that the Board currently includes four directors who are

women, two directors who are racially diverse and two directors who have served in the military. The table below reflects

self-identified diversity characteristics of the Board.

C. Arnold

T. Bernlohr

P. B r o w n

T. Crews

R. Currey

S. Harrison

G. Martore

J. Nevels

J. Savage

D. Sewell

D. Stockton

A. Wilson

Gender

Male

ŠŠŠŠ Š ŠŠŠ

Female

ŠŠŠŠ

Race/Ethnicity

Hispanic or Latino

White

ŠŠŠŠŠŠŠ ŠŠ Š

Asian

Black or African American

ŠŠ

Native Hawaiian or Other Pacific Islander

American Indian or Alaska Native

Two or More Races

Openly LGBTQIA+

Disability

Military Service

ŠŠ

WestRock Company 2024 Proxy Statement 9

Board and Governance Matters

Board Refreshment

We recognize the importance of Board refreshment. The Governance Committee regularly considers Board composition

and how Board composition changes over time. As a result of the Board’s robust refreshment process, the Board currently

includes four directors with less than five years of service on the Board (two of whom joined the Board in 2022). These

additions demonstrate the Board’s commitment to refreshment with independent nominees who provide important

perspectives and experience to oversee our business strategy.

Pursuant to the Governance Guidelines, directors must retire when they reach age 72, provided that they may continue to

serve thereafter until the next annual or special meeting of stockholders at which directors are to be elected. However, the

Board, on the recommendation of the Governance Committee, has determined it is appropriate to waive the retirement age

with respect to Ms. Martore until our 2025 annual meeting of stockholders after considering her extensive qualifications and

valuable, ongoing contributions to the Board. As the former chair of the Audit Committee and the chair of the independent

Transaction Committee created expressly to oversee all aspects of the Transaction, Ms. Martore has played and continues

to play a crucial leadership role on the Board. Her ongoing service will enable the Board to continue to function efficiently

and effectively over the next year as we prepare for the Transaction.

The Board has not established term limits because it believes that, on balance, term limits would sacrifice the contribution of

directors who have developed deep insight into our industry, strategy and operations. The Governance Committee

evaluates the qualifications, skills and performance of each incumbent director before recommending his or her nomination

for an additional term. A director who has a significant change in full-time job responsibilities must submit a letter of

resignation to the Board, which allows the Board to review the continued appropriateness of the director’s membership on

the Board.

Majority Voting Standard in Uncontested Elections

Our directors are elected by a majority of the votes cast for them in uncontested elections. If a director does not receive a

greater number of “for” votes than “against” votes, then the director must tender his or her resignation to the Board. The

Board then determines whether to accept the resignation. Our directors are elected by a plurality vote standard in contested

elections.

Overboarding Policy

Our directors may not serve on more than four other public company boards, and a director who is actively employed as a

public company executive officer is expected to limit his or her public company directorships to two in the aggregate.

Messrs. Sewell and Brown and Ms. Savage, who are public company executive officers, each serve on one other public

company board, and none of our remaining director nominees serves on more than three other public company boards.

Director Independence

Under the Governance Guidelines and the NYSE corporate governance listing standards (the “NYSE Standards”), the

Board must consist of at least a majority of independent directors. The Board annually reviews director independence under

standards set forth in the Governance Guidelines. The Board has affirmatively determined that all director nominees, other

than Mr. Sewell, our President and Chief Executive Officer (“CEO”), are independent.

In the normal course of business, we purchase products and services from many suppliers, and we sell products and

services to many customers. In some cases, these transactions have occurred with companies with which our directors

have relationships as directors or executive officers. Board members may also have relationships as directors with

companies that hold or held our securities.

Director Orientation and Continuing Education

New directors participate in an orientation program and receive materials and briefings to become familiar with our

business, strategies and governance policies and other documents. Continuing education is provided for all directors

through various sources, including board materials and presentations (including by outside speakers), discussions with

management, visits to our facilities and access to external resources.

