Government of the

District of Columbia

Muriel Bowser

Mayor

Fitzroy Lee

Chief Financial Officer

Tax Rates and Tax Burdens

In the District of Columbia -

A Nationwide Comparison

2020

Issued April 2022

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

ii

(This page intentionally left blank)

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

iii

Table of Contents

Tax Rates and Tax Burdens in the District of Columbia:

A Nationwide Comparison

Table of Contents ......................................................................................................................... iii

Listing of Charts, Tables, and Maps .......................................................................................... iv

Executive Summary ..................................................................................................................... vi

Acknowledgment .......................................................................................................................... ix

Part I: Tax Burdens in Washington DC Compared with Those in the Largest City in Each

State, 2020..……………………………………………………………………………………….1

Overview………………………………………………………………………………………….2

Why Do Tax Burdens Differ From One City to Another?.………………………………………3

Chapter I: How Tax Burdens are Computed for the Largest City in each State ................... 5

Individual Income Tax ........................................................................................................ 6

Real Property Tax ................................................................................................................ 8

Sales and Use Tax ............................................................................................................. 11

Automobile Taxes ............................................................................................................. 12

Chapter II: Overall Tax Burdens for Hypothetical Families in the Largest City in Each

State .............................................................................................................................................. 13

Chapter III: Comparing Specific Tax Burdens for a Hypothetical Family of Three in the

Largest City in Each State ......................................................................................................... 25

Individual Income Tax ...................................................................................................... 25

Real Property Tax .............................................................................................................. 31

Sales and Use Tax ............................................................................................................. 38

Automobile Taxes ............................................................................................................. 42

Chapter IV: How Do Tax Burdens in Washington DC Compare with Those in the Largest

City in Each State?...................................................................................................................... 46

Individual Income Tax ...................................................................................................... 46

Real Property Tax .............................................................................................................. 47

Sales and Use Tax ............................................................................................................. 48

Automobile Taxes ............................................................................................................. 48

Summary ........................................................................................................................... 48

Part II: A Comparison of Selected Tax Rates in DC with Those in the 50 States ................ 51

Tax Rate Comparisons at a Glance……………………………………….…………….……..52

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

iv

Appendix... ................................................................................................................................... 71

Office Locations and Telephone Numbers ............................................................................... 79

Listing of Charts, Tables, and Maps

Charts

Charts 1a-e: 2020 Estimated Burdens of Major Taxes for 5 Hypothetical Families……......14-22

Chart 2: 2020 Income Tax Burdens for All Income Levels, Sorted by Highest Income Level .. 27

Chart 3: Residential Property Tax Rates in the Largest City in Each State, 2020 ...................... 34

Chart 4: 2020 Property Tax Burdens for All Income Levels, Sorted by Lowest Income Level..37

Chart 5: Composition of State and Local General Sales Tax Rates in Each of the 51 Cities as of

December 31, 2020………………………………………………………………………………39

Chart 6: 2020 Auto Tax Burdens, Family Earning $75,000/year………………………...…….45

Chart 7: Combined 2020 Tax Burdens at Each Income Level; Comparison of DC and the

Average of the 50 Cities................................................................................................................50

Tables

Tables 1a-e: 2020 Estimated Burdens of Major Taxes for 5 Hypothetical Families………..15-23

Table 2: States That Index Some Part of Their Individual Income Tax, 2020……………..…...29

Table 3: State and Local Income Tax Burden as a Percent of Income in the Largest Cities by

Type of Income Tax for a Hypothetical Family of Three, 2020…………………………………30

Table 4: Residential Property Tax Rates in the Largest City in Each State 2020........................ 33

Table 5: Housing Value Assumptions, 2020 ............................................................................... 35

Table 6: Cities That Allow Exemptions or Reduced Rates in the Calculation of Real Estate

Taxes for Homeowners, 2020 ....................................................................................................... 36

Table 7: State and Local General Sales Tax Rates in Each of the 51 Cities as of December 31,

2020............................................................................................................................................... 40

Table 8: Cumulative Tax Rates on Gasoline in the 51 Cities as of December 31, 2020……..…43

Table 9: Summary of Types of Automobile Registration Taxes 2020 ........................................ 44

Table 10: Automobile Tax Assumptions 2020 ............................................................................ 44

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

v

Table 11: Tax Burdens in Washington, DC for a Hypothetical Family Compared with the

Average for the Largest City in Each State by Income Level, 2020 ............................................ 49

Table 12: Comparison of Selected State Tax Rates ..................................................................... 52

Table 13: Individual Income Tax Washington Metropolitan Area .............................................. 53

Table 14: Individual Income Tax 43 States and the District of Columbia .................................. 54

Table 15: Characteristics of State Individual Income Taxes ....................................................... 58

Table 16: State Corporate Income Tax Rates .............................................................................. 60

Table 17: State Gross Premiums Tax Rates on Foreign (Out-of-State) Life Insurers ................. 61

Table 18: State General Sales and Use Tax Rates ....................................................................... 62

Table 19: State Beer Tax Rates .................................................................................................... 63

Table 20: State Light Wine Tax Rates ......................................................................................... 64

Table 21: State Distilled Spirits Tax Rates .................................................................................. 65

Table 22: State Cigarette Tax Rates ............................................................................................. 66

Table 23: State Gasoline Excise Tax Rates ................................................................................. 67

Table 24: State Motor Vehicle Sales and Excise Taxes............................................................... 68

Table 25: State Motor Vehicle Annual Registration Fees ........................................................... 69

Table 26: State Real Estate Deed Recordation and Transfer Tax Rates …………………….….70

Table 27: Population Changes of the Largest City in Each State ............................................... 77

