STATE OF ILLINOIS

Department of Central Management Services

Bureau of Benets

FY 2025

State Employees Group

Insurance Program

Benet Choice Period

May 1 - May 31, 2024 • Effective July 1, 2024

ONLINE ENROLLMENT PLATFORM

Making benet elections is simple through the MyBenets website.

Follow these steps:

1. Go to MyBenets.illinois.gov.

2. In the top right corner of the home page, click Login.

3. If you are logging in for the rst time, click Register in the bottom

right corner of the login box and follow the prompts. You will need

to provide your name as printed on the Benet Choice materials

mailed to your home.

4. Enter your login ID and password. After logging in and landing on

the welcome page, explore your benet options by clicking on the

benet tiles.

5. After exploring your benet options and determining which

benets you would like to elect, click on the Benet Choice Event,

located on the Welcome page.

WHAT YOU NEED TO DO

1. Go to MyBenets.illinois.gov to review your benet options.

2. Choose the benets you’d like to elect at MyBenets.illinois.gov

between May 1 - May 31, 2024.

3. Provide, or update your email address at MyBenets.illinois.gov

to receive quick responses and notications through electronic

communications.

4. Take advantage of your new benets which will become

effective July 1, 2024.

Note: If you are not currently enrolled in benets due to previous

nonpayment of premiums, contact the Premium Collection Unit

at 217-558-4783 to discuss your enrollment options.

DISCLAIMER

Monthly health insurance contributions are based on your

March 1st salary, or initial salary for new hires. Your monthly

contribution amount reflected within this site is based on the salary

reported on your paycheck for the rst pay period in March, and will

be adjusted as necessary, if updated information is provided.

Need Help?

AVA, the interactive digital assistant, is available online at

MyBenets.illinois.gov

Or

Contact MyBenets Service Center (toll-free)

844-251-1777, or 844-251-1778 (TDD/TTY) with inquiries.

Representatives are available

Monday – Friday, 8:00 AM - 6:00 PM CT.

Table of Contents

Benet Choice Period

What's New.....................1

Be Well Illinois ..................1

What is Available in Your Area .....2

Monthly Contributions ............3

Dependent Monthly Contributions . .3

Adding a Dependent .............4

Opt-Out........................4

Transition of Care................4

Medicare Requirements . . . . . . . . ..4

Health Plans

HMO Benets...................5

Open Access Plan (OAP) Benets ..6

Quality Care Health Plan

(QCHP) Benets ...............7

Consumer Driven Health Plan

(CDHP) Benets ...............8

Flexible Spending Accounts (FSA) and

Health Savings Accounts (HSA)

MCAP .........................9

DCAP .........................9

HSA...........................9

Vision......................... 10

Dental ........................ 10

Life .......................... 11

Contacts . . . . . . . . . . . . . . . . . . . . . . 12

Federally Required Notices ...... 13

FY2025 Benet Choice Options

SEGIP 1MyBenets.illinois.gov

Benet Choice Period

Elect Your Benets May 1 - May 31, 2024

What’s New

Health Plan Availability

There are several changes this year. It is your responsibility to verify what Health Plans are available in

your area (see page 2).

A New Enhanced Delta Dental Benets Program

The Delta Dental of Illinois’ Enhanced Benets Program integrates medical and dental care – where oral

health meets overall health. This program enhances coverage for individuals who have specic health

conditions that can be positively affected by additional oral health care. These enhancements are based

on scientic evidence that shows treating and preventing oral disease in these situations can improve

overall health. For more information on this program please go to www.deltadentalil.com or by calling

them at 1-800-323-1743.

Additional Vision Benets

The Vision Plan administered by EyeMed now offers additional coverage for Progressive Lenses,

Premium Anti-Reflective Coating and coverage for Photochromic and Polarized lenses. For additional

information, please visit the State Vision Plan page at MyBenets.illinois.gov.

The State of Illinois’ ongoing comprehensive approach to wellness.

The State of Illinois cares about you and your health.

Be Well Illinois is designed to not only focus on supporting your physical

health but also your mental, nancial, and social wellbeing. As a wellness

plan member, you can use this site to access health plan information

and educational resources including wellness webinars, monthly health

awareness causes, nancial wellness, healthy eating, and exercise.

While the decision to make healthy lifestyle changes is your choice and not

a job requirement, the hope is that by creating an environment where these

choices are supported by the work culture makes it easier and supports

your success.

Engaging with Be Well Illinois is easy, connect with us in one of the following ways.

Visit us at www.Illinois.gov/BeWell

Follow us on Facebook at https://www.facebook.com/BeWellIllinois

Or email us at BeW[email protected]v

FY2025 Benet Choice Options

2

What is Available in Your Area in FY25

Review the following map and charts to identify plans available in your county.

Then, review your monthly contribution and plan benets to determine which plan is

best for you.

Please note: This map is

accurate as of the printing of

this book; however changes may

occur without notice. Always

contact the appropriate plan

for verication of provider

status in your area. See page

12 to contact plan providers.

HMO Illinois

Blue Advantage HMO

Health Alliance HMO

Aetna HMO

HealthLink OAP (except Iroquois - no tier 1)

Aetna OAP

Blue Cross Blue Shield OAP

Consumer Driven Health Plan (CDHP)

Quality Care Health Plan (QCHP)

Health Alliance HMO

Aetna HMO

Aetna OAP

BCBS OAP

Consumer Driven Health Plan (CDHP)

Quality Care Health Plan (QCHP)

HMO Illinois

Blue Advantage HMO

HealthLink OAP

Aetna OAP

Blue Cross Blue Shield OAP

Consumer Driven Health Plan (CDHP)

Quality Care Health Plan (QCHP)

HMO Illinois

Health Alliance HMO

Aetna HMO

HealthLink OAP

Aetna OAP

BCBS OAP

Consumer Driven Health Plan (CDHP)

Quality Care Health Plan (CDHP)

Aetna HMO

Aetna OAP

Health Alliance HMO

Consumer Driven Health Plan (CDHP)

Quality Care Health Plan (QCHP)

Aetna HMO

Aetna OAP

BCBS OAP

Health Alliance HMO

Consumer Driven Health Plan (CDHP)