Director Nominees

After evaluating each director nominee and the composition of the Board, the Governance Committee recommended all the

current directors for election at the 2024 Annual Meeting. lf elected, each of the 12 nominees will hold office until the next

annual meeting of stockholders and until his or her successor is elected and qualified. Each nominee has agreed to serve

as a director if elected. lf, for some unforeseen reason, a nominee becomes unwilling or unable to serve, proxies may be

voted as recommended by the Board to elect substitute nominees recommended by the Board to the extent permitted by

applicable law. The Board may allow the vacancy created to remain open until such time as it is filled by the Board, or the

Board may determine not to elect substitute nominees and may instead determine to reduce the size of the Board.

10 WestRock Company 2024 Proxy Statement

Board and Governance Matters

Information about the director nominees, including additional information concerning their qualifications for office, is set forth

below.

COLLEEN F. ARNOLD

Background:

Ms. Arnold has served as a director of the Company since July 2018. She served as senior vice president,

sales and distribution for lnternational Business Machines Corporation (“lBM”) from 2014 to 2016. Prior to

that, Ms. Arnold held a number of senior positions with lBM from 1998 to 2014, including senior vice

president, application management services, lBM Global Business Services; general manager of GBS

Strategy, Global Consulting Services, Global lndustries and Global Application Services; general manager,

Europe, Middle East and Africa; general manager, Australia and New Zealand Global Services; and CEO of

Global Services Australia.

Key qualifications, experience and skills:

Ms. Arnold’s experience serving in a number of senior roles with a large, multinational technology company

provides her with global business experience, financial expertise, consumer markets and sales experience,

innovation experience and experience working for a company with significant scale.

Current public boards: Other public boards within 5 years:

None Cardinal Health, lnc.

Age: 66

Director Since: 2018

Independent

Standing Committees:

• Compensation

• Executive

• Finance (Chair)

TIMOTHY J. BERNLOHR

Background:

Mr. Bernlohr served as a director of Smurfit-Stone Container Corporation (“Smurfit-Stone”) from 2010 until it

was acquired by RockTenn Company (“RockTenn”) in 2011, and he served as a director of RockTenn from

2011 until the effective date of the 2015 merger of RockTenn and MeadWestvaco Corporation

(“MeadWestvaco,” and such merger, the “Combination”), when he became a director of the Company.

Mr. Bernlohr currently serves as the managing member of TJB Management Consulting, LLC, a consultant

to businesses in transformation and a provider of interim executive management and strategic planning

services. From 1997 to 2005, he served in various executive capacities, including as president and CEO, at

RBX Industries, Inc. Prior to joining RBX Industries, Mr. Bernlohr spent 16 years in various management

positions with Armstrong World Industries, Inc.

Key qualifications, experience and skills:

Mr. Bernlohr’s experience as a strategic consultant, a director of various publicly traded companies, and the

CEO of an international manufacturing company provides him with broad corporate strategy and global

business experience. In addition, Mr. Bernlohr has deep experience in the paper and packaging industry.

Current public boards: Other public boards within 5 years:

International Seaways, Inc. Atlas Air Worldwide Holdings, Inc.

Skyline Champion Corp.

F45 Training Holdings, Inc.

Age: 64

Director Since: 2015

Independent

Standing Committees:

• Audit

• Compensation (Chair)

• Executive

J. POWELL BROWN

Background:

Mr. Brown served as a director of RockTenn from 2010 until the effective date of the Combination, when he

became a director of the Company. He has served as president of Brown & Brown, Inc. since 2007 and as

CEO since 2009. Mr. Brown previously served as a regional executive vice president of Brown & Brown.

From 2006 to 2009, he served on the board of directors of SunTrust Bank/Central Florida, a commercial

bank and subsidiary of SunTrust Banks, Inc.