Maps

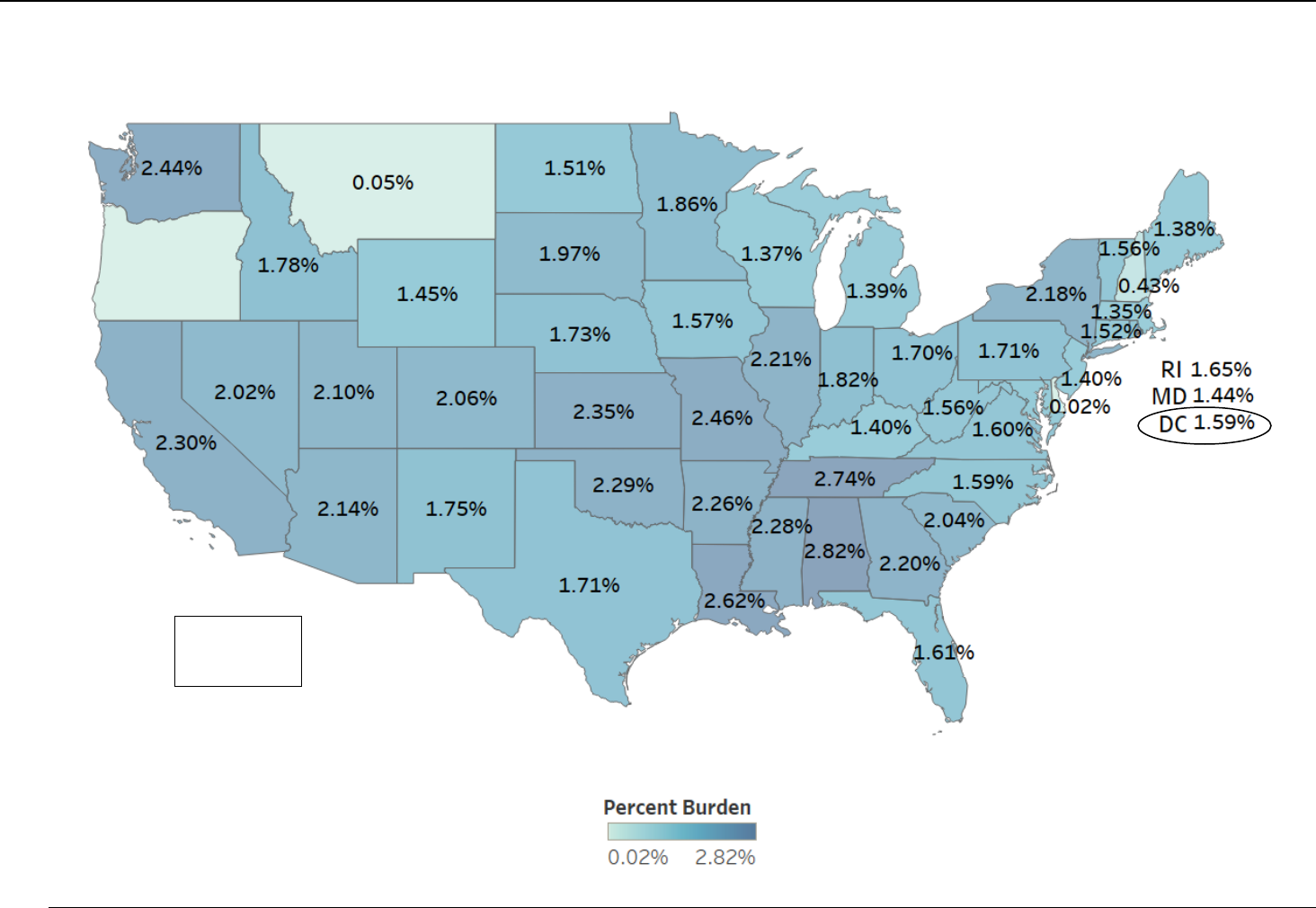

Map 1: Total 2020 Tax Burdens (Income, Property, Sales, & Auto) as a % of Income (Family

Earning $75,000/Year) ……………………………………………………...…………….……. 24

Map 2: 2020 Income Tax Burdens (Family Earning $75,000/Year)……...………………...…..28

Map 3: 2020 Property Tax Burdens ($) (Family Earning $75,000/Year)…. ............................... 32

Map 4: 2020 Sales Tax Burdens (Family Earning $75,000/Year)...…………………………….41

Maps 5-9: Combined 2020 Tax Burdens (Inc., Prop., Sales, & Auto) as a % of Income ...... 72-76

Map 10: Population of the Largest Cities as a % of the State’s Total Population, 2020………..78

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

vi

EXECUTIVE SUMMARY

State and local tax systems in the United States are widely diverse. The District of

Columbia and governments in the 50 states employ a broad range of taxes and fees to fund state

and local government operations. The combination of taxes and fees used by a particular

jurisdiction is dependent upon many factors, including revenue needs, the tax base of the local

government, the fiscal relationship between the state and local governments, constitutional

limitations in some states, and the level of local government services demanded by residents.

The District’s tax structure employs taxes typically used by local governments, such as

real and personal property taxes, deed taxes, and others. At the same time, the District has taxes

usually associated with the state level of government, such as the income tax, estate tax, sales

and use taxes, excise taxes, gross receipts taxes, and motor vehicle taxes. About two-thirds of the

District’s generated revenues come from taxes usually administered by the states.

However, the District’s tax rates are often compared to either state rates, or other city

rates, and typically not a combination of both rates that would be applicable to residents living in

those locales. As such, this study aims to calculate the combined state and local tax burdens that

would apply to a hypothetical family of three at five different income levels living in DC as well

as the largest city in each state. The study includes four main tax types: income, property, sales,

and auto taxes. For these four tax types, tax burdens are calculated by applying the relevant state

and local tax rates to economic data on average and median costs of various consumer goods and

housing. The study assumes that the incidence of each tax is on the individual and makes other

assumptions that affect the findings. These assumptions, the sources of data, and the steps taken

to arrive at the tax burdens are laid out in the following pages.

The main findings are presented in Charts 1a-e and Tables 1a-e (pages 14-23), with

combined tax burdens broken out by tax type and income level. Readers may view the rankings

at five income levels: $25,000, $50,000, $75,000, $100,000, and $150,000. At the $25,000/year

income level, the lowest combined tax burden is on a family living in Burlington, Vermont,

while the highest combined tax burden falls on a family earning $150,000 and living in

Bridgeport, Connecticut. Washington, DC’s combined tax burdens are lower than the 50-city

average for all five income levels in the study.

Income tax: Residents in 44 of the 51 cities in this study are subject to some type of

individual income tax at the state and/or local levels (Table 3, page 30). There are several types

of individual income tax systems, including graduated state and local rates, graduated state and

flat local rates, flat state and local rates (or fees), graduated state tax rates, and flat state rates

with exemptions. Income tax burdens in jurisdictions levying an income tax ranged from a low

of negative $1,290 in Burlington, Vermont, for a family earning $25,000 (this negative amount

represents an income tax refund due to a refundable Earned Income Tax Credit, to a high of

$11,213 for a family earning $150,000 and living in New York, New York.

Executive Summary

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

vii

The District’s 2020 income tax structure included six rates, with the highest rate of 8.95 percent

applying to income over $1,000,000. The District’s income tax burden was below the average for

the 44 states that levied an income tax at the first four income levels in the report, and the fifth

lowest overall at the $25,000 income level due to a refundable Earned Income Tax Credit. The

income tax burden in DC was higher than the 44-city average for the highest income level

($150,000), resulting from the progressive structure of the District’s income tax.

Property tax: All 51 cities in this study levy a tax on real property located within the city,

and effective tax rates range from a high of $3.26 per $100 of assessed value in Detroit,

Michigan, to a low of $0.35 per $100 of assessed value in Honolulu, Hawaii (Table 4, page 33).

In addition, several jurisdictions allow tax exemptions and credits in the calculation of the real

property tax liability (Table 6, page 36). Property tax burdens range from a low of $180 on a

family earning $50,000 a year and living in Boston, Massachusetts (which has a generous

homestead exemption/credit), to a high of $18,018 on a family earning $150,000/year and living

in Newark, New Jersey.

In 2020, the District taxed residential property at a rate of $0.85 per $100 of assessed

value; and offered a $75,700 homestead deduction for owner-occupied residences. DC’s property

tax burdens were below the 50-city average for the top four income levels (all of those assumed

to own homes). However, the District’s property tax burden for those earning $25,000 (who are

assumed to rent) was slightly higher than the 50-city average. This is due to the high cost of

rental housing, and the assumption that a portion of rental payments goes toward the property

tax; however, DC’s rent burden is alleviated by a refundable property tax credit available to

lower-income homeowners and renters, which is administered through the income tax and

reflected in the property tax burdens in this report (it has been presented with the income tax in

previous reports).

Sales tax: As shown in Table 7, page 40, residents in 46 of the 51 cities studied are

subject to some form of sales and use tax. In 2020, the highest combined (state + local) sales tax

rates were in Los Angeles, California (10.5 percent); Chicago, Illinois (10.25 percent); Seattle,

Washington (10.1 percent); Birmingham, Alabama (10.0 percent); and New Orleans, Louisiana

(9.45 percent). Residents of Honolulu, Hawaii; Milwaukee, Wisconsin; and Portland, Maine

have the lowest combined sales tax rates. These lowest rates range from 4.5 to 5.5 percent total.

Sales tax burdens in jurisdictions levying a general sales tax ranged from a low of $689 for a

family earning $25,000 in Newark, New Jersey; to a high of $2,721 for a family earning

$150,000 in Birmingham, Alabama.