Quality Care Health Plan (QCHP)

Health Alliance HMO

Aetna HMO

HealthLink OAP

Aetna OAP

BCBS OAP

Consumer Driven Health Plan (CDHP)

Quality Care Health Plan (QCHP)

SEGIP 3MyBenets.illinois.gov

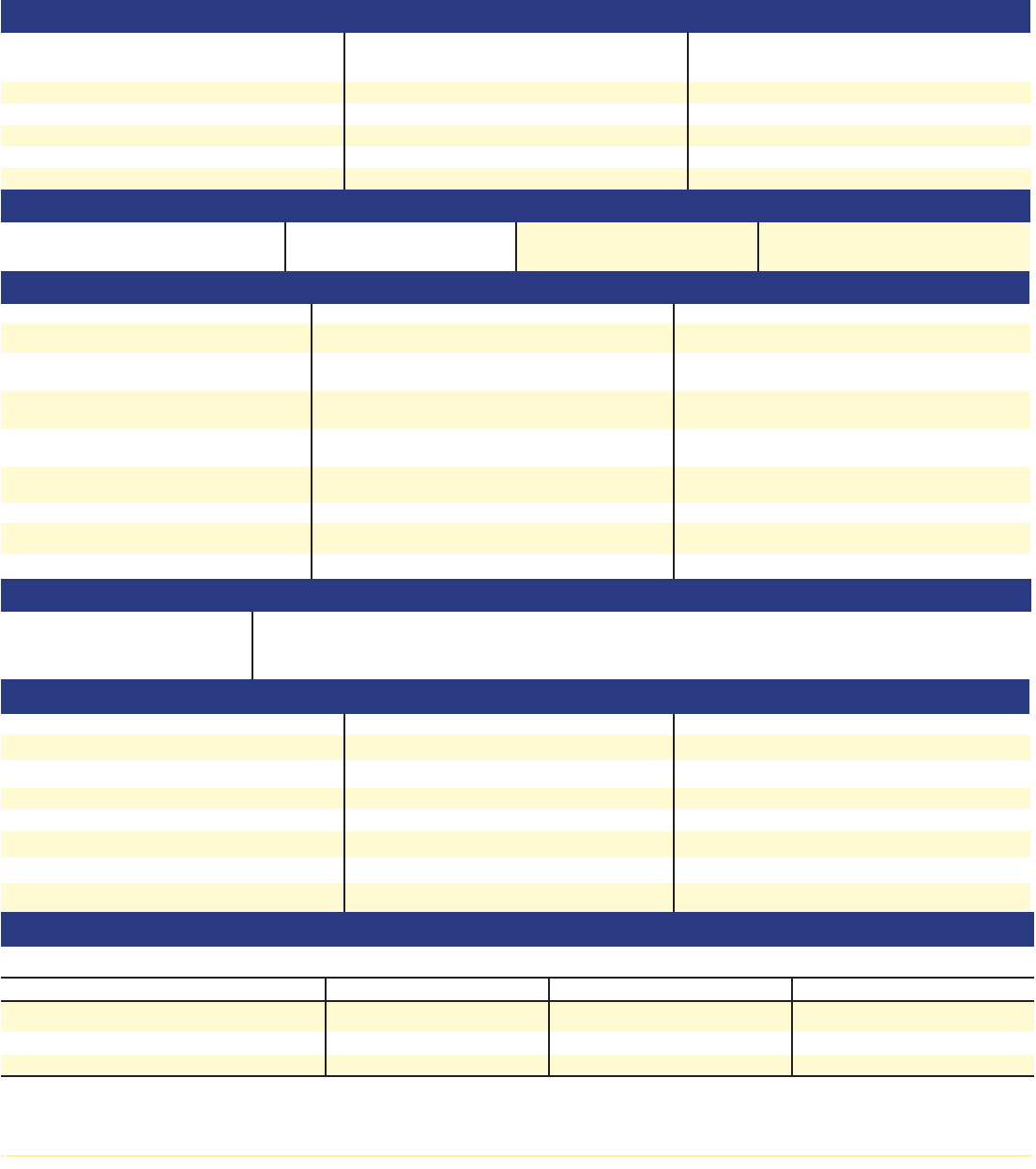

Monthly Contributions

The State shares the cost of health coverage with you. While the State covers most of the cost, you must make

monthly contributions determined by your annual salary. The following charts outline monthly contribution rates

for full-time members. Part-time members are required to pay a percentage of the State’s portion of the monthly

contribution in addition to their own. Special rules apply for non-IRS dependents (see MyBenets.illinois.gov for

more information).

Employee

Annual Salary

Aetna

HMO

Blue

Advantage

Health

Alliance

Illinois

HMO

Illinois

Aetna

OAP

BCBSIL*

OAP

HealthLink

OAP

CDHP**

QCHP***

$30,200 & below $130 $104 $130 $108 $124 $124 $138 $105 $144

$30,201 - $45,600 $149 $123 $149 $127 $143 $143 $157 $124 $163

$45,601 - $60,700 $168 $142 $168 $146 $162 $162 $176 $143 $181

$60,701 - $75,900 $186 $160 $186 $164 $180 $180 $194 $161 $200

$75,901 - $100,000 $205 $179 $205 $183 $199 $199 $213 $180 $219

$100,001 - $125,000 $259 $233 $259 $237 $253 $253 $267 $234 $273

$125,001 - and over $292 $266 $292 $270 $286 $286 $300 $267 $306

Members who retire, accept a salary reduction, or return to State employment at a different salary may have their monthly

contribution adjusted based upon the new salary. This applies to members who return to work after having a 10-day or greater

break in State service after terminating employment. This does not apply to members who have a break in coverage due to a

leave of absence.

Dependent Monthly Health Plan Contributions

In addition to monthly contributions for their own health coverage, members must make additional monthly

contributions for dependents they cover. Dependents must be enrolled in the same plan as the member. The

Medicare dependent monthly contribution applies only if the member is a retiree or annuitant and Medicare is

primary for both Parts A and B.