Key qualifications, experience and skills:

Mr. Brown’s experience as a CEO of a publicly traded insurance services company provides him with broad

experience and knowledge of risk management and loss minimization and mitigation, as well as capital

allocation experience and perspective on leadership of publicly traded companies.

Current public boards: Other public boards within 5 years:

Brown & Brown, Inc. None

Age: 56

Director Since: 2015

Independent

Standing Committees:

• Compensation

• Governance

WestRock Company 2024 Proxy Statement 11

Board and Governance Matters

TERRELL K. CREWS

Background:

Mr. Crews served as a director of Smurfit-Stone from 2010 until it was acquired by RockTenn in 2011, and

he served as a director of RockTenn from 2011 until the effective date of the Combination, when he became

a director of the Company. Mr. Crews served as executive vice president and chief financial officer (“CFO”)

of Monsanto Company from 2000 to 2009, and as the CEO of Monsanto’s vegetable business from 2008 to

2009.

Key qualifications, experience and skills:

Mr. Crews’ experience as a CFO and executive of a publicly traded company and as a director of other

public companies provides him with broad business knowledge and in-depth experience in complex financial

matters. He also has experience working for a company with significant scale.

Current public boards: Other public boards within 5 years:

Archer Daniels Midland Company Hormel Foods Corporation

Age: 68

Director Since: 2015

Independent

Standing Committees:

• Audit (Chair)

• Executive

• Finance

RUSSELL M. CURREY

Background:

Mr. Currey served as a director of RockTenn from 2003 until the effective date of the Combination, when he

became a director of the Company. He has served as the president of Boxwood Capital, LLC, a private

investment company, since 2013. Mr. Currey worked for RockTenn from 1983 to 2008 and served as

executive vice president and general manager of its corrugated packaging division from 2003 to 2008.

Key qualifications, experience and skills:

Mr. Currey’s experience with RockTenn in a number of leadership roles over a period of 25 years provides

him with valuable manufacturing experience, as well as substantial knowledge of our industry, business and

customers. Mr. Currey’s background has also provided him with capital allocation experience and financial

expertise.

Current public boards: Other public boards within 5 years:

None None

Age: 62

Director Since: 2015

Independent

Standing Committees:

• Audit

• Finance

SUZAN F. HARRISON

Background:

Ms. Harrison has served as a director of the Company since January 2020. She served as president of

Global Oral Care at Colgate-Palmolive Company (“Colgate”), a worldwide consumer products company

focused on the production, distribution, and provision of household, health care, and personal products, from

2012 to 2019. Previously, Ms. Harrison served as President of Hill’s Pet Nutrition Inc. North America from

2009 to 2011, Vice President, Marketing for Colgate U.S. from 2006 to 2009 and Vice President and

General Manager of Colgate Oral Pharmaceuticals, North America and Europe from 2005 to 2006. She held

a number of other leadership roles at Colgate beginning in 1983.

Key qualifications, experience and skills:

Ms. Harrison’s experience serving in a number of senior roles with a large, global consumer products

company provides her with global business experience, consumer markets experience, innovation

experience, and experience working for a company with significant scale.

Current public boards: Other public boards within 5 years:

Archer Daniels Midland Company None

Ashland Inc.

Age: 66

Director Since: 2020

Independent

Standing Committees:

• Audit

• Governance

12 WestRock Company 2024 Proxy Statement

Board and Governance Matters

GRACIA C. MARTORE

Background:

Ms. Martore served as a director of MeadWestvaco from 2012 until the effective date of the Combination,

when she became a director of the Company. She served as the president and CEO and as a director of

TEGNA Inc. (formerly Gannett Co., Inc.), a broadcast, digital media and marketing services company,

from 2011 to 2017, and she served as president and COO of Gannett from 2010 to 2011. Ms. Martore

also served as Gannett’s executive vice president and CFO from 2006 to 2010, its senior vice president

and CFO from 2003 to 2006 and in various other executive capacities beginning in 1985. She has served

as a director of FM Global since 2005 and of The Associated Press since 2013.

