CITY OF SANTA FE

AFFORDABLE

HOUSING PLAN

Prepared for:

New Mexico Mortgage Finance Authority

344 4

th

Street SW

Albuquerque, NM 87102

Prepared by:

The City of Santa Fe

Office of Affordable Housing

PO Box 909

Santa Fe, NM 87504-0909

BBC Research &Consulting

1999 Broadway, Suite 2200

Denver, CO 80202-9750

FINAL DRAFT-REVISED December 2016

TABLE OF CONTENTS

I. Executive Summary i

II. Introduction 1

New Mexico Affordable Housing Act 1

Purpose of the Plan 1

Methodology 1

III. Community Profile 2

Top Trends 2011 to 2014 2

Demographic Profile 3

Housing Stock and Characteristics 9

Affordable Housing Inventory 13

IV. Land Use and Policy Review 19

Introduction ................................................................................................................... 19

Land Use Code ................................................................................................................... 20

Other Best Practices .............................................................................................................. 25

Historic Preservation ............................................................................................................. 27

Development Fees and Review Process ................................................................................ 29

Santa Fe General Plan ............................................................................................................ 30

Housing and Transportation Affordability ............................................................................. 31

Affordable Housing Policies ................................................................................................... 33

Conclusion: Barriers to Affordable Development ................................................................. 34

V. Housing Development Feasibility Analysis ................................................................. 35

Single Family Housing Development...................................................................................... 35

Multi-Family Housing Development ..................................................................................... 36

Analysis of Current Zoning to Support Affordable Housing ................................................... 38

Sites Analysis ......................................................................................................................... 39

VI. Housing Needs Analysis .......................................................................................... 42

Update from 2013 Needs Analysis 42

Gaps Analysis 48

Existing and Projected Housing Needs

51

VII. Goals and Recommendations .................................................................................. 54

Appendices

Appendix A: Funding Sources for Affordable Housing

Appendix B: SFCC Chapter XXVI (City of Santa Fe Code)

Appendix C: 2013 Housing Needs Assessment

LIST OF FIGURES

Figure 1. Population and Households, City of Santa Fe, 2000 to 2014

Figure 2. Race and Ethnicity, City of Santa Fe, 2000 through 2014

Figure 3. Age Distribution, City of Santa Fe, 2000, 2007, 2010 and 2014

Figure 4. Change in Population by Age, 2000 to 2010 and 2010 to 2014

Figure 5. Reason for Moving Out of the City of Santa Fe

Figure 6. Household by Tenure, City of Santa Fe, 2000, 2007, 2010 and 2014

Figure 7. Median Household Income by Tenure, City of Santa Fe 1999, 2006, 2010 and 2014

Figure 8. Poverty by Age, City of Santa Fe, Santa Fe County and New Mexico, 2014

Figure 9. Employment, Santa Fe MSA 2001 to 2013

Figure 10. Employment by Industry, Santa Fe MSA, Q3 2011 and Q4 2013

Figure 11. Household Trends, City of Santa Fe, 2000 to 2014

Figure 12. Inventory of Subsidized Rental Units

Figure 13. City of Santa Fe Zoning Districts

Figure 14. Permitted Uses by District, City of Santa Fe

Figure 15. Dimensional Standards for Residential Districts

Figure 16. City of Santa Fe Historic Districts

Figure 17.

Housing and Transportation Costs as a % of Income

Figure 18.

AMI and Affordability in Santa Fe County – 2016

Figure 19. Single Family Development Feasibility Analysis

Figure 20. Multi-Family Development Feasibility Analysis

Figure 21. Analysis of City Zoning Districts

Figure 22.

SUMMARY Sites Analysis

Figure 23.

Median Home Value, City of Santa Fe, 2000 to 2014

Figure 24 Median Sale Price of Single Family Homes, City of Santa Fe, by Quarter, 2000 - Q2 2015

Figure 25. Median Sale Price of Condominiums, City of Santa Fe, 2000 through Q2 2015

Figure 26. Residential Affordability, City of Santa Fe, 2000 to 2014

Figure 27. Median Contract Rent, City of Santa Fe, 2000 through 2014

Figure 28. Average Rent by Unit Type, City of Santa Fe, 2004 through 2014

Figure 29. AMI Distribution of Rents, City of Santa Fe, 2011 and 2014

Figure 30. Vacancy Rates, City of Santa Fe, 2005 through 2014

Figure 31. Vacancy Rates by Unit Type, City of Santa Fe, 2005 through 2014

Figure 32. Rental Market Mismatch, City of Santa Fe, 2014

Figure 33. Renters’ Ability to Buy, City of Santa Fe, 1999/2000–2014

Figure 34. Ownership Gaps for Renters Who May Wish to Buy, City of Santa Fe, 2014

Figure 35. Poverty, Housing Problems and Special Needs Populations, City of Santa Fe, 2014

Figure 36. Existing and Projected Housing Needs, City of Santa Fe, 2014

Figure 37. Spectrum of Housing Need

Figure 38. City of Santa Fe Housing Production Plan – Five Year Production Goals

Figure 39. Affordable Housing Goals and Outcomes (Consolidated Plan)

Figure 40. Recommendations for Funding to Support Housing

Figure 41. Recommendations for Increasing Capacity to Provide Housing

Figure 42. Recommendations for Program Development

Figure 43. Recommendations for Real Estate Development

Figure 44. Recommendations for Regulatory Environment

I. Executive Summary

The purpose of the City of Santa Fe Affordable Housing Plan is to assess housing need in Santa Fe

and to provide recommendations for addressing the needs. This study is required by the New

Mexico Mortgage Finance Authority and must be in compliance with the New Mexico Affordable

Housing Act, the enabling legislation that exempts affordable housing from the Anti Donation

clause of the New Mexico State Constitution. Under the Act’s rules, it identifies specific

requirements to ensure that governmental entities donate resources to qualifying grantees

under terms that ensure long-term affordability.

This plan provides a community profile, establishes housing needs and identifies gaps in existing

inventory and services, and provides objectives for future programming, funding and capacity

building in order to achieve housing goals. It is required as a condition to receiving financial

assistance and to qualify the city for other housing benefits, including consideration for Low

Income Housing Tax Credits. Lastly, this plan serves to inform other housing studies as required

by HUD, including the Analysis of Impediments to Fair Housing and its successor, the

Assessment of Fair Housing, The analysis is organized by the categories described below with a

summary of the findings and recommendations.

Community Profile

This section describes demographic trends in the City of Santa Fe, with an emphasis on how the

city has changed since the 2013 Housing Needs Assessment (2013 HNA).

Most of Santa Fe’s population growth between 2011 and 2014 can be attributed to the

annexation of approximately 13,000 residents. Population growth excluding the annexation

was about 0.8 percent per year.

Santa Fe’s senior population increased from 18 percent of the total population in 2010 to 20

percent in 2014, primarily due to Baby Boomers aging into the 65 and over cohort from the

45 to 64 cohort.

Median household income increased by 12 percent between 2010 and 2014—from $44,090

to $49,380. Renters experienced a 24 percent income increase (from $28,240 to $34,945)

and owners experienced a 7 percent increase (from $58,467 to $62,727).

The increase in renter incomes is a departure from previous trends and a phenomenon

seen in other desirable cities. (Median renter incomes increased in the state and nation

overall, but not at the same rate as in Santa Fe—8% in New Mexico and 12% in the U.S.). It

is unclear if this is a result of rising wages for renters or an in-migration of higher income

renters and displacement of lower income renters. As shown in Figure 18, the income

distribution of renters has shifted dramatically since 2011: proportionately fewer renters

earn between 30 and 50 percent of the Area Median Income (AMI) and more earn more

than 100 percent of the AMI.

The median home value declined by 8.5 percent between 2011 and 2014, increasing

ownership affordability for city residents. In 2014, one-quarter of renters could afford the

median value home, up from 14 percent in 2011.

Overall affordability has improved for Santa Fe residents since 2011, due to increasing

incomes and stable home prices. However, the rental gaps analysis reveals a persistent

CITY OF SANTA FE HOUSING PLAN EXECUTIVE SUMMARY, PAGE I

shortage 2,435 rental units priced below $625 per month. This compares to 3,074 in 2011.

The smaller gap in 2014 is primarily due to increasing renter incomes.

Rental affordability is a particular challenge for the 47 percent of renters earning less than

50 percent of AMI due to mismatch of supply and demand of units priced in that

affordability range (28% of units compared to 47% of renters).