Number of

Dependents

Aetna

HMO

Blue

Advantage

Health

Alliance

Illinois

HMO

Illinois

Aetna

OAP

BCBSIL*

OAP

HealthLink

OAP

CDHP**

QCHP***

1 Dependent $201 $164 $201 $168 $192 $192 $210 $175 $297

2+ Dependents $246 $200 $247 $207 $237 $237 $263 $219 $335

1 Medicare A & B

Primary Dependent

$178 $143 $177 $147 $169 $169 $186 $152 $190

2+ Medicare A & B

Primary Dependents

$220 $178 $221 $184 $211 $211 $233 $193 $251

DISCLAIMER

Retiree, annuitant, and survivor contributions for all health plan options will be in accordance with the levels set forth above

in FY25. For future years, the State reserves the right to designate the plan options which constitute the basic program of

health benets and to require additional contributions in accordance with the law for any optional coverage elected by an

annuitant, retiree, or survivor.

* BCBSIL OAP = Blue Cross Blue Shield of Illinois

** CDHP = Consumer Driven Health Plan

*** QCHP = Quality Care Health Plan

FY2025 Benet Choice Options

4

Adding a Dependent

If you add a dependent for the rst time, or re-enroll a dependent during open enrollment, you must provide

the required documentation to complete enrollment no later than June 10, 2024. Failure to provide adequate

documentation by this deadline, will result in dependents not being added to your plan. Note: Any documentation

received after May 31, 2024, may result in a delay of ID cards.

Opt-Out

Full-time employees, retirees, annuitants, and survivors have the option to opt-out of health coverage if they

have other comprehensive coverage provided by an entity other than the Department of Central Management

Services. Be advised that if you have previously opted out, or waived benets, you can re-enroll during the

Benet Choice Period or if you experience a Qualifying Change in Status.

Transition of Care after Health Plan Change

Members and their dependents who elect to change health plans and are then hospitalized prior to July 1, 2024

and discharged on or after July 1, 2024, are involved in an ongoing course of treatment, or have entered the

third trimester of pregnancy, should contact their new plan administrator before July 1, 2024 to coordinate the

transition of services.

State Employees Group Insurance Program

Medicare Requirements

Retirees and survivors must apply for Medicare benets upon turning age 65. If the Social Security

Administration (SSA) determines that the member and/or dependent is eligible for Medicare Part A and/or Part B,

the member and/or dependent is required by the State to enroll in Medicare Parts A and B. Those on a disability

leave are also required to apply for Medicare Part A and B. Once enrolled in Medicare, the member and/or

dependent is required to fax or email the front-side copy of the Medicare identication card to the State of Illinois

Medicare COB Unit (contact information below).

If the SSA determines that a member and/or dependent is not eligible for premium-free Medicare Part A based

on their own work history or the work history of a spouse (current, ex-spouse or deceased) at least 62 years of

age, the member must request a written statement of the Medicare ineligibility from the SSA. Upon receipt, the

written statement must be forwarded to the State of Illinois Medicare COB Unit to avoid a nancial penalty.

For more information regarding the Medicare Advantage Prescription Drug “TRAIL” Program, go to

https://cms.illinois.gov/benets/trail.html, or contact:

State of Illinois Medicare COB Unit

PO Box 19208

Springeld, Illinois 62794-9208

Fax: 217-557-3973

SEGIP 5MyBenets.illinois.gov

HMO Benets

Health Maintenance Organization (HMO) members are required to stay within the health plan provider network.

No out-of-network services are available, other than listed below. Members will need to select a primary care

physician (PCP) from a network of participating providers. The PCP will direct all healthcare services and make

referrals to specialists and hospitalization. Benets are outlined in each plan’s Summary Plan Document (SPD). It

is the member’s responsibility to know and follow the specic requirements of the HMO plan selected. For a copy

of the SPD, contact the plan administrator (see page 12).

HMO Plan Design

Plan Year Out-of-Pocket Maximum $3,000 Individual $6,000 Family

Hospital Services

In-Network Out-of-Network

Emergency Room Services $275 copayment per visit $275 copayment per visit

Inpatient Hospitalization $425 copayment per admission Not covered

Inpatient Alcohol and Substance Abuse $425 copayment per admission Not covered

Inpatient Psychiatric Admission $425 copayment per admission Not covered

Outpatient Surgery $300 copayment per visit Not covered

Skilled Nursing Facility 100% covered Not covered

Diagnostic Lab and X-ray 100% covered Not covered

Complex Imaging (CT/Pet Scans/MRIs) $30 copayment Not covered

Transplant Services

Organ and Tissue

Transplants

$375 copay limited to network transplant facilities as determined by the medical plan administrator.

To assure coverage, the transplant candidate must contact your plan provider prior to beginning

evaluation services.

Professional and Other Services

In-Network Out-of-Network

Preventive Care/Well-Baby/Immunizations 100% covered Not covered

Physician Ofce Visit $30 copayment per visit Not covered

Specialist Ofce Visit $40 copayment per visit Not covered

Telemedicine $10 copayment Not covered

Outpatient Psychiatric and Substance

Abuse

$30 or $40 copayment per visit Not covered

Durable Medical Equipment 80% covered Not covered

Home Health Care $40 copayment per visit Not covered

Complex Imaging (CT/Pet Scans/MRIs) $30 copayment Not covered

Prescription Drugs

Plan Year Pharmacy Deductible – $150 per enrollee Preventive Prescription Drugs – $0

Reduced Tier I * Tier I Tier II Tier III

Copayments (30-day supply) $4.00 $20.00 $35.00 $60.00

Copayments (90-day supply) $10.00 $50.00 $87.50 $150.00

* Applies to specic medications as dened by the plan.

Some HMOs may have benet limitations based on a calendar year.

FY2025 Benet Choice Options

6

Open Access Plan (OAP) Benets

Open Access Plan (OAP) members will have three tiers of providers from which to choose to obtain services.

• Tier I offers a managed care network which provides enhanced benets and operates similar to an HMO.

• Tier II offers an expanded network of providers and is a hybrid plan operating like an HMO and PPO.

• Tier III covers all providers which are not in the managed care networks of Tiers I or II (out-of-network

providers). It is the member’s responsibility to know and follow the specic requirements of the OAP.