Key qualifications, experience and skills:

Ms. Martore’s background and experience as CEO and CFO of a publicly traded company provide her with

leadership, business, financial and governance skills. She also has experience working for a company with

significant scale.

Current public boards: Other public boards within 5 years:

Omnicom Group Inc. None

United Rentals, Inc.

Age: 72

Director Since: 2015

Independent

Standing Committees:

• Audit

• Finance

JAMES E. NEVELS

Background:

Mr. Nevels served as a director of MeadWestvaco from 2014 until the effective date of the Combination,

when he became a director of the Company. He currently serves as managing partner of Unicorn Partners,

LLC, a consulting company. He served as chairman of The Swarthmore Group, an investment advisory

firm, from 1991 until 2022.* From 2020 to 2023, Mr. Nevels served on the board of Renew Financial, a

private company that provides financing for solar energy. Mr. Nevels also served as a director of The

Hershey Company from 2007 to 2017, including as lead independent director from 2015 to 2017, and as

chairman from 2009 to 2015. Mr. Nevels also previously served as a director of the Federal Reserve Bank

of Philadelphia (and as its chairman) and of MMG Insurance Company, a privately-held provider of

insurance services. He served as our lead independent director from September 2017 through February

2019.

Key qualifications, experience and skills:

Mr. Nevels’ background and experience as an investment advisor and board member, chairman and lead

independent director of public companies provide him with broad knowledge and perspective on the

governance and leadership of publicly traded companies, as well as financial expertise and capital

allocation experience.

Current public boards: Other public boards within 5 years:

None Alcoa Corp.

First Data Corp.

Age: 71

Director Since: 2015

Independent

Standing Committees:

• Compensation

• Executive

• Governance (Chair)

* The Swarthmore Group filed a petition in Federal Bankruptcy Court under Chapter 7 of the Bankruptcy Code in August 2022.

E. JEAN SAVAGE

Background:

Ms. Savage has served as a director of the Company since January 2022. She has served as president

and CEO of Trinity Industries, Inc. (“Trinity”), a company providing railcar products and services, since

February 2020 and as a director on the Trinity board since 2018. Ms. Savage previously served in a

variety of leadership roles at Caterpillar, Inc., a construction and mining, engines, turbines and

locomotives manufacturing company, including as the vice president of the Surface Mining & Technology

division of Caterpillar from 2017 through 2020. Ms. Savage also held numerous leadership roles at

Progress Rail, including as vice president of Quality and Continuous Improvement before its acquisition

by Caterpillar in 2006, and in a variety of manufacturing and engineering positions for 14 years at Parker

Hannifin Corporation. She began her career as an intelligence officer in the U.S. Army Reserves.

Key qualifications, experience and skills:

Ms. Savage’s experience in multiple executive roles at large, public companies, including as CEO of

Trinity, provides her with global business experience and financial expertise, as well as significant

experience transforming industrial enterprises, including through optimization of business operations and

corporate infrastructure.

Current public boards: Other public boards within 5 years:

Trinity Industries, Inc. None

Age: 59

Director Since: 2022

Independent

Standing Committees:

• Audit

• Compensation

WestRock Company 2024 Proxy Statement 13

Board and Governance Matters

DAVID B. SEWELL

Background:

Mr. Sewell has served as a director of the Company since March 2021 when he also became our president

and CEO. From March 2019 until joining the Company, he served as president and chief operating officer of

The Sherwin-Williams Company (“Sherwin-Williams”), a company in the paint and coating manufacturing

industry. From August 2014 to March 2019, Mr. Sewell served as president of the performance coatings

group at Sherwin-Williams. Prior to joining Sherwin-Williams in February 2007, Mr. Sewell spent 15 years

working for General Electric Company (“GE”).

Key qualifications, experience and skills:

Mr. Sewell’s service as our president and CEO provides him with knowledge of our business, strategy and

capabilities. His presence on the Board also helps provide a unified focus for management to execute our

strategy and business plans, and his in-depth knowledge of and experience in manufacturing and operations

helps supports these initiatives.