Land Use and Policy Review

Though this review did not reveal any severe barriers to affordable development in the land use

code, General Plan or housing policies, the analysis did reveal several things the City of Santa Fe

could improve to help foster affordable development:

Increase the current low density limits for multifamily residential construction in high

density residential zones. If that is not possible, provide height bonus as an affordable

development incentive;

Add an intent to comply with state and federal fair housing laws and regulations in the

general code purpose statement or in the residential district purpose statement;

Provide exemptions for affordable housing to nonconforming structure requirements; and

Provide assistance to homeowners living in historic district with necessary repairs either

through existing homeowner programs or through a new program designed specifically for

such a purpose.

Housing Development Feasibility Analysis

Analysis of housing development and affordability is predicated by the payment capacity of

potential low- and moderate-income buyers or renters. Affordability as a function of area

median income is the starting point for analysis of housing development scenarios. By

comparing development costs across varying densities with pricing and the ability of

homebuyers and renters to cover their housing payment only using 30% or less of their

income, two development scenarios were provided:

Single Family Housing Development. The conclusion is that without any subsidy to bring

down costs, only homebuyers at 100%AMI can afford to buy a home when densities are at

least 8 DU/acre

. Homebuyer subsidy is needed at all income levels and in every development

scenario for those homebuyers at 80% AMI and below. Only the homebuyers at 100% AMI

and above can afford the sales price of homes in the medium and higher density subdivisions.

No buyers can afford homes in 1DU/acre zoning.

Multi-Family Housing Development. The conclusion is that only those renters at

80%AMI and above can reliably afford market rents. At medium densities, if rents are based

on carrying cost, then renters at 60%AMI and above can afford rents. Even with substantial

cost reductions, renters at 30%AMI can’t afford rents in any scenario. While higher densities

reduce per unit carrying cost which could be translated into lower rents, it is highly unlikely in

a rental market with 3% vacancy that a property owner wouldn’t charge the highest rent that

the market will bear.

Analysis of Current Zoning to Support Affordable Housing Development. When the

City’s current zoning map is analyzed, the amount of land that is zoned at densities to support

CITY OF SANTA FE HOUSING PLAN EXECUTIVE SUMMARY, PAGE II

affordable housing is simply not adequate. In the City of Santa Fe, approximately 27,450 acres

are residentially zoned, both undeveloped and developed. Of this total, 78% is zoned at densities

of 5 DU/acre and below. As illustrated in the analysis, this zoning density cannot support

affordable housing without substantial subsidy or reduction in market rate costs. Sixteen

percent (16%) of residential zoning can support affordable homeownership, while only 5% of

residential zoning can support affordable multi-family zoning. An additional 1% has the

potential to support affordable housing, however, affordability is only likely in the Mobile Home

Park zoning.

Housing Needs Analysis

The analysis in this section examines housing need across all income levels to identify

mismatches in supply and demand for all households in Santa Fe. It reports the results of a

modeling effort called a gaps analysis, which compares the demand for and supply of housing

by income level. Instead of estimating the type of housing each household in the city would

prefer, income is used as a proxy, as income is the most important factor in accessing housing.

The gaps analysis shows the following:

The greatest need in Santa Fe’s market is for rental units priced between $375 and $500 per

month, serving renters earning between $15,000 and $20,000 per year. In this income

range, there is a current shortage of 800 rental units, up from 715 in 2011.

The rental gap for households earning $20,000 to $25,000 also increased between 2011

and 2014—from 169 to 444. However, the cumulative rental gap, for all households earning

less than $25,000 declined from 3,074 in 2011 to 2,435 in 2014.

The gaps model estimates that as many as 2,435 renters earning $25,000 and less cannot

find affordable units and, as such, are cost burdened. Most of these renters earn less than

$20,000.

The median home value declined by 8.5 percent between 2011 and 2014, increasing

ownership affordability for some city residents. In 2014 nearly one-quarter of renters could

afford the median value home, up from 14 percent in 2011. This increase in

homeownership affordability is also a result of renters’ incomes increasing since 2011.

Over 400 homes are in substandard condition (incomplete kitchen/plumbing facilities) and

are in probable need of rehabilitation.

Goals and Recommendations

The needs identified above are likely to be met by a combination of efforts by non-profits,

market offerings and public investments by the City of Santa Fe. The city’s current goals to

address affordable housing needs identified in the city's most recent Consolidated Plan and in

the 2015-2016 CAPER aim to support over 200 households per year: 124 (long term rental

assistance); 57 (short term rental assistance), 31 (downpayment assistance loans) and 14 (home

improvement grants/loans). If these goals are applied to the needs identified above, over the

next five years the City of Santa Fe would be able to assist 875 low income renters. The city

would also support increased homeownership opportunities with downpayment assistance

loans for 150 current renters and would assist over 40 current homeowners with necessary

repairs through home improvement loans.

CITY OF SANTA FE HOUSING PLAN EXECUTIVE SUMMARY, PAGE III

Recommendations. The following recommendations are thus organized to meet the housing

needs discussed above and correlated with the goals identified in the City’s Consolidated Plan.

The analysis of demographic, economic and housing data provides a basis for determining need

by income level and housing type. Five organizing principles are considered:

• Funding to Support Housing

• Capacity to Provide Housing

• Program Development

• Real Estate Development

• Regulatory Environment

Funding to Support Housing Services. The biggest challenge for the City of Santa Fe over

the next five years will be to continue to address the increasing demands of housing needs with

limited financial resources. Therefore, the funding policy recommendation that spans all housing

needs is for the City to establish a permanent funding mechanism to support affordable housing

that is not dependent on local budgeting processes or federal programs. Recommendations are

as follows:

• Continue support for street outreach and other linkage services for youth, veterans,

those with disabilities, and families experiencing homelessness.

• Continue funding for human services, and children and youth programs that focus on

expanding educational, life skills, and job training opportunities.

• Identify and dedicate a funding stream to support a short-term, rental assistance

program based on Rapid Rehousing to stabilize those in precarious housing situations.

• Continue supporting the use of federal funds for tenant-based and project-based rental

assistance.

• Identify a funding stream to support a landlord/tenant counseling service that is free of

charge, bi-lingual, and locally accessible.

• Continue to provide financial support for foreclosure prevention programs.

• Continue allocating city-controlled resources for downpayment assistance, energy

efficiency improvements, and home repair.

• Continue supporting administrative contracts with housing providers for

homebuyer/owner support services.

Capacity to Provide Housing. The City’s philosophy is to help build the capacity of

community-based service providers, rather than to increase the size of its bureaucracy. One

recommendation that spans all housing needs relative to building capacity is for the City to

convene a time-limited task force to drive implementation of this housing plan once it’s adopted.

Through this process, the task force would identify other solutions to address gaps in the current

affordable housing landscape, particularly the lack of affordable rental housing production, with

the end goal of providing strategic and actionable policy and program initiatives.

• Continue support for the work of nonprofit service providers on an administrative level

so that they can use City funds to leverage private and other governmental funds.

• Support efforts of the New Mexico Coalition to End Homelessness through participation

in a coordinated services network and linking homeless to appropriate services.

• Participate in coordinated efforts such as the proposed One-Door Homeless campus

and/or the Supportive Housing Toolkit.

CITY OF SANTA FE HOUSING PLAN EXECUTIVE SUMMARY, PAGE IV

• Coordinate the provision of services, including the development of a shared resource

database that provides referral information for those seeking services as well as listing

information for homes that are for rent or sale.

Program Development. The City supports highly effective homebuyer/owner services,

delivered through its nonprofit partners. However, the needs of very low income renters,

especially those who are housed, if precariously, are not well-addressed.

• Support a coordinated services delivery system to ensure that homeless who seek

shelter or housing have access to support services.

• Re-instate tenant-based rental assistance that is short-term without restrictions to keep

housed those renters who are in danger of becoming homeless and/or are in arrears

with rent and utility payments or need deposit funds to secure immediate housing.

• Re-fund landlord/tenant counseling services that are bilingual and free to Santa Fe

residents.

• Work with private landowners to create scattered-site rental program using ADUs and

guesthouses.

• Identify all existing affordable rentals and develop a preservation plan as needed.

• Design an energy efficiency program to retrofit rental properties owned by low-income

landlords and/or large-scale privately-owned rental properties where energy savings

are passed on to the low-income renter to reduce utility payments.