Benets are outlined in the plan's Summary Plan Document (SPD). For a copy of the SPD, contact the

plan administrator (see page 12).

Benet Tier I Tier II

Tier III (Out-of-

Network)**

Plan Year Out-of-Pocket Maximum

• Per Individual

• Per Family

$3,000 (includes eligible charges from Tiers I & II combined)

$6,000 (includes eligible charges from Tiers I & II combined)

Not Applicable

Plan Year Deductible (must be

satised for all services)

$0

$300 per enrollee* $400 per enrollee*

Hospital Services (Percentages listed represent how much is covered by the plan)

Emergency Room Services $275 copayment per visit $275 copayment per visit $275 copayment per visit

Inpatient Hospitalization

$425 copayment per admission

90% of network charges after

$475 copayment per admission*

60% of allowable charges after

$575 copayment per admission*

Inpatient Alcohol and

Substance Abuse

$

425

copayment per admission

90% of network charges after

$475 copayment per admission*

60% of allowable charges after

$575 copayment per admission*

Inpatient Psychiatric Admission

$

425

copayment per admission

90% of network charges after

$475 copayment per admission*

60% of allowable charges after

$575 copayment per admission*

Outpatient Surgery $300 copayment per visit

90% of network charges after

$300 copayment*

60% of allowable charges after

$300 copayment*

Skilled Nursing Facility 100% covered 90% of network charges* Not covered

Diagnostic Lab and X-ray 100% covered 90% of network charges* 60% of allowable charges*

Complex Imaging (CT/Pet Scans/MRIs)

$30 copayment 90% of network charges* 60% of allowable charges*

Transplant Services

Organ and Tissue

Transplants

Tier I: 100% covered. Tier II: 90% of network charges. Tier III: Not covered. To assure coverage,

the transplant candidate must contact your plan provider prior to beginning evaluation services.

Professional and Other Services

Preventive Care/Well-Baby

/Immunizations

100% covered 100% covered Not covered

Physician Ofce Visits $30 copayment 90% of network charges* 60% of allowable charges*

Specialist Ofce Visits $40 copayment 90% of network charges* 60% of allowable charges*

Telemedicine $10 copayment Not covered Not covered

Outpatient Psychiatric and

Substance Abuse

$30 or $40 copayment 90% of network charges* 60% of allowable charges*

Durable Medical Equipment 80% of network charges 80% of network charges* 60% of allowable charges*

Home Health Care $40 copayment 90% of network charges* Not covered

Prescription Drugs

Plan Year Pharmacy Deductible – $150 per enrollee Preventive Prescription Drugs – $0

Tier I Tier II Tier III

Copayments (30-day supply) $20.00 $35.00 $60.00

Copayments (90-day supply)*** $50.00 $87.50 $150.00

Maintenance Choice (90-day supply)**** $25.00 $43.75 $75.00

* A plan year deductible must be met before Tier II and Tier III plan benets apply. Benet limits are measured on a plan year basis.

** Using out-of-network services may signicantly increase your out-of-pocket expense. Amounts over the plan’s allowable charges do not count

toward your plan year out-of-pocket maximum; this varies by plan and geographic region.

*** If a member or dependent elects a higher Tier drug where a lower Tier drug is available, the member or dependent is responsible for the higher

copayment plus the difference in cost between the drugs.

**** Medications received at CVS Caremark® Retail Pharmacy or through CVS Caremark® Mail Service Pharmacy.

SEGIP 7MyBenets.illinois.gov

Quality Care Health Plan (QCHP) Benets

Quality Care Health Plan (QCHP) members may choose any physician or hospital for medical services; however,

when receiving services from a QCHP in-network provider, members receive enhanced benets, resulting

in lower out-of-pocket costs. QCHP has a nationwide network of providers through Aetna PPO. Benets are

outlined in the plan’s Summary Plan Document (SPD). It is the member’s responsibility to know and follow the

specic requirements of the QCHP. For a copy of the SPD, contact the plan administrator (see page 12).

Plan Year Maximums and Deductibles

Employee’s Annual Salary (based on each

employee’s annual salary as of March 1st)

Individual Plan

Year Deductible

Family Plan Year

Deductible Cap

$60,700 or less $425 $1,000

$60,701 - $75,900 $525 $1,250

$75,901 and more $575 $1,375

Retiree/Annuitant/Survivor $425 $1,000

Dependents $425 N/A

Out-of-Pocket Maximum Limits

In-Network Individual

$1,750

In-Network Family

$4,375

Out-of-Network Individual

$7,000

Out-of-Network Family

$13,500

Hospital Services (Percentages listed represent how much is covered by the plan)

In-Network Out-of-Network*

Emergency Room Services $450 per visit; Deductible applies $450 per visit; Deductible applies

Inpatient Hospitalization

85% of network charges; Deductible applies

after $200 per admission

60% of allowable charges; Deductible applies

after $800 per admission

Inpatient Alcohol and Substance Abuse

85% of network charges; Deductible applies

after $200 per admission

60% of allowable charges; Deductible applies

after $800 per admission

Inpatient Psychiatric Admission

85% of network charges; Deductible applies

after $200 per admission

60% of allowable charges; Deductible applies

after $800 per admission

Outpatient Surgery 85% of network charges; Deductible applies 60% of allowable charges; Deductible applies

Skilled Nursing Facility 85% of network charges; Deductible applies 60% of allowable charges; Deductible applies

Diagnostic Lab and X-ray 85% of network charges; Deductible applies 60% of allowable charges; Deductible applies

Complex Imaging (CT/Pet Scans/MRIs) 85% of network charges; Deductible applies 60% of allowable charges; Deductible applies

Transplant Services

Organ and Tissue

Transplants

85% after $200 transplant deductible, limited to network transplant facilities as determined by

the medical plan administrator. Benets are not available unless approved by the Notication

Administrator. To assure coverage, contact Aetna prior to beginning evaluation services.