The District’s general sales tax of six percent is the fourth lowest of the rates in all 51

cities (seven other jurisdictions have the same combined rate), when looking at total state and

local sales tax rates combined. Consequently, sales tax burdens in DC were lower than the 50-

city average at all five income levels.

Auto tax: Table 9, page 44, indicates that residents in all 51 cities in this study pay some

type of automobile registration fee or tax—usually either a flat rate per vehicle or by weight of

the vehicle. In addition, either state or local personal property taxes on automobiles are levied in

10 of the cities. Auto tax burdens ranged from a low of $105 for a family earning $50,000 in

New Orleans, Louisiana, to a high of $2,547 for a family earning $150,000 in Omaha, Nebraska.

The District’s annual auto registration fees range from $72 to $155, depending on vehicle

Executive Summary

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

viii

weight, and are among the highest in the study; however, DC does not charge an annual excise

tax or personal property tax on automobiles. District gas tax rates were 28.8 cents per gallon, and

DC auto tax burdens were below the 50-city average for all five income levels.

There is no single pattern that characterizes either a high or low tax burden city. Details

concerning the various taxes levied and why the tax burdens differ from one jurisdiction to

another are presented in this publication. Part I compares selected tax burdens in DC with those

of the most populous city in each state, through December 31, 2020. Part II contains tax rate

tables for DC and the 50 states for 12 different types of taxes as of January 1, 2021.

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

ix

ACKNOWLEDGMENT

Each year the Government of the District of Columbia, Office of the Chief Financial

Officer, Office of Revenue Analysis publishes several reports to provide information to the

residents and taxpayers of the District of Columbia about the tax rates of states and large cities.

The reports contain information about the rates and burdens of major taxes in the District of

Columbia compared with states and the largest city in those states.

This publication contains two reports: (I) Tax Burdens in Washington, DC Compared

with Those in the Largest City in Each State, 2020 and (II) A Comparison of Selected Tax Rates

in the District of Columbia with Those in the 50 States as of January 1, 2021. This information is

requested annually by committees of the US Congress and the District of Columbia Council. It is

provided pursuant to Public Law 93-407.

Correspondence concerning “Tax Rates and Tax Burdens in the District of Columbia – A

Nationwide Comparison” should be addressed to Lori Metcalf, Fiscal Analyst, Economic Affairs

Administration, Office of Revenue Analysis, 1101 4

th

Street, SW, Suite W770, Washington, DC

20024, telephone (202) 727-7775.

Appreciation is extended to the many state and local officials in various state offices who

responded to our state survey and provided data in response to our follow up inquiries. Their

cooperation in providing information and their helpful suggestions make this publication

possible. I would also like to thank Lori Metcalf, who conducted the research and prepared this

document, and Farhad Niami and Bob Zuraski who offered editing assistance.

Norton Francis,

Chief Economist &

Deputy Chief Financial Officer (Interim)

April 2022

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

1

Part I

Tax Burdens in Washington, DC Compared with

Those in the Largest City in Each State

2020

Part I: Tax Burdens in Washington, DC Compared with Those in the Largest City in Each State

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

2

Overview

There is a wide diversity in state and local tax systems in the United States. The fifty

states and the District of Columbia employ a broad range of taxes and fees to fund state and local

government operations. The combination of taxes and fees used by a particular jurisdiction is

dependent upon many factors, including its revenue needs, the local government tax base, the

fiscal relationships between the state and the local government, constitutional and legal

limitations on the powers of taxation, and the jurisdiction’s philosophy of government taxation.

The District’s tax structure includes taxes typically imposed by local governments, such

as real and personal property taxes, deed taxes, and others. At the same time, the District also

levies taxes usually associated with the state level of government, such as individual and

corporate income taxes, excise taxes, and motor vehicle related taxes. About two-thirds of the

District’s locally generated revenues come from taxes usually administered by a state.

The District is often compared to other cities, or states, independently, and without

considering its unique situation of having taxes that both a city and a state normally levy.

Therefore, a primary goal of this study is to add the nominal state and local tax rates in a

consistent way to provide a comparison of tax burdens across major taxes in the District and the

largest city in each state. Further, this study defines the term ‘tax burden’ as the dollar amount of

taxes owed if the final incidence of each major tax examined (income, property, sales, and auto)

is on the individual.

1

This study compares the income, property, sales, and auto tax burdens in 51 different

jurisdictions for a hypothetical family of three, at five different income levels. For context,

Appendix Table 27 presents data on population and recent changes in population in these

jurisdictions. Appendix Map 10 shows the population of the largest cities as a portion of total

state population and illustrates how many people, and what portion of each state are represented

by the combined tax rates presented in this study.

Useful information and insights can be gleaned from comparing the tax burdens in one

jurisdiction with the burdens in other jurisdictions. However, in evaluating or interpreting these

comparisons, consideration should be given to special circumstances within each jurisdiction that

may affect tax burdens. Further, these tax burden comparisons reflect the assumptions used in

their computation. For this reason, it is important to study the methodology used in the report

before drawing conclusions. The methodology used in this report is best suited to provide a

relative comparison of tax burdens, within a single tax type and within a single year, across each

of the 51 cities studied.

As in past years, readers are advised not to compare the hypothetical tax burdens across

years; any number of small changes in the assumptions of the study can result in misleading

information under such comparisons. The purpose of the study remains to compare tax burdens

on a hypothetical household in different jurisdictions in a specific year, and not over time.

Further, the report does not include all taxes levied in each jurisdiction, as there are state

and/or local taxes not captured in the calculations here. However, the report makes every effort

1

This approach differs from the use of the phrase ‘tax burden’ that may be more common in the field of economics, which includes an economic

analysis of which group bears the ‘burden’ of a tax by ultimately having to pay it, also known as the ‘incidence’ of a tax.

Part I: Tax Burdens in Washington, DC Compared with Those in the Largest City in Each State

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

3

to consistently capture and measure tax burdens across jurisdictions for the taxes we include,

making comparisons of the relative tax burdens presented a key feature of the report.

Why Do Tax Burdens Differ from One City to Another?

In the following chapters, the differences in tax burdens for the largest city in each state

in the United States will be discussed. The assumptions used to compute the various tax burdens

will affect the relative tax burdens for the 51 cities. This is especially true for the real estate tax,

because both the methodology used to derive housing values and the relative housing values

from one income level to another and from one city to another are important determinants of the

real property tax burden. However, no matter what set of assumptions is used in such a study;

there will be substantial tax burden differences from one city to another. Some of the reasons for

these differences are as follows:

1) This study only measures major state and local tax burdens for individuals.

Business tax burdens also differ substantially from one city to another. Many

cities, because of a large manufacturing base or because of a dominant

industry, can shift a large portion of the tax burden away from individuals to

businesses. Cities in natural resource states, for example, may shift a

substantial portion of the tax burden to industry, thus exporting, to some

extent, their local government tax burden. Convention and tourist activity in

cities such as Chicago, Las Vegas, New York City, and Washington, DC, can

help reduce local tax burdens by increasing sales tax, gasoline tax, and

parking tax revenues from non-residents, another form of tax exporting.

2) Service demands in each of the 51 cities may vary a great deal. Cold weather

services, such as snow removal, in northern cities may increase costs.

Furthermore, residents of some cities simply desire, or are accustomed to,

more government services than residents of other cities.

3) The costs of providing services may differ substantially from one city to

another. Wage levels, efficiency of the work force, and costs of overhead

items, such as utilities, may be very different.

4) The tax base of each city is different. Cities that have a relatively large

percentage of employed residents will normally have a broad tax base. This

type of city can levy taxes at lower rates than can those with low levels of

employment or high levels of exempt property. External forces, such as the

federal presence in Washington, DC, can restrict the tax base. The tax base

can also be defined by the scope of a tax. For example, it is desirable from a

social point of view to exempt groceries from the sales tax; however, such an

exemption can narrow the sales tax base and may require a higher sales tax

rate to raise enough revenues.

