DELIVERING PERFORMANCE

DIRECT MAIL IN THE

UNITED STATES 2023

SEPTEMBER 023

PRESENTED BY

NOTICE

This report contains brief, selected information and analysis pertaining to the advertising, marketing and technology industries and has been prepared by Winterberry

Group. It does not purport to be all-inclusive or to contain all of the information that a prospective manager, investor or lender may require. Projections and opinions

in this report have been prepared based on information provided by third parties. Neither Winterberry Group nor its respective sponsors make any representations or

assurances that this information is complete or completely accurate, as it relies on self-reported data from industry leaders—including advertisers, marketing service

providers, technology developers and agencies. Nor shall any of the forgoing (or their respective officers or controlling persons) have any liability resulting from the

use of the information contained herein or otherwise supplied. All trademarks are the property of their respective owners.

© 2023 Verista Partners Inc. d/b/a Winterberry Group. All rights reserved.

This report woud not hve been possibe without the sinificnt contributions

of hundreds of mrketin industry eders who contributed their time nd

insihts in support of this reserch To of them we sy thnk you

ACKNOWLEDGMENTS

PRESENTING SPONSOR

PREMIER SPONSORS

SUPPORTING SPONSORS

TABLES

AND CHARTS

TABLE OF CONTENTS

05 U.S. direct mail spending, 2019-2023E

08 U.S. direct mail spending, 2019 vs. 2023E, postage and non-postage expense

10 How is the role of direct mail changing in your organization?

11 Brands have come to widely embrace the “omnichannel” philosophy

12 Which of the following is the most important use case direct mail

fulfills for your organization?

13 Marketers are increasingly prioritizing performance

15 DM growing more competitive given growing cost, challenges associated

with addressability of certain digital media

17 Tech-driven innovations allowing direct mailers to achieve long-promised value

18 Robust data availability, mature supply chain support DM programs

19 Brands looking to marketing channels and partners that support flexibility,

scalability and adaptability

NTRODUCTON & EXECUTVE SUMMARY

It’s old school. Out of touch with the digital age. Unlikely to

connect with younger consumers. And yet this year, U.S. brands

will invest more than $39 billion on the channel (inclusive of

postage, materials, printing and mailing services, data and a host

of other functions associated with executing campaigns). If stood

up against a roster of other paid advertising vehicles, this “out of

touch” medium would thus rank fifth among advertising and

marketing channels used by U.S. brands—commanding a

healthier share of total expenditures than those directed to

connected TV, online display advertising, email and other

tools considered central to modern marketing.

That may come as a surprise to those who see the postal channel

as something of a relic. But the primary factor underlying direct

mail’s resilience ought to come as no surprise—even if the

terminology used to describe it is very contemporary. Direct

mi in short is performnce mrketin chnne It’s

proven to be a highly capable tool for helping brands acquire new

customers, drive incremental sales and support winback and

cross-selling efforts—all while generating the kind of data that

supports measurability, audience segmentation, granular

targeting, personalization and other functions that are

increasingly at the heart of the modern marketing playbook.

Marketers continue leaning into the channel because it works—

and for that reason, say they intend to continue investing in

direct mail at comparable levels for the foreseeable future.

Nevertheless, direct mail today exists at something of a

crossroads—delivering reliable value when brands are looking to

capitalize upon its modern, performance-oriented benefits,

but often saddled with a reputation for being expensive,

cumbersome and distinctly traditional in form and consumer

appeal. How should brands thus be thinking about incorporating

direct mail in their long-term spending mix? And what

factors should they keep in mind as they work toward

improving their marketing effectiveness, efficiency and

bottom-line performance?

The answers to those questions will vary from vertical-to-vertical,

and brand-to-brand. Today, no fewer than six dominant themes

are dictating how U.S. brands invest in—and derive value from—

direct mail in the United States:

Brnds hve come to widey embrce the “omnichnne”

phiosophy

, emphasizing the integration of all marketing

channels, both digital and traditional, in a diverse media mix

Mrketers re incresiny prioritizin performnce—the

ability to achieve specific, incremental objectives with respect

to customer acquisition, sales and other outcomes—over

other use cases

Growin costs nd chenes ssocited with the

ddressbiity of dt-driven diit medi

are leading

many marketers (and digitally native direct-to-consumer

brands, in particular) to test alternative channels, like direct

mail, in support of their growth ambitions

Improvements in the integration of data and creative

content, coupled with the advent of less expensive and more

capable marketing technologies, are allowing direct mailers

to

chieve on-promised vue from on-demnd

production personiztion trier-driven prorms

retretin nd other innovtions tht cpitize on

intent sins in the buyin cyce

The continued robust vibiity of icensbe

third-prty dt—bcked by mture mutifceted

suppy chin

—represents the foundation upon which

brands responsibly orchestrate their direct mail programs

at scale; and

Seeking to manage the vast complexity inherent in modern

marketing, brnds re ookin to medi chnnes nd

suppy chin prtners tht provide for exibiity

scbiity nd the biity to rpidy dpt to

chnin needs

The tired od misconceptions bout direct mi hve

been repeted time nd time in

INTRODUCTION & EXECUTIVE SUMMARY

US DRECT MAL EXPENDTURES—N SUMMARY

n US mrketers wi invest biion on their direct mi efforts

supportin diverse rne of mrketin use cses new customer cquisition

direct ses/merchndisin cross- nd up-ses trnspromotions incorportin

mrketin messes into customer service nd biin messes nd oyty

communictions mon others

U.S. DIRECT MAIL EXPENDITURES—IN SUMMARY

SPENDING REMAINS ROBUST DESPITE MACROECONOMIC VOLATILITY

Winterberry Group (2023)

U.S. DIRECT MAIL SPENDING, 2019-2023E

U.S. Direct Mail Spending

(2019-2023E, $BB)

2019

$43.18

2020

$38.79

CAGR:

0.49%

2021

$41.06

2022

$41.70

2023E

$39.36

Direct mail (DM) in the U.S. has represented a multi-billion-

dollar annual enterprise for many decades, with brands having

long ago understood the channel to represent a reliable means of

supporting certain clear-cut performance objectives. But, like

other media, DM has been both a beneficiary and victim of

macroeconomic forces that have reshaped marketer priorities—

sometimes significantly and without much advance warning.

The COVID-19 pandemic presents just such a case study. As

with other channels, direct mail spending declined precipitously

in 2020 as brands moved to conserve precious resources and

redirect their efforts to support short-term business priorities.

In the case of certain verticals—store-based retail, automotive

and travel & hospitality, most notably—this no longer included

“new customer acquisition,” for which DM had long represented

a tried-and-tested tool.