Professional and Other Services

In-Network Out-of-Network*

Preventive Care/Well-Baby/Immunizations 100% covered 60% of allowable charges; Deductible applies

Physician Ofce Visit

85% of network charges; Deductible applies

60% of allowable charges; Deductible applies

Specialist Ofce Visit

85% of network charges; Deductible applies

60% of allowable charges; Deductible applies

Telemedicine

85% of network charges; Deductible applies

Does Not Apply

Outpatient Psychiatric and Substance Abuse

85% of network charges; Deductible applies

60% of allowable charges; Deductible applies

Durable Medical Equipment

85% of network charges; Deductible applies

60% of allowable charges; Deductible applies

Home Health Care

85% of network charges; Deductible applies

60% of allowable charges; Deductible applies

Prescription Drugs

Plan Year Pharmacy Deductible – $175 per enrollee Preventive Prescription Drugs – $0

Tier I Tier II Tier III

Copayments (30-day supply) $20.00 $40.00 $65.00

Copayments (90-day supply) $50.00 $100.00 $162.50

Maintenance Choice (90-day supply)** $25.00 $50.00 $81.25

* Using out-of-network services may signicantly increase your out-of-pocket expense. Amounts over the plan’s allowable charges do

not count toward your plan year out-of-pocket maximum; this varies by plan and geographic region.

** Medications received at CVS Caremark® Retail Pharmacy or through CVS Caremark® Mail Service Pharmacy.

FY2025 Benet Choice Options

8

Consumer Driven Health Plan (CDHP) Benets

This is a high-deductible health plan as dened by the IRS. Consumer Driven Health Plan (CDHP) members

may choose any physician or hospital for medical services; however, when receiving services from a CDHP

in-network provider, members receive enhanced benets, resulting in lower out-of-pocket costs. CDHP has

a nationwide network of providers through Aetna PPO. CDHP is available for active employees only, under

the State Employees’ Group Insurance Program. This plan is not available to retirees. Benets are outlined in

the plan’s Summary Plan Document (SPD). It is the member’s responsibility to know and follow the specic

requirements of the CDHP. For a copy of the SPD, contact the plan administrator (see page 12).

Plan Year Medical Deductibles

In-Network Individual

$1,600

In-Network Family

$3,200

Out-of-Network Individual

$1,600

Out-of-Network Family

$3,200

Out-of-Pocket Maximum Limits

In-Network Individual

$3,000

In-Network Family

$6,000

Out-of-Network Individual

$3,000

Out-of-Network Family

$6,000

Hospital Services (Percentages listed represent how much is covered by the plan)

In-Network Out-of-Network*

Emergency Room Services 90% of coinsurance; Deductible applies 90% of coinsurance; Deductible applies

Inpatient Hospitalization 90% of network charges; Deductible applies 65% of allowable charges; Deductible applies

Inpatient Alcohol and Substance Abuse 90% of network charges; Deductible applies 65% of allowable charges; Deductible applies

Inpatient Psychiatric Admission 90% of network charges; Deductible applies 65% of allowable charges; Deductible applies

Outpatient Surgery 90% of network charges; Deductible applies 65% of allowable charges; Deductible applies

Skilled Nursing Facility 90% of network charges; Deductible applies 65% of allowable charges; Deductible applies

Diagnostic Lab and X-ray 90% of network charges; Deductible applies 65% of allowable charges; Deductible applies

Complex Imaging (CT/Pet Scans/MRIs) 90% of network charges; Deductible applies 65% of allowable charges; Deductible applies

Transplant Services

Organ and Tissue

Transplants

90% after plan year deductible, limited to network transplant facilities as determined by the medical

plan administrator. Not covered out-of-network. Benets are not available unless approved by the

Notication Administrator. To assure coverage, contact Aetna prior to beginning evaluation services.

Professional and Other Services

In-Network Out-of-Network*

Preventive Care/Well-Baby/Immunizations 100% covered 65% of allowable charges; Deductible applies

Preventive Services (IRS-allowed)**

90% of network charges; No Deductible

65% of allowable charges; Deductible applies

Physician Ofce Visit

90% of network charges; Deductible applies

65% of allowable charges; Deductible applies

Specialist Ofce Visit

90% of network charges; Deductible applies

65% of allowable charges; Deductible applies

Telemedicine

90% of network charges; Deductible applies

Does Not Apply

Outpatient Psychiatric and Substance Abuse

90% of network charges; Deductible applies

65% of allowable charges; Deductible applies

Durable Medical Equipment

90% of network charges; Deductible applies

65% of allowable charges; Deductible applies

Complex Imaging (CT/Pet Scans/MRIs)

90% of network charges; Deductible applies

65% of allowable charges; Deductible applies

Prescription Drugs

Preventive Prescription Drugs – $0 Preventive Prescription Drugs (IRS-allowed) **

90% covered; No Deductible

Tier I Tier II Tier III

Copayments (30-day supply) 90%; Deductible Applies 90%; Deductible Applies 90%; Deductible Applies

Copayments (90-day supply) 90%; Deductible Applies 90%; Deductible Applies 90%; Deductible Applies

Maintenance Choice (90-day supply)*** 95%; Deductible Applies 95%; Deductible Applies 95%; Deductible Applies

* Using out-of-network services may signicantly increase your out-of-pocket expense. Amounts over the plan’s allowable charges do

not count toward your plan year out-of-pocket maximum; this varies by plan and geographic region.

** Contact Aetna for IRS-allowed services and prescriptions.

*** Medications received at CVS Caremark® Retail Pharmacy or through CVS Caremark® Mail Service Pharmacy.

SEGIP 9MyBenets.illinois.gov

Health Savings Accounts (HSA) for Active State Employees -

Companion to CDHP Enrollment ONLY

EMPLOYEE CONTRIBUTION MUST BE RE-ELECTED EACH PLAN YEAR

An HSA is like a 401(k) for healthcare, yet the HSA tax benets are far greater. Administered by Optum Financial,

the HSA is a tax-favored, interest-bearing account that active State employees can use to pay for qualied

medical expenses now, or in the future. Active State employees who qualify (see Qualifying for an HSA below),

can save, or invest the account funds. Paired with the Consumer Driven Health Plan (CDHP), an HSA is a

powerful nancial tool that gives you more control of your healthcare decisions.

The State will contribute a third of the deductible to an active State employee's HSA. Maximum HSA

contributions (Employer + Employee) for FY25 will be:

• Be covered under a high-deductible health plan.