Current public boards: Other public boards within 5 years:

Huntsman Corp. None

Age: 55

Director Since: 2021

Non-Independent

(President and CEO)

Standing Committees:

• Executive

DMITRI L. STOCKTON

Background:

Mr. Stockton has served as a director of the Company since July 2022. He most recently served as senior vice

president and special advisor to the chairman of GE from 2016 until his retirement in 2017. Mr. Stockton joined

GE in 1987 and held various positions of increasing responsibility during his 30-year tenure. From 2011 to 2016,

Mr. Stockton served as chairman, president and CEO of GE Asset Management, a global asset management

company affiliated with GE, and as senior vice president of GE. From 2008 to 2011, he served as president and

CEO for GE Capital Global Banking and senior vice president of GE based in London, UK. He previously also

served as president and CEO for GE Consumer Finance for Central and Eastern Europe.

Key qualifications, experience and skills:

Mr. Stockton’s background and experience as a senior executive in various roles at GE and as a public

company director provide him with leadership experience and expertise in risk management, governance,

finance and asset management.

Current public boards: Other public boards within 5 years:

Deere & Co. Stanley Black & Decker, Inc.

Ryder System, Inc.

Target Corp.

Age: 59

Director Since: 2022

Independent

Standing Committees:

• Audit

• Finance

ALAN D. WILSON

Background:

Mr. Wilson served as a director of MeadWestvaco from 2011 until the effective date of the Combination,

when he became a director of the Company. He served as chairman of the board of McCormick &

Company, Inc. (“McCormick”), a consumer food company, from 2009 to 2017, and CEO of McCormick from

2008 to 2016. Mr. Wilson joined McCormick in 1993 and also served in a variety of other positions, including

as president from 2007 to 2015, president of North American Consumer Products from 2005 to 2006,

president of the U.S. Consumer Foods Group from 2003 to 2005 and vice president – sales and marketing

for the U.S. Consumer Foods Group from 2001 to 2003.

Key qualifications, experience and skills:

Mr. Wilson’s background and experience as chairman and CEO of a publicly traded multinational consumer

food company provides him with leadership, market expertise, and business and governance skills. He also

has experience working for a company with significant scale.

Current public boards: Other public boards within 5 years:

T. Rowe Price Group, Inc. None

Age: 66

Director Since: 2015

Independent Chair

Standing Committees:

• Executive (Chair)

• Finance

• Governance

14 WestRock Company 2024 Proxy Statement

Board and Governance Matters

BOARD OPERATIONS

Board Leadership Structure

The Board regularly evaluates the effectiveness of its leadership structure. The Board currently has an independent,

non-executive Chair leadership structure. Mr. Wilson began serving a two-year term as the Board’s independent Chair in

January 2022, following the retirement of our former Non-Executive Chair. The Board continues to believe that the

separation of the roles of CEO and Chair is appropriate and is in the best interests of the Company and our stockholders

and recently determined to again elect Mr. Wilson as independent Chair upon, and subject to, his election as a director at

the 2024 Annual Meeting. In doing so, the Board concluded that this leadership structure enhances the accountability of the

CEO to the Board, strengthens the Board’s independence from management, and ensures a greater role for the

independent directors in the oversight of the Company. In addition, this separation allows our CEO to focus efforts on

running our business and managing the Company in the best interests of our stockholders. The Chair provides guidance to

the CEO and, in consultation with management, helps to set the agenda for Board meetings and establishes priorities and

procedures for the work of the full Board. The Chair also presides over meetings of the full Board, as well as executive

sessions (without management), which the Board holds at least at every regularly scheduled Board meeting.