Direct mail did not suffer from this development in

significant disproportion to other advertising and marketing

media. (And, in fact, the channel fared well relative to its

experience during the last significant economic downturn.

In the wake of the “Great Recession,” for example, 2009 U.S.

DM spending declined 16.7 percent from the previous year as

some brands “paused” their outbound marketing efforts, and

others redirected a significant share of expenditures toward

digital media that until then had been considered new

and untested.) Nevertheless, aggregate marketer investment

in the DM channel has yet to return to pre-COVID levels—

and may not do so for another year or longer based on

prevailing demand trends.

Marketers began 2023 with a relatively bullish outlook

for the year, with optimism that the doldrums of late 2022

would give way to a more robust economic environment

once the new year got underway. But that sentiment shifted

sharply toward the end of the first quarter, as continued

macroeconomic uncertainty drove brands to adopt a more

conservative approach to their marketing investments—

particularly those focused on acquiring customers and

driving incremental sales in verticals that were most

susceptible to inflation-related pullbacks. On a full-year

basis, DM spending will remain robust relative to other

prominent advertising vehicles (and especially as compared

to other “traditional” channels, many of which are rapidly

losing share to emergent digital media). But with postage

and other campaign costs on the rise, and no federal

elections or major tentpole marketing events—like an

Olympics or World Cup—on the calendar, it’s unlikely the

channel will repeat the spending gains it garnered in each of the

two years since the COVID crisis began.

Circumstances vary significantly across verticals. But while most

brands are now projecting that marketing expenditures will grow

this year, many say the pace of that growth will slow relative to

the past few years. And while diminished inflation, higher-than-

expected GDP growth and the easing of supply chain pressures

have helped instill enough confidence such that many expect to

soon resume their focus on customer acquisition and growth, the

persistence of high interest rates and tepid consumer confidence

have led many to remain cautious with budgets for the third and

fourth quarter of 2023. The net result: the back half of the year

should bring with it some growth in DM expenditures, but not

enough to make up for the sleepy first two quarters of the year,

and total annual U.S. direct mail spending will slip more than

5 percent relative to 2022.

2023: OPTIMISM AT NEW YEAR’S, REALITY BY THE BEGINNING OF SPRING

US DRECT MAL EXPENDTURES—N SUMMARY

US DRECT MAL EXPENDTURES—N SUMMARY

Direct mail’s inherent measurability has always helped

substantiate its prominent place in the marketing mix. And

DM has fared particularly well in recent years as better data

availability (and the advent of sophisticated measurement

and attribution technologies) have allowed for more precise

comparison against other channels.

Increasingly, though, brands are making marketing spending

decisions later in the promotional process, with a close eye on

changing market conditions (and a default understanding that

media ought to be able to support last-minute pivots from one

channel to another). That’s had a mixed effect on DMers, since

traditional production planning associated with the channel has

typically required longer campaign cycle times than those

supporting digital media. Brands may thus be less willing

to commit to more conventional/longer-run programs, but

more inclined to experiment with shorter-run programs—

leveraging digital production technology that allows for

quicker turnaround times while incorporating richer content

personalization to enhance relevance, and thus optimize

campaign performance.

That development is foundational to brands’ long-term confidence

in direct mail—and their plans, most say, to continue investing in

the channel at comparable levels well into the foreseeable future.

“Direct mi is sti n importnt chnne” sys the

vice president of cient enement of one udience

dt provider “t’s core chnne for mny brnds

tht re seekin cretive soutions to expnd”

“There is wys tk of direct mi ‘oin wy’”

dded the vice president of predictive soutions t

n enterprise-focused dt provider “But in reity

it remins one of the rest chnnes in mrketin

budets nd wi continue to be”

WHAT’S DRIVING GROWTH?

Where marketers are expanding their direct mail investment,

several themes are now playing a regular role. In particular,

brands are:

Emphasizing channels and strategies that deliver clear

performance at meaningful scale

Seeking channels that can help achieve desired returns given

challenges to performance of digital advertising outside of

walled garden environments (a function of declining

addressability of identifiers needed to support online

audience targeting), and/or

Refocusing their efforts on targeted customer acquisition

across all marketing touchpoints—including reinvestment

in traditional “offline” channels to balance the increased

volume of digital ads shown during the COVID and

immediate post-COVID periods.

OVER THE LONG TERM: BRANDS SAY THEY EXPECT TO

MAINTAIN DM BUDGETS AT COMPARABLE LEVELS

Where marketers are pausing their direct mail investments (or

redirecting such funds to other media), another combination of

factors is likewise commonplace. In these cases, brands may be

looking to manage:

Macroeconomic conditions, in certain verticals, that have

diminished their need to drive demand, acquire customers

or pursue incremental sales

The transformation of the role and format of the DM

catalog from a platform for merchandising to one supporting

omnichannel/connected commerce strategies (with attendant

changes in page counts and physical formats)

An emerging generation of brand-side marketing leadership

that’s “digitally native,” inexperienced with the DM channel

and thus less understanding of DM’s role and impact,

particularly as a lever for both performance and brand

marketing objectives; and/or

The rising cost of postage (and certain other components

of DM campaigns), thus diminishing the net return on

investment associated with the channel.

Many research contributors were pointed in their feedback on the

impact of rising postage and materials costs—noting that, even

in relatively healthy industry verticals, higher costs have been

eroding mailers’ ability to sustain historical campaign volumes,

compounding the impact of soft demand in other segments—and

resulting in the 16 percent volume decrease that USPS reported

in its Marketing Mail class during the second quarter of calendar

2023, as compared to the same period last year.

In a diverse mix of dedicated and shared functional expenses

(supporting DM campaigns typically requires marketers to

invest in materials, printing and mailing services, licensed data/

mailing lists, data management, predictive analytics, creative

development and other functions) those cost increases are

being offset, to an extent, by the advent of technology-enabled

efficiencies that are allowing brands to better manage the costs

associated with data licensing, campaign management and even

production. But as postage and materials typically represent

the largest components of DM budgets, higher costs in those

categories are now being reflected in a rebalancing of spending

across the entire channel. In 2023, for example, postage will

represent 48.4 percent of total DM expenditures—up from

45.7 percent as recently as 2019.

US DRECT MAL EXPENDTURES—N SUMMARY

WHAT’S STANDING IN THE WAY?