• Have no other health coverage (except what is

permitted under Other health coverage:

https://www.irs.gov/publications/p969#en_

US_2019_publink1000204039)

• Not be enrolled in Medicare. This includes Part A.

• Not be claimed as a dependent on someone

else’s tax return.

Qualifying for an HSA

To be an eligible individual and qualify for an HSA, you must:

You cannot be enrolled in BOTH an HSA and MCAP Flexible Spending Account.

Contributions to your HSA can be made through pre-tax payroll deductions or post-tax direct payment. Active

State employees can make tax-free withdrawals to pay for qualied medical expenses, for you and your eligible

dependents. HSAs are portable and all contributions rollover to the next plan year. If the employee invests

HSA funds, those funds remain in the investment account. HSAs may be used for future healthcare expenses

including out-of-pocket expenses after retirement, Medicare, and long-term care (LTC) premiums, up to IRS limits

and certain LTC expenses. There are no income limitations.

Under Age 55

Individual Family

Employer Contribution = $533.34 $1,066.68

Employee Contribution = $3,616.66 $7,233.32

Max IRS Allowed Contribution =

$4,150 $8,300

Aged 55 and older

Individual Family

Employer Contribution = $533.34 $1,066.68

Employee Contribution = $4,616.66 $8,233.32

Max IRS Allowed Contribution =

$5,150 $9,300

Medical Care Assistance Program (MCAP) - Companion to your

HMO, OAP, QCHP, or CDHP (if not enrolled in an HSA)

EMPLOYEES MUST RE-ENROLL EACH PLAN YEAR

The MCAP maximum contribution limit is $3,200 for the FY25 plan year period. Funds must be used within the

plan year, July 1, 2024 – June 30, 2025, and all claims must be submitted by September 30, 2025. The rollover

of unused FY25 funds will be capped at $640.00. Participants who do not re-enroll for the new plan year will

forfeit any amount eligible for rollover.

Dependent Care (Day Care) Assistance Program (DCAP)

DCAP is an account that allows you to set aside pre-tax contributions per pay period to pay for dependent care

(Day Care) expenses, for children aged 12 and under, or care for a physically or mentally disabled dependent.

DCAP cannot be used for dependent medical expenses or for children for which you are not considered the

primary or custodial parent. The DCAP maximum contribution limit is $5,000 for the FY25 plan year period. Any

unused DCAP funds at the end of the plan year will be forfeited.

FY2025 Benet Choice Options

10

Vision

Vision coverage is provided at no cost to all members enrolled in a State health plan and is administered by EyeMed.

All enrolled members and dependents receive the same vision coverage regardless of the health plan selected.

Service In-Network Out-of-Network** Benet Frequency

Eye Exam $30 copayment $30 allowance Once every 12 months

Standard Frames $30 copayment

(up to $175 retail

frame cost; member responsible

for balance over $175)

$70 allowance Once every 24 months

Vision Lenses* (single, bifocal

and trifocal)

$30 copayment $50 allowance for

single

vision lenses. $80 allowance

for bifocal and trifocal lenses

Once every 12 months

Contact Lenses

(All contact

lenses are in lieu of vision lenses)

$120 allowance $120 allowance Once every 12 months

* Vision Lenses: Member pays all optional lens enhancement charges. In-network providers may offer additional discounts on lens

enhancements and multiple pair purchases.

** Out-of-network claims must be led within one year from the date of service.

Dental

Employees have the option to enroll in Dental Only coverage. However, if you enroll in health coverage and

choose dental coverage, dependents must mirror the coverage of the member.

The State’s Quality Care Dental Plan (QCDP) offers a comprehensive range of benets and is available to all members

and is administered by Delta Dental of Illinois. Visit MyBenets.illinois.gov for a Dental Schedule of Benets.

Deductible and Plan Year Maximum

Plan year deductible for preventive services N/A

Plan year deductible for all other covered services $175

Plan Year Maximum Benet (Orthodontics + All Other Covered Expenses = Maximum Benet)

In-network plan year maximum benet $2,500

Out-of-network plan year maximum benet $2,000

It is strongly recommended that plan members obtain a pretreatment estimate through Delta Dental for any service more than $200. Failure

to obtain a pretreatment estimate may result in unanticipated out-of-pocket costs.

Child Orthodontia Benet

Length of Orthodontia Treatment* Maximum Benet

In-Network Out-of-Network

0 - 36 Months $2,000 $1,500

0 - 18 Months $1,820 $1,364

0 - 12 Months $1,040 $780

Member Monthly Quality Care Dental Plan (QCDP) Contributions**

Member Only Member + 1 Dependent Member + 2 or More Dependents

$15.00 $25.00 $27.50

* Orthodontia Treatments must start prior to age 19.

** Part-time employees are required to pay a percentage of the State’s portion of the contribution in addition to the member contribution.

Special rules apply for non-IRS dependents (see MyBenets.illinois.gov for more information).

SEGIP 11MyBenets.illinois.gov

Member Optional Life coverage is provided at a cost

to all active employees, retirees, and annuitants.

• For active employees, and retirees and

annuitants under age 60 – coverage is available

up to 8 times their Basic Life amount.

• For retirees and annuitants aged 60 or older –

coverage is available up to 4 times their Basic

Life amount.

The maximum benet allowed for Member Optional

Life plus Basic Life is $3,000,000. Rate changes due to

age will be effective the rst pay-period following the

member’s birthday.

Optional Term Life Rate

Member Age Monthly Rate Per $1,000

Under 30 $0.03

30-39 $0.05

40-44 $0.09

45-49 $0.12

50-54 $0.19

55-59 $0.36

60-64 $0.56

65-69 $1.26

70 and Over $2.06

Accidental Death & Dismemberment (AD&D)

coverage is available to eligible members in an

amount equal to either their Basic Life amount or the

combined amount of their Basic and Member Optional

Life. This coverage is subject to a total maximum of 5

times the Basic Life amount or $3,000,000, whichever

is less.