• Continue to support emergency repair grant programs targeted toward very-low income

homeowners (less than 50%AMI), including possible use of subsidy to pay for short-

term insurance to cover the construction process.

• Continue to support rehabilitation loan programs targeted toward low to moderate

income homeowners (50%-80% AMI), which includes home renovations and energy

conservation measures including the purchase of new appliances, retrofits, and solar

water heaters.

• Design and implement a home repair program specific to income-qualified homeowners

living in Santa Fe’s historic districts which may include subsidy or an exemption to offset

the cost of historic retrofits.

Real Estate Development. Future production of new units will need to reflect the needs of

emerging populations, specifically older, smaller households; the elderly; the self-employed;

and special needs groups such as veterans. While realtors and lenders report that activity is

rebounding in the real estate market which indicates positive benefit for the economy as a

whole, many cite high land costs and regulatory constraints as reasons not to build in Santa Fe.

• Leverage City-owned resources to support facilities such as the proposed One Door

Homeless Campus.

• Work with for-profit and non-profit organizations to develop at least one new multi-

family, mixed income rental property.

• Support the SFCHA’s RAD conversion project to renovate 121 public housing units and

build 30 new units. Support the project through fee waivers if they receive the second

round of funding for the conversion of 237 public units for seniors.

• Incentivize construction of affordably-priced rental units through donations of city-

owned land, fee waivers, regulatory exemptions and other municipal resources.

• Require LIHTC projects that receive City donations to set aside a percentage of units for

households earning less than 50% of the AMI.

• Complete the Paseo del Sol Road extension in Tierra Contenta to open up Phase 3 of the

Master Plan for development.

CITY OF SANTA FE HOUSING PLAN EXECUTIVE SUMMARY, PAGE V

Regulatory Environment. Santa Fe’s regulatory environment is characterized by its long

history of implementing an inclusionary zoning program which has resulted in the construction

of nearly 1,000 affordable homes. However, other aspects of the land use development code and

the Santa Fe Homes Program regulation have unintended consequences and may actually be

hindering housing production. One regulatory recommendation that is relevant to all housing

needs is to add the intent to comply with state and federal fair housing laws and regulations in

the general code purpose statement or in the residential district purpose statement of the City’s

Land Use Code. Another is to exempt affordable housing from nonconforming structure

requirements. And finally, the City needs to bring its code into compliance with the revised Rules

of the NM Affordable Housing Act, specifically Chapter 26-2.

• Exempt emergency shelters from nonconforming structure requirements.

• Modify the Santa Fe Homes Program (SFHP) so that the rental requirement is financially

viable from the prospective of a multi-family development proforma.

• Convert existing and support the development of new ADUs into affordable rental stock

through the modification of Chapter 14 restrictions (eg. allow greater diversity of

placement on the site -on top of garages or other outbuildings-and eliminate

architectural consistency standards if under a certain size, allow existing ADUs to be

nonconforming uses).

• Increase low-density limits for multi-family residential construction.

• Raise the square footage threshold that triggers a development plan requirement on

residential projects from 10,000 square feet to over 30,000 square feet when the

proposed project meets redevelopment and mixed use goals.

• Revise density bonus incentives so that it is tiered to award deeper levels of affordability

or higher percentages of affordability in homeownership and rental projects subject to

the Santa Fe Homes Program.

CITY OF SANTA FE HOUSING PLAN EXECUTIVE SUMMARY, PAGE VI

II. Introduction

The New Mexico Affordable Housing Act

The New Mexico Affordable Housing Act is enabling legislation that exempts affordable housing

from the Anti Donation clause of the New Mexico State Constitution. Under the Act,

municipalities or counties wishing to donate, provide incentives or pay all or a portion of the

costs of affordable housing (including land, acquisition, renovation, financing, or infrastructure)

must have in place an affordable housing plan or a housing component in their general plan in

addition to an affordable housing ordinance.

The Affordable Housing Act Rules identify specific requirements to ensure that governmental

entities donate resources to qualifying grantees under terms that ensure long-term affordability.

This plan is submitted the NM Mortgage Finance Authority to ensure compliance with the NM

Affordable Housing Act. As per the Rules, the required housing plan elements provide a

community profile, establish housing needs and gaps in existing inventory and services, and

provide objectives for future programming, funding and capacity building in order to achieve

housing goals.

Definition of Affordable Housing

For purposes of this document, affordable housing is defined as a dwelling unit whose monthly

cost does not exceed 30% of a family’s gross monthly income. This applies to all households

earning up to 120% of the Area Median Income (AMI).

Purpose of Plan

The purpose of the City of Santa Fe’s Affordable Housing Plan is to assess housing need in Santa

Fe and to provide recommendations for addressing the needs. As approved by the New Mexico

Mortgage Finance Authority, this plan is in full compliance with the New Mexico Affordable

Housing Act. This enables the City of Santa Fe to revise its ordinance and mobilize public

resources to support the provision of affordable housing and related services, new construction

and the rehabilitation of existing homes.

This plan is organized to identify needs based on the entire housing spectrum. It evaluates

existing housing gaps for the current population and projects needs for the future. Most

importantly, it proposes strategies and recommendations for meeting housing needs and

identifies opportunities for increasing and improving the City’s housing stock to serve a variety

of housing situations.

The information in this plan will help the City of Santa Fe to:

• Establish baseline information for current and future housing needs and evaluate

progress in meeting goals.

• Develop and implement strategies to ensure that Santa Fe offers its residents a full range

of housing choices and opportunities.

• Implement specific affordable housing projects and obtain financing from federal, state,

and private lending institutions.

• Recommend roles and responsibilities for implementation.

CITY OF SANTA FE HOUSING PLAN INTRODUCTION, PAGE 1

III. Community Profile

This section provides an update to select data tables from the 2013 Housing Needs Assessment

Update (HNA).

For the sake of convenience the figure notes in this document reference the

comparable 2013 HNA figures.

The City of Santa Fe annexed territory that included

approximately 13,000 new residents effective January 1, 2014. However, that annexation does

not appear to be represented in 2014 ACS data. Unless otherwise noted, the figures relying on

ACS data exclude the recent annexation.

Top Trends 2011 to 2014

The primary findings from the data update include:

Most of Santa Fe’s population growth between 2011 and 2014 can be attributed to the

annexation of approximately 13,000 residents. Population growth excluding the annexation

was about 0.8 percent per year.

Santa Fe’s senior population increased from 18 percent of the total population in 2010 to 20

percent in 2014, primarily due to Baby Boomers aging into the 65 and over cohort from the

45 to 64 cohort.

Median household income increased by 12 percent between 2010 and 2014—from $44,090

to $49,380. Renters experienced a 24 percent income increase (from $28,240 to $34,945)

and owners experienced a 7 percent increase (from $58,467 to $62,727).

The increase in renter incomes is a departure from previous trends and a phenomenon

seen in other desirable cities. (Median renter incomes increased in the state and nation

overall, but not at the same rate as in Santa Fe—8% in New Mexico and 12% in the U.S.). It

is unclear if this is a result of rising wages for renters or an in-migration of higher income

renters and displacement of lower income renters. As shown in Figure 18, the income

distribution of renters has shifted dramatically since 2011: proportionately fewer renters

earn between 30 and 50 percent of the Area Median Income (AMI) and more earn more

than 100 percent of the AMI.

The median home value declined by 8.5 percent between 2011 and 2014, increasing

ownership affordability for city residents. In 2014, one-quarter of renters could afford the

median value home, up from 14 percent in 2011.

Overall affordability has improved for Santa Fe residents since 2011, due to increasing

incomes and stable home prices. However, the rental gaps analysis reveals a persistent

shortage 2,435 rental units priced below $625 per month. This compares to 3,074 in 2011.

The smaller gap in 2014 is primarily due to increasing renter incomes.

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 2

Rental affordability is a particular challenge for the 47 percent of renters earning less than

50 percent of AMI due to mismatch of supply and demand of units priced in that

affordability range (28% of units compared to 47% of renters).

Demographic Profile: Updates from Section I of the 2013 HNA

This section describes demographic trends in the City of Santa Fe, with an emphasis on how the

city has changed since the 2013 Housing Needs Assessment (2013 HNA).

City population and trends. The population of Santa Fe increased by 14,166 residents

between 2011 and 2014. However, the vast majority of that growth can be attributed to the

annexation of approximately 12,500 residents. Population growth excluding the annexation was

1,657 residents, or about 0.8 percent per year between 2011 and 2014.