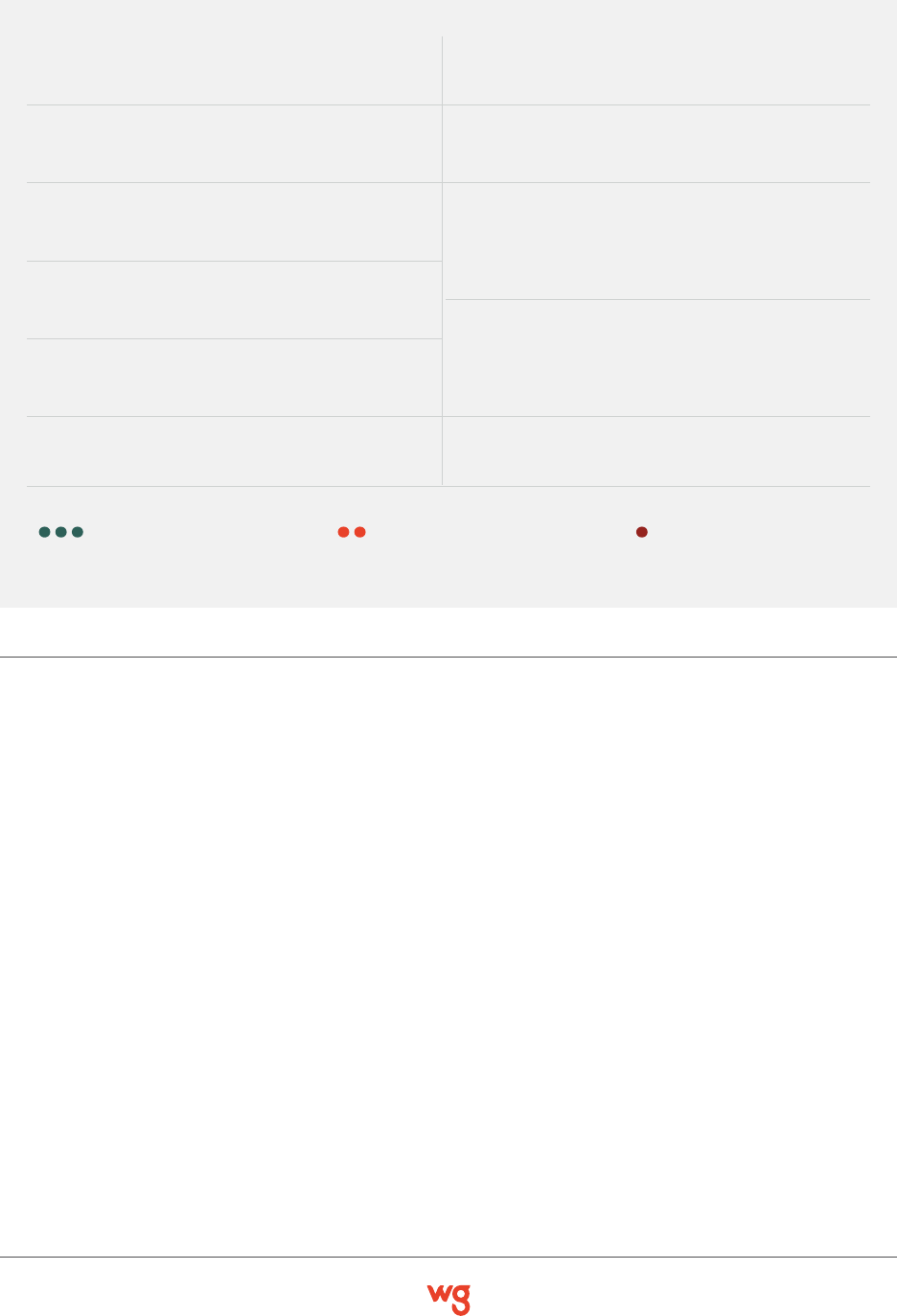

U.S. DIRECT MAIL SPENDING, 2019 VS. 2023E, POSTAGE AND NON-POSTAGE EXPENSE

Winterberry Group (2023)

POSTAGE

45.7%

OTHER

54.3%

U.S. Direct Mail Spending, 2019

Postage vs. Other Components

POSTAGE

48.4%

OTHER

51.6%

U.S. Direct Mail Spending, 2023E

Postage vs. Other Components

+2.7%

OTHER: includes production, materials & logistics; agency services; data management/hygiene;

licensed/third-party data; predictive analytics & campaign measurement

TRENDS

The origins of the marketing concept we now call “omnichannel”

stretch back decades. Some tie the concept to growth of the first

global agency holding companies in the mid-20th century—

which stitched together firms of diverse capability in an effort

to drive buying efficiencies (and better alignment of content and

tactics) on clients’ behalf. Others look to the world of retail

and the advent of the e-commerce channel, where building a

unified merchandising and fulfillment infrastructure was

just as important as maintaining a fresh and consistent

consumer-facing brand.

No matter what its origins, brands today are broadly aware

of “omnichannel” and even more closely aligned with its

underlying premise: marketing performance can be optimized

when brands orchestrate a range of channels and tactics

to support desired objectives.

"Brnds re definitey tkin more omnichnne

pproch to their efforts seekin wys to be more

nimbe nd consumer-minded” sid the vice president

of cient enement of one udience dt provider “f

they were doin so previousy they’ve definitey one

-in on the strtey over the st few yers”

Direct mail has proven to be a particularly good teammate to

omnichannel strategies—particularly when brands are looking to:

Drive customer acquisition

Engage audiences of significant scale (which might be

otherwise difficult to achieve using online media alone)

Convert prospects who’ve otherwise been highly qualified

or known to be exploring a potential purchase, and/or

Support transactions that happen predominately via

e-commerce channels. (The emerging practice of direct

mail retargeting—whereby brands leverage digital identifiers

to generate on-demand direct mail pieces targeted to

in-market shoppers—is practical embodiment of how

omnichannel drives clear, meaningful advantage relative

to less-integrated approaches to deploying media).

Not surprisingly, brands are all-in on the omnichannel

opportunity. Nearly 60 percent of surveyed marketers said they’re

taking steps to better align their DM efforts with other channel

initiatives, for example. And the same panel said “improved ability

to activate omnichannel campaigns” is the single most impactful

factor driving their overall investment in the channel.

Brnds hve come to widey embrce the “omnichnne” phiosophy emphsizin the

intertion of mrketin chnnes both diit nd trdition in diverse medi mix

TRENDS 2023

WHAT FACTORS ARE DRIVING INVESTMENT

IN THE DIRECT MAIL CHANNEL?

Winterberry Group Survey (2023)

HOW IS THE ROLE OF DIRECT MAIL CHANGING IN YOUR ORGANIZATION?