AD&D Monthly Rate per $1,000

$0.02

Beneciary Elections

Don’t forget to elect your beneciaries at

metlife.com/stateollinois/ and make the appropriate

updates when necessary to ensure that your Life

Insurance benet is paid out according to your

wishes. Remember, you may also have death benets

through various state-sponsored programs, each

having a separate beneciary form, including Life

Insurance, retirement benets, and the Deferred

Compensation Program.

Spouse life coverage is available in a lump sum

amount of $10,000 for:

• The spouse of an active employee.

• The spouse, under age 60, of a retiree or an

annuitant.

A spouse, aged 60 and older, of a retiree or an

annuitant, will have coverage available in the amount

of $5,000. Rate changes due to age will be effective

the rst day of the pay period following the spouse’s

birthday.

Spouse Life Monthly Rates

Spouse Life $10,000 Coverage

(Members, retirees, and annuitants under

aged 60)

$5.70

Spouse Life $5,000 Coverage

(Retirees and annuitants aged 60 and older)

$2.85

Child life coverage is available in a lump sum amount

of $10,000 per child. The monthly contribution applies

to all dependent children regardless of the number

of children enrolled. Eligible children include children

aged 25 and under or, children in the disabled

category.

Child Life Monthly Rate

Child Life $10,000 Coverage

$0.60

Underwriting

A Statement of Health (SOH) is required for members

to add/increase optional life or to add Spouse Life

(unless you are a new hire, or this is a newly acquired

spouse/civil union partner). A Statement of Health is

not needed to add Child Life coverage or AD&D.

Life Insurance

Basic Life Insurance coverage is provided by MetLife at no cost to all active employees, retirees, and annuitants

through the State Employees Group Insurance Program.

• Active employees, retirees, and annuitants under the age of 60, receive a

benet amount equal to their annual salary.

• Retirees and annuitants, age 60 or older, receive a $5,000 benet.

FY2025 Benet Choice Options

12

Contacts

Purpose

Administrator Name and Address

Phone Website

Enrollment MyBenets – MyBenets Service Center (MBSC)

134 N. LaSalle Street, Suite 2200, Chicago, IL 60602

844-251-1777

844-251-1778 (TDD/TTY)

mybenets.illinois.gov

Health Plan Aetna HMO (Group Number 285654)

Aetna OAP (Group Number 285650)

Consumer Driven Health Plan (CDHP) - Aetna PPO

(Group Number 285658)

Quality Care Health Plan (QCHP) - Aetna PPO

(Group Number 285658)

Address for all Aetna Plans:

PO Box 981106, El Paso, TX 79998-1106

855-339-9731

800-628-3323 (TDD/TTY)

Fax: 859-455-8650 Attn: Claims

aetnastateollinois.com

BlueAdvantage HMO (Group Number B06800)

HMO Illinois (Group Number H06800)

Blue Cross Blue Shield OAP (Group Number 263995)

Address for all Blue Cross Plans:

PO Box 805107, Chicago, IL 60680-4112

800-868-9520

866-876-2194 (TDD/TTY)

855-810-6537

bcbsil.com/stateollinois

Health Alliance Medical Plans HMO

(Group Number 2001688)

3310 Fields South Drive, Champaign, IL 61822

800-851-3379

800-526-0844 (TDD/TTY

healthalliance.org/stateollinois

HealthLink OAP (Group Number 160000)

PO Box 419104, St. Louis, MO 63141-9104

877-379-5802

877-232-8388 (TDD/TTY)

healthlink.com/soi/learn-more

Prescription Drug Plan CVS Caremark® (for QCHP, CDHP, or OAP Plans)

Group Numbers: (QCHP 1400SD3)

(CDHP 1400SD9)

(Aetna OAP 1400SCH)

(BCBSIL OAP 1400SCJ)

(HealthLink OAP 1400SCF)

Paper Claims: CVS Caremark®

PO Box 52136, Phoenix, AZ 85072-2136

Mail Order Rx: CVS Caremark®

PO Box 94467, Palatine, IL 60094-4467

877-232-8128

800-231-4403 (TDD/TTY)

caremark.com

Vision Plan EyeMed Out-of-Network Claims

PO Box 8504, Mason, OH 45040-7111

866-723-0512

TTY users, call 711

eyemedvisioncare.com/stil

Dental Plan Delta Dental of Illinois (Group Number 20240)

PO Box 5402, Lisle, IL 60532

800-323-1743

800-526-0844 (TDD/TTY)

soi.deltadentalil.com

Life Insurance

MetLife Insurance Company, Group Life Claims

PO Box

6100, Scranton, PA 18505

800-880-6394

TTY users, call 711

metlife.com/stateollinois

Flexible Spending

Accounts (FSA) and

Health Savings

Accounts (HSA)

Optum Financial

PO Box 622317, Orlando, FL 32862-2317

888-469-3363

800-526-0844 (TDD/TTY)

443-681-4602 (fax)

Optumnancial.com

Commuter Savings Program

(CSP)

Edenred Benets Claims Administrator

265 Winter Street, 3rd Floor, Waltham, MA 02451

888-235-9223

844-878-0594 (TDD/TTY)

login.commuterbenets.com/

Employee Assistance

Program (EAP)

ComPsych Corporation

455 N. Cityfront Plaza Drive, Chicago, IL 60611

833-955-3400

800-697-0353 (TDD/TTY)

guidanceresources.com

ComPsych Member Web ID Code:

StateofIllinois

Personal Support Program

(PSP – AFSCME EAP)

AFSCME Council 31

205 N Michigan 2100, Chicago, IL 60601

800-647-8776 (statewide)

800-526-0844 (TDD/TTY)

afscme31.org

State Employees’

Retirement System

2101 South Veterans Parkway

PO Box 19255, Springeld, IL 62794-9255

217-785-7444

866-321-7625 (TDD/TTY)

srs.illinois.gov

State Universities

Retirement System

1901 Fox Drive, Champaign, IL 61820 800-275-7877

800-526-0844 (TDD/TTY)

217-378-8800 (dial direct)

217-378-9800 (fax)

surs.org

Teachers’ Retirement

System (TRS)

2815 West Washington Street

PO Box 19253, Springeld, IL 62794-9253

877-927-5877

(877-9-ASK-TRS)

866-326-0087 (TDD/TTY)

trsil.org

CMS Bureau of Benets

Group Insurance

PO Box 19208, Springeld, IL 62794-9208 800-442-1300

800-526-0844 (TDD/TTY)

benetschoice.il.gov

MyBenets.illinois.gov SEGIP 13

Federally Required Notices

Notice of Creditable Coverage

Prescription Drug information for State of Illinois Medicare-eligible Plan Participants

This Notice conrms that the State Employees Group Insurance Program (SEGIP) has determined that the

prescription drug coverage it provides is Creditable Coverage. This means that the prescription coverage offered

through SEGIP is, on average, as good as, or better than the standard Medicare prescription drug coverage

(Medicare Part D). You can keep your existing group prescription coverage and choose not to enroll in a

Medicare Part D plan.