The Board recognizes that no single leadership model is right for all companies at all times and that, depending on the

circumstances, other leadership models, such as combining the Chair and CEO roles, might be appropriate. Accordingly,

our governance documents provide flexibility for the Board to modify or continue its leadership structure in the future, as it

deems appropriate in its business judgment. The Board believes the Company and our stockholders benefit from this

flexibility, as our directors are well positioned to determine our leadership structure given their in-depth knowledge of our

management team, our strategic goals, and the opportunities and challenges we face. Our governance documents further

provide that if the Chair position is held by the CEO or another non-independent director in the future, the independent

directors of the Board would elect on an annual basis an independent director to serve as Lead Independent Director and

that this role would have clearly delineated oversight responsibilities.

Board Committees

The Board assigns responsibilities and delegates authority to its committees, which regularly report on their activities and

actions to the Board. The Board has determined that each current member of each standing committee (other than the

Executive Committee) is “independent” within the meaning of the NYSE Standards and the Governance Guidelines,

including any applicable additional committee-specific independence requirements. The principal responsibilities of each

standing committee are summarized below and set forth in more detail in such committee’s written charter (other than the

Executive Committee, which does not have a charter). All other standing committee charters can be found on our website.

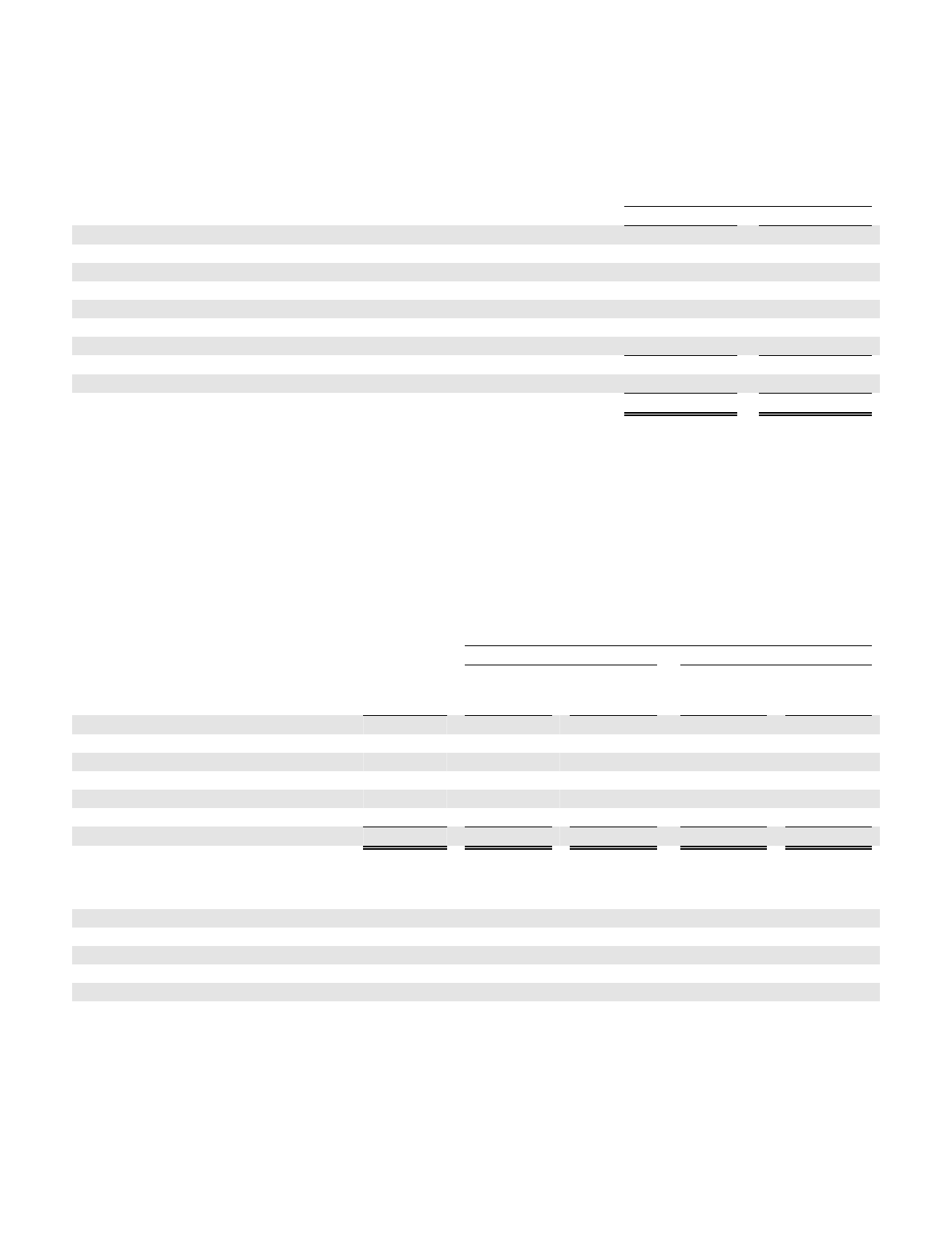

AUDIT COMMITTEE

Members:

Terrell K. Crews (Chair)

Timothy J. Bernlohr

Russell M. Currey

Suzan F. Harrison

Gracia C. Martore

E. Jean Savage

Dmitri L. Stockton

Meetings in Fiscal 2023: 8

* All members meet the independence requirements of Rule 10A-3 of

the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), the NYSE Standards and the Governance Guidelines, and

are “financially literate” within the meaning of the NYSE Standards.

Each of Mses. Martore and Savage and Messrs. Bernlohr, Crews

and Stockton is an “audit committee financial expert” within the

meaning of SEC regulations.

Principal Responsibilities:

• Provide oversight of our financial reporting process and our

system of internal control over financial reporting.