We are taking steps to better integrate direct

mail with other marketing channels, and are

seeing benets from doing so

We are taking steps to better integrate direct

mail with other marketing channels, but are

not (yet) seeing benets from doing so

We are leveraging online identiers to

drive direct mail targeting, and are

seeing benets from doing so

We are leveraging online identiers to

drive direct mail targeting, but are not

(yet) seeing benets from doing so

We are taking steps to dissolve organizational

"silos" in internal teams, technology

platforms and other resources historically

used to manage separate channels

We are interested in increasing our

use of online and oine markers

to support direct mail targeting

We are increasing our eorts to personalize

and target all addressable channels

We have not pursued signicant changes in

the service of "omnichannel" alignment

39.0%

20.2%

19.2%

9.8%

4.0%

3.8%

3.6%

0.4%

But challenges in leveraging DM as a full partner in the

omnichannel effort still persist. In many marketer organizations,

omnichannel strategies and infrastructure—encompassing

underlying workflows, technology and the budgets that power all

of the above—have been developed with an understanding that

only fully digital channels need be integrated to drive desired

outcomes. The result: some brands are making great progress in

standing up teams to support a complex, coordinated weave of

interconnected customer-facing digital media, all while

maintaining parallel silos (often underfunded and seen as

ancillary to the core marketing effort) to support direct

mail and other legacy media.

Increasingly, marketers are waking up to the critical importance

of building infrastructure to support omnichannel execution.

Early-stage, direct-to-consumer product brands and retailers are

particularly progressive in this respect (potentially because they

don’t have to wrestle with the added challenge of transforming

“legacy” operating structures), though brands across virtually all

DM verticals are increasingly recognizing the inherent urgency of

that evolution.

“One sinificnt chene our cients re fcin is

fiurin out how to interte direct mi with their

efforts cross other chnnes” sid the vice president

of product of mjor mrketin services provider

“We’re in prticury difficut time riht now

becuse ecy orniztion ps nd issues

reconciin udience identity sti persist mkin it

difficut for mrketers to understnd how to incorporte

direct mi into their omnichnne pproch”

TRENDS

Mrketers re incresiny prioritizin performnce—the biity to chieve specific

increment objectives with respect to customer cquisition ses nd other

outcomes—over other use cses

TRENDS

SURVEY HIGHLIGHT

OF MARKETERS SAY THAT

THEIR IMPROVED ABILITY

TO ACTIVATE OMNICHANNEL

CAMPAIGNS WILL BE A CORE

DRIVER OF THEIR INCREASED

DIRECT MAIL SPEND OVER

THE NEXT YEAR—THE MOST

CITED OF ANY FACTOR

37%

Late in the 20th century, progressive

marketers started seeing their postal

efforts as supporting a broader, more

strategic purpose. “Direct mail” explained

only a narrow application of what brands

were looking to achieve in harnessing data,

targeting offers and measuring results.

The name of their discipline would have

to change to reflect a broader marketing

remit and the incorporation of other

addressable channels into the effort.

The practice of direct marketing was

thus born.

Fast-forward a few decades, and the

nomenclature evolved yet again. “Direct

marketing” once may have symbolized

how brands were looking to optimize

one-to-one marketing communications—

but it’s also a term rooted in an era when

digital channels weren’t even yet in their

infancy, much less central to the practice

of customer engagement. Once cutting

edge, the term has thus been dropped from

the names of trade associations, industry

publications and marketing departments

all over the world.

But a funny thing happened while

direct marketers began to consider

the need to rename their own discipline.

Corporate leadership—empowered with

better data and the tools to measure

performance across an expanded array

of functional areas—began holding their

marketing teams accountable for results

that supported corporate growth

objectives. Marketing could no longer

afford to see themselves exclusively

as the engine behind “campaigns,” but

enablers of direct and quantifiable

business outcomes.

trend is sinificnt fctor

in drivin DM investment/strteies

trend is fctor in drivin

DM investment/strteies

but does not predominte

trend pys itte/no roe

in drivin DM investment/strteies

RETAIL

(predomine brick-nd-morr/cog)

•••

RETAIL/CONSUMER PRODUCTS

(predomine direc-o-consumer)

•••

TRAVEL HOSPITALITY

•••

INSURANCE

•••

POLITICAL

•

NOTFORPROFITAUTOMOTIVE

•• ••

BB SERVICES TECHNOLOGY

••

FINANCIAL SERVICES

••

HOME SERVICES

••

MEDIA TELECOMMUNICATIONS

••

BRANDS HAVE COME TO WIDELY EMBRACE THE “OMNICHANNEL” PHILOSOPHY

Winterberry Group Survey (2023)

WHICH OF THE FOLLOWING IS THE MOST IMPORTANT USE

CASE DIRECT MAIL FULFILLS FOR YOUR ORGANIZATION?

Customer acquisition (at scale and/or

among specialized target audiences)

Win-back of lost customers

Re-targeting customers

Driving prospects to our store

General customer retention/loyalty

Driving prospects to our website

Brand awareness

Transactional communications

45.4%

18.0%

11.8%

7.8%

5.6%

4.8%

3.4%

3.2%

Nowhere is that mandate more

evident today than in the widespread

embrace of performance media and

marketing use cases as a central area of

marketing focus. Though the term itself is

a creation of digital marketers (who had to

distinguish between campaigns intended

to elevate brand awareness from those that

were expected to drive specific and

quantifiable results), the concept

perfectly encapsulates the key attributes

that have long characterized—and

differentiated—the direct mail channel.

For many former “direct marketers,”

in fact, the embrace of performance

has required little change in their

tactical approach to building and

executing campaigns; direct mail,

after all, has long been the tool of

choice for brands looking to leverage

data to support audience segmentation,

offer targeting, personalization and other

means of optimizing marketing outcomes.

And for an emerging generation of

quantitatively-focused, “digitally-native”

marketing leaders, incorporating DM—

which brings a higher average return

on investment than any comparable

marketing channel, according to the

Association of National Advertisers¹—

is typically easy to rationalize… once

old preconceptions are put aside.

¹ Source: Association of National

Advertisers, 2022 Response Rate Report

"Direct mi is due for

re-brndin” sid the vice

president of predictive soutions

t n enterprise-focused dt

p r o v i d e r “Much of the benefit to

utiizin mi s performnce

chnne hs been ost in the morss

of misunderstndin bout wht is

nd is not ‘direct mrketin’ But

direct mi isn’t the probem

perceptions re Direct mi

continues to be one of the best

toos to drive performnce”

Looking ahead to the future, it seems

inevitable that marketers will continue

to emphasize performance-oriented

objectives—and look to channels,

technologies and supply chain partners

that can show how they deliver

incremental results relative to other

approaches. That should position DM well

to continue playing its traditional role—

so long as stakeholders across the brand

organization understand its true impact.