Figure 1.

Population and Households, City of Santa Fe, 2000 to 2014

Note: Year 2000 and 2010 population and household estimates are from the US Census, 2005 and 2007 population and household estimates are

from the 2005 and 2007 Santa Fe Trends Reports. The 2014 estimate that excludes annexation is from the 2014 ACS; the 2014 estimate

including annexation is from the 2014 Santa Fe Trends Report. The annexation was effective January 1, 2014. State data are from the 2000

and 2010 Census and the 2007, 2011 and 2014 ACS.

This is an update to Figure I-2 in the 2013 HNA.

Source: 2000 Census, 2010 Census, 2005 ACS, 2007 ACS, 2011 ACS, 2013 HNA, 2014 ACS and 2014 Santa Fe Trends report.

Excluding the annexed population, Santa Fe’s share of the county population remained relatively

stable over the last 15 years (47 percent in 2014 and 2010 and 48 percent in 2000) after falling

from 56 percent in 1990. However, with the addition of the 12,500 new residents through

annexation, the city’s share of the total county population is now back up to 56 percent.

Population growth between 2010 and 2014 (3.4% excluding the annex; 21.9% including the

annex) in the city exceeded the rate of growth both in the county (2.8%) and the state (1.3%)

overall.

Year

City of Santa Fe

2000 62,203 27,569

2005 65,800 1.1% 29,788 1.6%

2007 68,359 1.9% 30,490 1.2%

2010 67,947 -0.2% 31,895 1.5%

2011 68,634 1.0% 30,493 -4.4%

2014 excluding annexation

70,291 0.8% 31,001 0.6%

2014 includng annexation

82,800 6.5% 36,518 6.2%

State of New Mexico

2000 1,819,046 677,971

2005 1,887,200 0.7% 727,820 1.4%

2007 1,969,915 2.2% 734,847 0.5%

2010 2,059,179 1.5% 791,395 2.5%

2011 2,037,136 -1.1% 767,285 -3.0%

2014 2,080,085 0.7% 760,916 -0.3%

Compound

Annual

Growth Rate

Compound

Annual

Growth Rate

Population

Households

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 3

Race and ethnicity. The racial and ethnic distribution of Santa Fe residents has not changed

substantially since 2011. According to 2014 data, nearly half of Santa Fe residents are of

Hispanic descent. Forty-five percent are non-Hispanic white, 3 percent are Native American, 2

percent are Asian and 1 percent are African American.

Compared to the state overall, the City of Santa Fe has a higher proportion of residents who are

non-Hispanic white and a lower proportion of residents identifying as a racial or ethnic minority.

Figure 2.

Race and Ethnicity, City of Santa Fe, 2000 through 2014

Note: This figure did not appear in the 2013 HNA.

Source: 2000 Census, 2007 ACS, 2011 ACS and 2014 ACS.

Age distribution. Figure 3 compares the age distribution of the city's population in 2014 to

2000, 2007 and 2010. Santa Fe’s senior population increased from 18 percent of the total

population in 2010 to 20 percent in 2014, primarily due to Baby Boomers aging into the 65 and

over cohort from the 45 to 64 cohort. The increase in seniors was offset by a drop in the

proportion of Baby Boomers. The proportion of all age cohorts under the age of 45 remained

steady between 2010 and 2014.

Figure 3.

Age Distribution,

City of Santa Fe,

2000, 2007, 2010 and

2014

Note:

This is an update to Figure I

-7 in

the 2013 HNA.

Source:

2013 HNA and 2014 ACS.

Figure 4 presents the change in residents by age group between 2000 and 2010 and between 2010

and 2014. The most notable changes between 2010 and 2014 are a substantial increase in

2000 2007 2011 2014 2014

Total Population 61,805 63,977 68,634 70,291 2,085,572

Race

White 77% 73% 84% 84% 73%

Black or African American 1% 1% 1% 1% 2%

American Indian and Alaska Native 2% 2% 1% 3% 10%

Asian 1% 2% 3% 2% 2%

Native Hawaiian and Other Pacific Islander 0% 0% 0% 0% 0%

Some other race

15% 19% 7% 9% 11%

Two or more races

5% 2% 3% 3% 3%

Ethnicity

Hispanic 48% 47% 47% 49% 48%

Non-Hispanic 52% 53% 53% 51% 52%

Non-Hispanic white

48% 47% 45% 45% 39%

City of Santa Fe

New Mexico

2000

2007 2010 2014 2014

Infants and toddlers (under 5) 5% 5% 6% 5% 6%

School aged children (5 to 17) 15% 13% 13% 13% 17%

College aged adults (18 to 24) 9% 9% 8% 8% 10%

Young adults (25 to 44) 29% 27% 25% 25% 25%

Baby boomers (45 to 64) 28% 30% 31% 29% 26%

Seniors (65 and older) 14% 17% 18% 20% 15%

Total 100% 100% 100% 100% 100%

City of Santa Fe

New Mexico

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 4

residents aged 65 to 74 which indicates that Santa Fe continues to be a desirable location for

retirees. Declines were evident for residents aged 25 to 44 and slight declines noted for children

between 5 and 17 years old.

Figure 4.

Change in Population by Age, 2000 to 2010 and 2010 to 2014

Note: This is an update to Figure ES-3 and Figure I-8 in the 2013 HNA.

Source: 2013 HNA and 2014 ACS.

As part of the 2013 HNA, BBC surveyed Santa Fe residents and in-commuters. Of the survey

respondents, 22 percent once lived within city limits. Most moved out more than 5 years ago and

moved because housing was too expensive, as shown in Figure 5.

Figure 5.

Reason for Moving Out of

the City of Santa Fe

Note:

n=32. There were too few respondents to

allow for reliable comparison between

owners and renters.

This is an update to Figure

ES-4 and Figure

II

I-13 in the 2013 HNA.

Source:

BBC Research & Consulting 2012

Resident Survey.

Tenure. The city’s homeownership rate rose slightly between 2000 (58%) and 2010 (61%) but

dropped back to 59 percent by 2014. According to survey results, the 2007 homeownership rate

was also in this range at 59 percent. The slight decline in homeownership between 2010 and

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 5

2014 is consistent with state and national trends, both of which reflect a two percentage point

drop in homeownership over the same period, partially due to the introduction of Millennials,

who are most likely to rent, into the housing market.

Compared to the county and the state overall, the City of Santa Fe has a higher proportion of

renters—typical for urban areas.

Figure 6.

Household by Tenure, City of Santa Fe, 2000, 2007, 2010 and 2014

Note: This is an update to Figure I-3 in the 2013 HNA.

Source: 2013 HNA and 2014 ACS.

Income and poverty. The median household income in the City of Santa Fe was $49,380 in

2014—higher than the state overall ($44,803) but slightly below Santa Fe County ($52,809).

Figure 7 displays median household income of both renters and owners in Santa Fe for 1999,

2006, 2010, 2011 and 2014. Overall, median household income increased by 12 percent between

2010 and 2014—from $44,090 to $49,380. Renters experienced a 24 percent income increase

(from $28,240 to $34,945) and owners experienced a 7 percent increase (from $58,467 to

$62,727). It is unclear whether the increase in renter incomes reflects the incomes of current

renters or whether it’s indicative of lower-earning renters leaving the city to seek more

affordable housing in other communities. Likewise, newer residents moving into the city since

2011 are possibly higher earners with more mobility options.

Num.

Pct. Num. Pct. Num. Pct. Num. Pct.

Total

households

27,569

100% 30,586 100% 31,895 100% 31,001 100% 60,565 760,916

Own 16,052 58% 18,168 59% 19,299 61% 18,156 59% 68% 67%

Rent 11,517 42% 12,418 41% 12,596 39% 12,845 41% 32% 33%

New

Mexico,

2014

2014

2010

2007

2000

City of Santa Fe

Santa Fe

County ,

2014

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 6

Figure 7.

Median Household Income by Tenure, City of Santa Fe 1999, 2006, 2010 and 2014

Note: This is an update to Figure I-10 in the 2013 HNA.

Source: 2013 HNA and 2014 ACS.

Nearly 12,000 Santa Fe residents (17% of the population) are living in poverty. Children are the

most likely age group to be living in poverty (30%) and seniors are the least likely to be living in

poverty (6%). The city has a lower poverty rate than the state (21%) but a higher rate than Santa

Fe County (14%). Figure 8 displays poverty by age for Santa Fe residents in 2014.