• Oversee the independence, qualifications and performance

of our independent auditor and performance of the internal

audit function.

• Discuss with management policies with respect to risk

assessment and risk management.

• Discuss our major information technology and cybersecurity

risk exposures and the steps that management has taken to

monitor and control such exposures.

• Oversee compliance with legal and regulatory requirements,

including through discussion of compliance with WestRock’s

Code of Business Conduct and Ethics.

WestRock Company 2024 Proxy Statement 15

Board and Governance Matters

COMPENSATION COMMITTEE

Members:

Timothy J. Bernlohr (Chair)

Colleen F. Arnold

J. Powell Brown

James E. Nevels

E. Jean Savage

Meetings in Fiscal 2023: 3

* All members meet the independence requirements of the NYSE

Standards and the Governance Guidelines and qualify as

“non-employee directors” for purposes of Rule 16b-3 under the

Exchange Act.

Principal Responsibilities:

• Set the overall compensation strategy and compensation

policies for our executives and non-employee directors.

• Oversee the performance evaluation of our CEO and other

senior executives, including assessment of performance

relative to goals and objectives.

• Review and approve compensation levels of our CEO and

other NEOs.

• Approve or make recommendations to the Board regarding

non-employee director compensation.

• Review our incentive compensation arrangements to confirm

that incentive pay does not encourage inappropriate risk

taking.

GOVERNANCE COMMITTEE

Members:

James E. Nevels (Chair)

J. Powell Brown

Suzan F. Harrison

Alan D. Wilson

Meetings in Fiscal 2023: 5

* All members meet the independence requirements of the NYSE

Standards and the Governance Guidelines.

Principal Responsibilities:

• Maintain an active Board refreshment and director

succession planning process and lead the search for

potential director candidates.

• Evaluate and recommend changes to the size, composition

and structure of the Board and its committees.

• Oversee the annual Board and committee evaluation

process.

• Oversee and provide input to management on the

Company’s policies, strategies and programs related to ESG

matters, including sustainability.

• Assist the Board in fulfilling its responsibility for CEO

succession.

FINANCE COMMITTEE

Members:

Colleen F. Arnold (Chair)

Terrell K. Crews

Russell M. Currey

Gracia C. Martore

Dmitri L. Stockton

Alan D. Wilson

Meetings in Fiscal 2023: 7

Principal Responsibilities:

• Review and recommend capital budgets to the Board for

approval.