TRENDS

RETAIL

(predomine brick-nd-morr/cog)

RETAIL/CONSUMER PRODUCTS

(predomine direc-o-consumer)

TRAVEL HOSPITALITY

INSURANCE

POLITICAL

NOTFORPROFITAUTOMOTIVE

BB SERVICES TECHNOLOGY

FINANCIAL SERVICES

HOME SERVICES

MEDIA TELECOMMUNICATIONS

TRENDS

trend is sinificnt fctor

in drivin DM investment/strteies

trend is fctor in drivin

DM investment/strteies

but does not predominte

trend pys itte/no roe

in drivin DM investment/strteies

•••

•••

•••

•••

••

•• ••

•••

••

•••

•••

MARKETERS ARE INCREASINGLY PRIORITIZING PERFORMANCE

Growin costs nd chenes ssocited with the ddressbiity of dt-driven

diit medi re edin mny mrketers nd diity ntive direct-to-consumer

brnds in prticur to test terntive chnnes ike direct mi in support of

their rowth mbitions

The prevailing wisdom in advertising circles over the last few

decades would suggest that digital media is the great budgetary

share eater—perpetually clawing dollars away from TV, print

and other traditional channels to ensure messages reach

consumers increasingly tethered to their smartphones and

other connected devices.

Certainly, that trend foots to a host of data (and the unfortunate

learned experience of newspaper publishers, linear TV networks

and others). But what would happen if digital’s growth weren’t

quite so predestined? What if the same free-market dynamics that

impact other channels were to finally set their sights on online

advertisers (and the vast network of agencies, adtech companies

and other intermediaries who support those campaigns)?

Over the past 18 months, the marketing community has begun

to see answers to those questions materialize. Though aggregate

digital spending continues to pace the broader advertising and

marketing services marketplace—both in the U.S. and globally—

a confluence of unique factors has diminished the once-

unimpeachable performance of digital as an advertising platform,

particularly with respect to online ads that are dependent on

the sharing of third-party identifiers to support audience

segmentation and targeting. What’s happened to all that data?

Several factors are at work, including:

Heightened public/regulatory scrutiny of online data collection,

sharing and use (as most clearly seen through the introduction

of federal and state-level legislation curtailing brands’ ability

to use such data without explicit consent)

Ongoing preparations (among both brands and third-party

adtech providers) to accommodate Google’s long-anticipated

deprecation of third-party tracking cookies; and

Changes in the policies of certain large technology platforms

(most visibly including Apple, through the introduction of

its App Tracking Transparency protocol) that require

consumers to affirmatively “opt-in” to the sharing of data

for advertising purposes.

TRENDS

To brands hungry to drive performance, the result of these

developments has been straightforward: diminished data

availability has taken a huge bite out of “targetable” digital ad

inventory, heightening the price of the inventory that remains—

and leading brands on a search for alternative channels that

offer a combination of reach and performance they need to

meet their growth objectives.

“We expect tht privcy reution wi ony

continue to tihten” sid the CEO of one ency

“And tht wi ony intensify brnds’ focus on

findin new wys to drive resuts”

“The current [privcy nd dt shrin] reutions

in the mrket whether proposed or in effect re

much more hihy focused on diit ppictions

thn those ppied in the direct mi word” dded

the CEO of one mrketin technooy deveoper

“Tht supports the sustinbiity of direct mi

nd shoud present n onoin tiwind

for the chnne s whoe”

Increasingly, direct mail is filling the gap where targeted digital

advertising is no longer able to deliver the kind of performance

marketers had grown to expect. Though the channel will likely

never substitute entirely for the low-cost, easy-to-access

eyeballs proffered by Meta, Google and other digital walled

gardens, DM competes well on a cost-per-acquisition basis with

virtually all other media, positioning itself to support the efforts

of enterprise brands (who will have budgets large enough to

drive tests of meaningful scale) and those with sophisticated

measurement and attribution capabilities (who will be best

able to look past DM’s high upfront cost to understand its

true impact on bottom-line results).

“We’re seein hue inux of brnds expndin

into direct mi for the first time—either becuse of

decinin [pid diit] trffic or hvin exhusted

the opportunities vibe vi other diit medi”

sid one ency CEO “Mny of these re emerent

direct-to-consumer brnds tht were historicy

focused ony on Fcebook Gooe nd

other diit offerins”

“We’ve unched brnds over the st five yers

into direct mi for the first time” dded the CEO

of n nytics-oriented consutncy “These re DTC

or e-commerce brnds tht re diity ntive onine

retiers nd whoese brnds tht hve exhusted

their biity to row throuh diit”

DM GROWING MORE COMPETITIVE GIVEN GROWING COST, CHALLENGES

ASSOCIATED WITH ADDRESSABILITY OF CERTAIN DIGITAL MEDIA

RETAIL

(predomine brick-nd-morr/cog)

RETAIL/CONSUMER PRODUCTS

(predomine direc-o-consumer)

TRAVEL HOSPITALITY

INSURANCE

POLITICAL

NOTFORPROFITAUTOMOTIVE

BB SERVICES TECHNOLOGY

FINANCIAL SERVICES

HOME SERVICES

MEDIA TELECOMMUNICATIONS

trend is sinificnt fctor

in drivin DM investment/strteies

trend is fctor in drivin

DM investment/strteies

but does not predominte

trend pys itte/no roe

in drivin DM investment/strteies

•••

•••

••

••

•

•• •

•

••

••

••

mprovements in the intertion of dt nd cretive content couped with the dvent

of ess expensive nd more cpbe mrketin technooies re owin direct miers

to chieve on-promised vue from on-demnd production personiztion

trier-driven prorms retretin nd other innovtions tht cpitize on intent

sins in the buyin cyce

Even as they work to activate the transformative growth

that should come from better orchestration of direct mail

and other touchpoints in their omnichannel mix, brands are

already seeing improved returns from their DM investment

through the activation of data-enabled innovations that allow

them to capitalize on the channel’s inherent differentiator: the

ability to deliver relevant, timely and compelling offers directly

into the hands of a target consumer. In most cases, these

advances reflect the maturation of technology and process

that have been long available in nascent form—but now

benefit from better workflow or output hardware, data software

(allowing for seamless data integration, segmentation

and targeting) and better general understanding of the

use cases they’re positioned to support. Today, these

innovations include:

Diit/on-demnd printin where lower hardware costs,

faster production speeds and higher quality output have

allowed for richer levels of targeting and content

personalization (at more palatable cost economics)—

enabling a paradigmatic shift away from generic,

high-volume campaigns

Retretin nd other trier-driven prorms

where the availability of rich, actionable digital and terrestrial

identifiers—and growing brand focus on deploying technology-

centered solutions to integrate this vast trove of data, whether

originated independently (“first-party”), provided by partners

and via cooperative data solutions ("second-party") or

sourced from outside entities (“third-party”)—is providing

insight into consumer intent and life stages that allow brands

to engage audiences likely to be “in market” for various

products, spurring deeper consideration and purchase activity

nformed Deivery providing an additional digital

touchpoint for the mailer and another potential indicator

of audience engagement (as well as improved postage pricing,

in some cases, via USPS promotions); and

Post optimiztion enabling more economical fulfillment

of shorter-run campaigns.