Figure 8.

Poverty by Age, City of Santa Fe, Santa Fe County and New Mexico, 2014

Note: This figure did not appear in the 2013 HNA.

Source: 2014 ACS.

Employment. The total number of jobs in the Santa Fe metropolitan statistical area (MSA)

peaked in 2007 at 90,272 jobs.

1

Between 2007 and 2010, the MSA lost an average of nearly

1,100 jobs per year, dropping the total jobs count to 86,987. Between 2010 and 2013, the

number of jobs stabilized and job losses slowed to just 28 per year on average. Figure 9 displays

employment trends in the Santa Fe MSA between 2001 and 2013.

1

Employment data from the Bureau of Economic Analysis is only available at the MSA or county level.

Median HH Income

1999 $40,392 $52,634 $28,177 $33,974 $40,432 $22,267

2006 $50,000 $60,000 $36,344 $40,629 $49,948 $24,651

2010 $44,090 $58,467 $28,240 $42,090 $51,871 $26,278

2011 $46,617 $64,690 $29,291 $41,963 $52,711 $25,980

2014 $49,380 $62,727 $34,945 $44,803 $55,135 $28,410

1999 to 2006 24% 14% 29% 20% 24% 11%

2006 to 2011 -7% 8% -19% 3% 6% 5%

1999 to 2011 15% 23% 4% 24% 30% 17%

2011 to 2014 6% -3% 19% 7% 5% 9%

Percent Change in MHI

Renters

City of Santa Fe

State of New Mexico

All Households

Owners

All Households

Owners

Renters

Num. in

Poverty

Pct. in

Poverty

Num. in

Poverty

Pct. in

Poverty

Num. in

Poverty

Pct. in

Poverty

Total population 11,938 17% 20,673 14% 436,153 21%

Under 18 years 3,700 30% 5,853 21% 145,966 30%

18 to 64 years

7,333 17% 13,003 15% 248,861 20%

65 years and over

905 6% 1,817 6% 41,326 13%

New Mexico

Santa Fe County

City of Santa Fe

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 7

Figure 9.

Employment

, Santa Fe MSA 2001

to 2013

Note:

CAGR is defined as “

compound annual growth rate.”

This is an update to Figure I

-14 in the 2013 HNA.

Source

s:

2013 HNA and Bureau

of Economic Analysis (BEA).

One quarter of all 2010 and 2014 jobs were self-proprietor jobs, a slight increase over 2007 self-

employment rates. According to the 2014 Economic and Industry Snapshot for Santa Fe, the

Santa Fe MSA has a larger percentage of self-employed workers than any other MSA in the state

except Las Cruces.

Industry profile. As of the fourth quarter of 2013, Public Administration (local, state and

federal government) was the largest employment sector in the city, which is typical of a capital

city. Retail Trade and Health Care are the next largest sectors, each accounting for 15 percent of

total Santa Fe employment. The Accommodation and Food Services industry also supports a

large share of jobs, indicative of the tourism economy in Santa Fe. Figure 10 displays these Santa

Fe employment data by industry. Employment data for the third quarter of 2011 are also

included for the sake of comparison.

2001 62,787 16,717

79,504

2005 68,367 19,656

88,023 2.6%

2007 70,114 20,158

90,272 1.3%

2010 65,425 21,562 86,987

-1.2%

2013 65,234

21,670 86,904 0.0%

Wage

and Salary

Jobs

Proprietor Jobs

Total Jobs

CAGR from

previous

period

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 8

Figure 10.

Employment by Industry, Santa Fe MSA, Q3 2011 and Q4 2013

Note: Total employment in Q3 2011 was 60,825. Total employment in Q4 2013 was 61,252.

This is an update to Figure I-16 in the 2013 HNA.

Source: Economic and Industry Snapshot, Santa Fe MSA/County, 2012 and 2014.

Average wages in the Santa Fe MSA have recently trailed the U.S average, but are similar to the

average for the state of New Mexico. According to the Bureau of Labor Statistics’ Quarterly

Census of Employment, in 2014 the average annual wage for the private sector in the Santa Fe

MSA was $39,468, compared with $49,192 in the U.S. and $39,520 in New Mexico.

2

Housing stock and household characteristics

Figure 11 provides an overview of some of the housing stock and household characteristics in

Santa Fe in 2000, 2010 and 2014.

2

Average annual wages applies a full-time, 52 week work year to average weekly wage statistics provided by the Bureau of

Labor Statistics.

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 9

Although the population of Santa Fe increased slightly (excluding annexation) between

2010 and 2014, the total number of housing units remained flat. The overall mix of housing

structure types (single family, multifamily and mobile homes) also held steady.

The homeownership rate declined slightly from 61 percent in 2010 to 59 percent in 2014. A

corresponding drop in the rental vacancy rate was evident over the same period as more

households began to occupy the rental housing stock. A local study by Southwest Planning

indicates that the occupancy rate in 2015 was 96.5 percent. In other words, the most

current research indicates that the City of Santa Fe has an approximate 3 percent rental

vacancy rate. The 2015 CBRE Apartment Market Survey also reports a 3 percent vacancy

rate for 2015—indicating a very tight rental market.

3

Median home value and the median mortgage payment for Santa Fe owners declined

between 2010 and 2014 after rising substantially the previous decade (2000 to 2014). In

contrast, the median contract rent increased by 14 percent between 2010 and 2014 (from

$767 to 872).

Average household size for owners dropped slightly from 2.2 to 2.1 but average household

size for renters increased from 2.0 to 2.4 between 2010 and 2014. The reason for the renter

household size is unclear; however, renter income also increased over the period which

may reflect larger households or families that are typically owners opting to rent instead. A

possible reason for households opting in to the rental market is the decline in home value

and the high cost of maintaining a home makes renting more economically appealing.

The distribution of householders by age reflects the overall age trends in the city—an

increase in senior householders offset by a decrease in boomer-aged householders (aged 55

to 64) and to a lesser extent middle aged adult households (aged 35 to 54).

As discussed earlier in this report, the median income in Santa Fe increased for all

households between 2010 and 2014, with renters experienced the largest percentage gains

(24% increase compared to 7% for owners).

The number and proportion of cost burdened households in the city declined between 2010

and 2014. In 2014, 11,313 households (38% of all households) were paying more than 30%

of their income on housing, compared to 14,275, (46%) in 2010.

3

CB Richard Ellis Apartment Market Surveys, Apartment Association of New Mexico Apartment Market Survey, RRC Associates