5) The proportion of public versus private services may differ from one city to

another. Some cities may provide services such as garbage collection and

hospital care, while in other cities the private sector may perform these

Part I: Tax Burdens in Washington, DC Compared with Those in the Largest City in Each State

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

4

services for a fee.

As a result, a city in which the private sector performs such functions may

have a lower tax burden than one in which these functions are performed by

the city. In these instances, the fees charged by the private sector represent

payments by individuals for public services that are not reflected in tax

burdens.

6) Certain taxes that are not discussed in this study may affect state and local tax

burdens. Taxes which are levied on individuals, but not covered by the study,

include liquor and cigarette taxes and taxes on public utility bills. Rates for

some of these taxes are listed at the end of the report.

As noted above, the number and kind of public services each city provides necessarily

has a bearing on the amount of revenue that must be raised. The tax burden comparisons in this

report should be studied in the context of these differing conditions, in addition to the

assumptions and methodologies used.

In addition to these factors which may apply to any jurisdiction, the District’s

circumstances further set it apart from other state and local governments. The Government

Accountability Office (GAO) has documented in the past that the District has had a structural

imbalance, due primarily to two factors. First, the District has a higher service delivery cost than

the average state fiscal system—due to the higher rates of poverty and crime associated with an

urban area, as well as a higher cost of living.

2

Further, the District’s revenue capacity is restricted

by the federal presence—the District cannot tax the income of non-residents who work in the city,

and as of Tax Year 2020 property assessments, 31 percent of the land value in the District is tax

exempt.

3

In spite of these restrictions, GAO notes that the District has a high revenue capacity.

The city’s economic and fiscal situation has changed over the past two decades; however, these

factors remain relevant when considering the District’s tax structure and its tax burdens.

2

“Structural Imbalance and Management Issues.” GAO–03–666. Government Accountability Office. Washington, DC: 2003. p. 1.

3

“DC Tax Facts 2021.” 2020 Tax Exempt Land Value as a % of Total Taxable and Exempt Land Value. Government of the District of

Columbia, Office of the Chief Financial Officer, Office of Revenue Analysis. Washington, DC: 2021. p. 51.

Part I: Tax Burdens in Washington, DC Compared with Those in the Largest City in Each State

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

5

CHAPTER I

How Tax Burdens are Computed

for the Largest City in Each State

Many taxpayers in the United States are aware that the amount of state and local tax

liability of an individual taxpayer varies from one jurisdiction to another. The extent of these

differences in state and local tax burdens across the country, however, may not be fully

recognized.

The taxing systems of states and local jurisdictions differ in many aspects. The

relationship of state taxes to federal tax law is one of several factors causing differences in tax

burdens from one state to another. Other differences reflect decisions by state and local

governments on what should and should not be subject to tax. For example, several states do not

levy an individual income tax, although for many others it represents a major source of state

funding. Tax burdens also differ because some states can shift a larger portion of governmental

costs to business and may be able to “export” some of their tax burden. This has been true, for

example, for energy producing states and states specializing in tourism.

This report compares the major state and local tax burdens of hypothetical households in

Washington, DC, with the burden for the households in the largest city in each of the 50 states

for 2020. The four major taxes used in the comparison are the individual income tax, the real

property tax on residential property, the general sales and use tax, and automobile taxes,

including the gasoline tax, registration fees, excise tax, and the personal property tax. This study

does not incorporate the effects of differing local tax burdens on the federal individual income

tax burden. Income and property taxes are deductible in computing federal income taxes and the

effect of federal deductibility is to reduce the overall difference in tax burdens between

jurisdictions.

All tax burdens reflect state and local tax rates. Tax burdens are compared for a

hypothetical family that consists of two wage-earning spouses and one school-age child. The

gross family annual income levels used are: $25,000, $50,000, $75,000, $100,000, and $150,000,

and income is assumed to have been earned in the city. The wage and salary split is assumed to

be 70-30 between the two spouses. The families at the top four income levels are assumed to

own a single-family home and to reside within the confines of the city. At the $25,000 income

level, the study assumes that the household rents and does not own its housing unit. The

assumptions used in the calculation of each major tax type are indicated on the following pages.

• Housing Values. The Census data typically used to arrive at a house value for each

income level were not released for 2020 due to disruptions in data collection caused by

the pandemic. To determine a median house value by metropolitan statistical area (MSA)

for the current report, data on median house values by MSA from the National

Association of Realtors (NAR) for both 2019 and 2020 were used to calculate a percent

growth figure. Next, median income levels by MSA from the Bureau of Economic

Analysis for 2019 and 2020 were used to calculate percent growth in median income

Part I: Tax Burdens in Washington, DC Compared with Those in the Largest City in Each State

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

6

from 2019 to 2020. These two measures of growth from a consistent data series were

applied to the 2019 ACS data on median house value and median household income to

grow them to 2020. From there, we proceed with the standard methodology of creating a

linear multiplier from the median house value and median income within each MSA to

assign a house value at each income level for the MSA, as in previous reports.

4

• Mortgage Interest. The mortgage interest amount (for use as an itemized deduction in

the income tax) in the 2020 study is derived by calculating an amortization schedule for

the estimated home value for each income level in each city. Home values for calculating

the Mortgage Interest Deduction (MID) at each income level are calculated based on

median house values and median incomes for mortgage holders for a house purchased in

2015. A linear multiplier created from these two figures is used to derive a house value

for each income level at which home ownership is assumed.

• Renters versus Owners. The hypothetical family at the $25,000 income level in this

year’s study is assumed to rent, rather than own a home. Given the real estate values in

most cities around the country, the assumption that families earning $25,000 per year rent

may be more realistic than the assumption that they own a home.

Individual Income Tax

The five income levels used in this study are divided between wage and salary income. In

previous versions of this report, capital gains and interest income were included, as well as the

assumptions of major itemized deductions on the following page. However, capital gains and

interest income are not included in the current report to remove some of the variation that

inconsistently changed the original income levels used, with little methodological benefit. (See

the following page for more information on the itemized deductions that continue to be included

in this report.) The following income levels are used for the income tax starting point in each

state and the District of Columbia, where Spouse 1 is assumed to earn 70 percent of the total

income and Spouse 2 is assumed to earn 30 percent.

5

Gross

Income:

$25,000

$50,000

$75,000

$100,000

$150,000

Spouse 1:

$17,500

$35,000

$52,500

$70,000

$105,000

Spouse 2:

7,500

15,000

22,500

30,000

45,000

Total itemized deductions used for calculating state and local income taxes, which are

also used in the federal tax computation, are shown below. The methodology for two of the

itemized deductions—the medical and dental expenses deduction and the charitable contribution

deduction—are consistent with the 2019 report, when the methodology changed from that used

in prior reports. In the past, the amounts for these deductions were based on actual average

deduction amounts for taxpayers within a range around each income level for Washington, DC,

4

This method may lead to lower house values than would be expected for some areas given the large jump in home values reported in DC and

other major cities in 2020. Because the data source takes the entire MSA into account and assigns a median house value by income level, the

values tend to be lower than they would be for the central cities alone. However, this method continues to be the best approach identified to allow

for the use of a consistent data source across each city in the report.

5

DC and various states allow married couples to file separately on the same return, even when filing jointly on the federal return. The tax

software used for calculating income tax burdens for this report automatically selects the most advantageous filing status.