• Review management’s assessment of our capital structure,

including dividend policies and stock repurchase programs,

debt capacity and liquidity.

• Review financing and liquidity initiatives proposed by

management.

EXECUTIVE COMMITTEE

Members:

Alan D. Wilson (Chair)

Colleen F. Arnold

Timothy J. Bernlohr

Terrell K. Crews

James E. Nevels

David B. Sewell

Meetings in Fiscal 2023: 3

Principal Responsibilities:

• Exercise the authority of the Board in managing our

business and affairs; however, the Executive Committee

does not have the power to (i) approve, adopt or recommend

to our stockholders any action or matter (other than the

election or removal of directors) that Delaware law requires

to be approved by stockholders or (ii) adopt, amend or

repeal our Bylaws.

16 WestRock Company 2024 Proxy Statement

Board and Governance Matters

Meeting Attendance in Fiscal 2023

ln fiscal 2023, the Board held 23 meetings and its standing committees held a total of 26 meetings. Each director attended

at least 75% of the aggregate of all meetings of the Board and the committees on which he or she served. The Company

does not have a policy with regard to director attendance at annual meetings of stockholders. Each director attended our

annual meeting of stockholders on January 27, 2023 (the “2023 Annual Meeting”).

Meetings of Non-Management Directors and Independent Directors

Our non-management directors meet in regularly scheduled executive sessions conducted outside the presence of

management, unless non-management directors request management to attend. All of our non-management directors are

independent and, during fiscal 2023, they met separately from management in executive session at least at every regularly

scheduled Board meeting.

Human Capital Management

The Board believes that effective human capital management throughout the organization

is important to our success and oversees management’s strategies for attracting,

developing and retaining talent. In fiscal 2023, the Board and its committees engaged with

senior management, including our Chief Human Resources Officer, across a broad range

of human capital management topics, such as safety, culture, succession planning and

development, compensation and benefits, employee recruitment and retention and

Diversity and Inclusion. High-potential leaders are given exposure to directors through

formal presentations and informal events.

Our Governance

Guidelines

expressly identify the

Board’s oversight role with

respect to our strategies

related to human capital

management matters such

as Diversity and Inclusion.

Self-Evaluations

Each year, the directors participate in a self-evaluation of the Board and its standing committees (other than the Executive

Committee). The Governance Committee, which oversees the process and implementation of the self-evaluations,

assesses the process of conducting self-evaluations annually and has used a variety of methods over the years to conduct

the self-evaluations, including written questionnaires, interviews and discussions conducted by internal and external parties.

For fiscal year 2023, the self-evaluation process was as follows:

Step 1. Process Review

The Governance Committee reviewed the self-evaluation

process to ensure that it would facilitate a candid assessment

and discussion of the effectiveness of the Board and each

standing committee.

Step 2. Self-Evaluation Questionnaires

Directors completed written questionnaires, anonymized

versions of which were reviewed by the independent Chair.

Step 3. Evaluation Interviews

Our independent Chair used the results of the written

questionnaires to conduct one-on-one interviews with each

director.

Step 4. Board Review

The Board discussed the results of the self-evaluation

process in executive session. Among other things, the results

suggested that the Board and its committees were

functioning effectively and Board dynamics were healthy.

WestRock Company 2024 Proxy Statement 17

Board and Governance Matters

Risk Oversight

The Board provides oversight of our risk management processes. The Board

performs this function as a whole and by delegating to its standing committees

(other than the Executive Committee), each of which meets regularly and reports

back to the Board. Our independent Chair also attends all standing committee

meetings. The risk oversight responsibilities of these committees are summarized

below. While the Board and these committees oversee risk management,

management is charged with managing enterprise risks. The Board recognizes

that it is neither possible nor desirable to eliminate all risk; rather, the Board views