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 10

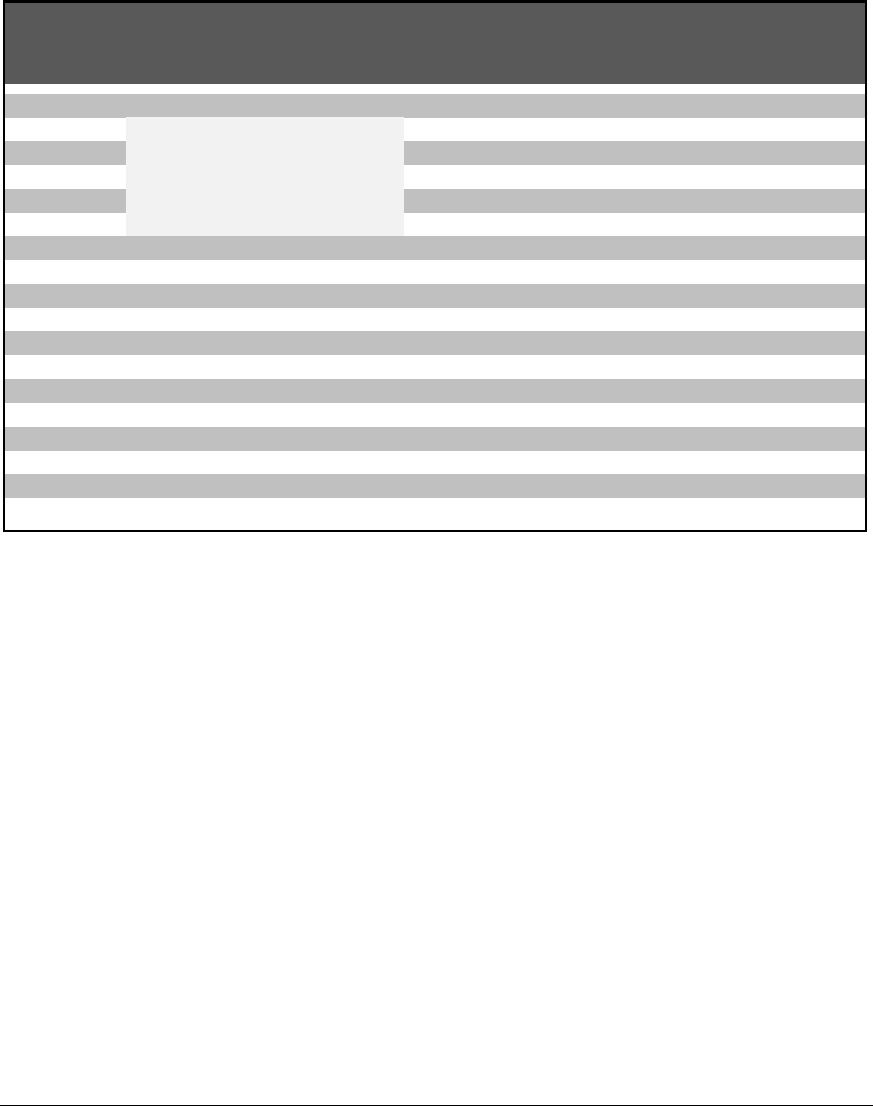

Figure 11.

Household Trends, City of Santa Fe, 2000 to 2014

Note: 2014 data do not include recent annexation of approximately 13,000 residents. This is an update to Figure I-1 in the 2013 HNA.

Sources: 2013 HNA and 2014 ACS.

New Mexico

2014

Population and Housing Units

Population 62,203 67,947 70,291 9% 3% 2,085,572

Housing Units 30,533 37,200 37,051 22% 0% 912,910

Occupancy and Tenure:

Occupied Housing Units 27,569 31,895 31,001 16% -3% 760,916

– Owner Occupied Units 58% 61% 59% 67%

– Renter Occupied Units 42% 40% 41% 33%

Vacant Housing Units 10% 14% 16% 17%

– For rent 2% 4% 3% 3%

– For sale 1% 2% 2% 1%

– Rented or sold, not occupied 0% 1% 1% 1%

– Seasonal/recreational/occasional use

5% 6% 7% 6%

– Other vacant 1% 2% 3% 6%

Type of Housing Unit:

Single family 60% 57% 58% 65%

Multifamily 37% 38% 37% 19%

Mobile homes 4% 4% 5% 16%

Value/Price of Housing:

Median Home Value 182,800$ 301,000$ 269,900$ 65% -10% 158,400$

Median Mortgage Payment 1,177$ 1,597$ 1,447$ 36% -9% 1,195$

Median Contract Rent 644$ 767$ 872$ 19% 14% 655$

Household Characteristics

Average Household Size 2.2 2.1 2.2 2.7

Owners 2.3 2.2 2.1 2.7

Renters 2.1 2.0 2.4 2.6

1-person 36% 41% 40% 30%

2-persons 34% 33% 36% 34%

3-persons 14% 12% 12% 14%

4-persons 10% 8% 9% 12%

5+ persons 6% 6% 3% 10%

Household Type

Percent married couples with children 16% 13% 13% 16%

Percent married couples without children

22% 21% 22% 28%

Percent Single parent 11% 10% 9% 11%

Percent other family without children 6% 6% 6% 9%

Percent living alone 36% 41% 40% 30%

Percent other non-family 9% 9% 10% 6%

Percent

Change 2010

to 2014

Percent

Change 2000

to 2010

2000

2010

2014

City of Santa Fe

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 11

Figure 11 (continued).

Census Profile and Trends, City of Santa Fe, 2000 to 2014

Note: 2014 data do not include recent annexation of approximately 13,000 residents. This is an update to Figure I-1 in the 2013 HNA.

Sources: 2013 HNA and 2014 ACS

New Mexico

2014

Household Characteristics (continued)

Age of Householder

15 to 24 years 4% 4% 3% 5%

25 to 34 years 15% 12% 13% 14%

35 to 44 years 20% 15% 14% 16%

45 to 54 years 24% 19% 17% 19%

55 to 64 years 16% 24% 20% 21%

65 years and older 21% 26% 33% 26%

Household Income

Under $15,000 16% 19% 10% 17%

$15,000 to $24,999 14% 12% 13% 13%

$25,000 to $34,999 14% 11% 12% 10%

$35,000 to $49,999 17% 11% 16% 15%

$50,000 to $74,999 19% 20% 16% 17%

$75,000 to $99,999 10% 10% 13% 11%

$100,000 or more 12% 16% 21% 17%

Average Household Income 56,494$ 65,306$ 70,642$ 16% 8% 61,470$

Median Household Income 40,184$ 44,090$ 49,380$ 10% 12% 44,803$

Owners 52,634 58,467 62,727 11% 7% 55,135

Renters 28,177 28,240 34,945 0.2% 24% 28,410

Housing Problems

Percent of cost-burdened

(spending 30% or more of income for housing)

34% 46% 38% 31%

Number of cost-burdened 8,566 14,275 11,313 67% -21% 232,697

Percent of overcrowded units

(1.01 or more persons per room)

5% 3% 2% 4%

Percent of substandard units

(incomplete kitchen/plumbing facilities)

1% 1% 1% 2%

City of Santa Fe

Percent

Change 2000

to 2010

Percent

Change 2010

to 2014

2000

2010

2014

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 12

Affordable Housing Inventory

Emergency Services. Emergency shelter programs generally provide short-term crisis

oriented support services including case management, meals, and crisis counseling. Increasingly

the limitations to this approach have become obvious. Service models have shifted to emphasize

permanent supported housing which provide a range of longer-term services designed to

support client stability and growth, including general case management services to identify

client needs and to develop client specific case management plans, general counseling services

for mental health, substance abuse services, family counseling, life skills education, GED and

personal financial counseling, employment counseling, and child development classes. The

following describes the facilities and services available in Santa Fe to homeless people or those

in danger of becoming homeless:

• St. Elizabeth. St. Elizabeth provides 28 year-round emergency shelter beds for men at

its main facility, in addition to a library, TV room, laundry, showers and some case

management. The organization also offers longer term and transitional shelter options.

Casa Familia offers five family rooms, with 16 additional dormitory beds reserved for

women, in addition to supportive services and can house up to 30 people per night. Casa

Cerrillos contains 28

efficiency

apa

rtments

for longer term residency for people with

physical, mental, and co-occurring substance abuse issues. Sonrisa Family Shelter offers

eight apartments where families can stay

for up to two years while they stabilize their

finances and find permanent housing.

•

Interfaith Shelter. Several faith based organizations support a seasonal shelter from

November to May. The shelter offers meals, showers and laundry, in addition to beds and

also some case management services. Embedded within the shelter is the Resource

Opportunity Center which is open two days per week, serves 120-140 people per day,

and offers more intensive case management and legal services.

• Life Link. Established in 1987 in a motel, Life Link has evolved into a highly effective

mental health center. At La Luz, 24 transitional apartment units are provided to people

with mental illness and other co-occurring disorders. The facility also offers extensive

outpatient treatment, pyscho-social rehabilitation, homeless prevention and rental

assistance, peer support services and onsite healthcare screening. Additionally, an offsite

facility called Casa Milagro offers permanent housing for 12 individuals.

•

Esperanza. Esperanza is a full service organization offering counseling, case

management and advocacy for survivors of domestic violence. The organization operates

a shelter that can house up to 42 people, as well as 21 beds of transitional housing to

allow clients establish independence while still receiving supportive services. The

organization also offers comprehensive non-residential counseling services.

•

Youth Shelters. On any given night, the organization estimates that 100 youth may

be

homeless

on the streets of Santa Fe. Services are provided to homeless, runaway and in-

crisis youth and their families including street outreach, emergency shelter, transitional

living, counseling and Civic Justice Corps. Special initiatives are the Pregnant and

Parenting Project, including referrals, case management, parenting skills; and the

Workforce Development/GED Initiative, which helps youth with job readiness skills and

GED preparation. Youth can stay at the emergency shelter for up to 30 days and in the

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 13

transitional, apartment style living program for 18 months. Street Outreach is a drop-in

resource center that assists youth with emergency services such as food and warm

clothing and provides longer term services to help youth leave the streets. All services

are free of charge.