Part I: Tax Burdens in Washington, DC Compared with Those in the Largest City in Each State

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

7

taxpayers who were married filing jointly and had itemized deductions. However, in recent years

the pool of married taxpayers filing jointly that also itemized was insufficient at the lower

income levels to produce representative deduction amounts (perhaps resulting from the Tax Cuts

and Jobs Act of 2017 (TCJA) leading more taxpayers to take the standard deduction). Therefore,

beginning in the 2019 report, Internal Revenue Service (IRS) data for all itemizers in tax year

2019 were used to calculate the average percent of AGI reflected by the medical deduction,

which is eight percent of AGI. For charitable contributions, the level of four percent of AGI is

applied across incomes.

6

These changes in the methodology make the inputs in the income tax

calculations more consistent across incomes and conform more closely to the methodology

across the other tax types (which do not rely on DC-specific data).

Gross Income Level

Deduction $ 25,000 $ 50,000 $ 75,000 $100,000 $150,000

Medical (Gross) 1/ 2,000 4,000 6,000 8,000 12,000

Nondeductible Medical 2/ -1,875 -3,750 -5,625 -7,500 -11,250

Net Medical Deduction 125 250 375 500 750

Deductible Taxes 3/ 3/ 3/ 3/ 3/

Mortgage Interest 4/ 4/ 4/ 4/ 4/

Contribution Deduction 2/, 5/ 1,000 2,000 3,000 4,000 6,000

Total Deductions-without taxes

And mortgage interest 6/ 1,125 2,250 3,375 4,500 6,750

1/ Medical deductions above 7.5 percent of federal AGI are allowed. All or part of medical deduction

may be allowed in some states.

2/ Beginning with the 2019 Study, a new methodology was used for assumptions of medical and contribution deductions.

8% of AGI for medical (minus the 7.5% of AGI limit); 4% for charitable contribution. Based on analysis of data from:

IRS. Table 2.1. Returns with Itemized Deductions: Sources of Income, Adjustments, Itemized Deductions by Type,

Exemptions, and Tax Items, by Size of Adjusted Gross Income, Tax Year 2019, and Tax Policy Center analysis of IRS

data on charitable giving (average % of AGI for all returns used for all incomes in this study).

3/The tax deduction varies from city to city and is based on real and personal property taxes computed in the current 2020

Study and individual income taxes computed in the 2019 study for tax year 2019.

4/ Assumed mortgage interest varies from city to city and is based on 5th year interest paid on a home purchased in 2015

at an interest rate of 3.85%.

5/ Contribution Deduction represents charitable contributions claimed.

6/ Note: the current report does not include miscellaneous deductions, taxable interest income or capital gains which have

been included in previous reports. Further, if all itemized deductions do not exceed the amount of the standard deduction,

the standard deduction amount will be automatically used.

Because the Federal Earned Income Tax credit (EITC) at the $25,000 income level in

some states will determine the state’s EITC, and because several states (such as Alabama, Iowa,

Louisiana, Missouri, Montana, and Oregon) allow the deduction of all or part of an individual’s

federal income tax liability in computing the state income tax, it is necessary to compute the

2020 federal individual income tax at each income level using the above assumptions. Many

states in 2020 allowed taxpayers to begin their state income tax computations with federal

adjusted gross income (AGI) or federal taxable income. Other states do not use either of these

two measures of federal income as a starting point.

6

Tax Policy Center analysis of IRS data on charitable giving (average % of AGI for all returns used for all incomes in this study)

Part I: Tax Burdens in Washington, DC Compared with Those in the Largest City in Each State

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

8

Further, depending on levels of deductions used in each state, the standard deduction may

be more advantageous for certain taxpayers. In 2020, the federal standard deduction was $24,800

for married taxpayers filing jointly; and state level standard deductions varies by state (see Table

14 for more detail on state income tax parameters). Because the federal standard deduction was

significantly increased in the TCJA of 2017, more of the families included will now take the

standard deduction. For the current study of tax year 2020, all families earning $75,000 per year

and below, and most of the families earning $100,000, would take the federal standard deduction

as it was higher than the itemized deductions assumed for these income levels in the report.

7

The 2020 deductible real and personal property taxes computed in the current year’s 51-

city study are used for the 2020 property tax deduction. For the 2020 state and local individual

income tax deduction, 2019 income tax burdens from the previous year’s study were used

(unless the calculated sales tax burdens were higher, which was often the case for the lower two

income levels). Each of these figures was used in computing the 2020 federal income tax burden,

which is the starting point for the state income tax burden calculations.

Real Property Tax

Real property tax burdens in the 51 cities are a function of residential real estate market

values, assessed values and the ratio of the two, and the tax rate. Some jurisdictions allow certain

deductions from the value of residential property before the tax is calculated while others allow

credits against the calculated real estate tax. These deductions and/or credits are normally limited

to owner-occupied properties.

The nominal property tax rates for each of the 51 cities, presented in Table 4 (page 33)

indicate a wide range in these rates. This information is based upon survey data received from

various state agencies and/or local assessors and is intended to represent the total rate applicable

to a homeowner in each city, inclusive of any state, city, and other local property taxes. In

addition to tax rate differences, data presented in Table 5 (page 35) indicate that the assumed

market value of a residence for purposes of this study varies widely from one city to another at

all income levels. For example, based on extrapolations of 2019 Census’ American Community

Survey (ACS) data and growth rates from two other consistent data series (see more below), the

estimated house value at the $75,000 income level ranges from a high of $433,527 in Honolulu,

Hawaii, to a low of $124,118 in Charleston, West Virginia.

The housing values for each income level (except the $25,000 income level) shown in

Table 5 were derived in a new way for the current study. Typically, house values are derived

from Census ACS data, using a median house value and median household incomes of mortgage

holders for each Metropolitan Statistical Area (MSA) within which the largest city in each state

falls. These two figures were then used to create a multiplier to assign a house value for each of

the income levels in the report which are assumed to own their own home ($50,000, $75,000,

$100,000, and $150,000). This year, the Census released 2020 ACS data in an experimental

format, which did not include MSA level house value data, and did not include any median

income data.

7

In some states, taxpayers taking the federal standard deduction are required to take the state’s standard deduction, even if itemizing would be

more advantageous at the state level. For the purposes of this report taxpayers eligible to take the federal standard deduction are assumed to have

done so.

Part I: Tax Burdens in Washington, DC Compared with Those in the Largest City in Each State

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

9

To determine a median house value by MSA for the current report, data on median house

values by MSA from the National Association of Realtors (NAR) for both 2019 and 2020 were

used to calculate a percent growth figure. Next, median income levels by MSA from the Bureau

of Economic Analysis for 2019 and 2020 were similarly used to calculate percent growth in

median income from 2019 to 2020. Using these two measures of growth within a consistent data

series, we then applied the growth measure to the 2019 ACS data on median house value and

median household income to grow them to 2020. From there, we proceed with the standard

methodology of creating a linear multiplier to assign a house value at each income level, as in

previous reports.

8

The use of the above methodology is an attempt to reflect the different values of housing

in different parts of the country and at different income levels. These are hypothetical values

based on income levels and do not represent average values for a particular jurisdiction.

For the present 2020 Study (just as in the 2018 and 2019 Studies), median sales ratio

statistics have been included where available to derive an “effective assessment level.”

9

A sales

ratio (or assessment sales ratio) is the ratio of the assessed value of the property to the sales

price, or market value of the property; the median is the median ratio value of all the properties

included in the study.

10

Median sales ratios are a measure of the property valuation and

assessment practices within a jurisdiction. If property assessments do not keep up with market

value, residents’ property taxes will be lower than they would otherwise be if taxed at the full

market value of the property. Including the available median sales ratio statistic into the property

tax burden calculations is an attempt to reflect how property tax systems in each jurisdiction are

administered in practice.