TRENDS

Adoption of these innovations, many

added, will have the added benefit of

promoting a virtuous cycle of sorts—

with technological advances in data

management, retargeting, trigger-driven

marketing technology and integrated

print production enabling the sorts of

performance gains that will ultimately

spur investment from a diverse range of

marketers: first those leading-edge brands

who are already astute managers of their

return on marketing investment (ROMI)

and customer lifetime value (CLV), then

enterprise marketers with responsibility

for supporting the growth of billion-

dollar-plus product lines, and finally

the smaller and more emergent corps of

brands who may come to represent the

next generation of direct mail innovators.

TRENDS

SURVEY HIGHLIGHT

OF MARKETERS ARE SHIFTING

TO MORE PERSONALIZED

CONTENT OVER THE

NEXT YEAR

53%

SURVEY HIGHLIGHT

OF MARKETERS CITE

ENHANCED TARGETING

ABILITY AND 34% CITE

INCREASED PERSONALIZATION

ABILITY AS CORE DRIVERS

FOR INCREASING DIRECT

MAIL SPEND OVER THE

NEXT YEAR—COMING IN

JUST BEHIND OMNICHANNEL

ACTIVATION AT 37%

OF MARKETERS

36%

The Top 8: Direct Mail Innovations

Marketers Say Offer Most Potential

to Drive Improved Performance Over

Coming Years

“The innovtion tht we’re

seein cross the direct mi

ecosystem is driven by need for

cost efficiency nd reter biity

to tret specific udiences—

incresiny everin triers

nd retreted mi bsed on

behvior ttributes” sid the

vice president of one consumer

dt provider

“The on-term trend is rey

bout movin wy from the

notion of direct mi bein

buk impersonized dvertisin

ve hi c e” sid the CEO of one

mrketin technooy deveoper

“We’re mkin ret proress

but there is much to do to drive

more nd more impctfu

personiztion—nd optimize

the timin of cmpins to et

the most out of the chnne”

INCREASED MATCHBACK

ATTRIBUTION CAPABILITIES

INCREASED ABILITY TO DRIVE

AUTOMATED BEHAVIORAL

OR EVENTTRIGGERED CAMPAIGNS

ABILITY TO RETARGET CUSTOMERS

LEVERAGING ONLINE IDENTIFIERS

INCREASED PERSONALIZATION OF CONTENT

INCREASED USE OF UNIQUE/DIMENSIONAL

DIRECT MAIL FORMATS

ABILITY TO MANAGE DIRECT MAIL CAMPAIGNS

IE, MANAGE/SEGMENT DATA, ENGAGE

PRODUCTION SUPPLIERS VIA MARKETING

AUTOMATION PLATFORMS

USPS’S INFORMED DELIVERY PRODUCT

DATA HYGIENE EFFORTS FOCUSED ON

SUPPRESSING LIKELY UNREACHABLE

AUDIENCE MEMBERS

Winterberry Group Survey (2023)

TECH-DRIVEN INNOVATIONS ALLOWING DIRECT

MAILERS TO ACHIEVE LONG-PROMISED VALUE

RETAIL

(predomine brick-nd-morr/cog)

RETAIL/CONSUMER PRODUCTS

(predomine direc-o-consumer)

TRAVEL HOSPITALITY

INSURANCE

POLITICAL

NOTFORPROFITAUTOMOTIVE

BB SERVICES TECHNOLOGY

FINANCIAL SERVICES

HOME SERVICES

MEDIA TELECOMMUNICATIONS

trend is sinificnt fctor

in drivin DM investment/strteies

trend is fctor in drivin

DM investment/strteies

but does not predominte

trend pys itte/no roe

in drivin DM investment/strteies

•••

•••

•••

•••

•

•• •

•

•••

•••

••

The continued robust vibiity of icensbe third-prty dt—bcked by mture

suppy chin ecosystem—represents the foundtion upon which brnds responsiby

orchestrte their direct mi prorms t sce

Without question, marketers interested in pursuing direct mail

innovation have a number of options at their disposal—whether

grounded in better use of data, emergent technology or simply

more modern format design and architecture. But the true

foundations of direct mail’s capability and differentiation (relative

to other marketing channels) have not changed much in decades.

They include:

A vast array of licensable, third-party data assets that may

be used to assemble, segment and target audiences; and

A diverse supply chain of providers that support program

execution and serve as a safeguard to ensure that DM

campaigns (and the data that support them) are deployed in

ways that are responsible, ethical and in the best interests

of both brands and consumer audiences.

Critically, those factors differentiate direct mail from more

emergent channels—and even from how DM is practiced in other

countries (where strict regulatory guidelines often require affir-

mative consumer opt-in to the kinds of marketing programs that

are addressable, via DM, across the broad consumer

marketplace in the U.S.). These factors also help contrast DM’s

strong executional foundation against the digital landscape,

where the burgeoning supplier and technology platform network

is extensive and maturing rapidly—but also all too often subject

to the malign influence of fraudsters, data thieves and other bad

actors. All of the above reinforce the need to safeguard data and

use it responsibly, but also to look out for interests of the data

ecosystem itself, given the critical role it plays in enabling DM

and the vast economic activity that it drives.

TRENDS

ROBUST DATA AVAILABILITY, MATURE SUPPLY CHAIN SUPPORT DM PROGRAMS

RETAIL

(predomine brick-nd-morr/cog)

RETAIL/CONSUMER PRODUCTS

(predomine direc-o-consumer)

TRAVEL HOSPITALITY

INSURANCE

POLITICAL

NOTFORPROFITAUTOMOTIVE

BB SERVICES TECHNOLOGY

FINANCIAL SERVICES

HOME SERVICES

MEDIA TELECOMMUNICATIONS

trend is sinificnt fctor

in drivin DM investment/strteies

trend is fctor in drivin

DM investment/strteies

but does not predominte

trend pys itte/no roe

in drivin DM investment/strteies

•••

•••

•••

•••

•••

••• •••

•••

•••

•••

•••

Seekin to mne the vst compexity inherent in modern mrketin brnds re

ookin to medi chnnes nd suppy chin prtners tht provide for exibiity

scbiity nd the biity to rpidy dpt to chnin needs

Trends like “omnichannel” and “performance” are dominant

today because they deliver clear-cut benefits and represent

natural solutions to long-standing marketer challenges (with

better technology and more abundant data helping power the

kind of orchestrated campaigns that once would have been

impractical). But these initiatives bring with them an ancillary

cost: complexity.