Continuum of Care/Shelter Plus Care. The purpose of HUD’s Shelter Plus Care program is to

subsidize rents

for people

with disabilities and their families. Shelter Plus Care rental vouchers

are administered either on a project basis or directly to tenants to use at privately-owned

scattered sites. Life Link uses vouchers to subside its rents at La Luz, as well as administering

them to its clients who are able to live off site. For several years, the Housing Trust has

administered vouchers to people living with AIDS and is initiating a project-based voucher for its

newly constructed subsidized rental projects, the Village Sage and the Stagecoach Apartments.

Another Shelter Plus Care grant, initiated in 2012 is administered by St. Elizabeth at its Siringo

Senior Housing site.

Emergency rent, mortgage and utility assistance. Given the effects of the economic

recession, concerted efforts have been made to expand the safety net of services in Santa Fe. In

2010, the city allocated CDBG and Housing Trust funds to Faith at Work which provided 3 months

of emergency rent/mortgage assistance to 62 families, preventing immediate eviction and

default. Of these families, 53 percent were extremely low-income, earning less than 30 percent

AMI. Forty-one families in 2011 were provided emergency rent/mortgage assistance through

Esperanza Shelter’s Emergency Assistance Program (EAP), all of whom were female-headed

household with presumed household incomes in the 30 –50 percent AMI range. In FY 2015-16,

the City provided Affordable Housing Trust Funds to Life Link to provide short term rental

assistance. 90 very low income renters were served, earning an average of 26%AMI.

Santa Fe Civic Housing Authority. As reported in 2015, the Santa Fe Civic Housing Authority

(SFCHA) is the public housing agency in Santa Fe. It manages 490 units of public housing, and

administers 670 Section 8 vouchers in Santa Fe. There are a total of 369 units for seniors,

leaving 121 for families. Currently, 269 people are on the public housing waiting list for a

housing authority apartment unit, and approximately 171 people on the Section 8 waiting list for

Santa Fe. SFCHA receives approximately 35 applications per month for public housing. The wait

for a household to receive a unit is between 18 and 24 months, and the voucher wait list contains

132 households. It takes a household between 12 and 18 months to get to the top of that list.

All of the units are in livable condition but maintenance is a continuous effort. With the

exception of the new Villa Alegre and Campo Alegre units, all are planned for rehabilitation over

the next several years. SFCHA is participating in the RAD program and by June of 2016, 120 units

will be substantially rehabilitated to be brought up to modern code standards, incorporate

“green” building standards such as solar panels, and include modern amenities such as

daylighting. The sites include Agua Fria (6 units), Cerro Gordo (25 units), Gallegos Lane (25

units), Hopewell/Mann (40 units) and Senda Lane/Senda del Valle (24 units).

Additional affordable units in the production pipeline include two tax-credit projects for senior

units: a 116-unit development at Villa Hermosa (one- and two-bedroom units for seniors) which

has already received tax-credits and a 120-unit senior development at Pasa Tiempo for which a

LIHTC application will be submitted to MFA next year.

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 14

Subsidized Rental Units

Santa Fe’s inventory of subsidized rental units is fairly robust. However, with the exception of

the units constructed by the Housing Trust and those rehabilitated by the Housing Authority,

many are aging and in need of renovation. It doesn’t appear that any will revert to market rate.

Figure 12

Inventory of Subsidized Rental Units

Tax Credit Apt Name Address Type

# of

Units

Council

District

The Bluffs

6600 Jaguar Drive

Family

160

3

Cedar Creek

3991 Camino Juliana

Family

94

3

Country Club

5999 Airport Road

Family

62

3

Evergreen

2020 Calle Lorca

Family

70

2

Las Palomas

2001 Hopewell

Family

280

2

Paseo del Sol

4551 Paseo del Sol

Family

80

3

Tuscany at St. Francis

2218 Miguel Chavez

Family

176

2

Ventana de Vida

1500 Pacheco

Elderly

120

2

Casa Rufina

2823 Rufina

Elderly

120

4

Villa Real

501 W. Zia

Family

120

2

Vista Linda

6332 Entrada de Milagro

Family

109

3

Tres Santos

189 Pacheco

Family

136

2

Casa Vallita

3330 Calle Po Ae Pi

Elderly

106

4

Villas de San Ignacio

3493 Zafarano

Family

127

4

Village Sage

5951 Larson Loop

Family

60

3

Stagecoach Apt

3360 Cerrillos Rd

Family

60

4

TOTAL

1880

Civic Housing Authority

Villa Alegre Senior Housing

811 W. Alameda

Elderly

50

1

Villa Alegre Family Housing

821 W. Alameda

Family

60

1

Villa Alegre Ph. III

104 Camino del Campo

Elderly

28

1

TOTAL

138

1

Section 8/202 Apt Name

Sangre de Cristo

1801 Espinacitas

Family

164

2

Santa Fe Apts

255 Camino Alire

Family

64

1

Encino Villa

1501 Montano

Elderly

40

1

La Cieneguita

1601 La Cieneguita

Elderly

32

1

TOTAL

300

Project Based Rental

La Luz

2325 Cerrillos

Family

24

1

TOTAL

24

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 15

Construction of New Units

Nonprofit production. Santa Fe’s three primary nonprofit single-family home developers are

Habitat for Humanity, Homewise, and The Housing Trust. To date, Habitat has created 100

affordable homes; Homewise, 599; and the Housing Trust, 711; for a total of 1,410 homes

created by nonprofit partners.

Habitat for Humanity. Like all Habitat affiliates, the Santa Fe office develops homes

through a self-help model that brings together the future homeowner, a licensed contractor

and a team of volunteers to build each home. The price of the home is thereby reduced by

the 500 hours of “sweat equity” earned by the homeowner in helping to build the home.

Habitat clients earn less than 50 percent of the area median income.

Homewise. Homewise was founded in 1987 as a nonprofit agency helping homeowners

repair and renovate their homes. Since then, the organization has expanded into a full

service homeownership center, offering homebuyer training and counseling, financial

fitness classes, mortgage financing and refinancing, ongoing home repair services, and

assistance with energy efficiency retrofits. The organization has also built many affordably-

priced homes in Santa Fe.

The Housing Trust. Formerly known as the Santa Fe Community Housing Trust, the Trust

was established in 1991 to use the land trust model to increase affordability. Since then, the

organization has expanded its model to provide a full range of homebuyer and homeowner

services including: homebuyer training and counseling, reverse mortgage financing, rental

assistance for special needs populations, and real estate development. Since 2010, the

Housing Trust has constructed 120 units of affordable rental housing that is green-built and

serves renters earning up to 60% AMI, with one-quarter of units at each site reserved for

renters transitioning out of homelessness.

NSP-funded acquisition and rehab. The City of Santa Fe was one of the first communities in

New Mexico to use HUD’s Neighborhood Stabilization Program (NSP) funds. NSP was

administered according to CDBG guidelines as a means through which communities could

purchase and redevelop abandoned or foreclosed homes.The city partnered with Homewise to

finance the purchase of 14 homes by qualified buyers and also partnered with Life Link to

purchase and rehabilitate four homes to be used as permanent housing for renters with mental

illness.

Homebuyer training and counseling. In partnership with Homewise and the Housing Trust,

the city supports homebuyer training and counseling through administrative contracts. Potential

homebuyers attend classes where they learn about real estate transactions, budgeting, mortgage

lending and other aspects related to buying a home. Specifically, the nonprofits work with clients

to make them “buyer-ready” with the overall objective of ensuring that homebuyers are

approved for prime rate mortgages that they can afford and are capable of paying. Several

funding sources are dedicated to these efforts including CDBG, CIP-Funded Assistance, and the

Affordable Housing Trust Fund. Approximately 400 buyers are trained per year.

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 16

Homeowner assistance. The city and its partners also support homeownership through

rehabilitation and home repair, energy efficiency upgrades, and foreclosure prevention

programs. In 2015 the city funded 16 single-family rehabilitation projects between Community

Development Block Grant and Affordable Housing Trust Funds between two local non-profit

service providers: Habitat for Humanity and Homewise. Of this number, approximately ten (10)

of the single family homes have mortgages. Central New Mexico Housing Corporation is the

weatherization provider for Santa Fe, using funds through the NM Energy$mart program.

Approximately 25 homes per year are weatherized in the city with an average cost of $6000 per

unit.