In computing property tax burdens, it is also necessary to consider the various

exemptions and credits noted in Table 6 (page 36). The variety of real property tax exemptions,

most of which apply only to residential real property, is very broad. Table 6 does not include

widely available exemptions that are not available to all homeowners, such as senior citizen

exemptions or credits for disabled persons, nor can it adjust for “caps” on the growth of assessed

values or limitations on tax liability over time. Some states have a type of assessment limitation

or valuation freeze. For example, strict limits in California mean many families’ assessments

would be much lower than those assumed here, particularly if they have owned their home for

many years.

Table 4 (page 33), which compares residential real estate tax rates for each city, does not

reflect the various exemptions and credits noted in Table 6 (unless the homestead exemption is

included in the assessment level or nominal rate, as is the case in a few states). Other exemptions

and credits may be available, such as those mentioned above for senior citizens, but are also not

reflected in Table 4 because seniors are not included in the hypothetical households of this study.

However, the property tax burdens computed and shown in Tables 1a-e of this study reflect the

8

Newark, New Jersey, falls in the New York City MSA and Wilmington, Delaware, falls in the Philadelphia MSA, thus those MSA data are

used for both cities. And as previously noted, this method may lead to lower house values than would be expected for some areas given the large

jump in home values reported in DC and other major cities in 2020. Because the data source takes the entire MSA into account and

assigns a median house value by income level, the values tend to be lower than they would be for the central cities alone. However, this method

continues to be the best approach identified to allow for the use of a consistent data source across each city in the report.

9

For Vermont, the Common Level of Appraisal value that is used for school funding equalization is used in lieu of a sales ratio statistic.

Similarly, an equalization statistic is used for Illinois.

10

“Glossary for Property Appraisal and Assessment,” International Association of Assessing Officers. 2013. Page 150.

https://www.iaao.org/media/Pubs/IAAO_GLOSSARY.pdf.

Part I: Tax Burdens in Washington, DC Compared with Those in the Largest City in Each State

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

10

provisions in Table 6 applicable to families owning and residing in their homes. In certain

jurisdictions, such as DC, MN, and VT, renter or property tax credits are provided as refunds

through the income tax and in previous years’ reports they were accounted for within the income

tax burdens. However, this year marks the first time this report has accounted for these refunds in

the property tax burdens presented. Various states offer income tax deductions and

nonrefundable credits for rent or property taxes paid; however, the distinguishing factor in our

presentation is that those included in the property tax burdens are refundable, regardless of

income tax owed.

Property Tax Equivalent of Rent

As previously noted, the study assumes that the family with an annual income of $25,000

does not own a home (and as a result does not pay property tax directly), but instead rents.

Because renters indirectly pay property taxes through their rent,

11

this study computes a

percentage of said rent constituting property taxes. This concept is called the property tax

equivalent of rent (PTER) and is an important tool in comparing the incidence of the property tax

on renters versus homeowners. In a 2021 50-State Property Tax Comparison report, the Lincoln

Institute of Land Policy and the Minnesota Center for Fiscal Excellence note that states vary in

how they tax rental properties in comparison to homesteads; on average, cities tax apartments 33

percent more than homesteads.

12

Their report presents a table illustrating this information for the

largest city in each state; Charleston, South Carolina, has the largest difference in effective rates

between apartment buildings and homesteads, taxing apartments almost four times the effective

rate of that levied on homesteads.

13

Conversely, in six of the largest cities in each state (and DC),

apartments are given preferential treatment over homesteads with the most preference toward

apartments given in Bridgeport, Connecticut.

14

In eight cities, apartments are given the same

treatment as homesteads.

To relieve the implicit tax burden on renters that exists in various locations, some states

have a property tax circuit breaker program that offsets renters’ tax burdens (often through the

income tax since they do not pay property taxes directly). These programs must make

assumptions of the PTER to calculate the amount that renters are paying in property taxes, and

the amount of relief they will receive through the circuit breaker program. Of the states that offer

circuit breaker programs, the PTER assumptions generally range from six to 25 percent (New

Mexico has a low of six percent while Massachusetts uses a 25 percent assumption); on average,

states assume that 17 percent of rent goes toward paying property taxes.

15

DC’s circuit breaker

program assumes 20 percent.

Prior to the 2016 Tax Burden Study, a 20 percent assumption was used with some

reservation given that it has a large impact on the calculated tax burdens of the families earning

$25,000 per year. The assumption often seemed unrealistic in cities with higher rental prices in

which calculated PTERs would be the highest, especially given that rental buildings in more

competitive markets may not be able to pass on all taxes paid since prices are set by the local

11

“50-State Property Tax Comparison Study for Taxes Paid in 2020.” The Lincoln Institute of Land Policy and the

Minnesota Center for Fiscal Excellence. June 2021: pg. 4.

12

Ibid.

13

Ibid, pg. 104-5.

14

Ibid. The study found that in Washington, DC, the classification ratio between apartments and homesteads is 1.069, indicating

that homesteads are treated slightly preferentially to rental buildings by the property tax rates (exclusive of credits) in DC.

15

Based on analysis of state programs in the Lincoln Institute of Land Policy’s Significant Features of the Property Tax

Database for 2017.

Part I: Tax Burdens in Washington, DC Compared with Those in the Largest City in Each State

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

11

market. And as the Lincoln report illustrates, the specific PTER level in a city is primarily based

on the tax system in each jurisdiction. It is not clear whether states with higher PTER

percentages in their circuit breakers have data leading to the choice of PTER percentage in their

state, or if these states are using the circuit breaker to provide a subsidy to lower income renters

hit hardest by higher rental markets.

16

In a January 2016 report, the Minnesota Department of

Revenue (MN DOR) used several techniques based on both ACS and internal tax data to assess

the percentage of rent that constitutes property taxes throughout Minnesota. MN DOR found the

statewide PTER hovered around 15 percent each year from 2009 to 2014, though in Minneapolis

it was often up to 16.9 percent.

17

After considering the available information we decided to use a level of 15 percent for

PTER in the 2016 Study and have continued to do so through the current 2020 Study to attempt

to be more realistic in the property tax burden on renters, particularly in cities with more

expensive rental markets. Future refinements may be made as new information and data become

available. The PTER in each city was calculated as 15 percent of median rents in each MSA.

These data were obtained from the US Department of Housing and Urban Development.

18

This

flat assumption means that any variation in the property tax burden for renters (families earning

$25,000) is driven by the housing market in each jurisdiction, and not the tax system in place.

Even with the lower assumption of PTER in the current study, this number still implies

that the lowest income families in the report are spending, on average, 45 percent of their

incomes on rent, with that portion being as high as 87 percent in Boston and New York City and

76 percent in Washington, DC. However, viewed in the context of some DC metro area statistics

it may not be that unrealistic. In 2017, of renters earning less than $50,000/year, more than 80

percent were spending over 30 percent of their income on rent.

19

A 2017 DC Fiscal Policy

Institute (DCFPI) analysis of 2014 Census data found that 42 percent of extremely low-income

renters (earning between $16,100 - $32,100/year for a family of four) in DC paid 80 percent of

their income or more in rent.

20

Further, a 2018 DCFPI analysis of 2016 Census data found that

63 percent of renters at this income level paid more than half of their income in rent.

21

Sales and Use Tax

The sales tax burdens included in this study are based on information from the 2020

Bureau of Labor Statistics’ Consumer Expenditure Survey (CES), and local and state sales tax

rates. The CES provides data on average consumer expenditures by income level. The average

expenditures by income level have been adjusted for a 3-person household. The same CES

categories have been included since the 2013 Tax Burden Study and include: food (at home);

food (away from home); over the counter drugs; housekeeping supplies, household furnishings,

and equipment; apparel and footwear; new and used cars and trucks; vehicle finance charges,

16

This discussion does not intend to assess appropriate levels of PTER used in circuit breaker programs. It is intended solely to consider whether

and how these levels are used as an input for the Tax Burden Study’s calculation of renter’s tax burdens as compared to homeowner’s tax burdens

across the 50 states.