In an era when macroeconomic conditions are evolving fast (and

budget priorities, consumer preferences and merchandising

needs changing right along with them), it should then come as no

surprise that brands today are prioritizing media channels and

supply chain relationships that provide for flexibility, scalability,

modularity and maximum adaptability to changing need.

Such qualities have long been hallmarks of most digital

marketing channels. But the physical nature of direct mail

(and its corresponding requirements with respect to package

design, workflow management, production and fulfillment)

have long been known to add precious time, cost and risk to the

execution of marketing campaigns, diminishing the appeal—

and, in many cases, the viability—of the channel relative to

its contemporary counterparts.

“On the diit side mrketers tend to hve reter

biity to neotite pricin nd exibiity to sce or

shrink budets to mintin performnce” sid the

president of one ency “Direct mi budets by

contrst re essentiy fixed upfront The brnd

bsicy tkes on risk once they sin on to cmpin”

But many brands say that dynamic needs to change—and

tomorrow’s DM leaders will be those who lean aggressively

into process and workflow innovations geared to:

Adopting shorter-run, “always-on” programs—often driven

by a continuous feed of data triggers

Heightened focus on mail tracking, workflow optimization

and alignment with other media channels; and

Establishing internal process and supply chain relationships

focused on aggregating a host of audience data inputs—from

both structured and unstructured sources, both “traditional”

and “digital.”

TRENDS

BRANDS ARE LOOKING TO MEDIA CHANNELS AND SUPPLY CHAIN PARTNERS

THAT PROVIDE FOR FLEXIBILITY, SCALABILITY AND THE ABILITY

TO RAPIDLY ADAPT TO CHANGING NEEDS

RETAIL

(predomine brick-nd-morr/cog)

RETAIL/CONSUMER PRODUCTS

(predomine direc-o-consumer)

TRAVEL HOSPITALITY

INSURANCE

POLITICAL

NOTFORPROFITAUTOMOTIVE

BB SERVICES TECHNOLOGY

FINANCIAL SERVICES

HOME SERVICES

MEDIA TELECOMMUNICATIONS

trend is sinificnt fctor

in drivin DM investment/strteies

trend is fctor in drivin

DM investment/strteies

but does not predominte

trend pys itte/no roe

in drivin DM investment/strteies

•••

•••

•••

•••

•••

••• •••

•••

•••

•••

•••

TRENDS

LOOKNG AHEAD

For the most part, the channel appears well positioned to keep

doing so. After navigating the rocky economic waters of 2023,

U.S. marketers say they expect that their direct mail spending

will largely hold steady through the foreseeable future—buoyed

by a combination of improved economic conditions and general

refocus on growth (backed by performance-oriented marketing

investments) in the corporate c-suite. And, of course, DMers

will benefit from innovations with respect to format, content

personalization, campaign workflow/process optimization,

supporting technology and delivery logistics—all reinforced by

the continued focus and advocacy of a multi-billion-dollar supply

chain with deep investment in the channel and its future.

So what factors should brands be considering as they think about

the role of direct mail in the not-too-distant future? And what

innovations are on the horizon? The possibilities are vast, but

many industry participants have stressed the likelihood that:

Deeper integration of direct mail with enterprise martech

platforms will support more seamless campaign management,

orchestration and reporting (assuming martech platforms

continue evolving to support DM integration, embracing its

natural role in the omnichannel mix)

The rapid maturity of AI and machine learning applications

will impact how DM programs are conceptualized, built and

executed. As with other marketing disciplines, innovation

in this respect is more likely than outright disruption, with

new generative AI tools showing great promise as a means

to automate certain manual composition and workflow

functions. Over time, the technology may grow to

power more granular (and faster-paced) predictive

segmentation, personalization and cross-channel

messaging applications, as well

Measurement will continue to represent the keystone to

campaign optimization. Brands will need to go “beyond the

offer code” to better incorporate DM in their multichannel

attribution strategies—with the aim of better understanding

how the channel impacts a range of desired actions

Technology will play a more prominent role in facilitating

faster campaign turnarounds, vendor coordination and other

core functions—all essential if DM is going to continue

playing a central omnichannel role alongside digital media

that seem purpose-built to support speed and targetability; and

Legacy preconceptions of direct mail will continue to give way

as more brands embrace its role as a dynamic performance

media channel—substantiating, in turn, the business cases

needed to dissolve legacy operating silos, pursue deeper

integration of DM in omnichannel strategies and build

even more robust marketing infrastructure geared to

drive desired outcomes, honor consumer preferences

and safeguard data in accordance with changing

regulatory standards.

f “omnichnne” is truy the wy of the mrketin future then direct mi’s future

s with tht of other chnnes wi hine upon its biity to support mrketers’

performnce objectives

LOOKING AHEAD

THE FUTURE OF DIRECT

MAIL IN THE U.S.

METHODOLOGY

METHODOLOGY

The concusions in this report re rounded in

n intensive primry reserch effort oriiny

commissioned by the United Sttes Post Service nd

substntiy competed by Winterberry Group between

November nd Mrch with updtes

competed between My nd Auust

This reserch incuded series of thouht eder

interviews with sever dozen senior executives from

mjor US miers nd compnies in the direct mi

suppy chin incudin encies dt providers

mrketin technooy deveopers commerci printers

miin service compnies nd others s we s

survey tht eicited responses from more thn

enterprise nd midde-mrket mrketin nd ency

executives tht evere direct mi to support their

compnies’ promotion efforts

Approximately what was your

company's marketing budget focused

on direct mail last year?

Do you currently work for a marketing

agency or as an in-house marketer?

AGENCIES, 24%

MARKETERS, 76%

Approximately, what is the annual revenue

for the company for which you work?

$5 MILLION TO $25 MILLION, 25%

$1 TO $5 MILLION, 5%

MORE THAN

$500 MILLION, 3%

$100 TO

$500 MILLION, 25%

$25 TO $100 MILLION, 42%

$100 THOUSAND TO $1 MILLION, 25%

$25 TO $100 THOUSAND, 3%

$10 MILLION

OR MORE, 5%

$5 TO

$10 MILLION, 8%

$1 TO $5 MILLION, 59%

Which of the following marketing and

advertising functions aligns most

closely with your current role?

MARKETING

LEADERSHIP, 31%

MARKETING OPERATIONS /

SUPPLIER MANAGEMENT, 20%

BRAND

MANAGEMENT,

15%

PRODUCT

MARKETING,

15%

DIGITAL PERFORMANCE

MARKETING, 12%

OTHER, 7%

Which of the following best describes

the industry for which you work?