Tierra Contenta. Until recently, production of affordably-priced homeownership units in Santa

Fe occurred primarily in Tierra Contenta, a master-planned community of 1,400 acres. The

Tierra Contenta Corporation, a nonprofit development entity, provides builder ready tracts of

land to both nonprofit and for profit builders. Nearly 2,500 homes have been built since 1995, 45

percent of which are affordable.

Inclusionary zoning. One of the city’s most effective tools for spurring the provision of

affordable housing is through its inclusionary zoning programs. The first city program, the

Housing Opportunity Program (HOP), was implemented in the late 1990s. The program required

that all new development trigger an affordability requirement so that either 11 percent or 16

percent of units built were sold to qualified homebuyers at a predetermined price point (reliant

on homebuyer’s family size, HUD income limits, etc.). HOP homebuyers on average earn 65

percent of area median income and no more than 80 percent of area median income.

In the mid-2000s, the city initiated a more stringent inclusionary zoning program, the Santa Fe

Homes Program (SFHP) which originally mandated a 30 percent requirement for any application

including annexation, rezoning, subdivision plat and increase in density. For homeownership

housing, three income tiers are served: 50-65 percent AMI; 65-80 percent AMI; and 80-100

percent AMI, with 10 percent of the total units serving each tier. The requirement for rental

housing is 15%, with the income tiers adjusted downward to include a tier for renters earning

less than 50%.

In 2010, in response to the economic slowdown, in particular the building and construction

industries, the city further modified the requirement such that 20 percent of new homes

proposed for construction are sold to income-qualified homebuyers (down from the original

30%). The rental requirement remains the same. In 2016, further adjustments were made to the

program to allow multifamily developers to pay a fee-in-lieu by right (as opposed to having to

get City Council approval). This accommodation was motivated by Santa Fe’s historically high

rental occupancy rates which have had the effect of driving up rents across all segments of the

market. Those with the lowest incomes are least able to absorb the increases and it is assumed

that some of these renters have left the community due to their increased cost burdens. The

amendment to the requirement has a four year sunset period when it will expire. At year three,

staff is directed to evaluate whether it has had any positive effect on the construction of market

rate rental housing with the expectation that increasing rental inventory will expand choices.

Santa Fe offers development incentives through the Santa Fe Homes Program (SFHP) in the form

of a density bonus and fee waivers. The density bonus allows for the number of base units: the

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 17

total number of units that would otherwise be allowed by the zoning district to be multiplied by

15 percent. It does not impact other code standards such as height limits, lot sizes or require a

general plan amendment. While this is an important incentive, its applicability to fairly low

maximum density limits (10 units per acre), somewhat limits its effectiveness, since a maximum

density of 11.5 units per acre is still below that achieved by many townhouse developments (and

some single-family detached developments). The fee waivers reduce development review,

construction permit and impact fees as well as utility expansion charges proportionately based

on the number of SFHP units in the development.

As with its other housing programs, the city relies on its nonprofit partners, Homewise and the

Housing Trust to train, counsel and qualify the buyers. Additionally, homebuyers are often

subsidized with downpayment assistance funded through CDBG, the Affordable Housing Trust

Fund, the NM Mortgage Finance Authority, or other sources accessed by the housing counseling

agencies.

To date, approximately 100 HOP, 27 SFHP and 397 Low-Priced Dwelling Units have been

created, with an additional 400 units created through annexation agreements that predate the

inclusionary zoning program.

Economic Development

The City of Santa Fe’s Economic Development Division has refined its strategy to focus on

entrepreneurship of its main initiative. Developing home grown entrepreneurs is a proven job

creation strategy as small businesses often create one, two or more jobs and in aggregate these

form the largest sector of private sector employment in Santa Fe. The City launched a pilot

accelerator program designed to provide a fast track to growth for small businesses. The City

also continues to support its business incubator which provides the support of a shared facility

and business development services for resident and affiliate companies.

Through these efforts the city is diversifying the local economy through job creation and support

for small business creation and growth. The main goal of the City’s economic development work

is to strengthen the economy by developing industries other than the main employment areas of

government and tourism. This is outlined in the policy document adopted in 2008 by the City

Council, the Strategy for Implementation in economic development.

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 18

IV. Land Use and Policy Review for Barriers to

Affordable Housing

This section summarizes BBC’s evaluation of the City of Santa Fe’s public policies related to

housing opportunities. Specifically BBC reviewed the city’s land use code, historic

preservation policies, impact fees, General Plan, and housing policies in order to identify

any

potential constraints to affordable housing development present in policies.

Introduction

One of the most common local governmental constraints to the private production of affordable

housing is zoning, subdivision, and land development regulations. In some cases, land use

regulations that intentionally or unintentionally cause barriers to affordable development can

offset the impact of affordable housing subsidies or increase the need for subsidies as a vehicle

for meeting affordable housing goals.

A number of studies, including a 2006 book by Jonathan Levine (Zoned Out), have documented

the impact of zoning regulations on the supply of affordable housing.

4,

5

Common zoning

regulations negatively impacting affordable development include:

Minimum house size, lot size, or yard size requirements;

Prohibitions on accessory dwelling units;

Restrictions on land zoned and available for multifamily and manufactured housing; and

Excessive subdivision improvement standards.

A national study conducted by the National Association of Home Builders in 2007 evaluated

which types of subdivision regulations have the greatest impacts on housing costs.

6

The study

compared benchmark standards for single family housing (necessary for public health and

safety) and compared the cost of building homes under those benchmarks with actual costs of

single family home construction. The study found that

65 percent of the added costs were caused by minimum lot size requirements; and

9 percent of the added costs were caused by lot width requirements.

4

Levine, Jonathan, Zoned Out (RFF Press, Washington, D.C., 2006).

5

Colorado Deportment of Local Affairs, Reducing Housing Costs through Regulatory Reform (Denver: Colorado Department of

Local Affairs, 1998).

6

Study of Subdivision Requirements as a Regulatory Barrier. EcoNorthwest, for National Association of Homebuilders

Research Center, 2007.

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 19

Minimum house size requirements also had a significant impact on cost—accounting for 17

percent of the added costs in communities that have such restrictions.

7

Land Use Code

The zoning review conducted for this analysis focuses on key land use regulations that can have

significant impacts on housing affordability and availability, derived from work conducted by

Don Elliott of Clarion Associates. The following discussion is organized by:

Permitted uses, or types of housing units allowed (e.g., multifamily parcels, manufactured

homes, accessory dwelling units (ADU’s), mixed use districts, and group housing);

Residential development standards such as lot size, minimum house size, density and

parking standards;

Other best practices to help foster the production of affordable housing (purpose

statements, flexibility on nonconforming structures and incentives for affordable

development).

The City of Santa Fe’s zoning code does include multiple mixed use districts and the residential

districts are generally inclusive of many housing types. Even low density residential districts

allow multifamily development, manufactured homes and accessory dwelling units. Group

homes for eight or fewer residents are also allowed by right in all residential districts, although

the occupancy limit for unrelated persons in a single family home that isn’t a “group home” is

five persons.

Figure 13 displays the zoning map for the City of Santa Fe.

7

This is an uncommon requirement; only 8 percent of local governments imposed a minimum house size at the time the study

was conducted.

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 20

Figure 13.

City of Santa Fe Zoning

Districts

Source: City of Santa Fe.

CITY OF SANTA FE HOUSING PLAN LAND USE AND POLICY REVIEW, PAGE 21

Permitted uses. In order to promote affordability, the zoning code should allow for a diversity

of housing types and should accommodate the construction of multifamily and manufactured

housing as well as encouraging housing production in close proximity to employment. Best

practices for residential uses that foster affordable development are described below:

Mixed Use. Housing should be allowed near businesses that employ workers, particularly

moderate and lower income employees. To do that the code should permit residential units

in at least one commercial zone district (preferably more) and/or should map some lands

for multifamily development in close proximity to commercial districts.

Multifamily Parcels. At least one zone district (or overlay district, or permit system)—

preferably more—should allow the construction of multifamily housing, and enough land

should be mapped into that district to allow a reasonable chance that multifamily housing

will be developed. Maximum heights should be reasonable and consistent with the

maximum density permitted; avoid mapping areas for multifamily densities and then

imposing height restrictions that prohibit efficient development at those densities. Failure

to provide opportunities for multifamily development has been identified as one of the four

leading regulatory causes of increased housing costs.

Accessory Dwelling Units. The code should allow accessory dwelling units in at least

one zone district—preferably more—either as an additional unit within an existing home