17

The MN Renter’s Property Tax Refund program allowed renters to qualify for a refund on their rent of up to 17% of rent paid

(dependent on the renter’s income level) in 2019.

18

US Department of Housing and Urban Development, “2019 50th Percentile Rent Estimates.” Data for studio apartments used. HUD provides

data for Newark, NJ, but not for Wilmington, DE (thus the value for Philadelphia, PA, is used).

19

Analysis of US Census Bureau, 2013-2017 American Community Survey 5-Year Estimates.

20

Zippel, Claire. “A Broken Foundation: Affordable Housing Crisis Threatens DC’s Lowest-Income Residents.”

DC Fiscal Policy Institute. December 8, 2016.

21

Zippel, Claire. “Building the Foundation: A Blueprint for Creating Affordable Housing for DC’s Lowest-Income Residents.”

DC Fiscal Policy Institute. April 4, 2018.

Part I: Tax Burdens in Washington, DC Compared with Those in the Largest City in Each State

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

12

maintenance and repairs, and insurance; vehicle rentals, leases, and licenses and other charges;

public and other transportation; entertainment: fees and admissions, audio visual equipment and

services, and reading; and personal care products and services.

22

The CES expenditure data and the specific state and local tax rates on each type of item are used

to determine the sales tax that these expenditures would generate.

23

The state and local general

sales tax rates in each city are reported in Table 7, page 40. It is important to note that the sales

tax burdens will be a function of the size of the sales tax base in a particular jurisdiction and the

specific sales tax rates that apply to the consumer items included.

Automobile Taxes

Automobile taxes included in this study are gasoline taxes, motor vehicle registration fees

(state and local), excise taxes, and personal property taxes levied on automobiles. Table 10 (page

44) summarizes automobile ownership assumptions for each income level, including types of

vehicles, weight, value, and annual gasoline consumption.

22

In cases where a category includes items that are both taxed and not taxed, such as “drugs” which includes both prescription and over the

counter (OTC) drugs, the expenditure amount is divided by two before applying the tax rate of the item that is taxed (For example, states often

tax OTC drugs but not prescription drugs. Similarly, states often tax personal care products, but not personal care services.)

23

The consumer expenditure data between 2020 and 2019 shows more change in several categories than in previous years, presumably due to

the 2020 pandemic and subsequent economic recession. For example, the most noticeable change is that families at all five income levels in the

report spent considerably less in 2020 than in 2019 on food away from home, public transportation, and personal care products and services.

While families at all incomes in our study spend less on food away from home, the lower two income levels also spent less on food at home in

2020 than in 2019, while the three highest income levels spent more on food at home in 2020 than in 2019. Similarly, the highest income family

on average spent more in 2020 than 2019 on new cars and trucks and household furnishings, while the lowest income family spent less in both

categories in 2020 than in 2019.

Part I: Tax Burdens in Washington, DC Compared with Those in the Largest City in Each State

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

13

CHAPTER II

Overall Tax Burdens for

Hypothetical Families in the

Largest City in Each State

The major state and local tax burdens by tax type for the five different income levels used

in this study are presented in Tables 1a-e (pages 14-23). As reflected in Table 1, tax burdens

across the 51 cities vary widely at all income levels. At the $25,000 income level, the $4,933

combined burden of all four taxes added together for Seattle, Washington, is significantly greater

than the refund of $45 that a similar taxpayer in Burlington, Vermont, would receive (or the $433

tax that would be owed in Minneapolis, Minnesota). At the $150,000 income level, the

Bridgeport, Connecticut, tax burden of $25,638 is almost four times the Anchorage, Alaska, tax

burden of $6,491. Differences in state and local tax structures, as well as housing markets and

costs-of-living, contribute to the variation.

The highest combined tax burdens at the $25,000 income level occur in Seattle,

Washington; Philadelphia, Pennsylvania; Birmingham, Alabama; Los Angeles, California; and

Honolulu, Hawaii. Seattle’s high rental costs and sales taxes, coupled with a higher auto tax

burden put it at the top of the list. Philadelphia’s local wage tax adds to the state income tax to

make it the highest income tax burden at this income level, with the second highest combined

burden. The high property tax burdens (which are assumed to be a portion of rent) due to

expensive real estate markets in Los Angeles and Honolulu also put them on this list, while

Birmingham’s high sales tax burden contributes to its ranking. The lowest combined tax burdens

of all four taxes added together at the $25,000 income level occur in Burlington, Vermont;

Minneapolis, Minnesota; Washington, DC; Albuquerque, New Mexico; and Baltimore,

Maryland. Each of these has a refundable EITC, and Burlington, Vermont; Washington, DC; and

Minneapolis, Minnesota, each offer a renter’s refund through the income tax, which contributes

to their low rankings.

The highest combined tax burdens of all four taxes added together at the $150,000

income level occur in Bridgeport, Connecticut; Newark, New Jersey; Detroit, Michigan;

Baltimore, Maryland; and New York City, New York. The lowest combined tax burdens at this

income level are Anchorage, Alaska; Cheyenne, Wyoming; Sioux Falls, South Dakota;

Nashville, Tennessee; and Fargo, North Dakota. These lower tax burdens are primarily a result

of the lack of an income tax in all but one (ND) of these jurisdictions. Map 1 (page 24) illustrates

the combined burden of all four taxes for a family earning $75,000/year.

24

No single pattern characterizes a high or a low tax burden city. High tax burden cities

generally have a graduated individual income tax rate and/or high real estate tax rates and

moderate to high housing values. Low tax burden cities generally have a low or no individual

income tax and average or below average property tax rates.

24

See the Appendix (page 72) for maps showing the combined burdens by state for the other income levels.

Part I: Tax Burdens in Washington, DC Compared with Those in the Largest City in Each State

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

14

Chart 1a: 2020 Estimated Burdens of Major Taxes for a Hypothetical Family

Earning $25,000/Year

Source: ORA. Cities are ranked by total estimated tax burden as a percentage of income (highest at the top).

Note: Negative bars represent income tax refunds due to state EITC refunds (or refundable renter’s credits). See Table 1a on the following page for

totals and tax burdens as a percent of income and additional notes.

Part I: Tax Burdens in Washington, DC Compared with Those in the Largest City in Each State

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

15

Table 1a: 2020 Estimated Burdens of Major Taxes for a Hypothetical Family

Earning $25,000/Year

RANK

CITY

ST

TAXES

BURDEN

INCOME 2/

PROPERTY 3/

SALES 4/

AUTO

AMOUNT

PERCENT

1

Seattle

WA

-

3,128

1,267

538

4,933

19.7%

2

Philadelphia

PA

1,736

1,676

856

305

4,572

18.3%

3

Birmingham

AL

908

1,575

1,607

172

4,263

17.1%

4

Los Angeles

CA

(125)

2,488

1,208

516

4,086

16.3%

5

Honolulu

HI

0

2,842

787

314

3,943

15.8%

6

Chicago

IL

247

1,881

1,190

528

3,846

15.4%

7

Boston

MA

(591)

3,263

697

242

3,612

14.4%

8

Atlanta

GA

273

1,917

1,225

179

3,594

14.4%

9

New York

NY

(1,159)