RETAIL: MULTI-CHANNEL

(CATALOG/ECOMMERCE), 16%

AUTOMOTIVE,

14%

CONSUMER

PACKAGED

GOODS, 9%

FOOD/BEVERAGE/

RESTAURANTS, 8%

TRANSPORTATION, 8%

FINANCIAL SERVICES (BANKING/

INVESTING/LENDING), 8%

RETAIL: TRADITIONAL

(BRICK AND MORTAR), 7%

AGRICULTURE, 7%

HEALTHCARE/

MEDICAL/

PHARMACEUTICALS,

6%

TRAVEL/

HOSPITALITY, 6%

OTHER, 12%

ABOUT OUR SPONSORS

ABOUT OUR PRESENTING SPONSOR, THE UNITED STATES POSTAL SERVICE

ABOUT OUR PREMIER SPONSORS

ABOUT ALLANT

Alliant is trusted by thousands of brands and agencies as an

independent partner bringing a human element to modern data

solutions. The Alliant DataHub—built on billions of consumer

transactions, an expansive identity map, advanced data

science and high-performance technology—enables marketers to

execute omnichannel campaigns with responsive consumers at

the center. Data security and privacy have been core values since

day one, and we continually validate our people, processes, and

data through meaningful certifications such as SOC2, IAB Tech

Lab Data Transparency, NAI Membership, NQI certification from

Neutronian, and quarterly quality scoring with Truthset.

For more information, visit

intdt.com.

The United States Postal Service is an independent federal

establishment, mandated to be self-financing and to serve

every American community through the affordable, reliable

and secure delivery of mail and packages to nearly 165 million

addresses six and often seven days a week. Overseen by a

bipartisan Board of Governors, the Postal Service is

implementing a 10-year transformation plan, Delivering for

America, to modernize the postal network, restore long-term

financial sustainability, dramatically improve service across all

mail and shipping categories, and maintain the organization as

one of America’s most valued and trusted brands. The Postal

Service generally receives no tax dollars for operating expenses

and relies on the sale of postage, products and services to fund

its operations. For more information, visit

bout.usps.com.

ABOUT WLAND

Wiland, Inc. is the marketing data and audiences company that

thousands of brands trust to help them develop and maintain

more customer relationships that produce higher revenue, less

advertising waste, and more profit. The company’s products are

informed by the largest set of detailed, individual-level spending

signals ever assembled. Wiland’s AI-enabled response prediction

platform analyzes this vast information to deliver powerful

insights and solutions that enable clients to market more

profitably across all addressable channels. The company has

long served as an industry innovator whose targeted marketing

solutions have their foundation in consumer data ethics and

privacy protection. For more information, visit wind.com.

ABOUT OUR SPONSORS

ABOUT OUR SUPPORTING SPONSORS

ABOUT PATHRESPONSE

Path2Response is a data-driven marketing company that helps businesses

and nonprofit organizations reach responsive audiences and improve their

marketing ROI. We combine an experienced team with untapped data

sources, the latest open source technology, and leading edge data science

to deliver transformative results. Our transformational cooperative data

platform powers customer acquisition and retention in both offline and

online channels. We are based in Broomfield, CO, and we serve businesses

and organizations of all sizes across the United States. For more

information, visit pth2response.com.

ABOUT FREEDOM

Freedom is one of the largest privately held direct mail companies in the

United States with four manufacturing facilities strategically located

throughout North America. Specializing in the production of data-driven

direct mail programs integrated into omni-channel marketing campaigns,

Freedom offers a wide range of services, from strategy and format design

through mail deployment, creating a single source solution for direct

marketers. With its robust certifications in data security, Freedom has been

enabling the imagination of direct marketers for over 37 years, developing

customized solutions for the financial services, insurance, healthcare,

telecommunications, and non-profit marketing verticals. For more

information, visit

fs.com.

ABOUT NAVSTONE

NaviStone is the proud inventor of a revolutionary marketing channel,

Digitally Powered Mail. Our marketing technology platform allows brands

to acquire new customers by using online intent data and delivering high-

response personalized direct mail within 24 hours. As marketers experience

major disruptions to digital programs including loss of third party cookies,

ad blockers and Apple IOS changes, brands are looking for new ways to

reconnect. At NaviStone, we turn bits and bytes from the digital world into

tangible marketing with ink and paper. The result? A marketing product

that helps brands grow their business and makes their customers smile.

We understand the importance of privacy in this day and age. NaviStone’s

approach and secure technology ensure consumer privacy every step along

the way. For more information, visit

nvistone.com.

ABOUT LS DRECT

LS Direct is the industry leader in harnessing the power of intent-based postal

retargeting. Through our cutting-edge Boomerang direct® solution, we utilize

your valuable first-party data to craft highly targeted and personalized direct

mail campaigns that effectively drive conversions for customers who have

already engaged with your website. Our innovative marketing tech-stack

seamlessly merges the online and offline realms, making us your go-to

provider for your direct mail needs. Trusted by top brands, retailers,

catalogers, and more, we are here to support you at every stage of the

customer journey, from attracting new customers to nurturing existing ones

and reactivating past buyers. With our data-first approach and advanced

predictive analytics, we empower your campaigns to achieve a provable

and predictable ROI. For more information, visit

sdirect.com.

Winterberry Group is a specialized management consultancy that offers more than

two decades of experience and deep expertise in the intersecting disciplines of

advertising, marketing, data, technology and commerce. Offering a range of growth

strategy, collaborative activation, mergers & acquisitions and market intelligence

solutions, Winterberry Group helps brands, publishers, marketing service providers,

technology developers and information companies—plus the financial investors who

support these organizations—understand emerging opportunities, create actionable

strategies and grow their value and global impact.

Growth Strategy

Corporate strategy that drives growth is at the heart

of what we do. We work with clients to identify core

competencies, evaluate strategic alternatives and

build comprehensive, actionable growth plans.

Collaborative Activation

We guide brands and marketing practices through

business process planning efforts aimed at helping

them achieve lasting competitive advantage.

Mergers & Acquisitions

We leverage our industry knowledge to help

financial investors make sound, value-driven

investment decisions.

Market Intelligence

We maintain an active research and publishing

practice that gives our consultants direct access

to insights from senior industry executives and

complements our client engagements.

ABOUT WNTERBERRY GROUP

ABOUT WINTERBERRY GROUP

WINTERBERRY GROUP SERVICES

CONTACT US

Bruce Biegel

Senior Managing Partner

bruce@winterberrygroup.com

Jonathan Margulies

Managing Partner

jmargulies@winterberrygroup.com

Brittany Meeks

Engagement Director

bmeeks@winterberrygroup.com

www.winterberrygroup.com

61 Broadway, Suite 1030

New York, NY 10006