Because your existing coverage is Creditable Coverage, you will not be penalized if you later decide to enroll in

a Medicare prescription drug plan. However, you must remember that if you drop your coverage through SEGIP

and experience a continuous period of 63 days or longer without Creditable Coverage, you may be penalized

if you enroll in a Medicare Part D plan later. If you choose to drop your SEGIP coverage, the Medicare Special

Enrollment Period for enrollment into a Medicare Part D plan is two months after your SEGIP coverage ends.

If you keep your existing group coverage through SEGIP, it is not necessary to join a Medicare prescription drug

plan this year. Plan participants who decide to enroll in a Medicare prescription drug plan may need to provide a

copy of the Notice of Creditable Coverage to enroll in the Medicare prescription plan without a nancial penalty.

Participants may obtain a Benets Conrmation Statement as a Notice of Creditable Coverage by contacting the

MyBenets Service Center (toll-free) 844-251-1777, or 844-251-1778 (TDD/TTY).

Summary of Benets and Coverage (SBC) and Glossary

Under the Affordable Care Act, health insurance issuers and group health plans are required to provide you with

an easy-to-understand summary about a health plan’s benets and coverage. The summary is designed to help

you better understand and evaluate your health insurance choices.

The forms include a short, plain language Summary of Benets and Coverage (SBC) and a glossary of terms

commonly used in health insurance coverage, such as “deductible” and “copayment.”

All insurance companies and group health plans must use the same standard SBC form to help you compare

health plans. The SBC form also includes details, called “coverage examples,” which are comparison tools that

allow you to see what the plan would generally cover in two common medical situations. You have the right to

receive the SBC when shopping for, or enrolling in coverage, or if you request a copy from your issuer or group

health plan. You may also request a paper copy of the SBCs and glossary of terms from your health insurance

company or group health plan. All State health plan SBCs are available on MyBenets.illinois.gov.

Notice of Privacy Practices

The Notice of Privacy Practices will be updated at MyBenets.illinois.gov, effective July 1, 2024. You have a right

to obtain a paper copy of this Notice, even if you originally obtained the Notice electronically. We are required to

abide by the terms of the Notice currently in effect; however, we may change this Notice. If we materially change

this Notice, we will post the revised Notice on our website at MyBenets.illinois.gov.

Printed by the Authority of the State of Illinois. SEGIP WebADA 042924 IOCI 23-0840

Illinois Department of

Central Management Services

Bureau of Benets

PO Box 19208

Springeld, IL 62794-9208

PRSRT STD

U.S. POSTAGE

PAID

SPRINGFIELD, IL

PERMIT NO. 489

Benet Choice Fairs

CMS Sponsored Benet Choice Open Enrollment Member Fairs are scheduled from 9:00 am to 4:00 pm with three

identical presentations given at 10:00 am, 12:00 pm and 3:00 pm, with time for questions to be addressed. Events are

open to all active and retired members not enrolled in a Medicare Advantage Prescription Drug (MAPD) Plan. CMS

representatives, as well as benet vendors, available in your area, will be present during the fairs to answer questions.

Date Agency/Location Address

Weds. May 1, 2024 IL State Library 300 S. 2nd Street, 403/404 Rooms and Atrium, Springeld, IL 62701

Fri. May 3, 2024 UIUC-iHotel and Conf Center 1900 S. 1st St, Quad Room and Technology Room, Champaign, IL 61820

Mon. May 6, 2024 Governor State University One University Parkway, Engbertson Hall and Hall of Honors, University Park, IL 60484

Tues. May 7, 2024 CMS-Chicago-Downtown 555 W. Monroe, Lincoln and Peoria Conf. Rooms, Chicago, IL 60661

Weds. May 8, 2024 NIU DeKalb 340 Carroll Avenue, Holmes Student Center, DeKalb, IL 60115

Thurs. May 9, 2024 IDOT District 1 Headquarters 201 W. Center Court, Schaumburg, IL 60196

Fri. May 10, 2024 UIC Student Center East 750 S Halsted St, Cardinal Room and Ft Dearborn Room, Chicago, IL 60607

Mon. May 13, 2024 IDOT Springeld 2300 South Dirksen Parkway, Auditorium, Springeld, IL 62764

Tue. May 14, 2024 ISU 100 N. University St, Prairie Room, Normal, IL 61790

Weds. May 15, 2024 NEIU 5500 N St Louis Ave, FA Building Room 202 and Cafeteria 01A Chicago, IL 60625

Thur. May 16, 2024 WIU Moline 3300 River Drive, W Riverfront Hall Rm 102/103/104, Moline, IL 61265

Fri. May 17, 2024 WIU Macomb

1 University Circle, University Union is on Murray Street, located in building 4N, Macomb, IL 61455

Mon. May 20, 2024 IDOT District 8 1102 Eastport Plaza Drive, Collinsville, IL 62234

Tues. May 21, 2024 SIU Carbondale 1255 Lincoln Drive, Student Center, Ballroom B and Corker Lounge, Carbondale, IL 62901

Weds. May 22, 2024 EIU Charleston 1720 7th. St, MLK Student Union Bldg, Charleston, IL 61920

Thur. May 23, 2024 IDOT Springeld 2300 South Dirksen Parkway, Auditorium, Springeld, IL 62764

To view a recorded version of the Member Fair presentation, click here:

https://cms.illinois.gov/benets/benet-choice-fairs.html