3,278

1,097

268

3,484

13.9%

10

Nashville

TN

-

1,741

1,499

209

3,449

13.8%

11

Indianapolis

IN

835

1,292

940

330

3,398

13.6%

12

Kansas City

MO

252

1,309

1,346

425

3,332

13.3%

13

Denver

CO

(282)

2,178

1,074

289

3,260

13.0%

14

Louisville

KY

991

1,177

731

282

3,181

12.7%

15

New Orleans

LA

126

1,490

1,427

107

3,151

12.6%

16

Virginia Beach

VA

0

1,845

863

427

3,136

12.5%

17

Charleston

WV

818

1,039

823

440

3,119

12.5%

18

Portland

OR

515

2,264

-

331

3,111

12.4%

19

Charlotte

NC

53

1,757

885

384

3,079

12.3%

20

Charleston

SC

0

1,764

1,119

183

3,066

12.3%

21

Columbus

OH

625

1,307

888

240

3,059

12.2%

22

Jackson

MS

27

1,382

1,287

282

2,978

11.9%

23

Detroit

MI

799

1,237

719

203

2,957

11.8%

24

Salt Lake City

UT

0

1,510

1,125

300

2,935

11.7%

25

Phoenix

AZ

(75)

1,640

1,110

247

2,922

11.7%

26

Little Rock

AR

206

1,226

1,238

177

2,847

11.4%

27

Las Vegas

NV

-

1,393

1,040

372

2,805

11.2%

28

Oklahoma City

OK

(120)

1,312

1,299

187

2,678

10.7%

29

Houston

TX

-

1,598

893

167

2,658

10.6%

30

Sioux Falls

SD

-

1,141

1,119

234

2,494

10.0%

31

Portland

ME

(635)

2,047

715

322

2,449

9.8%

32

Cheyenne

WY

-

1,364

755

286

2,405

9.6%

33

Jacksonville

FL

-

1,350

835

192

2,377

9.5%

34

Providence

RI

(538)

1,525

857

491

2,335

9.3%

35

Omaha

NE

(358)

1,246

897

542

2,326

9.3%

36

Wichita

KS

(277)

1,022

1,306

151

2,203

8.8%

37

Wilmington

DE

313

1,676

10

145

2,143

8.6%

38

Des Moines

IA

(137)

1,156

832

267

2,117

8.5%

39

Newark

NJ

(877)

2,005

689

277

2,094

8.4%

40

Boise

ID

(290)

1,161

995

207

2,073

8.3%

41

Anchorage

AK

-

1,789

87

191

2,067

8.3%

42

Fargo

ND

0

1,057

811

198

2,066

8.3%

43

Milwaukee

WI

(143)

1,195

712

265

2,029

8.1%

44

Bridgeport

CT

(817)

1,706

773

329

1,992

8.0%

45

Manchester

NH

-

1,530

206

209

1,945

7.8%

46

Billings

MT

225

1,111

19

415

1,770

7.1%

47

Baltimore

MD

(1,161)

1,746

736

234

1,555

6.2%

48

Albuquerque

NM

(609)

1,102

936

124

1,553

6.2%

49

Washington

DC

(1,133)

1,667

811

203

1,548

6.2%

50

Minneapolis

MN

(1,136)

360

956

253

433

1.7%

51

Burlington

VT

(1,290)

251

782

212

(45)

-0.2%

AVERAGE

1/

(67)

1,602

922

282

2,733

10.9%

MEDIAN

0

1,525

890

265

2,847

11.4%

1/ Based on jurisdictions levying tax.

2/ Amounts in parentheses represent refundable State Earned Income Tax Credits. States with dashes do not have an income tax. Tennessee and

New Hampshire tax interest and dividend income but the exemptions are high enough to eliminate individual income taxes at all income levels

used in the study.

3/ Based on 15 percent of estimated annual rent.

4/ States with dashes do not have a sales tax. For states with no state sales tax where there is a small sales tax burden listed, such as AK, DE,

MT, and NH, some selective sales taxes apply to consumption items included.

Part I: Tax Burdens in Washington, DC Compared with Those in the Largest City in Each State

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

16

Chart 1b: 2020 Estimated Burdens of Major Taxes for a Hypothetical Family

Earning 50,000/Year

Source: ORA. See Table 1b on the following page for totals and tax burdens as a percent of income and additional notes.

Part I: Tax Burdens in Washington, DC Compared with Those in the Largest City in Each State

2020 Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison

17

Table 1b: 2020 Estimated Burdens of Major Taxes for a Hypothetical Family

Earning $50,000/Year

RANK

CITY

ST

TAXES

BURDEN

INCOME

2/

PROPERTY

3/

SALES

4/

AUTO

AMOUNT

PERCENT

1

Newark

NJ

1,086

6,006

908

283

8,283

16.6%

2

Bridgeport

CT

636

5,216

1,010

326

7,188

14.4%

3

Baltimore

MD

2,672

3,119

965

228

6,984

14.0%

4

Detroit

MI

2,664

2,524

928

206

6,322

12.6%

5

Louisville

KY

3,305

1,672

934

289

6,200

12.4%

6

Chicago

IL

2,012

2,058

1,476

519

6,065

12.1%

7

Philadelphia

PA

3,471

1,114

1,112

297

5,994

12.0%

8

Portland

OR

2,686

2,396

-

325

5,407

10.8%

9

Des Moines

IA

1,339

2,663

1,053

272

5,327

10.7%

10

Los Angeles

CA

0

3,255

1,541

513

5,309

10.6%

11

Indianapolis

IN

2,321

1,290

1,218

356

5,185

10.4%

12

New Orlean

LA

1,265

1,950

1,751

105

5,071

10.1%

13

Kansas City

MO

1,472

1,509

1,639

448

5,069

10.1%

14

New York

NY

2,076

1,255

1,429

262

5,022

10.0%

15

Providence

RI

730

2,649

1,101

515

4,996

10.0%

16

Birmingham

AL

2,088

843

1,883

170

4,984

10.0%

17

Columbus

OH

2,030

1,536

1,134

234

4,934

9.9%

18

Atlanta

GA

1,683

1,593

1,472

174

4,922

9.8%

19

Phoenix

AZ

534

2,593

1,428

318

4,874

9.7%

20

Jackson

MS

923

2,014

1,517

342

4,797

9.6%

21

Milwaukee

WI

591

2,940

913

260

4,705

9.4%

22

Virginia Beach

VA

1,687

1,376

1,063

442

4,567

9.1%

23

Omaha

NE

764

2,068

1,158

573

4,563

9.1%

24

Portland

ME

584

2,516

924

379

4,402

8.8%

25

Oklahoma City

OK

1,126

1,339

1,526

184

4,175

8.3%

26

Charleston

WV

1,955

706

1,042

453

4,156

8.3%

27

Salt Lake City

UT

1,196

1,160

1,396

336

4,089

8.2%

28

Wichita

KS

1,215

1,142

1,563

148

4,067

8.1%

29

Charlotte

NC

1,371

1,216

1,066

389

4,042

8.1%

30

Albuquerque

NM

737

1,895

1,176

121

3,930

7.9%

31

Seattle

WA

-

1,741

1,631

548

3,919

7.8%

32

Las Vegas

NV

-

2,122

1,350

431

3,903

7.8%

33

Denver

CO

1,131

1,017

1,374

370

3,893

7.8%

34

Little Rock

AR

1,201

1,013

1,502

175

3,891

7.8%

35

Burlington

VT

709

1,929

1,017

208

3,863

7.7%

36

Wilmington

DE

1,544

2,144

16

141

3,845

7.7%

37

Minneapolis

MN

1,078

1,036

1,237

274

3,625

7.2%

38

Billings

MT

1,642

1,409

32

421

3,504

7.0%

39

Nashville

TN

-

1,450

1,825

205

3,479

7.0%

40